Global Phenolic Resins Market By Product(Novolac, Resol, Other Products), By Application(Wood Adhesives, Insulation, Molding, Laminates, Coatings, Paper Impregnation, Other Applications), By End-use Industry(Building & Construction, Electrical and Electronics, Automotive, Lumber, Building and Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 26010

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

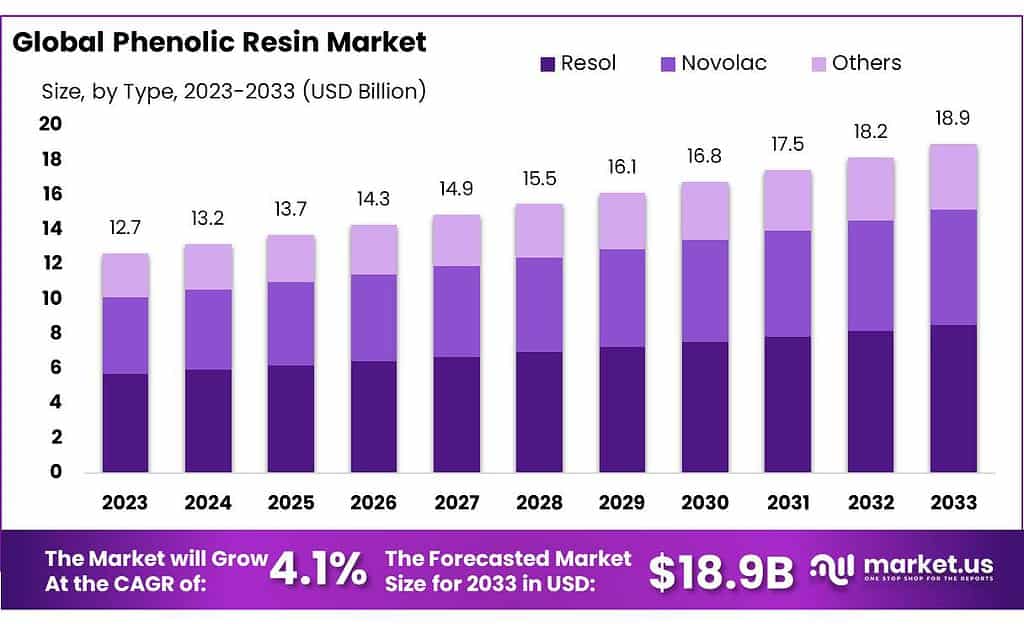

The global Phenolic Resin market size is expected to be worth around USD 18.9 billion by 2033, from USD 12.67 billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2033.

Phenolic resins are synthetic polymers known for their heat resistance, durability, and excellent insulating properties. They’re used in various industries due to their high-performance characteristics.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Expected Market Worth: The market is projected to reach approximately USD 18.9 billion by 2033, showing substantial growth from USD 12.67 billion in 2023, at a CAGR of 4.1%.

- Drivers of Growth: Factors like superior properties, increased demand in various industries, and innovative product variations are propelling this growth.

- Product Analysis: Novolac resins account for 35% of the market, while resole resins are expected to grow at a CAGR of 4.2%, driven by increased construction spending in economies like the Asia Pacific.

- Application Analysis: Wood adhesives, insulation, molding, laminates, coatings, paper impregnation, and other applications constitute the diversified usage of phenolic resins.

Growing Segments: Wood adhesives in the Asia Pacific, molding components in various industries, and the use of phenolic resins in construction are driving market demand. - End-use Industry Impact: From Building & Construction to Electrical and Electronics, Automotive, and Lumber sectors, phenolic resins play a crucial role in enhancing properties like durability, insulation, and heat resistance.

- Factors Influencing Market Dynamics: Environmental Regulations: Stricter regulations due to the potential health risks associated with phenolic resin production, lead to compliance challenges for manufacturers.

- Opportunities in Lightweight Vehicles: The automotive industry’s push for lightweight, fuel-efficient vehicles creates a significant opportunity for phenolic resin usage.

