Global Point of Sale Software Market By Deployment Mode (Cloud-Based and On-Premise), By Application (Fixed POS and Mobile POS), By Enterprise Size (Small and Medium-Sized Enterprises (SMEs) and Large Enterprises), By Industry Vertical (Retail, Hospitality, Entertainment, Healthcare, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: March 2024

- Report ID: 51827

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

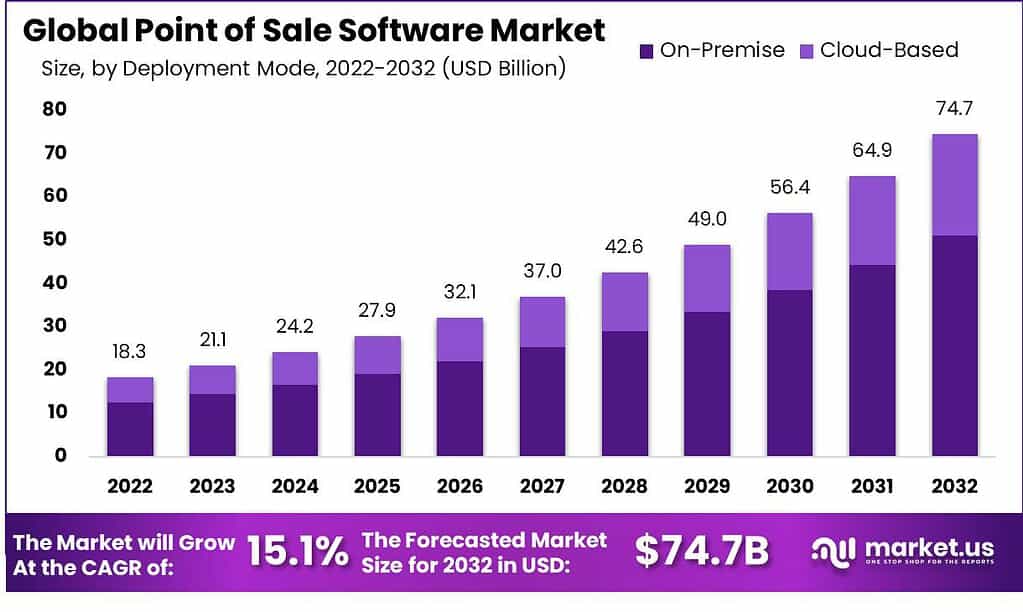

The Global Point of Sale (POS) Software market is estimated to be worth USD 21.1 billion in 2023 and projected to be valued at USD 74.7 billion in 2032. Between 2023 and 2032, the market is expected to register a growth rate of 15.1%.

Point of Sale (POS) software is a critical component in the retail and hospitality industries, serving as the central platform through which sales transactions are managed. This software facilitates the processing of sales and transactions, inventory management, customer management, and sales reporting. Designed to streamline operations, POS software enhances efficiency by automating the sales process, thereby reducing manual errors and increasing transaction speed.

The Point of Sale Software Market is experiencing significant growth, driven by the increasing adoption of cloud-based solutions, the need for efficient transaction processing, and the demand for advanced analytics and reporting features. The market’s expansion can be attributed to the widespread digitalization across retail and hospitality sectors, and the growing preference for contactless payments and mobile POS systems.

A recent study conducted by Software Advice underscores a pivotal shift in the retail industry’s approach to Point of Sale (POS) technology. The investigation revealed that in 2022, a majority of 55% of retailers had embraced cloud-based POS systems, marking a significant increase from 43% in the preceding year.

This survey, encompassing nearly 300 retail businesses across the United States, highlights the industry’s ongoing journey towards technological modernization. The transition towards cloud-based solutions is indicative of retailers’ efforts to refine their technology infrastructure, leveraging the cloud’s scalability, flexibility, and real-time data access to enhance operational efficiency and customer service.

