Global Pet Dental Health Market Size, Share, Growth Analysis By Animal Type (Dogs, Cats, Others), By Indication (Gum Diseases, Endodontic Diseases, Dental Calculus, Oral Tumor, Others), By Distribution Channel (Veterinary Hospitals & Clinics, Retail Pharmacies, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162696

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

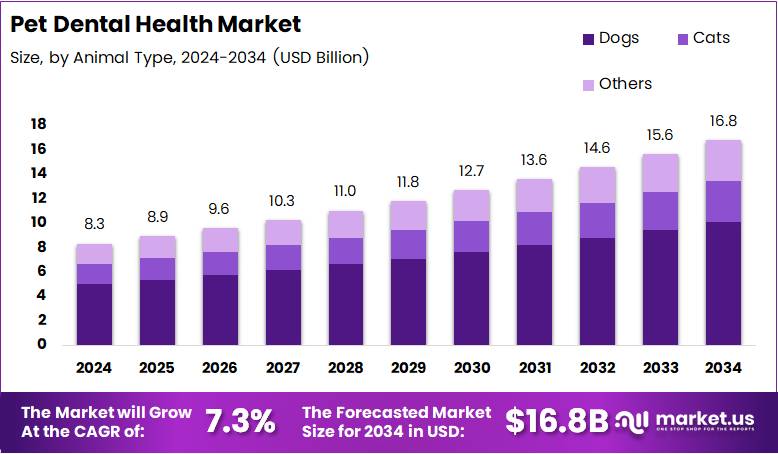

The Global Pet Dental Health Market size is expected to be worth around USD 16.8 Billion by 2034, from USD 8.3 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The Pet Dental Health Market focuses on products and services that support oral hygiene for companion animals, including dental chews, toothpaste, and veterinary treatments. As pet ownership increases globally, awareness of preventive dental care has grown rapidly, driving steady demand and creating strong business potential for manufacturers and service providers.

Furthermore, rising disposable incomes and the humanization of pets continue to fuel market expansion. Pet parents are increasingly treating animals as family members, prompting higher spending on premium dental care products. This trend positions the market for long-term growth, supported by innovation in oral hygiene formulations and veterinarian-recommended solutions.

In addition, digital campaigns and pet health education programs are promoting regular dental checkups, further enhancing adoption rates. Governments and animal welfare organizations are investing in preventive healthcare standards, indirectly benefiting the pet dental health segment. Such regulatory initiatives encourage improved product safety, labeling, and veterinary certification processes, fostering consumer trust.

Moreover, technological advancements in dental diagnostics and treatment tools are reshaping veterinary practices. The integration of smart devices, ultrasonic tools, and 3D imaging enhances precision and efficiency, providing lucrative opportunities for veterinary equipment suppliers and clinics. This progress aligns with the broader trend of modernization across veterinary healthcare markets worldwide.

According to an industry report, 90% of U.S. dog owners believe their dog’s health is as important as or more important than their own, while 41% consider it even more significant. This mindset highlights shifting consumer priorities and reinforces consistent spending on preventive and therapeutic dental care solutions.

Additionally, data from industry report, covering over 3 million pets across 1,000+ clinics in the U.S., revealed that in 2023, 73% of dogs and 64% of cats had dental-related issues. These findings emphasize a critical need for regular oral care and suggest massive untapped potential for dental-focused veterinary services and product innovation.

Key Takeaways

- The Global Pet Dental Health Market was valued at USD 8.3 Billion in 2024 and is projected to reach USD 16.8 Billion by 2034, growing at a 7.3% CAGR.

- Dogs dominated the market by animal type with a 67.4% share in 2024, driven by higher adoption and increased oral health awareness.

- Gum Diseases led the indication segment with a 34.6% share due to high prevalence among both dogs and cats.

