Global Phlebotomy Equipment Market By Product (Needles and syringes, blood collection tubes, blood bags, others); By End-User (Hospitals & clinics, diagnostic centres and others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169286

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

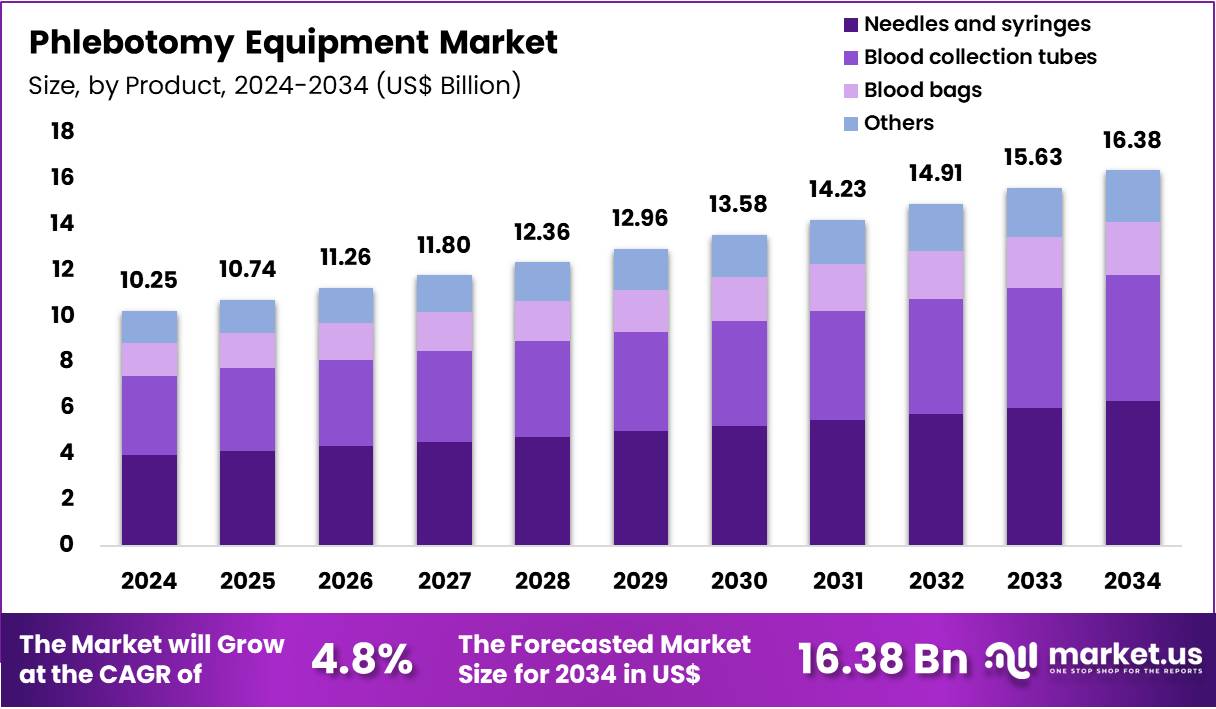

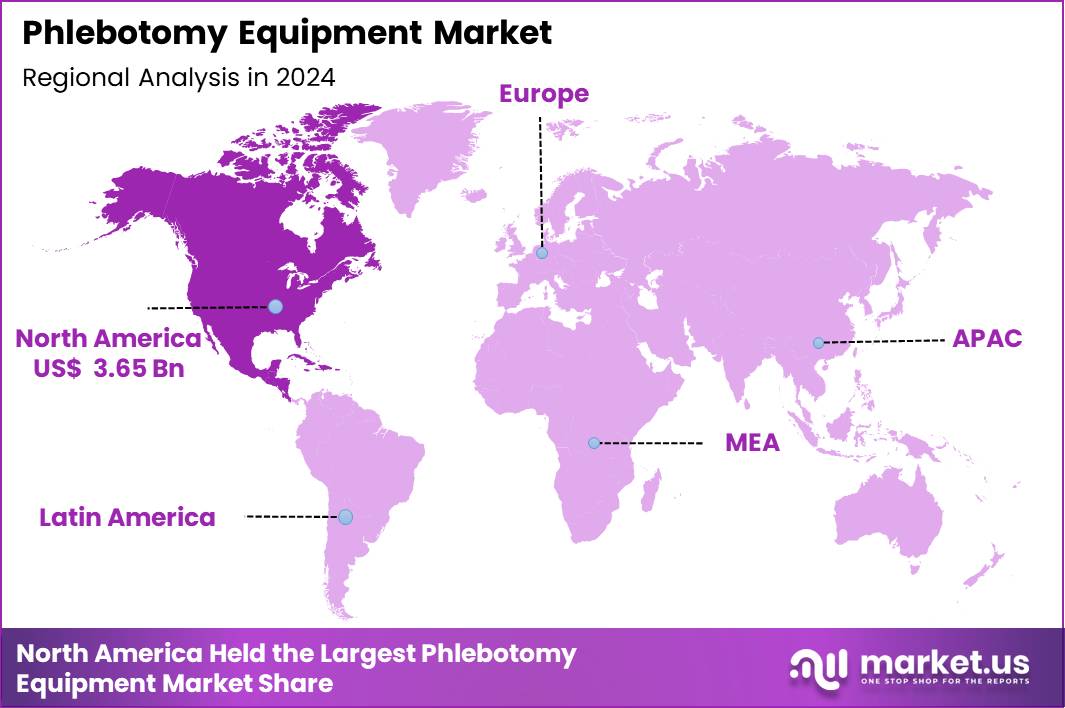

Global Phlebotomy Equipment Market size is expected to be worth around US$ 16.38 billion by 2034 from US$ 10.25 billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 35.6% share with a revenue of US$ 3.65 Billion.

The Phlebotomy Equipment Market supports global blood-collection workflows across hospitals, diagnostic laboratories, blood banks, and outpatient clinics. This market covers essential consumables required for safe venipuncture, blood draw standardization, and sample integrity preservation.

Increasing chronic disease prevalence, expanding diagnostic volumes, and rising demand for sterile consumables drive the adoption of phlebotomy equipment across healthcare systems. Manufacturers continue to introduce safety-engineered needles, evacuated tubes with advanced additives, and blood-bag systems aligned with transfusion guidelines.

Demand accelerated due to infection-control protocols, growing outpatient testing, and the expansion of national laboratory networks. Strong government emphasis on safe blood-collection practices and needle-stick injury reduction supports market growth. Innovations such as pre-barcoded tubes, closed-system safety needles, pediatric micro-collection devices, and environmentally compliant disposables broaden product adoption across regions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 10.25 billion, with a CAGR of 4.8%, and is expected to reach US$ 16.38 billion by the year 2034.

- The Product segment is divided into Needles and syringes, blood collection tubes, blood bags, others, with Needles and syringes taking the lead in 2024 with a market share of 38.5%

