Philippines Tourism Market Size, Share, Growth Analysis By Tourism Type (Cultural & Heritage Tourism, Medical Tourism, Eco/Sustainable Tourism, Sports Tourism, Wellness Tourism, Others), By Booking Channel (Online Booking, Phone Booking, In Person Booking), By Tourist Type (Domestic, International), By Age Group (15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, 66-75 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176102

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

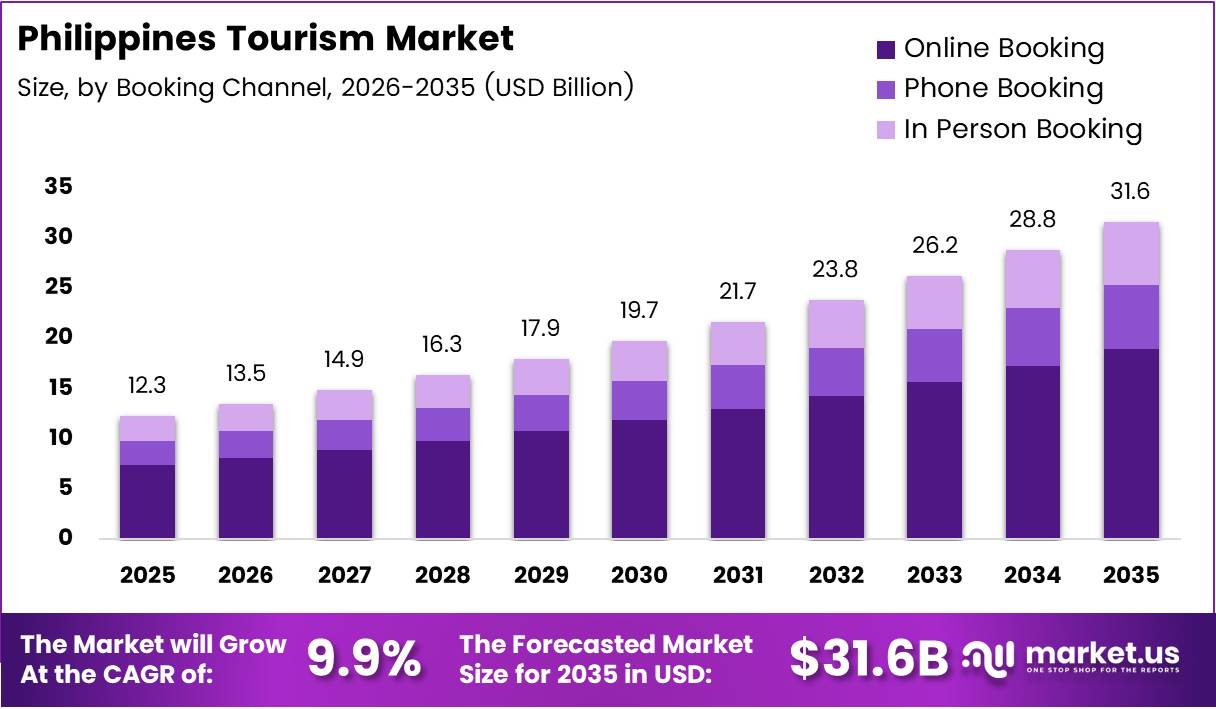

Philippines Tourism Market size is expected to be worth around USD 31.6 Billion by 2035 from USD 12.3 Billion in 2025, growing at a CAGR of 9.9% during the forecast period 2026 to 2035.

The Philippines Tourism Market encompasses comprehensive travel services, hospitality infrastructure, and visitor experiences across cultural heritage sites, natural landscapes, and urban destinations. This sector includes domestic and international travel facilitated through various booking channels. Moreover, the market serves diverse tourist demographics seeking cultural immersion, wellness retreats, and adventure activities throughout the archipelago.

Tourism development accelerates economic growth by creating employment opportunities in hospitality, transportation, and local enterprises. The sector attracts foreign investment in resort infrastructure and sustainable tourism projects. Additionally, government initiatives promote regional tourism development through infrastructure improvements and marketing campaigns targeting key source markets.

