Global Plywood Boxes Market Size, Share, Growth Analysis By Product Type (Standard Plywood Boxes, Customized Plywood Boxes, Heavy-Duty Plywood Boxes, Lightweight Plywood Boxes), By Design Features (Stackable Plywood Boxes, Waterproof Plywood Boxes, Insulated Plywood Boxes, Foldable Plywood Boxes), By Size (Small Sized, Medium Sized, Large Sized), By Application (Food and Beverage, Aerospace and Defense, Furniture and Home Décor, Electronics Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156337

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

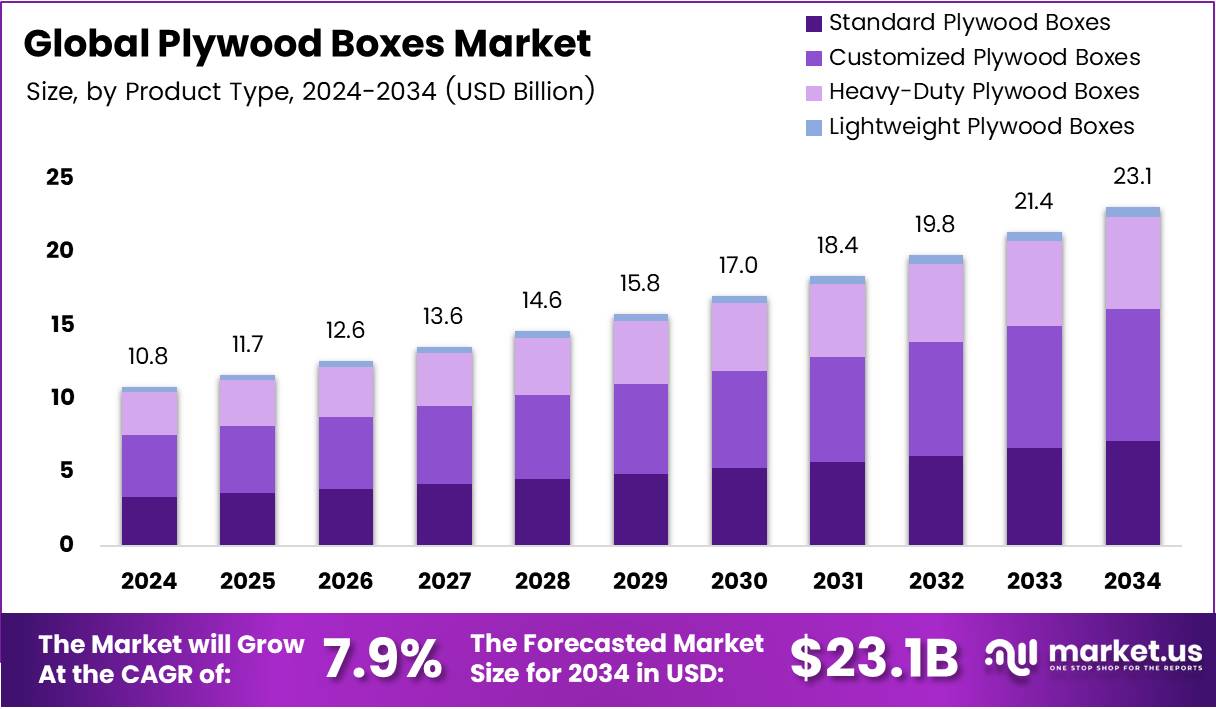

The Global Plywood Boxes Market size is expected to be worth around USD 23.1 Billion by 2034, from USD 10.8 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The plywood boxes market refers to the global trade and usage of wooden packaging solutions primarily manufactured from engineered plywood sheets. These boxes are widely used across logistics, automotive, chemical, and food industries due to their strength, reusability, and ability to safeguard goods in transit. They are also valued for compliance with international shipping standards.

The plywood boxes market is growing steadily as global trade volumes continue to rise and demand for secure packaging strengthens. The market benefits from rising e-commerce activities and increasing exports of heavy machinery and sensitive goods that require durable, ISPM-certified packaging. In this context, plywood boxes serve as an efficient balance between cost and sustainability.

Growth opportunities in the plywood boxes market are driven by industrial expansion and global supply chain modernization. With industries aiming to reduce damages in long-distance shipments, demand for lightweight but sturdy packaging is anticipated to increase. The market is further supported by the rising preference for sustainable materials, as plywood can be sourced responsibly compared to single-use plastic packaging.