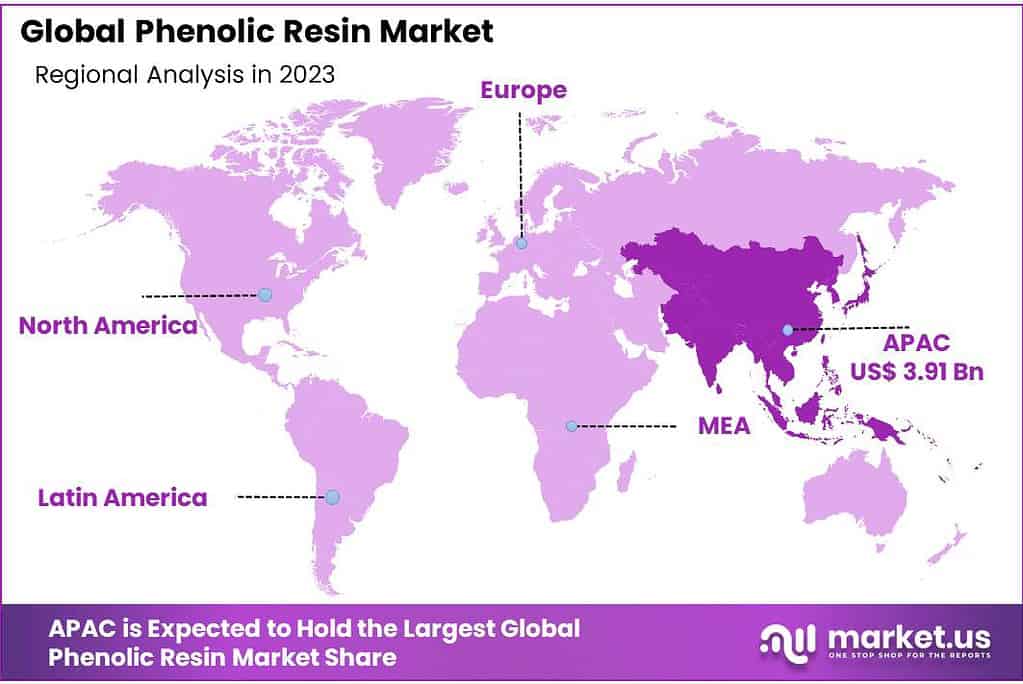

- Regional Impact Asia Pacific Dominance: The region holds the highest market share due to rapid expansions in various industries. North America, Europe, MEA, Latin America Growth: These regions exhibit rising demand due to increased R&D, technological innovations,and economic stability.

- Key Players: Companies like BASF SE, Hexion Inc., DIC Corporation, among others, are investing in expansions, acquisitions, and R&D to drive market growth.

- Challenges Faced by Industry: Striking a balance between material costs and affordability remains a challenge for companies manufacturing products using phenolic resins.

Product Analysis

The market can be divided into novolac or resole. Resoles can be further split into liquid and solid resins. Novolac resins accounted for 35% of the total market volume. Due to their superior properties (e.g. solvent resistance, hardness, and heat), they are expected to be in high demand. Also driving growth is the rise in North American countries’ electrical and electronic industries.

With a CAGR of 4.2%, resole resins are expected to be the fastest-growing product over the forecast period. This market is expected to grow owing to increased construction spending by developing economies like the Asia Pacific.

Also, repairs and remodeling are growing in popularity. This is reducing the use of resoles in the construction industry in developing regions. Products with innovative properties that have been discovered are likely to satisfy the changing consumer requirements and increase market growth.

Many substrates are protected from corrosive chemicals by the impermeable nature of phenolic resins. The market will also be boosted by the addition of modified resins of phenolic, cyanate ester resins, and benzoxazine phenolic.

