Global PET Syrup Bottle Market Size, Share, Growth Analysis By Type (Clear, Color), By Capacity (Less than equal to 250ml, 250ml to 500ml, 500ml above), By End Use (Pharmaceuticals, Food & Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155909

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

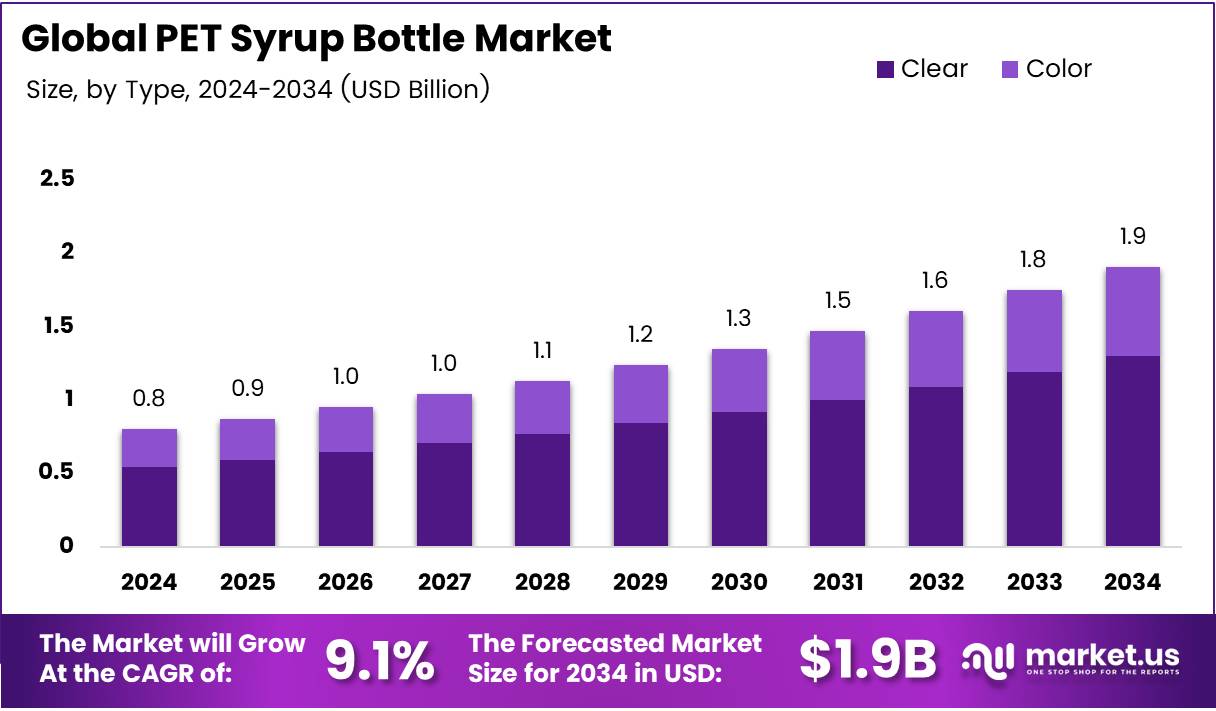

The Global PET Syrup Bottle Market size is expected to be worth around USD 1.9 Billion by 2034, from USD 0.8 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

The PET Syrup Bottle Market is a rapidly growing sector within the packaging industry, driven by increasing demand for bottled beverages, including syrups and other liquid products. Polyethylene terephthalate (PET) bottles are preferred for their lightweight, durable, and recyclable properties. As consumers and industries prioritize convenience, PET syrup bottles are becoming the go-to packaging solution for a variety of liquid products.

One of the major drivers of the PET Syrup Bottle Market is the growing preference for sustainable packaging. With environmental concerns rising, manufacturers are shifting towards more eco-friendly solutions. PET bottles, being recyclable, provide a more sustainable alternative compared to traditional glass or other non-recyclable packaging materials. This shift towards sustainable packaging solutions is expected to fuel further market growth.

