Global Pharmaceutical Solvents Market By Product Type (Alcohols, Ethers, Esters, Glycols, Aromatic Hydrocarbons, Ketones, and Others), By Applications (Pharmaceutical Formulations, Drug Development and Manufacturing, Cleaning and Processing, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160010

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

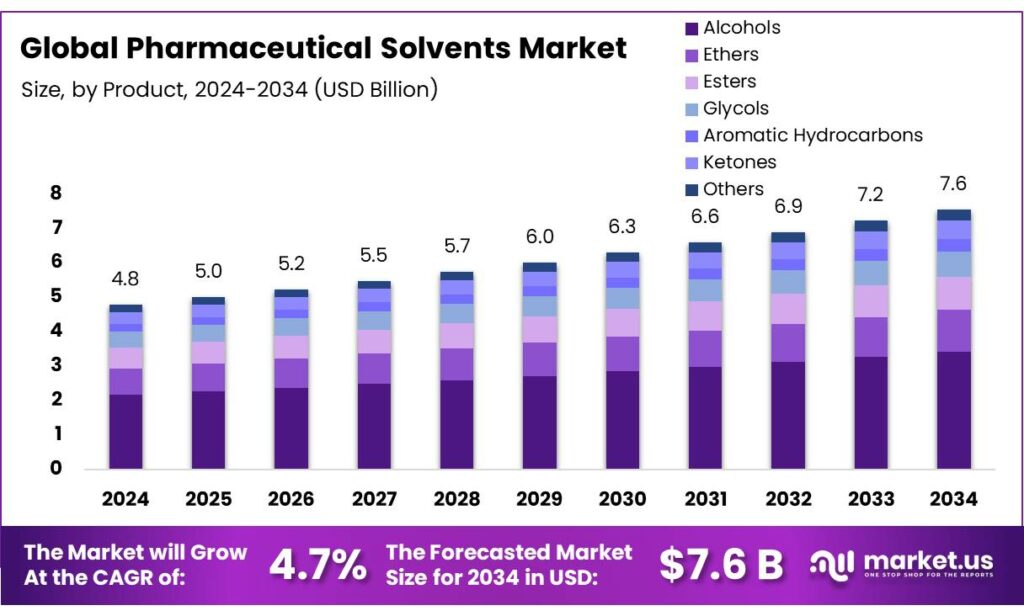

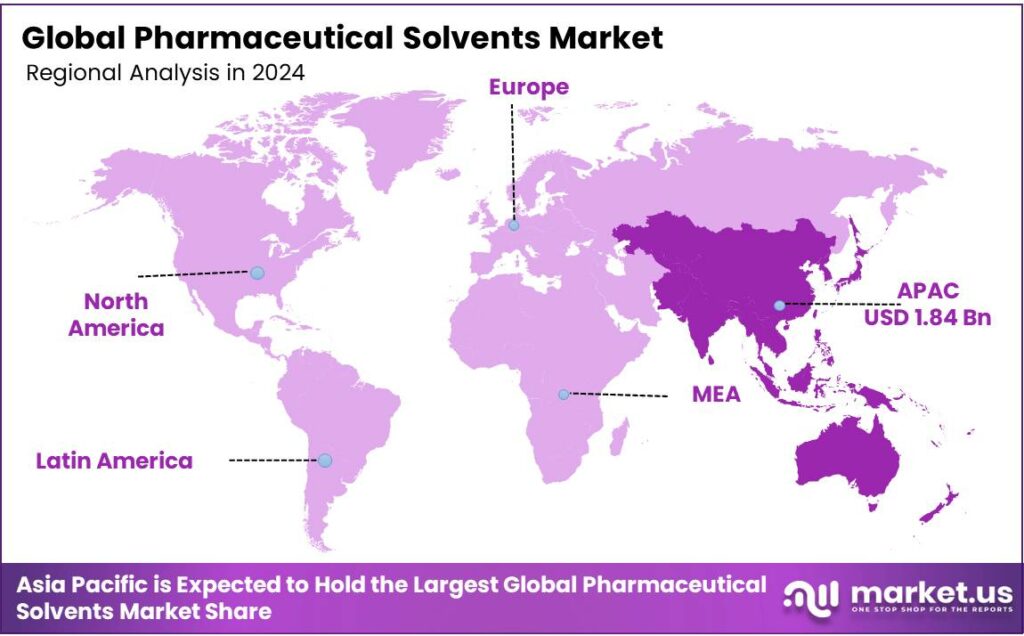

The Global Pharmaceutical Solvents Market size is expected to be worth around USD 7.6 Billion by 2034, from USD 4.78 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.4% share, holding USD 1.8 Billion in revenue

