Global Pet Food Ingredients Market By Pet (Dog, Cat, Fish, and Others), By Ingredients (Specialty Proteins, Amino Acids, Mold Inhibitors, Gut Health Ingredients, Phosphates, Vitamins, Acidifiers, Carotenoids, Enzymes, Mycotoxin Detoxifiers, Flavors & Sweeteners, Antimicrobials & Antibiotics, Minerals, and Antioxidants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 26017

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

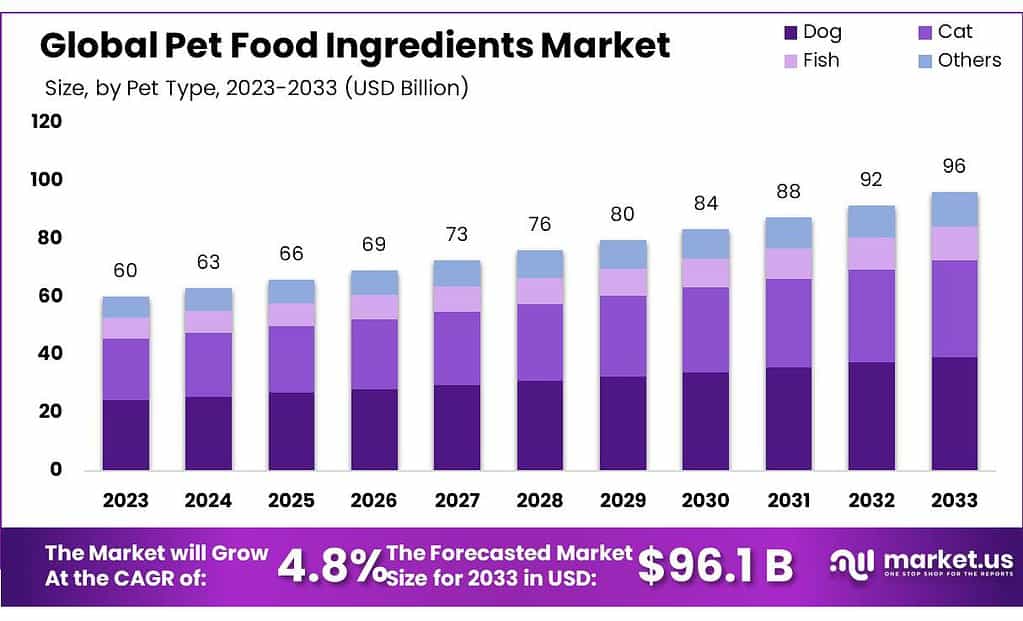

The global Pet Food Ingredients market size is expected to be worth around USD 96.1 billion by 2033, from USD 60.15 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

Pet food ingredients are the components, both natural and synthetic, that makeup pet food, providing essential nutrients for animals’ health.’

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth and Size Projected Growth: Expected market size to reach around USD 96.1 billion by 2033, growing from USD 60.15 billion in 2023 at a CAGR of 4.8%.

Major Drivers: Shift towards organic and healthier pet food ingredients, with a notable increase in spending on high-quality pet food. - Pet Segmentation: Dogs lead the market with over 40% share, followed closely by cats. Fish and other pets constitute smaller segments.

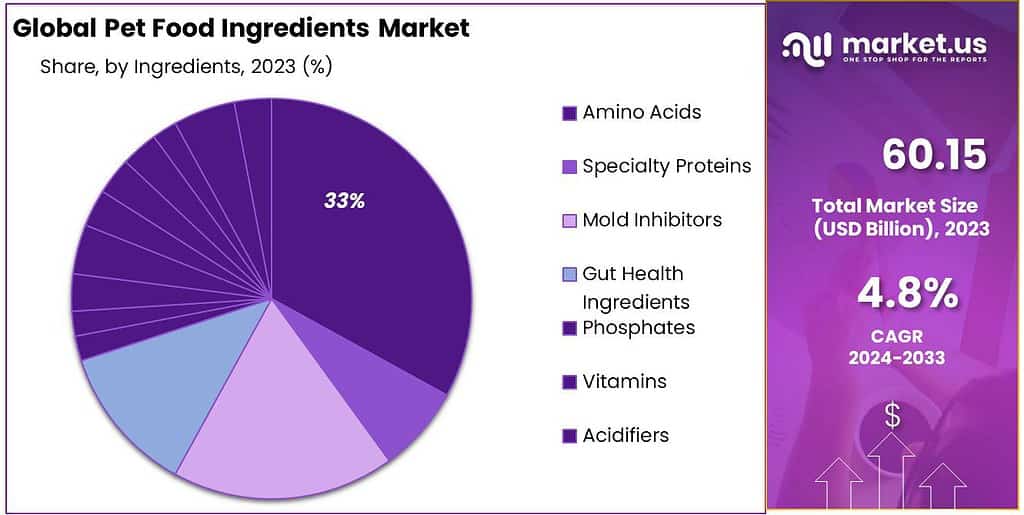

- Ingredient Analysis: Amino acids dominate the market, contributing over 33%, followed by phosphates and gut health ingredients.