Government investments in recycling and waste management technologies are also influencing the market. Increased regulatory focus on recycling rates and packaging waste reduction is encouraging manufacturers to adopt more sustainable practices. In regions like the U.S., government incentives and policies are pushing companies to enhance recycling processes, contributing to the growing demand for recyclable PET syrup bottles.

The ongoing innovation in the PET Syrup Bottle sector presents opportunities for further expansion. Manufacturers are developing PET bottles with improved features, such as higher durability, better sealing capabilities, and enhanced designs. These innovations provide businesses with more options for optimizing their packaging solutions to meet consumer preferences for quality, convenience, and sustainability.

According to a survey by the National Association for PET Container Resources, in the United States, PET bottle recycling rates reached 33% in 2023, a significant increase from 29% in 2022, marking the highest recycling rate since 1996. This highlights the growing consumer awareness and the positive environmental impact of using recyclable PET materials.

Moreover, over 90% of the U.S. population now has access to PET bottle recycling programs, according to a report from the same association. This accessibility is expected to further boost demand for PET syrup bottles, as more consumers and manufacturers are aligning with sustainable practices. The increasing recycling rate and accessibility to recycling facilities are contributing to the growth and demand for PET syrup bottles in the market.

Key Takeaways

- The Global PET Syrup Bottle Market is expected to reach USD 1.9 Billion by 2034, growing at a CAGR of 9.1% from 2025 to 2034.

- In 2024, Clear bottles dominated the By Type Analysis segment with a 68.9% market share.

- The 250ml to 500ml capacity segment held a 48.4% share in 2024, representing the ideal range for syrup applications.

