Global Plenoptic Camera Market Size, Share, Growth Analysis By Product (Standard Plenoptic Camera, Focused Plenoptic Camera, Coded Aperture Camera), By Application (Industrial, Individual, Enterprise), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173030

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

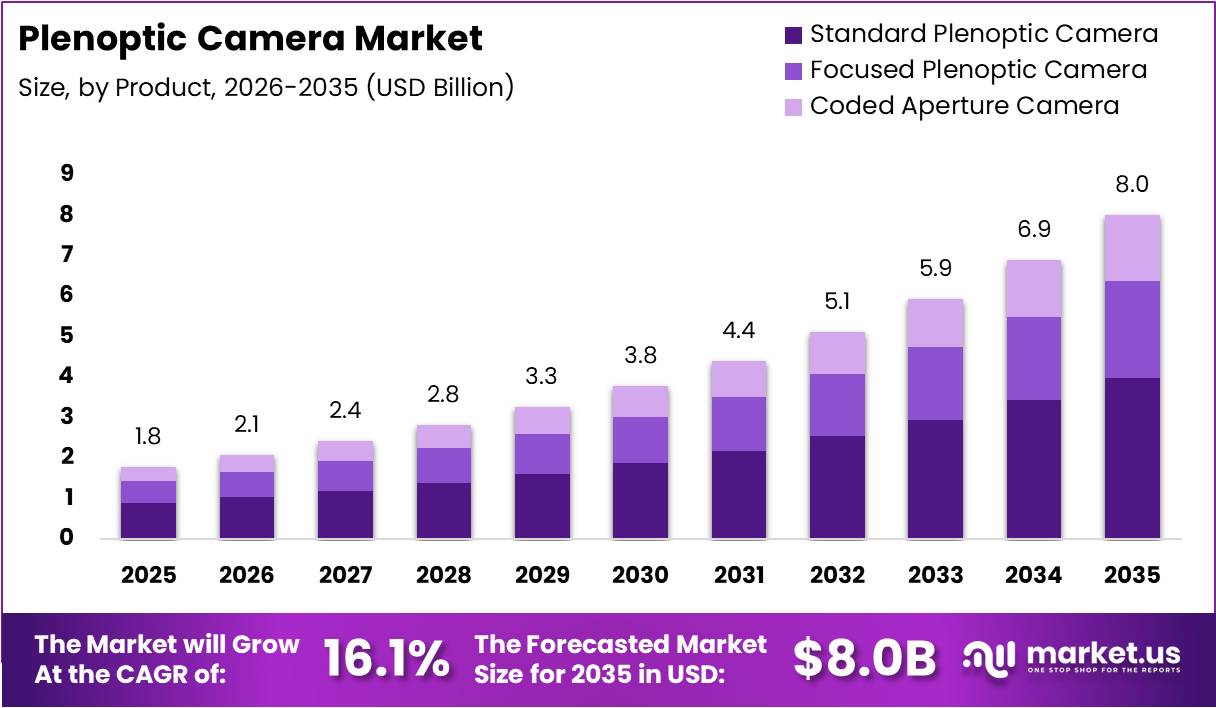

The Global Plenoptic Camera Market size is expected to be worth around USD 8.0 Billion by 2035, from USD 1.8 Billion in 2025, growing at a CAGR of 16.1% during the forecast period from 2026 to 2035.

The plenoptic camera market represents a transformative segment within advanced imaging technology. These light-field cameras capture comprehensive spatial and angular information simultaneously, enabling post-capture refocusing capabilities. Industries increasingly adopt this technology for three-dimensional mapping, robotics, and medical imaging applications. Market expansion accelerates as manufacturing costs decrease and computational processing power improves significantly.

Growth prospects appear robust as automotive manufacturers integrate plenoptic systems for autonomous navigation solutions. Healthcare providers leverage this technology for minimally invasive surgical procedures requiring precise depth perception. Subsequently, the industrial inspection sector demonstrates strong adoption rates, particularly in quality control and defect detection applications where traditional imaging proves insufficient.