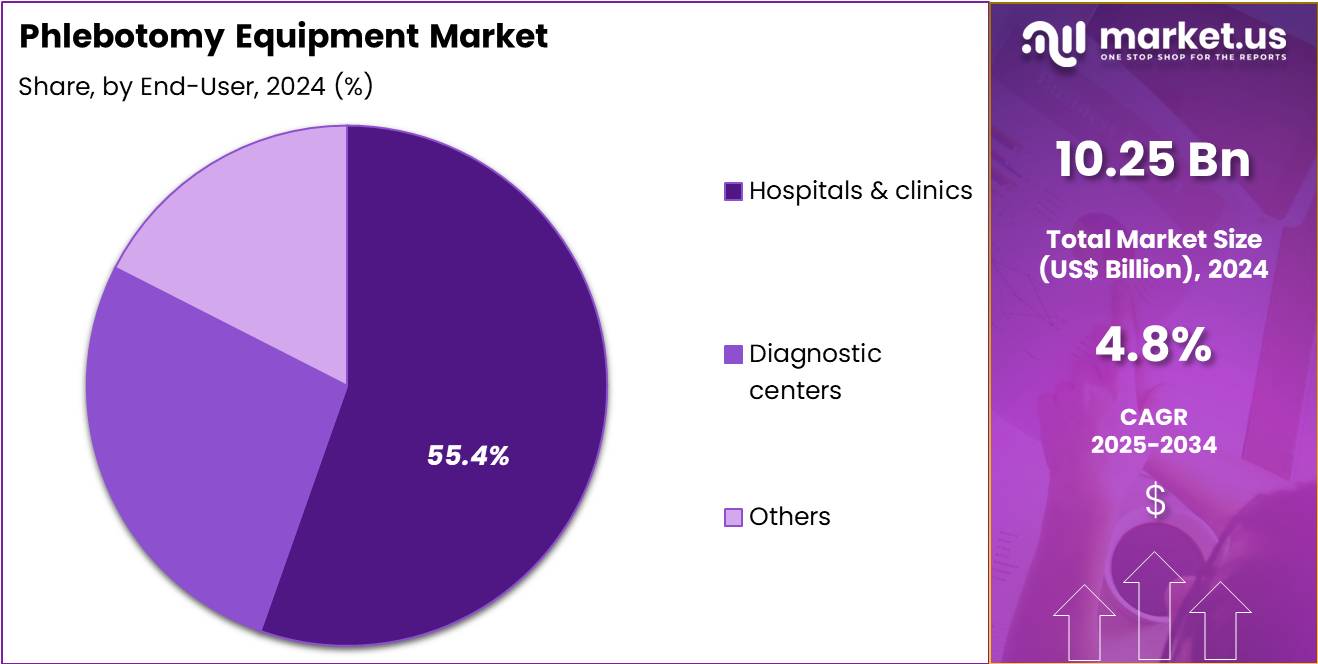

- The End-User segment is divided into Hospitals & clinics, diagnostic centers, others, with Hospitals & clinics taking the lead in 2024 with a market share of 55.4%

- North America led the market by securing a market share of 35.6% in 2024.

Kit Type Analysis

Needles and syringes dominated the market with 38.5% market share in 2024 due to high daily utilization rates across emergency rooms, inpatient wards, pathology labs, and mobile phlebotomy units. Large hospitals conduct millions of venipuncture procedures annually, fueling continual demand for sterile, single-use, and safety-engineered devices. Needlestick injury-prevention mandates in the US, EU, and APAC strengthen adoption of retractable and shielded designs. Growing preference for single-use syringes in blood culture collection, pediatric blood draws, and outpatient care reinforces segment leadership.

Evacuated blood collection tubes form the second-largest segment owing to standardized sample handling and compatibility with automated analyzers. Tubes with EDTA, citrate, serum-separator gels, and heparin additives support hematology, biochemistry, coagulation, and molecular tests. Pre-barcoded tubes improve traceability and reduce laboratory errors, promoting strong adoption in centralized laboratory networks. In September 2025, the joint-venture’s TS Blood Collection Kit received certification as a controlled medical device under Japan’s Pharmaceuticals and Medical Devices Act enabling distribution of self-administered blood-collection devices in Japan.

End-User Analysis

Hospitals & clinics constitute the largest end-user segment accounted for over 55.4% market share due to continuous blood-draw requirements in inpatient diagnostics, emergency care, surgeries, and chronic-disease management. High admissions, rapid diagnostic turnaround needs, and large multispecialty networks drive steady product consumption. Infection-control policies and staff-safety guidelines further expand demand for safety needles and closed-system tubes.

Diagnostic laboratories, pathology centers, and standalone testing facilities account for significant equipment usage, especially with increased outpatient visits, corporate health screenings, and preventive-health programs. Automation-driven laboratories prefer pre-labeled evacuated tubes to support sample processing efficiency. Rapid expansion of urban diagnostic chains in APAC and the Middle East strengthens growth.

