Global Payment Gateway Market By Type (Hosted and Non-hosted), BY Enterprise Size (Large Enterprises and Small & Medium Enterprises), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 32318

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

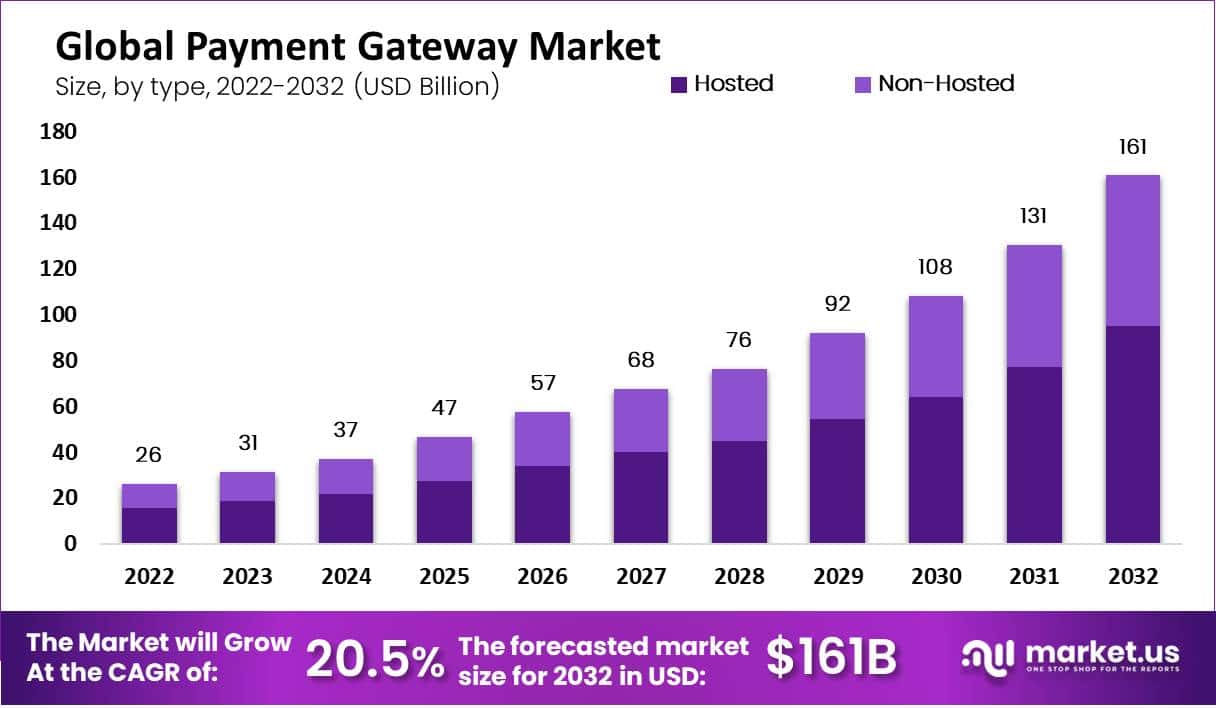

In 2023, the global payment gateway market was valued at USD 31 billion and is expected to reach USD 161 billion in 2032. This market is estimated to register the highest CAGR of 20.5% between 2023 and 2032.

Increasing e-commerce sales also expanding the use of the internet globally are significant factors that are anticipated to contribute to the growth of the payment gateway market. The industry is also predicted to grow in the upcoming years as a result of the shift in consumer as well as merchant preferences towards digital channels that enable online money transfers. The market for payment gateways is one area of the financial technology (Fintech) business that is expanding quickly. By allowing the flow of payment information between the merchant and the acquiring bank or payment processor, a payment gateway is a piece of technology that enables merchants to safely conduct online transactions.

Note: Actual Numbers Might Vary In Final Report

Fintech companies are creating cutting-edge payment solutions to meet the growing need for convenient also secure online payment methods. New competitors are now entering the payment gateway market as a result of this. Payment gateways built on the blockchain, offer greater security as well as transparency in transactions.

Key Takeaways

- Market Growth: The global payment gateway market was valued at USD 26.1 billion in 2022 and is expected to reach USD 161 billion by 2032, with a projected CAGR of 20.5% between 2023 and 2032.

