Global Pipeline Monitoring Systems Market By Technology(Ultrasonic, LIDAR, Smart Ball, PIG, Magnetic Flux Leakage Technology, Other Technologies), By Pipe Type(Metallic, Non-Metallic), By Application(Operating Condition, Pipe Leakage Detection, Leak Detection, Other Applications), By End-Use Industry(Water and Wastewater, Oil and Gas, Other End-Use Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 25961

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

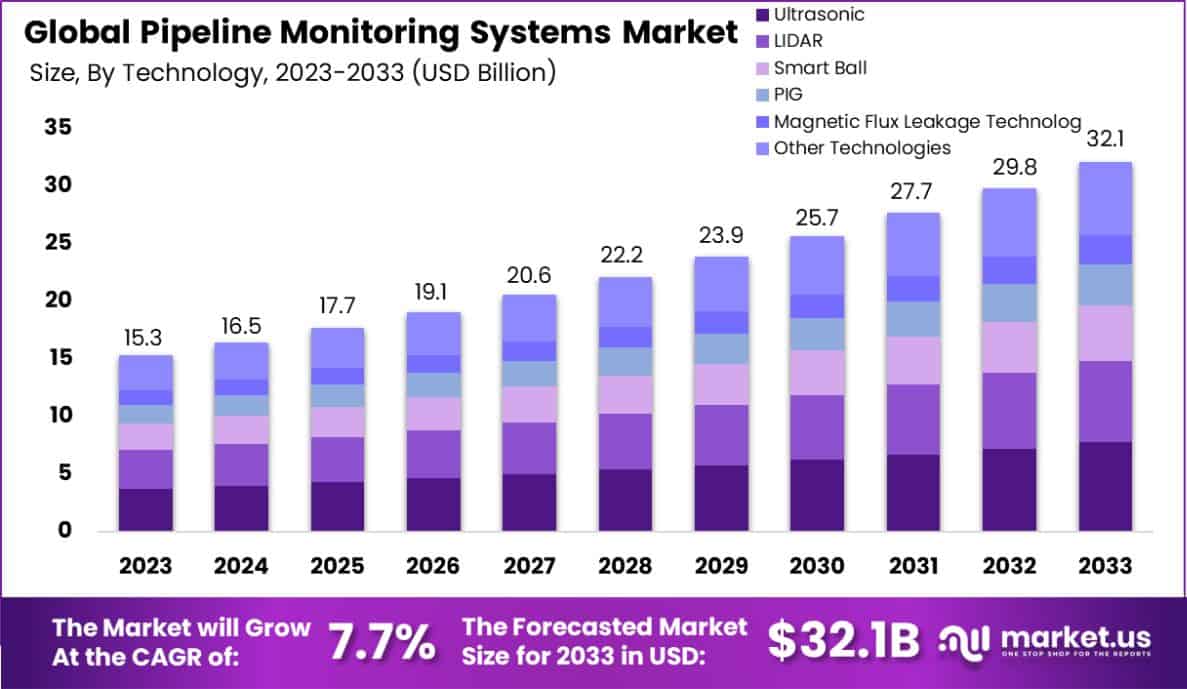

The Global Pipeline Monitoring Systems Market is expected to be worth around USD 32.1 billion by 2033, up from USD 15.3 billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

Pipeline monitoring systems are integrated technologies designed to detect and monitor any unauthorized or abnormal conditions within pipelines, such as leaks, ruptures, and pressure changes. These systems play a crucial role in ensuring the safety, efficiency, and maintenance of pipelines across various industries including oil and gas, water and wastewater, and chemicals.

The Pipeline Monitoring Systems Market is expanding as industries globally prioritize infrastructure security and integrity. This market comprises technologies and services that facilitate real-time monitoring and diagnosis, helping to prevent leaks, minimize downtime, and comply with environmental regulations.

One of the primary growth factors for the Pipeline Monitoring Systems Market is the increasing need for leak detection in oil and gas pipelines to prevent environmental disasters and operational disruptions. Enhanced regulatory frameworks worldwide also drive demand for sophisticated monitoring solutions.

Demand for pipeline monitoring systems is driven by the critical necessity for operational safety in the transportation of hazardous materials. This demand is amplified by growing energy requirements worldwide and the need for safe and efficient transport of commodities.

