Global Pet Apparel Market By Product Type (Shirts and Tops, Coats, Jackets, Sweaters and Hoodies, Others), By Material Type (Cotton, Polyester, Lenin, Others), By Pet Type (Dogs, Cats, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132825

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

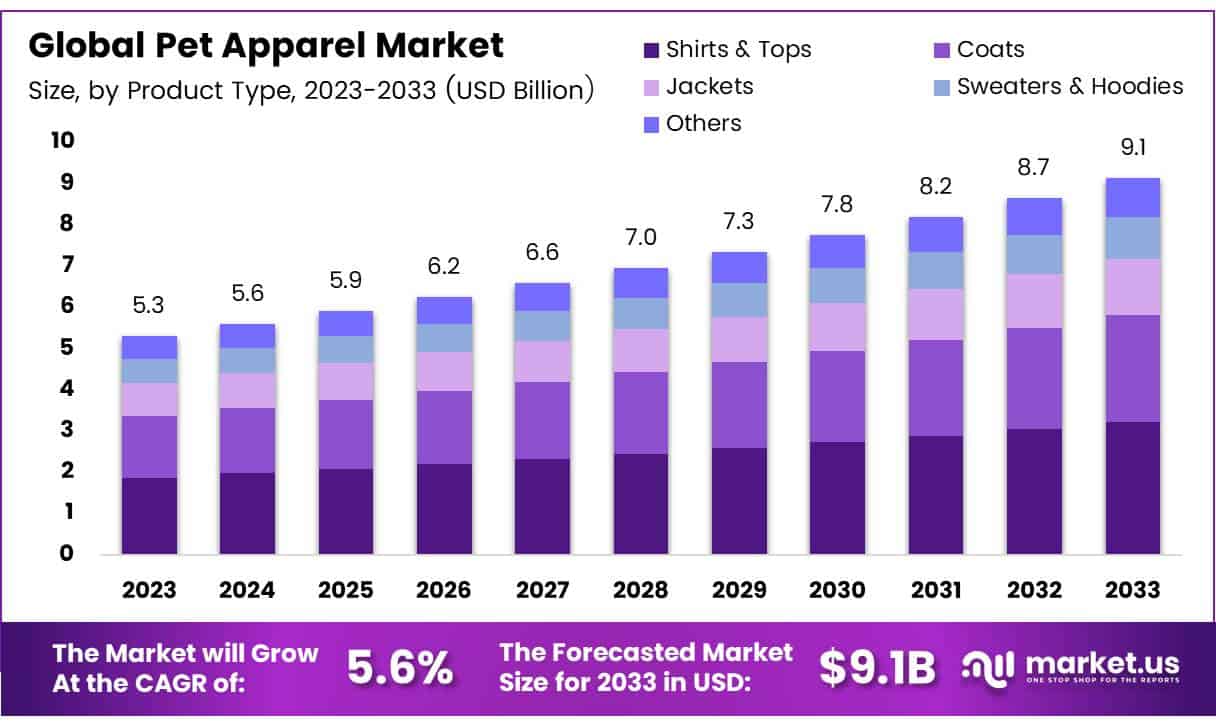

The Global Pet Apparel Market size is expected to be worth around USD 9.1 Billion by 2033, from USD 5.3 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Pet apparel refers to clothing designed specifically for pets, primarily dogs and cats, although it can extend to other animals. These products include jackets, sweaters, boots, costumes, raincoats, and accessories, offering comfort, style, and protection from environmental conditions.

As pet ownership continues to grow, particularly in urbanized and affluent areas, the demand for pet apparel has surged. This market is a key segment of the broader pet care industry, driven by the growing trend of pet humanization, where pets are increasingly treated as family members. Pet apparel is available through various distribution channels, including online platforms, pet stores, and specialty boutiques.

The pet apparel market is experiencing robust growth, driven by rising pet ownership, changing consumer preferences, and increased awareness of pet well-being.

In the U.S., 66% of households own at least one pet, with dogs in 65.1 million homes and cats in 46.5 million homes, according to the American Pet Products Association and Data Axle. This expanding pet population presents significant opportunities for pet apparel companies, as owners are increasingly willing to invest in products that enhance their pets’ comfort, functionality, and appearance.