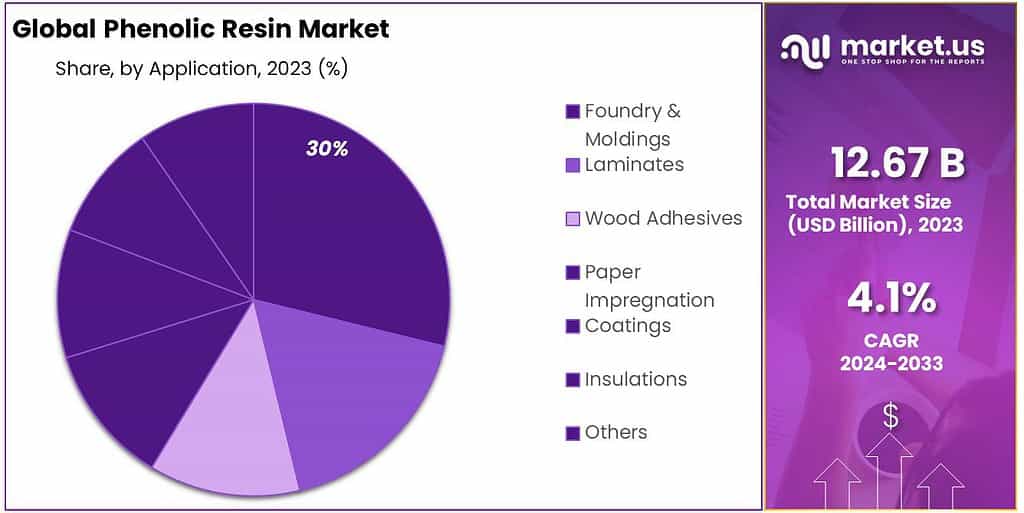

Application Analysis

In 2023, Foundry & Moldings was the big leader, holding over 30% of the market. Based on their application, the market for phenolic resins can be divided into wood glues, mold, insulation, paper impregnation, and laminates. Wood adhesives have exceptional water resistance, water dilution ability, excellent moisture resistance, and weather resistance.

This has led to a flurry of wood adhesives being used in various industries. The Asia Pacific is expected to be the largest market in wood adhesives because of the increase in disposable income.

Molding components are used in many industries including electrical & electronics, household applications, automobile commutators, and automotive commutators.

Because of their excellent dimensional stability, these compounds can be used to manufacture electrical equipment as well as kitchenware. This will drive up demand for molding resins in the near future.

Because of China’s rapidly expanding petrochemical sector, the molding resins segment is among the fastest-growing. This is increasing demand for molding in the Asia Pacific.

The market is also experiencing bulk trading, production, and distribution of petrochemical derivatives because of low crude oil prices. This will in turn encourage the market’s growth over the next few years.

Numerous prominent companies involved in the phenolic resins industry have begun adopting strategies to sustain annual growth and minimize the effect of lower oil prices. This trend is expected to boost the performance of phenolic resins as well as propel the demand for various molding activities in the future.

By End-use Industry

Building & Construction Segment: In the phenolic resin market, Building & Construction is a major segment. These resins are widely used for insulation materials, laminates, and as binders in building materials like particleboards due to their durability and heat resistance.

Electrical and Electronics Segment: Another significant segment is Electrical and Electronics. Phenolic resins play a crucial role in this industry as they are used in circuit boards and as flame-retardant materials due to their excellent insulating properties.

Automotive Segment: Automotive is an important segment in the phenolic resin market. These resins are utilized in brake and clutch linings for their ability to withstand high temperatures, ensuring safety and reliability in automotive applications.

Lumber Segment: In the phenolic resin market, the Lumber segment is notable. Phenolic resins are used in lumber treatments, enhancing the wood’s strength, durability, and resistance to environmental factors like moisture and insects.

Key Market Segments

By Product

- Novolac

- Resol

- Other Products

By Application

- Wood Adhesives

- Insulation

- Molding

- Laminates

- Coatings

- Paper Impregnation

- Other Applications

By End-use Industry

- Building & Construction

- Electrical and Electronics

- Automotive

- Lumber

- Building and Construction

- Others

Drivers

Advanced properties of phenolic resin

Phenolic resins are becoming really popular in lots of industries because they’re awesome in many ways. They can handle high heat, are easy to shape, are super strong, and when they burn, they don’t produce much harmful smoke. In cars and electrical stuff, they’re used a lot because they can handle really high temperatures.

They’re also great for insulation because they don’t let heat pass through easily. In construction and making wood panels, they work as a strong glue that doesn’t get messed up by water. In cars and buildings, they’re used for brakes, insulation, and making strong stuff because they’re excellent at staying stable even when it’s really hot and they don’t catch fire easily. And the cool thing is, by changing how they’re made, you can make them perfect for different jobs!

Restraints

Environmental Regulations

Phenolic resins are a clear gas that can catch fire easily and has a pretty strong smell. They’re made mainly from formaldehyde and phenol. These resins are used in lots of things like wood products, building materials, paints, and paper.

But here’s the tricky part—they can be harmful if breathed in, eaten, or absorbed through the skin because phenol is kind of like a poison for our bodies. That’s why using formaldehyde and phenol is really controlled, especially in places like North America and Europe. The Environmental Protection Agency (EPA) keeps a close eye on this.

The Toxic Substances Control Act (TSCA) keeps an eye on how formaldehyde is used to make resins. In the US, the Clean Water Act (CWA) makes sure that formaldehyde and similar pollutants don’t get dumped into the water. Companies have to invest a lot to follow the rules about how much they can release into the air.

