Global Platelet Function Test Market By Product Type (Systems, Accessories, and Reagents), By Application (Clinical Applications, Pharmaceutical Development, Research Applications, and Others), By End-user (Hospitals, Diagnostic Centers, Blood Banks, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165407

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

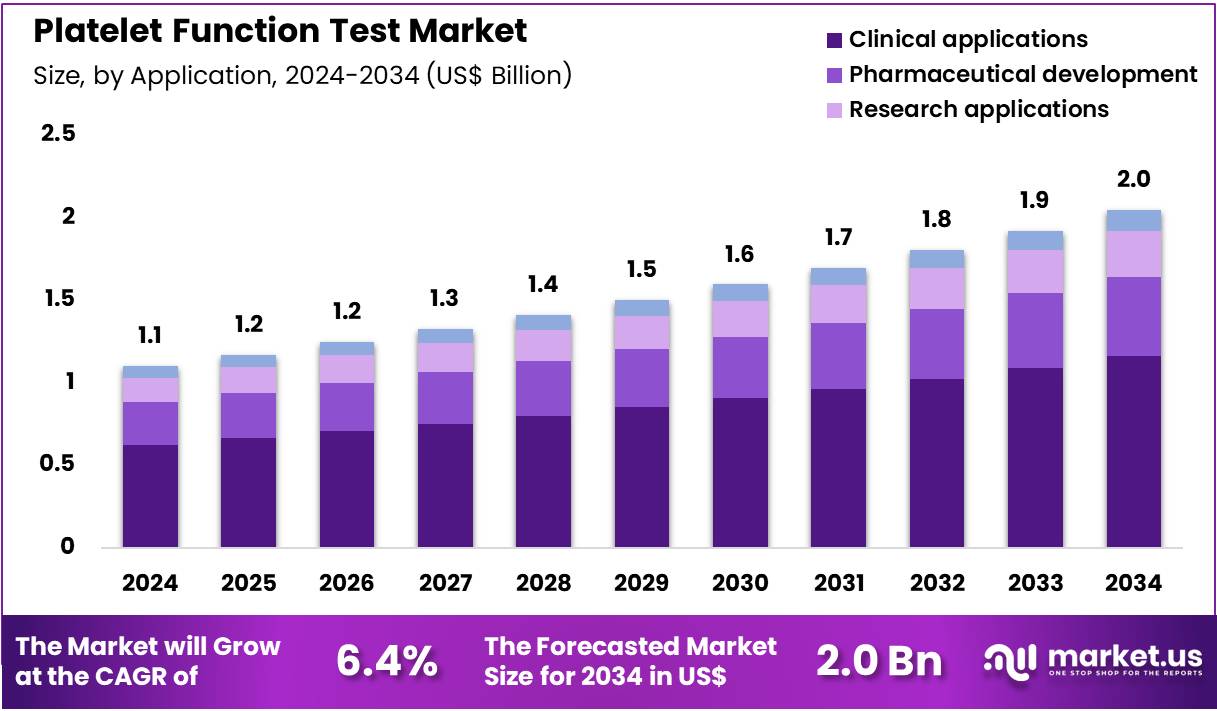

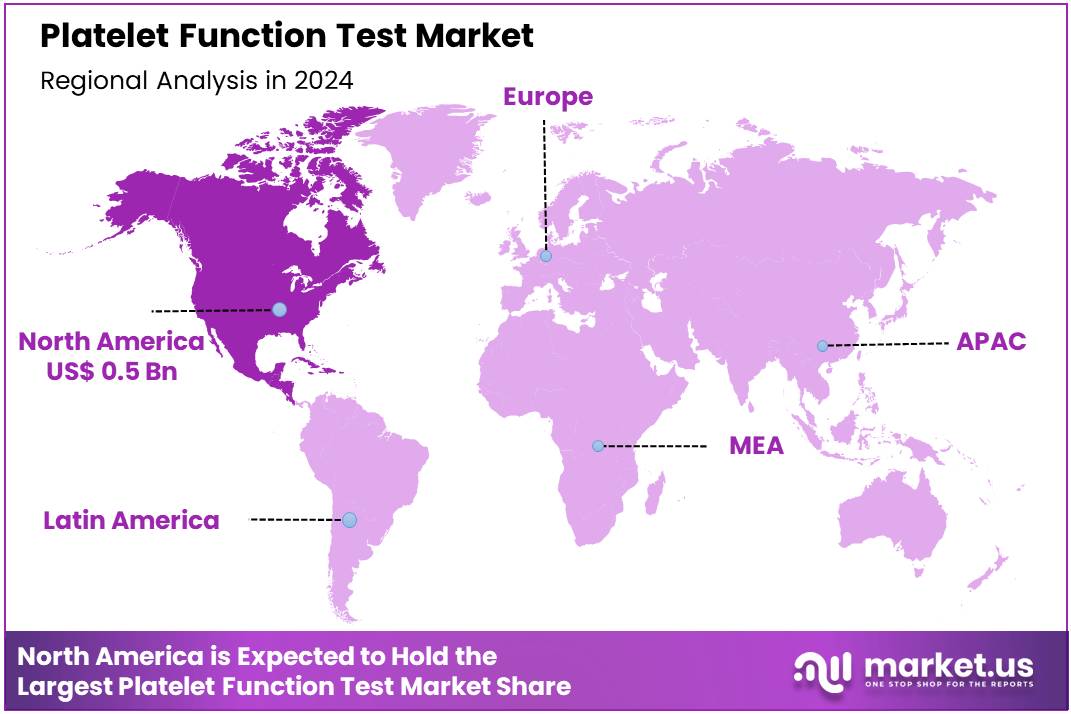

Global Platelet Function Test Market size is expected to be worth around US$ 2.0 Billion by 2034 from US$ 1.1 Billion in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.4% share with a revenue of US$ 0.5 Billion.

Increasing adoption of point-of-care platelet isolation drives the Platelet Function Test Market, as clinicians demand rapid autologous PRP preparation during interventions. Hematologists utilize compact devices like Exocube Set to generate PRP from whole blood in minutes, enabling immediate platelet function assessment in bleeding disorders. These systems support orthopedic procedures by providing real-time platelet activation profiles, optimizing regenerative therapy outcomes.

Research laboratories apply portable PFTs to evaluate drug-induced platelet inhibition, accelerating antiplatelet agent development. In September 2025, the FDA cleared the Exocube Set device by StemC Biyoteknoloji, validating decentralized PRP technologies for enhanced diagnostic efficiency. This approval accelerates market growth by reducing reliance on central labs and improving procedural accessibility.

Growing precision in thrombotic risk prediction creates opportunities in the Platelet Function Test Market, as microfluidic platforms replicate physiological shear conditions. Cardiologists deploy advanced PFTs to monitor clopidogrel response in coronary stent patients, tailoring dual antiplatelet therapy duration. These assays aid neurology by assessing aspirin efficacy in stroke prevention, guiding personalized secondary prophylaxis.

