Global Peristaltic Pumps Market By Pressure (Tube Pump and Hose Pump), By Discharge (Up to 30 psi, Above 150 psi, 51 to 100 psi, 31 to 50 psi, and 101 to 150 psi), By End-user (Pharmaceutical & Medical, Water & Wastewater, Pulp & Paper, Food & Beverage, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145353

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

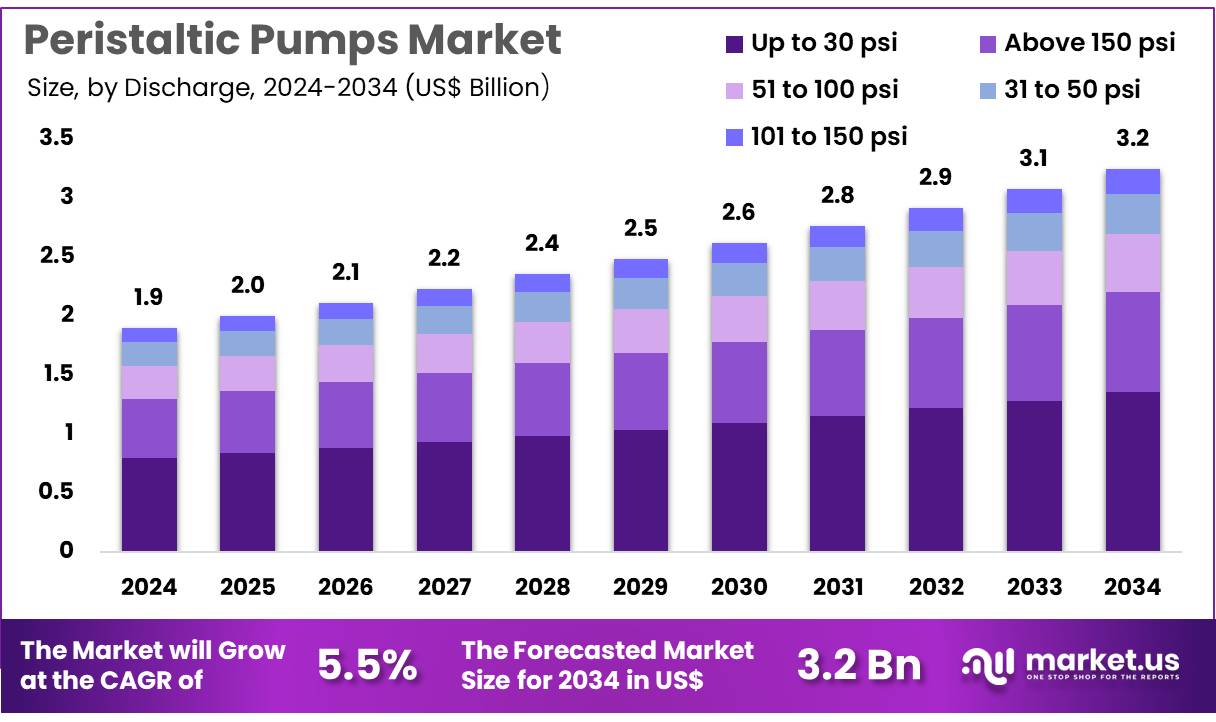

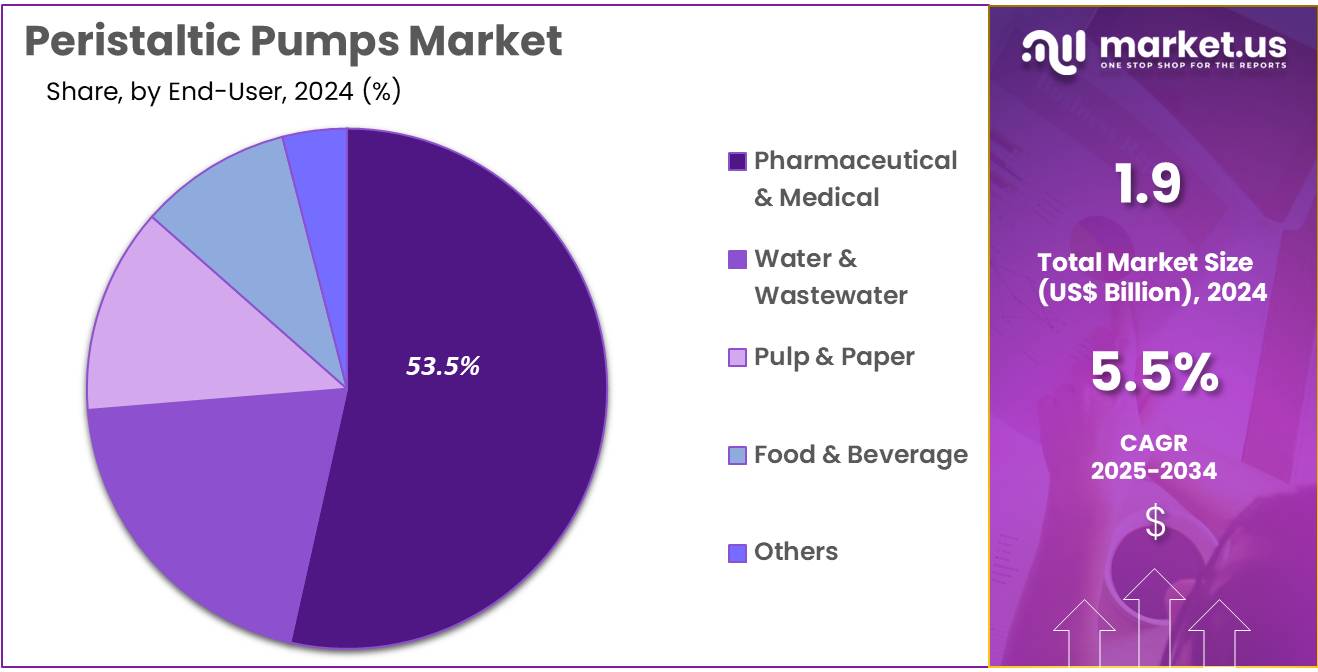

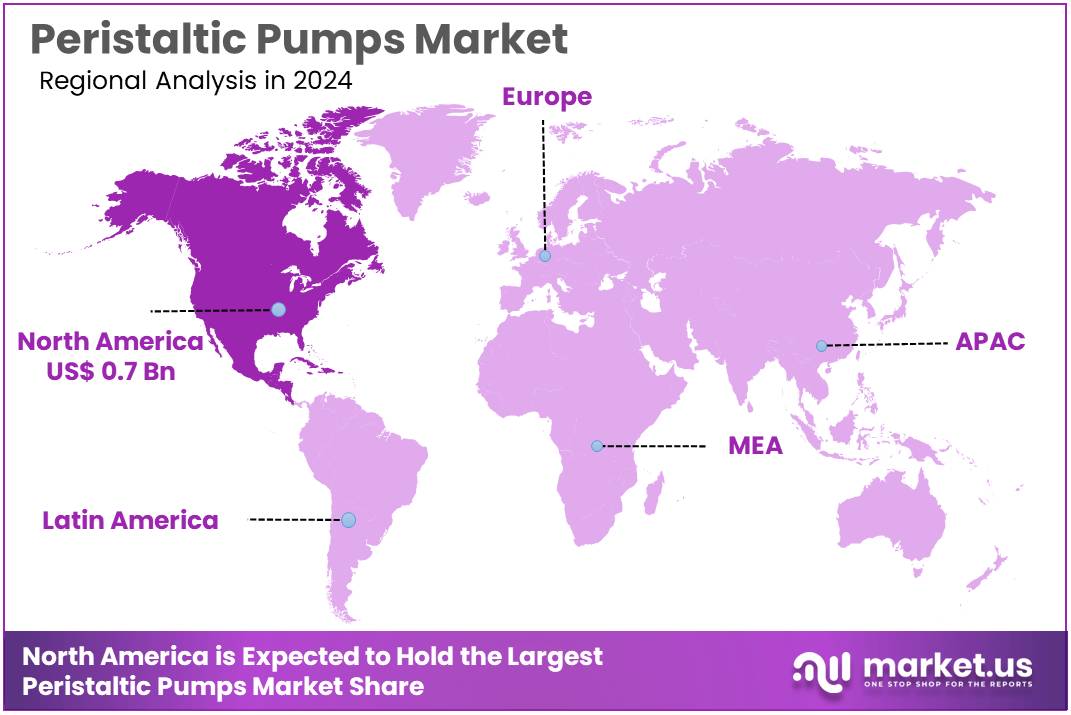

Global Peristaltic Pumps Market size is expected to be worth around US$ 3.2 billion by 2034 from US$ 1.9 billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.1% share with a revenue of US$ 0.7 Billion.