Government investment in infrastructure and trade policies has significantly influenced the plywood boxes market. For example, many nations are funding logistics hubs, boosting containerized trade, and promoting eco-friendly packaging solutions. Regulatory compliance with phytosanitary measures under ISPM 15 standards also drives adoption, ensuring international acceptance of plywood packaging across multiple industries.

Regulations play a crucial role in shaping market dynamics, particularly around export packaging. Plywood boxes are often treated to meet fumigation or heat-treatment requirements, making them compliant with global phytosanitary standards. These guidelines protect ecosystems from pests while ensuring smooth cross-border shipments, indirectly expanding the market potential.

Future growth is expected as industries transition toward standardized packaging solutions for global operations. The plywood boxes market is projected to strengthen due to demand from construction, heavy engineering, and electronics exports. Additionally, the growing emphasis on reusable packaging aligns with global circular economy initiatives, making plywood boxes a vital segment in sustainable packaging.

Key Takeaways

- The Global Plywood Boxes Market is projected to reach USD 23.1 Billion by 2034, growing from USD 10.8 Billion in 2024 at a 7.9% CAGR.

- Standard Plywood Boxes led the product type segment in 2024 with a 31.9% share, driven by versatility and broad usability.

- Stackable Plywood Boxes dominated the design features segment in 2024 with a 29.3% share, reflecting efficiency in storage and transport.

- Medium Sized Plywood Boxes secured a 45.2% share in the size segment in 2024, highlighting their balance of handling and capacity.

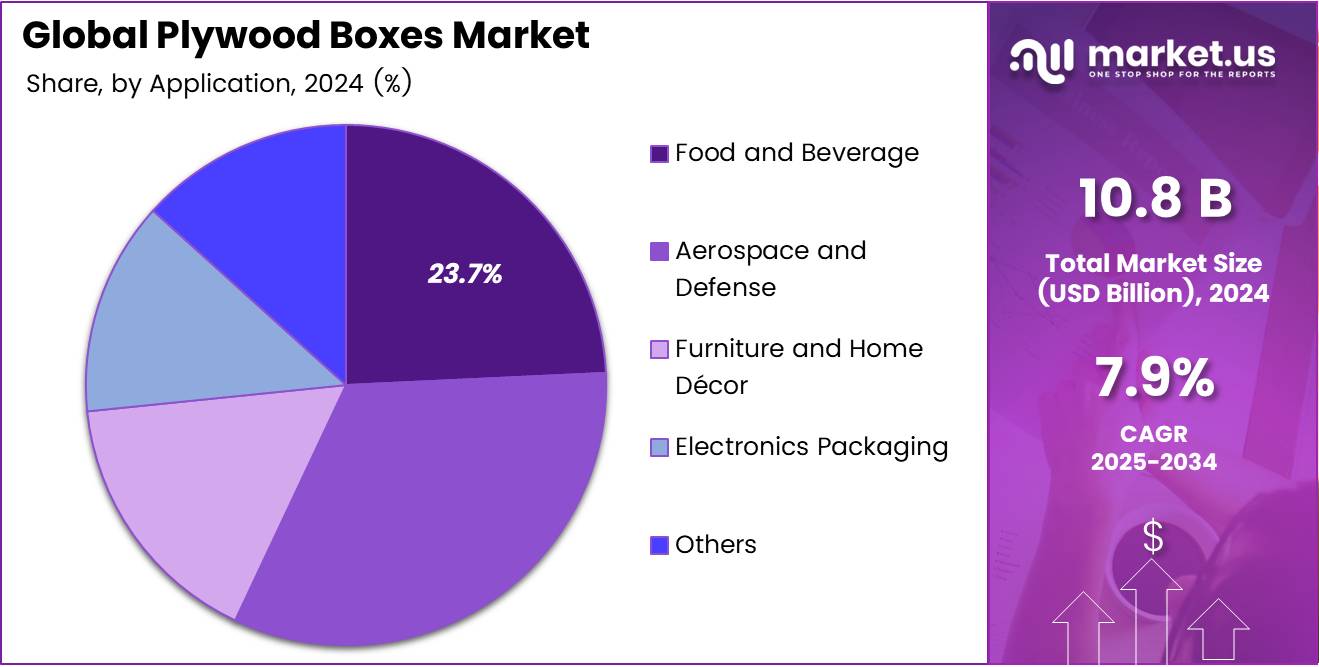

- Food and Beverage applications accounted for a 23.7% share in 2024, emphasizing strict standards and rising food trade needs.