Opportunity emerges prominently within augmented reality and virtual reality ecosystems demanding immersive content creation. Entertainment industries transition toward light-field cinematography, enabling viewers to experience dynamic perspective shifts. Furthermore, scientific research institutions employ plenoptic cameras for microscopy and particle tracking, expanding the addressable market beyond commercial applications into specialized academic domains.

Government investment patterns reflect strategic priorities in defense and aerospace imaging capabilities. Regulatory frameworks increasingly mandate advanced safety systems in vehicles, indirectly stimulating plenoptic camera adoption. Consequently, public-private partnerships accelerate research initiatives, particularly in nations prioritizing technological sovereignty and innovation leadership within photonics sectors.

Technical advancements demonstrate impressive precision metrics that validate commercial viability across demanding applications. According to research , plenoptic cameras achieve depth accuracy reaching 0.5 mm with precision maintained at ±0.2 mm at medium operational distances. The metric calibration accuracy stands at 1.14 ± 0.80 mm for plenoptic camera systems and 1.57 ± 0.90 mm for hand-eye calibration configurations, per academic evaluations.

Performance testing reveals operational versatility across extensive distance ranges. Evaluations conducted with 50 mm lens configurations covered ranges from 1 m to 30 m, while 100 mm lens setups demonstrated functionality from 2 m to 100 m, according to technical assessments. These specifications position plenoptic technology competitively against conventional stereo vision systems across industrial metrology applications.

Key Takeaways

- The Global Plenoptic Camera Market is expected to reach USD 1.8 Billion in 2025, growing to USD 8.0 Billion by 2035 at a CAGR of 16.1%.

- Standard Plenoptic Camera dominates the By Product segment with a 49.8% market share due to its established technology and reliable light-field capture capabilities.

