Global Plasma Protein Products Market By Product Type (Immunoglobulin, Coagulation Factors, and Others), By Application (Hospitals, Retail Pharmacy, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152535

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

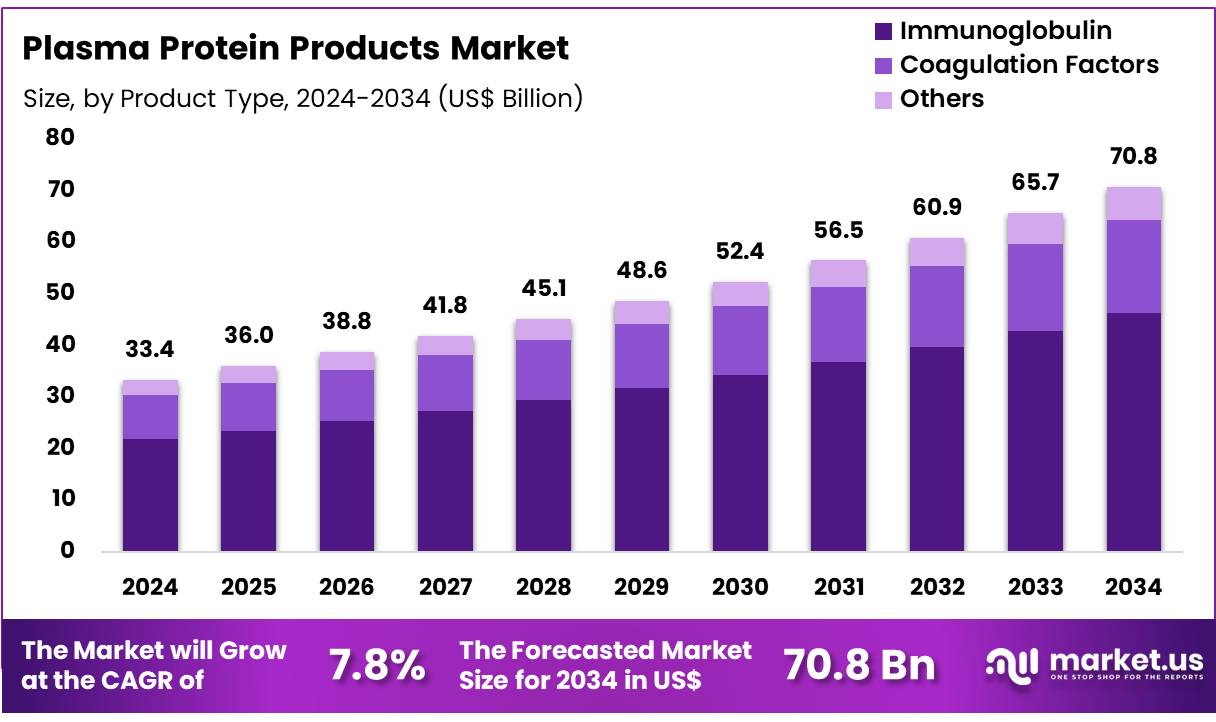

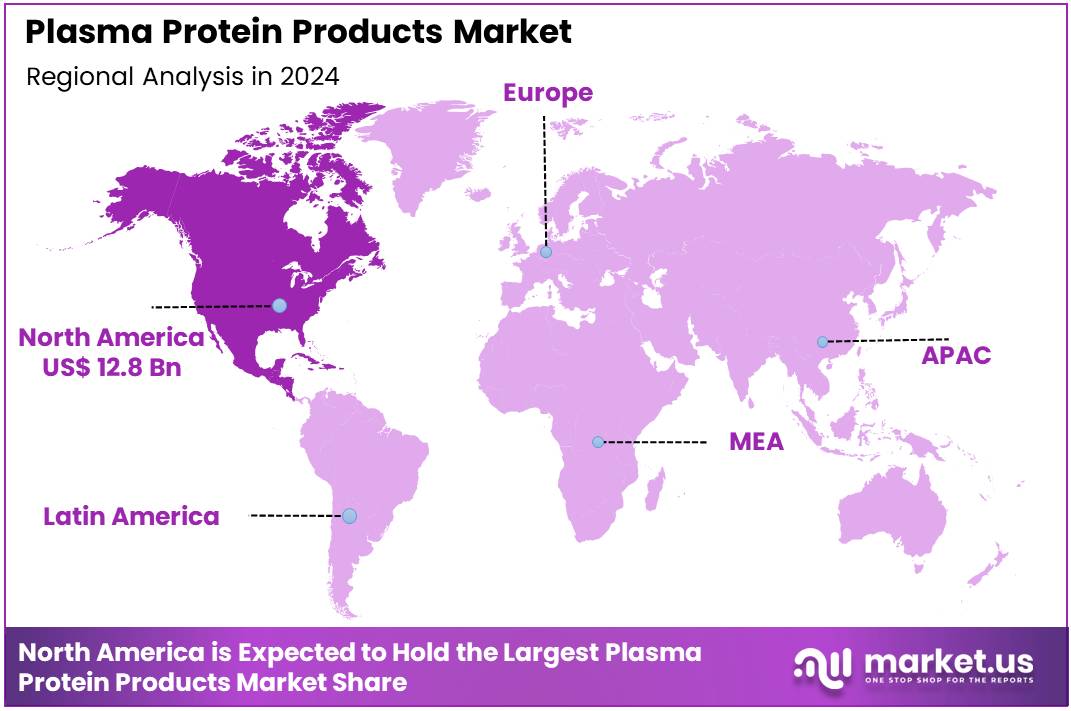

Global Plasma Protein Products Market size is expected to be worth around US$ 70.8 Billion by 2034 from US$ 33.4 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 12.8 Billion.

Rising demand for advanced therapeutic treatments and the growing awareness of plasma protein products’ clinical benefits are driving the expansion of the plasma protein products market. Plasma-derived therapies, such as immunoglobulins, clotting factors, and albumin, play a critical role in treating a wide range of diseases, including immune deficiencies, bleeding disorders, and liver diseases. Increasing cases of chronic conditions like hemophilia, autoimmune disorders, and burns have significantly contributed to the market’s growth.

Additionally, advancements in the production and purification processes of plasma protein products have improved product efficacy and safety, creating new opportunities for growth in the market. Plasma protein products are also gaining traction in emerging therapeutic areas such as neurology and oncology, offering potential for expanded applications.

In July 2024, Cornell University researchers in New York discovered that circulating cell-free RNA in plasma might serve as a potential biomarker for tuberculosis. This finding could enhance early disease detection and provide additional use cases for plasma-based diagnostics, further expanding the potential applications of plasma protein products.

The increasing focus on personalized medicine and the development of novel therapies utilizing plasma-derived products present significant opportunities for pharmaceutical companies. As technology advances and new indications for plasma protein products are explored, the market is likely to witness sustained growth, driven by innovation and an expanding range of treatment options.

Key Takeaways

- In 2024, the market for plasma protein products generated a revenue of US$ 33.4 billion, with a CAGR of 7.8%, and is expected to reach US$ 70.8 billion by the year 2034.

- The product type segment is divided into immunoglobulin, coagulation factors, and others, with immunoglobulin taking the lead in 2023 with a market share of 65.3%.