- Driving Factors:

- Growing E-commerce: Increasing online sales and global internet usage are driving the demand for reliable and secure payment gateway solutions.

- Mobile Payments: The widespread use of smartphones has increased the need for mobile-optimized payment gateways.

- Security: Concerns about data security and privacy are pushing businesses to offer secure payment processing solutions.

- Globalization: With the rise of global e-commerce, there’s a growing need for payment gateways that support multi-currency transactions and localization capabilities.

- Regulatory Compliance: Adherence to standards such as PCI DSS, GDPR, and PSD2 is essential for gaining a competitive edge.

- Innovation: Providers offering faster processing times, enhanced security, and improved user experiences have a significant advantage in the market.

- Restraining Factors:

- Security Concerns: Customer worries about data security can discourage the use of payment gateways, especially due to potential breaches and data leaks.

- Transaction Fees: High transaction fees might deter small and medium-sized businesses from utilizing payment gateways.

- Limitations: Inability to handle certain forms of payment and complex integration processes can limit the applicability of payment gateways.

- Market Segmentation:

- Types: Hosted and Non-hosted, with the hosted segment holding 59% of the market share.

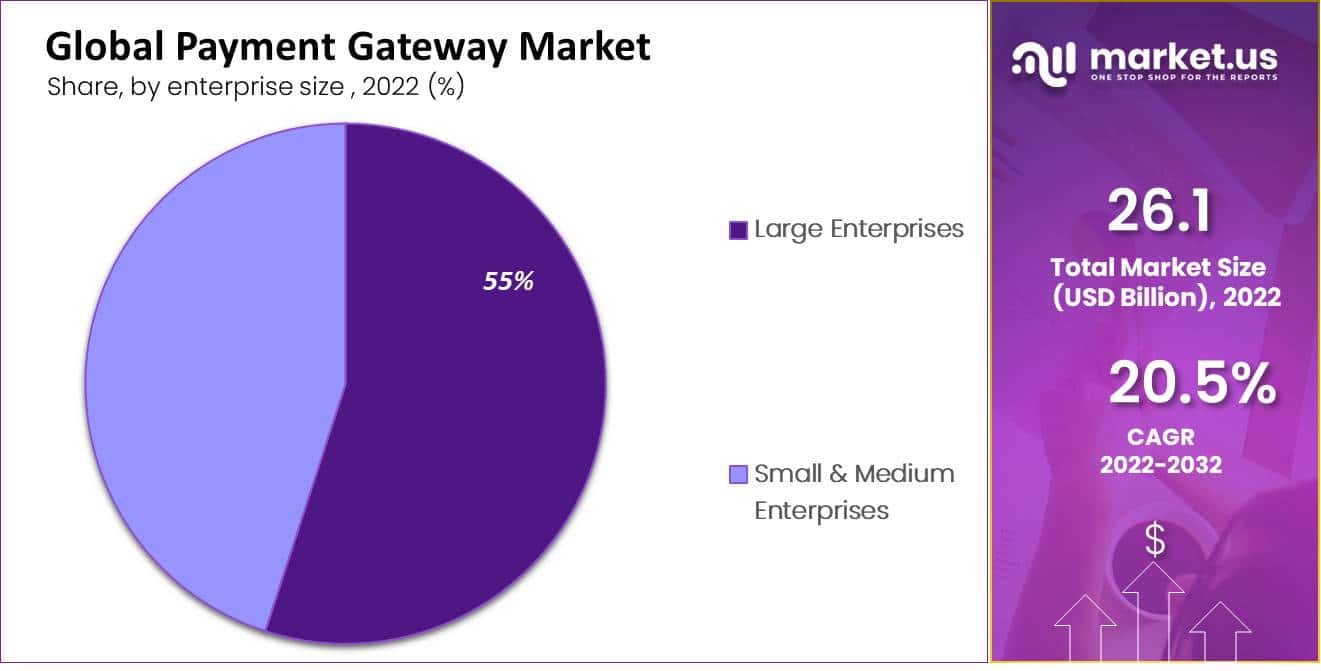

- Enterprise Size: Large Enterprises dominate with a 55% market share, while Small & Medium Enterprises are expected to witness significant growth.