Automated microfluidic chips ensure reproducible aggregation measurements in high-volume settings. In December 2024, Frontiers in Bioengineering and Biotechnology research highlighted microfluidic devices mimicking arterial shear for accurate platelet function testing. This advancement drives market expansion through miniaturized, disposable systems ideal for bedside thrombotic risk evaluation.

Rising integration of regenerative applications propels the Platelet Function Test Market, as PFTs quantify PRP quality for therapeutic efficacy. Dermatologists measure growth factor release from activated platelets in aesthetic procedures, standardizing PRP treatment protocols. These tests support veterinary medicine by evaluating equine platelet function in tendon injury repair, advancing animal orthobiologics.

Trends toward multiplex PFT panels combine aggregation with adhesion metrics, offering comprehensive hemostasis insights. Portable analyzers with disposable cartridges streamline workflow in surgical suites. These innovations position the market for sustained growth by enhancing platelet-based therapy validation and standardization.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.1 Billion, with a CAGR of 6.4%, and is expected to reach US$ 2.0 Billion by the year 2034.

- The product type segment is divided into systems, accessories, and reagents, with systems taking the lead in 2023 with a market share of 49.8%.

- Considering application, the market is divided into clinical applications, pharmaceutical development, research applications, and others. Among these, clinical applications held a significant share of 56.7%.