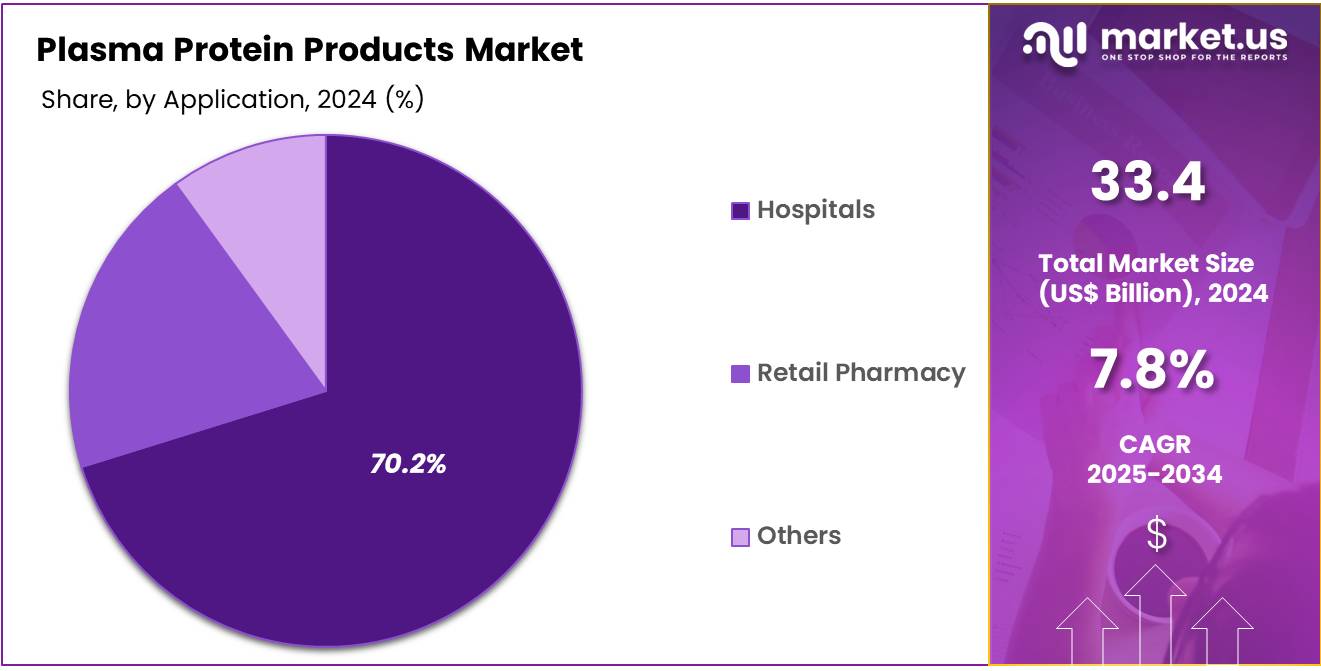

- Considering application, the market is divided into hospitals, retail pharmacy, and others. Among these, hospitals held a significant share of 70.2%.

- North America led the market by securing a market share of 38.4% in 2023.

Product Type Analysis

Immunoglobulin holds the largest share of 65.3% in the plasma protein products market. This dominance is expected to continue due to the increasing prevalence of immune deficiencies, autoimmune disorders, and chronic inflammatory diseases, all of which require immunoglobulin treatments. The growing number of patients with conditions like primary immune deficiency (PID) and other autoimmune diseases is projected to boost demand for immunoglobulin therapies.

Additionally, the effectiveness of immunoglobulin in treating various diseases, including its ability to reduce the frequency and severity of infections, is anticipated to fuel market growth. The increasing awareness and diagnosis of immune system disorders are also likely to expand the immunoglobulin treatment market. Furthermore, advancements in production methods and the availability of immunoglobulin in various formulations make these products more accessible to patients.

The continued development of immunoglobulin therapies tailored for specific diseases is estimated to drive further market expansion. As the market for immunoglobulin products grows, the increasing acceptance of these treatments by healthcare professionals will also play a key role in strengthening this segment’s dominance.

Application Analysis

Hospitals hold a dominant share of 70.2% in the plasma protein products market. This segment’s growth is expected to be driven by the rising number of patients requiring plasma-based therapies in hospital settings. Hospitals are the primary source of administration for plasma protein products due to their access to specialized healthcare professionals and advanced medical equipment. The increasing prevalence of chronic diseases, such as hemophilia and immune deficiencies, is anticipated to boost the demand for these therapies in hospitals.

Furthermore, hospitals are expected to see increased patient flow as healthcare systems evolve and treatment options improve, particularly for conditions that require frequent plasma infusions. The growing global demand for advanced treatments in hospital settings is also contributing to this segment’s expansion. With new therapies and advanced techniques being developed, hospitals are projected to remain a key focal point for plasma protein product administration.

Additionally, the growing number of healthcare infrastructure developments, particularly in emerging markets, is likely to support the continued growth of this segment. Hospitals are increasingly adopting advanced treatment protocols, further driving the demand for plasma protein products in their facilities.

Key Market Segments

By Product Type

- Immunoglobulin

- Coagulation Factors

- Others

By Application

- Hospitals

- Retail Pharmacy

- Others

Drivers

Increasing Prevalence of Immunological, Neurological, and Hematological Disorders is Driving the Market

The increasing global prevalence of a wide range of immunological, neurological, and hematological disorders is a primary driver fueling the demand for plasma protein products. These life-threatening and often chronic conditions frequently require lifelong treatment with plasma-derived therapies to manage symptoms, prevent complications, and improve patients’ quality of life.