Increasing demand for precise and reliable fluid transport solutions is driving the growth of the peristaltic pumps market. These pumps, known for their ability to handle viscous, aggressive, and sterile fluids, are widely used in industries such as healthcare, pharmaceuticals, food and beverage, and chemical processing. The rising need for automation in fluid handling and the increasing adoption of peristaltic pumps in laboratory applications further fuel market expansion.

Peristaltic pumps are favored for their ease of use, accuracy, and contamination-free operation, making them ideal for critical applications like dialysis, drug delivery, and fluid dispensing. In July 2023, Duoning Biotechnology Co. Ltd. strengthened its market position by acquiring Changzhou PreFluid Technology Co. Ltd., a leading manufacturer of peristaltic pumps.

This acquisition allows Duoning to enhance its capabilities, ensuring the provision of efficient and reliable fluid transport solutions across diverse industries, further expanding the potential of peristaltic pumps in various sectors.

Key Takeaways

- In 2024, the market for peristaltic pumps generated a revenue of US$1.9 billion, with a CAGR of 5.5%, and is expected to reach US$ 3.2 billion by the year 2033.

- The pressure segment is divided into tube pump and hose pump, with tube pump taking the lead in 2024with a market share of 56.4%.

- Considering discharge, the market is divided into up to 30 psi, above 150 psi, 51 to 100 psi, 31 to 50 psi, and 101 to 150 psi. Among these, up to 30 psi held a significant share of 14.7%.

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical & medical, water & wastewater, pulp & paper, food & beverage, and others. The pharmaceutical & medical sector stands out as the dominant player, holding the largest revenue share of 53.5% in the peristaltic pumps market.

- North America led the market by securing a market share of 38.1% in 2024.

Pressure Analysis

The tube pump segment led in 2024, claiming a market share of 56.4% as industries continue to demand precise fluid handling solutions. Tube pumps offer several advantages, including their ability to handle sensitive fluids without contamination, which is crucial in applications such as pharmaceuticals and food processing. The increasing demand for sterile fluid transfer and the rise in automated systems across various industries are anticipated to drive the growth of this segment.

Furthermore, tube pumps provide excellent control over flow rates and offer ease of maintenance, making them a preferred choice in industries requiring high levels of precision. These factors are expected to fuel the continued growth of the tube pump segment in the peristaltic pumps market.

Discharge Analysis

The up to 30 psi held a significant share of 41.7% as industries requiring lower pressure systems seek cost-effective, efficient solutions. Applications in laboratories, pharmaceuticals, and food processing, where lower pressure is adequate for handling fluids, are likely to drive the demand for peristaltic pumps with discharge capabilities up to 30 psi.

The growing trend towards precision in fluid handling and the adoption of more compact, easy-to-operate pumps in smaller-scale operations further supports the growth of this segment. As industries continue to prioritize low-pressure, reliable pumps for sensitive fluid applications, this segment is expected to gain significant market share.

End-User Analysis

The pharmaceutical & medical segment had a tremendous growth rate, with a revenue share of 53.5% owing to the increasing need for precise fluid handling in drug production, medical diagnostics, and patient care applications. As the pharmaceutical and medical industries demand higher accuracy and contamination-free fluid handling systems, peristaltic pumps, which offer sterile and reliable solutions, are expected to see more widespread adoption.

Additionally, the growing global healthcare needs, including the rise of chronic diseases and the increasing number of surgical procedures, are likely to contribute to the expansion of this segment. The pharmaceutical and medical sectors’ focus on improving production efficiency and patient safety is expected to drive continued growth in the use of peristaltic pumps.

Key Market Segments

By Pressure

- Tube Pump

- Hose Pump

By Discharge

- Up to 30 psi

- Above 150 psi

- 51 to 100 psi

- 31 to 50 psi

- 101 to 150 psi

By End-user

- Pharmaceutical & Medical

- Water & Wastewater

- Pulp & Paper

- Food & Beverage

- Others

Drivers

Growing Demand in Pharmaceutical Manufacturing is Driving the Market

The pharmaceutical industry’s expansion is significantly driving the demand for peristaltic pumps, particularly in sterile fluid transfer applications. With the rapid growth of the pharmaceutical market, especially due to the production of biopharmaceuticals and vaccines, the need for precise and contamination-free fluid handling has risen.