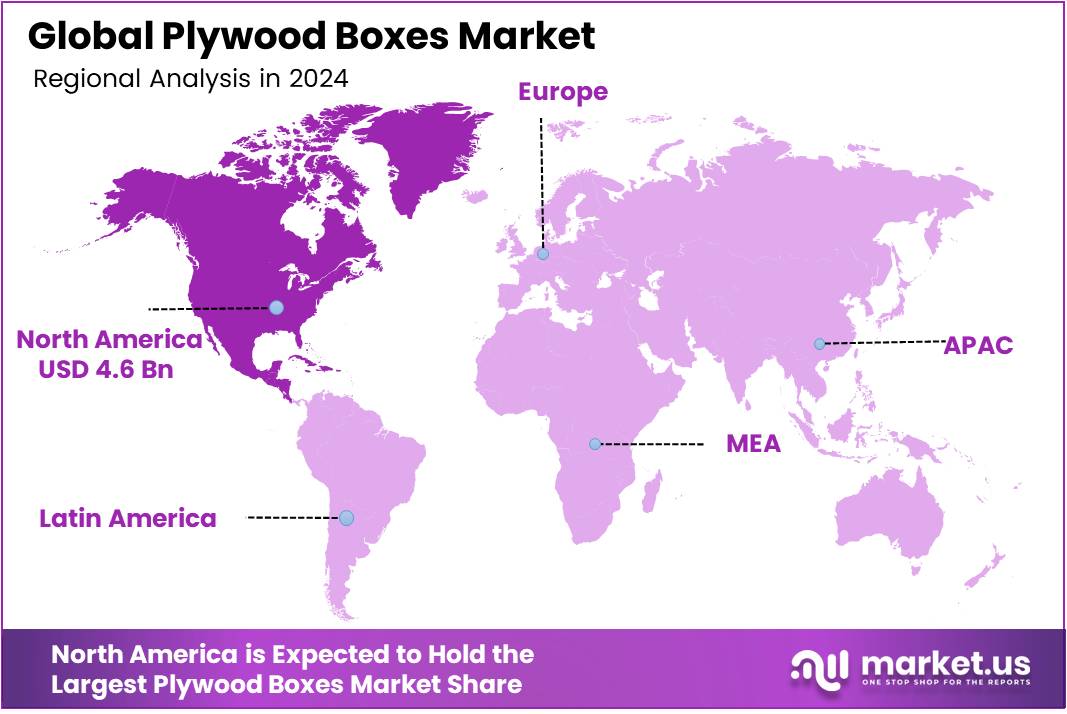

- North America remained the largest regional market with 42.8% of demand in 2024, valued at USD 4.6 Billion, supported by logistics strength, safety norms, and sustainability initiatives.

Product Type Analysis

Standard Plywood Boxes dominates with 31.9% due to their versatility and cost-effectiveness across multiple industries.

In 2024, Standard Plywood Boxes held a dominant market position in By Product Type Analysis segment of Plywood Boxes Market, with a 31.9% share. This leadership position stems from their universal applicability and balanced performance characteristics that meet diverse packaging requirements.

Customized Plywood Boxes represent a growing segment, catering to specialized industry needs where standard dimensions and features are insufficient. These solutions command premium pricing due to their tailored design and engineering requirements.

Heavy-Duty Plywood Boxes serve critical applications in industrial and commercial sectors where maximum strength and durability are paramount. Their robust construction makes them ideal for heavy machinery and equipment transport.

Lightweight Plywood Boxes address the growing demand for cost-effective shipping solutions, particularly in e-commerce and retail sectors where weight reduction translates to lower logistics costs.

Design Features Analysis

Stackable Plywood Boxes dominates with 29.3% due to their space optimization benefits and logistics efficiency.

In 2024, Stackable Plywood Boxes held a dominant market position in By Design Features Analysis segment of Plywood Boxes Market, with a 29.3% share. This dominance reflects the critical importance of storage and transportation efficiency in modern supply chains.

Waterproof Plywood Boxes cater to industries requiring moisture protection, particularly in marine, pharmaceutical, and food packaging applications. Their specialized coating and sealing technologies command higher market values.