Another key factor fueling the pet apparel market is the growing willingness of pet owners to spend on their pets. The average U.S. pet owner spends nearly $1,400 annually on their pet, with some spending more based on their pet’s needs. This spending creates a strong market opportunity for brands offering innovative and appealing pet clothing.

Additionally, seasonal events, such as Halloween, contribute to spikes in demand for pet costumes. A National Survey from PetSmart revealed that 76% of adult pet owners plan to dress their pets in costumes, with 30% dressing them multiple times during the holiday season.

Government regulations and investment are also shaping the pet apparel market. Many countries have established safety standards for pet products, including apparel, to ensure they are non-toxic, durable, and comfortable. As pet fashion continues to evolve, regulations may address new concerns like sustainability and eco-friendly manufacturing practices.

In markets like the U.S. and Europe, governments recognize the economic significance of the pet care sector and are supporting businesses through tax incentives, grants, and funding initiatives, fostering innovation and growth. Local governments are also encouraging startups in the pet apparel industry by providing entrepreneurship support.

The data surrounding pet ownership and spending highlights the substantial potential of the pet apparel market. With 66% of U.S. households owning at least one pet, and the growing number of pet owners willing to spend on accessories, the market for pet apparel, especially for dogs and cats, is promising. The increasing trend of dressing pets for holidays and special occasions further boosts demand, creating opportunities for seasonal and themed apparel.

Key Takeaways

- The global pet apparel market is projected to grow from USD 5.3 billion in 2023 to USD 9.1 billion by 2033, at a CAGR of 5.6%.

- Shirts & Tops dominate the pet apparel market, accounting for 49% of the segment share in 2023, driven by their versatility and appeal.

- Cotton remains the leading material in pet apparel, valued for its natural, breathable properties that enhance comfort, particularly in warmer climates.

- Pet Specialty Stores capture 40.5% of the pet apparel market share, driven by their curated selection and premium offerings.

- North America holds 54.6% of the global pet apparel market, with the United States leading due to high pet ownership and a growing trend of pets as family members.

Product Type Analysis

Shirts & Tops Lead the Pet Apparel Market in 2023 with a 49% Share in Product Type Segment

In 2023, Shirts & Tops held a dominant market position in the By Product Type Analysis segment of the Pet Apparel Market, with a 49% share. The significant demand for shirts and tops can be attributed to their versatility, comfort, and widespread appeal among pet owners seeking both functionality and style for their pets. These products are often favored for their ease of wear and variety of designs, ranging from casual to formal styles, making them suitable for a broad spectrum of pet types and seasonal conditions.

Coats, the second-largest category, captured a notable portion of the market, driven by their practicality in colder climates and their ability to provide warmth and protection for pets. Jackets and Sweaters & Hoodies also saw considerable uptake, particularly among pet owners in regions with colder weather, where these items offer additional comfort and insulation.

The Others category, which includes accessories such as scarves, booties, and rainwear, accounted for a smaller yet growing share of the market. While these products typically cater to niche consumer segments, their increasing popularity highlights the growing trend toward diverse pet apparel options.

Material Type Analysis

Cotton Dominates the Pet Apparel Market in 2023

In 2023, cotton held a dominant market position in the By Material Type Analysis segment of the pet apparel market. This can be attributed to cotton’s natural, breathable properties that provide optimal comfort for pets, particularly in warmer climates or for pets with sensitive skin.

Cotton is widely regarded for its softness, hypoallergenic nature, and ease of care, which has made it a preferred choice among pet owners. As consumers increasingly seek sustainable and natural materials, cotton’s market share is further bolstered by its eco-friendly profile.

Polyester, while a popular alternative, accounted for a significant portion of the market due to its durability, moisture-wicking capabilities, and cost-effectiveness. Polyester blends offer a balance between functionality and affordability, making them appealing for a broader range of consumers.

Linen, although a smaller segment, is gaining traction among premium pet apparel products due to its lightweight and breathable qualities, making it an attractive option for high-end product lines targeting discerning pet owners.

Other materials, including nylon and wool, continue to hold niche positions within the market, driven by specific use cases such as outdoor apparel or cold-weather gear. However, cotton’s dominance in terms of market share remains unchallenged, supported by its versatility, natural properties, and consumer preference trends toward sustainability.