Pharmaceutical solvents are liquid substances used in drug production to dissolve, extract, and purify active pharmaceutical ingredients (APIs) and other components to create final drug products such as creams, syrups, and injectables. They act as a reaction medium, enabling chemical processes that transform raw materials into the final ingredient. The major driver of the market is the demand for high-quality pharmaceuticals, mainly due to the increasing prevalence of chronic diseases.

Due to their potential for toxicity, which is a significant challenge, pharmaceutical solvents are subject to strict regulations from bodies such as the International Council for Harmonization (ICH). Due to these regulations, in recent years, there has been a shift towards deep eutectic solvents (DESs), which are considered green solvents, and bio-based solvents, which offer lower toxicity and reduced environmental impact.

- As of October 2024, there were over 12,700 medicines, almost all of which require the use of solvents, at different phases of clinical development globally, supported by the pharmaceutical industry, biotechs, academia, and medical research charities.

Key Takeaways

- The global pharmaceutical solvents market was valued at USD 4.78 billion in 2024.

- The global pharmaceutical solvents market is projected to grow at a CAGR of 4.7% and is estimated to reach USD 7.6 billion by 2034.

- Based on product types, alcohol based pharmaceutical solvents dominated the market in 2024, comprising about 45.2% share of the total global market.

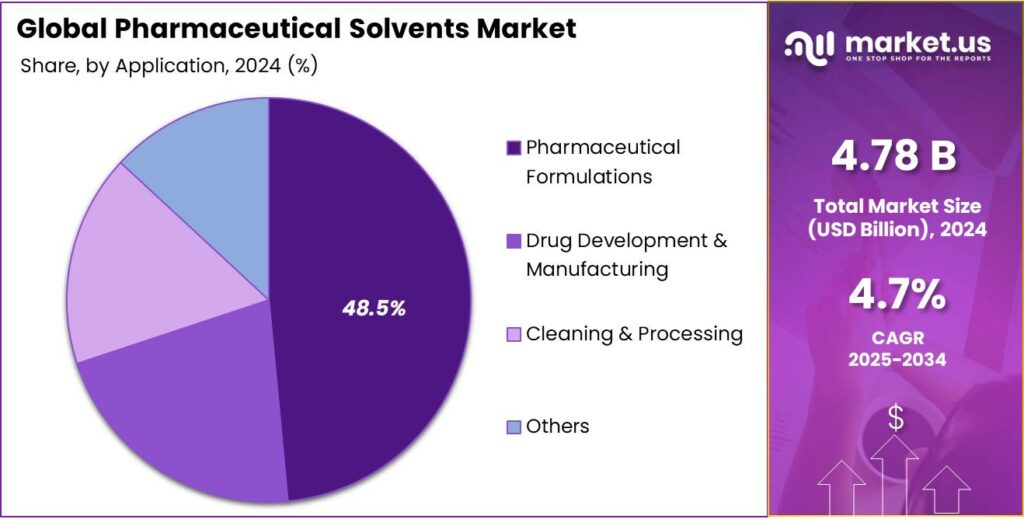

- Among the applications, pharmaceutical formulations dominated the market in 2024, accounting for around 48.5% of the market share.

