Pharmacovigilance Market By Type (Spontaneous Reporting, Targeted Spontaneous Reporting, Intensified ADR Reporting, EHR Mining, and Cohort Event Monitoring), By Life Cycle (Phase IV, Phase III, Phase II, Phase I, and Pre-clinical), By Service Provider (Contract Outsourcing and In-house), By Application (Oncology, Respiratory Systems, Neurology, Cardiology, and Others), By Process Flow (Signal Detection (Adverse Event Review & Reporting, Adverse Event Logging, and Adverse Event Analysis), Case Data Management (Case Data Analysis and Case Logging), Medical Reviewing & Reporting, and Risk Management System (Risk Mitigation System and Risk Evaluation System)), By End-user (Pharmaceuticals, Medical Device Manufacturers, Biotechnology Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 96646

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Life Cycle Analysis

- Service Provider Analysis

- Application Analysis

- Process Flow Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

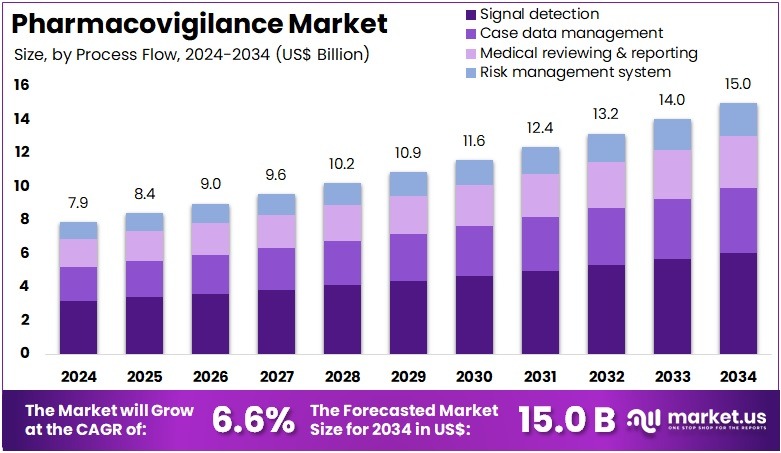

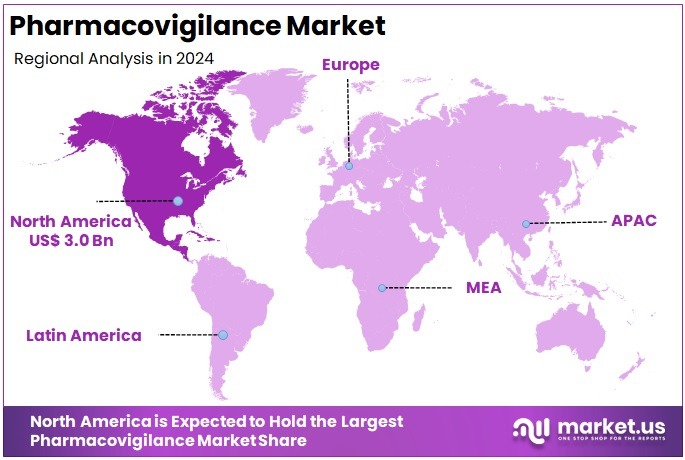

The Pharmacovigilance Market Size is expected to be worth around US$ 15.0 billion by 2034 from US$ 7.9 billion in 2024, growing at a CAGR of 6.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.4% share and holds US$ 3.0 Billion market value for the year.

Increasing regulatory scrutiny drives the Pharmacovigilance Market, as authorities enforce stringent safety monitoring for new therapeutics. Pharmaceutical companies apply pharmacovigilance to track adverse drug reactions during clinical trials, ensuring compliance with global safety standards. These practices support post-market surveillance by analyzing real-world data to detect rare side effects in diverse patient populations.

Regulatory agencies rely on pharmacovigilance data to update drug labeling and risk management plans. In March 2023, ICON plc partnered with LEO Pharma to enhance real-time adverse event tracking in dermatology trials, streamlining safety reporting. This collaboration fuels market growth by integrating advanced monitoring into specialized therapeutic development.