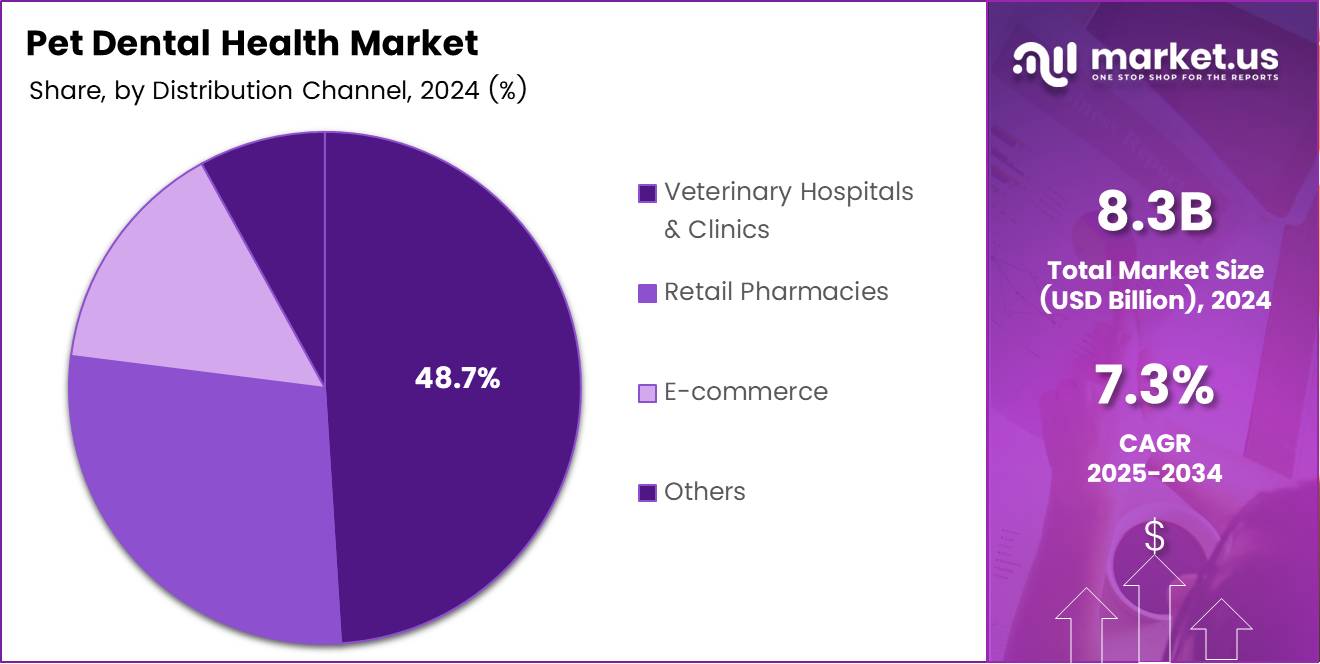

- Veterinary Hospitals & Clinics held the largest share of 48.7% by distribution channel, reflecting trust in professional dental care services.

- North America led the global market with a 43.7% share, valued at approximately USD 3.6 Billion in 2024.

By Animal Type Analysis

Dogs dominate with 67.4% due to their higher adoption rate and increased awareness of dental hygiene among pet owners.

In 2024, Dogs held a dominant market position in the By Animal Type segment of the Pet Dental Health Market, with a 67.4% share. The growing ownership of dogs globally and the rise in oral health concerns such as plaque and gum issues have boosted the demand for specialized dental products. Pet parents are increasingly investing in professional dental treatments and oral care accessories to ensure overall pet wellness, further enhancing the segment’s growth.

The Cats segment also captured a notable portion of the market, driven by rising awareness of feline dental health issues like periodontal disease. Although cats require more specialized dental care due to their grooming habits and diet, advancements in cat-specific oral care products are supporting gradual growth in this segment.

The Others category, including small mammals and exotic pets, represents a niche yet steadily expanding portion of the market. Increased veterinary attention toward the dental hygiene of rabbits, hamsters, and other small pets is contributing to this segment’s growth. As awareness spreads, more owners are expected to adopt routine dental health practices for their smaller companions.

By Indication Analysis

Gum Diseases dominate with 34.6% due to their high prevalence among both dogs and cats.

In 2024, Gum Diseases held a dominant market position in the By Indication segment of the Pet Dental Health Market, with a 34.6% share. The segment leads owing to the widespread occurrence of gingivitis and periodontitis in pets. Veterinary professionals are increasingly emphasizing preventive care, which has led to higher adoption of dental cleaning procedures and medicated oral products.

The Endodontic Diseases segment is gaining attention as awareness about root canal issues and pulp infections rises. With growing veterinary capabilities and advanced diagnostic technologies, early detection and treatment of these dental issues are becoming more common, supporting segmental growth in the coming years.

