Global Personalized Packaging Market Size, Share, Growth Analysis By Packaging Type (Bottles, Boxes, Envelopes, Containers & Jars, Cartons, Bags & Pouches), By End-User (Food, Pharmaceutical, Logistics, Beverage, Personal Care, Others), By Material Type (Plastic, Paper & Paperboard, Glass, Metal), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154325

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

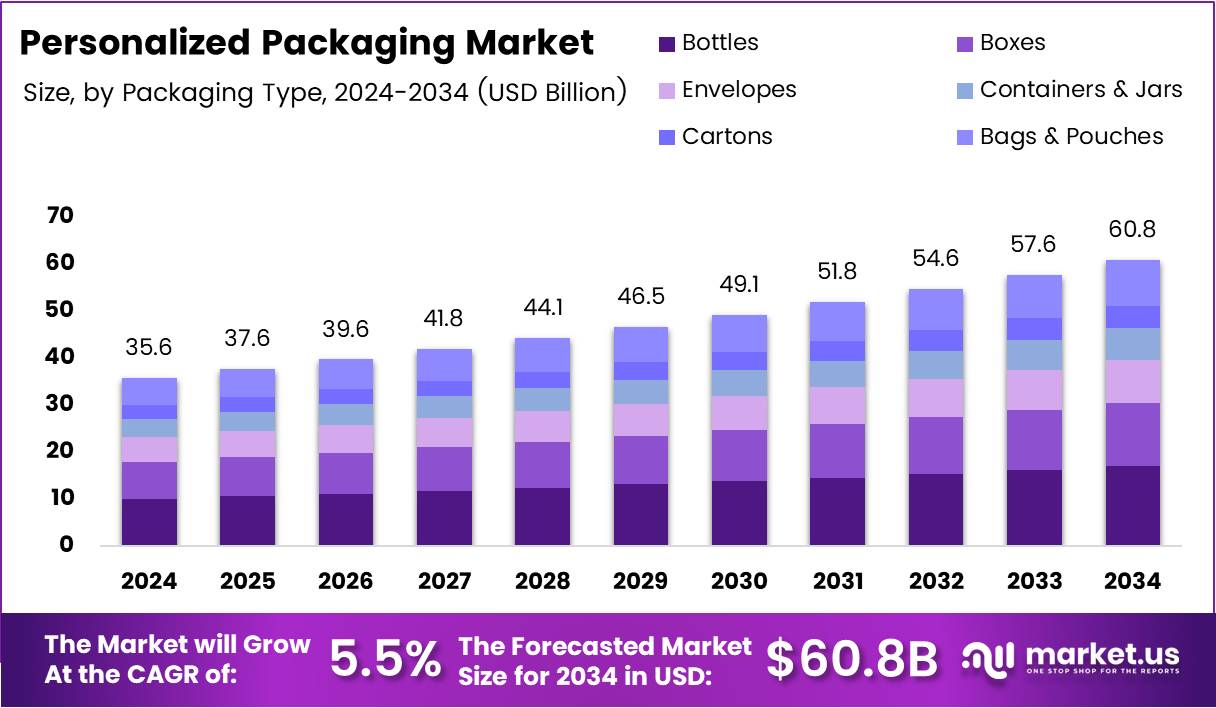

The Global Personalized Packaging Market size is expected to be worth around USD 60.8 Billion by 2034, from USD 35.6 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The Personalized packaging market is rapidly transforming traditional branding by adding tailored experiences to every product. Personalized packaging refers to the customization of packaging elements—like names, colors, messages, or designs—to align with specific customer profiles. This practice boosts brand engagement and creates a unique unboxing moment that adds value to the product itself.

As more brands compete for consumer attention, businesses are turning to personalized packaging to stand out. According to a recent Ipsos survey, 72% of American consumers admitted that the design of a product’s packaging significantly influences their purchasing decisions. This presents a strong growth opportunity for packaging companies willing to invest in customization technologies.