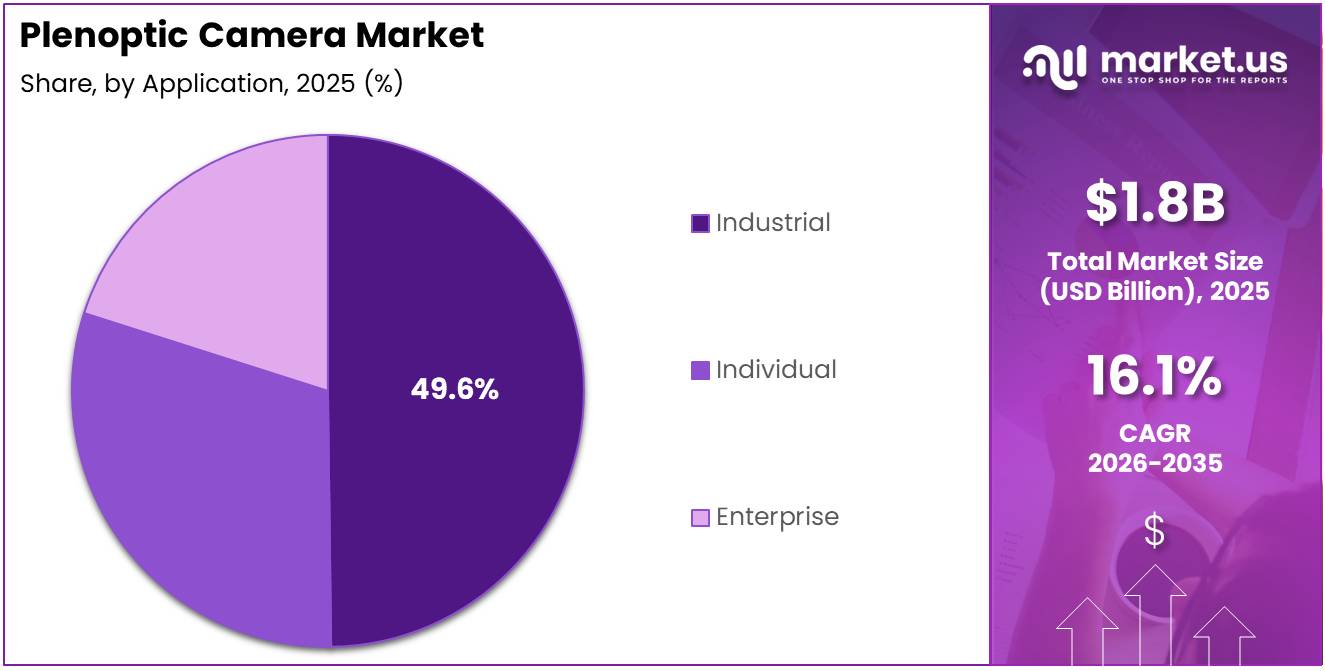

- In the By Application segment, Industrial leads with a 49.6% share, driven by demand for precise dimensional measurement, defect detection, and quality assurance.

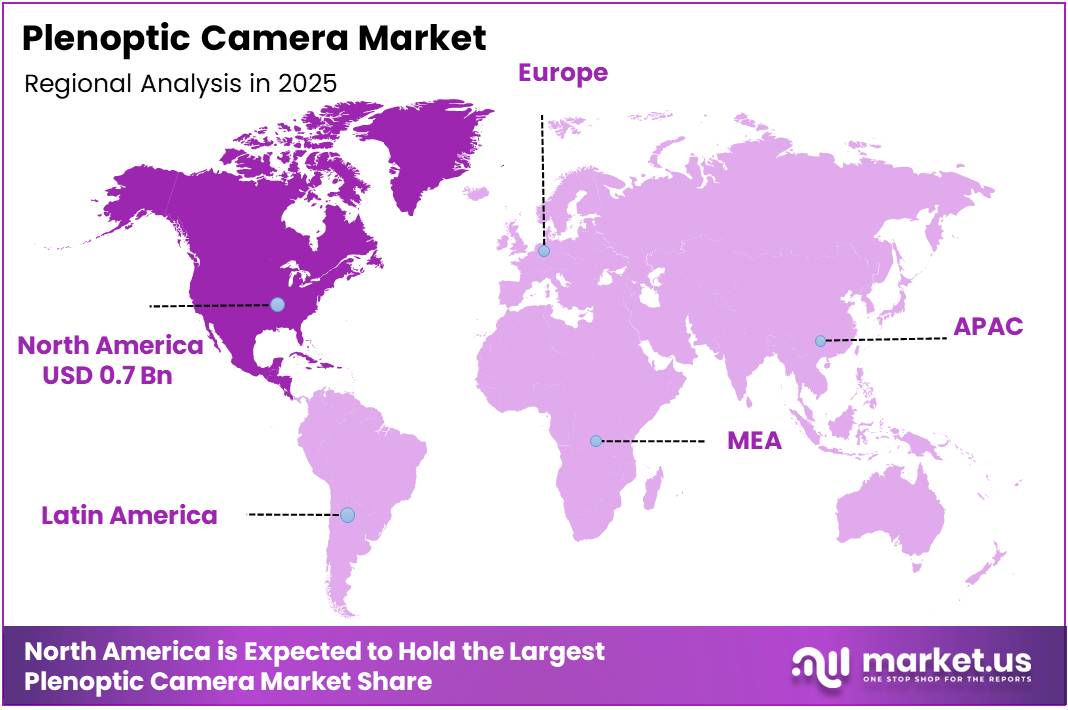

- North America dominates the regional market with a 39.6% share, valued at USD 0.7 Billion, supported by high technology adoption and R&D investments.

By Product Analysis

Standard Plenoptic Camera dominates with 49.8% due to its established technology and reliable light-field capture capabilities.

In 2025, Standard Plenoptic Camera held a dominant market position in the By Product Analysis segment of Plenoptic Camera Market, with a 49.8% share. This segment leads primarily because of its well-established technological framework and proven performance in capturing comprehensive light-field data. Standard plenoptic cameras utilize microlens arrays positioned at the focal plane, enabling them to record both spatial and angular information simultaneously.

