Global Photocatalyst Market By Type(Titanium Dioxide, Zinc Oxide, Other Materials), By Application(Air Purification, Self-cleaning, Water Purification), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 21184

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

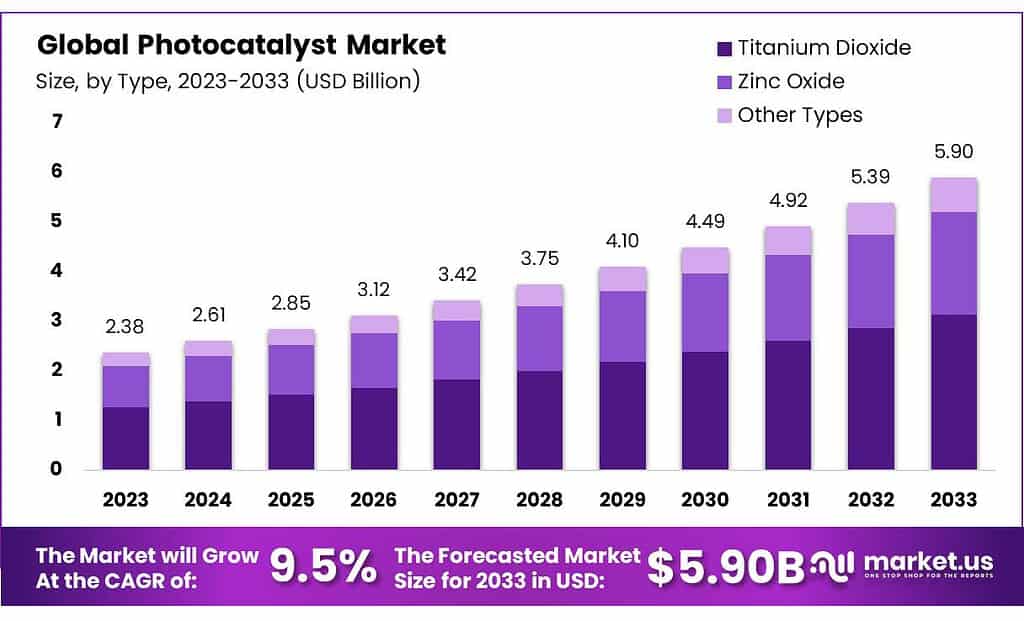

The Photocatalyst Market size is expected to be worth around USD 5.90 billion by 2033, from USD 2.38 Bn in 2023, growing at a CAGR of 9.45% during the forecast period from 2023 to 2033.

Photocatalysts have many applications. These include water treatment, textile antibacterial, wastewater treatment, and antibacterial treatment at different medical facilities. Its significant consumption of water purification in the paper and fabric industries is expected to bring in substantial revenue.

Water treatment will increase across the globe due to increasing water scarcity as a result of rapid industrial growth and diminishing freshwater resources. Photocatalysts possess superior chemical properties that enhance water treatment. This is expected to increase growth over the forecast period.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth Projection: The Photocatalyst Market is expected to soar to approximately USD 5.90 billion by 2033, escalating from USD 2.38 billion in 2023, indicating a robust CAGR of 9.45%.

- Dominant Types: Titanium Dioxide emerges as the frontrunner among photocatalysts, securing over 53.2% of the market share in 2023, owing to its exceptional properties and wide-ranging applications.