Key Market Segments

By Product

- Needles and syringes

- Blood collection tubes

- Blood bags

- Others

By End-User

- Hospitals & clinics

- Diagnostic centers

- Others

Drivers

Growing Diagnostic Volumes and Rising Chronic Disease Burden

The expansion of global diagnostic testing is expected to drive significant demand for phlebotomy equipment, especially as chronic illnesses continue to rise across major economies. For example, the International Diabetes Federation reported 537 million adults living with diabetes in 2021, projected to increase to 643 million by 2030, creating strong requirements for routine blood draws to monitor HbA1c, renal profiles, lipid panels, and glucose levels.

Cardiovascular diseases contribute further: the WHO states that 17.9 million people die each year from CVDs, requiring frequent biochemical assessments through blood samples. Hospitals conduct millions of venipuncture procedures annually, with large US hospitals performing over 25,000 blood draws per day in high-volume settings. Growing oncology cases also elevate sample-collection demand, as cancer patients undergo repeated blood testing to track tumor markers and therapy response.

The global rise in preventive healthcare significantly contributes as well annual health check-ups in APAC countries such as Japan and South Korea generate massive demand for evacuated tubes, needles, and safety-engineered consumables. With expanding diagnostic infrastructure in India, Indonesia, and Vietnam, outpatient testing volumes are expected to grow sharply. Increased surgical procedures—over 310 million performed globally each year further amplify the consumption of phlebotomy supplies for perioperative diagnostics.

Restraints

High Costs, Waste Burden, and Uneven Access in Emerging Markets

Cost pressures and waste-management challenges remain primary restraints in phlebotomy equipment adoption, especially in low-income and developing regions. Safety-engineered needles can cost 2–5 times more than conventional needles, restricting usage in budget-constrained hospitals. Smaller diagnostic centers often rely on cheaper alternatives, despite needle-stick injury risk. According to CDC estimates, 385,000 needle-stick injuries occur annually among US healthcare workers, highlighting the need for safety devices that many regions struggle to afford.

Medical waste generation adds another burden: hospitals generate 0.5–2.5 kg of biohazard waste per bed per day, with phlebotomy consumables forming a significant share. Many countries in Africa and Southeast Asia lack regulated waste-disposal systems, increasing infection-control risks. Supply-chain dependence on medical-grade plastics has created volatility, as seen during COVID-19 when resin shortages caused global delays in tube and syringe manufacturing.

Rural and semi-urban regions face severe shortages of trained phlebotomists, leading to improper venipuncture practices and underutilization of advanced equipment. In resource-limited settings, transportation challenges and inconsistent cold-chain support impact the reliability of blood-storage products such as bags and anticoagulant tubes. These combined factors restrain uniform adoption of standardized phlebotomy practices across global healthcare environments.

Opportunities

Growth in Safety Devices, Automation, and Pediatric Micro-Collection Systems

A major opportunity exists in developing safety-enhanced, automated, and specialized phlebotomy solutions that address growing global demand. Needle-stick injury-prevention mandates in the US, EU, and APAC are accelerating the shift toward retractable needles, shielded systems, and closed blood-collection devices. The Needlestick Safety and Prevention Act in the US drove more than 70% adoption of safety-engineered needles within hospitals, demonstrating large-scale transition potential worldwide. Automation of sample labeling, pre-barcoding, and integrated tube-handling systems presents another opportunity as laboratories move toward digital workflow optimization.

Major hospitals now process over 10,000–50,000 samples daily, requiring automated phlebotomy carts, pneumatic tube compatibility, and traceability solutions. Pediatric micro-collection systems are growing rapidly as neonatal testing increases; for instance, UNICEF reports 2.4 million neonatal deaths annually, driving the need for improved diagnostics and safer collection systems in infants, especially in low-resource areas.

Eco-friendly product innovations such as recyclable sharps containers and reduced-plastic tubes offer manufacturers new growth pathways as healthcare networks commit to sustainability targets. Emerging markets in Africa, Latin America, and Southeast Asia are investing heavily in diagnostic infrastructure, providing opportunities for global players to expand distribution of standardized phlebotomy consumables and safety kits in regions previously underserved.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical developments are expected to have a significant influence on the Phlebotomy Equipment Market, primarily through their effects on healthcare spending, supply-chain reliability, and global medical device distribution. Periods of economic slowdown often push governments and hospitals to restrict capital spending, delaying procurement of advanced safety-engineered needles or automated phlebotomy accessories. Inflationary pressures increase the cost of key raw materials such as medical-grade plastics, stainless steel, rubber, and anticoagulant additives, resulting in higher prices for syringes, blood collection tubes, and blood bags.