Cultural heritage attractions drive visitor interest in historical landmarks, traditional festivals, and indigenous communities. Coastal destinations offer marine biodiversity experiences including diving, island hopping, and beach tourism. Furthermore, urban centers provide shopping, dining, and entertainment options that complement natural attractions across multiple regions.

Government investment strengthens tourism infrastructure through airport expansions, road networks, and destination facilities. Regulatory frameworks support sustainable tourism practices while ensuring visitor safety and service quality standards. Consequently, policy initiatives facilitate visa liberalization and digital payment integration to enhance tourist convenience.

According to Sunstar Manila, 6.48 million international tourist arrivals were recorded in the Philippines in 2025. This figure demonstrates sustained recovery momentum in visitor volumes across major entry points. The arrival statistics reflect growing confidence among international travelers in Philippine tourism offerings and safety protocols.

According to Sunstar Manila, international visitor spending from 2025 arrivals was an estimated ₱694 billion based on Department of Tourism preliminary figures. This spending level indicates strong economic contribution from tourism activities. Moreover, revenue generation supports local businesses and government tax collections essential for continued sector development.

In June 2025, Indian nationals were granted visa-free entry to the Philippines for tourism purposes, with 14-day visa-free stays. This policy change expands market access from emerging Asian source countries. Therefore, simplified entry requirements position the Philippines competitively against regional tourism destinations targeting Indian travelers.

Key Takeaways

- Philippines Tourism Market reaches USD 12.3 Billion in 2025 and projects USD 31.6 Billion by 2035 at 9.9% CAGR