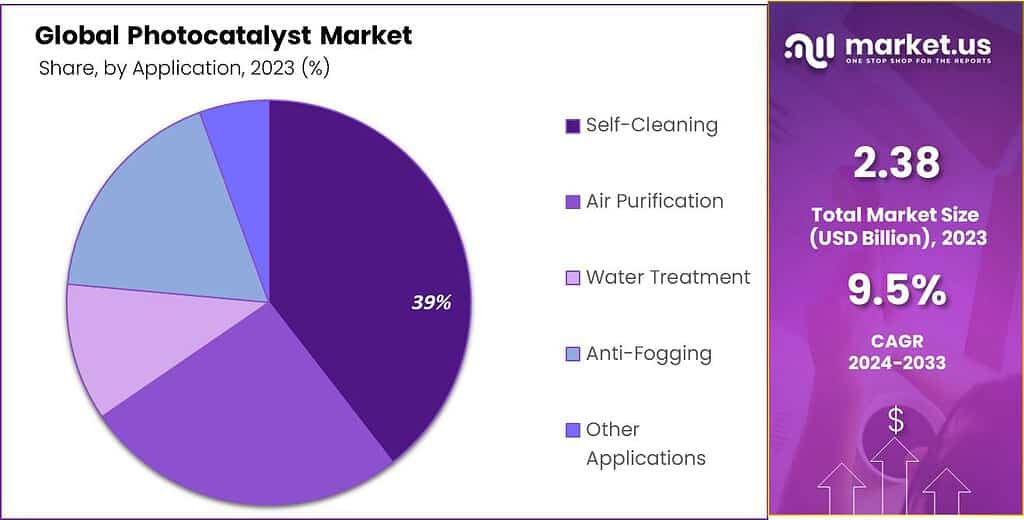

- Application Dominance: Self-cleaning applications take the lead, capturing 39.5% of the market share in 2023, reflecting the substantial demand for photocatalysts in creating surfaces resistant to dirt and grime.

- Market Drivers: Rapid industrial growth and water scarcity fuel the demand for photocatalysts, notably titanium dioxide, as a solution for water treatment. Also, their use in construction for improving air quality and self-cleaning properties spurs market growth.

- Opportunities: Research and development initiatives present significant opportunities for advancements in photocatalyst materials, fostering more efficient, cost-effective, and eco-friendly solutions.

- Challenges: Limited awareness hampers widespread adoption. Additionally, environmental regulations and fluctuating raw material prices pose hurdles. Achieving optimal efficiency and scalability remains an ongoing challenge in photocatalyst technology.

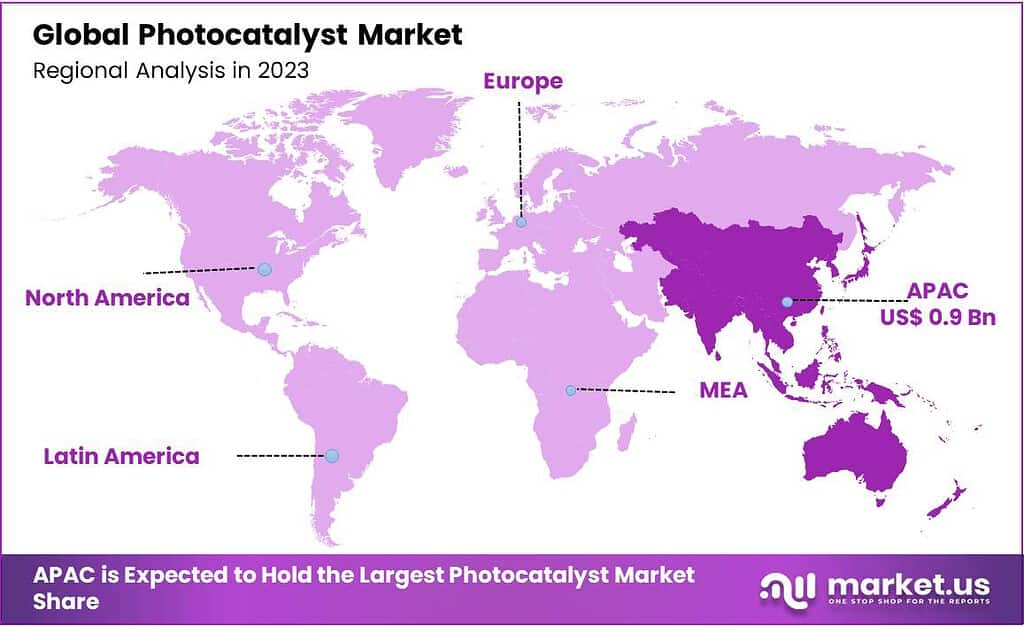

- Regional Insights: APAC leads the market with 38.14% revenue share in 2023, with Japan and China being key players. North America is forecasted as the fastest-growing region due to increased investment and technological innovation.