Focused Plenoptic Camera represents an advanced variation that enhances spatial resolution by positioning microlens arrays away from the focal plane. This configuration allows for improved image quality and better detail capture, making it particularly valuable for applications requiring high-resolution output. The segment continues gaining traction among professional photographers and specialized industrial users who prioritize image clarity over traditional light-field recording methods.

Coded Aperture Camera employs innovative computational imaging techniques using specially designed aperture patterns to capture light-field information. This approach offers unique advantages in terms of flexibility and post-processing capabilities, enabling sophisticated image manipulation and depth estimation. The technology appeals to researchers and developers exploring next-generation imaging solutions for emerging applications.

By Application Analysis

Industrial dominates with 49.6% due to increasing demand for advanced quality control and 3D measurement solutions.

In 2025, Industrial held a dominant market position in the By Application Analysis segment of Plenoptic Camera Market, with a 49.6% share. This segment’s leadership stems from the growing need for precise dimensional measurements, defect detection, and quality assurance processes across manufacturing sectors. Industrial applications leverage plenoptic cameras’ ability to capture depth information in single shots, significantly streamlining inspection workflows and reducing production downtime while ensuring consistent product quality standards.

Individual application encompasses consumer-oriented uses including photography enthusiasts, content creators, and hobbyists exploring creative imaging possibilities. This segment benefits from increasing accessibility to light-field technology and growing interest in innovative photography techniques that enable post-capture focus adjustment and perspective shifting. The democratization of plenoptic technology drives gradual adoption among individual users seeking enhanced creative control.

Enterprise application covers business implementations across sectors like healthcare, architecture, virtual reality development, and professional media production. Organizations utilize plenoptic cameras for specialized documentation, immersive content creation, and advanced visualization projects. The segment experiences steady growth as enterprises recognize the strategic value of light-field imaging for differentiated service offerings and operational improvements.

Key Market Segments

By Product

- Standard Plenoptic Camera

- Focused Plenoptic Camera

- Coded Aperture Camera

By Application

- Industrial

- Individual

- Enterprise

Drivers

Growing Adoption of Plenoptic Cameras in Computational Photography Drives Market Expansion

The plenoptic camera market is experiencing significant growth due to increasing adoption in computational photography and light field imaging applications. These cameras capture both the intensity and direction of light rays, enabling users to refocus images after capture and create detailed depth maps. This capability is particularly valuable for professional photographers and content creators seeking advanced imaging solutions.

Depth mapping and 3D imaging requirements in robotics and machine vision systems are fueling market demand. Industries are deploying plenoptic cameras for precise object recognition, spatial analysis, and navigation tasks. The technology provides superior depth perception compared to traditional cameras, making it essential for automated systems.

Continuous technological advancements in micro-lens arrays and image sensor design are improving camera performance and affordability. Manufacturers are developing more efficient sensors with higher resolution and better light capture capabilities, making plenoptic technology more accessible to various industries.

The medical and scientific research sectors show rising demand for advanced imaging solutions. Plenoptic cameras enable researchers to capture detailed 3D structures of microscopic specimens and biological tissues. This technology supports breakthrough discoveries in life sciences, pharmaceutical research, and diagnostic imaging applications where precise depth information is critical.

Restraints

Complex Light Field Data Processing Challenges Limit Market Growth

The plenoptic camera market faces significant restraints due to complex light field data processing and image reconstruction challenges. These cameras generate massive amounts of data that require sophisticated algorithms and substantial computational power to process. The raw light field data must be converted into usable images through complex mathematical operations, which can be time-consuming and resource-intensive. This complexity creates barriers for end-users who lack technical expertise or access to high-performance computing systems.

Many organizations struggle with implementing the necessary software infrastructure to handle light field processing efficiently. The learning curve associated with understanding and manipulating light field data is steep, requiring specialized training and skills. This technical barrier slows down adoption rates across various industries that could otherwise benefit from the technology.