Immunoglobulins (Ig), for example, are crucial for treating primary immunodeficiency disorders (PIDDs), a group of inherited conditions that impair the immune system, and a growing number of autoimmune and neurological conditions. Coagulation factors derived from plasma are indispensable for individuals with bleeding disorders like hemophilia.

The consistent diagnosis and growing patient populations for these complex diseases ensure a steady and increasing demand for plasma protein products. For instance, the Centers for Disease Control and Prevention (CDC) continuously monitors conditions like hemophilia; as of 2022, approximately 33,000 individuals in the United States were living with hemophilia. Furthermore, the rising awareness and improved diagnostic capabilities for rare diseases, many of which are treated with plasma-derived therapies, contribute significantly to this demand.

The American Academy of Allergy, Asthma & Immunology (AAAAI) also regularly highlights the increasing diagnosis of primary immunodeficiencies, underscoring the growing patient pool requiring immunoglobulin replacement therapy. This sustained need for essential treatments directly drives pharmaceutical companies to expand their production and supply of plasma protein products to meet the critical medical requirements of these patient populations.

Restraints

Stringent Regulatory Landscape and Plasma Collection Challenges are Restraining the Market

The stringent regulatory landscape governing plasma collection, fractionation, and the manufacturing of plasma protein products, coupled with inherent challenges in plasma supply, significantly restrains market growth. Regulatory bodies worldwide, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose exceptionally rigorous standards to ensure the safety and purity of plasma-derived medicinal products.

These regulations cover every aspect, from donor screening and collection center operations to viral inactivation processes, quality control, and post-market surveillance. Adhering to these strict guidelines involves substantial costs for manufacturing facilities, extensive testing, and complex compliance procedures, which can deter new entrants and increase operational expenses for existing players. Furthermore, the reliance on human plasma donations creates a fundamental supply constraint.

Plasma collection is a labor-intensive process, and maintaining a consistent and sufficient supply of high-quality plasma depends on donor availability and the network of collection centers. The U.S. remains a major source of plasma for fractionation globally. While a precise government-issued percentage for global plasma collection is not readily available, the Centro Nazionale Sangue reported in May 2024 that the global volume of plasma for fractionation (source and recovered) represented about 72 million liters in 2022.

In 2023, source plasma volume grew 12-14% over 2022, driven primarily by U.S. collections, while European collections increased by about 3-6%. Despite this growth, meeting the ever-increasing demand remains a challenge, impacting the overall production capacity and market expansion potential for these life-saving therapies.

Opportunities

Expansion of Approved Indications and Orphan Drug Designations is Creating Growth Opportunities

The continuous expansion of approved indications for existing plasma protein products and the increasing number of orphan drug designations are creating significant growth opportunities in the market. Pharmaceutical companies are actively investing in clinical research to identify new therapeutic applications for plasma-derived therapies, extending their utility beyond traditional uses. This includes exploring their efficacy in various autoimmune conditions, neurological disorders, and critical care settings. Gaining approval for new indications allows manufacturers to address previously unmet medical needs and expand their patient base.

Furthermore, governments worldwide offer incentives for developing “orphan drugs,” which are treatments for rare diseases, many of which are severe and chronic conditions effectively treated by plasma protein products. These incentives, such as tax credits, fee waivers, and periods of market exclusivity, encourage pharmaceutical companies to invest in research and development for these conditions, even with smaller patient populations. The U.S. Food and Drug Administration (FDA) Center for Drug Evaluation and Research (CDER) continues to show a strong focus on rare diseases.

For instance, in 2024, 26 of CDER’s 50 novel drug approvals (52%) were approved to treat rare or orphan diseases. In 2023, 28 of CDER’s 55 novel drug approvals (51%) received orphan drug designation. This consistent trend of prioritizing and facilitating the development of treatments for rare diseases directly benefits the plasma protein products market by creating new avenues for therapeutic application and fostering innovation in this critical area.

Impact of Macroeconomic / Geopolitical Factors

The plasma protein products market is significantly shaped by macroeconomic conditions and geopolitical dynamics, which collectively influence both operational challenges and strategic growth directions. Economic indicators such as inflation and shifts in national healthcare budgets have a direct bearing on the affordability and reimbursement of plasma-derived therapies, which are typically high-cost and critical for patient survival.