Growing demand for real-world evidence creates opportunities in the Pharmacovigilance Market, as stakeholders seek robust safety insights beyond clinical trials. Biotech firms utilize pharmacovigilance systems to monitor biologics safety, addressing immunogenicity risks in patient cohorts. These applications extend to medical device surveillance, tracking performance and adverse events in post-market settings.

Automated signal detection tools enhance efficiency, enabling rapid identification of safety concerns. In February 2023, Parexel International launched its “Expert Series – New Medicines, Novel Insights,” offering biopharma companies analytical safety and regulatory insights. This initiative drives market expansion by promoting evidence-based pharmacovigilance practices across the industry.

Rising adoption of integrated service models propels the Pharmacovigilance Market, as companies consolidate safety and regulatory operations for efficiency. Contract research organizations employ pharmacovigilance to support vaccine safety monitoring, ensuring rapid response to adverse events in mass immunization programs. These systems aid in risk-benefit assessments for orphan drugs, facilitating approvals for rare disease treatments.

Trends toward artificial intelligence enhance data processing, improving signal detection accuracy in large datasets. In February 2024, Ergomed plc’s PrimeVigilance acquired Panacea, expanding its pharmacovigilance and regulatory service portfolio for pharma and biotech clients. This acquisition positions the market for sustained growth by enabling scalable, compliant safety monitoring solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 9 billion, with a CAGR of 6.6%, and is expected to reach US$ 15.0 billion by the year 2034.

- The type segment is divided into spontaneous reporting, targeted spontaneous reporting, intensified ADR reporting, EHR mining, and cohort event monitoring, with spontaneous reporting taking the lead in 2024 with a market share of 42.8%.

- Considering life cycle, the market is divided into phase IV, phase III, phase II, phase I, and pre-clinical. Among these, phase IV held a significant share of 38.9%.

- Furthermore, concerning the service provider segment, the market is segregated into contract outsourcing and in-house. The contract outsourcing sector stands out as the dominant player, holding the largest revenue share of 53.1% in the market.

- The application segment is segregated into oncology, respiratory systems, neurology, cardiology, and others, with the oncology segment leading the market, holding a revenue share of 44.6%.

- The process flow segment is divided into signal detection, case data management, medical reviewing & reporting, and risk management system, with signal detection taking the lead in 2024 with a market share of 40.3%.

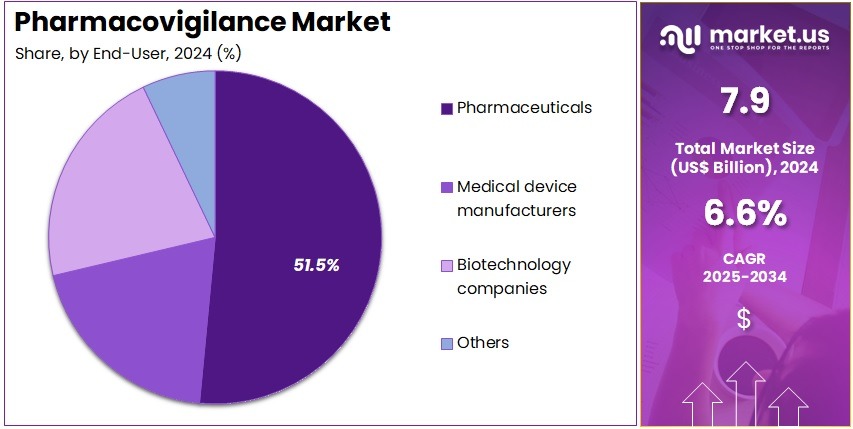

- Considering end-user, the market is divided into pharmaceuticals, medical device manufacturers, biotechnology companies, and others. Among these, pharmaceuticals held a significant share of 51.5%.

- North America led the market by securing a market share of 37.4% in 2024.