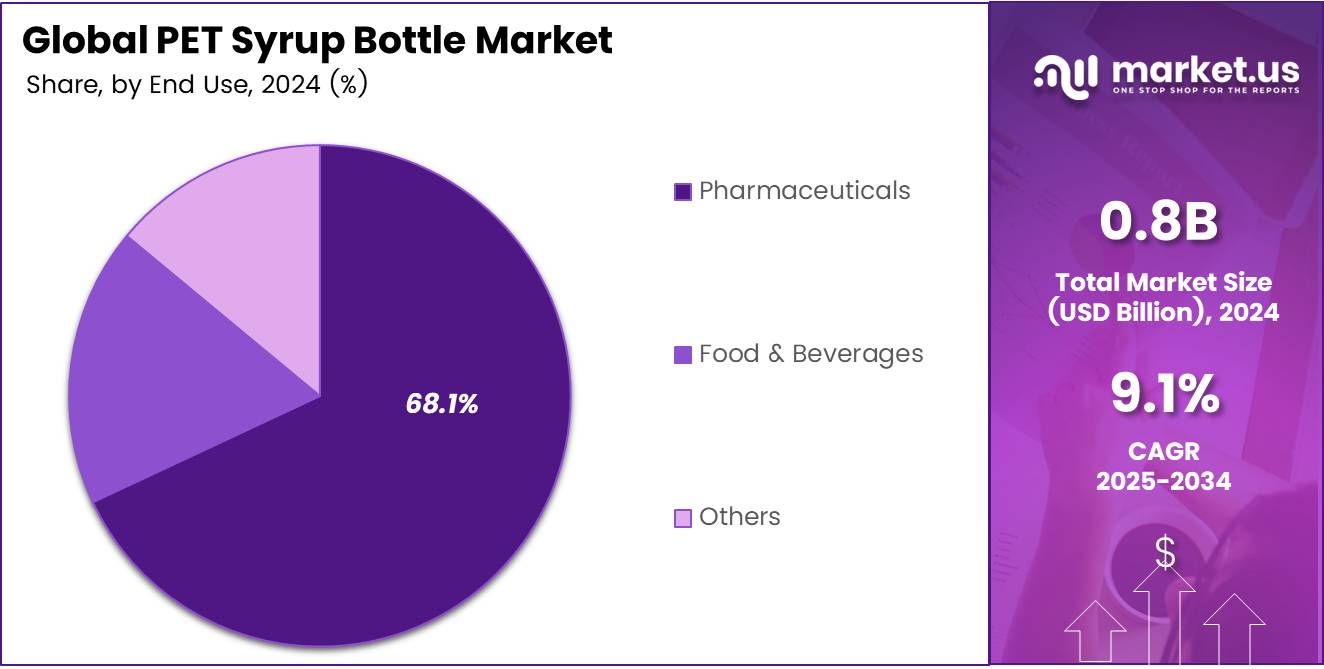

- The Pharmaceuticals sector led the By End Use segment with a 68.1% share in 2024.

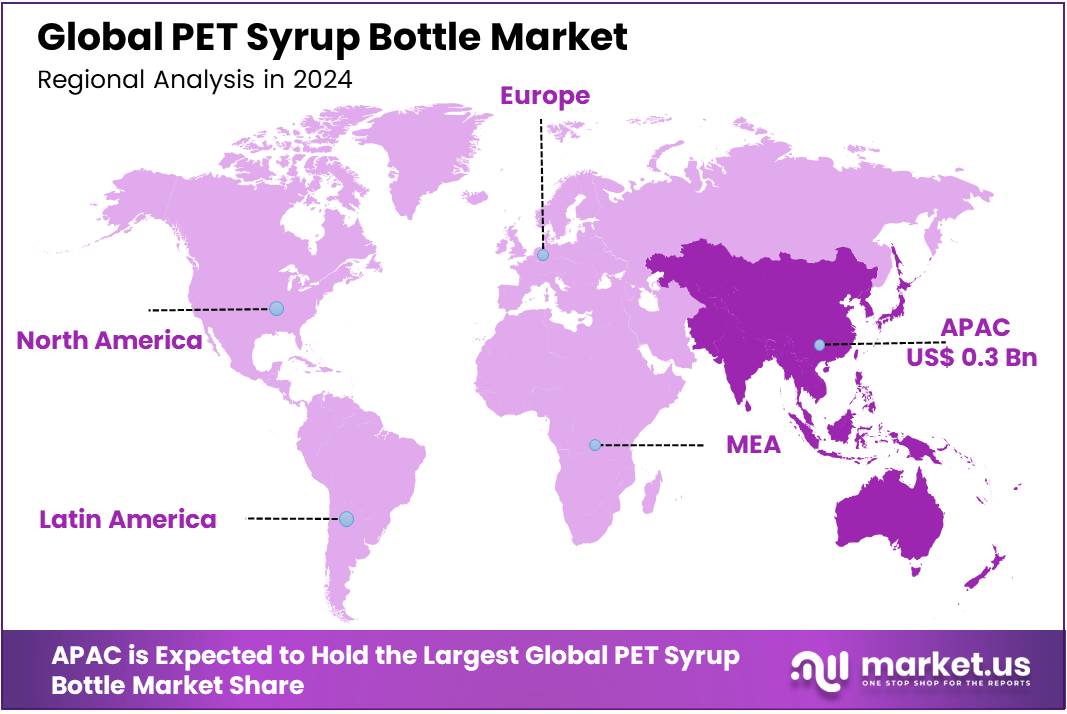

- Asia Pacific held the dominant position in the PET Syrup Bottle Market with 48.2% market share, valued at USD 0.3 Billion in 2024.

Type Analysis

Clear Color dominates with 68.9% due to its widespread consumer preference and product visibility requirements.

In 2024, Clear held a dominant market position in By Type Analysis segment of PET Syrup Bottle Market, with a 68.9% share. The clear variant’s overwhelming market leadership stems from consumer preferences for product transparency and visibility. Clear bottles allow end-users to assess product quality, color, and quantity at a glance, which is particularly crucial for pharmaceutical and food applications.