During periods of elevated inflation, the expenses associated with plasma collection, processing, and distribution rise substantially. As a result, healthcare systems may face increased costs, potentially limiting access or delaying the adoption of new therapies. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index for All Urban Consumers (CPI-U) rose by 3.1% in the 12 months ending January 2024. This inflationary trend exerts additional strain on healthcare supply chains and budgets, particularly within publicly funded systems, which may respond by intensifying price evaluations and reimbursement constraints.

Geopolitical developments further compound these challenges. Trade disputes, international conflicts, and shifts in diplomatic relations can disrupt the global plasma supply chain, which relies on cross-border collection and manufacturing. Restrictions on plasma movement or trade sanctions can lead to regional shortages. However, such disruptions also encourage nations to prioritize self-reliance in critical biotherapeutics. In response, several countries have increased investments in domestic plasma collection infrastructure and fractionation capabilities, fostering more resilient and diversified global supply networks.

In the United States, current tariff policies have both direct and indirect repercussions on the plasma protein products market. Tariffs on imported raw materials, manufacturing equipment, or pharmaceutical products increase the input costs for plasma manufacturers. Companies may absorb these expenses, leading to reduced margins, or pass them on to healthcare providers, potentially raising the end price of life-saving therapies.

A June 2025 study by the Johns Hopkins Bloomberg School of Public Health reported that the value of U.S. pharmaceutical imports surged from US$73 billion in 2014 to over US$215 billion in 2024. This underscores the U.S. healthcare system’s substantial dependence on international supply chains. The analysis highlighted that tariffs on Chinese active pharmaceutical ingredients (APIs) reached levels as high as 245%, significantly affecting pricing across the pharmaceutical landscape. While plasma proteins are biologics rather than chemical APIs, the broader impact of tariffs on pharmaceutical supply chains can indirectly influence manufacturing and logistics costs for plasma products.

Moreover, trade uncertainties associated with tariff regimes may reduce foreign investment in U.S.-based plasma collection and manufacturing operations. Conversely, such policies can serve as a catalyst for domestic investment. By encouraging U.S.-based production and research in plasma protein therapies, these developments may enhance national self-sufficiency, generate employment, and contribute to a more secure and independent supply chain for essential plasma-derived medicines.

Latest Trends

Technological Advancements in Fractionation and Purification is a Recent Trend

A prominent recent trend significantly impacting the plasma protein products market in 2024 and continuing into 2025 is the accelerated pace of technological advancements in plasma fractionation and purification processes. Manufacturers are investing heavily in innovative technologies aimed at enhancing the efficiency, safety, and yield of plasma-derived therapeutic proteins. These advancements include the implementation of more sophisticated chromatographic techniques, advanced viral inactivation methods, and improved filtration systems.

The goal is to maximize the recovery of valuable proteins from donated plasma while simultaneously ensuring an even higher level of product purity and safety, thereby reducing the risk of pathogen transmission. These technological upgrades not only improve the quality of existing products but also enable the extraction of novel plasma components for new therapeutic applications. Key players in the industry are actively adopting these advanced manufacturing processes.

For example, in June 2024, the U.S. FDA approved Biotest’s Yimmugo, an intravenous immunoglobulin (IVIg) therapy, indicating ongoing innovation and regulatory approval of new products leveraging advanced manufacturing.

Furthermore, companies are exploring and integrating automation and digital solutions into their fractionation facilities to optimize workflows, reduce human error, and increase overall production capacity. This continuous technological evolution is crucial for meeting the escalating global demand for these life-saving products efficiently and safely, pushing the boundaries of what is possible in plasma-derived therapeutics.

Regional Analysis

North America is leading the Plasma Protein Products Market

North America dominated the market with the highest revenue share of 38.4% owing to the increasing diagnosis of rare diseases, a growing awareness of the therapeutic benefits of these products, and consistent efforts to expand plasma collection capacities. These essential medicines, derived from human plasma, are crucial for treating conditions such as primary immunodeficiencies, hemophilia, and alpha-1 antitrypsin deficiency.