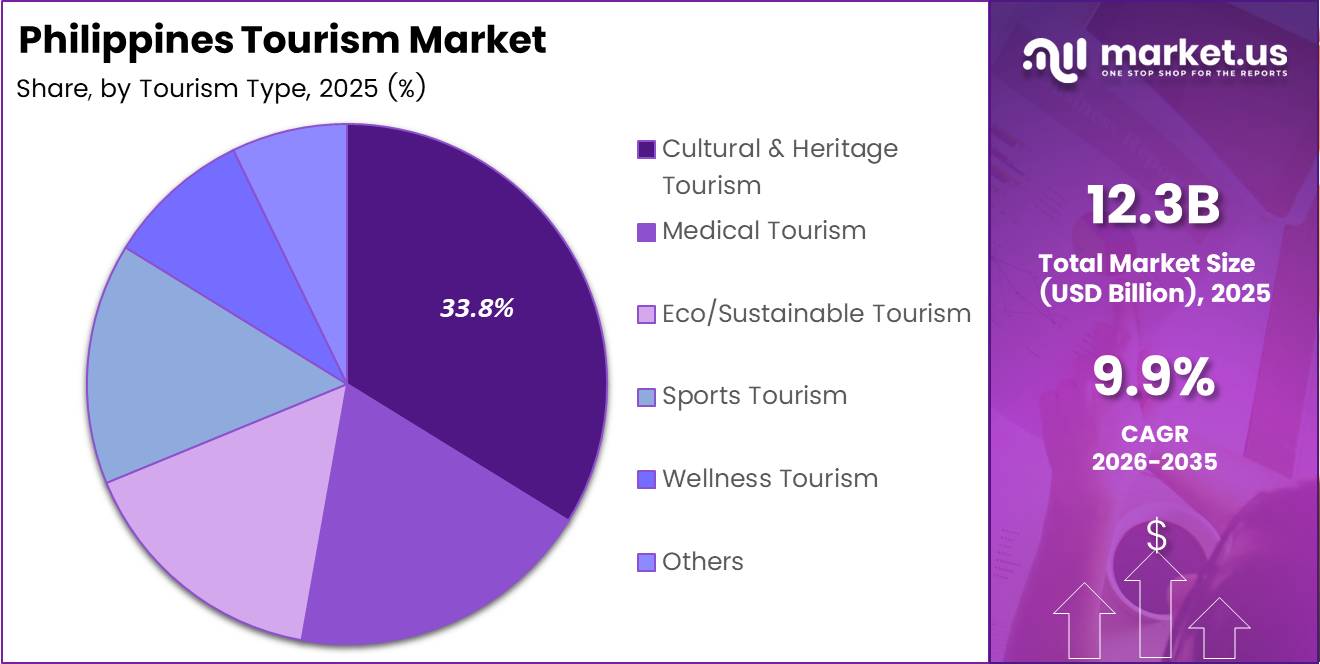

- Cultural & Heritage Tourism dominates tourism type segment with 33.8% market share in 2025

- Online Booking channel commands 67.2% share driven by digital platform adoption and convenience

- Domestic tourists represent 69.9% of total tourist volume reflecting strong local travel demand

- Age group 26-35 Years holds 31.4% share as primary demographic for tourism activities

- Asia-Pacific region generates majority of international arrivals with 6.48 million visitors in 2025

- Government training initiatives reached 409,859 individuals through service excellence programs in 2025

Tourism Type Analysis

Cultural & Heritage Tourism dominates with 33.8% due to rich historical sites and indigenous cultural experiences.

In 2025, Cultural & Heritage Tourism held a dominant market position in the By Tourism Type segment of Philippines Tourism Market, with a 33.8% share. Visitors seek authentic experiences at UNESCO heritage sites, Spanish colonial landmarks, and traditional tribal communities. Historical attractions in Manila, Vigan, and Cebu draw substantial international interest. Consequently, this segment benefits from government preservation efforts and cultural festival promotions.

Medical Tourism attracts international patients seeking affordable healthcare services combined with leisure travel opportunities. Philippine hospitals offer specialized treatments in cosmetic surgery, dental care, and wellness therapies at competitive prices. Moreover, English-speaking medical staff and internationally accredited facilities enhance service appeal. Healthcare tourism packages integrate treatment with post-recovery beach resort stays.

Eco/Sustainable Tourism focuses on environmental conservation experiences in marine sanctuaries, rainforests, and protected wildlife areas. Travelers engage in responsible tourism activities including coral reef monitoring and community-based conservation projects. Additionally, eco-lodges and sustainable resorts minimize environmental impact while supporting local communities. This segment grows as environmental awareness increases among conscious travelers.

Sports Tourism encompasses diving expeditions, surfing competitions, and adventure sports in natural settings. The Philippines hosts international sporting events that attract athlete participants and spectators. Furthermore, unique geography provides ideal conditions for water sports, mountain trekking, and extreme adventure activities. Sports tourism generates revenue through event organization and equipment rentals.

Wellness Tourism delivers holistic health experiences through spa treatments, yoga retreats, and traditional healing practices. Destinations offer wellness programs combining natural hot springs, therapeutic massages, and organic cuisine. Therefore, health-conscious travelers seek stress relief and rejuvenation in peaceful island and mountain settings. Wellness resorts integrate modern amenities with indigenous healing traditions.

Others includes business tourism, educational travel, and niche interest segments serving specialized visitor needs. MICE tourism attracts corporate events and international conferences to major urban centers. Additionally, educational institutions host international students and academic exchange programs. Diverse offerings accommodate varied traveler preferences beyond mainstream tourism categories.

Booking Channel Analysis

Online Booking dominates with 67.2% due to digital platform convenience and competitive pricing transparency.

In 2025, Online Booking held a dominant market position in the By Booking Channel segment of Philippines Tourism Market, with a 67.2% share. Digital platforms provide instant confirmation, price comparisons, and user reviews that inform booking decisions. Mobile applications enable travelers to arrange complete itineraries including flights, accommodations, and activities. Moreover, online channels offer promotional discounts and loyalty rewards that reduce travel costs.

Phone Booking serves customers preferring personalized assistance and verbal confirmation of reservation details. Call centers provide multilingual support and handle complex booking requirements involving group travel. Additionally, phone channels accommodate travelers with limited internet access or digital literacy. Travel agencies maintain phone booking services for corporate clients requiring invoice documentation and specialized arrangements.