Type Analysis

Spontaneous reporting holds 42.8% of the Pharmacovigilance market and is expected to remain dominant due to its central role in detecting adverse drug reactions (ADRs) post-market approval. This method serves as the foundation of pharmacovigilance programs globally, enabling early identification of unexpected safety issues through voluntary reporting by healthcare professionals and patients. The growing adoption of digital platforms and mobile-based ADR reporting tools is expected to enhance efficiency and data accuracy.

Regulatory authorities, including the EMA and FDA, are promoting user-friendly electronic submission systems to increase participation. The rising number of marketed drugs and biologics drives higher volumes of ADR data, reinforcing the importance of spontaneous reporting. Integration of real-world evidence and patient-reported outcomes further strengthens this process. Pharmaceutical companies increasingly invest in automated data mining and AI-assisted tools to analyze spontaneous reports more effectively.

The expansion of national pharmacovigilance centers, particularly in emerging markets, broadens reporting networks. Growing emphasis on public health transparency and global collaboration in drug safety further supports adoption. As pharmacovigilance evolves toward predictive surveillance, spontaneous reporting remains a cornerstone of risk identification and signal detection.

Life Cycle Analysis

Phase IV holds 38.9% of the life cycle segment and is projected to lead due to the extensive need for post-marketing surveillance and real-world safety evaluation. This phase focuses on long-term monitoring of drug efficacy and adverse events once products reach the market. The rising number of drug approvals and the complexity of biologics and combination therapies are driving demand for continuous safety assessment.

Pharmaceutical companies increasingly conduct Phase IV studies to meet regulatory obligations and maintain market authorization. The growing focus on patient-centric healthcare and pharmacogenomics supports the integration of real-world data into post-marketing research. Advanced analytics and AI-based data processing tools enhance signal detection and trend analysis during this phase.

Governments and regulatory bodies emphasize post-market vigilance to prevent large-scale drug withdrawals and ensure public safety. Expansion of global health monitoring programs enhances collaboration across countries for adverse event tracking. Hospitals and healthcare providers contribute valuable clinical data through electronic health records and registries. The ongoing growth of generic and biosimilar markets further necessitates robust Phase IV pharmacovigilance frameworks. As patient safety remains a top priority, Phase IV continues to anchor long-term drug risk management strategies.

Service Provider Analysis

Contract outsourcing represents 53.1% of the service provider segment and is anticipated to dominate as pharmaceutical companies increasingly rely on specialized service providers to manage pharmacovigilance operations. Outsourcing enables cost optimization, scalability, and access to expert regulatory and data analytics capabilities.

The rising complexity of global drug safety regulations encourages collaboration with contract research organizations (CROs) and pharmacovigilance service providers. These organizations offer end-to-end services, including case processing, signal detection, and regulatory reporting, allowing pharmaceutical companies to focus on core R&D activities.

The increasing number of drug launches and expansion of clinical trial networks globally fuel the need for efficient data management through outsourcing. Integration of AI, automation, and cloud-based safety databases enhances operational efficiency for outsourced partners. Contract outsourcing also facilitates compliance with regional pharmacovigilance frameworks such as EudraVigilance and FAERS.

The trend toward partnerships and long-term service contracts between biopharma companies and CROs strengthens reliability and cost-effectiveness. Emerging economies in Asia-Pacific, particularly India and the Philippines, are becoming key outsourcing hubs due to skilled labor and lower operational costs. As data volumes rise and regulatory requirements tighten, outsourcing continues to play a pivotal role in ensuring drug safety compliance.

Application Analysis

Oncology holds 44.6% of the application segment and is expected to remain the largest due to the growing number of oncology drug approvals and complex treatment regimens requiring close safety monitoring. Cancer therapies, particularly immunotherapies and targeted biologics, exhibit unique adverse reaction profiles that demand robust pharmacovigilance frameworks.

