Global Pocket Video Camera Market Size, Share, Growth Analysis By Product Type (Action Pocket Video Cameras, 360-Degree Pocket Video Cameras, Standard Pocket Video Cameras, Smartphone-Compatible Pocket Video Cameras), By Sensor Type (CMOS Sensors, Hybrid Sensors, CCD Sensors), By Video Resolution (Full HD, HD, 6K and 8K Video Capable, 4K Ultra HD), By Connectivity Features (Wi-Fi Enabled Pocket Video Cameras, USB- Connectivity, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155025

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

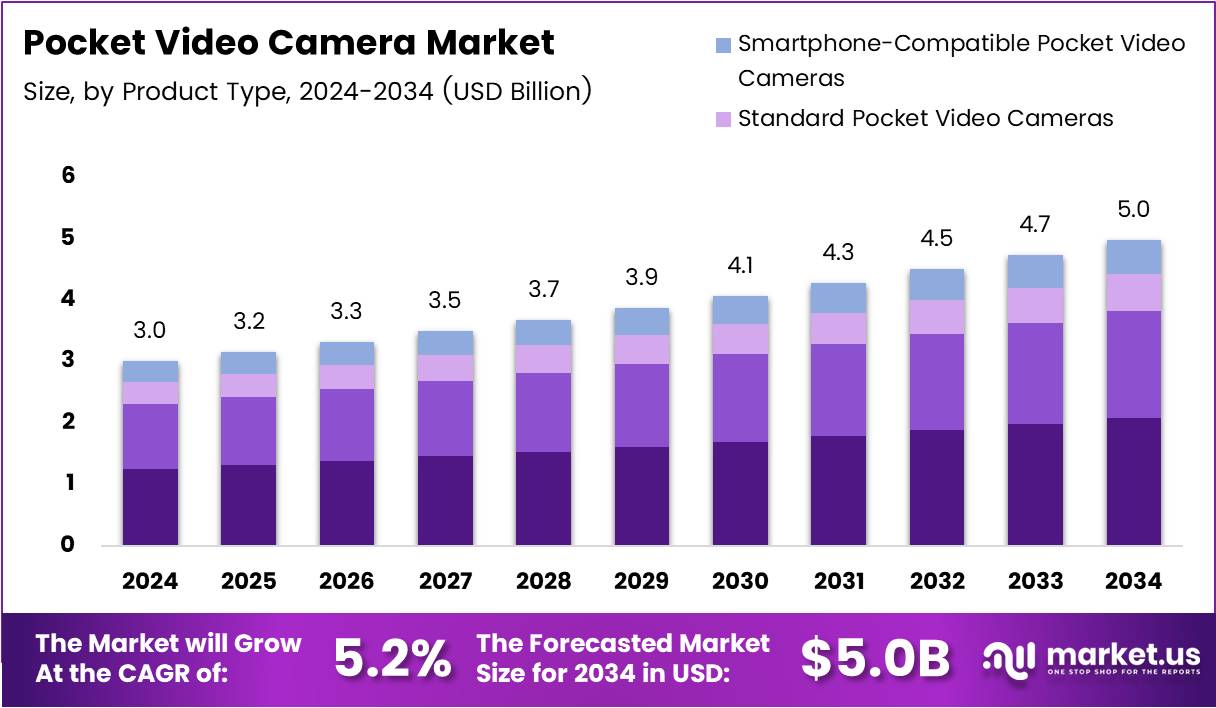

The Global Pocket Video Camera Market size is expected to be worth around USD 5.0 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The Pocket Video Camera Market refers to compact, portable devices designed for quick video recording with high-quality output. These cameras appeal to consumers seeking mobility, ease of use, and instant sharing capabilities. Unlike bulky DSLRs or smartphones, they offer dedicated video features, appealing to travel vloggers, content creators, and casual users alike.

Pocket video cameras combine affordability with performance, filling a niche between professional gear and smartphones. They often include advanced stabilization, wide-angle lenses, and robust battery life. This positioning creates opportunities for brands to capture tech-savvy users who value portability without compromising on video resolution or creative control.