- Drivers: Transition to natural and grain-free products due to increased pet owner focus on pet health and nutrition.

- Restraints: Limited ingredient availability and price sensitivity due to increased costs of raw materials. Regional Insights Asia Pacific: Emerged as the largest regional market in 2023, driven by rising pet ownership and disposable income.

- Major Players: FoodSafe Technologies, Symrise, AFB International, DuPont Nutrition & Health, among others.

- Opportunities: Increased demand for natural, high-quality ingredients aligning with pet owner preferences.

- Challenges: Threat from counterfeit products impacting market growth and potentially harming pets’ health.

- Fragmented Market: Competitive landscape with initiatives like acquisitions driving market share growth.

Pet Analysis

In 2023, dogs were leading the pet food ingredients market, holding more than 40% of the share. The demand for dog food ingredients remains high due to the substantial population of pet dogs globally. Cats also held a significant share, trailing closely behind dogs.

The cat food ingredient market remains robust, catering to the large population of pet cats across the world. Fish, however, represented a smaller segment in the market compared to dogs and cats. Ingredients for fish food are essential for aquarium fish, serving a specific segment of pet owners.

The category of “Other Pets” includes birds, small mammals, reptiles, and various smaller pets. Collectively, these pets constitute a smaller share in the pet food ingredients market due to their relatively smaller populations compared to dogs and cats, dominating the market.

Ingredients Analysis

In 2023, amino acids were the big players in the pet food ingredients market, holding over 33% of it. Amino acids are super important for pets’ health, used widely in their food to help them grow and stay healthy.

Lysine is a building block for protein. Supplementation or diet are the best options for this amino acid as it is not produced in sufficient quantities by the animal’s body. Lysine, which has the same biological value as soybean, is an economically viable ingredient to be added to companion animals’ diets.

The market for phosphates is another important segment that is expected to grow at an impressive rate. Monocalcium, dicalcium, and phospholipids are some of the most popular phosphates used in animal nutrition. These phosphates improve the health and well-being of companion animals by providing vital nutrients.

Gut health ingredients are further classified as beta-glucan, Fructooligosaccharides (FOS), Mannan-oligosaccharide (MOS), prebiotics, and probiotics. This product enjoys wide acceptance because it stimulates antimicrobial activity and anti-tumor activities by binding to receptors on macrophages and white blood cells.

Due to the growing focus on pet food palatability, Palatants are also experiencing steady growth in demand. Animals make their decisions about palatability based on three sensory attributes: texture, macronutrient profile, and aroma. Due to their hypersensitive noses, dogs are particularly sensitive to smells.

There is a growing concern over antibiotic use in agricultural applications. This has pushed the development of antioxidants, acidifiers, enzymes, and other compounds. Formic acid and fumaric acids are all common feed acidifiers. Fumaric Acid is a cost-effective and affordable energy source, similar to glucose. It is used as the primary driver for the product.

The market also includes specialty proteins, minerals mycotoxin detoxifiers carotenoids flavors & sweetness, mold inhibitors vitamins, antimicrobials & antioxidants, and other important product segments.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Pet

- Dog

- Cat

- Fish

- Others (rabbits, birds, and horses)

Ingredients

- Specialty Proteins

- Amino Acids

- Mold Inhibitors

- Gut Health Ingredients

- Phosphates

- Vitamins

- Acidifiers

- Carotenoids

- Enzymes

- Mycotoxin Detoxifiers

- Flavors & Sweeteners

- Antimicrobials & Antibiotics

- Minerals

- Antioxidants

Drivers

Switch from mass products to organic pet food ingredients

People are really into giving their pets healthier food. They’re switching from regular stuff to organic ingredients. In the US, they spent a lot, around $8.2 billion, on organic pet food in 2016.