In Person Booking facilitates face-to-face consultations with travel agents who provide destination expertise and customized itinerary planning. Physical offices build customer trust through direct interaction and relationship development. Furthermore, in-person channels serve travelers seeking comprehensive travel insurance explanations and visa assistance. Traditional booking methods remain relevant for complex multi-destination trips requiring detailed coordination.

Tourist Type Analysis

Domestic tourists dominate with 69.9% due to strong local travel culture and regional destination diversity.

In 2025, Domestic tourists held a dominant market position in the By Tourist Type segment of Philippines Tourism Market, with a 69.9% share. Filipino travelers explore provincial destinations during holidays, long weekends, and summer vacation periods. Domestic tourism supports local economies in secondary cities and rural communities dependent on visitor spending. Moreover, affordable domestic travel packages encourage family trips and group excursions to nearby islands and heritage towns.

International tourists contribute higher per-capita spending on premium accommodations, guided tours, and luxury experiences. Foreign visitors arrive primarily from Asian countries, North America, and European markets seeking tropical destinations. Additionally, international travelers extend average stay durations compared to domestic tourists, generating sustained revenue for hospitality providers. Visa policies and flight connectivity influence international visitor volumes significantly.

Age Group Analysis

26-35 Years age group dominates with 31.4% due to disposable income and adventure travel preferences.

In 2025, 26-35 Years age group held a dominant market position in the By Age Group segment of Philippines Tourism Market, with a 31.4% share. Young professionals possess financial resources and flexible vacation time for leisure travel experiences. This demographic seeks adventure activities, cultural immersion, and social media-worthy destinations. Consequently, millennial travelers drive demand for eco-tourism, wellness retreats, and off-the-beaten-path locations.

15-25 Years represents budget-conscious travelers including students and young adults seeking affordable beach destinations and backpacking experiences. Educational tours and youth group travel constitute significant portions of this segment. Moreover, social media influences destination choices among younger travelers prioritizing Instagram-worthy locations. Hostels, budget accommodations, and group tour packages cater to price-sensitive younger demographics.

36-45 Years encompasses family travelers planning vacations with children in beach resorts and theme parks. This age group values safety, convenience, and family-friendly amenities in destination selection. Additionally, mid-career professionals seek work-life balance through regular leisure travel. Family packages combining accommodation, meals, and activities appeal to this demographic.

46-55 Years includes established professionals and pre-retirees with higher discretionary income for luxury travel experiences. Cultural heritage tours, wellness retreats, and premium resort stays attract this mature demographic. Furthermore, this age group demonstrates loyalty to preferred destinations through repeat visitation patterns. Comfort, service quality, and authentic experiences drive purchasing decisions.

66-75 Years represents retirees seeking relaxed vacation experiences in accessible destinations with medical facilities nearby. Senior travelers prefer organized tours with minimal physical exertion and comprehensive support services. Therefore, this segment values safety, healthcare access, and comfortable transportation options. Senior-friendly infrastructure and specialized tour programs accommodate mobility considerations.

Drivers

Rising Influx of International Tourists from Asia-Pacific Countries Drives Market Growth

International arrivals accelerate from neighboring Asian markets including China, South Korea, and Japan seeking tropical destinations. Flight connectivity expands through regional carriers offering direct routes to Philippine airports. Moreover, visa liberalization policies simplify entry requirements for key source markets in Asia. According to Manila Bulletin, the Philippines logged 2.9 million international tourist arrivals in the first half of 2025, demonstrating sustained visitor momentum.

Government marketing campaigns target emerging Asian middle-class populations with growing disposable income for international travel. Tourism promotions highlight unique cultural attractions, pristine beaches, and adventure opportunities unavailable in other regional destinations. Additionally, competitive pricing positions the Philippines favorably against established Southeast Asian tourism markets. Digital marketing through social media platforms reaches younger Asian demographics planning leisure trips.

