Global Piling Machine Market By Product (Piling Rigs, Impact Hammer, Vibratory Drivers, Others), By Piling Method (Impact Driven, Air-lift RCD Rig, Auger Boring, Drilled Percussive, Continuous Flight Auger, Rotary Bored, Others), By End Use (Building and Construction, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132331

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

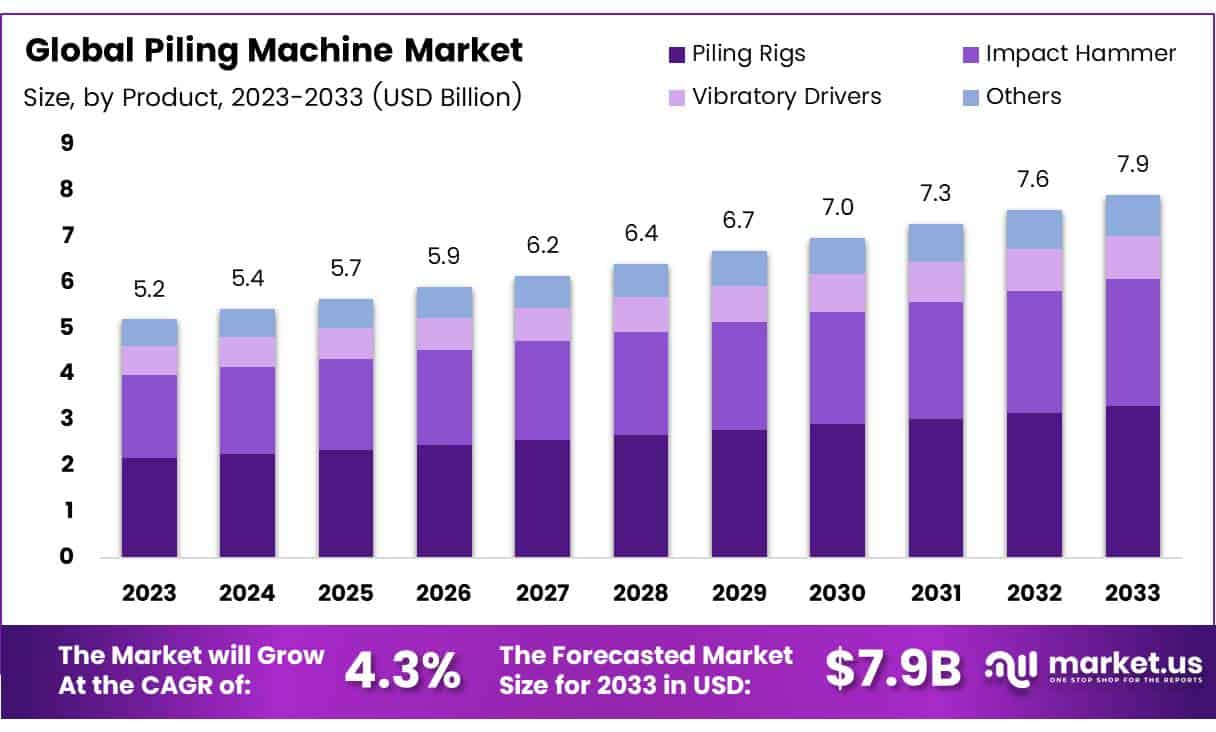

The Global Piling Machine Market size is expected to be worth around USD 7.9 Billion by 2033, from USD 5.2 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

A piling machine is essential construction equipment used to drive piles into the soil, providing foundational support for buildings or other structures. This equipment is crucial in areas with soft or unstable ground conditions.

There are various types of piling machines, such as diesel hammers, hydraulic hammers, vibrating hammers, and drilling rigs, chosen based on factors like soil composition, pile type, project size, and environmental considerations.

The piling machine market includes the sales, manufacturing, and distribution of these machines globally, serving construction, infrastructure, and industrial projects. The market growth is driven by an increase in global infrastructure development, urbanization, and industrialization, adapting to new environmental regulations and efficiency standards.

Key stakeholders in this market include manufacturers, contractors, engineering firms, and regulatory bodies, all contributing to the market dynamics and technological advancements. The demand for piling machines is increasing with more investments in transportation, residential buildings, and energy projects, and the push for sustainable construction practices that reduce environmental impact and increase efficiency.