- Key Players: Major market players include TOTO Corporation, KRONOS Worldwide Inc., Tronox Holdings PLC, among others, with competition notably higher in Japan due to a concentration of manufacturers.

Type Analysis

In 2023, Titanium Dioxide took a commanding lead in the Photocatalyst market, securing over 53.2% of the market share. This substantial dominance highlights the unparalleled prominence of Titanium Dioxide among other types of photocatalysts.

Its widespread utilization is attributed to its exceptional properties and diverse applications across numerous industries. Titanium Dioxide’s efficacy as a photocatalyst, particularly in environmental purification, coatings, and healthcare sectors, has solidified its position as the preferred choice for various applications, contributing significantly to its dominant market share.

The staggering market share held by Titanium Dioxide underscores its extensive adoption and recognition within the photocatalyst market. Its exceptional photocatalytic properties, including high reactivity and stability, make it a versatile component in addressing environmental concerns, air purification systems, and self-cleaning surfaces.

The extensive use and multifaceted applications of Titanium Dioxide affirm its indispensable role in advancing technologies and solutions across industries, consolidating its dominant position within the photocatalyst market landscape.

Application Analysis

In 2023, the Self-Cleaning application segment emerged as the primary driver within the Photocatalyst market, capturing a commanding 39.5% share. This significant market dominance underscores the widespread adoption and demand for photocatalysts in facilitating self-cleaning functionalities across various industries.

The application of photocatalysts in self-cleaning solutions has gained substantial momentum due to its efficacy in creating surfaces that resist dirt, organic matter, and grime upon exposure to light, making them inherently easier to clean and maintain.

The prevalent use of photocatalysts for self-cleaning purposes signifies their pivotal role in developing sustainable and low-maintenance surfaces across diverse sectors.

Industries such as construction, automotive, and healthcare benefit from the implementation of self-cleaning photocatalysts, contributing to enhanced durability, cleanliness, and reduced maintenance costs. This dominant market position of photocatalysts in self-cleaning applications emphasizes their integral role in advancing technologies geared toward creating more efficient and sustainable surface solutions.

Actual Numbers Might Vary in the Final Report

Key Market Segments

By Type

- Titanium Dioxide

- Zinc Oxide

- Other Materials

By Application

- Air Purification

- Self-cleaning

- Water Purification

Drivers

The rapid industrial development and subsequent rise in water scarcity serve as a significant driver for the global photocatalyst market. Photocatalysts, particularly titanium dioxide, are instrumental in treating and purifying water through advanced oxidation processes.

With the intensification of water scarcity issues, the demand for effective water treatment solutions utilizing photocatalysts is expected to surge. This heightened demand is poised to fuel the expansion of the global photocatalyst market, emphasizing their pivotal role in addressing water scarcity concerns.

Photocatalysts’ growing use in building and construction acts as another compelling driver in the global market. Photocatalytic coatings and materials are increasingly employed to enhance air and surface quality, diminish pollution, and augment the self-cleaning and antimicrobial properties of buildings.

As the demand escalates for sustainable and innovative building solutions, the adoption of photocatalysts is projected to increase. This rise in adoption contributes significantly to the expansion and growth of the global photocatalyst market, aligning with the industry’s shift towards eco-friendly and efficient building technologies.

Restraints

The lack of awareness and understanding surrounding photocatalyst technology presents a notable challenge in its widespread adoption. Potential customers may exhibit hesitation towards embracing photocatalyst solutions due to insufficient knowledge about their benefits and applications.

Limited awareness can impede efforts aimed at educating the market about the potential advantages of photocatalysts, thereby hindering market growth. Collaborations and educational initiatives within the industry can play a crucial role in overcoming this restraint, driving awareness, and fostering market growth by enhancing understanding about photocatalyst technology and its diverse applications.

This global photocatalyst market report encapsulates comprehensive details encompassing recent developments, trade regulations, import-export analysis, production trends, and various market dynamics. It provides valuable insights into market share, the influence of both local and international market players, emerging revenue opportunities, regulatory alterations, strategic growth analyses, market size, application niches, technological innovations, and expansions.