The POS software market is characterized by its fragmentation, with a multitude of vendors competing for market presence. However, a few key players have managed to secure substantial shares, indicating their influence and the competitive dynamics within this sector. In 2022, Shopify emerged as a market leader, commanding a 22.5% share, followed by Square with an 18.2% market share. Lightspeed also made a significant mark with a 10.3% share, while PayPal and Toast secured 8.1% and 7.9% of the market, respectively.

Key Takeaways

- The global Point of Sale (POS) Software market is estimated to have a significant growth, projected to reach a value of USD 74.7 billion by 2032, with a notable CAGR of 15.1% during the forecast period.

- A pivotal shift in the retail industry is observed, with 55% of retailers embracing cloud-based POS systems in 2022, showcasing a significant increase from the previous year.

- Deployment Mode: On-premise solutions lead the market with a major revenue share of 68.4%, favored by larger enterprises prioritizing control and customization.

- Application: Fixed POS systems dominate, holding a major revenue share of 55.7%, offering stability and robust functionality.

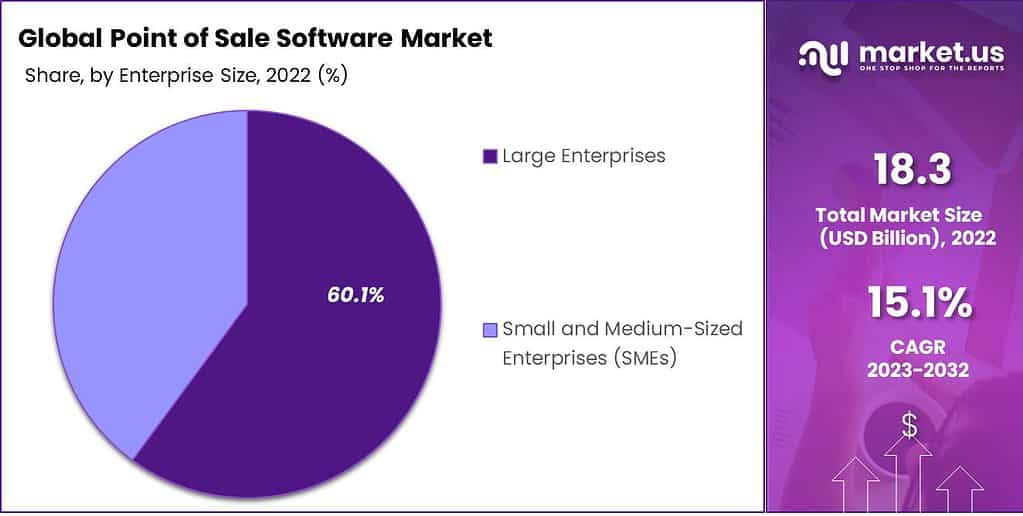

- Enterprise Size: Large enterprises command a significant revenue share of 60.1%, driven by their need for advanced POS solutions to manage complex operations.

- Industry Vertical: The retail segment leads the market with a major revenue share of 32.6%, relying heavily on POS systems to enhance customer experiences and streamline operations.