Even in the UK, folks are buying less pet food but spending more on better-quality stuff. Plus, in the US, folks want treats and chews that are natural and made nearby. Pets getting chubby has made

owners want healthier, protein-packed food for them.Restraints

Limited availability of ingredients and price sensitivity

Making pet food has become more expensive ’cause the stuff needed, like vitamins, has gotten pricier. Companies like BASF bumped up their vitamin prices by quite a bit in recent years. Sometimes, it’s hard to even find the raw materials for these ingredients, which jacks up their prices even more.

And since some ingredients come from plants, changes in the weather from things like climate change mess with how much we can get, making them more expensive too. All these pricey hurdles make it tough for the pet food ingredient market to grow.

Opportunities

Shift in focus toward natural and grain-free products

Pet owners want the best for their furry pals, so they’re spending more on top-notch pet food. They’re all about food that helps their pets grow strong and healthy. Lots of folks are talking about natural and grain-free pet food now.

They think it’s better for their pets, and that’s why sales went up from $3.6 billion in 2011 to a huge $5.4 billion in 2015! This trend is a golden chance for companies making pet food ingredients. If they focus on making natural and grain-free ingredients, they can make good money and keep up with what pet owners want.

Challenges

Threat from counterfeit products

Lately, the pet food market has been booming, but there’s a hitch: fake products are popping up. These knockoffs are bad news for pets’ health. They’re messing with the market and, worst of all, we don’t even know how much money they’re making.

This whole counterfeit deal is a big threat to the pet food industry, especially the part that makes extruded pet food. Just a while back, Champion Pet Foods, a big player in the pet food world, found fake versions of its food being sold online. These fake things could mess up pets’ health and slow down the growth of the whole pet food business.

Regional Analysis

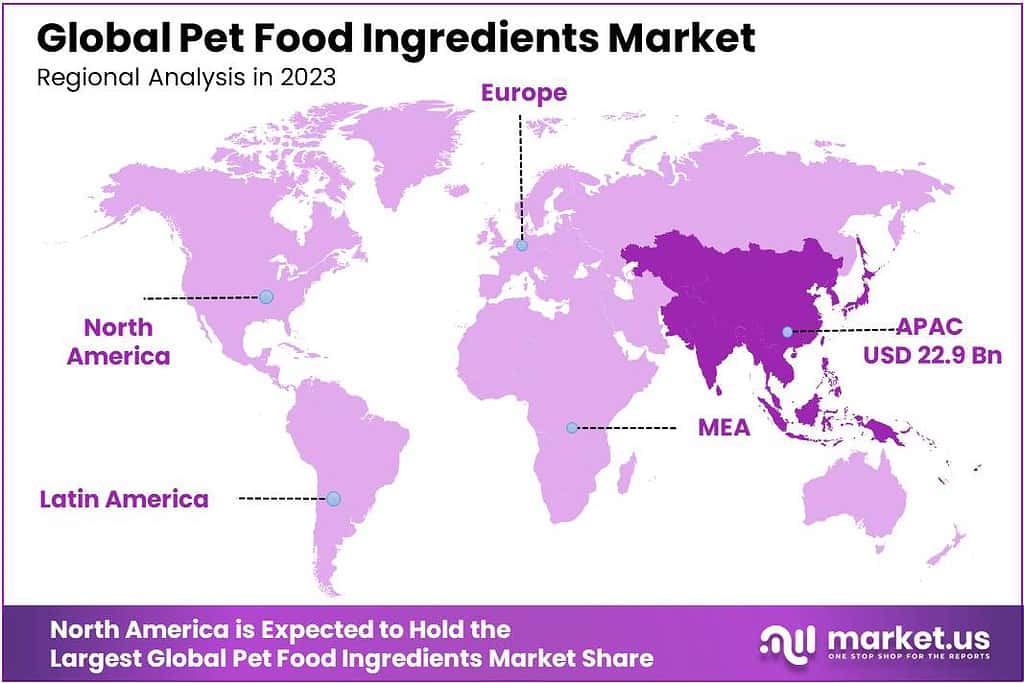

The Asia Pacific, which had a market share greater than 36.9% in revenue, emerged as the largest regional market in 2023. The main drivers of consumer spending for companion animal care are the increasing population, rising disposable income, growing humanization trends in the region, and an increase in disposable income.

Due to growing consumer preference for natural products and a shift in the market, premium products are being replaced by mass-market products.

North America, which included the U.S. and Canada, was the largest region in 2023. Mexico came in third. Because of the existence of a well-developed pet food sector and high ownership percentages of dogs, cats, and horses, the U.S. emerged as the largest market in North America. The country is ranked among the top five countries for the number of pets, cats, and dogs it has.