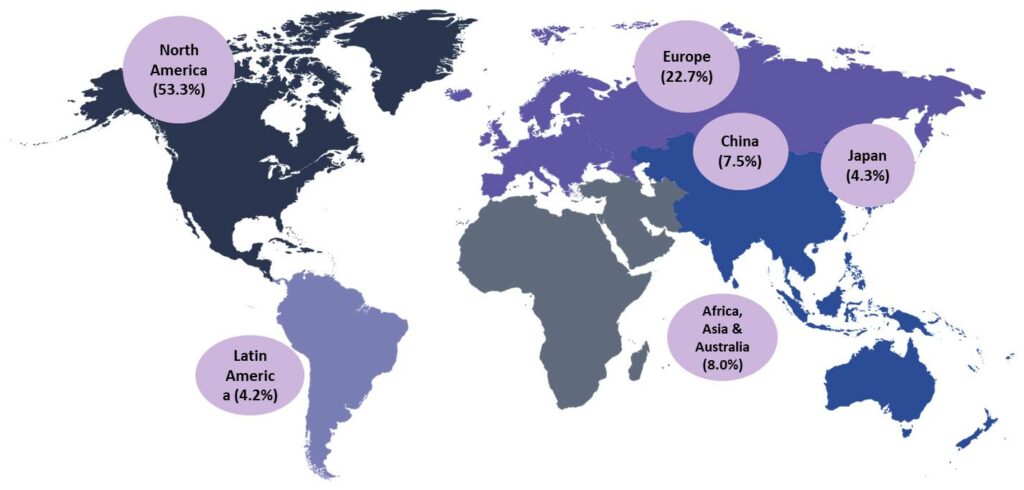

- Asia Pacific was the largest market for pharmaceutical solvents in 2024, accounting for around 38.4% of the total global consumption.

Type Analysis

Alcohol-Based Pharmaceutical Solvents Dominated the Market in 2024.

Based on product type, the pharmaceutical solvents market is segmented into solvents based on alcohols, ethers, esters, glycols, aromatic hydrocarbons, ketones, and others. Alcoholic pharmaceutical solvents dominated the market in 2024 with a market share of 45.2%. Alcohol-based solvents are more commonly used in the pharmaceutical industry due to their favorable safety profile, effectiveness, and regulatory acceptance. Solvents such as ethanol and isopropanol are less toxic compared to many ethers, esters, aromatic hydrocarbons, or ketones, making them suitable for use in formulations intended for human consumption.

Additionally, they exhibit good solvency for a wide range of active pharmaceutical ingredients (APIs) and excipients, supporting efficient drug formulation. Similarly, alcohols are relatively easy to remove during manufacturing due to their volatility and are less likely to leave harmful residues, helping manufacturers comply with strict regulatory limits on residual solvents.

Application Analysis

In 2024, the Pharmaceutical Solvents Market was Primarily Driven by Pharmaceutical Formulations.

In the pharmaceutical industry, solvents are most used in formulation, with 48.5% of the total consumption in the sector, driving applications such as drug development & manufacturing, and cleaning & processing. Most solvents in the pharmaceutical industry are primarily used in the formulation of APIs and excipients because this stage demands precise solubilization, purification, and stabilization of compounds to ensure drug efficacy and safety. Formulation processes require solvents to dissolve both APIs and excipients uniformly, allowing accurate dosing and consistent drug performance.

In contrast, solvent use in drug development and manufacturing, while important, often involves smaller quantities or more specialized applications. Cleaning and processing require solvents, but typically on a different scale and with different solvent types focused on removing residues rather than solubilizing active compounds. The critical role of solvents in formulation lies in enabling the final drug product’s stability, bioavailability, and patient acceptability, making this the primary area of solvent consumption in the pharmaceutical industry.

Key Market Segments

By Product Type

- Alcohols

- Ethers

- Esters

- Glycols

- Aromatic Hydrocarbons

- Ketones

- Others

By Application

- Pharmaceutical Formulations

- Active Pharmaceutical Ingredients (APIs)

- Excipients

- Drug Development & Manufacturing

- Cleaning & Processing

- Others

Drivers

Increasing Global Demand for Pharmaceuticals Drives the Pharmaceutical Solvents Market.

The rising global demand for pharmaceuticals is a key driver of the pharmaceutical solvents market, fueled by an aging population, growing prevalence of chronic diseases, and expanding access to healthcare in developing regions. According to the U.S. Centers for Disease Control and Prevention, in the country, more than 90% of the annual healthcare expenditures are for people with chronic and mental health conditions.

- Similarly, according to the World Health Organization, non-communicable diseases such as cardiovascular conditions, cancer, and diabetes account for over 70% of global deaths, necessitating a steady supply of effective medications. Pharmaceutical solvents play a critical role in drug formulation, purification, and manufacturing processes.

Additionally, the global increase in vaccination campaigns and biologic drug development has intensified the need for high-purity solvents that ensure product stability and safety. As countries invest in healthcare infrastructure and governments streamline drug approval processes, pharmaceutical manufacturers are scaling up production, further driving the demand for solvents that meet stringent regulatory standards for efficacy and safety in drug delivery systems.

Source: European Federation of Pharmaceutical Industries and Associations

Restraints

Solvent Residue in Drugs Might Pose a Significant Challenge in the Pharmaceutical Solvents Market.