The Dental Calculus segment experiences steady expansion due to increased recognition of tartar buildup as a cause of severe dental conditions. Owners are investing in oral care solutions such as dental chews and enzymatic toothpaste to minimize plaque accumulation.

The Oral Tumor segment remains a smaller yet vital part of the market. Increased cases of oral cancers in older pets are leading to more specialized treatments. Meanwhile, the Others segment includes minor conditions, reflecting growing awareness of overall pet oral hygiene.

By Distribution Channel Analysis

Veterinary Hospitals & Clinics dominate with 48.7% due to their specialized dental services and professional expertise.

In 2024, Veterinary Hospitals & Clinics held a dominant market position in the By Distribution Channel segment of the Pet Dental Health Market, with a 48.7% share. The segment’s strength lies in the trust pet owners place in veterinary professionals for accurate diagnosis, treatment, and preventive dental care services, including cleanings and surgeries.

The Retail Pharmacies segment follows closely, supported by the easy availability of pet dental products such as oral rinses, dental sticks, and toothpastes. The convenience of in-store purchasing and growing partnerships between pharmacies and pet care brands are expanding product accessibility for consumers.

The E-commerce segment is rapidly expanding as online platforms offer a wide range of pet dental products at competitive prices. Increased digital awareness and home delivery options are attracting tech-savvy pet owners, especially in urban areas.

The Others segment includes local distributors and specialty pet stores that contribute modestly to market revenue. These outlets often cater to regional demands and provide customized solutions for specific pet dental needs, adding diversity to the distribution network.

Key Market Segments

By Animal Type

- Dogs

- Cats

- Others

By Indication

- Gum Diseases

- Endodontic Diseases

- Dental Calculus

- Oral Tumor

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- Retail Pharmacies

- E-commerce

- Others

Drivers

Rising Pet Ownership and Humanization Trends Boosting Oral Care Spending

The growing number of pet owners globally has significantly increased spending on overall pet care, especially in dental health. As pets are increasingly seen as family members, owners are more willing to invest in products and treatments that support their pets’ wellbeing. This emotional connection drives demand for premium dental care items like toothbrushes, chews, and oral rinses.

Awareness about the link between oral hygiene and overall pet health is also rising. Pet parents now understand that untreated dental issues can lead to more serious health problems such as infections and organ diseases, leading to higher preventive care adoption.

The market is further supported by the availability of veterinarian-endorsed dental products. Endorsements and recommendations from professionals build trust and encourage regular use among pet owners.

Additionally, premium and subscription-based oral hygiene solutions are expanding rapidly. These models make dental care convenient and consistent, ensuring pets receive ongoing oral maintenance. Such developments are driving strong growth in the pet dental health market worldwide.

Restraints

Limited Awareness of Preventive Oral Care in Developing Markets

One of the major restraints in the pet dental health market is the limited awareness of preventive oral care in developing regions. Many pet owners still focus on feeding and grooming while overlooking dental hygiene, which leads to low adoption of dental care products.

Administering dental products also presents a challenge. Pets often resist brushing or using oral rinses, making it difficult for owners to maintain consistent dental routines. This behavioral barrier restricts product usage despite availability.

Furthermore, the lack of standardization in dental formulations and marketing claims creates confusion among consumers. Some products promise quick results without clinical backing, leading to trust issues and slow market penetration.

Overall, these challenges limit growth potential, particularly in price-sensitive and awareness-lacking markets, where educational campaigns and veterinarian involvement are still limited. Addressing these barriers is key to unlocking broader global adoption.

Growth Factors

Rising Demand for Natural and Enzymatic Pet Dental Products

Consumers are increasingly seeking natural and enzyme-based pet dental products as they look for safe and chemical-free solutions. These formulations appeal to health-conscious pet owners who prefer sustainable and non-toxic alternatives.

The rapid growth of e-commerce and digital retail platforms has also opened new sales channels for pet dental products. Online stores offer convenience, subscription options, and a wide range of products, making it easier for owners to maintain pet dental hygiene.

Collaboration between veterinary clinics and pet care brands is another growth opportunity. Such partnerships help create awareness, build credibility, and promote regular dental care through professional recommendations.

Product innovation in treats, chews, and dental wipes is also transforming the market. These easy-to-use solutions provide both functional and enjoyable ways to maintain oral hygiene, attracting busy pet owners and expanding the customer base.