Insulated Plywood Boxes serve temperature-sensitive cargo requirements, especially in pharmaceutical and food industries where thermal protection is essential for product integrity.

Foldable Plywood Boxes offer innovative space-saving solutions for return logistics and storage optimization, appealing to companies focused on sustainable packaging practices and cost reduction.

Size Analysis

Medium Sized boxes dominates with 45.2% due to their optimal balance between capacity and handling convenience.

In 2024, Medium Sized held a dominant market position in By Size Analysis segment of Plywood Boxes Market, with a 45.2% share. This substantial market leadership reflects the preference for boxes that offer practical handling while maximizing cargo capacity.

Small Sized boxes serve specialized applications requiring precise packaging dimensions, particularly in electronics and pharmaceutical industries where product protection and space efficiency are crucial.

Medium Sized boxes represent the sweet spot for most industrial applications, providing adequate volume capacity while maintaining manageable weight and dimensions for standard handling equipment and transportation vehicles.

Large Sized boxes cater to bulk packaging requirements in industries such as furniture, machinery, and construction materials, where maximum volume utilization outweighs handling convenience considerations.

Application Analysis

Food and Beverage dominates with 23.7% due to stringent packaging requirements and growing export demands.

In 2024, Food and Beverage held a dominant market position in By Application Analysis segment of Plywood Boxes Market, with a 23.7% share. This leadership position reflects the industry’s strict packaging standards and the global expansion of food trade.

Aerospace and Defense applications demand the highest quality standards and specialized certifications, driving premium pricing despite smaller volume requirements. These boxes must meet rigorous safety and security specifications.

Furniture and Home Décor represents a stable market segment with consistent demand driven by residential and commercial construction activities. The focus on protective packaging for high-value items sustains steady growth.

Electronics Packaging requires precise dimensional tolerances and anti-static properties to protect sensitive components during transportation. This segment benefits from the continued expansion of technology manufacturing.

Others category encompasses diverse applications including automotive parts, medical equipment, and industrial components, reflecting the versatile nature of plywood box packaging solutions.

Key Market Segments

By Product Type

- Standard Plywood Boxes

- Customized Plywood Boxes

- Heavy-Duty Plywood Boxes

- Lightweight Plywood Boxes

By Design Features

- Stackable Plywood Boxes

- Waterproof Plywood Boxes

- Insulated Plywood Boxes

- Foldable Plywood Boxes

By Size

- Small Sized

- Medium Sized

- Large Sized

By Application

- Food and Beverage

- Aerospace and Defense

- Furniture and Home Décor

- Electronics Packaging

- Others

Drivers

Rising Demand for Durable and Reusable Packaging in Logistics and Exports Drives Market Growth

The plywood boxes market is experiencing strong growth due to the rising demand for durable and reusable packaging in logistics and exports. Plywood boxes provide superior strength and can handle heavy loads, making them a preferred choice for long-distance shipments. Their reusability reduces overall packaging costs for exporters.

The market is further supported by growing adoption of eco-friendly packaging solutions over plastics. With increasing pressure to reduce plastic waste, many companies are shifting towards sustainable wooden packaging. Plywood boxes are biodegradable, recyclable, and align with green packaging trends, giving them a competitive edge in global trade.

Expansion of e-commerce and global trade activities is another significant driver. With increasing international shipments of consumer goods, electronics, and industrial equipment, plywood boxes ensure secure transportation. Their resistance to pressure and damage during transit makes them highly reliable for bulk packaging in cross-border trade.

Additionally, increasing use of plywood boxes for heavy-duty industrial equipment transportation is strengthening the market outlook. Industries such as automotive, machinery, and chemicals rely on robust packaging to protect high-value equipment during exports. Plywood boxes provide the durability and customization required, boosting their adoption across industrial supply chains.

Restraints

Fluctuations in Raw Material Prices Affecting Production Cost Challenges Market Stability

The plywood boxes market faces restraints due to frequent fluctuations in raw material prices, particularly wood. Any sudden increase in timber costs directly impacts manufacturing expenses, reducing profit margins for packaging companies. This cost instability makes pricing less predictable for customers.

In addition, stringent government regulations on deforestation and timber usage are limiting market expansion. Many countries have introduced strict policies to ensure sustainable forest management, which restricts raw material supply. While these regulations promote environmental conservation, they also raise compliance costs for manufacturers.