Demand is rising across FMCG, cosmetics, food, and e-commerce sectors. According to Cart.com, customer loyalty can increase by as much as 40% when packaging includes personalization. This indicates a significant competitive advantage for brands prioritizing tailored customer engagement through packaging.

Startups and SMEs are leveraging digital print technologies to offer low-cost, short-run customized packaging. This is pushing innovation in sustainable materials and eco-friendly packaging. According to CustomDesignsBoxes, 63% of consumers said paper and cardboard boxes make a product appear more luxurious and premium, amplifying brand perception.

Governments are also stepping in. Many regions are incentivizing sustainable and digital packaging investments through grants and subsidies. Regulatory shifts in the EU and North America are supporting eco-conscious packaging, opening doors for compliant personalized packaging products.

E-commerce growth is another catalyst, with businesses seeking to strengthen direct-to-consumer (DTC) relationships through memorable packaging. Personalized subscription boxes, influencer kits, and limited-edition packaging are enhancing customer retention and brand storytelling.

Rising disposable income, especially in emerging markets, is further driving premiumization. Consumers are more willing to pay for brands that offer personalized and aesthetically pleasing packaging experiences.

Technological advancements such as AI-driven customer insights, augmented reality (AR) labels, and smart QR codes are boosting interactivity. This is reshaping the personalized packaging market, especially in beauty, beverages, and luxury sectors.

To capitalize on this growing trend, companies must invest in agile packaging supply chains and data-driven design systems. The market is poised for robust expansion as personalization becomes a standard branding expectation.

Key Takeaways

- The Global Personalized Packaging Market is projected to reach USD 60.8 Billion by 2034, up from USD 35.6 Billion in 2024, growing at a CAGR of 5.5% from 2025 to 2034.

- In 2024, Bottles dominated the packaging type segment with a 23.1% share, driven by their widespread use in beverages, personal care, and pharmaceuticals.