In April 2025, the Philippine government authorized the issuance of Digital Nomad Visas for foreign remote workers to stay and work temporarily in the country. This initiative attracts long-term visitors who combine remote work with extended travel experiences. Furthermore, affordable living costs and reliable internet connectivity appeal to digital professionals seeking tropical work environments. Remote worker visa programs diversify visitor demographics beyond traditional tourist categories.

Restraints

Vulnerability to Natural Disasters Impacting Tourist Safety Limits Market Expansion

Typhoon seasons create periodic disruptions in tourism operations, affecting flight schedules and resort accessibility. Natural disasters damage infrastructure including coastal resorts, transportation networks, and heritage sites requiring costly repairs. Moreover, severe weather events generate negative international media coverage that temporarily reduces visitor confidence. Insurance costs increase for tourism operators in disaster-prone regions.

Earthquake and volcanic activity in certain regions pose safety concerns that influence destination selection among risk-averse travelers. Emergency preparedness infrastructure requires continuous investment to protect visitors during natural calamities. Additionally, evacuation procedures and disaster response systems must accommodate large tourist populations. Climate change intensifies weather patterns, increasing frequency and severity of natural hazards affecting tourism stability.

Inadequate tourism infrastructure in remote regions restricts destination accessibility and limits visitor experiences in emerging areas. Transportation networks remain underdeveloped in secondary destinations with tourism potential. Furthermore, insufficient accommodation capacity and service facilities prevent visitor overflow from saturated popular destinations. Infrastructure gaps require substantial government and private investment to unlock untapped tourism opportunities in provincial locations.

Growth Factors

Technological Advancements and Government Support Accelerate Market Expansion

Digital platforms transform tourism marketing and booking processes, enabling direct engagement with global travelers. Virtual reality tours and immersive content showcase Philippine destinations to international audiences before travel. Moreover, mobile applications provide real-time information on attractions, transportation, and local services enhancing visitor experiences. According to PIA, the Department of Tourism’s training initiatives in 2025 trained 409,859 individuals through service excellence and skills programs.

Investment in luxury resorts and high-end hospitality elevates service standards and attracts premium traveler segments. International hotel chains expand operations in major tourist destinations, creating employment and raising service benchmarks. Additionally, boutique resorts and eco-luxury properties offer exclusive experiences commanding higher room rates. Upscale hospitality development generates increased tourism revenue per visitor arrival.

In September 2025, the Department of Tourism launched the Tourism Start-Up Challenge 2025 to provide funding and support for innovative tourism project proposals from Luzon, Visayas, and Mindanao. This initiative stimulates entrepreneurship in tourism-related businesses and service innovations. Furthermore, startup support programs encourage creative tourism products including experiential tours and community-based tourism ventures. Innovation funding accelerates new concept development that differentiates Philippine tourism offerings.

Emerging Trends

Experiential Tourism and Digital Transformation Reshape Market Landscape

Experiential tourism focuses on authentic cultural immersion through participation in local traditions, crafts, and daily community life. Travelers seek meaningful connections with Filipino culture beyond passive sightseeing experiences. Moreover, homestay programs and village tourism initiatives provide income directly to rural communities. Authentic experiences generate higher satisfaction and encourage positive word-of-mouth marketing among travelers.

Eco-friendly travel options grow as environmental consciousness influences destination and accommodation choices. Sustainable resorts implement waste reduction, renewable energy, and marine conservation practices. Additionally, travelers participate in environmental protection activities including beach cleanups and coral restoration projects. According to PIA, a total of 1,089 tourist-oriented police officers were trained and deployed across the Philippines in 2025 under the TOPCOP program, enhancing visitor safety infrastructure.

Social media platforms drive destination popularity through user-generated content and influencer marketing campaigns. Instagram and TikTok showcase Philippine landscapes, attracting younger demographics seeking photogenic travel experiences. Furthermore, viral content creates sudden demand surges for previously obscure destinations featured in popular posts. Tourism operators leverage social media for real-time engagement and targeted promotional campaigns reaching global audiences.