The presence of solvent residues in pharmaceutical products, combined with stringent regulatory standards, presents a significant challenge in the pharmaceutical solvents market. Residual solvents, which remain after the manufacturing process, can pose toxicological risks if not properly controlled. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established strict limits under guidelines such as the International Council for Harmonization (ICH) Q3C, which categorizes solvents based on their toxicity.

- For instance, Class 1 solvents such as benzene are prohibited due to their carcinogenicity, while Class 2 solvents like methanol and toluene have restricted use due to potential organ toxicity.

Pharmaceutical manufacturers must invest in advanced purification and monitoring technologies to ensure compliance, which increases production complexity and cost. Even trace amounts of non-compliant residues can lead to product recalls, regulatory penalties, or delayed drug approvals. The need to balance efficacy, safety, and compliance continues to challenge solvent selection and usage in drug development.

Opportunity

Deep Eutectic Solvents (DESs) May Create Opportunities in the Pharmaceutical Solvents Market.

Deep eutectic solvents (DESs) are emerging as a promising class of green solvents, potentially transforming the pharmaceutical solvents market due to their low toxicity, biodegradability, and customizable properties. DESs are formed by mixing hydrogen bond donors and acceptors, often resulting in non-volatile, stable liquids suitable for pharmaceutical applications. Their tunable nature allows for the development of task-specific solvents, particularly valuable in drug synthesis, purification, and formulation. For instance, choline chloride-based DESs have shown efficacy in extracting bioactive compounds and enhancing the solubility of poorly water-soluble drugs, which addresses a major challenge in drug delivery.

According to a study by the United States National Institute of Health, the relatively easy preparation of API-DES and their capacity to tune the API’s release profile when incorporated in (bio)polymer-based systems represent an effective alternative to improve the API’s therapeutic action and to develop controlled drug delivery systems. As regulatory pressure grows to reduce the environmental impact of pharmaceutical manufacturing, DESs offer a sustainable pathway that aligns with green chemistry principles and innovation in drug development.

Trends

Demand for Bio-Based Solvents.

The demand for bio-based solvents is an ongoing trend in the pharmaceutical solvents market, driven by the industry’s shift toward sustainability and environmental responsibility. Bio-based solvents, derived from renewable resources such as corn, sugarcane, and cellulose, offer lower toxicity and reduced environmental impact compared to conventional petrochemical-based solvents. For instance, ethyl lactate is increasingly used as a green alternative in drug formulation and cleaning processes due to its biodegradability and low volatility.

- According to the U.S. Environmental Protection Agency, bio-based solvents can significantly reduce volatile organic compound (VOC) emissions, which are linked to air pollution and health hazards.

Pharmaceutical companies are adopting these solvents to comply with stricter environmental regulations and to minimize hazardous waste generation. Moreover, bio-based solvents are proving effective in enhancing the solubility of active pharmaceutical ingredients (APIs), especially in formulations for topical and oral drug delivery, making them a viable and sustainable alternative for future pharmaceutical applications.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Pharmaceutical Solvents Market.

Geopolitical tensions can significantly disrupt the pharmaceutical solvents market by affecting global supply chains, raw material availability, and trade policies. Many solvents used in pharmaceutical manufacturing, such as acetone, ethanol, and ethyl acetate, are sourced or processed in countries heavily involved in chemical production, including China, India, the United States, and some European countries.

- For instance, China and India, combined, produce more than 90% of the global supply of generic medicines. Conflicts or trade restrictions in these nations can lead to supply shortages, increased costs, and delays in drug manufacturing.

For instance, during the Russia-Ukraine conflict, disruptions in the global petrochemical supply chain led to price volatility and reduced availability of key chemical feedstocks used in solvent production. Additionally, sanctions or export controls can restrict access to critical raw materials or finished solvents, forcing pharmaceutical companies to seek alternative suppliers or reformulate processes, often at higher costs.

- For instance, China is a primary supplier of APIs to the U.S. pharmaceutical industry, with over 40% of generic drugs in the U.S. relying on Chinese imports. The newly imposed 245% tariff on Chinese APIs has raised concerns about both supply shortages and increased costs.

Regional Analysis

Asia Pacific was the Largest Market for Pharmaceutical Solvents in 2024.