For instance, the demand for intravenous immunoglobulins (IVIg), a key plasma-derived product, continued its upward trajectory, fueled by the rising prevalence of neurological and immunological disorders. Companies like CSL Behring, a major producer of plasma-derived therapies, reported strong performance in North America. CSL Behring’s total revenue for the half-year ended December 31, 2024, increased by 10% compared to the prior comparable period, with immunoglobulin sales demonstrating robust growth as global supply recovered and patient diagnosis rates steadily increased.

Grifols, another leading player in the sector, stated that its first quarter 2025 results, building on record-setting performances in 2023 and 2024, clearly demonstrate continued momentum with healthy underlying demand in Biopharma across all parts of its business, which includes plasma protein products. Takeda, a significant player in rare diseases and plasma-derived therapies, reported core revenue growth for its Plasma-Derived Therapies (PDT) Immunology segment, contributing to its overall strong financial year 2024 results, signifying robust demand for these life-saving treatments across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to improving healthcare infrastructure, increasing diagnosis rates of relevant conditions, and a growing recognition among medical professionals of the importance of these life-saving treatments. Governments across the region are likely to continue enhancing their blood product management systems, including efforts to increase plasma collection and ensure product availability.

For example, in 2023, China witnessed a record high in voluntary blood donations, reaching 16.99 million donations, an increase of 5.9 percent from 2022, according to data from China’s National Health Commission. This expansion in plasma collection infrastructure is estimated to directly support the production of various plasma-derived medicines. Japan’s Ministry of Health, Labour and Welfare is anticipated to maintain its rigorous oversight of blood products, ensuring safe and effective supply.

Companies with significant plasma-derived therapy portfolios are actively expanding their operations in Asia Pacific. Takeda, for instance, a global leader with a strong presence in the region, is likely to further leverage its robust pipeline and manufacturing capabilities to meet the increasing demand for these specialized treatments. As patient access to advanced medical care improves and national health programs prioritize the management of rare and chronic diseases, the adoption of plasma-derived therapies is projected to accelerate significantly across the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the plasma protein products market pursue several growth strategies to strengthen their positions. They focus on expanding product lines by developing specialized therapies for conditions such as hemophilia, immunodeficiencies, and autoimmune disorders. Strategic collaborations with healthcare providers and research institutions allow for the advancement of novel treatments. These companies also invest in global market expansion, particularly in emerging economies where healthcare access is improving.

In addition, increasing production capacity and optimizing supply chains are essential for meeting rising demand. To ensure patient accessibility, some firms focus on patient assistance programs and education initiatives. Enhanced regulatory compliance and innovation in manufacturing processes also drive their market growth.

One key player, CSL Behring, is a global biotechnology leader in the development of plasma-derived therapies. Specializing in products for rare and serious diseases, CSL Behring operates a vast network of manufacturing facilities worldwide. The company focuses on expanding its portfolio of immunoglobulins and clotting factor concentrates. CSL Behring has a strong commitment to research and development, constantly innovating to offer new treatment options for complex medical conditions.

Top Key Players

- PlasmaGen Biosciences

- Octapharma

- LFB Group

- Kedrion Biopharma

- CSL Behring

- China Biologic Products

- BioLife

- Bio Products Laboratory

Recent Developments

- In May 2023, PlasmaGen Biosciences launched a new manufacturing plant in Kolar, Bengaluru. This 8-acre facility will process up to 500,000 liters of plasma annually, producing key plasma-based products like albumin, immunoglobulin, and coagulation factors.

- In September 2022, LFB Plasma became a member of the Plasma Protein Therapeutics Association (PPTA), aiming to enhance its network of plasma collection centers across the U.S. to support plasma-derived therapies.

Report Scope

Report Features Description Market Value (2024) US$ 33.4 Billion Forecast Revenue (2034) US$ 70.8 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Immunoglobulin, Coagulation Factors, and Others), By Application (Hospitals, Retail Pharmacy, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PlasmaGen Biosciences, Octapharma, LFB Group, Kedrion Biopharma, CSL Behring, China Biologic Products, BioLife, Bio Products Laboratory. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plasma Protein Products MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Plasma Protein Products MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PlasmaGen Biosciences

- Octapharma

- LFB Group

- Kedrion Biopharma

- CSL Behring

- China Biologic Products

- BioLife

- Bio Products Laboratory