The transparency factor plays a vital role in building consumer trust and confidence. Healthcare professionals and consumers alike prefer clear containers as they enable easy identification of contents and detection of any contamination or deterioration. This visual accessibility has made clear PET syrup bottles the preferred choice across multiple industries.

Additionally, clear bottles offer superior versatility in branding and labeling applications. Manufacturers can implement various design elements without color interference, making clear bottles more adaptable to different marketing strategies and product positioning requirements.

Capacity Analysis

250ml to 500ml dominates with 48.4% due to its optimal balance between convenience and cost-effectiveness.

In 2024, 250ml to 500ml held a dominant market position in By Capacity Analysis segment of PET Syrup Bottle Market, with a 48.4% share. This capacity range represents the sweet spot for most syrup applications, offering an ideal balance between practicality and economic efficiency.

The mid-range capacity addresses the primary needs of both pharmaceutical and food & beverage sectors. For pharmaceutical applications, this size provides sufficient quantity for standard treatment courses while maintaining product stability and preventing waste. The portion size aligns well with typical prescription requirements and household consumption patterns.

From a manufacturing perspective, this capacity range optimizes production costs and material utilization. The size allows for efficient packaging, storage, and transportation logistics while minimizing per-unit overhead costs. Retailers also prefer this range as it maximizes shelf space utilization and inventory turnover rates.

Consumer convenience drives significant demand in this segment, as the capacity is manageable for regular handling while providing adequate product volume for extended use periods.

End Use Analysis

Pharmaceuticals dominates with 68.1% due to stringent quality requirements and regulatory compliance needs.

In 2024, Pharmaceuticals held a dominant market position in By End Use Analysis segment of PET Syrup Bottle Market, with a 68.1% share. The pharmaceutical sector’s dominance reflects the critical importance of specialized packaging solutions for liquid medications and therapeutic formulations.

Pharmaceutical applications demand the highest quality standards and regulatory compliance, making PET syrup bottles an ideal choice due to their chemical inertness and barrier properties. These bottles effectively preserve drug potency and prevent contamination while meeting stringent FDA and international regulatory requirements.

The growing global healthcare market and increasing prevalence of chronic diseases drive substantial demand for liquid pharmaceutical formulations. PET syrup bottles offer excellent compatibility with various drug formulations while providing tamper-evident features essential for pharmaceutical packaging.

Additionally, the pharmaceutical sector values PET’s recyclability and environmental sustainability, aligning with industry initiatives toward sustainable packaging solutions. The material’s lightweight properties also reduce transportation costs, making it economically attractive for pharmaceutical manufacturers operating in competitive markets.

Key Market Segments

By Type

- Clear

- Color

By Capacity

- Less than equal to 250ml

- 250ml to 500ml

- 500ml above

By End Use

- Pharmaceuticals

- Food & Beverages

- Others

Drivers

Increasing Consumer Demand for Convenient and Durable Packaging Solutions Drives PET Syrup Bottle Market Growth

The growing demand for convenient, portable packaging solutions is significantly driving the PET syrup bottle market. As consumers look for ease of use, lightweight, and durable packaging, PET bottles have become a preferred choice. PET bottles offer resilience, protecting contents from damage and ensuring safety during transportation.

The expansion of industries like food & beverage and pharmaceuticals is another key driver. With more products being packaged in PET syrup bottles, industries are meeting consumer demands for secure, hygienic, and user-friendly packaging. This shift towards PET packaging allows manufacturers to cater to a wide range of consumer preferences.

Advancements in PET bottle manufacturing technologies are also enhancing production efficiency and reducing costs. Innovations in blow molding and injection molding technologies have made it easier to create high-quality, precise bottles while minimizing waste.

Furthermore, the rising trend of eco-friendly packaging solutions is contributing to PET’s growing popularity. As sustainability becomes a focal point for consumers and businesses, PET bottles that are lightweight and recyclable are increasingly preferred. This growing awareness and adoption of eco-conscious packaging alternatives are driving the demand for PET syrup bottles.