The combination of rising production costs and regulatory hurdles creates supply chain challenges. Manufacturers are forced to balance between meeting sustainability norms and maintaining competitive prices. Smaller producers, in particular, struggle to absorb these rising costs, which limits their participation in the market.

As demand grows globally, these restraints highlight the importance of innovation and alternative raw material sourcing. Without addressing cost volatility and regulatory restrictions, the growth potential of the plywood boxes market may face constraints in the long term.

Growth Factors

Development of Lightweight and Strong Plywood Boxes Creates New Growth Opportunities

The plywood boxes market is witnessing opportunities through the development of lightweight yet strong box variants. These innovative solutions reduce shipping costs while maintaining durability, making them highly attractive for exporters seeking efficiency in packaging.

Rising adoption in pharmaceuticals and electronics exports is also driving opportunities. Both sectors require sturdy packaging to protect sensitive products during international transit. Plywood boxes offer superior safety compared to cardboard alternatives, ensuring compliance with global export standards.

Customizable plywood packaging solutions are gaining traction in the premium and luxury goods sector. High-end brands are increasingly adopting personalized and branded plywood boxes for safe yet stylish packaging. This trend enhances the market appeal beyond just industrial use.

As demand shifts towards sustainable, cost-effective, and specialized packaging, companies offering innovative plywood solutions stand to gain a competitive edge. These opportunities underline a promising future for plywood boxes across multiple industries.

Emerging Trends

Integration of RFID and Smart Tracking Technology Shapes Market Trends

A key trend in the plywood boxes market is the integration of RFID tags and smart tracking systems. These technologies improve supply chain visibility, allowing real-time monitoring of shipments. Exporters are adopting such solutions to enhance security and efficiency.

Growing preference for heat-treated and pest-resistant plywood boxes is also shaping trends. International trade regulations often require pest-free packaging materials. Heat-treated plywood ensures compliance, reduces the risk of infestation, and supports smooth customs clearance in global exports.

Another notable trend is the rising use of biodegradable coatings for wooden packaging. These coatings enhance resistance against moisture and extend product life while maintaining sustainability. Companies are increasingly investing in such eco-friendly innovations to meet global green packaging demands.

Together, these trends reflect a market shifting towards technology integration and sustainability. As industries modernize their logistics and supply chains, plywood boxes are evolving from traditional packaging solutions to advanced, value-added products.

Regional Analysis

North America Dominates the Plywood Boxes Market with a Market Share of 42.8%, Valued at USD 4.6 Billion

North America remains the anchor of demand as exporters, OEMs, and 3PLs prioritize durable, reusable wood packaging for machinery, automotive components, and industrial supplies. A mature logistics network and stricter safety norms sustain premium adoption across heavy-duty and custom SKUs. Sustainability programs keep wood competitive versus plastics, while e-commerce fulfillment adds consistent volume. Overall, North America accounted for 42.8% of demand, valued at USD 4.6 Billion.

Europe Plywood Boxes Market Trends

Europe shows steady uptake supported by automotive, aerospace, and engineered equipment exports that require high-strength crating. EU packaging and waste directives favor recyclable, repairable wood systems, reinforcing plywood over single-use formats in B2B flows. Strict phytosanitary compliance and standardized pallets streamline intra-EU trade. Eastern Europe’s cost advantages and rising contract manufacturing bolster regional supply.

Asia Pacific Plywood Boxes Market Trends

Asia Pacific expands on the back of large-scale manufacturing for electronics, machinery, pharmaceuticals, and renewables equipment. Export-oriented clusters and deep-sea ports create persistent demand for seaworthy, ISPM-15 compliant plywood boxes. Rapid e-commerce and cross-border fulfillment add recurring shipments for consumer durables. Investments in port capacity and industrial corridors in China, India, and ASEAN enhance throughput and packaging intensity.

Middle East and Africa Plywood Boxes Market Trends

ME&A demand is underpinned by project cargo for energy, utilities, and infrastructure, where heavy-duty crating protects high-value equipment. Economic diversification and free zones improve logistics efficiency, lifting wood packaging rotations. Import dependence for plywood sheets can influence costs, but resilient supply lines are forming via key ports. Moisture-resistant and treated boxes gain traction for desert and coastal conditions.