Key Company Insights

Scorpio Travel and Tours Inc. provides comprehensive travel packages combining domestic and international destinations with customized itinerary planning. The company specializes in corporate travel management, group tours, and leisure vacation arrangements across Philippine destinations. Moreover, Scorpio maintains partnerships with major airlines and hotel chains ensuring competitive pricing and reliable service delivery. Digital booking platforms enable customers to access real-time availability and instant confirmation for travel arrangements.

Baron Travel operates as a leading travel agency offering outbound and inbound tour services through extensive destination expertise. The agency provides visa assistance, travel insurance, and complete tour packages for Filipino travelers exploring international markets. Additionally, Baron Travel manages corporate accounts requiring business travel logistics and expense management solutions. Strong supplier relationships ensure preferential rates and exclusive access to premium travel products.

Asiaventure Tours & Travel focuses on adventure tourism experiences including diving expeditions, mountain trekking, and eco-tourism activities throughout the Philippines. The company curates specialized tours for small groups seeking authentic cultural immersion and outdoor adventure challenges. Furthermore, Asiaventure employs experienced local guides providing safety oversight and destination knowledge. Sustainable tourism practices minimize environmental impact while supporting local communities.

Vansol Travel & Tours delivers personalized travel services for leisure and business clients through customized package development and concierge support. The agency maintains expertise in honeymoon packages, family vacations, and educational tours across domestic and Asian destinations. Moreover, Vansol provides airport transfers, accommodation bookings, and activity reservations ensuring seamless travel experiences. In June 2025, the Department of Tourism and Mastercard announced a strategic collaboration to leverage data, analytics, and digital payments to enhance tourism growth in the Philippines.

Key players

- Scorpio Travel and Tours Inc.

- Baron Travel

- Asiaventure Tours & Travel

- Vansol Travel & Tours

- Kapwa Travel

- Marsman Drysdale Travel Inc.

- Rajah Tours Philippines

- Atlas Tours and Travel Inc.

- Bridgeway Travel and Tours

- Haranah Tours Corporation

Recent Developments

- June 2025 – Indian nationals were granted visa-free entry to the Philippines for tourism purposes, with 14-day visa-free stays and up to 30 days for holders of certain foreign visas. This policy expands market access from India’s growing outbound tourism segment.

- September 2025 – The Department of Tourism launched the Tourism Start-Up Challenge 2025 to provide funding and support for innovative tourism project proposals from Luzon, Visayas, and Mindanao. The initiative encourages entrepreneurship and innovation in tourism product development.

- July 2025 – The Turismo Asenso Loan Program began offering low-interest financing packages to tourism MSMEs, allowing loans of up to ₱20 million to support business expansion. This financial assistance strengthens small enterprise capacity in the tourism sector.

- September 2025 – Nine tourism-related MSMEs received Turismo Asenso Loans under the national MSME financing initiative to expand operations and boost service quality. The loans facilitate infrastructure improvements and service enhancement investments.

Report Scope

Report Features Description Market Value (2025) USD 12.3 Billion Forecast Revenue (2035) USD 31.6 Billion CAGR (2026-2035) 9.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tourism Type (Cultural & Heritage Tourism, Medical Tourism, Eco/Sustainable Tourism, Sports Tourism, Wellness Tourism, Others), By Booking Channel (Online Booking, Phone Booking, In Person Booking), By Tourist Type (Domestic, International), By Age Group (15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, 66-75 Years) Competitive Landscape Scorpio Travel and Tours Inc., Baron Travel, Asiaventure Tours & Travel, Vansol Travel & Tours, Kapwa Travel, Marsman Drysdale Travel Inc., Rajah Tours Philippines, Atlas Tours and Travel Inc., Bridgeway Travel and Tours, Haranah Tours Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Scorpio Travel and Tours Inc.

- Baron Travel

- Asiaventure Tours & Travel

- Vansol Travel & Tours

- Kapwa Travel

- Marsman Drysdale Travel Inc.

- Rajah Tours Philippines

- Atlas Tours and Travel Inc.

- Bridgeway Travel and Tours

- Haranah Tours Corporation