Opportunities in the Pipeline Monitoring Systems Market are abundant, particularly with the advent of IoT and AI technologies. These innovations offer advanced analytics and predictive maintenance capabilities, enabling more proactive and less costly interventions. Additionally, emerging markets are increasingly adopting pipeline infrastructure, presenting new expansion opportunities.

The Pipeline Monitoring Systems Market is poised for significant growth, influenced by a confluence of regulatory focus and technological advancements. With the U.S. Department of Transportation allocating substantial resources towards pipeline safety, approximately $434.6 million is requested for FY 2025 under PHMSA’s pipeline safety operations.

This funding underscores a heightened governmental emphasis on maintaining pipeline integrity and enhancing safety protocols, which significantly catalyzes the adoption of monitoring technologies.

Of particular note, $1.5 million is designated for State Damage Prevention Grants aimed at mitigating risks to pipeline infrastructure. Additionally, $1.1 million allocated for State One-Call Grants emphasizes improving communications between utilities and excavators to prevent pipeline damage during construction activities.

These grants are vital in fostering a safer operational environment, reducing the likelihood of accidental breaches, and thus driving demand for monitoring solutions that can detect and report such vulnerabilities preemptively.

Moreover, the budget provisions include $46.8 million funded by registration fees to help communities formulate emergency response strategies and train first responders. This allocation not only bolsters immediate responses to pipeline incidents but also enhances the broader ecosystem supporting pipeline monitoring systems. These financial injections into infrastructure safety and emergency preparedness present robust opportunities for market growth.

The strategic governmental funding, coupled with advances in IoT and AI technologies, positions the Pipeline Monitoring Systems Market on a trajectory of accelerated growth and innovation.

Market stakeholders can expect an expanded deployment of sophisticated monitoring solutions that offer real-time data and predictive capabilities, thereby enhancing operational safety and efficiency across critical pipeline networks.

Key Takeaways

- The Global Pipeline Monitoring Systems Market is expected to be worth around USD 32.1 billion by 2033, up from USD 15.3 billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

- In 2023, Ultrasonic held a dominant market position in the By Technology segment of the Pipeline Monitoring Systems Market, with a 24.2% share.

- In 2023, Metallic held a dominant market position in the By Pipe Type segment of the Pipeline Monitoring Systems Market, with a 75.1% share.

- In 2023, Leak Detection held a dominant market position in the By Application segment of the Pipeline Monitoring Systems Market, with a 43.1% share.