In 2023, the pharmaceutical market surpassed US$1.5 trillion, and the FDA approved over 50 new drugs, many of which require aseptic processing—an area where peristaltic pumps excel. Leading manufacturers such as Watson-Marlow and Cole-Parmer reported notable revenue growth in their pump divisions during 2022-2023, attributing much of this to increased demand from biopharmaceuticals and vaccine production.

In particular, COVID-19 vaccine manufacturing further accelerated the adoption of these pumps in production processes. Government initiatives, including funding from the US Biomedical Advanced Research and Development Authority (BARDA), continue to support the development of pharmaceutical infrastructure, indirectly fueling the demand for peristaltic pumps.

Restraints

High Maintenance Requirements are Restraining the Market

Despite their advantages, peristaltic pumps face a significant restraint due to high maintenance requirements. While these pumps are known for their contamination-free operation, the need for frequent tube replacements contributes to substantial ongoing costs. Tubing typically accounts for about 70% of the total ownership cost, with replacements needed every 200 to 1,000 hours of operation, depending on the application.

The US Department of Energy’s 2023 report on industrial pump systems highlighted maintenance as a primary cost driver, especially in continuous process applications. This maintenance burden leads some industries, particularly in water treatment and chemical processing, to consider alternative pumping technologies.

Manufacturers have developed longer-life tubing materials to address these issues, but these materials come with higher upfront costs, which can be a deterrent, especially in price-sensitive markets, including developing regions. The need for regular maintenance and the associated costs remain a significant challenge for the widespread adoption of peristaltic pumps.

Opportunities

Expansion of Water and Wastewater Treatment is Creating Growth Opportunities

Global investments in water infrastructure, particularly in water and wastewater treatment, present substantial growth opportunities for peristaltic pump manufacturers. The United Nations reported that annual spending on water treatment upgrades has exceeded US$30 billion since 2022. The US Environmental Protection Agency (EPA) allocated US$30 billion for water treatment facility upgrades in 2023 alone.

Peristaltic pumps are increasingly preferred for chemical dosing in treatment plants due to their leak-proof design and precision in delivering chemicals for water purification. This trend is especially pronounced in municipal water projects. Companies like Xylem Inc.

have reported significant growth in their dosing equipment segment, with an 18% increase in 2023, driven in large part by municipal water treatment projects. Emerging markets, such as India’s Jal Jeevan Mission, which plans to equip over 100,000 water testing laboratories by 2024, present further opportunities for peristaltic pumps to meet the growing demand for accurate chemical metering solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the peristaltic pump market, creating both challenges and opportunities. Rising inflation has led to increased raw material costs, particularly for specialty polymers used in pump tubing, placing pressure on manufacturer profit margins. Trade tensions between the US and China have disrupted global supply chains, with critical component deliveries delayed by 8-12 weeks in 2023, impacting the availability of essential parts.

However, government initiatives such as the US Infrastructure Investment and Jobs Act, which allocated substantial funding for infrastructure projects, have created offsetting demand for advanced equipment like peristaltic pumps. The energy crisis in Europe has accelerated the adoption of more efficient pumping solutions, with regulations pushing for more energy-efficient systems.

Additionally, the geopolitical challenges have disrupted the supply of raw materials but have also encouraged regional manufacturing efforts to mitigate these risks. Although currency fluctuations in emerging markets create pricing challenges, the global emphasis on water security and pharmaceutical independence ensures stable long-term market growth. Continuous technological advancements in materials and IoT connectivity help manufacturers adapt to these evolving market conditions, ensuring that the peristaltic pump sector remains robust.

Latest Trends

Integration of Smart Monitoring Systems is a Recent Trend

A recent trend in the peristaltic pump market is the increasing integration of smart monitoring systems, particularly IoT-enabled features. These advancements enable predictive maintenance, real-time performance monitoring, and reduced downtime. Watson-Marlow’s introduction of the “Connected Pump” series in 2023, which features real-time tube wear monitoring, is an example of how manufacturers are incorporating IoT into their designs.

Additionally, Grundfos reported that its smart dosing pumps saw adoption rates 40% higher than conventional models in 2023. This trend aligns with the broader adoption of Industry 4.0 technologies across process industries, where efficiency, automation, and real-time data analytics are increasingly critical.

Food and beverage manufacturers, in particular, have embraced these innovations to optimize cleaning-in-place processes and reduce operational downtime. While the addition of smart features increases initial equipment costs by 15-20%, the long-term savings in maintenance and overall process optimization have driven market acceptance, making it a key trend in the sector.