The global rise in cancer incidence has led to an increase in oncology clinical trials, thereby generating substantial safety data. Pharmaceutical companies and regulators are emphasizing active surveillance to manage immune-related toxicities and combination therapy risks. Advanced analytics, including real-world evidence and AI-driven pattern recognition, are improving early signal detection in oncology pharmacovigilance.

Post-marketing studies assessing long-term survival and secondary effects further expand the scope of safety monitoring. Hospitals and cancer centers play a key role in reporting adverse events, enhancing data reliability. The integration of electronic medical records and genomic data supports personalized oncology safety assessment.

Collaborations between regulatory bodies, industry, and academia ensure data transparency and cross-study learning. As oncology pipelines expand globally, pharmacovigilance activities in this therapeutic area are projected to intensify, reinforcing oncology’s dominant role in drug safety management.

Process Flow Analysis

Signal detection accounts for 40.3% of the process flow segment and is anticipated to dominate due to its crucial function in identifying potential safety risks from large datasets. The growing use of AI and machine learning for pattern recognition enhances accuracy and speed in detecting adverse drug reactions. Signal detection allows early identification of unexpected events, enabling proactive risk mitigation.

The increasing digitization of healthcare systems and availability of electronic health records significantly expand real-world evidence for signal analysis. Regulatory agencies are adopting standardized methodologies to harmonize signal evaluation processes globally. Pharmaceutical companies use advanced pharmacovigilance software integrated with predictive analytics to prioritize safety signals effectively.

Collaborative data-sharing initiatives between industry and regulatory bodies strengthen detection systems. As the volume of safety reports rises from global markets, automated signal detection tools ensure timely response and regulatory compliance. Continuous innovation in algorithmic modeling improves precision, reducing false positives in safety alerts.

The importance of early detection in minimizing patient risk and avoiding costly product withdrawals underscores signal detection’s central role in pharmacovigilance. Its evolution toward real-time monitoring systems is projected to drive sustained growth in this segment.

End-User Analysis

Pharmaceutical companies hold 51.5% of the end-user segment and are projected to dominate as they remain the primary stakeholders in global drug safety and risk management. These organizations bear regulatory responsibility for monitoring and reporting adverse events across the entire drug life cycle. The expanding pipeline of innovative drugs, biologics, and biosimilars drives demand for comprehensive pharmacovigilance systems.

Increasing emphasis on patient safety and regulatory compliance motivates pharmaceutical firms to invest in advanced pharmacovigilance infrastructure. Integration of AI-based data analysis and predictive modeling enables early risk identification and trend forecasting. Collaboration with CROs and outsourcing partners enhances scalability and efficiency. Pharmaceutical companies also engage in post-marketing surveillance and Phase IV studies to meet global regulatory requirements.

Expansion of cross-border drug distribution increases the complexity of safety reporting, encouraging centralized pharmacovigilance systems. The rise in regulatory inspections and audits further promotes adherence to global standards such as ICH E2E. The growing focus on real-world data and patient-reported outcomes enhances post-market risk assessment. As innovation accelerates in drug development, pharmaceutical companies continue to lead pharmacovigilance efforts to ensure global compliance, patient trust, and market sustainability.

Key Market Segments

By Type

- Spontaneous Reporting

- Targeted Spontaneous Reporting

- Intensified ADR Reporting

- EHR Mining

- Cohort Event Monitoring

By Life Cycle

- Phase IV

- Phase III

- Phase II

- Phase I

- Pre-clinical

By Service Provider

- Contract Outsourcing

- In-house

By Application

- Oncology

- Respiratory Systems

- Neurology

- Cardiology

- Others

By Process Flow

- Signal Detection

- Adverse Event Review & Reporting

- Adverse Event Logging

- Adverse Event Analysis

- Case Data Management

- Case Data Analysis

- Case Logging

- Medical Reviewing & Reporting

- Risk Management System

- Risk Mitigation System

- Risk Evaluation System

By End-user

- Pharmaceuticals

- Medical Device Manufacturers

- Biotechnology Companies

- Others

Drivers

Increasing Number of New Drug Approvals is Driving the Market

The surge in new drug approvals worldwide has markedly accelerated the pharmacovigilance market, as each novel therapeutic necessitates rigorous post-marketing surveillance to monitor safety profiles and ensure patient protection. Pharmacovigilance encompasses the detection, assessment, and prevention of adverse drug reactions, becoming indispensable for biologics and small molecules alike, where unforeseen interactions emerge post-approval. This driver is amplified by the complexity of modern pharmaceuticals, including gene therapies and immunotherapies, requiring advanced signal detection systems to track rare events.