Government policies and investments also significantly impact this market, with regulations on safety, noise, and emissions shaping the development and adoption of new, less polluting technologies like hydraulic impact hammers. These factors make the piling machine market a vital component of global construction and infrastructure growth.

Integrating the technical capabilities of piling machines, diesel hammers exemplify traditional technology with their ability to deliver adjustable energy levels per blow, ranging significantly from about 17 kNm to a robust 1,335 kNm. This range underscores their versatility across various construction conditions.

However, the efficiency of these diesel hammers generally lies between 30-40%, which, while effective, is markedly lower than the 60-80% efficiency rates achieved by hydraulic impact hammers. This stark contrast highlights a shift towards more advanced technologies in the market that prioritize energy transfer efficiency.

Diesel hammers possess the added advantage of autonomy as they do not require an external power source, showcasing an operational rate of 30-50 blows per minute for closed-end types and 70-80 for open-end types.

These characteristics make them highly suitable for projects without readily available power infrastructures, thus supporting their continued relevance in remote and undeveloped areas despite environmental concerns.

Key Takeaways

- The global Piling Machine Market is projected to reach USD 144.6 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

- Piling Rigs held a 41.8% share in the Product Analysis segment in 2023, driven by their precision and efficiency in foundational construction.

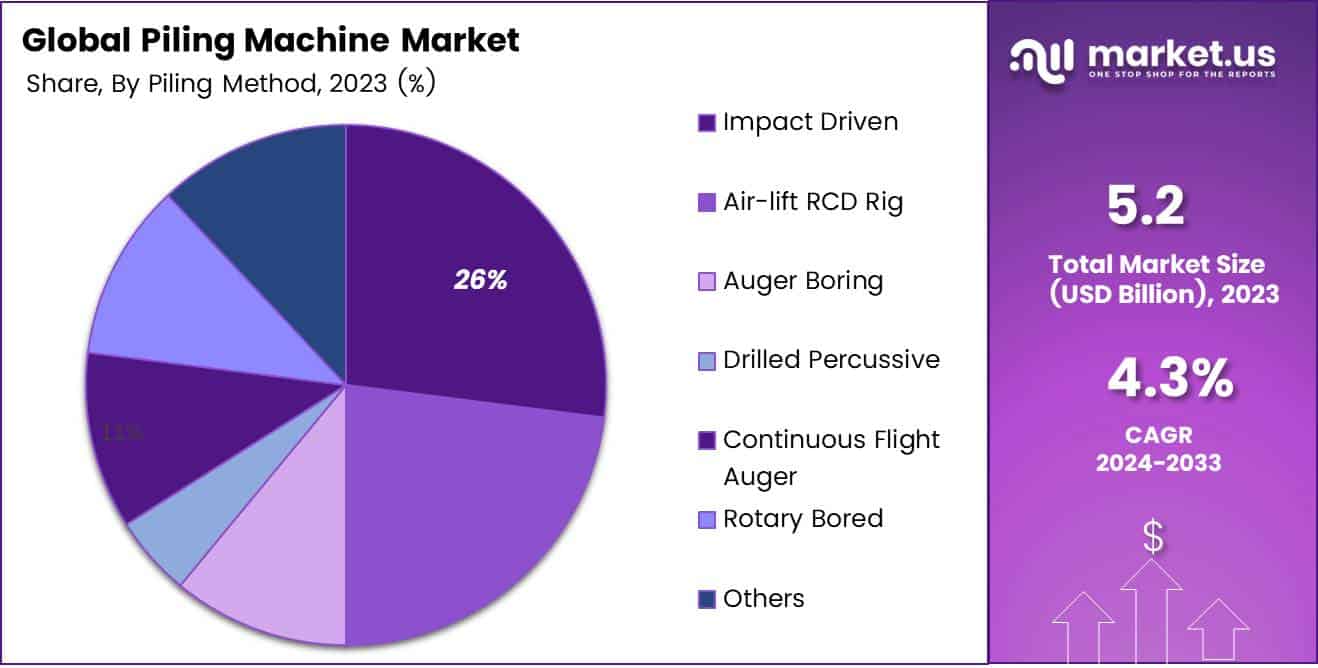

- The Impact Driven method led the Piling Method Analysis with a 26% share in 2023, favored for its robustness in driving piles into substrates.