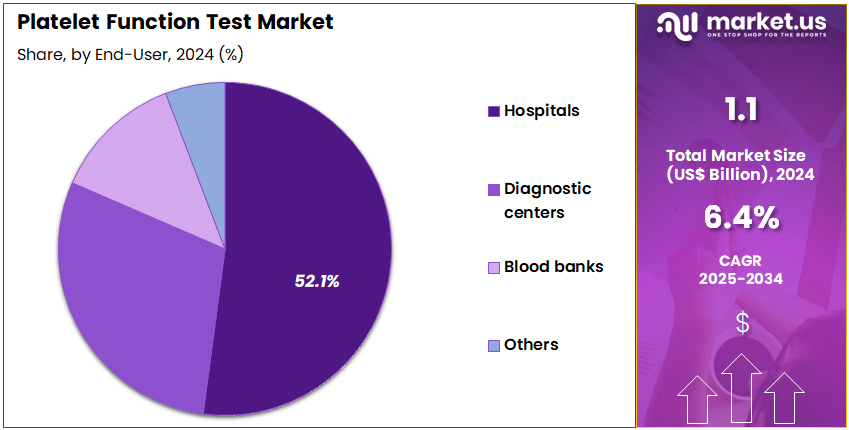

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic centers, blood banks, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 52.1% in the market.

- North America led the market by securing a market share of 41.4% in 2023.

Product Type Analysis

Systems hold 49.8% of the Platelet Function Test market and are anticipated to remain the leading product segment due to the growing preference for automated analyzers that provide rapid and precise platelet aggregation results. The increasing demand for standardized testing platforms in hospitals and research laboratories drives the adoption of platelet function testing systems. These instruments offer reproducibility, enhanced accuracy, and integration with digital data management platforms.

Manufacturers are investing in advanced systems featuring multiple detection methods, including optical and impedance aggregometry, for comprehensive platelet analysis. Rising awareness of antiplatelet therapy monitoring among clinicians supports system deployment in cardiovascular and hematology departments. Portable and user-friendly point-of-care testing systems are gaining popularity for emergency and surgical settings. .

Continuous innovation in cartridge-based analyzers with minimal blood volume requirements enhances patient convenience. Hospitals favor automated systems for consistent throughput in high-volume testing. As healthcare facilities expand their diagnostic capabilities for thrombotic and bleeding disorders, platelet function systems are projected to drive the segment’s continued growth globally.

Application Analysis

Clinical applications account for 56.7% of the Platelet Function Test market and are projected to dominate due to the growing prevalence of cardiovascular diseases and bleeding disorders requiring platelet activity assessment. The tests play a crucial role in monitoring patients receiving antiplatelet therapy, evaluating platelet function before surgeries, and diagnosing inherited platelet function defects. Rising incidences of coronary artery disease and stroke are amplifying the need for platelet function monitoring to ensure therapy efficacy.

Hospitals and diagnostic centers increasingly utilize platelet aggregation assays and flow cytometry in routine clinical settings. The adoption of these tests is further supported by global clinical guidelines recommending platelet monitoring for patients under dual antiplatelet therapy. Enhanced accessibility of point-of-care platelet function analyzers simplifies testing in emergency care environments.

Integration of automated reporting and interpretation tools improves clinical workflow efficiency. Continuous education among healthcare professionals about platelet diagnostics strengthens utilization rates. As precision medicine evolves, clinical platelet function testing is expected to remain essential for individualized therapy and cardiovascular risk management.

End-User Analysis

Hospitals contribute 52.1% of the Platelet Function Test market and are expected to retain their leading position owing to their high patient volume and advanced diagnostic infrastructure. These institutions serve as primary centers for testing patients undergoing cardiovascular interventions, hematologic evaluations, and preoperative screenings. The growing prevalence of conditions requiring antiplatelet therapy, such as myocardial infarction and stroke, fuels hospital-based testing demand. Integration of platelet function analyzers within hospital laboratories enhances diagnostic speed and reliability.

The presence of skilled pathologists and cardiologists supports precise result interpretation. Hospitals benefit from automation, allowing multiple sample analyses in a short time frame. Increasing government funding for hospital-based diagnostic modernization improves access to advanced testing technologies. Collaborations between hospitals and manufacturers for technology evaluation and clinical trials further accelerate adoption.

Additionally, hospital laboratories often serve as referral hubs for smaller diagnostic facilities, amplifying testing volumes. As hospitals continue prioritizing early detection and therapy optimization for thrombotic and bleeding disorders, their share in platelet function testing is anticipated to remain dominant globally..