Asia Pacific held the major share of the global pharmaceutical solvents market, valued at around US$1.8 billion, commanding an estimated 38.4% of the total revenue share. Asia Pacific has emerged as the largest market for pharmaceutical solvents, driven by rapid industrialization, expanding pharmaceutical manufacturing capabilities, and growing domestic demand for medicines. Countries such as China and India are at the forefront, with India being one of the world’s largest producers of generic drugs and active pharmaceutical ingredients (APIs). For instance, while China is the largest producer of API, India ranks third, accounting for an 8% share of the global API industry.

Additionally, more than 500 different APIs are manufactured in India, and they contribute 57% of APIs to the prequalified list of the World Health Organization (WHO). Similarly, according to the Indian Ministry of Chemicals and Fertilizers, India contributes over 20% to the global supply of generics, necessitating large volumes of pharmaceutical-grade solvents.

Furthermore, favorable government initiatives, such as China’s Healthy China 2030 plan, have stimulated pharmaceutical research and development, further increasing solvent demand. The presence of low-cost labor, skilled chemists, and well-established supply chains has also made the Asia Pacific a preferred destination for contract manufacturing. Moreover, rising healthcare awareness and expanding access to medications across rural and urban regions continue to boost regional pharmaceutical production.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the pharmaceutical solvents market are Clariant AG, Arkema, Avantor, BASF SE, Dow Chemicals, Eastman Chemical Company, Exxon Mobil Corporation, Honeywell International, INEOS, Lanxess, LyondellBasell Industries Holdings B.V., Yip’s Chemical Holdings Limited, Sasol, Seqens, and Mitsubishi Chemical Corporation.

Arkema produces a range of solvents, including oxygenated solvents and acetone derivatives. The company has expanded its international reach through a strategy of targeted acquisitions and industrial investments, balancing its presence across Europe, North America, and Asia.

INEOS produces a variety of chemical compounds, including oxygenated solvents, esters, and alcohols. The company maintains a significant manufacturing presence for solvents in Europe, particularly in Germany, with a workforce dedicated to producing the chemicals.

Avantor supplies high-purity solvents and reagents essential for various applications, under its well-known J.T. Baker brand. The company offers cGMP-manufactured solvents in various package sizes to meet pharmaceutical customers’ stringent quality requirements and facilitate convenient usage.

Dow offers pharmaceutical-grade solutions, including APIs, excipients, API manufacturing aids, and packaging materials. The company emphasizes quality and supply reliability, leveraging decades of experience with regulated products to meet the stringent demands of the pharmaceutical sector.

The major players in the industry

- Clariant AG

- Arkema

- Avantor, Inc.

- BASF SE

- Dow Chemicals

- Eastman Chemical Company

- Exxon Mobil Corporation

- Honeywell International Inc.

- INEOS

- Lanxess

- LyondellBasell Industries Holdings B.V.

- Yip’s Chemical Holdings Limited

- Sasol

- Seqens

- Mitsubishi Chemical Corporation

- Other Key Players

Key Developments

- In April 2024, INEOS Nitriles introduced INVIREO, a bio-based acetonitrile necessary for the production of many pharmaceuticals such as insulin and vaccines.

- In October 2024, Clariant presented the company’s portfolio of products for the healthcare industry at the CPHI tradeshow in Milan, Italy. The company introduced VitiPure LEX 3350 S, VitiPure LEX 4000 S, and Polyglykol 1450 S solvents to solve API delivery and bioavailability challenges.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Bn Forecast Revenue (2034) USD 7.6 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Alcohols, Ethers, Esters, Glycols, Aromatic Hydrocarbons, Ketones, Others), By Applications (Pharmaceutical Formulations, Drug Development & Manufacturing, Cleaning & Processing, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Clariant AG, Arkema, Avantor, BASF SE, Dow Chemicals, Eastman Chemical Company, Exxon Mobil Corporation, Honeywell International, INEOS, Lanxess, LyondellBasell Industries Holdings B.V., Yip’s Chemical Holdings Limited, Sasol, Seqens, Mitsubishi Chemical Corporation, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Pharmaceutical Solvents MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Solvents MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Clariant AG

- Arkema

- Avantor, Inc.

- BASF SE

- Dow Chemicals

- Eastman Chemical Company

- Exxon Mobil Corporation

- Honeywell International Inc.

- INEOS

- Lanxess

- LyondellBasell Industries Holdings B.V.

- Yip’s Chemical Holdings Limited

- Sasol

- Seqens

- Mitsubishi Chemical Corporation

- Other Key Players