Opportunities

The surging focus on research and development initiatives presents a substantial opportunity within the global photocatalyst market. Ongoing R&D endeavors drive significant advancements in photocatalyst materials, manufacturing methodologies, and their application scopes. These joint efforts contribute to the creation of more efficient, cost-effective, and eco-friendly photocatalytic solutions.

As researchers delve deeper into this field they uncover novel insights and technological breakthroughs creating an environment conducive for innovation. This evolution enables companies to introduce enhanced photocatalyst products that meet the evolving needs of various industries, propelling market growth.

Collaborative efforts in research and development help not only to enhance existing photocatalyst capabilities but also open the way to uncover novel applications and functionalities. Advancements in materials science, catalysis, and surface chemistry also play a part in making photocatalytic properties more versatile and adaptable to specific industry demands.

The expanding knowledge base and continuous innovation encourage companies to introduce cutting-edge photocatalyst solutions tailored to address specific challenges, thereby fostering market expansion and driving adoption across multiple sectors.

Challenges

One of the primary challenges in the photocatalyst market is the complex nature of educating consumers and industries about its advantages and applications. Limited awareness and understanding of photocatalysts hinder their widespread adoption.

This lack of familiarity may lead potential consumers to hesitate in embracing these solutions, impacting market growth. Additionally, stringent environmental regulations surrounding the use of certain photocatalysts due to their potential environmental and health hazards pose challenges to their application in specific sectors.

Another challenge of photocatalyst production lies in the fluctuating prices of raw materials used for manufacture. Price fluctuations due to supply-demand dynamics or geopolitical events can alter manufacturing costs significantly and ultimately affect final product prices; especially in price-sensitive markets.

Though photocatalyst technology continues to advance rapidly, attaining desired efficiency and scalability remains an ongoing challenge. Therefore, additional research must be conducted to enhance effectiveness, durability, and cost-efficiency, to better meet industry needs.

Competition among market players and the need to remain at the forefront of innovation present companies with challenges in differentiating their offerings and maintaining their position within this rapidly evolving market landscape.

Meeting this challenge requires concerted efforts in research, education, and technological innovation to promote photocatalyst solutions and their adoption into society.

Geopolitical and Recession Impact Analysis

Geopolitical Impact

Geopolitical stuff matters for photocatalysts too. When countries argue, they might put tariffs on imports and exports of these materials. That messes up how they’re made, costs more, and might make it harder to get them. Rules about quality, safety, and labels can change too, which means companies have to adjust how they make these things and follow new rules.

Places where things are not stable can make it tough for companies to grow. If there are fighting or issues, companies might not want to invest there, limiting growth chances. Plus, if there’s a fight over resources like where to get materials from, it can mess up how these things are made and hurt efforts to be eco-friendly.

Recession Impact

When money gets tight in tough times, people might spend less on photocatalysts. Even though they’re useful, folks might stick to other options to save money. Because everyone’s watching their wallets, they’ll pay closer attention to prices. To stay in the game, companies might need to rethink how much they charge.

Economic tough spots can mess up how things are made and delivered. If suppliers or shipping have money problems, it could slow down making and getting these materials out. Also, when things aren’t great financially, people might care more about eco-friendly packaging. They might like stuff that’s good for the environment and cuts down on waste.

Regional Analysis

APAC dominated the market, accounting for the largest revenue share of 38.14% in 2023. Japan dominated 2021’s market in terms of revenue. This was due to the high adoption of technology, large number of patents, major manufacturers, and high technology usage.

The country’s growing R&D activity is expected to boost growth over the forecast period. China is projected to grow at a 10.5% annual growth rate due to its penetration in the construction sector. The rising pollution level in China is expected to drive the use of low-cost photocatalyst-based air purification, thereby fueling the market growth over the forecast period.

North America will be the fastest-growing region, thanks to increased investment and technological innovation. Photocatalysts will be in high demand because of their low maintenance cost and rising awareness. Germany was the country that used the most nanoparticle-based water treatments in 2021. The trusted method of disinfection is also photocatalysis with Nanocatalysts. This is expected to drive industry growth, as well as the increasing demand for photocatalyst.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The industry has a small number of manufacturers, with most players operating in Japan. However, increased awareness of the technology and its advantages coupled with the development of new photocatalytic material is expected to draw new players into the market driving demand across the regions.