- End-Users: Retail & E-commerce is the dominant segment, followed by BFSI, Media & Entertainment, Travel & Hospitality, and others.

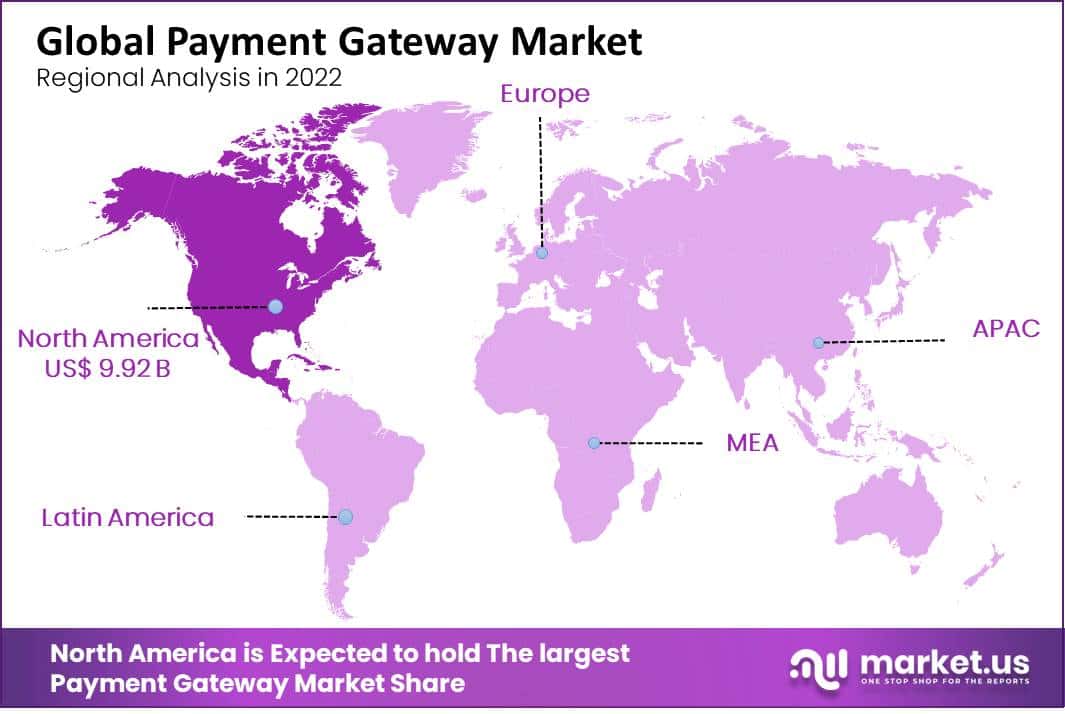

- Regional Analysis:

- North America holds the largest market share (38%), led by the United States and Canada due to a robust e-commerce industry and increasing mobile payment adoption rates.

- Asia-Pacific countries such as Japan, India, China and South Korea are seeing substantial expansion of the payment gateway market.

- Key Players: The market is highly competitive, with major companies like PayPal Holdings Inc, Stripe Inc, Amazon Payments Inc, Authorize.net and Square Inc being at the forefront.

Driving Factors

- Growing E-commerce: The need for payment gateway solutions has been fuelled by the expansion of the e-commerce sector. Businesses need dependable also secure payment gateway solutions to process their transactions as more customers shop online.

- Mobile Payments: There is a rising need for payment gateway solutions that are mobile device-optimized due to the widespread use of smartphones and other mobile devices. Payment gateways that handle mobile payments have become a critical component of many firms’ payment processing operations.

- Security: Security is a key element influencing the payment gateway business. While making online transactions, consumers are concerned about the security of their financial and personal information, therefore businesses must make sure they offer safe payment processing solutions.

- Globalization: As e-commerce has become more prevalent, there is a greater need for payment gateways that can handle transactions in many currencies as well as tongues. The importance of payment gateways with multi-currency support and localization capabilities is growing in the context of global e-commerce.

- Regulatory Compliance: Payment gateway providers must adhere to a number of standards, including PCI DSS, GDPR, and PSD2. So, businesses who offer adherence to these rules have a competitive edge.

- Innovation: New solutions from providers that offer quicker payment processing times, more secure payment options, and greater client experiences are boosting the payment gateway market. The ability to offer cutting-edge payment gateway solutions gives providers a major advantage over rivals.