Regulatory bodies mandate comprehensive safety databases, compelling pharmaceutical entities to invest in scalable pharmacovigilance infrastructures. The emphasis on real-world evidence generation further integrates pharmacovigilance into lifecycle management, facilitating timely label updates and risk mitigation strategies. Public health priorities underscore its role in averting drug withdrawals, influencing global harmonization efforts.

The U.S. Food and Drug Administration approved 50 new drugs never before approved or marketed in the U.S. in 2024, underscoring the heightened demand for robust pharmacovigilance systems to oversee these innovations. This volume highlights the operational imperative, as each approval expands the scope of ongoing safety monitoring.

Technological integrations, such as automated case processing, enhance its efficiency, accommodating exponential data influxes. Economically, proactive pharmacovigilance averts litigation costs, justifying strategic allocations for compliance tools. International collaborations standardize reporting formats, promoting seamless data exchange across borders. This approval proliferation not only intensifies pharmacovigilance activities but also reinforces its foundational position in regulatory ecosystems.

Restraints

High Compliance Costs from Stringent Regulations is Restraining the Market

The escalating compliance expenditures imposed by rigorous regulatory frameworks continue to constrain the pharmacovigilance market, particularly for smaller pharmaceutical firms navigating multifaceted global requirements. These mandates, encompassing electronic submission standards and risk management plans, demand substantial investments in software and personnel training, straining operational budgets. This restraint manifests in deferred adoptions of advanced tools, as mid-sized entities prioritize core development over expansive safety monitoring.

Jurisdictional divergences, such as varying timelines for adverse event reporting, compound administrative burdens and inflate cross-border coordination costs. Developers encounter prolonged validation cycles, diverting resources from innovation to audit preparations. The resultant fiscal pressures exacerbate disparities, with resource-limited organizations relying on manual processes prone to errors.

Pharmacovigilance fees payable to the European Medicines Agency increased by 5.6% as of 3 October 2022, to reflect inflation adjustments of 0.3% in 2020 and 5.3% in 2021. Such escalations reflect systemic intensifications, as harmonization efforts lag behind enforcement vigor. Stakeholder apprehensions regarding penalties favor conservative approaches, limiting exploratory pharmacovigilance expansions. Advocacy for streamlined guidelines advances gradually, impeded by evidentiary complexities. These cost impediments not only curtail scalability but also perpetuate vulnerabilities in safety oversight.

Opportunities

Adoption of AI for Signal Detection is Creating Growth Opportunities

The integration of artificial intelligence in pharmacovigilance signal detection has unveiled considerable expansion potentials, enabling automated pattern recognition across vast adverse event datasets to expedite risk identification. AI algorithms, employing natural language processing, sift unstructured reports from social media and electronic health records, surpassing traditional manual reviews in speed and accuracy.

Opportunities proliferate in real-time analytics platforms, subsidizing validations for predictive modeling in post-marketing surveillance. Pharmaceutical alliances underwrite AI pilots, bridging gaps in proactive causality assessments for biologics. This computational leverage addresses volume overloads, positioning AI as a prophylactic against delayed interventions.