The market benefits from rising social media usage, as platforms like YouTube and TikTok drive demand for quick, on-the-go filming. Consequently, manufacturers innovate with AI-driven editing tools, wireless connectivity, and 4K recording. These enhancements strengthen the market’s relevance among younger demographics, influencing purchase decisions and expanding potential user bases across global regions.

Transitioning further, product design plays a critical role in consumer adoption. Sleek, lightweight builds attract travel bloggers, while durable, waterproof options appeal to adventure seekers. Additionally, minimal setup times and intuitive controls encourage repeat use, supporting brand loyalty. Therefore, companies that invest in ergonomic design gain competitive advantage in this evolving segment.

Moreover, distribution channels are diversifying. E-commerce dominates, offering global reach, while specialty electronics stores provide hands-on demonstrations. Collaborations with influencers and lifestyle brands also boost visibility. As a result, companies leverage both online marketing and experiential retail to capture different consumer segments, ensuring steady growth in brand recognition and product sales.

However, competition from smartphones remains a notable challenge. Brands counter this by highlighting unique features such as extended optical zoom, better low-light performance, and longer recording times. These value propositions encourage consumers to view pocket video cameras as complementary rather than redundant devices, maintaining their place in the digital imaging ecosystem.

The pocket video camera market stands at a promising intersection of portability, innovation, and content-driven lifestyles. Continuous product differentiation, targeted marketing, and integration with social media ecosystems will remain key to capturing the next wave of consumer demand in this competitive yet opportunity-rich market.

Key Takeaways

- Global Pocket Video Camera Market size projected to reach USD 5.0 Billion by 2034 from USD 3.0 Billion in 2024, growing at a 5.2% CAGR (2025–2034).

- Action Pocket Video Cameras led by product type in 2024 with a 38.2% share, driven by demand for extreme sports, travel, and outdoor content.

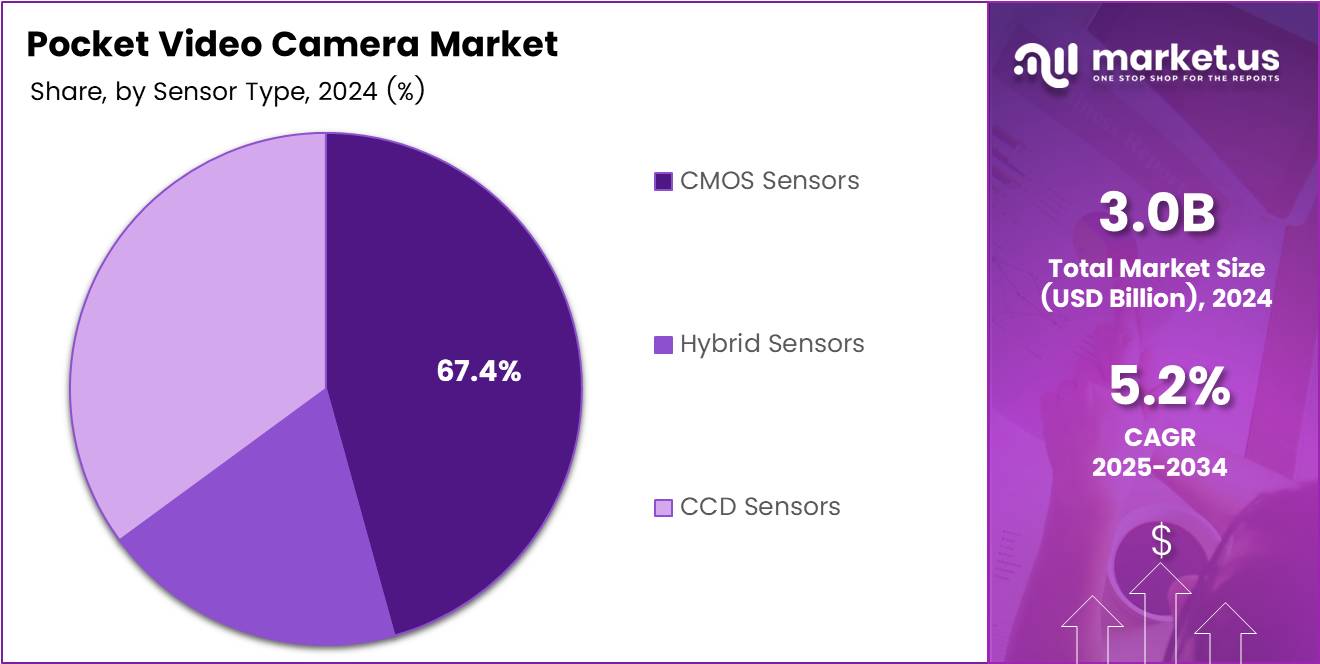

- CMOS Sensors dominated by sensor type in 2024 with a 67.4% share, favored for low-light performance, energy efficiency, and affordability.