Key Market Segments

By Product Type

- Systems

- Accessories

- Reagents

By Application

- Clinical Applications

- Pharmaceutical Development

- Research Applications

- Others

By End-user

- Hospitals

- Diagnostics Centers

- Blood Banks

- Others

Drivers

Increasing Prevalence of Cardiovascular Diseases is Driving the Market

The escalating burden of cardiovascular diseases has substantially propelled the platelet function test market, as these assays are vital for assessing antiplatelet drug efficacy and guiding personalized anticoagulation to prevent thrombotic events. Platelet function tests, employing methods like light transmission aggregometry and VerifyNow, quantify platelet reactivity, identifying non-responders to clopidogrel to mitigate stent thrombosis risks. This driver is particularly acute in post-percutaneous coronary intervention patients, where routine testing optimizes dual antiplatelet therapy durations.

Healthcare facilities are integrating these tests into cardiology protocols, leveraging point-of-care devices for immediate results in cath labs. The condition’s link to ischemic heart disease underscores the need for preemptive assessment, embedding tests in risk stratification algorithms. Public health priorities highlight their role in lowering mortality, subsidizing lab access for high-risk cohorts.

The Centers for Disease Control and Prevention reported 695,000 deaths from heart disease in the United States in 2022, accounting for one in five deaths and emphasizing the need for effective diagnostic tools. This mortality figure illustrates the clinical urgency, as tests enable tailored regimens to avert adverse outcomes. Enhancements in thromboelastography improve real-time accuracy, accommodating surgical contexts.

Economically, their deployment reduces readmissions, justifying investments in device fleets. International societies standardize reactivity thresholds, ensuring consistent interpretations globally. This cardiovascular prevalence not only amplifies test volumes but also solidifies assays’ integration in thrombotic risk frameworks. Collectively, it catalyzes refinements in multiplex formats, aligning evaluations with preventive cardiology imperatives.

Restraints

Regulatory and Quality Assurance Requirements is Restraining the Market

The rigorous regulatory and quality control standards for platelet function tests continue to impede market accessibility, as comprehensive validation mandates prolong approval timelines for new devices. These tests, demanding proof of precision across platelet agonists, often encounter extended FDA reviews, delaying clinical deployment. This restraint disproportionately impacts innovative point-of-care formats, where evidence of equivalence to lab standards lags.

Coverage discrepancies among payers aggravate the challenge, with Medicare’s determinations imposing stringent performance criteria for home use. Developers allocate substantial resources to compliance audits, diverting funding from innovation to documentation. The consequence sustains reliance on legacy systems, hindering adoption of advanced features like wireless connectivity. The Centers for Medicare & Medicaid Services indicated that Medicare Part B payments for clinical lab tests declined 10% to $8.4 billion in 2022 from $9.3 billion in 2021, reflecting volume constraints amid stable rates.

These reductions underscore fiscal pressures, as policy stabilizations hindered broader implementations. Clinician preferences for endorsed devices marginalize emerging alternatives. Efforts for harmonized endorsements progress methodically, limited by inter-device variabilities. These regulatory hurdles not only attenuate scalability but also perpetuate diagnostic delays. Thus, they necessitate collaborative validations to balance oversight with practical deployment.

Opportunities

Growth in Personalized Antiplatelet Therapy is Creating Growth Opportunities

The advancement of individualized antiplatelet regimens has unveiled significant prospects for the platelet function test market, facilitating tailored dosing based on reactivity profiles to enhance efficacy in high-risk patients. Personalized approaches, using tests to identify CYP2C19 poor metabolizers, enable switches to prasugrel or ticagrelor, reducing ischemic events post-stenting. Opportunities proliferate in pharmacogenomic integrations, where funding supports validations for combined genotyping and function assays.

Biopharma partnerships underwrite device optimizations, addressing gaps in clopidogrel response prediction. This customization counters uniform dosing limitations, positioning tests as enablers of precision cardiology. Appropriations for stratified trials hasten endorsements, diversifying toward integrated cardiovascular panels. The U.S. Food and Drug Administration approved 139 artificial intelligence-enabled medical devices in 2022, including tools for platelet function analysis in cardiovascular risk assessment. This endorsement validates extensible models, with adoptions projecting heightened reagent demands in therapeutic profiling.

Innovations in impedance aggregometry improve sensitivity for low-platelet samples, broadening utility in thrombocytopenia. As digital platforms mature, test outputs unlock predictive modeling revenues. These personalized evolutions not only diversify assay applications but also interweave the market into tailored cardiovascular architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising cardiovascular disease burdens and stronger focus on antiplatelet therapies motivate hematologists to integrate platelet function tests into standard protocols, enabling quicker adjustments to medications that reduce clotting risks and improve patient mobility. Robust insurance expansions for preventive cardiology further fuel device uptake in outpatient clinics, cutting emergency interventions and enhancing long-term care efficiency.