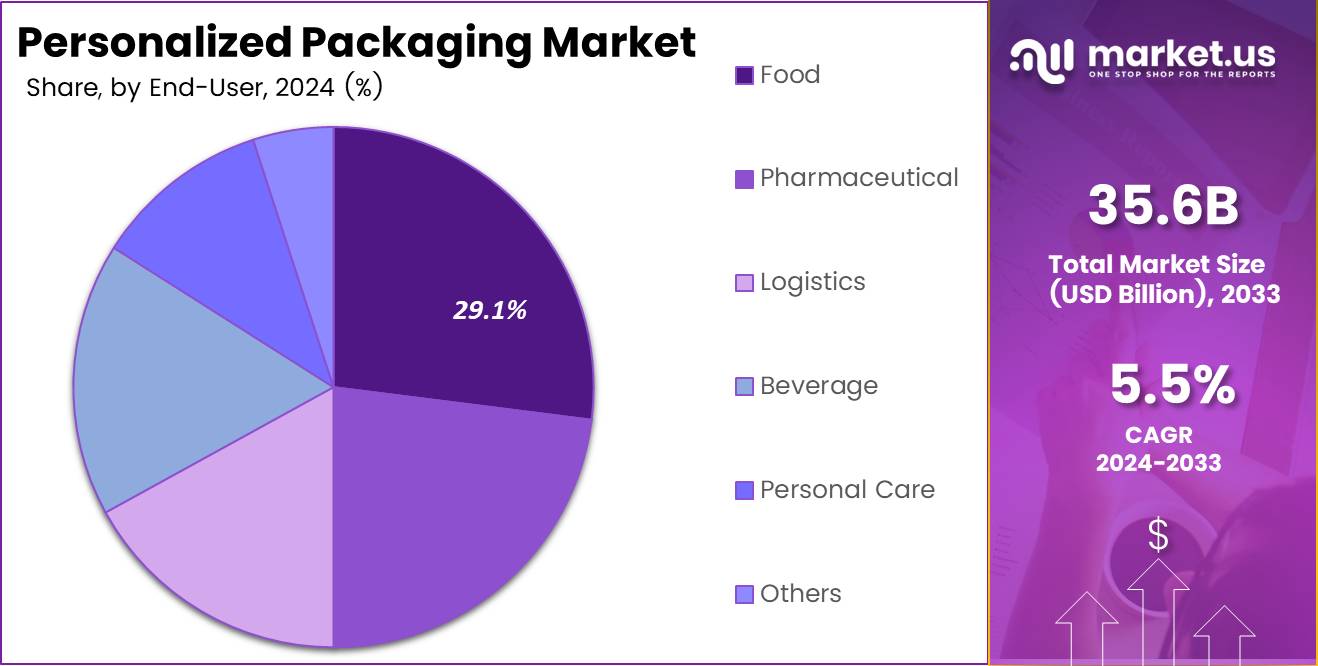

- The Food sector led the end-user segment in 2024 with a 29.1% share, fueled by growing demand for customized and informative packaging.

- Plastic was the top material type in 2024, holding a 38.5% share, due to its low cost, flexibility, and printability.

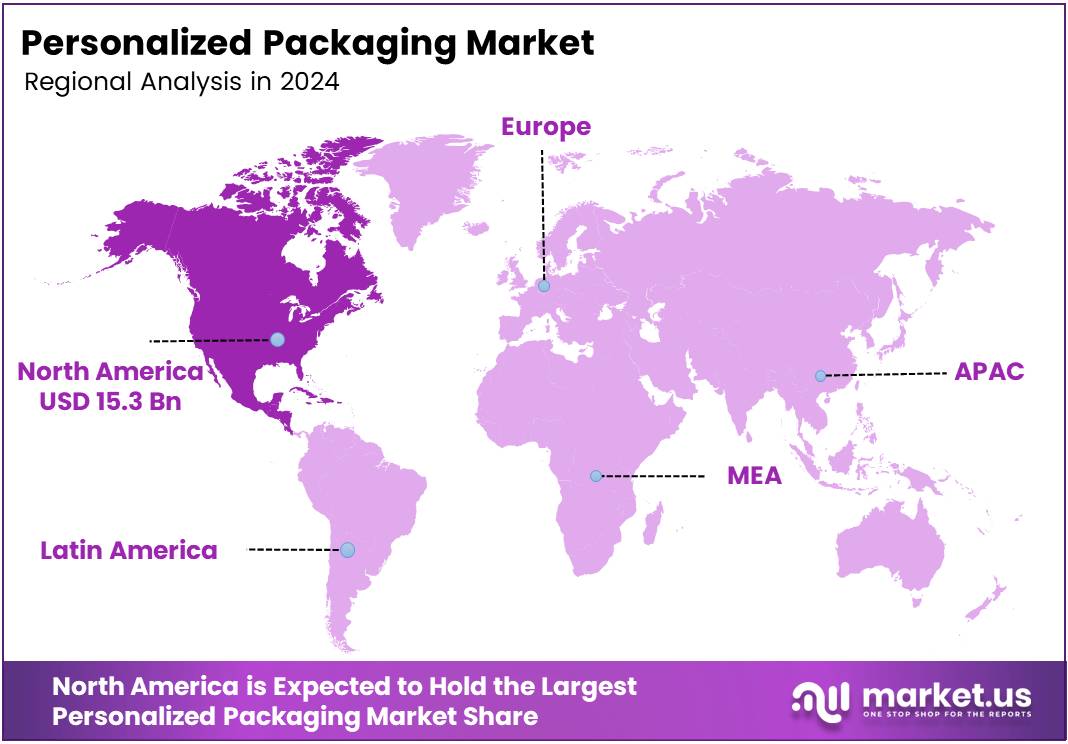

- North America led the global market with a 43.2% share and a value of USD 15.3 Billion, thanks to high adoption in e-commerce, retail, and luxury goods, along with technological innovations and strong consumer demand.