Pet Type Analysis

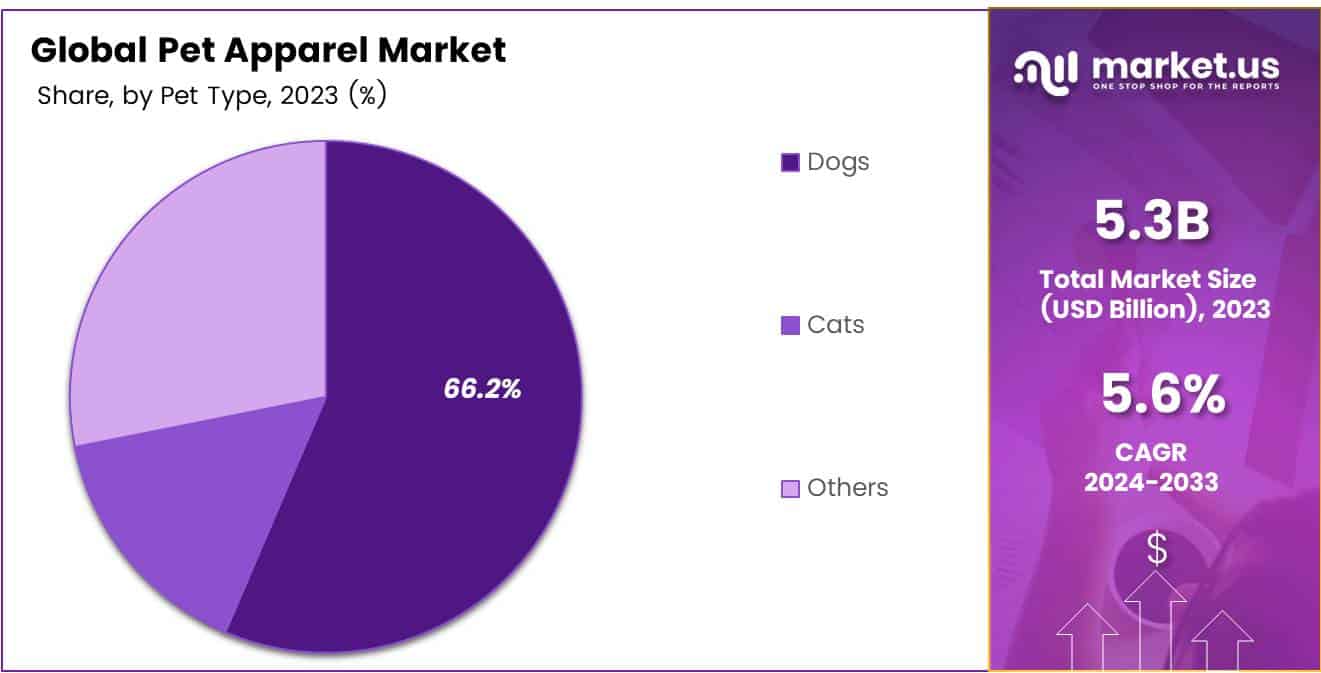

Dogs Dominate the Pet Apparel Market with a 66.2% Share in 2023

In 2023, dogs held a dominant market position in the By Pet Type Analysis segment of the Pet Apparel Market, accounting for a substantial 66.2% share. This commanding share can be attributed to the widespread adoption of dogs as pets and the increasing trend of pet humanization, where pets are increasingly considered family members and are dressed in apparel for both functional and aesthetic purposes.

As pet owners continue to seek products that enhance their pets’ comfort and appearance, the demand for dog apparel has surged, especially in developed markets where discretionary spending on pets is higher.

Cats followed as the second-largest segment, holding a smaller but significant share. While the demand for cat apparel has been rising, it remains relatively niche compared to the dog apparel segment, primarily driven by specific breeds and the growing trend of fashion-conscious cat owners.

The Others category, which includes smaller pets such as rabbits, ferrets, and birds, accounted for a minor portion of the market. While these segments show potential for growth, the overall demand for apparel remains low compared to dogs and cats, due to the specialized nature of these animals and their more limited exposure to fashion trends.

Sales Channel Analysis

Pet Specialty Stores Lead with 40.5% Share in 2023, Dominating Pet Apparel Market by Sales Channel

In 2023, Pet Specialty Stores held a dominant market position in the By Sales Channel Analysis segment of the Pet Apparel Market, with a 40.5% share. This channel’s prominence can be attributed to its specialized offerings, curated selection of high-quality pet apparel, and personalized customer service, which appeal to pet owners seeking premium products. Pet specialty stores have cultivated a loyal customer base, fostering an environment conducive to repeat purchases and brand loyalty.