Fiscal incentives for digital transformations catalyze procurements, diversifying toward hybrid human-AI workflows. Innovations in explainable AI mitigate interpretability concerns, broadening clinical trust. As federated learning evolves, collaborative datasets unlock anonymized revenue streams. These AI integrations not only variegate pharmacovigilance modalities but also entrench the market within data-centric health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the pharmacovigilance market, pushing them to delay AI-driven analytics upgrades while focusing on essential reporting tools. U.S.-China trade barriers and Black Sea shipping delays are disrupting supplies of encryption modules from European vendors, slowing system integrations and raising costs for global safety networks. To tackle these issues, developers are partnering with Virginia-based encryption firms, adopting security measures that speed regulatory approvals and attract compliance-focused funding.

Growing drug approval demands are driving EMA support for automated signal detection, boosting use in biotech monitoring teams. U.S. tariffs on imported lab equipment are increasing costs for Asian-sourced servers, tightening budgets for research firms and occasionally hindering global data sharing. In response, developers are using CHIPS Act incentives to build North Carolina tech hubs, launching secure data workflows and enhancing skills in real-time risk tracking. These efforts are strengthening a robust foundation for continued innovation and market leadership.

Latest Trends

FDA’s Emerging Drug Safety Technology Program is a Recent Trend

The establishment of dedicated regulatory programs for innovative technologies has epitomized a seminal progression in pharmacovigilance during 2024, prioritizing AI and machine learning to refine adverse event monitoring. The U.S. Food and Drug Administration’s Emerging Drug Safety Technology Program facilitates pilot collaborations with industry to validate computational tools for signal detection and causality analysis. This initiative embodies a maturation toward evidence-based endorsements, accommodating diverse data sources from wearables to claims databases in unified frameworks.

Oversight validations affirm methodological robustness, expediting integrations amid surging therapeutic complexities. This framework resonates with post-approval imperatives, tethering outputs to risk evaluation frameworks for proactive label modifications. The program addresses evidentiary gaps, emphasizing tools resilient to bias in heterogeneous populations.

The Food and Drug Administration launched the Emerging Drug Safety Technology Program in June 2024 under its Center for Drug Evaluation and Research, focusing on AI applications to enhance pharmacovigilance efficiency. Such launches underscore viability, as implementations affirm concordance with traditional benchmarks. Observers anticipate guideline assimilations, elevating its precedence in multinational protocols.

Longitudinal benchmarks confirm variance reductions, optimizing resource deployments. The progression envisions blockchain synergies, prognosticating tamper-proof reporting. This technology-centric evolution not only augments pharmacovigilance precision but also harmonizes with adaptive regulatory visions.

Regional Analysis

North America is leading the Pharmacovigilance Market

In 2024, North America commanded a 37.4% share of the global pharmacovigilance market, propelled by stringent FDA requirements for electronic submission of adverse event reports under the E2B(R3) standard, which took effect on January 16, 2024, compelling pharmaceutical firms to upgrade digital surveillance systems for expedited post-marketing monitoring of biologics and novel therapies.

Biopharma leaders accelerated investments in AI-driven signal detection platforms to process surging data volumes from real-world evidence, enabling proactive identification of rare safety signals in oncology drugs, where timely interventions reduced recall costs by optimizing compliance with REMS programs.

The FDA’s Emerging Drug Safety Technology Program, launched in June 2024, fostered collaborations with tech providers to integrate machine learning for automated case triage, addressing the exponential rise in submissions amid 50 new molecular entity approvals that year. Institutional expansions in contract research organizations supported multinational trials, correlating with federal grants for harmonized data exchange across borders, mitigating risks in combination product launches.

Demographic pressures from chronic disease epidemics further intensified demand for robust adverse event tracking in vulnerable populations, backed by enhanced interoperability with electronic health records. These dynamics affirmed the region’s preeminence in regulatory-compliant safety ecosystems. The FDA’s FAERS database received 4,304,335 reports from Q1 2022 to Q2 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National agencies across Asia Pacific project the pharmacovigilance sector to expand robustly during the forecast period, as regulatory harmonization accelerates post-approval monitoring for biosimilars in burgeoning biopharma landscapes. Officials in India and China direct resources toward ADRMS platforms, equipping public health networks to capture case data from vaccine rollouts in high-density provinces.