Packaging Type Analysis

Bottles lead the pack with 23.1% as the top choice in personalized packaging.

In 2024, Bottles held a dominant market position in the By Packaging Type Analysis segment of the Personalized Packaging Market, with a 23.1% share. Bottles continue to be preferred in industries such as beverages, personal care, and pharmaceuticals due to their durability and convenience in labeling and branding.

Boxes followed closely, offering secure and sustainable packaging solutions, particularly for e-commerce and gifting purposes. Their customizable nature makes them ideal for businesses aiming to enhance unboxing experiences.

Envelopes, although niche, are essential in sectors like stationery and document handling, gaining attention for their eco-friendly variants. Containers & Jars remain relevant, especially for cosmetics and gourmet food products, where visual presentation and reusability are valued.

Cartons hold utility in retail and food segments, where compact packaging and branding are vital. Meanwhile, Bags & Pouches are expanding across FMCG and snack industries for their lightweight and portable features.

End-User Analysis

Food segment dominates with 29.1% due to demand for safe, attractive, and informative packaging.

In 2024, Food held a dominant market position in the By End-User Analysis segment of the Personalized Packaging Market, with a 29.1% share. The rising consumer preference for customized and informative food packaging has propelled growth in this segment.

Pharmaceutical packaging also witnessed steady traction as regulatory compliance and safety labeling continue to drive innovation in the sector. Tamper-evident designs and traceability features are enhancing adoption.

Logistics packaging plays a critical role in product protection and identification, especially with the rise in e-commerce. The focus on traceability and sustainability adds further value to this segment.

The Beverage industry is increasingly using personalized labels and bottle shapes to improve customer engagement, supporting its steady growth. Personal Care packaging benefits from rising demand for luxury and giftable products, where appearance is key.

The Others segment includes sectors like electronics and apparel, where personalization boosts brand recall and consumer satisfaction.

Material Type Analysis

Plastic leads the material segment with 38.5% due to flexibility and cost-effectiveness.

In 2024, Plastic held a dominant market position in the By Material Type Analysis segment of the Personalized Packaging Market, with a 38.5% share. Its adaptability, low cost, and compatibility with various printing technologies make it the go-to choice for personalized packaging.

Paper & Paperboard follow as sustainable alternatives, favored in food, cosmetics, and gifting segments. Brands prefer them for their premium feel and recyclability, aligning with eco-conscious consumer values.

Glass remains a staple for premium and reusable packaging in beverages and cosmetics. Its non-reactive nature and elegance make it a favored choice despite its weight and fragility.

Metal, though used less frequently, serves specialized markets like luxury goods and pharmaceuticals, where strength and longevity are essential. Its high-end appeal supports its niche demand.

Key Market Segments

By Packaging Type

- Bottles

- Boxes

- Envelopes

- Containers & Jars

- Cartons

- Bags & Pouches

By End-User

- Food

- Pharmaceutical

- Logistics

- Beverage

- Personal Care

- Others

By Material Type

- Plastic

- HDPE

- LDPE

- LLDPE

- PP

- PET

- Others

- Paper & Paperboard

- Corrugated

- Carton Board

- Paper

- Glass

- Metal

Drivers

Rising Adoption of Digital Printing Technologies in Packaging Drives Market Growth

The personalized packaging market is seeing significant growth due to the increased use of digital printing technologies. These printing methods allow companies to create unique, high-quality designs quickly and affordably. This flexibility supports small batch runs, which is ideal for custom packaging needs across various industries.

E-commerce has played a major role in boosting customization demand. As online shopping becomes more common, brands are seeking new ways to stand out. Personalized packaging helps businesses leave a strong impression, improve customer experience, and encourage repeat purchases.