Supermarkets and hypermarkets, which account for a notable portion of the market, follow with a significant share. However, the convenience and affordability they offer may be offset by a less specialized assortment of pet apparel. Wholesalers and distributors also represent a key channel, particularly for bulk purchasing by retailers or businesses in the pet care industry.

Direct sales, although comparatively smaller in share, remain relevant for boutique brands or niche market players seeking to establish direct connections with consumers. The rise of online retailers continues to reshape the market landscape, contributing to increased consumer access and variety, with digital platforms gaining traction in reaching tech-savvy pet owners.

Overall, while Pet Specialty Stores maintain a stronghold, online retail and other emerging sales channels are expected to exhibit substantial growth in the coming years.

Key Market Segments

By Product Type

- Shirts & Tops

- Coats

- Jackets

- Sweaters & Hoodies

- Others

By Material Type

- Cotton

- Polyester

- Lenin

- Others

By Pet Type

- Dogs

- Cats

- Others

Drivers

Growing Disposable Income Boosting Pet Apparel Demand

The pet apparel market has experienced significant growth, driven by a range of factors that reflect broader societal and economic shifts. A major driver is the rising disposable income, particularly in emerging markets, which has led to increased consumer spending on non-essential items like premium pet accessories. With more people able to afford higher-end goods, pet apparel, including fashionable and functional clothing, has become more accessible.

Additionally, rising awareness around pet health and wellness is pushing demand for apparel that serves practical purposes, such as protecting pets from extreme weather conditions, reducing allergens, or providing therapeutic benefits for conditions like joint pain or skin sensitivities. As pet owners seek to enhance their pets’ comfort and well-being, apparel designed for specific health needs is becoming more popular.

Furthermore, the growing influence of social media and the rise of pet influencers on platforms like Instagram and TikTok have played a pivotal role in shaping trends in pet fashion. Pets showcased wearing stylish outfits quickly gain attention, driving a demand for similar products among pet owners who wish to emulate these trends.

The visibility of pets in apparel has thus become an effective form of marketing, where the desire for unique, fashionable pieces is fostered not only by practical needs but also by social media culture and influencer impact.

Restraints

Short Lifecycle of Pet Apparel

One significant restraint for the pet apparel market is the short lifecycle of pet clothing. Pets, especially those that are active, can quickly wear out or damage their clothes due to frequent movements, rough play, or even chewing. This constant wear and tear leads to a higher frequency of repurchases, which can make consumers hesitant to invest heavily in pet apparel.

While some pet owners may enjoy dressing their pets, the idea of regularly replacing clothing due to its rapid deterioration can limit overall spending in this category.

Additionally, pet apparel often lacks the long-term value seen with other pet products like food or health-related items, which are viewed as more essential and necessary for a pet’s well-being. This limitation in durability, combined with the relatively low priority given to non-essential items like clothing, can restrict the market’s growth potential.

Consumers may choose to allocate their budgets to more crucial pet needs, leaving pet apparel to be seen as an occasional purchase rather than a regular necessity. Therefore, the pet apparel market faces the challenge of balancing durability, cost, and consumer willingness to spend on items that may not have a long shelf life.

Growth Factors

Growth Opportunities in the Pet Apparel Market

The pet apparel market has significant growth potential driven by several key opportunities. One of the primary factors fueling growth is the expansion into emerging markets. As urbanization increases and disposable incomes rise in developing regions, more consumers are willing to spend on their pets, including on pet clothing.

This shift creates a promising opportunity for pet apparel brands to tap into these new markets, especially in countries where pet ownership is rising and middle-class populations are expanding.

Another growth opportunity lies in customization and personalization. Pet owners are increasingly seeking unique products, and offering customizable apparel—such as pet names, unique designs, or sizes—can cater to this demand, enhancing brand loyalty and attracting a broader customer base. Lastly, collaborations with established fashion brands present another avenue for market growth.