Sharp inflation spikes from global energy costs, however, pinch hospital procurement funds, pushing managers to postpone advanced aggregometer purchases and rely on manual methods that slow turnaround times. Geopolitical clashes in the Persian Gulf choke off resin supplies for test cartridges from petrochemical hubs, compelling vendors to chase spot markets and endure markup swings that disrupt quarterly planning.

Recent US tariff adjustments layer a 10% charge on foreign-sourced electrode strips and analyzers entering the market since mid-2025, hiking expenses for cross-border suppliers and forcing distributors to trim promotional budgets in competitive bids. These strains, nonetheless, rally domestic engineering teams to refine affordable, benchtop analyzers that bypass import chains and align with FDA fast-track approvals. Widening digital health platforms also link test results to patient apps, streamlining follow-ups and appealing to value-driven payers.

Latest Trends

Integration of Microfluidic and AI-Enabled Platelet Function Analyzers is a Recent Trend

The platelet function test market is witnessing a significant shift toward compact, AI-integrated analyzers designed for rapid and precise platelet activity assessment. Developers are introducing microfluidic-based systems capable of using minimal blood samples to measure platelet aggregation dynamics within minutes, improving efficiency in operating rooms and cardiac care settings. These innovations align with the growing demand for personalized antiplatelet therapy monitoring, allowing clinicians to adjust treatment based on real-time data.

Regulatory clearances for automated analyzers that interpret aggregation curves have accelerated clinical adoption, particularly in hospitals managing acute coronary syndromes. The integration of wireless data transfer enables seamless connectivity with electronic health records, supporting trend analysis and remote oversight. Diagnostic firms are also advancing multi-marker panels that assess platelet function alongside coagulation and endothelial parameters, enabling comprehensive clot-risk profiling. This transition toward intelligent, portable platforms underscores the industry’s emphasis on precision diagnostics, automation, and interoperability in thrombosis management.

Regional Analysis

North America is leading the Platelet Function Test Market

North America holds a 41.4% share of the global Platelet Function Test market, cementing its preeminence in hemostasis evaluation technologies amid 2024 developments. The sector realized marked progression in 2024, impelled by unrelenting cardiovascular morbidity that mandates precise platelet response evaluations to tailor antiplatelet regimens and mitigate ischemic recurrences in post-stent patients. The Centers for Disease Control and Prevention recorded 702,880 heart disease fatalities in the United States in 2023, a figure that perpetuates the urgency for rapid, reliable assays in emergency and outpatient venues to inform therapeutic decisions.

The National Heart, Lung, and Blood Institute directed US$2,037.3 million toward heart and vascular diseases research in fiscal year 2022, advancing to US$2,105.5 million in 2023 and US$2,106.4 million in 2024, financing investigations that incorporate advanced aggregometry for prognostic insights. Evolving consensus from the American Heart Association in 2024 advocated serial testing during dual antiplatelet therapy, institutionalizing these diagnostics within interventional cardiology suites.

Innovations in flow cytometry-based methods elevated sensitivity for clopidogrel resistance detection, aligning with surging percutaneous procedures. Payer alignments through the Affordable Care Act expanded coverage for high-risk cohorts, streamlining adoption in diverse clinical landscapes. These catalysts synergized to amplify North America’s sectoral vitality, outstripping worldwide paces via entrenched R&D pipelines and guideline endorsements.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The platelet aggregation diagnostics arena in Asia Pacific projects vigorous ascent during the forecast period, galvanized by intensifying thrombotic threats and amplified public surveillance frameworks. The World Health Organization documented 19.8 million cardiovascular fatalities worldwide in 2022, with Asia Pacific subregions confronting amplified incidences that necessitate scalable hemostasis profiling for stroke prevention strategies.

India’s National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke achieved screenings of 39.53 crore adults aged 30 and above by December 2024, a cumulative escalation that underscores commitments to proactive coagulation assessments in community health outposts.

China anticipates cardiovascular mortality to elevate from 0.39% of total deaths in 2021 to 0.46% in 2024 under evolving epidemiological patterns, spurring infrastructure for indigenous platelet function analyzers in urban hospitals. Southeast Asian alliances under the ASEAN Post-Ministerial Conference foster cross-border validations, customizing assays for regional pharmacogenomic variances.