Luxury and premium brands are also shifting toward more refined packaging. These companies see customized packaging as a way to highlight their identity and offer a memorable unboxing experience. This trend is especially noticeable in cosmetics, fashion, and gourmet food sectors.

Another driver is the use of augmented reality (AR) in packaging. AR enables interactive experiences for customers using smartphones, such as scanning a package to view a 3D product model or promotional video. This increases consumer engagement and strengthens brand connection.

Restraints

High Initial Capital Investment for Custom Packaging Equipment Limits Market Adoption

One of the main restraints in the personalized packaging market is the high cost of custom equipment. Many businesses, especially small and medium-sized ones, find it difficult to invest in expensive digital printers and design tools needed for personalized production.

Scalability is another issue. Personalized packaging works well for small batches, but it becomes challenging and costly to produce at large volumes. This limits its use for companies needing mass production capabilities.

Managing short-run orders also adds complexity to the supply chain. Handling multiple unique designs, smaller quantities, and quick turnarounds increases coordination efforts and leads to higher operational costs.

In sectors like food and pharmaceuticals, regulatory requirements pose another challenge. Personalized packaging in these industries must meet strict standards, and ensuring compliance while offering custom designs can be complicated and time-consuming.

Growth Factors

Expansion of Subscription-Based Product Packaging Models Creates New Growth Opportunities

Subscription-based business models are providing fresh opportunities for personalized packaging. Brands that offer monthly boxes or curated kits are using custom packaging to build stronger connections with subscribers and enhance brand loyalty.

Smart packaging is another exciting area. By combining personalized design with digital features like QR codes or sensors, companies can offer interactive experiences while also gathering data on customer preferences and product usage.

Localized branding in global markets is gaining popularity. Brands are customizing packaging based on regional tastes, language, and cultural preferences. This strategy helps improve brand relevance and customer satisfaction in different markets.

There is also a growing focus on sustainability. Eco-friendly personalized packaging—made with recyclable or biodegradable materials—is being adopted by brands looking to reduce their environmental impact while still offering unique designs.

Emerging Trends

Use of AI and Machine Learning for Real-Time Personalization Influences Market Trends

Artificial intelligence (AI) and machine learning are transforming personalized packaging by enabling real-time customization. Brands can analyze customer data to tailor packaging for different segments or even individual buyers, enhancing the customer experience.

Another trend is the rise of consumer-driven packaging design platforms. These tools allow customers to personalize packaging directly, such as adding names, images, or messages. This direct involvement boosts engagement and creates a sense of ownership.

Social media is also shaping packaging trends. Consumers often share visually appealing packaging on platforms like Instagram and TikTok, making attractive and shareable designs a powerful marketing tool for brands.

Lastly, direct-to-consumer (DTC) channels are integrating personalization into their packaging strategies. These brands use custom packaging not only for branding but also to provide a premium, personalized unboxing experience that builds long-term customer relationships.

Regional Analysis

North America Dominates the Personalized Packaging Market with a Market Share of 43.2%, Valued at USD 15.3 Billion

North America leads the global personalized packaging market, accounting for a dominant share of 43.2%, with a market value of USD 15.3 Billion. The region’s leadership is attributed to the high adoption of customized solutions across e-commerce, retail, and luxury goods sectors. Technological advancements in packaging design and strong consumer demand for unique brand experiences further drive the market.

Europe Personalized Packaging Market Overview

Europe follows closely, driven by growing consumer preference for sustainable and innovative packaging designs. Countries like Germany, the UK, and France are seeing increasing investments in eco-friendly packaging solutions tailored to individual brands. Regulatory emphasis on sustainable materials also supports the growth of personalized packaging in the region.

Asia Pacific Personalized Packaging Market Trends

Asia Pacific is witnessing rapid expansion in the personalized packaging sector due to booming e-commerce and a rising middle-class population. Markets such as China, Japan, and India are experiencing increased demand for tailored packaging that enhances customer engagement. Local manufacturers are also embracing digital printing and smart packaging technologies.