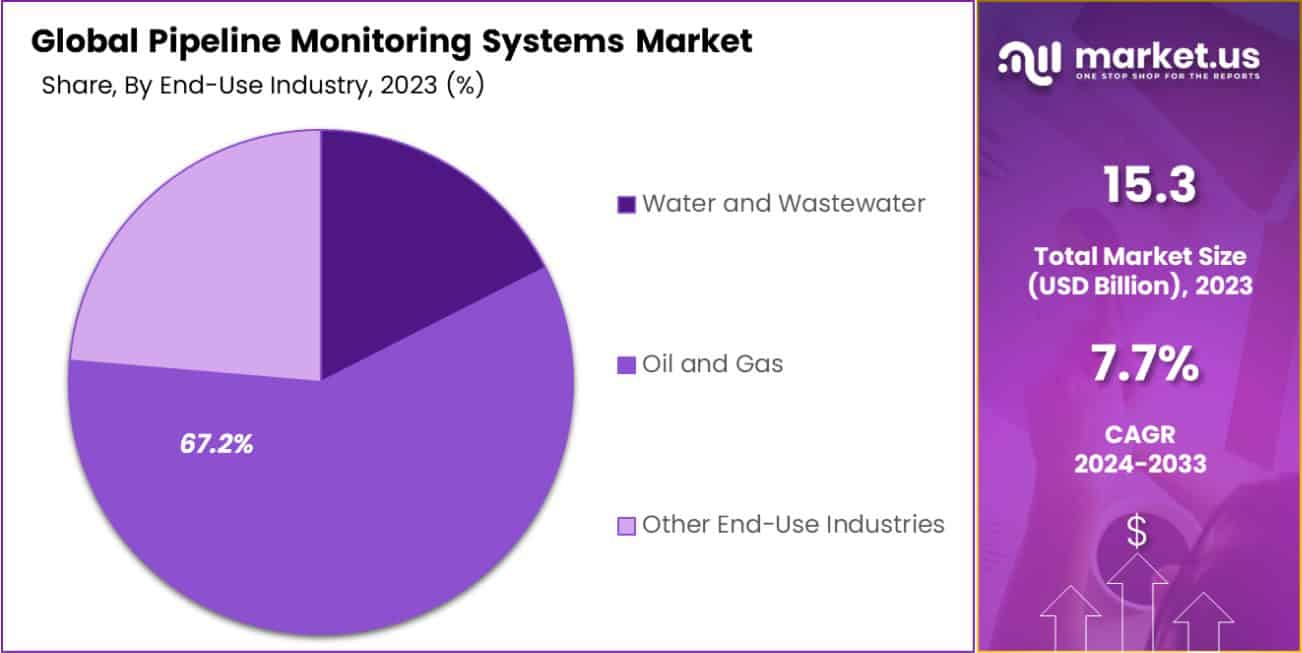

- In 2023, Oil and Gas held a dominant market position in the By End-Use Industry segment of the Pipeline Monitoring Systems Market, with a 67.2% share.

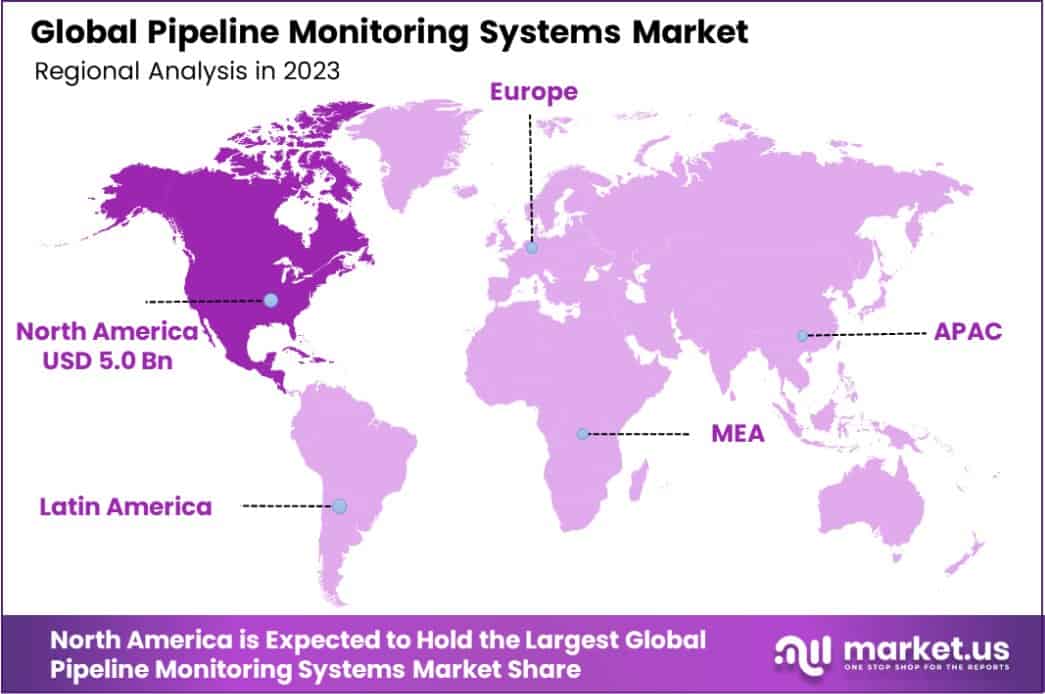

- North America dominated a 33.1% market share in 2023 and held USD 5.0 Billion revenue of the Pipeline Monitoring Systems Market.

By Technology Analysis

In 2023, Ultrasonic technology held a dominant position in the “By Technology” segment of the Pipeline Monitoring Systems Market, commanding a 24.2% share. This technology is favored for its accuracy and reliability in detecting anomalies and changes in flow within pipelines.

Following closely are LIDAR and Smart Ball technologies, which have also seen significant adoption due to their advanced diagnostic capabilities and non-intrusive nature. Pipeline Inspection Gauges (PIGs) and Magnetic Flux Leakage Technology represent other critical technologies, each contributing to the comprehensive monitoring and maintenance of pipeline integrity.

Other technologies in the segment include various innovative solutions that cater to specific industry needs, offering tailored monitoring approaches that enhance detection precision and operational safety.

The diverse technology landscape within the Pipeline Monitoring Systems Market allows for versatile applications across oil, gas, and water pipelines, ensuring that industry standards for safety and efficiency are met while adapting to the evolving demands of global infrastructure development.