National insurance expansions embed these tools within primary care reimbursements, countering urbanization-induced risks. This synergy estimates Asia Pacific to forge a commanding niche, exploiting epidemiological imperatives and sovereign investments to cultivate resilient testing ecosystems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent organizations in the coagulation assessment sector advance their operations by deploying advanced light transmission aggregometry systems that quantify platelet reactivity to multiple agonists, enabling cardiologists to refine antiplatelet therapy in high-risk patients. They forge strategic alliances with cardiovascular research institutes to co-validate point-of-care analyzers, accelerating clinical endorsements and integration into perioperative protocols.

Enterprises channel substantial investments into microfluidic cartridge innovations that deliver results in under five minutes, appealing to ambulatory care settings amid surging demand for personalized dosing. Executives execute selective buyouts of biosensor developers to incorporate impedance-based detection, enhancing portfolio versatility for veterinary and human applications.

They intensify commercialization in Europe and the Middle East, negotiating with national health services to embed solutions in thrombotic risk screening programs for tender-based volumes. Moreover, they introduce digital connectivity suites with subscription-based outcome tracking, deepening hospital engagements and anchoring diversified revenue through compliance consulting.

Sysmex Corporation, established on February 20, 1968, and headquartered in Kobe, Japan, engineers comprehensive in vitro diagnostic systems for hematology, hemostasis, and urinalysis, serving global laboratories with precision instruments that support over 200 countries. The firm deploys its CS-5100 series for automated platelet function evaluation, integrating flow cytometry and optical detection to guide therapeutic decisions in cardiovascular care.

Sysmex directs focused R&D toward automation enhancements, including AI-assisted flagging for abnormal aggregation patterns, as highlighted in its Sysmex Report 2025. CEO Hisashi Ietsugu leads a Tokyo Stock Exchange-listed entity with paid-in capital of ¥14,887.8 million as of March 31, 2025, emphasizing sustainable innovation and regulatory leadership. The company partners with clinical networks to refine testing workflows, advancing equitable access to coagulation insights. Sysmex reinforces its market preeminence by synergizing hardware reliability with data ecosystems to address evolving hemostatic challenges.

Top Key Players

- Aggredyne, Inc.

- Drucker Diagnostics

- Hoffmann-La Roche Ltd

- Fresenius SE & Co KGaA

- Haemonetics Corporation

- Helena Laboratories

- SENTINEL Ch. S.p.A

- Siemens AG

- Terumo BCT, Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

- In August 2025, Siemens Healthineers’ partnership with a major healthcare network marked a significant step in embedding platelet function testing into routine hospital workflows. The collaboration enhances test standardization and real-time data interpretation across clinical settings. This strategic move expands Siemens’ footprint in the PFT segment while promoting wider adoption of automated analyzers that optimize throughput and diagnostic precision.

- In September 2025, Roche Diagnostics introduced a next-generation platelet testing system capable of delivering rapid, high-sensitivity results. The launch directly supports the market’s demand for faster and more accurate testing in cardiology and surgery departments. Roche’s innovation not only diversifies its diagnostics portfolio but also underscores the global trend toward integrating advanced sensor technologies into hemostasis management, driving modernization and competition within the PFT market.

Report Scope

Report Features Description Market Value (2024) US$ 1.1 Billion Forecast Revenue (2034) US$ 2.0 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Systems, Accessories, and Reagents), By Application (Clinical Applications, Pharmaceutical Development, Research Applications, and Others), By End-user (Hospitals, Diagnostic Centers, Blood Banks, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aggredyne, Inc., Drucker Diagnostics, F. Hoffmann-La Roche Ltd, Fresenius SE & Co KGaA, Haemonetics Corporation, Helena Laboratories, SENTINEL Ch. S.p.A, Siemens AG, Terumo BCT, Inc., Thermo Fisher Scientific Inc.. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Platelet Function Test MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Platelet Function Test MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aggredyne, Inc.

- Drucker Diagnostics

- Hoffmann-La Roche Ltd

- Fresenius SE & Co KGaA

- Haemonetics Corporation

- Helena Laboratories

- SENTINEL Ch. S.p.A

- Siemens AG

- Terumo BCT, Inc.

- Thermo Fisher Scientific Inc.