For example, resin shortages during COVID-19 increased plastic procurement costs by 20–35%, affecting tube production globally. Geopolitical conflicts and trade restrictions disrupt cross-border shipment of components such as rubber stoppers, pre-barcoded labels, and sterilization reagents—leading to delays in manufacturing cycles. Tensions between major exporting nations affect the availability of bulk needles and laboratory consumables in dependent regions like Africa and Southeast Asia.

Currency fluctuations in emerging markets make imported phlebotomy equipment costly for hospitals, pushing them toward low-cost alternatives that may not meet safety standards. Furthermore, global refugee movements and humanitarian crises increase demand for emergency medical kits, including phlebotomy supplies, placing additional pressure on supply chains during periods of geopolitical instability.

Latest Trends

Shift Toward Safety-Engineered Devices and Digital, Workflow-Integrated Phlebotomy

A strong trend shaping the phlebotomy equipment market is the shift toward safety-focused, digitally integrated, and ergonomically advanced blood-collection systems. Healthcare facilities are adopting safety-engineered needles to minimize needle-stick injuries, a major occupational hazard that affects hundreds of thousands of workers annually. The WHO estimates that unsafe injections cause over 1.3 million deaths per year, reinforcing the urgency of safety innovations. Hospitals are increasingly integrating barcode-enabled tubes to reduce specimen mislabeling errors that historically accounted for 13% of laboratory identification mistakes according to CAP studies.

Digital phlebotomy carts, automated vein-finding devices using near-infrared (NIR) imaging, and mobile sample-tracking applications are becoming more common. For example, modern NIR devices can reduce failed venipuncture attempts by up to 39%, improving patient comfort and lab efficiency. Sustainability is another major trend, with hospitals aiming to reduce plastic waste by adopting recyclable PET tubes or lightweight polymer formulations.

Telehealth expansion also contributes to the rise of home-based blood-collection kits and mobile phlebotomy services. With rapid urbanization and workforce expansion in diagnostic labs, ergonomic phlebotomy chairs, adjustable carts, and efficient workflow layouts are transforming the way sample collection is executed globally.

Regional Analysis

North America is leading the Phlebotomy Equipment Market

North America remains the largest region accounting for 35.6% market share in 2024 in the Phlebotomy Equipment Market due to its advanced healthcare infrastructure, high diagnostic volumes, and strong adoption of safety-engineered blood-collection devices. The United States alone performs more than 7 billion laboratory tests each year, with over 70% of clinical decisions depending on blood diagnostics, creating consistently high demand for needles, syringes, and evacuated tubes.

The CDC notes that US hospitals conduct over 400 million venipuncture procedures annually, reinforcing continual consumption of sterile phlebotomy consumables. Strong regulatory mandates—such as the Needlestick Safety and Prevention Act—led to widespread adoption of retractable and shielded needles across hospitals and outpatient centers.

Large diagnostic chains including Labcorp and Quest Diagnostics process hundreds of thousands of blood samples daily, requiring massive tube and accessory procurement. Canada also contributes significantly, supported by widespread chronic-disease screening; for example, approximately 1 in 12 Canadians has diabetes, resulting in ongoing demand for routine blood testing. Together, these factors solidify North America’s leading market share.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific represents the fastest-growing region due to accelerating healthcare investment, expanding diagnostic laboratory networks, and rising chronic-disease prevalence. The region accounts for nearly 60% of the world’s diabetic population, with India and China alone contributing more than 240 million diabetic individuals, driving a massive surge in regular blood testing.

Countries such as Japan and South Korea maintain some of the world’s highest health-checkup rates, with Japan conducting over 50 million annual preventive screenings, increasing demand for blood-collection tubes and needles. Southeast Asian nations, including Indonesia, Vietnam, and the Philippines, are rapidly expanding hospital infrastructure and private diagnostic chains, which boosts procurement of phlebotomy consumables.