Regional Analysis

North America is leading the Peristaltic Pumps Market

North America dominated the market with the highest revenue share of 38.1% owing to expanded applications in pharmaceuticals, water treatment, and food processing. The US Food and Drug Administration approved 15% more new drug applications in 2023 compared to 2022, leading to an increased demand for sterile fluid transfer systems in pharmaceutical manufacturing.

According to the US Environmental Protection Agency, federal funding for water infrastructure projects reached US$7 billion in 2023, which facilitated the adoption of peristaltic pumps in wastewater treatment applications. The US Department of Agriculture reported a 6% increase in food safety compliance inspections in 2023, prompting food processors to invest in hygienic pumping solutions.

Major manufacturers saw increased orders from biotech companies, with the US biopharmaceutical sector growing by 8% in production capacity during 2023, as tracked by industry trade associations. Automation trends in chemical processing also contributed to market expansion, with the US Occupational Safety and Health Administration recording a 10% rise in automated system implementations in 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to pharmaceutical expansion and environmental initiatives. China’s National Medical Products Administration approved 22% more pharmaceutical production facilities in 2023 than in 2022, creating demand for precision fluid handling equipment. India’s Central Pollution Control Board mandated a 30% increase in effluent treatment plants in 2023 across industrial zones, requiring reliable pumping solutions.

Japan’s Ministry of Health reported a 12% increase in biopharmaceutical exports in 2023, further driving the need for contamination-free transfer systems. Australia’s Therapeutic Goods Administration registered 18% more medical device manufacturers in 2023, many of whom require specialized fluid management technologies.

Southeast Asian nations collectively invested US$3.5 billion in water treatment infrastructure during 2023, according to regional development banks, with a significant portion allocated to pumping systems. These developments suggest sustained demand across multiple industries in the region in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the peristaltic pumps market focus on technological advancements, product diversification, and expanding their global footprint to drive growth. They invest in developing more efficient, reliable, and versatile pumps suitable for various industries, including healthcare, food processing, and pharmaceuticals.

Companies also integrate advanced features such as digital controls, enhanced flow rates, and better material compatibility to meet the specific needs of customers. Strategic partnerships with distributors and OEMs help improve product accessibility. Additionally, targeting emerging markets with growing industrial sectors and increased demand for fluid handling solutions supports market expansion.

Watson-Marlow Fluid Technology Group, headquartered in Falmouth, United Kingdom, is a global leader in the manufacture of peristaltic pumps and fluid management systems. The company offers a broad range of high-performance pumps designed for use in diverse industries such as biopharmaceuticals, food and beverage, and water treatment.

Watson-Marlow focuses on innovation, continuously improving the design and efficiency of its pumps. With a strong global presence and a commitment to sustainability, the company continues to expand its market share through strategic acquisitions and a focus on customer-centric solutions.

Top Key Players

- Watson-Marlow Inc

- Verder Liquids

- ProMinent

- Ingersoll Rand

- Gilson Incorporated

- Boyser

- Boxer GmbH

- ANKO

Recent Developments

- In April 2024, Watson-Marlow Fluid Technology Solutions (WMFTS) introduced WMArchitect, a cutting-edge, single-use platform designed for biopharmaceutical fluid management. Building on previous models like puresu and asepticsu, WMArchitect offers flexible solutions that simplify processes, enhance product safety, and ease regulatory compliance for biopharma companies.

- In August 2023, Verder Liquids announced major updates to its Verderflex iDura peristaltic pump series. The revamped iDura pumps feature advanced technology and innovative upgrades, making them ideal for a wide range of industries, including water treatment, food and beverage production, and filter press applications, reinforcing their leadership in the peristaltic pump market.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 billion Forecast Revenue (2034) US$ 3.2 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Pressure (Tube Pump and Hose Pump), By Discharge (Up to 30 psi, Above 150 psi, 51 to 100 psi, 31 to 50 psi, and 101 to 150 psi), By End-user (Pharmaceutical & Medical, Water & Wastewater, Pulp & Paper, Food & Beverage, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Watson-Marlow Inc, Verder Liquids, ProMinent, Ingersoll Rand, Gilson Incorporated, Boyser, Boxer GmbH, and ANKO Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

Top Key Players

- Watson-Marlow Inc

- Verder Liquids

- ProMinent

- Ingersoll Rand

- Gilson Incorporated

- Boyser

- Boxer GmbH

- ANKO