The U.S. and China have an enviable demand-supply balance in the pet food and animal feed industries. Companies in these markets are likely to see positive developments. China’s ingredient manufacturers have experienced faster consolidation than other countries in terms of acquisitions or integrations.

Nearly 27% of 2021’s market share was held by Europe. A number of factors are driving the pet food industry, including the presence of developed economies and a high-level pet ownership rate, as well as consumers’ willingness to pay more for pet care. According to the European Pet Food Industry Federation(FEDIAF), over 80 million households own at least one pet in Europe. Due to cat ownership, cat food dominates the regional market.

Nearly 84.9 and 49.8 million of the total European pet population were dogs and ornamental birds. Europe has a large number of pet food manufacturers and 200 production facilities, making it a competitive market for pet ingredient companies.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The pet food ingredients market remains fragmented. To increase their market share in the global marketplace, major manufacturers have launched a number of strategic initiatives including acquisitions.

Contrary to many commodity value chains, livestock value chains include a majority, which makes them easily identifiable and distinguishable transactions.Pet food ingredients manufacturers are now looking for technological breakthroughs to reduce their energy consumption and sourcing ingredients. The producers will face both a significant challenge and an opportunity because of the growing demand for pet food ingredients.

Producing contracts with pet food manufacturers and producers of ingredients is expected to be beneficial for the ingredient producers, as it creates opportunities to increase the profit margin.

Market players are now focusing on Asia Pacific countries, where the pet foods industry is expected to grow at an impressive rate. This is a significant driver for the product marketplace. The region’s lower pet ownership rate is driving global players to expand their operations there.

Key Market Players

- FoodSafe Technologies

- Symrise

- AFB International

- DuPont Nutrition & Health

- Biorigin

- Lallemand, Inc.

- Eurotec Nutrition

- Impextraco Ltda Brazil

- Pancosma

- Alltech

- Vitablend Nederland B.V.

- Elanco

Recent Development

In July 2022, BASF SE (Germany) announced plans to expand its vitamin A formulation plant for animal nutrition. With this strategic initiative, the company intended to consolidate its market position as a market leader in the industry.

In June 2022, DSM (Netherlands) acquired Prodap (Brazil), one of Brazil’s leading animal nutrition technologies, to enhance its R&D and technological capabilities in the animal nutrition industry. This acquisition would also enable access to more markets on a global scale and cater to a larger customer base.

In May 2022, Darling Ingredients Inc. (US) completed the acquisition of Valley Proteins (US), a leading producer of animal-based fats and by-product meals, based in the US. This strategic initiative was intended to strengthen the product portfolio of the company and cater efficiently to the rising demand in the industry.

In September 2022, Royal DSM acquired Prodap, which will work on precision and personalization with the power of digital solutions, which will strengthen animal nutrition knowledge.

Report Scope

Report Features Description Market Value (2023) USD 11.2 Billion Forecast Revenue (2033) USD 19.9 Billion CAGR (2023-2032) 6.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Titanate, Alumina, Ferrite, Zirconate, Other Material Types), By Application (Monolithic Ceramics, Ceramic Coatings Ceramic Filters, Others), By End-use Industry (Electrical & Electronics, Transportation, Medical, Defence & Security, Environmental, Chemical, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape The 3M Company, AGC Ceramics Co., Ltd., CeramTec GmbH, CoorsTek Inc., Elan Technology, KYOCERA Corporation, Morgan Advanced Materials, Murata Manufacturing Co., Ltd., Nishimura Advanced Ceramics Co., Ltd., Ortech Advanced Ceramics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Pet Food Ingredients?Pet food ingredients are components used to make pet food, providing essential nutrients like proteins, carbohydrates, fats, vitamins, and minerals necessary for pets' health.

What types of Ingredients are used in Pet Food?Ingredients include proteins from meat or plants, carbohydrates from grains and veggies, fats and oils for energy, vitamins, minerals, and additives for taste and freshness.

Why are Amino Acids important in Pet Food?Amino acids are vital building blocks for pet growth and health. They help in muscle development, immune function, and overall well-being.

Pet Food Ingredients MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Pet Food Ingredients MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample - Market Growth and Size Projected Growth: Expected market size to reach around USD 96.1 billion by 2033, growing from USD 60.15 billion in 2023 at a CAGR of 4.8%.

-

-

- FoodSafe Technologies

- Symrise

- AFB International

- DuPont Nutrition & Health

- Biorigin

- Lallemand, Inc.

- Eurotec Nutrition

- Impextraco Ltda Brazil

- Pancosma

- Alltech

- Vitablend Nederland B.V.

- Elanco