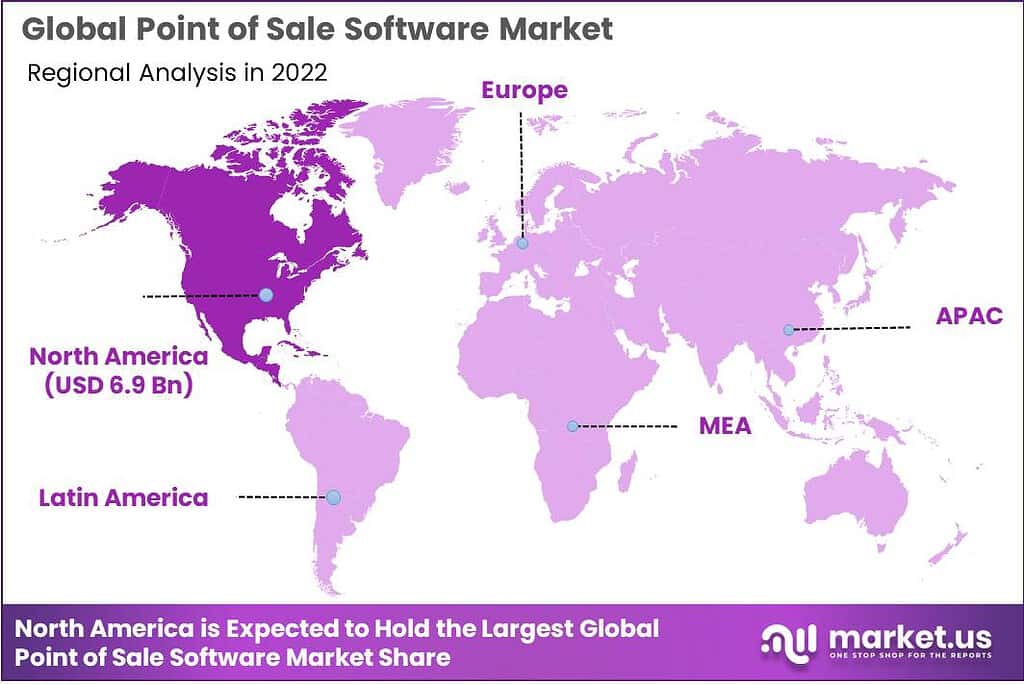

- The North America region dominates the market by holding a major revenue share of 37.8%.

- 46% of small businesses plan to invest in POS software updates or replacements in 2023.

- A 2022 report highlights 60% of retailers see POS upgrades as crucial, with a focus on flexible solutions.

- The U.S. POS market is forecasted to grow from ~USD 5.7 billion in 2023 to ~USD 14.0 billion by 2030.

- Year-on-year growth for mobile payment transactions stands at 40.2%. Early adopters of mobile POS systems navigated pandemic challenges more effectively.

- 61% of retailers are considering cloud-based POS systems, as reported by Forbes.

- POS systems are predominantly used by small and mid-sized brands, making up 79%, while large enterprises account for 21%.

- 23% of mobile POS users report the inability to accept payments using the tool.

- Currently, 46% of retailers do not use mobile POS for transaction processing.

- In 2023, 57% of businesses value integration with third-party applications and services as a key selection criterion for POS software.

- By 2024, 41% of retailers plan to adopt POS software with advanced payment processing features to meet the demands of tech-savvy consumers

Deployment Mode Analysis

In the Point of Sale (POS) software market, the deployment mode analysis examines how POS software is implemented and managed by businesses. The on-premise segment leads the market by holding a major revenue share of 68.4%. On-premise deployment involves installing the POS software directly on the hardware and servers owned by the business. This deployment mode offers greater control and customization possibilities for businesses, as they have direct access to the software and data.

It is particularly favored by larger enterprises with specific security or compliance requirements. On-premise solutions require upfront investment in hardware and infrastructure but provide businesses with full control over their systems and data, making them suitable for organizations that prioritize data privacy and security.

Application Analysis

The application analysis in the POS software market focuses on different types of POS systems used by businesses. The fixed POS segment dominates the market by holding a major revenue share of 55.7%. Fixed POS systems consist of stationary terminals, such as cash registers or kiosks, where customers make transactions. These systems are commonly used in retail stores, restaurants, and other brick-and-mortar establishments.

Fixed POS systems provide stability, durability, and robust functionality, making them suitable for businesses that have a high volume of transactions or require specialized features specific to their industry. They often include features such as barcode scanning, receipt printing, cash management, and integration with other systems like inventory management and customer relationship management. The dominance of fixed POS systems is driven by their reliability and familiarity, as well as the need for businesses to have a dedicated checkout point for efficient transaction processing.