By partnering with well-known human fashion brands, pet apparel companies can introduce their products to a more upscale, fashion-conscious audience, boosting their appeal and reaching a wider market. These collaborations can also bring more credibility and visibility to pet apparel, positioning it as both a functional and fashionable accessory for pets. Together, these factors present a robust landscape for growth and innovation in the pet apparel sector, with significant opportunities to meet the evolving needs of pet owners globally.

Emerging Trends

Fashion Forward for Furry Friends

The pet apparel market is being shaped by several key trends, reflecting both evolving consumer preferences and greater emphasis on pet well-being. One of the most notable trends is the rise of athleisure for pets, with sporty jackets and leggings for dogs gaining popularity. This trend mirrors the broader athleisure movement in human fashion, where pets are now seen as active companions requiring comfortable, performance-driven clothing.

At the same time, luxury and designer pet apparel is on the upswing. As pets are increasingly considered family members, pet owners are eager to invest in high-end, stylish garments. This trend is fueled by a growing sense of pet humanization and the desire to express status through pet fashion, making luxury pet products more mainstream.

Additionally, seasonal and weather-adaptive clothing is becoming a necessity. With more pet owners seeking specialized attire for different weather conditions, items like raincoats, sun-blocking shirts, and winter jackets are in high demand.

These functional yet fashionable designs help pets stay comfortable and safe in various environments, contributing to the growing demand for practical yet stylish pet apparel. These trends collectively highlight the increasing investment in pet care, as consumers prioritize their pets’ comfort, style, and health.

Regional Analysis

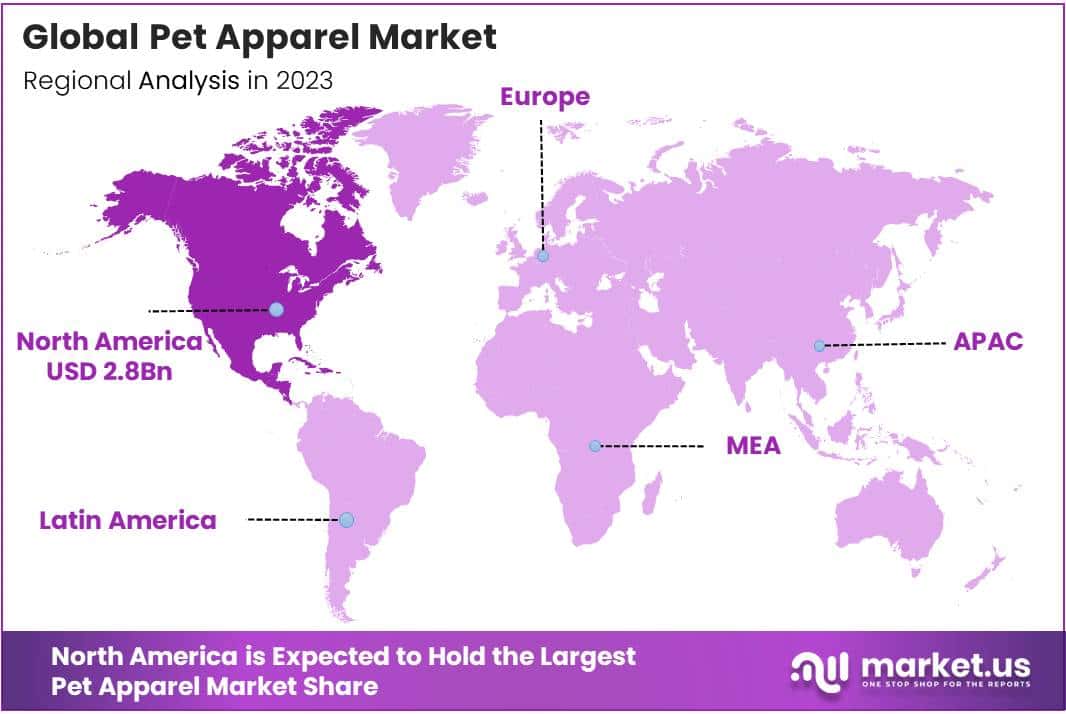

North America Dominates with 54.6% Share, Valued at USD 2.8 Billion in 2023

The global pet apparel market is experiencing diverse growth across various regions, with North America maintaining a dominant position. North America accounts for 54.6% of the global market share, with a market value of USD 2.8 billion in 2023. The region’s leadership is primarily driven by high pet ownership rates, particularly in the United States, where pets are increasingly viewed as family members.