- Full HD (1080p) led by video resolution in 2024 with a 45.8% share, balancing sharp visuals and manageable file sizes.

- Wi-Fi enabled cameras held the lead by connectivity in 2024 with a 42.7% share, supporting real-time uploads and remote control.

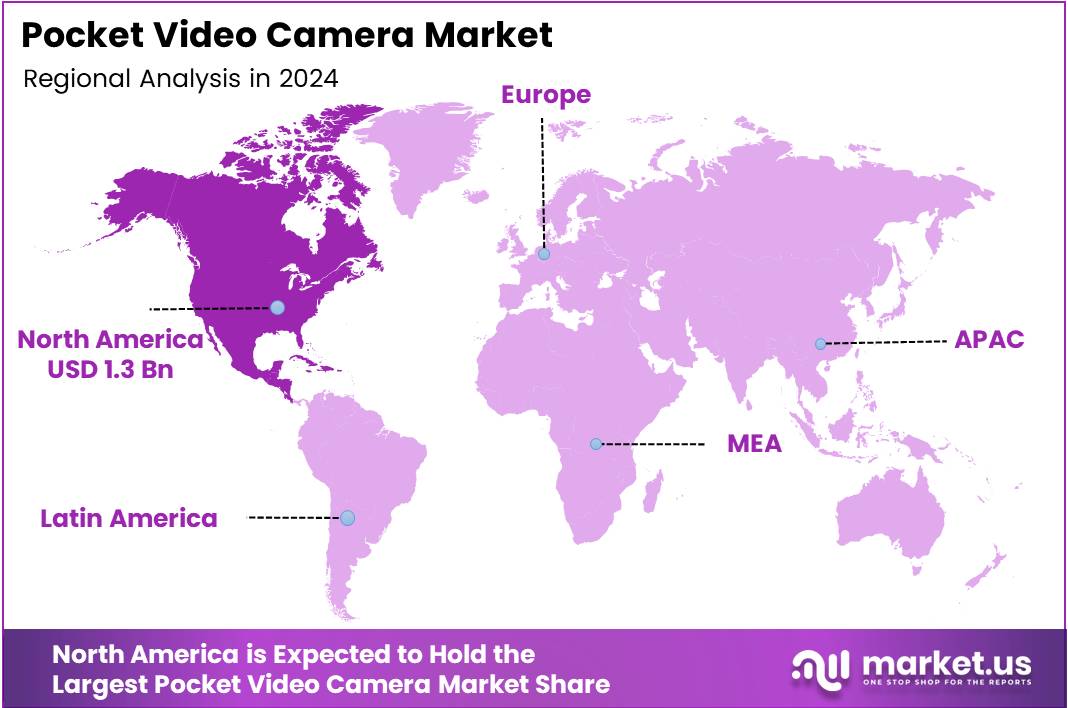

- North America dominated regionally with a 43.8% share valued at USD 1.3 Billion, fueled by content creation, vlogging, and social media engagement.

Product Type Analysis

Action Pocket Video Cameras lead with 38.2% due to rising demand for adventure and sports content creation.

In 2024, Action Pocket Video Cameras held a dominant market position in the By Product Type Analysis segment of the Pocket Video Camera Market, with a 38.2% share. Their popularity is driven by growing consumer interest in capturing high-intensity activities such as extreme sports, travel, and outdoor adventures. The compact, durable, and waterproof design of these cameras enhances usability across challenging environments.

360-Degree Pocket Video Cameras are also gaining traction as immersive media and VR content production grow. These devices cater to a niche but expanding segment of consumers and professionals focused on interactive video experiences.

Standard Pocket Video Cameras remain a steady choice for casual users who value straightforward controls and affordability. While their market share is smaller, they continue to serve as an entry point for first-time buyers.