Safety consortia partner with regional institutes to deploy AI triage tools, anticipating swifter signal resolution for herbal medicine interactions in traditional therapy cohorts. Oversight bodies in Japan and South Korea subsidize cloud-based repositories, positioning contract firms to handle multinational trial data without jurisdictional silos.

Administrative frameworks estimate integrating real-world evidence feeds, expediting risk assessments for imported generics in migrant-heavy ports. Regional pharmacologists pioneer multilingual reporting modules, coordinating with WHO hubs to profile ethnic variations in adverse reactions. These initiatives solidify a cohesive infrastructure for drug safety governance. India’s PvPI program processed 81,942 ADR reports in 2022 and 98,567 in 2023.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the Pharmacovigilance Market drive growth by integrating AI for automated adverse event detection, streamlining safety monitoring. They acquire regional specialists to expand regulatory expertise and global reach. Companies invest in cloud platforms for real-world evidence analysis, enhancing risk management. Leaders form outsourcing partnerships with CROs to optimize costs and talent access. They target Asia-Pacific and Latin America, aligning with local regulations for market entry.

Additionally, they offer patient-centric reporting tools, securing long-term biopharma contracts. IQVIA Inc., founded in 2016 in Durham, North Carolina, leads in clinical research and analytics, offering safety solutions across 100 countries. Its Safety Intelligence platform uses AI to process adverse event data efficiently. IQVIA focuses on innovation, integrating real-world data for robust safety strategies. CEO Ari Bousbib oversees operations, emphasizing ethical data use. The firm collaborates with regulators and pharma to refine standards. IQVIA maintains dominance through advanced analytics and global partnerships.

Top Key Players in the Pharmacovigilance Market

- TAKE Solutions Limited

- Parexel International

- ITClinical

- IQVIA Inc

- ICON plc

- IBM

- Cognizant

- Capgemini

- ArisGlobal

- Accenture

Recent Developments

- In March 2025: Tech Mahindra introduced an AI-driven pharmacovigilance platform in partnership with NVIDIA, marking a major step toward automation in drug safety monitoring. By integrating NVIDIA’s AI Enterprise suite with the TENO framework, the platform automates adverse event processing and compliance reporting, significantly improving accuracy and efficiency. This innovation strengthens the pharmacovigilance market by reducing operational delays and enabling real-time safety insights across global drug programs.

- In April 2025: Parexel collaborated with Palantir to embed Palantir’s Foundry and AI Platform (AIP) into its clinical trial systems. This partnership enhances data transparency and predictive analytics in drug development, directly supporting more robust pharmacovigilance through improved detection and analysis of safety signals throughout clinical and post-market phases.

Report Scope

Report Features Description Market Value (2024) US$ 7.9 billion Forecast Revenue (2034) US$ 15.0 billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Spontaneous Reporting, Targeted Spontaneous Reporting, Intensified ADR Reporting, EHR Mining, and Cohort Event Monitoring), By Life Cycle (Phase IV, Phase III, Phase II, Phase I, and Pre-clinical), By Service Provider (Contract Outsourcing and In-house), By Application (Oncology, Respiratory Systems, Neurology, Cardiology, and Others), By Process Flow (Signal Detection (Adverse Event Review & Reporting, Adverse Event Logging, and Adverse Event Analysis), Case Data Management (Case Data Analysis and Case Logging), Medical Reviewing & Reporting, and Risk Management System (Risk Mitigation System and Risk Evaluation System)), By End-user (Pharmaceuticals, Medical Device Manufacturers, Biotechnology Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TAKE Solutions Limited, Parexel International, ITClinical, IQVIA Inc, ICON plc, IBM, Cognizant, Capgemini, ArisGlobal, Accenture. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TAKE Solutions Limited

- Parexel International

- ITClinical

- IQVIA Inc

- ICON plc

- IBM

- Cognizant

- Capgemini

- ArisGlobal

- Accenture