Emerging Trends

Shift Toward Organic, Fluoride-Free Pet Dental Formulations

A key trend shaping the pet dental health market is the move toward organic and fluoride-free dental care products. Pet owners are becoming cautious about synthetic ingredients and prefer formulations with natural extracts that are gentle yet effective.

The popularity of pet dental subscription boxes and oral care kits is also increasing. These subscriptions offer regular product deliveries, helping owners maintain consistent dental care routines while discovering new brands.

Technology is playing a growing role through smart toothbrushes and oral monitoring tools. These innovations allow owners and veterinarians to track dental health more accurately, improving prevention and early detection.

In addition, pet insurance plans are expanding their coverage to include dental treatments. This trend is encouraging more owners to invest in professional cleanings and advanced oral care, strengthening overall market demand and service utilization.

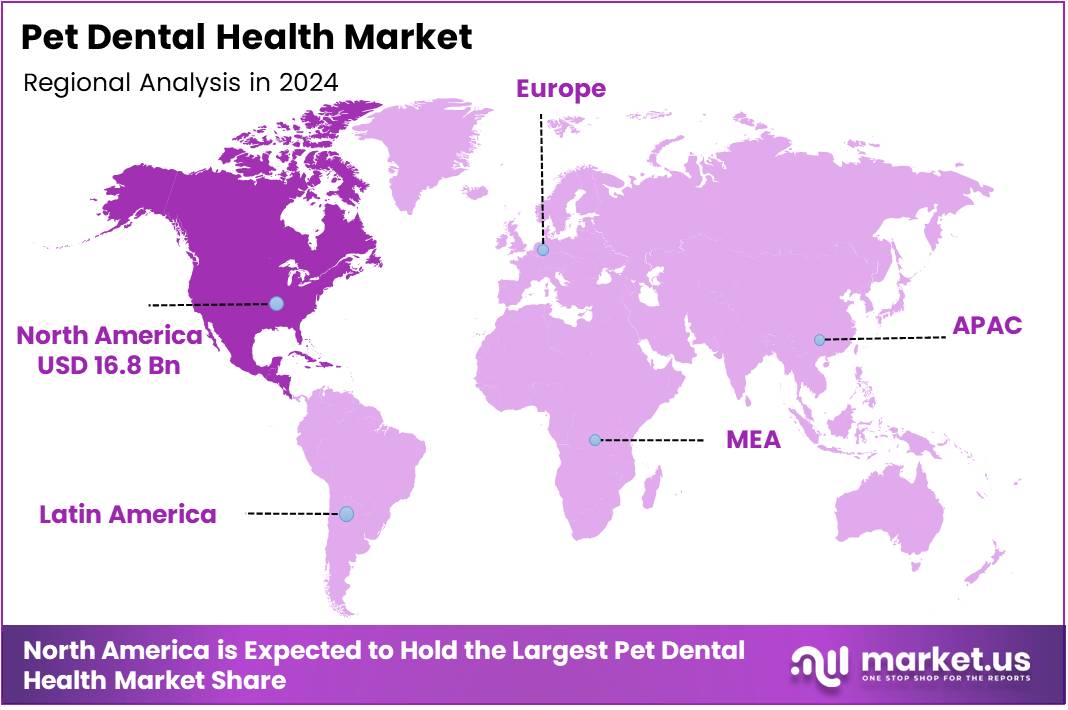

Regional Analysis

North America Dominates the Pet Dental Health Market with a Market Share of 43.7%, Valued at USD 3.6 Billion

North America holds the leading position in the global pet dental health market, accounting for a substantial 43.7% share and generating a market value of approximately USD 3.6 Billion. The region’s dominance is primarily driven by the high pet ownership rates, increasing awareness about pet oral hygiene, and the strong presence of veterinary infrastructure. Moreover, rising consumer expenditure on premium pet care products and preventive healthcare is further accelerating market expansion across the United States and Canada.

Europe Pet Dental Health Market Trends

Europe represents a significant share of the pet dental health market, supported by a growing focus on animal welfare and a well-established veterinary healthcare system. Increasing adoption of companion animals and a surge in demand for specialized oral care products have propelled market growth. In addition, regulatory emphasis on animal health and hygiene continues to foster innovation and awareness among pet owners throughout major European nations.