Smartphone-Compatible Pocket Video Cameras appeal to social media creators seeking seamless mobile integration. They offer portability and quick connectivity for instant sharing, positioning them well in the influencer-driven content ecosystem.

Sensor Type Analysis

CMOS Sensors dominate with 67.4% owing to their efficiency, image quality, and cost advantages.

In 2024, CMOS Sensors held a dominant market position in the By Sensor Type Analysis segment of the Pocket Video Camera Market, with a 67.4% share. Their prevalence stems from advancements in low-light performance, energy efficiency, and integration with compact camera designs. Manufacturers favor CMOS technology for balancing high-quality video output with affordability.

Hybrid Sensors are emerging as a competitive alternative, combining the benefits of CMOS and CCD technologies. They cater to niche professional and enthusiast markets seeking higher dynamic range and specialized imaging capabilities.

CCD Sensors, while once an industry standard, now occupy a smaller share of the market. They remain valued in specific professional applications that require precise image fidelity, though their higher power consumption and cost limit broader adoption.

Overall, the sensor type landscape reflects a shift toward CMOS dominance, with innovation focusing on improving performance for compact, portable video devices.

Video Resolution Analysis

Full HD (1080p) leads with 45.8% driven by its balance of quality, storage efficiency, and device compatibility.

In 2024, Full HD (1080p) held a dominant market position in the By Video Resolution Analysis segment of the Pocket Video Camera Market, with a 45.8% share. Its enduring popularity is attributed to delivering sharp, clear visuals while maintaining manageable file sizes, making it ideal for both casual and professional use.

HD (720p) continues to serve the budget-conscious segment, especially in entry-level devices where affordability is a priority. Despite its lower resolution, it remains adequate for basic recording needs and online content sharing.

4K Ultra HD (2160p) has gained momentum among creators seeking higher detail and post-production flexibility. While adoption is growing, it still lags behind Full HD due to larger storage demands and higher device costs.

6K / 8K Video Capable cameras represent the cutting edge of resolution technology, appealing to high-end filmmakers and specialists. However, limited accessibility and processing requirements keep this category niche.

Connectivity Features Analysis

Wi-Fi Enabled Pocket Video Cameras lead with 42.7% thanks to instant sharing and cloud integration capabilities.

In 2024, Wi-Fi Enabled Pocket Video Cameras held a dominant market position in the By Connectivity Features Analysis segment of the Pocket Video Camera Market, with a 42.7% share. This leadership is fueled by consumer demand for real-time content uploads and remote camera control, especially in social media and live-streaming contexts.

USB-C Connectivity has grown in relevance due to its fast data transfer speeds and universal compatibility. This feature is increasingly standard among new models targeting professional and tech-savvy users.

HDMI Output remains essential for direct playback and integration with external monitors, particularly in professional shooting scenarios. While its adoption is steady, it is not the primary driver of purchasing decisions for most consumers.

Bluetooth Connectivity, although less dominant, provides convenience for quick pairing with accessories and smartphones. It supports peripheral integration without cables, appealing to users prioritizing minimal setup time.

Key Market Segments

By Product Type

- Action Pocket Video Cameras

- 360-Degree Pocket Video Cameras

- Standard Pocket Video Cameras

- Smartphone-Compatible Pocket Video Cameras

By Sensor Type

- CMOS Sensors

- Hybrid Sensors

- CCD Sensors

By Video Resolution

- Full HD (1080p)

- HD (720p)

- 6K / 8K Video Capable

- 4K Ultra HD (2160p)

By Connectivity Features

- Wi-Fi Enabled Pocket Video Cameras

- USB-C Connectivity

- HDMI Output

- Bluetooth Connectivity

Drivers

Rising Demand for Lightweight and Portable Video Recording Devices Drives Market Growth

The global pocket video camera market is witnessing strong momentum as more people create videos for vlogs and social media platforms. Short-form content on apps like Instagram, TikTok, and YouTube has encouraged users to look for compact and easy-to-use recording tools. This trend is driving steady demand for small cameras that deliver professional-looking videos without complex setups.

Technological improvements in compact imaging sensors have further boosted product appeal. Modern pocket video cameras now offer better resolution, sharper image quality, and improved color accuracy, making them more competitive against larger, traditional cameras. Consumers value this performance in a device small enough to fit in their pocket.