Restraints

Environmental Concerns Regarding Plastic Waste Restrain PET Syrup Bottle Market Growth

Despite the advantages, environmental concerns related to plastic waste are a major restraint for the PET syrup bottle market. The large-scale production and disposal of plastic bottles raise concerns about their contribution to environmental pollution. PET bottles, if not recycled properly, can take years to decompose, leading to an increased environmental footprint.

Stricter government regulations on packaging waste are also impacting market growth. Many countries have implemented or are planning to enforce regulations that restrict the use of non-biodegradable packaging. These regulations push businesses to adopt sustainable alternatives and reduce reliance on PET packaging, which may increase operational costs for manufacturers.

While the growing emphasis on sustainability is a positive trend, it presents challenges in balancing environmental concerns with market demands. This shift towards more eco-friendly packaging materials presents a key challenge for the PET syrup bottle industry.

Growth Factors

Expansion of E-commerce and Online Food Delivery Creates Growth Opportunities for PET Syrup Bottles

The rise of e-commerce and online food delivery services has opened new avenues for the PET syrup bottle market. With the increased demand for packaged beverages and ready-to-eat meals, there is a growing need for secure and convenient packaging. PET bottles, being lightweight and durable, are perfectly suited for online food delivery and e-commerce, as they offer ease of storage and transport.

Health-conscious consumers are also contributing to market growth. The popularity of health drinks, functional beverages, and organic products has increased the demand for PET syrup bottles. These bottles are ideal for packaging health-focused beverages, as they preserve the product’s integrity while remaining lightweight.

The development of biodegradable PET alternatives also presents a growth opportunity. Biodegradable materials are becoming more prevalent as consumers demand sustainable packaging solutions. Manufacturers are investing in research to create eco-friendly PET alternatives that offer the same benefits without the environmental impact.

Additionally, there is increasing demand for customized PET bottle designs. Brands are now focusing on creating unique packaging to stand out in the market. Customization offers an opportunity to cater to specific consumer preferences, providing businesses with a competitive edge in a growing market.

Emerging Trends

Shift Towards Sustainable Packaging Practices Drives PET Syrup Bottle Market Trends

The shift towards sustainable packaging practices is a key trend shaping the PET syrup bottle market. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that minimize environmental impact. Manufacturers are responding by incorporating recycled PET (rPET) into bottle production, reducing reliance on virgin plastic and promoting circular economies.

The integration of smart packaging technology into PET bottles is also a significant trend. Smart packaging features such as QR codes, temperature indicators, and freshness sensors are gaining traction. These technologies enhance user experience by offering real-time information about the product’s quality and safety.

In addition, PET bottles are increasingly being used for functional and nutraceutical products. The market for nutraceuticals, such as vitamin supplements and health drinks, is expanding, and PET bottles are an ideal choice for packaging these products due to their durability and ability to protect the contents.

Lastly, advancements in recycling technologies for PET packaging are transforming the market. Improved recycling methods enable the reuse of PET bottles, reducing waste and ensuring the material is repurposed efficiently, further supporting sustainability goals within the industry.

Regional Analysis

Asia Pacific Dominates the PET Syrup Bottle Market with a Market Share of 48.2%, Valued at USD 0.3 Billion

In 2024, Asia Pacific (APAC) held the dominant position in the PET Syrup Bottle Market, with a market share of 48.2%, valued at USD 0.3 Billion. The region’s growth can be attributed to the increasing demand for convenient packaging in the pharmaceutical and food & beverage industries. Additionally, the expanding manufacturing capabilities in countries such as China and India are further driving market expansion.

Europe PET Syrup Bottle Market Trends

Europe holds a significant portion of the PET Syrup Bottle Market, supported by a strong focus on eco-friendly packaging solutions. The region’s emphasis on sustainability and stringent regulations regarding plastic waste are key factors shaping the market. Growing consumer demand for lightweight and durable packaging also contributes to the market’s steady growth.