- The Building and Construction sector dominated the End Use Analysis in 2023, reflecting strong demand for foundational work in urban and commercial projects.

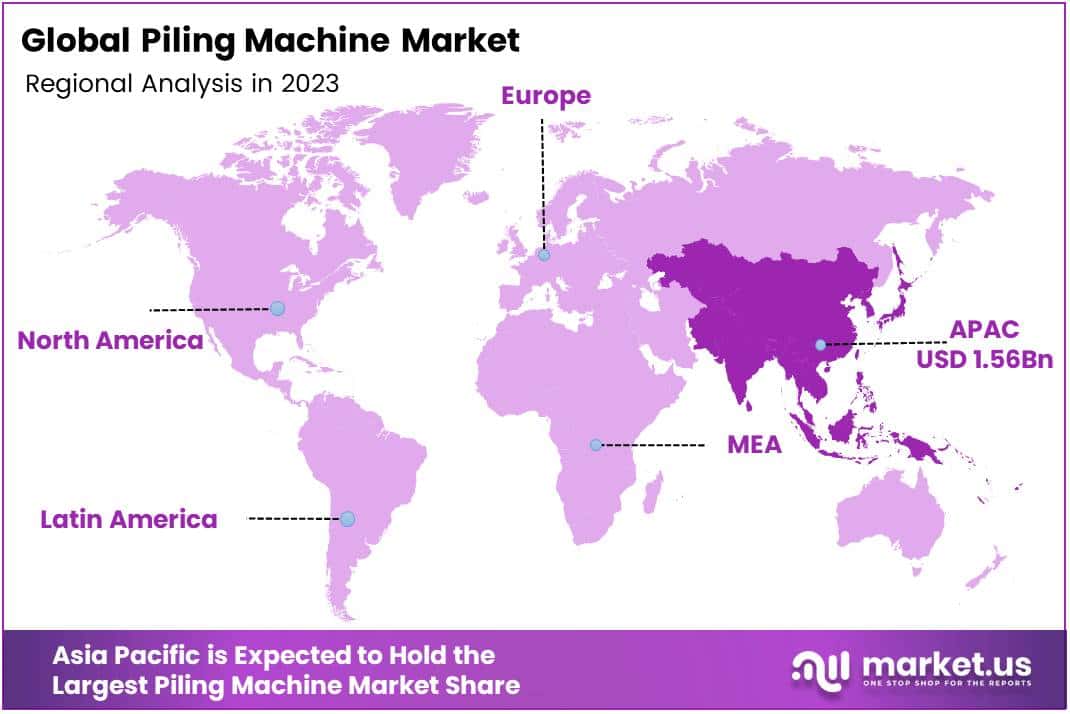

- Asia Pacific captured a 30% market share, valued at USD 1.56 billion, fueled by rapid urbanization, infrastructure development, and government initiatives.

- The market is driven by significant investments in infrastructure projects, including highways, bridges, and railways requiring deep foundations.

- Rising urbanization and demand for residential and commercial buildings are boosting the adoption of piling machines for reliable building foundations.

Product Analysis

Piling Rigs Lead with 41.8% Market Share in Piling Machine Sector

In 2023, Piling Rigs held a dominant market position in the By Product Analysis segment of the Piling Machine Market, capturing a 41.8% share. This prominent portion underscores the pivotal role that Piling Rigs play in foundational construction activities, where their precision and efficiency in driving piles into the soil are unmatched. These machines are favored for major infrastructure projects due to their reliability and ability to handle a variety of ground conditions.

Adjacent to Piling Rigs, the Impact Hammers and Vibratory Drivers also hold substantial segments within the market, though none command an equivalent share. Impact Hammers are particularly valued for their high-energy application, useful in dense or hard substrates where less forceful equipment might falter.

The Others category encompasses specialized equipment that addresses niche applications, indicating a segmented yet integral part of the market landscape. This diversification within the product types highlights the adaptability and broad applications of piling technology in modern construction, catering to a wide array of project requirements. .