Limited market awareness and low penetration outside specialized applications further restrain growth. Plenoptic cameras remain largely confined to niche sectors such as academic research, high-end industrial applications, and specialized medical imaging. Most potential users in mainstream markets are unfamiliar with light field technology and its advantages over conventional cameras. The lack of widespread understanding about practical benefits and use cases prevents broader market penetration and limits commercial opportunities for manufacturers.

Growth Factors

Expanding Integration in Autonomous Vehicles and ADAS Creates Growth Opportunities

The plenoptic camera market presents substantial growth opportunities through expanding integration in autonomous vehicles and advanced driver assistance systems (ADAS). These cameras provide precise depth perception and 3D environmental mapping essential for safe navigation and obstacle detection. Automotive manufacturers are increasingly recognizing the value of light field technology for improving vehicle safety and autonomous driving capabilities.

Virtual reality and augmented reality applications are driving rising demand for light field cameras. Content creators and developers need plenoptic technology to capture realistic 3D scenes that provide immersive experiences. The gaming and entertainment industries are exploring light field imaging to create more engaging and interactive content for users.

Industrial automation, inspection, and quality assurance sectors show increasing adoption of plenoptic cameras. Manufacturers are deploying these systems for defect detection, dimensional measurement, and product verification with unprecedented accuracy. The technology enables non-contact inspection of complex parts and assemblies, reducing production errors and improving efficiency.

Growing academic and research focus on next-generation light field imaging systems is accelerating innovation. Universities and research institutions are investing in developing improved algorithms, compact hardware, and novel applications. This R&D activity is creating new use cases and expanding the technology’s potential across multiple industries.

Emerging Trends

AI and Machine Learning Integration Shapes Plenoptic Image Processing Trends

The plenoptic camera market is witnessing important trending factors, with AI and machine learning integration transforming plenoptic image processing capabilities. Advanced algorithms are automating complex light field reconstruction tasks, reducing processing time and improving image quality. Machine learning models are being trained to extract depth information more accurately and handle various lighting conditions efficiently. This integration makes plenoptic technology more practical and accessible for real-world applications.

Development of compact and portable plenoptic camera modules is gaining momentum. Manufacturers are miniaturizing components and optimizing designs to create lightweight, easy-to-deploy systems. These portable solutions are opening new markets in mobile robotics, drone imaging, and handheld devices where space and weight constraints previously limited adoption.

Hybrid imaging solutions combining light field and conventional camera technologies are emerging as popular options. These systems offer flexibility by providing both traditional high-resolution images and light field capabilities in single devices. Users can switch between modes based on specific application requirements.

Increasing collaboration between imaging hardware manufacturers and software providers is accelerating market development. Partnerships are creating integrated solutions with optimized hardware-software combinations that deliver better performance and user experience for various industry applications.

Regional Analysis

North America Dominates the Plenoptic Camera Market with a Market Share of 39.6%, Valued at USD 0.7 Billion

North America maintains its position as the leading region in the plenoptic camera market, commanding a market share of 39.6% with a valuation of USD 0.7 billion. The region’s dominance is attributed to strong technology adoption, significant R&D investments, and extensive applications across industrial manufacturing, entertainment, and medical imaging sectors.

Europe Plenoptic Camera Market Trends

Europe represents a significant market for plenoptic cameras, driven by technological innovation and increasing adoption across industrial automation and automotive sectors. The region benefits from substantial photonics research investments, established manufacturing industries in Germany, France, and the UK, and growing demand for advanced driver assistance systems and precision manufacturing applications.

Asia Pacific Plenoptic Camera Market Trends

The Asia Pacific region is experiencing rapid growth in the plenoptic camera market, driven by expanding manufacturing capabilities and increasing industrial automation investments. Countries like China, Japan, and South Korea lead market development with their strong electronics base, growing robotics and machine vision applications, and government initiatives promoting smart manufacturing technologies.