Asia Pacific Pet Dental Health Market Trends

The Asia Pacific region is emerging as a high-growth market for pet dental health, fueled by rising disposable incomes, urbanization, and a growing culture of pet ownership. Countries such as China, Japan, and India are witnessing increased awareness about preventive pet healthcare and oral hygiene solutions. The expansion of the veterinary services sector and the rising influence of e-commerce in pet care product distribution are further supporting market growth.

Middle East and Africa Pet Dental Health Market Trends

The Middle East and Africa are gradually developing in the pet dental health market, driven by a growing number of companion animals and increasing pet humanization trends. Although the market is still in its early stages, rising awareness campaigns and the establishment of modern veterinary clinics are helping to build momentum. Economic development in countries such as the UAE and South Africa is expected to support further market expansion.

Latin America Pet Dental Health Market Trends

Latin America is experiencing steady growth in the pet dental health sector, supported by the expanding pet population and the growing popularity of pet grooming and healthcare services. Countries like Brazil and Mexico are leading this growth due to their rising middle-class population and increasing expenditure on pet wellness. Additionally, the growing availability of dental care products and veterinary education initiatives are enhancing market penetration in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Dental Health Company Insights

The global Pet Dental Health Market in 2024 is shaped by a mix of veterinary-focused pharma companies and consumer pet care brands that are pushing oral hygiene into mainstream pet wellness.

Virbac continues to position itself as a clinical leader in veterinary dental solutions, with enzymatic toothpastes, chews, and professional-grade treatments that are widely recommended by veterinarians. The company’s portfolio is built around disease prevention, plaque control, and compliance-friendly formats for pet owners.

Colgate-Palmolive Company, through its pet-focused oral care lines, leverages decades of human oral care expertise and translates it to companion animals. Its strategy focuses on daily-use dental hygiene formats for dogs and cats, including pastes, gels, water additives, and functional treats aimed at reducing tartar and improving breath. Colgate-Palmolive is also active in awareness-building campaigns that frame pet oral health as part of overall quality of life.

Dechra Pharmaceuticals plc targets veterinary channels with prescription-strength and clinic-supported dental products. Its approach is built around periodontal disease management, especially in aging companion animals, and it supports veterinarians with education and compliance tools. Dechra benefits from its credibility in companion animal therapeutics and its direct ties to specialty clinics.

Petzlife Products focuses on natural, non-brushing oral care solutions such as sprays, gels, and chews positioned as easy-use alternatives for pet owners who avoid manual brushing. The brand markets to preventive-minded consumers who view dental care as part of routine home wellness, not just a response to dental disease. Together, these players reinforce a shift from reactive treatment to proactive, at-home pet oral hygiene in 2024.

Top Key Players in the Market

- Virbac

- Colgate-Palmolive Company

- Dechra Pharmaceuticals plc

- Petzlife Products

- imrex

- Nestlé Purina Pet Care

- Vetoquinol SA

- Ceva Sane Animale

- TropiClean Pet Products

- Dentalaire, International.

- Midmark Corporation.

Recent Developments

- In August 2024, TEEF for Life unveiled its innovative “TEEF TREETS” dental treats during the SuperZoo 2024 event. These treats were introduced as a new oral care solution aimed at promoting pet dental health naturally.

- In September 2024, Vimian Group AB announced an agreement to acquire 100% of iM3 Dental Limited (Ireland) and 80% of iM3 Pty Ltd (Australia) for approximately EUR 84 million plus up to EUR 60 million in potential earn-out. This acquisition strengthened Vimian’s position in the global veterinary dental care market.

Report Scope

Report Features Description Market Value (2024) USD 8.3 Billion Forecast Revenue (2034) USD 16.8 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Dogs, Cats, Others), By Indication (Gum Diseases, Endodontic Diseases, Dental Calculus, Oral Tumor, Others), By Distribution Channel (Veterinary Hospitals & Clinics, Retail Pharmacies, E-commerce, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Virbac, Colgate-Palmolive Company, Dechra Pharmaceuticals plc, Petzlife Products, imrex, Nestlé Purina Pet Care, Vetoquinol SA, Ceva Sane Animale, TropiClean Pet Products, Dentalaire, International., Midmark Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Virbac

- Colgate-Palmolive Company

- Dechra Pharmaceuticals plc

- Petzlife Products

- imrex

- Nestlé Purina Pet Care

- Vetoquinol SA

- Ceva Sane Animale

- TropiClean Pet Products

- Dentalaire, International.

- Midmark Corporation.