Enterprise Size Analysis

The enterprise size analysis in the POS software market examines the adoption of POS systems across different types of businesses based on their size. The large enterprises segment holds a major revenue share of 60.1% in 2022. Large enterprises, with their extensive operations and complex requirements, often require advanced POS software solutions to manage multiple locations, inventory management, and sales analytics.

These organizations have the resources and infrastructure to implement and support sophisticated POS systems that can handle high transaction volumes, integrate with other enterprise systems, and provide comprehensive reporting and analysis capabilities. Large enterprises may have diverse sales channels, such as brick-and-mortar stores, e-commerce platforms, and mobile sales teams, and require POS software that can consolidate and analyze data from these various sources. The adoption of POS systems by large enterprises is driven by the need for centralized control, scalability, and the ability to generate insights for strategic decision-making.

Industry Vertical Analysis

The industry vertical analysis in the POS software market focuses on the adoption of POS systems in different sectors. Among these industry vertical segments, the retail segment leads the market by holding a major revenue share of 32.6%. Retail businesses, including both brick-and-mortar stores and e-commerce platforms, heavily rely on POS systems to manage sales, inventory, customer information, and loyalty programs.

The retail sector’s adoption of POS software is driven by the need for efficient transaction processing, accurate inventory management, real-time reporting, and seamless integration with e-commerce platforms. The retail segment encompasses various sub-segments, such as apparel, electronics, grocery, and specialty retail, all of which benefit from the functionality and features offered by POS software to enhance customer experiences and streamline operations.

In the retail industry, POS systems are often integrated with other solutions like customer relationship management (CRM) systems, inventory management systems, and e-commerce platforms to provide a unified and omnichannel retail experience. The retail sector’s adoption of POS software is further accelerated by the growing demand for personalized and frictionless shopping experiences, as well as the increasing use of data analytics to drive customer engagement and optimize sales strategies.

Key Market Segments

Deployment Mode

- Cloud-Based

- On-Premise

Application

- Fixed POS

- Mobile POS

Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Industry Vertical

- Retail

- Hospitality

- Entertainment

- Healthcare

- Other Industry Verticals

Driver

One driver in the Point of Sale (POS) software market is the increasing demand for improved customer experiences and streamlined operations. Businesses across various industries recognize the importance of providing seamless and efficient transactions to enhance customer satisfaction. POS software plays a crucial role in achieving this goal by enabling faster and more accurate transactions, reducing waiting times, and offering convenient payment options.

The ability of POS systems to integrate with other software solutions such as customer relationship management (CRM) platforms and inventory management systems further enhances the customer experience by providing personalized interactions and real-time inventory updates.

Moreover, POS software helps businesses optimize their operations by providing valuable insights into sales trends, inventory levels, and employee performance. By leveraging these insights, businesses can make data-driven decisions, improve inventory management, and enhance overall operational efficiency.

Restraint

One restraint in the POS software market is the high implementation and maintenance costs associated with advanced POS systems. Upgrading or implementing a new POS system requires significant investment in software licenses, hardware, training, and ongoing support. Small and medium-sized businesses, in particular, may find it challenging to allocate the necessary financial resources for a comprehensive POS solution.

Additionally, the maintenance and support costs can also be substantial, especially for on-premise systems that require regular updates, security patches, and hardware maintenance. The cost factor may deter some businesses from adopting or upgrading their POS software, particularly if they perceive their existing systems as sufficient for their current needs. However, it is important to note that the benefits of a modern POS system, such as improved efficiency, better inventory management, and enhanced customer experiences, often outweigh the initial costs in the long run.

Opportunity

One opportunity in the POS software market lies in the integration of mobile and cloud-based technologies. Mobile POS (mPOS) solutions, which leverage smartphones or tablets as point-of-sale devices, have gained popularity in recent years. With the ubiquity of mobile devices, mPOS systems offer flexibility, portability, and cost-effectiveness, particularly for small businesses or those with mobile operations. These solutions enable businesses to process transactions on the go, accept a variety of payment methods, and provide personalized customer experiences.