Restraining Factors

Customers that use payment gateways frequently worry about security. Any security lapse can result in the loss of confidential information, monetary losses also reputational harm to a business. The companies that supply payment gateways charge for each transaction. Businesses, especially small and medium-sized ones, may be discouraged from using payment gateways by high transaction fees.

Payment gateways might not handle all forms of payment, such as international transactions or specific credit card types, which could limit their applicability to some clients and organizations. It can be a challenging procedure that necessitates technical know-how and resources to integrate payment gateways into current systems. Payment gateway providers must adhere to numerous laws as well as standards, including PCI-DSS, which can take time also money. Other vendors are offering comparable services in the highly competitive payment gateway sector. This may make it challenging for new competitors to establish themselves in the market.

By Type Analysis

Based on type, the market is separated into hosted and non-hosted, the hosted segment dominates the market with 59% of the market share. Owing to the simple payment process and decreased merchant liability. The demand for hosted payment gateway is rising with retailers. Hosted payment gateways have a more number of benefits including better security and reduce merchant liability. The provider’s website is where the payment information was entered a timeless chance of fraud and data leakage because the merchant does not have access to the customer’s personal payment information.

The non-hosted segment is expected the significant growth over the period. All over the world, many merchants preferred a non-hosted payment gateway for their website because they can maintain control over the entire checkout process, including the design and layout process. While providing an effortless shopping experience for consumers with APIs, the retailer can permit customers to finish the transaction by directly entering their debit or credit card information on their checkout page.

By Enterprise Size Analysis

By enterprise size, the market is divided into large enterprises and SMEs the larger enterprise segment dominates the market with a 55% market share. Owing to the larger website traffic larger businesses them checkout solutions for their client. Supporting several digital payment methods such as net banking, and credit and debit card payment getaways system may guarantee a simple checkout process for their clients. These businesses need a very safe and secure method of transaction which was made possible by payment gateways.

The small and medium enterprises segment is anticipated the highest growth over the forecasting period. Small and medium enterprises are using payment gateways more quickly and providing customers with more convenience. Some small and medium enterprises are restructuring their revenue plan and operation by taking a more digital strategy.

Note: Actual Numbers Might Vary In Final Report

By End-User Analysis

Based on end-user, the market is segmented into BFSI, media & entertainment, retail & e-commerce, travel & hospitality, and other end-user. The retail and e-commerce segment dominates the payment gateway market with a 28% market share. For online shops and e-commerce companies to receive customer payments, payment gateways are crucial. They make it possible for companies to accept payments made with credit as well as debit cards as well as other electronic payment methods like bank transfers and mobile wallets. Traditional brick-and-mortar retailers also use payment gateways to take card payments at the point of sale. Usually, a physical card terminal also a mobile device with a card reader attached is used for this.

The BFSI segment is expected to witness significant growth during the forecasting period, with the rise of electronic payments and e-commerce, the BFSI sector’s payment gateway market is a quickly expanding business. Customers can use credit/debit cards, net banking, and mobile wallets to pay for goods and services on a secure platform provided by payment gateway providers.

Key Market Segments

Based on Type

- Hosted

- Non-hosted

Based on By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Based on End-User

- Retail & E-commerce

- BFSI

- Media & Entertainment

- Travel & Hospitality

- Healthcare

- Energy & Utilities

- IT & Telecom

- Other End User

Growth Opportunity

Payment gateway providers can expand into new geographic markets and cater to the unique payment preferences of consumers in those regions. With the growing popularity of mobile payments, digital wallets also other emerging technologies, payment gateway providers can integrate these technologies to provide a more seamless as well as convenient payment experience for their customers.

Payment gateway providers can collaborate with other players in the payments ecosystem, like banks, card networks, and merchants, to create new value propositions and enhance the overall customer experience. With the rise of cybercrime and fraud, payment gateway providers can differentiate themselves by offering enhanced security features also fraud prevention measures to their customers.

Latest Trends

The payment gateway industry has experienced substantial expansion and change in recent years. The demand for secure also effective payment processing solutions has exploded with the growth of e-commerce and the expanding use of digital payments. Such as, there are many suppliers vying for market share in the increasingly crowded and competitive payment gateway industry.