TOTO Corporation, JSR Corporation, and OSAKA Titanium Technologies Co. Ltd. are the major market players. These companies compete on price and region. Because of the high concentrations of Japanese manufacturers, competition in Japan is much higher than elsewhere.

Market Key Players

- TOTO Corporation

- KRONOS Worldwide Inc.

- Tronox Holdings PLC

- The Chemours Company

- Venator Materials PLC

- Lomon Billions

- Daicel Miraizu Ltd

- Green Millennium

- Hangzhou Harmony Chemical Co. Ltd

- ISHIHARA SANGYO KAISHA Ltd

- Nanoptek Corp.

- SHOWA DENKO KK

- TAYCA

- TitanPE Technologies Inc.

- Daicel Corporation

- Japan Photocatalyst Center Co. Ltd.

- Kaltech Co. Ltd.

- Sakai Chemical Industry Co Ltd

- Souma Co. Ltd.

- Others

Recent developments

In April 2022, Chemours Company, a global chemistry company, today announced it has entered into a Memorandum of Understanding (MoU) with North Carolina Agricultural and Technical State University (N.C. A&T). Under this MoU, Chemours will fund faculty-led research projects led by N.C. A&T graduate students to meet mutual interests like driving new science in water treatment to advance Chemours’ 2030 Corporate Responsibility Commitment goal of reducing process emissions of fluorinated organic chemicals by at least 99% by 2030.

In March 2022, LB Group a large Chinese chemical company announced to promotion of new titanium dioxide (TiO₂) pigments for coatings and inks at ACS 2022. It manufactures a range of chemicals including titanium, zirconium and lithium products that it sells to over 1,000 customers worldwide. The company has invested millions of dollars to grow its TiO2 pigment manufacturing business significantly

<Report Scope

Report Features Description Market Value (2023) USD 2.38 Bn Forecast Revenue (2033) USD 5.90 Bn CAGR (2023-2032) 9.45% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Titanium Dioxide, Zinc Oxide, Other Materials), By Application(Air Purification, Self-cleaning, Water Purification) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape TOTO Corporation, KRONOS Worldwide Inc., Tronox Holdings PLC, The Chemours Company, Venator Materials PLC, Lomon Billions, Daicel Miraizu Ltd, Green Millennium, Hangzhou Harmony Chemical Co. Ltd, ISHIHARA SANGYO KAISHA Ltd, Nanoptek Corp., SHOWA DENKO KK, TAYCA, TitanPE Technologies Inc., Daicel Corporation, Japan Photocatalyst Center Co. Ltd., Kaltech Co. Ltd., Sakai Chemical Industry Co Ltd, Souma Co. Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a photocatalyst?A photocatalyst is a substance that accelerates a photoreaction when exposed to light. It initiates or speeds up a chemical reaction without being consumed in the process.

What are the common applications of photocatalysts?Photocatalysts are used in various industries. They're employed in environmental applications for air and water purification, self-cleaning surfaces (like coatings on buildings or glass), anti-bacterial treatments, and even in the production of clean energy through water splitting for hydrogen production.

What are the types of photocatalysts available in the market?Common types include titanium dioxide (TiO2), zinc oxide (ZnO), and other metal oxides. These materials possess photocatalytic properties and are widely used due to their stability and effectiveness.

-

-

- TOTO Corporation

- KRONOS Worldwide Inc.

- Tronox Holdings PLC

- The Chemours Company

- Venator Materials PLC

- Lomon Billions

- Daicel Miraizu Ltd

- Green Millennium

- Hangzhou Harmony Chemical Co. Ltd

- ISHIHARA SANGYO KAISHA Ltd

- Nanoptek Corp.

- SHOWA DENKO KK

- TAYCA

- TitanPE Technologies Inc.

- Daicel Corporation

- Japan Photocatalyst Center Co. Ltd.

- Kaltech Co. Ltd.

- Sakai Chemical Industry Co Ltd

- Souma Co. Ltd.

- Others