Portability is becoming a key purchase factor. Users—especially travelers, vloggers, and hobbyists—prefer lightweight devices that can be carried anywhere without adding bulk. This convenience factor has been a major growth driver for the segment.

Adventure and travel documentation are also contributing to sales growth. Many buyers want to capture high-quality videos during hiking, diving, or sightseeing trips. Rugged and easy-to-handle designs make pocket cameras the go-to option for such activities, boosting their adoption rate globally.

Restraints

Competition from High-Resolution Smartphone Cameras Limits Market Expansion

One of the biggest challenges for the pocket video camera market is the growing capability of smartphones. Many flagship phones now offer high-resolution video recording, advanced stabilization, and multiple lens options, reducing the need for a separate camera. This overlap in functionality creates stiff competition.

Battery life is another limiting factor. Many pocket video cameras cannot record for long hours without recharging, making them less appealing for continuous shooting needs such as events or travel vlogging. Users often find this restriction inconvenient.

High price points for premium models also act as a restraint. While entry-level devices are affordable, high-end pocket cameras with advanced features can be costly, which limits adoption among casual users who may opt for using their phones instead.

Additionally, low-light performance in budget-friendly models is often inadequate. Poor results in night or indoor shooting situations can discourage potential buyers who require consistent quality in all conditions, especially content creators working in varied environments.

Growth Factors

Integration of AI-Based Video Stabilization and Editing Features Creates Growth Opportunities

The integration of AI-based stabilization and editing features is set to transform the pocket video camera market. AI can automatically correct shaky footage, adjust exposure, and even suggest creative edits, making professional-level video creation easier for beginners and experts alike.

Live streaming compatibility is another major opportunity. With the rise of real-time content on platforms like Twitch and YouTube Live, pocket cameras that can directly stream high-quality video will attract a new segment of content creators.

The growing demand for 4K and 8K ultra-HD video capture in small devices also presents a lucrative path for manufacturers. Users want cinematic-quality footage without the bulk of traditional gear, and compact devices delivering this resolution will be highly sought after.

Waterproof and rugged variants are another emerging segment. Travelers, adventurers, and extreme sports enthusiasts increasingly seek devices that can withstand challenging environments, from underwater filming to harsh weather conditions. This niche is expected to see rapid growth in the coming years.

Emerging Trends

Adoption of Foldable or Modular Camera Designs Shapes Market Trends

The pocket video camera market is seeing innovation through foldable and modular designs. Foldable cameras improve portability, while modular systems let users customize lenses, grips, and accessories, making the device versatile for different shooting needs.

Wireless and cloud-based video transfer is also becoming a popular trend. Users appreciate the ability to instantly upload or back up footage without needing cables, making the content creation workflow faster and more convenient.

Miniaturization of high-quality zoom lens systems is another notable advancement. Manufacturers are packing powerful zoom capabilities into smaller camera bodies, enabling close-up shots without sacrificing portability.

The inclusion of augmented reality (AR) shooting modes is gaining traction as well. These features allow creators to add interactive graphics, animations, and overlays in real time, appealing to a younger, tech-savvy audience looking for fresh and engaging content formats.

Regional Analysis

North America Dominates the Pocket Video Camera Market with a Market Share of 43.8%, Valued at USD 1.3 Billion

North America holds the leading position in the global pocket video camera market, driven by high consumer adoption of portable digital devices and strong penetration of advanced imaging technologies. The region’s dominance is supported by 43.8% market share, valued at USD 1.3 Billion, owing to rising demand for compact, high-quality video recording solutions. Growing interest in content creation, vlogging, and social media engagement continues to fuel sales across both professional and consumer segments.

Europe Pocket Video Camera Market Trends

Europe represents a significant share of the market, with strong demand for high-performance portable cameras among both hobbyists and professionals. Increasing travel and tourism activities, along with the rise of adventure sports, contribute to consistent product demand. Furthermore, the adoption of innovative video technologies and integration with mobile devices is shaping purchasing preferences in the region.