As the market progresses, these technologies continue to evolve, driven by ongoing research and development efforts aimed at improving their effectiveness and integration capabilities.

By Pipe Type Analysis

In 2023, Metallic pipelines held a dominant market position in the “By Pipe Type” segment of the Pipeline Monitoring Systems Market, with a commanding 75.1% share. This predominant use of metallic pipes is attributed to their durability, high-pressure resistance, and extensive application across major industries such as oil and gas and utilities.

These characteristics make metallic pipelines the preferred choice for long-distance and high-capacity transport needs, necessitating robust monitoring systems to ensure operational safety and efficiency.

On the other hand, non-metallic pipelines, which include materials like HDPE and PVC, are also gaining traction due to their corrosion resistance and cost-effectiveness, particularly suitable for smaller-scale or less hazardous operations.

Despite their growing adoption, the share of non-metallic pipes remains significantly lower in the market, reflecting ongoing preferences for metal in critical infrastructure.

The segmentation within the Pipeline Monitoring Systems Market highlights the evolving landscape where technological advancements and material innovations are influencing deployment strategies.

As industries continue to prioritize sustainability and cost-efficiency, non-metallic pipelines may see increased usage, challenging the dominance of metallic pipes, particularly in environments where corrosion and material degradation pose significant risks.

By Application Analysis

In 2023, Leak Detection held a dominant market position in the “By Application” segment of the Pipeline Monitoring Systems Market, with a 43.1% share. This significant prominence underscores the critical demand for immediate detection and response mechanisms to maintain pipeline integrity and prevent hazardous spills.

Leak detection technologies are essential for operational safety, especially in industries handling volatile or environmentally hazardous materials, where early detection can mitigate substantial financial and ecological damage.

Following Leak Detection, the Operating Condition and Pipe Leakage Detection applications also represent substantial segments of the market. These applications focus on monitoring the operational status of pipelines and detecting any physical or performance anomalies that could indicate potential failures.

While similar in function, Pipe Leakage Detection is specifically tailored to identify smaller leaks that may not immediately impact pipeline operations but could lead to larger issues if left unchecked.

Other Applications within the segment include pressure and flow monitoring, which are vital for the optimal performance and maintenance of pipeline systems. Collectively, these applications highlight the diverse needs and technological responses developed to ensure the safety, efficiency, and reliability of pipeline operations across various industries.

As the market evolves, the integration of advanced sensing technologies and data analytics continues to enhance the capabilities of pipeline monitoring systems, driving further adoption and market growth.

By End-Use Industry Analysis

In 2023, the Oil and Gas sector held a dominant market position in the “By End-Use Industry” segment of the Pipeline Monitoring Systems Market, with a substantial 67.2% share. This dominance is primarily driven by the critical need for robust monitoring systems in oil and gas pipelines, which are vital for preventing leaks and ensuring the safe transport of highly flammable and environmentally hazardous materials.

The sector’s reliance on pipeline integrity for operational safety, regulatory compliance, and environmental protection underscores the significant investment in advanced monitoring technologies.

Following Oil and Gas, the Water and Wastewater industry also constitutes a significant portion of the market. This sector increasingly adopts monitoring systems to prevent contamination, ensure supply integrity, and manage aging infrastructure, which is crucial for public health and environmental safety.

Other end-user industries include chemicals, food and beverage, and mining, where monitoring systems are utilized to maintain operational continuity and safeguard against the economic losses associated with unplanned downtime and equipment failures.

Each industry presents unique challenges and requirements, influencing the development of specialized monitoring solutions tailored to their specific operational needs. As industries continue to emphasize safety and efficiency, the demand for pipeline monitoring systems across various sectors is expected to grow, further expanding the market landscape.

Key Market Segments

By Technology

- Ultrasonic

- LIDAR

- Smart Ball

- PIG

- Magnetic Flux Leakage Technology

- Other Technologies

By Pipe Type

- Metallic

- Non-Metallic

By Application

- Operating Condition

- Pipe Leakage Detection

- Leak Detection

- Other Applications

By End-Use Industry

- Water and Wastewater

- Oil and Gas

- Other End-Use Industries

Drivers

Key Drivers in Pipeline Monitoring

The Pipeline Monitoring Systems Market is primarily driven by the urgent need for safety and efficiency in the transport of oil, gas, and other materials through pipelines. Increased global energy demands have emphasized the importance of secure and reliable pipeline infrastructure.