Furthermore, the adoption of cloud-based POS systems presents an opportunity for businesses to reduce hardware costs, improve scalability, and access real-time data from anywhere. Cloud-based POS solutions also offer seamless integration with other cloud-based applications, enabling businesses to leverage additional functionalities such as online ordering, loyalty programs, and analytics. The integration of mobile and cloud technologies in POS software opens up new avenues for innovation, enabling businesses to adapt to changing consumer preferences and offer enhanced shopping experiences.

Challenge

One challenge in the POS software market is the increasing concern over data security and privacy. As POS systems handle sensitive customer information, including payment card details, protecting this data from unauthorized access and breaches is of paramount importance. The evolving landscape of cyber threats poses a significant challenge for businesses, as hackers continuously develop sophisticated methods to exploit vulnerabilities in software and systems.

Any security breach can result in financial losses, reputational damage, and legal implications for businesses. Therefore, ensuring robust data security measures, such as encryption, tokenization, and compliance with industry standards like Payment Card Industry Data Security Standard (PCI DSS), becomes essential.

Additionally, businesses need to implement stringent access controls, regularly update and patch their POS software, and provide employee training on cybersecurity best practices. Addressing the challenge of data security requires continuous vigilance, investment, and collaboration between businesses, software vendors, and payment processors to stay ahead of emerging threats and protect customer data effectively.

Geopolitics and Recession Impact Analysis

Geopolitics Impact Analysis:

Trade and tariff disputes between countries interrupt supply chains, affecting the availability and cost of hardware components used in POS systems. This, in turn, may lead to increased expenses and uncertainty for POS software manufacturers and retailers, potentially causing delays in software upgrades. Moreover, shifts in data privacy and security regulations due to geopolitical changes can impact POS software development and implementation. Additionally, geopolitical instability, such as conflicts or political transitions, can influence global economic conditions, which, in turn, can impact the willingness and ability of businesses to invest in POS software solutions.

Recession Impact Analysis:

During economic downturns, businesses often face budget constraints, leading to reduced IT spending. Investments in POS software upgrades or replacements may be postponed or scaled back. In such challenging economic environments, businesses may prioritize cost-effective POS software options that offer essential functionality without extensive customization or advanced features. Operational efficiency becomes a key consideration, with companies seeking POS software to reduce costs, enhance productivity, and improve customer experiences. However, some businesses may view recessions as an opportunity to expedite their digital transformation efforts, including upgrading POS systems. They recognize that modernizing their POS software can lead to long-term cost savings and better positioning in a competitive market.

Regional Analysis

The North America region dominates the market by holding a major revenue share of 37.8%. The region’s dominance in the market can be attributed to various factors. North American region is home to a large and diverse retail landscape, including numerous global retail giants and a vibrant small and medium-sized business sector.

The region’s extensive retail industry demands sophisticated POS solutions to manage inventory, process transactions, and enhance customer experiences. Moreover, North America has been an early adopter of technology and digital payment methods, driving the need for advanced and adaptable POS software.

Furthermore, North American businesses prioritize data security and regulatory compliance, fostering the development of POS software with robust security features and adherence to industry standards. Nevertheless, the Asia-Pacific region is expected to register a higher CAGR in the forecasted period, owing to growing technology adoption in the region.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Global Point of Sale (POS) Software Market is a highly competitive and dynamic landscape characterized by a diverse range of players. Market leaders have established strong positions by offering comprehensive and feature-rich POS software solutions catering to various industries. Moreover, industry-specific players tailor their POS software to the unique needs of the hospitality, healthcare, and retail sectors.

Additionally, regional players offer localized solutions and support, addressing specific market requirements. This competitive landscape reflects the diverse customer demands and ongoing innovation within the POS Software Market on a global scale.

Top Market Leaders

- SAP SE

- Clover Network Inc.

- Oracle Corporation

- Block Inc.