Asia Pacific Pocket Video Camera Market Trends

Asia Pacific is witnessing rapid growth in the pocket video camera market, driven by expanding consumer electronics sectors in emerging economies. The rise of influencer marketing, online streaming, and mobile-first content creation is boosting adoption rates. Moreover, affordable product availability and increasing digital literacy across the region are accelerating market penetration.

Middle East and Africa Pocket Video Camera Market Trends

The Middle East and Africa market is experiencing steady expansion, supported by a growing interest in lifestyle and travel videography. Rising internet penetration and the popularity of social media platforms are encouraging more consumers to invest in portable video recording devices. Demand is also increasing among content creators and tourism-driven industries in key regional markets.

Latin America Pocket Video Camera Market Trends

Latin America shows promising growth potential, fueled by an increasing youth population engaging in digital content creation. Expanding internet access and rising smartphone integration with video accessories are influencing consumer buying patterns. Additionally, the popularity of outdoor and adventure activities is contributing to greater demand for compact and durable video cameras.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pocket Video Camera Company Insights

In 2024, the global pocket video camera market is experiencing steady growth, driven by advancements in imaging technology, portability, and the increasing demand for high-quality content creation.

Sony continues to dominate the market with its innovative compact camera models that combine professional-grade image quality with user-friendly interfaces. The brand’s strong reputation for reliability and advanced sensor technology keeps it a preferred choice for both casual users and semi-professionals.

Canon remains a significant player by leveraging its expertise in optics and video processing. Its pocket-sized cameras stand out for exceptional color reproduction and versatility, catering to vloggers, travelers, and enthusiasts seeking lightweight yet high-performance solutions. Canon’s focus on hybrid capabilities—strong stills and video—gives it an edge in a competitive market.

Cisco, though primarily known for networking, retains a niche presence through its compact video capture devices aimed at business and educational use. Its pocket video cameras are designed with integrated connectivity features, enabling seamless video streaming and conferencing, particularly appealing for corporate environments.

GoPro continues to thrive in the action and adventure segment, with pocket-sized cameras that offer rugged durability, high-resolution video, and superior stabilization. Their strong brand loyalty, coupled with innovations in slow-motion, waterproofing, and wide-angle recording, ensures GoPro remains the go-to choice for outdoor enthusiasts and content creators seeking dynamic footage.

These key players are shaping the competitive landscape by targeting different consumer needs—from professional videography to corporate communication—while capitalizing on trends like portability, 4K video, and social media-driven content creation.

Top Key Players in the Market

- Sony

- Canon

- Cisco

- GoPro

- JVC Corporation

- Kinefinity

- Panasonic

- Kodak

- Nikon Corporation

- NAC Image Technology

Recent Developments

- In Sept 2023, after completing its campaign with over $1.8 million in funding from more than 5,000 backers, the HoverAir X1 reached a major milestone. It officially became available for purchase on the open market, marking its transition from crowdfunding success to consumer product.

- In Feb 2024, Glass Imaging secured $9.3 million in an extended seed funding round led by GV (Google Ventures). The company, known for using AI to enhance smartphone camera image quality, also attracted investments from Future Ventures, Abstract Ventures, and LDV Capital.

- In Oct 2024, Sony Corporation acquired KinaTrax, Inc., a leader in markerless motion capture technology for sports. This move brought KinaTrax’s in-game biomechanical performance data expertise into Sony’s growing sports business portfolio.

Report Scope

Report Features Description Market Value (2024) USD 3.0 Billion Forecast Revenue (2034) USD 5.0 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Action Pocket Video Cameras, 360-Degree Pocket Video Cameras, Standard Pocket Video Cameras, Smartphone-Compatible Pocket Video Cameras), By Sensor Type (CMOS Sensors, Hybrid Sensors, CCD Sensors), By Video Resolution (Full HD (1080p), HD (720p), 6K / 8K Video Capable, 4K Ultra HD (2160p)), By Connectivity Features (Wi-Fi Enabled Pocket Video Cameras, USB-C Connectivity, HDMI Output, Bluetooth Connectivity) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sony, Canon, Cisco, GoPro, JVC Corporation, Kinefinity, Panasonic, Kodak, Nikon Corporation, NAC Image Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sony

- Canon

- Cisco

- GoPro

- JVC Corporation

- Kinefinity

- Panasonic

- Kodak

- Nikon Corporation

- NAC Image Technology