Governments and regulatory bodies worldwide are enforcing stricter safety regulations to prevent environmental disasters and operational disruptions. This regulatory pressure has led to greater adoption of advanced monitoring technologies that can detect leaks and potential failures early.

Additionally, the integration of IoT and AI technologies is transforming pipeline monitoring by enhancing real-time data collection and analysis, enabling more predictive maintenance approaches.

These factors collectively drive the market forward, ensuring continuous growth as industries seek smarter, safer, and more efficient monitoring solutions to meet modern challenges.

Restraint

Market Challenges in Pipeline Monitoring

A significant restraint in the Pipeline Monitoring Systems Market is the high cost of installation and maintenance of advanced monitoring technologies. Many companies, especially in developing regions, find it financially challenging to invest in sophisticated systems.

These costs include not only the initial setup but also ongoing operations and data management, which require substantial investment in both technology and skilled personnel.

Additionally, the complexity of integrating new technologies with existing infrastructure can deter widespread adoption, as upgrades often necessitate extensive modifications or complete system overhauls.

This complexity can lead to reluctance among smaller or budget-constrained operators, slowing down market penetration and growth despite the clear benefits of these advanced monitoring systems.

Opportunities

Growth Prospects in Pipeline Monitoring

The Pipeline Monitoring Systems Market is ripe with opportunities, particularly due to the expanding integration of digital technologies such as IoT and AI. These technologies are revolutionizing pipeline monitoring by enhancing precision in leak detection and predictive maintenance.

As energy and utility sectors worldwide continue to expand and modernize, the demand for sophisticated monitoring solutions that ensure operational safety and regulatory compliance is also increasing.

Furthermore, emerging markets are investing heavily in new pipeline infrastructure, which presents additional opportunities for the deployment of advanced monitoring systems.

This trend is supported by a growing focus on environmental safety and the efficient management of resources, positioning the market for sustained growth as industries increasingly rely on technology to meet stringent safety standards and operational demands.

Challenges

Hurdles in Pipeline Monitoring Growth

The Pipeline Monitoring Systems Market faces notable challenges, particularly with the technological integration and cyber security risks associated with digital monitoring solutions. As these systems become more connected and data-driven, they are increasingly vulnerable to cyber-attacks, which can compromise the integrity and functionality of critical infrastructure.

Additionally, the varied and often harsh environmental conditions in which pipelines operate pose significant challenges for monitoring technology, impacting reliability and durability. Another significant hurdle is the resistance to change within some sectors of the industry, where traditional practices are deeply ingrained.

Overcoming these challenges requires continuous innovation and investment in more robust, secure, and adaptive technologies, as well as efforts to educate and encourage stakeholders about the long-term benefits and necessity of advanced pipeline monitoring systems.

Growth Factors

Drivers for Pipeline Monitoring Expansion

The growth of the Pipeline Monitoring Systems Market is significantly driven by the increasing need for operational safety and regulatory compliance across industries. As the global energy demand continues to rise, there is a corresponding need to ensure the integrity and efficiency of the extensive networks of pipelines delivering oil, gas, and other crucial resources.

This demand catalyzes investments in monitoring technologies that can detect leaks, prevent spills, and ensure smooth operations. Additionally, advancements in technology, such as the integration of IoT and artificial intelligence, enhance the capabilities of these systems, making them more efficient and effective.

Regulatory bodies worldwide are also tightening safety standards, compelling companies to adopt high-standard monitoring systems to avoid hefty fines and environmental liabilities, further propelling market growth.

Emerging Trends

New Trends in Pipeline Monitoring

Emerging trends in the Pipeline Monitoring Systems Market are heavily influenced by technological innovation. The increasing use of IoT and AI technologies is transforming how pipelines are monitored by enabling real-time data analysis and predictive maintenance, which can forecast potential issues before they lead to failures.

Additionally, there’s a growing emphasis on sustainability and environmental protection, driving the adoption of systems that can detect even the smallest leaks to prevent environmental damage.

The integration of cloud computing is also gaining traction, offering enhanced data storage and accessibility, and facilitating better decision-making. Another notable trend is the development of more sophisticated smart sensor technologies, which are becoming more accurate, durable, and cost-effective.

These trends reflect a shift towards more connected, responsive, and sustainable monitoring solutions in the pipeline industry, aiming to meet the modern demands of safety, efficiency, and environmental care.