- Shopify Inc.

- Lightspeed Commerce

- NCR Corporation

- H&L Australia

- Idealpos

- Revel Systems

- TouchBistro Inc.

- VeriFone, Inc.

- Toast, Inc.

- Bindo Labs, Inc.

- Epicor Software Corporation

- Other Key Players

Recent Developments

1. Clover Network Inc.:

- April 2023: Launched Clover Connect, a new platform facilitating seamless integration with third-party applications for enhanced POS functionality.

- June 2023: Partnered with Mastercard to offer Clover Business Insights, a data analytics suite empowering merchants with actionable insights.

- October 2023: Announced integration with Google Pay, allowing customers to pay directly at Clover-powered businesses using their smartphones.

2. Oracle Corporation:

- February 2023: Launched Oracle Retail Xstore Cloud, a comprehensive cloud-based POS solution for omnichannel retail experiences.

- June 2023: Acquired Micros Retail, a leading provider of POS and store management solutions, strengthening its retail technology portfolio.

- November 2023: Partnered with Visa to offer Tap to Phone payments, enabling contactless transactions on Android smartphones without additional hardware.

Report Scope

Report Features Description Market Value (2023) US$ 21.1 Bn Forecast Revenue (2032) US$ 74.7 Bn CAGR (2023-2032) 15.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud-Based and On-Premise), By Application (Fixed POS and Mobile POS), By Enterprise Size (Small and Medium-Sized Enterprises (SMEs) and Large Enterprises), By Industry Vertical (Retail, Hospitality, Entertainment, Healthcare, Other Industry Verticals) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE, & Rest of MEA Competitive Landscape SAP SE, Clover Network Inc., Oracle Corporation, Block Inc., Shopify Inc., Lightspeed Commerce, NCR Corporation, H&L Australia, Idealpos, Revel Systems, TouchBistro Inc., VeriFone, Inc., Toast, Inc., Bindo Labs, Inc., Epicor Software Corporation, and Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Point of Sale (POS) Software?Point of Sale (POS) Software is a computerized system used by businesses to process transactions, manage inventory, and facilitate sales operations. It typically includes features such as sales tracking, inventory management, and payment processing capabilities.

How big is Point of Sale (POS) Software market?The Global Point of Sale (POS) Software market is estimated to be worth USD 21.1 billion in 2023 and projected to be valued at USD 74.7 billion in 2032. Between 2023 and 2032, the market is expected to register a growth rate of 15.1%.

What are the key benefits of using POS Software?Key benefits of POS Software include improved transaction accuracy, streamlined inventory management, enhanced customer experience, efficient sales reporting, and the ability to accept various payment methods, leading to increased operational efficiency and better decision-making.

What is the POS software market trend?The POS software market is currently experiencing trends such as the growing adoption of cloud-based POS solutions, mobile payment options and AI/data analytics for increased customer insights; along with contactless and biometric payment technologies to meet evolving consumer preferences.

What are the top 5 POS systems in India?Some of the top POS systems in India include Marg ERP 9+, QuickBooks, Tally.ERP 9, HDPOS Smart, and Gofrugal, which offer a range of features catering to diverse business needs, including inventory management, billing, and customer relationship management.

What is the future of POS in India?Future prospects of Point-of-Sale in India appear bright, with increasing digital payment adoption, the development of advanced POS technologies and GST compliance features, and growing demands for customized POS solutions tailored specifically to industry requirements. This trend should drive expansion and innovation of India's POS market in coming years.

Point of Sale Software MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Point of Sale Software MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- Clover Network Inc.

- Oracle Corporation

- Block Inc.

- Shopify Inc.

- Lightspeed Commerce

- NCR Corporation

- H&L Australia

- Idealpos

- Revel Systems

- TouchBistro Inc.

- VeriFone, Inc.

- Toast, Inc.

- Bindo Labs, Inc.

- Epicor Software Corporation

- Other Key Players