Latin America Plywood Boxes Market Trends

Latin America benefits from agribusiness, mining equipment, and industrial machinery exports requiring robust crating. Nearshoring and tighter North American supply chains stimulate demand for standardized and stackable plywood formats. Local timber resources support regional conversion, while currency swings shape sourcing strategies. Compliance with export standards drives upgrades to heat-treated, certified boxes.

U.S. Plywood Boxes Market Trends

The U.S. segment is reinforced by reshoring in advanced manufacturing and resilient capital-goods exports. Retail fulfillment and parcel networks favor reusable wood solutions for bulky and fragile items. Exporters prioritize ISPM-15 compliant, custom-engineered boxes with shock and moisture protection. Sustainability expectations and chain-of-custody certifications increasingly influence supplier selection and box specifications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Plywood Boxes Company Insights

In 2024, the global plywood boxes market witnessed steady contributions from leading manufacturers, each focusing on durability, customization, and sustainable solutions to meet evolving industrial and logistics needs. These players strengthened their positions by offering value-added features and adapting to global trade expansion.

Nefab Group maintained a strong foothold through its focus on sustainable packaging solutions and innovative plywood box designs for international shipping. The company’s emphasis on reducing environmental impact while ensuring supply chain efficiency allowed it to gain recognition in industries such as automotive and electronics where protective packaging is essential.

DNA Packaging Systems leveraged its expertise in custom plywood packaging, particularly for export-oriented businesses. The firm emphasized creating heavy-duty and reusable solutions to meet the demands of global logistics. Its specialization in tailor-made packaging for sensitive equipment supported its growing customer base in industrial manufacturing sectors.

Bharadwaj Packaging strengthened its presence in the Asian market with cost-effective plywood box offerings, addressing rising demand from domestic and international exporters. The company’s focus on affordable yet durable solutions positioned it as a reliable supplier for SMEs seeking dependable packaging for long-distance shipments.

Technomar & Adrem built its competitiveness by integrating advanced engineering into plywood packaging systems. The company’s designs emphasized precision, durability, and versatility, making them suitable for both heavy-duty machinery and delicate goods. Its strategic adaptability to global shipping requirements enhanced its standing in the European market.

Top Key Players in the Market

- Nefab Group

- DNA Packaging Systems

- Bharadwaj Packaging

- Technomar & Adrem

- Davpack

- Air Sea Packing

- Savopak

- WoodenboxUK

Recent Developments

- In May 2025, Dansk Træemballage A/S completed the acquisition of AB Karl Hedin Emballage, strengthening its footprint in the Scandinavian wood packaging sector. The deal is expected to enhance production capacity and broaden market access.

- In January 2025, HS Timber Group acquired the Latvian wood processing company Vika Wood, securing a stronger supply chain presence in the Baltic region. This move aims to support sustainable sourcing and expand the group’s wood product portfolio.

- In January 2025, PEC Packaging secured £2.5 million in funding from Skipton Business Finance, providing financial support to scale operations. The funding is anticipated to drive expansion into new product categories and strengthen working capital.

- In September 2024, White & Case advised Evolem on its acquisition of Groupe Alipa’s industrial packaging division, enhancing Evolem’s industrial packaging solutions. The transaction reflects growing consolidation in the European packaging sector.

- In May 2024, Fiberwood raised €7.7 million to advance ecological building insulation and packaging materials. The investment supports the company’s mission to replace fossil-based packaging with sustainable alternatives in European markets.

Report Scope

Report Features Description Market Value (2024) USD 10.8 Billion Forecast Revenue (2034) USD 23.1 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standard Plywood Boxes, Customized Plywood Boxes, Heavy-Duty Plywood Boxes, Lightweight Plywood Boxes), By Design Features (Stackable Plywood Boxes, Waterproof Plywood Boxes, Insulated Plywood Boxes, Foldable Plywood Boxes), By Size (Small Sized, Medium Sized, Large Sized), By Application (Food and Beverage, Aerospace and Defense, Furniture and Home Décor, Electronics Packaging, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nefab Group, DNA Packaging Systems, Bharadwaj Packaging, Technomar & Adrem, Davpack, Air Sea Packing, Savopak, WoodenboxUK Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nefab Group

- DNA Packaging Systems

- Bharadwaj Packaging

- Technomar & Adrem

- Davpack

- Air Sea Packing

- Savopak

- WoodenboxUK