Regional Analysis

In 2023, the global Pipeline Monitoring Systems Market exhibited significant regional diversity, with North America dominating at 33.1% of the market share, translating to a value of approximately USD 5.0 billion.

This leadership is primarily due to stringent regulatory standards and a well-established oil and gas industry, which necessitates advanced monitoring solutions to ensure pipeline integrity and operational safety.

North America’s pioneering adoption of technologies such as IoT and AI for pipeline monitoring further reinforces its market position.

Following North America, Europe, and Asia Pacific are also key players in the pipeline monitoring systems market. Europe benefits from a robust regulatory environment and high safety standards, driving the demand for monitoring systems across its aging pipeline infrastructure.

Meanwhile, Asia Pacific is experiencing rapid growth due to expanding industrialization and infrastructure development, particularly in emerging economies like China and India.

The Middle East & Africa, and Latin America regions, although smaller in market size, are recognizing the critical importance of pipeline safety, leading to gradual adoption driven by increasing oil production activities and modernization of infrastructure.

This geographical segmentation highlights the global prioritization of pipeline safety and the regional nuances influencing market dynamics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Pipeline Monitoring Systems market has been significantly shaped by the innovations and strategic initiatives of key players such as ABB Ltd., Honeywell International Inc., and Emerson Electric Co. Each of these companies has carved a niche through technological advancements and expansive geographic footprints, reinforcing their standings in the market.

ABB Ltd. has been a frontrunner, leveraging its strong portfolio in automation and digital technologies to enhance pipeline monitoring solutions. The company focuses on integrating IoT and real-time data analytics, providing customers with advanced predictive maintenance capabilities.

This approach not only improves safety and efficiency but also aligns with the industry’s shift towards digital transformation.

Honeywell International Inc. is another dominant force, known for its robust pipeline integrity products. The company’s technologies are geared towards ensuring the operational reliability of pipelines through comprehensive monitoring and leak detection systems.

Honeywell’s commitment to R&D and its global service network enables it to meet diverse customer needs effectively, making it a trusted partner across various sectors, including oil, gas, and chemicals.

Emerson Electric Co. stands out for its specialized sensors and diagnostic tools that form the backbone of its pipeline monitoring solutions. The company’s focus on innovation in wireless communication and sensor technology greatly enhances its ability to monitor vast pipeline networks in real time.

Emerson’s strategy to integrate smart devices and analytics aligns with modern industry requirements for data-driven operational insights, positioning it as a key player in facilitating safer and more efficient pipeline operations globally.

Together, these companies are not just participants but leading drivers in the Pipeline Monitoring Systems market, each bringing unique strengths that propel the industry forward amidst increasing safety regulations and a push for technological integration.

Top Key Players in the Market

- ABB Ltd.

- Honeywell International Inc.

- Emerson Electric Co.

- Huawei Investment and Holding Co. Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Generic Electric Co.

- ORBCOMM Inc.

- QinetiQ Group Plc

- Xylem Inc.

- Other Key Players

Recent Developments

- In May 2024, Schneider Electric introduced a cloud-based platform for pipeline monitoring, promising to reduce downtime by up to 25% through improved data analytics.

- In March 2024, Rockwell Automation acquired a startup specializing in sensor technologies, aiming to expand its pipeline monitoring capabilities by integrating advanced sensors.

- In January 2024, Huawei launched a new AI-driven pipeline monitoring system, enhancing detection accuracy by 30% compared to previous models.

Report Scope

Report Features Description Market Value (2023) USD 15.3 Billion Forecast Revenue (2033) USD 32.1 Billion CAGR (2024-2033) 7.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology(Ultrasonic, LIDAR, Smart Ball, PIG, Magnetic Flux Leakage Technology, Other Technologies), By Pipe Type(Metallic, Non-Metallic), By Application(Operating Condition, Pipe Leakage Detection, Leak Detection, Other Applications), By End-Use Industry(Water and Wastewater, Oil and Gas, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Honeywell International Inc., Emerson Electric Co., Huawei Investment and Holding Co. Ltd., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Generic Electric Co., ORBCOMM Inc., QinetiQ Group Plc, Xylem Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pipeline Monitoring Systems MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Pipeline Monitoring Systems MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Honeywell International Inc.

- Emerson Electric Co.

- Huawei Investment and Holding Co. Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Generic Electric Co.

- ORBCOMM Inc.

- QinetiQ Group Plc

- Xylem Inc.

- Other Key Players