The increased emphasis on security and fraud protection has been one of the key trends in the payment gateway industry. Payment gateway providers have had to make significant investments in cutting-edge security measures as cyber-attacks and data breaches become more common as well as sophisticated to safeguard sensitive client information and stop fraudulent transactions.

The increasing significance of mobile payments has been a further trend in the payment gateway industry. Payment gateway providers have had to modify their services to fit the needs of mobile customers as consumers use their cell phones to make transactions in greater numbers. Owing to mobile-specific payment methods like in-app purchases also mobile wallets have been created.

Regional Analysis

North America is estimated to be the most lucrative market in the global payment gateway market, with the largest market share of 38%. The North American payment gateway market is one of the largest worldwide, with the United States and Canada leading the market. The region’s highly developed e-commerce industry is fueling growth within this sector as well as rising mobile payment adoption also digital wallet adoption rates. All these factors have combined to propel market development within this region.

The Asia-Pacific region is one of the fastest growing regions for the payment gateway market with countries like Japan, India, China, and South Korea driving the growth sector. The growing adoption of mobile payment as well as e-commerce is driving the growth of the market in this region.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market for payment gateways is a sector that is expanding quickly, with the increased acceptance of online shopping as well as an increase in digital transactions. Such as several major firms are vying for market share, making the industry extremely competitive. PayPal Holdings, Inc., Stripe Inc., Amazon Payments Inc., Authorize.net, and Square, Inc. are a few of the market’s top competitors. These businesses provide several varieties of payment processing services, such as processing credit and debit cards, integrating digital wallets as well detecting and preventing fraud.

Market Key Players

Listed below are some of the most prominent global payment gateway market industry players.

- Adyen

- Amazon Payments Inc

- Authorize Net

- Bitpay Inc

- Braintree

- PayPal Holdings Inc

- PayU Group

- Stripe

- Verifone Holdings Inc

- Wepay Inc

- Stripe Inc

- Other Key Players

Recent Developments

- In November 2022- The premier e-commerce agency, object source, and Blue Snap, the payment orchestration platform for major B2B and B2C enterprises, have expanded their collaboration to help online retailers across Europe and improve Magneto integration for the developing EU Market.

- In August 2022- The Central Bank of India granted an in-principle Payment Aggregator (PA) license to the financial services platform Mswipe Technologies (RBI). Mswipe will be able to create its internal online payment mechanism with this approval.

Report Scope

Report Features Description Market Value (2023) USD 31 Bn Forecast Revenue (2032) USD 161 Bn CAGR (2023-2032) 20.5% Base Year for Estimation 2022 Historic Period 2016-2028 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type, By Enterprise Size, By End-User Regional Analysis North America – The US, Canada, Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, &Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, &Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, &Rest of MEA Competitive Landscape Adyen, Amazon Payments Inc, Authorize Net, Bitpay Inc, Braintree, PayPal Holdings Inc, PayU Group, Stripe, Verifone Holdings Inc, Wepay Inc, Stripe Inc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Payment Gateway Market in 2032?In 2032, the Payment Gateway Market will reach USD 161 billion.

What CAGR is projected for the Payment Gateway Market?The Payment Gateway Market is expected to grow at 20.5% CAGR (2023-2032).

List the segments encompassed in this report on the Payment Gateway Market?Market.US has segmented the Payment Gateway Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Hosted and Non-hosted. By Enterprise Size, the market has been further divided into Large Enterprises and Small & Medium Enterprises.

Which segment accounts for the greatest market share in the Payment Gateway industry?With respect to the Payment Gateway industry, vendors can expect to leverage greater prospective business opportunities through the Hosted segment, as this area of interest accounts for the largest market share.

Name the major industry players in the Payment Gateway Market.Adyen, Amazon Payments Inc, Authorize Net, Bitpay Inc, Braintree, PayPal Holdings Inc, PayU Group and Other Key Players are the main vendors in this market.

-

-

- Adyen

- Amazon Payments Inc

- Authorize Net

- Bitpay Inc

- Braintree

- PayPal Holdings Inc

- PayU Group

- Stripe

- Verifone Holdings Inc

- Wepay Inc

- Stripe Inc

- Other Key Players