This trend has led to greater consumer demand for pet apparel, including functional and fashionable items. The continued expansion of e-commerce platforms and retail outlets specializing in pet products further strengthens North America’s market position.

Regional Mentions:

Europe holds the second-largest share of the market, with significant growth attributed to the rising pet population and increasing demand for premium, sustainable pet products. Countries such as the United Kingdom, Germany, and France are seeing greater adoption of pet apparel, driven by trends in pet humanization and consumer interest in high-quality, environmentally friendly products.

The Asia Pacific region, while still in the early stages of pet apparel adoption, shows strong potential for future growth. Increasing disposable incomes, urbanization, and a growing number of pet owners in countries like China, Japan, and India are expected to support the market’s expansion. However, the market remains smaller compared to North America and Europe at present.

The Middle East & Africa (MEA) market remains limited but shows potential in specific countries such as the UAE, where pet ownership is on the rise among affluent consumers. Similarly, Latin America, although currently a smaller segment, is expected to experience gradual growth in pet apparel demand, driven by changing consumer behaviors and increased pet ownership.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global pet apparel market has witnessed significant growth in recent years, driven by increasing pet ownership, rising disposable incomes, and a growing focus on pet well-being. Leading players in this market are strategically positioned to capitalize on these trends, offering innovative, stylish, and functional products that cater to both the practical needs and fashion preferences of pet owners.

Petco Animal Supplies, Inc., a dominant force in the pet care industry, continues to leverage its extensive retail network and strong brand reputation to expand its pet apparel offerings. By aligning with consumer demands for quality and comfort, Petco has maintained a significant market share, focusing on value-driven product ranges that appeal to a broad demographic.

Bitch New York and Moshiqa cater to the premium segment of the market, providing high-end, designer pet apparel. These brands focus on exclusive, luxury products that emphasize aesthetics, quality materials, and craftsmanship, capitalizing on the growing trend of pet humanization and the increasing willingness of consumers to invest in their pets’ appearance.

Canada Pooch and Bedhead PJs have gained prominence by offering functional yet stylish apparel designed for specific climates, such as winter coats and pajamas. Their success lies in delivering both utility and fashion, which resonates well with pet owners seeking practicality without compromising on style.

Meanwhile, Ruffwear and Hurtta have carved out niches within the active pet apparel market, providing durable, performance-driven gear suitable for outdoor activities. These brands have experienced growth as more pet owners engage in active lifestyles, seeking apparel that supports pets’ physical needs.

Milk & Pepper, TRIXIE Heimtierbedarf GmbH & Co. KG, and Petrageous Designs LLC focus on diverse product ranges, targeting a wide array of consumer segments through affordable yet high-quality options.

Top Key Players in the Market

- Petco Animal Supplies, Inc.

- Bitch New York

- Moshiqa

- Petrageous Designs LLC

- Canada Pooch

- Bedhead PJs

- Ruffwear

- Hurttta

- Milk & Pepper

- TRIXIE Heimtierbedarf GmbH & Co. KG

Recent Developments

- In July 2024, Ani.VC, a newly launched pet venture fund, identified strong investment opportunities within the pet care sector. The fund plans to allocate $35 million over the next three years, targeting U.S., European, and Asian markets to support innovative pet-related companies.

- In September 2024, Maven Pet secured $4.42 million in a new investment round, further fueling its growth in the pet care industry. This funding will help Maven Pet expand its operations, enhance product offerings, and increase market reach.

Report Scope

Report Features Description Market Value (2023) USD 5.3 Billion Forecast Revenue (2033) USD 9.1 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Shirts and Tops, Coats, Jackets, Sweaters and Hoodies, Others), By Material Type (Cotton, Polyester, Lenin, Others), By Pet Type (Dogs, Cats, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Petco Animal Supplies, Inc., Bitch New York, Moshiqa, Petrageous Designs LLC, Canada Pooch, Bedhead PJs, Ruffwear, Hurttta, Milk & Pepper, TRIXIE Heimtierbedarf GmbH & Co. KG, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Petco Animal Supplies, Inc.

- Bitch New York

- Moshiqa

- Petrageous Designs LLC

- Canada Pooch

- Bedhead PJs

- Ruffwear

- Hurttta

- Milk & Pepper

- TRIXIE Heimtierbedarf GmbH & Co. KG