Government-led screening programs such as India’s national anemia screening initiative covering over 150 million women and children further accelerate usage volumes. China’s rising cancer burden, with 4.5 million new cases annually, increases oncology-related blood testing. These combined dynamics position Asia Pacific as the fastest-growing regional market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Becton, Dickinson and Company (BD), Cardinal Health, Terumo Corporation, Sarstedt AG & Co. KG, Medline Industries, Inc., Heathrow Scientific LLC, NIPRO Medical Corporation, Greiner Bio-One International GmbH, F.L. Medical s.r.l., Haemonetics Corporation, Retractable Technologies, Inc., Smiths Medical, Tasso, Inc., Dynarex Corporation, Fresenius Kabi, other key players.

BD leads global phlebotomy equipment with extensive safety-engineered needles, evacuated tubes, and blood-collection systems. Its BD Vacutainer line dominates hospitals, offering high accuracy, traceability, and strong compliance with infection-control standards worldwide.

Cardinal Health supplies large-scale phlebotomy consumables, including syringes, sharps containers, tourniquets, and blood-draw accessories. Its extensive distribution network supports North American hospitals and labs with reliable, cost-efficient, high-volume blood-collection products.

Terumo specializes in advanced venipuncture and blood-collection devices, including safety needles and closed blood-draw systems. Its SURFLO and Terumo Blood and Cell Technologies portfolio strengthens adoption across hospitals seeking improved safety, precision, and patient comfort.

Recent Developments

- In March 2025, BD announced that its BD MiniDraw Capillary Blood Collection System produces capillary-blood samples with testing accuracy clinically equivalent to conventional venous draws for multiple common analytes enabling blood collection from fingertip instead of traditional venipuncture.

- In February 2025, Tasso, Inc. launched a next-generation dried blood spot (DBS) collection system combining its new Tile‑T20 dried whole blood cartridge with its lancet device, enabling volumetrically controlled, patient-centric sample collection for clinical trials and remote testing.

- In February 2025, Tasso, Inc. + ARUP Laboratories announced a partnership to develop and operationalize high-quality at-home blood testing services for clinical research combining Tasso’s blood-collection solutions with ARUP’s laboratory testing capabilities.

Top Key Players

- Becton, Dickinson and Company (BD)

- Cardinal Health

- Terumo Corporation

- Sarstedt AG & Co. KG

- Medline Industries, Inc.

- Heathrow Scientific LLC

- NIPRO Medical Corporation

- Greiner Bio-One International GmbH

- L. Medical s.r.l.

- Haemonetics Corporation

- Retractable Technologies, Inc.

- Smiths Medical

- Tasso, Inc.

- Dynarex Corporation

- Fresenius Kabi

- Other key players

Report Scope

Report Features Description Market Value (2024) US$ 10.25 Billion Forecast Revenue (2034) US$ 16.38 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Needles and syringes, blood collection tubes, blood bags, others); By End-User (Hospitals & clinics, diagnostic centres and others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Becton, Dickinson and Company (BD), Cardinal Health, Terumo Corporation, Sarstedt AG & Co. KG, Medline Industries, Inc., Heathrow Scientific LLC, NIPRO Medical Corporation, Greiner Bio-One International GmbH, F.L. Medical s.r.l., Haemonetics Corporation, Retractable Technologies, Inc., Smiths Medical, Tasso, Inc., Dynarex Corporation, Fresenius Kabi, other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Phlebotomy Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Phlebotomy Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton, Dickinson and Company (BD)

- Cardinal Health

- Terumo Corporation

- Sarstedt AG & Co. KG

- Medline Industries, Inc.

- Heathrow Scientific LLC

- NIPRO Medical Corporation

- Greiner Bio-One International GmbH

- L. Medical s.r.l.

- Haemonetics Corporation

- Retractable Technologies, Inc.

- Smiths Medical

- Tasso, Inc.

- Dynarex Corporation

- Fresenius Kabi

- Other key players