As infrastructure demands evolve, the distribution of market share among these categories may shift, reflecting changes in technology adoption and construction practices.

Piling Method Analysis

Impact Driven Leads with 26% in Piling Machine Market Segment

In 2023, Impact Driven held a dominant market position in the By Piling Method Analysis segment of the Piling Machine Market, capturing a 26% share. This method is preferred for its robustness and efficacy in driving piles into the substrate, making it ideal for a variety of construction projects.

Following closely, the Rotary Bored method also asserts significant market presence due to its versatility and minimal environmental disruption. Meanwhile, the Continuous Flight Auger (CFA) offers benefits in terms of speed and noise reduction, which appeals to urban construction scenarios.

The Auger Boring and Drilled Percussive methods showcase moderate adoption, utilized for their precision and ability to operate in restricted spaces, a vital feature for congested sites.

On the other hand, the Air-lift Reverse Circulation Drilling (RCD) Rig method caters to deeper excavation needs with its advanced mechanism, although it accounts for a smaller portion of the market due to higher operational complexities and costs.

The segment labeled Others includes several less common techniques that fill niche but essential roles in specific project requirements, underlining the diverse technologies embraced by the industry to address various geological challenges.

Each method’s adoption is influenced by project specifications, local regulations, and environmental considerations, shaping the competitive landscape of the Piling Machine Market.

End Use Analysis

Piling Machine Market Dominated by Building and Construction in 2023

In 2023, Building and Construction held a dominant market position in the By End Use Analysis segment of the Piling Machine Market, indicating robust sector-specific demand. This sector leveraged piling machines extensively for foundational work in various construction projects, from high-rise buildings to infrastructure development, reflecting a surge in urbanization and commercial construction activities.

The enhanced precision and efficiency offered by modern piling machines have enabled quicker project turnarounds and adherence to stringent building standards, which are critical in urban construction environments.

The Oil and Gas sector also significantly utilized piling machines, particularly for constructing off-shore oil rigs and establishing stable bases in unpredictable geological areas. The demand in this sector is driven by the ongoing exploration activities and the development of new oil fields, necessitating robust infrastructure support.

The Others category, encompassing sectors like mining and utilities, shows a varied application of piling machines. These industries require specialized machines to manage different terrains and conditions, highlighting the versatility and adaptability of piling technology in supporting foundational work across diverse industries.

Key Market Segments

By Product

- Piling Rigs

- Impact Hammer

- Vibratory Drivers

- Others

By Piling Method

- Impact Driven

- Air-lift RCD Rig

- Auger Boring

- Drilled Percussive

- Continuous Flight Auger

- Rotary Bored

- Others

By End Use

- Building and Construction

- Oil and Gas

- Others

Drivers

Piling Machine Market Driven by Infrastructure Development

The Piling Machine market is primarily propelled by substantial investments in infrastructure projects. These projects include the construction of highways, bridges, and railways that require deep foundations to ensure stability and longevity.

As cities expand and more people move from rural to urban areas, there is a rising demand for new residential and commercial buildings to accommodate the growing population and urban lifestyle. This urban expansion further stimulates the need for piling machines that play a critical role in constructing reliable building foundations.

Additionally, the market benefits from industrial expansion, with an increasing number of factories and warehouses being built to support manufacturing and logistics operations. These industrial constructions often demand robust piling work to handle heavy machinery and equipment, reinforcing the demand for efficient and durable piling machines.

Thus, the growth of the Piling Machine market is closely linked to these dynamic construction activities across residential, commercial, and industrial sectors.

Restraints

High Initial Costs Hinder Market Growth

The piling machine market faces notable challenges that restrain its expansion. Firstly, the high initial costs associated with purchasing piling machines represent a significant barrier for many companies, particularly small to medium enterprises (SMEs) which may lack the financial resources for such substantial investments. This upfront expense can deter potential buyers, limiting the market’s growth and the widespread adoption of these machines.

Additionally, environmental concerns further complicate the market dynamics. Stringent regulations aimed at reducing noise, vibration, and overall environmental impact necessitate additional compliance measures from companies.