Opportunities

Growing need for fuel-efficient and lightweight vehicles

Phenolic resin makers are in a great spot because car makers really want vehicles to be lighter and use less fuel. In the car world, they’re working hard to make vehicles that are light and need less gas. To do this, they’re using different lightweight materials like aluminum, steel, and plastics.

By using special glues instead of bolts or welds, they can make cars lighter. These glues and special materials help keep cars strong during crashes. All of this means there’s going to be a big demand for phenolic resins in the coming years.

Challenges

Controlling prices to ensure affordability

One big issue for companies worldwide is keeping the costs in check for the stuff they use to make wood adhesives. They’ve got to make sure that the prices of these materials and the machines they need don’t get too high. That way, they can keep the prices of the final products reasonable for everyone.

Regional Analysis

The Asia Pacific accounted for the highest share of 30.9%. This growth can be attributed to the rapid expansions of end-use industries, such as construction, consumer goods, and automobiles. The region is also predicted to develop bio-based feedstock for the production of phenolic resins. This is expected to increase the industry’s dynamic in the near future.

North America and Europe will see an increase in the production of automobiles. This will boost the demand for phenolic resins in many applications like abrasives and adhesives. This will drive market growth in the coming years by increasing R&D spend and identifying key players.

The MEA market is also seeing wide-ranging R&D initiatives. This has made the region one of the fastest-growing to meet the rising domestic demands. This will result in a positive impact on the market. Market growth will be aided by technological innovation and a rise in disposable income.

Latin America has seen improved political stability recently, which has resulted in a strong economy for investments. It is expected that Latin America will continue to grow at the fastest rate over the forecast period. This region is investing in various sectors to meet export demand, including consumer electronics. The availability of low-cost technologies and labor will benefit phenolic resins.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market leaders are inclined to identify natural products and byproducts as raw materials. They are most often derived from biomass feedstock. These companies have invested huge amounts in R&D activities, innovations, and other business activities to gain traction.

BASF SE has just modernized and expanded its Korea plant, which will nearly double the current production capacity for phenolic resins in Ludwigshafen. The industry will also see other companies expanding their reach into developed countries, which will allow it to grow tremendously over the forecast period.

Key Market Players

- DIC CORPORATION

- Kolon Industries, Inc.

- Sumitomo Bakelite Co., Ltd.

- Hexcel Corporation

- Georgia-Pacific Chemicals

- KRATON CORPORATION

- Hexion

- Bostik, Inc.

- SI Group, Inc.

Recent Development

July 2022: DIC Corporation acquired Guangdong TOD New Material Co., Ltd., a Chinese coating resin manufacturer. This acquisition will help DIC Corporation to expand its phenolic resins capacity by operating at near full production capacity in Asia.

June 2023: Hexion Inc. acquired the phenolic resin business of Momentive Performance Materials. The acquisition is expected to strengthen Hexion’s position in the global phenolic resin market.

Report Scope

Report Features Description Market Value (2023) USD 12.67 Billion Forecast Revenue (2033) USD 18.9 Billion CAGR (2023-2032) 4.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Novolac, Resol, Other Products), By Application(Wood Adhesives, Insulation, Molding, Laminates, Coatings, Paper Impregnation, Other Applications), By End-use Industry(Building & Construction, Electrical and Electronics, Automotive, Lumber, Building and Construction, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DIC CORPORATION, Kolon Industries, Inc., Sumitomo Bakelite Co., Ltd., Hexcel Corporation, Georgia-Pacific Chemicals, KRATON CORPORATION, Hexion, Bostik, Inc., SI Group, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Phenolic Resins?Phenolic resins are synthetic polymers made by combining phenol and formaldehyde. They are known for their heat resistance, durability, and insulating properties.

Why are Phenolic Resins Important in Lightweight Vehicles?Phenolic resins help make vehicles lighter by reducing the use of heavy metal bodies and fasteners. They are used as adhesives and composites, increasing crash resistance without adding extra weight.

How are Environmental Concerns Addressed with Phenolic Resins?Efforts are ongoing to create more eco-friendly versions of phenolic resins with lower formaldehyde emissions and reduced environmental impact.

-

-

- DIC CORPORATION

- Kolon Industries, Inc.

- Sumitomo Bakelite Co., Ltd.

- Hexcel Corporation

- Georgia-Pacific Chemicals

- KRATON CORPORATION

- Hexion

- Bostik, Inc.

- SI Group, Inc.