Middle East and Africa Plenoptic Camera Market Trends

The Middle East and Africa region presents emerging opportunities for the plenoptic camera market, with gradual adoption driven by industrial modernization and infrastructure development. The market is supported by economic diversification efforts, increasing healthcare infrastructure investments, and growing interest in advanced surveillance and security applications, particularly in Gulf Cooperation Council countries.

Latin America Plenoptic Camera Market Trends

Latin America represents a developing market for plenoptic cameras, characterized by steady growth driven by increasing industrialization and technological modernization. The region’s expansion is supported by growing manufacturing automation, rising healthcare technology adoption, and increasing research activities, with Brazil and Mexico leading through their established industrial bases and automotive sectors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Plenoptic Camera Company Insights

In 2025, the global plenoptic camera market is shaped by a mix of specialized imaging innovators and established electronics leaders. The competitive landscape reflects rapid advancements in light‑field technology, with key players driving both hardware refinement and application expansion across consumer, industrial, and research segments.

Pelican Imaging Corp remains a pioneer in compact multi‑lens imaging solutions, focusing on enhancing depth capture and post‑capture refocusing capabilities. Its technology portfolio emphasizes integration with mobile devices and lightweight form factors, helping to broaden plenoptic adoption in mainstream markets.

Raytrix GmbH continues to lead in high‑resolution light‑field optics for scientific and industrial applications, offering modular plenoptic designs that support precision measurement and 3D reconstruction. The company’s specialized solutions strengthen its position in sectors where accuracy and depth fidelity are paramount.

Panasonic Corporation leverages its extensive imaging and sensor expertise to push plenoptic functionality into professional and broadcast systems. By combining traditional camera strengths with advanced light‑field processing, Panasonic aims to deliver enhanced creative control and workflow efficiencies for content creators.

Canon Inc integrates plenoptic technology into its broader ecosystem of photography and cinematography products, targeting both enthusiasts and professionals. Canon’s approach emphasizes seamless user experience and compatibility with existing lenses and platforms, reinforcing its brand value while fostering innovation in depth‑rich imaging.

Together, these companies illustrate distinct strategic priorities: Pelican’s mobile focus, Raytrix’s scientific precision, Panasonic’s professional orientation, and Canon’s ecosystem integration. Their collective efforts in 2025 underscore a market balancing niche specialization with broader commercial potential.

Top Key Players in the Market

- Pelican Imaging Corp

- Raytrix GmbH

- Panasonic Corporation

- Canon Inc

- Sony Corporation

- Samsung Electronics

- Axiom Optics

- Avegant Corp

- Japan Display Inc.

Recent Developments

- In March 2025, Canon Inc. announced the EOS R50 V, introducing a cinema-grade sensor designed for computational photography and advanced depth-mapping. This innovation supports the growing ‘creator-to-cinema’ light-field ecosystem, enabling filmmakers and content creators to capture highly detailed and immersive visuals.

- In January 2025, Canon developed a CMOS sensor with an unprecedented 410 Megapixels, marking the largest number of pixels ever achieved in a 35mm full-frame sensor. This breakthrough allows for ultra-high-resolution imaging and sets a new benchmark in professional photography and cinematography.

Report Scope

Report Features Description Market Value (2025) USD 1.8 Billion Forecast Revenue (2035) USD 8.0 Billion CAGR (2026-2035) 16.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Standard Plenoptic Camera, Focused Plenoptic Camera, Coded Aperture Camera), By Application (Industrial, Individual, Enterprise) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Pelican Imaging Corp, Raytrix GmbH, Panasonic Corporation, Canon Inc, Sony Corporation, Samsung Electronics, Axiom Optics, Avegant Corp, Japan Display Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pelican Imaging Corp

- Raytrix GmbH

- Panasonic Corporation

- Canon Inc

- Sony Corporation

- Samsung Electronics

- Axiom Optics

- Avegant Corp

- Japan Display Inc.