North America PET Syrup Bottle Market Insights

North America is another prominent region in the PET Syrup Bottle Market. The increasing preference for PET bottles in the food and pharmaceutical sectors is driving market growth. The region benefits from established manufacturing processes and strong consumer demand for high-quality, reliable packaging solutions, contributing to its competitive market position.

Latin America PET Syrup Bottle Market Trends

In Latin America, the PET Syrup Bottle Market is expanding due to the rising demand for affordable and durable packaging in various sectors. The region’s growing pharmaceutical industry, coupled with the increasing adoption of PET bottles for syrups and liquids, is enhancing the market outlook. However, challenges related to economic fluctuations remain a key factor to monitor.

Middle East and Africa PET Syrup Bottle Market Trends

The Middle East and Africa (MEA) region is witnessing moderate growth in the PET Syrup Bottle Market. The rising healthcare and food & beverage sectors, combined with expanding urbanization and infrastructure development, are driving demand for PET bottles. Despite challenges like regulatory hurdles and cost constraints, the region holds a steady growth trajectory.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key PET Syrup Bottle Company Insights

In 2024, Alpha Plastics Inc. remains a key player in the global PET Syrup Bottle Market, recognized for its strong manufacturing capabilities and focus on high-quality PET bottles. The company’s emphasis on sustainability and innovation in packaging solutions has allowed it to maintain a solid position in the market.

Altium Packaging is another significant player with a robust market presence. Known for its expertise in custom packaging solutions, Altium continues to innovate with eco-friendly materials and cutting-edge designs. The company is committed to reducing the environmental impact of its products, which aligns with increasing consumer demand for sustainable packaging.

Amcor Plc stands out as a global leader in packaging, with a diversified portfolio that includes PET syrup bottles. With a strong focus on sustainable packaging, Amcor has consistently invested in research and development to enhance its products’ recyclability and overall environmental footprint. Their strategic partnerships with various industries bolster their competitive advantage.

Berry Global Inc. holds a commanding position in the PET syrup bottle market due to its extensive production capabilities and commitment to meeting the growing demand for lightweight, durable, and eco-friendly packaging solutions. Berry Global has made significant strides in improving its product offerings through technological advancements and sustainable initiatives.

Top Key Players in the Market

- Alpha Plastics Inc.

- Altium Packaging

- Amcor Plc

- Berry Global Inc.

- Indorama Ventures Public Co. Ltd.

- Sheth PET and Polymers Pvt Ltd.

- Silgan Holdings Inc.

- KHS Group

- Gerresheimer AG

- Alpha Packaging

- Graham Packaging Company

Recent Developments

- In May 2025, Niche Cocoa installed its first-ever aseptic PET line in Ghana, marking a significant step towards improving its production capabilities in the region and expanding its market presence. This installation is expected to enhance the company’s efficiency in packaging and reduce its environmental impact.

- In January 2024, Aran Group strengthened its market presence by acquiring a majority stake in IBA Germany. This strategic acquisition is aimed at boosting Aran Group’s sustainability initiatives and expanding its portfolio in the European market.

Report Scope

Report Features Description Market Value (2024) USD 0.8 Billion Forecast Revenue (2034) USD 1.9 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Clear, Color), By Capacity (Less than equal to 250ml, 250ml to 500ml, 500ml above), By End Use (Pharmaceuticals, Food & Beverages, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alpha Plastics Inc., Altium Packaging, Amcor Plc, Berry Global Inc., Indorama Ventures Public Co. Ltd., Sheth PET and Polymers Pvt Ltd., Silgan Holdings Inc., KHS Group, Gerresheimer AG, Alpha Packaging, Graham Packaging Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alpha Plastics Inc.

- Altium Packaging

- Amcor Plc

- Berry Global Inc.

- Indorama Ventures Public Co. Ltd.

- Sheth PET and Polymers Pvt Ltd.

- Silgan Holdings Inc.

- KHS Group

- Gerresheimer AG

- Alpha Packaging

- Graham Packaging Company