These regulations, while crucial for protecting the environment, can increase operational costs and complexity, posing a further hindrance to the market’s expansion. Together, these factors create substantial hurdles for the growth of the piling machine market, as companies must navigate both financial and regulatory landscapes.

Growth Factors

Exploring Emerging Markets in the Piling Machine Sector

In the rapidly evolving construction industry, piling machines are set to gain significant traction due to burgeoning opportunities in emerging markets with expanding construction sectors. As developing regions continue to urbanize, the need for robust infrastructure development catalyzes demand for advanced piling solutions.

Moreover, the shift towards prefabricated and modular construction techniques is revolutionizing building methodologies, enhancing the utilization of piling machines to ensure structural integrity.

Additionally, the global push towards smart cities is amplifying investments in sophisticated urban projects, where piling machines play a crucial role in laying strong foundations for sustainable and resilient urban environments. These trends collectively represent a promising horizon for growth in the piling machine market, promising increased deployment and technological integration in coming years.

Emerging Trends

Electrification Redefines Piling Machine Use

The piling machine market is experiencing significant transformation driven by a shift towards electrification, responding to the global push for reduced carbon emissions in construction practices. This eco-friendly trend is propelling the adoption of electric piling machines that offer not only lower emissions but also operational efficiency.

Concurrently, hybrid technology is gaining traction, with machines that integrate electric and hydraulic systems becoming increasingly popular. These hybrid models balance power and energy efficiency, catering to diverse operational needs.

Additionally, the rise in urban construction projects is fueling the demand for compact piling machines. These smaller units are engineered to operate in limited spaces typical of urban environments, making them a practical choice for city-based construction firms. The convergence of these trends—electrification, hybrid technology, and compact design—is reshaping the market landscape, making piling machines more versatile and environmentally friendly.

Regional Analysis

Asia Pacific Dominates Piling Machine Market with 30% Share, Valued at USD 1.56 Billion

The global Piling Machine Market is experiencing diversified growth trajectories across different regions, each presenting unique market dynamics and opportunities influenced by regional construction activities and infrastructural investments.

Asia Pacific is the most dominant region in the Piling Machine Market, holding a 30% market share, with a valuation of USD 1.56 billion. This dominance is primarily due to rapid urbanization, rising infrastructural developments, and increasing government initiatives for public infrastructure in countries such as China, India, and Southeast Asia. The region benefits from the availability of robust manufacturing capabilities and relatively low-cost labor, which also supports export activities.

Regional Mentions:

In 2023, the global piling machine market continues to be shaped by prominent manufacturers such as Casagrande S.p.A., XCMG Group, and Junttan Oy, which have demonstrated significant technological advancements and geographic expansion. Casagrande S.p.A. has solidified its position through innovative adaptations in hydraulic piling rigs, focusing on enhanced operational efficiency and environmental sustainability. This strategy aligns with the industry’s shift towards more eco-friendly construction practices.

XCMG Group, known for its robust engineering and manufacturing capabilities, has expanded its global footprint by entering emerging markets. Their strategic partnerships and localized manufacturing tactics have effectively reduced costs and improved service delivery, increasing their market share and customer base.

Junttan Oy remains a key player due to its specialized focus on hydraulic impact hammers and piling rigs. Their commitment to reliability and service excellence continues to earn them a reputation as a preferred supplier in colder climates, where equipment reliability under harsh conditions is crucial.

The market also sees competitive actions from companies like Liebherr-International Deutschland GmbH and Sany Group, who are intensifying efforts in automation and data analytics to improve machine performance and predictive maintenance capabilities. This technological integration helps in minimizing downtime and operational costs, providing them an edge in a competitive market.

Emerging players like Kejr, Inc. and MKT Manufacturing Inc. are making inroads through niche offerings and customizable solutions, catering to specific customer needs and regional market dynamics.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global piling machine market continues to be shaped by prominent manufacturers such as Casagrande S.p.A., XCMG Group, and Junttan Oy, which have demonstrated significant technological advancements and geographic expansion. Casagrande S.p.A. has solidified its position through innovative adaptations in hydraulic piling rigs, focusing on enhanced operational efficiency and environmental sustainability. This strategy aligns with the industry’s shift towards more eco-friendly construction practices.