Middle East and Africa Personalized Packaging Insights

The Middle East and Africa region is gradually adopting personalized packaging, primarily led by premium product categories and luxury retail. While still developing, the market benefits from tourism-driven demand and brand differentiation strategies. Regional innovation in design and material is gaining pace.

Latin America Personalized Packaging Market Outlook

Latin America shows moderate growth in the personalized packaging market, supported by emerging local brands and growing urbanization. Brazil and Mexico lead regional adoption, with packaging increasingly seen as a tool for marketing and consumer retention. Investment in digital and sustainable packaging solutions is also on the rise.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Personalized Packaging Company Insights

In 2024, the global Personalized Packaging Market continues to witness strategic growth, driven by innovations and consumer-centric trends adopted by leading players.

Owens Illinois Inc. has remained a formidable force in the glass packaging segment, leveraging its deep expertise to deliver personalized, sustainable solutions for premium beverage and cosmetic brands. Their emphasis on lightweight glass innovations enhances both branding and environmental value.

Design Packaging Inc. continues to influence the luxury retail segment with its bespoke packaging designs. The company’s focus on merging aesthetic appeal with brand storytelling gives it a competitive edge in fashion and high-end consumer goods packaging.

Smurfit Kappa Group stands out for its integration of digital print technologies and sustainable corrugated solutions. The company’s smart packaging innovations cater to growing e-commerce demands, offering clients tailored, data-driven solutions that boost consumer engagement.

Pak Factory Inc. maintains its position by offering fully customizable packaging services with quick turnaround times. Their digital-first approach and user-friendly platform empower brands of all sizes to access premium packaging without high-volume constraints.

These key players are shaping the evolution of the personalized packaging landscape by aligning customization with sustainability, technological integration, and brand-specific innovation. Their strategies reflect a clear understanding of shifting consumer preferences toward packaging that is not only functional and attractive but also environmentally responsible and interactive. As market competition intensifies, their ability to scale innovation and maintain flexibility will be critical in capturing niche and mainstream demand alike.

Top Key Players in the Market

- Owens Illinois Inc.

- Design Packaging Inc.

- Smurfit Kappa Group

- Pak Factory Inc.

- CB Group

- Prime Line Packaging

- SoOPAK Company

- Huhtamaki Oyj

- Glenroy Inc.

Recent Developments

- In 21 May 2024, PulPac partnered with OptiPack, a top provider of packaging prints and barrier solutions. This collaboration aims to explore innovations in personalized packaging through sustainable, cutting-edge methods.

- In 31 Oct 2024, PackEdge, Inc. announced the acquisition of Fluted Partition, a specialized division of Valley Container. The move strengthens PackEdge’s custom packaging portfolio and expands its reach into structural packaging design.

- In 21 May 2024, PulPac also partnered with Seaman Paper to develop custom solutions using Dry Molded Fiber. This partnership focuses on advancing eco-friendly, customized packaging options for various applications.

Report Scope

Report Features Description Market Value (2024) USD 35.6 Billion Forecast Revenue (2034) USD 60.8 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Bottles, Boxes, Envelopes, Containers & Jars, Cartons, Bags & Pouches), By End-User (Food, Pharmaceutical, Logistics, Beverage, Personal Care, Others), By Material Type (Plastic, Paper & Paperboard, Glass, Metal) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Owens Illinois Inc., Design Packaging Inc., Smurfit Kappa Group, Pak Factory Inc., CB Group, Prime Line Packaging, SoOPAK Company, Huhtamaki Oyj, Glenroy Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Personalized Packaging MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Personalized Packaging MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Owens Illinois Inc.

- Design Packaging Inc.

- Smurfit Kappa Group

- Pak Factory Inc.

- CB Group

- Prime Line Packaging

- SoOPAK Company

- Huhtamaki Oyj

- Glenroy Inc.