XCMG Group, known for its robust engineering and manufacturing capabilities, has expanded its global footprint by entering emerging markets. Their strategic partnerships and localized manufacturing tactics have effectively reduced costs and improved service delivery, increasing their market share and customer base.

Junttan Oy remains a key player due to its specialized focus on hydraulic impact hammers and piling rigs. Their commitment to reliability and service excellence continues to earn them a reputation as a preferred supplier in colder climates, where equipment reliability under harsh conditions is crucial.

The market also sees competitive actions from companies like Liebherr-International Deutschland GmbH and Sany Group, who are intensifying efforts in automation and data analytics to improve machine performance and predictive maintenance capabilities. This technological integration helps in minimizing downtime and operational costs, providing them an edge in a competitive market.

Emerging players like Kejr, Inc. and MKT Manufacturing Inc. are making inroads through niche offerings and customizable solutions, catering to specific customer needs and regional market dynamics.

Top Key Players in the Market

- Casagrande S.p.a

- WATSON DRILL RIG

- XCMG Group

- Junttan Oy

- Sany Group

- BSP TEX

- Liebherr-International Deutschland GmbH

- TONTI TRADING S.R.L.

- ABI Maschinenfabrik und Vertriebsgesellschaft mbH

- Soilmec S.p.A

- Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.)

- Kejr, Inc.

- BAUER Group

- Epiroc AB

- Fundex Equipment

- Dieseko Group

- MKT Manufacturing Inc.

- IQIP

Recent Developments

- In January 2023, Sheet Piling (UK) Ltd expanded its equipment portfolio by adding the advanced Kobelco SK350 Excavator Piling Rig and the Movax SG-75 Side Grip Piling Vibratory Hammer, enhancing its capabilities in efficient and precise piling operations.

- In April 2023, Rochdale Piling Company announced a significant £500,000 investment in new machinery, positioning itself for accelerated growth and improved service delivery in the piling industry.

- In October 2024, Hammer & Steel, a leading provider of drilling and pile driving equipment, was acquired by Argonaut as part of its Fund V portfolio, marking Argonaut’s tenth strategic acquisition in this fund.

- In August 2024, Nextracker revealed during its annual earnings meeting the acquisition of Solar Pile International (SPI) for $48 million. SPI specializes in proprietary ground mount solutions, strengthening Nextracker’s position in solar infrastructure.

- In May 2024, ABI Maschinenfabrik secured a 70% stake in Scandinavian Pile Driving, aiming to leverage its advanced technology and broaden its market reach in Europe.

Report Scope

Report Features Description Market Value (2023) USD 5.2 Billion Forecast Revenue (2033) USD 7.9 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Piling Rigs, Impact Hammer, Vibratory Drivers, Others), By Piling Method (Impact Driven, Air-lift RCD Rig, Auger Boring, Drilled Percussive, Continuous Flight Auger, Rotary Bored, Others), By End Use (Building and Construction, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Casagrande S.p.a, WATSON DRILL RIG, XCMG Group, Junttan Oy, Sany Group, BSP TEX, Liebherr-International Deutschland GmbH, TONTI TRADING S.R.L., ABI Maschinenfabrik und Vertriebsgesellschaft mbH, Soilmec S.p.A, Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.), Kejr, Inc., BAUER Group, Epiroc AB, Fundex Equipment, Dieseko Group, MKT Manufacturing Inc., IQIP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)Global Piling Machine Market By Product (Piling Rigs, Impact Hammer, Vibratory Drivers, Others), By Piling Method (Impact Driven, Air-lift RCD Rig, Auger Boring, Drilled Percussive, Continuous Flight Auger, Rotary Bored, Others), By End Use (Building and Construction, Oil and Gas, Others), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

-

- Casagrande S.p.a

- WATSON DRILL RIG

- XCMG Group

- Junttan Oy

- Sany Group

- BSP TEX

- Liebherr-International Deutschland GmbH

- TONTI TRADING S.R.L.

- ABI Maschinenfabrik und Vertriebsgesellschaft mbH

- Soilmec S.p.A

- Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.)

- Kejr, Inc.

- BAUER Group

- Epiroc AB

- Fundex Equipment

- Dieseko Group

- MKT Manufacturing Inc.

- IQIP