Global Payment Card Technologies Market By Component (Hardware, Software & Solutions, Services), By Technology Type (Contactless Cards (NFC/RFID), EMV Chip Cards, Dual-Interface Cards, Biometric Cards), By Card Type (Credit Cards, Debit Cards, Prepaid Cards), By End-User (Banks & Financial Institutions, Retail & Hospitality, Corporates, Government & Public Sector), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 175368

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Global Adoption Rates

- Usage Statistics by Channel

- Drivers Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Technology Type Analysis

- Card Type Analysis

- End-User Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

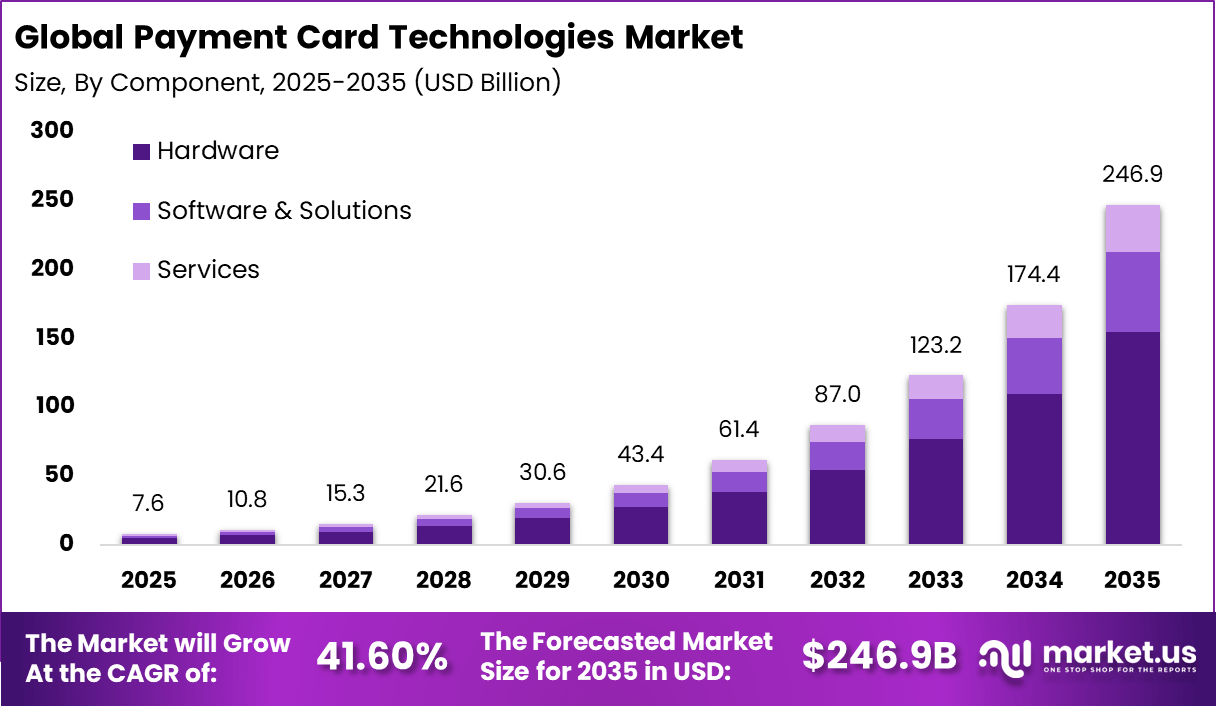

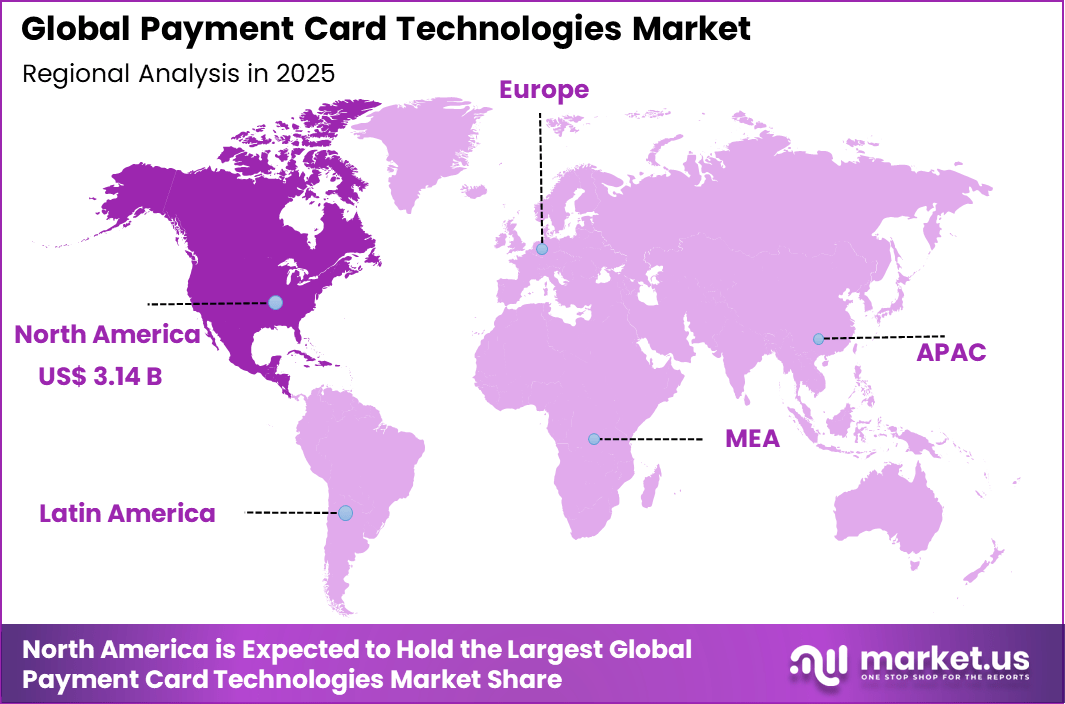

The Global Payment Card Technologies Market generated USD 7.6 billion in 2025 and is predicted to register growth from USD 10.8 billion in 2026 to about USD 246.9 billion by 2035, recording a CAGR of 41.60% throughout the forecast span. In 2025, North America held a dominant market position, capturing more than a 41.22% share, holding USD 3.14 Billion revenue.

The Payment Card Technologies Market covers the hardware, software, and embedded security features used in debit, credit, and prepaid cards. These technologies enable secure payment processing across physical and digital channels, including point of sale terminals, online platforms, and mobile environments. Payment cards remain a core payment instrument despite the growth of alternative digital methods. Continuous technology upgrades are required to meet security, performance, and usability expectations.

Modern payment cards integrate multiple functions such as authentication, encryption, and contactless communication. The market is shaped by evolving consumer behavior, rising transaction volumes, and increasing security requirements. As payment ecosystems become more interconnected, card technologies must support interoperability and global acceptance. This positions payment card technology as a critical infrastructure within the broader payments landscape.

One major driving factor is the persistent need to reduce payment fraud and unauthorized transactions. Traditional magnetic stripe cards exposed users to cloning and data theft risks. Advanced card technologies address these issues by introducing dynamic authentication and encrypted transaction data. This security improvement has accelerated the replacement of older card formats.

Demand for payment card technologies is driven by financial institutions issuing new cards and replacing expired or outdated ones. Regular card renewal cycles create consistent demand for upgraded features. Institutions also issue specialized cards tailored to specific consumer segments. These factors support steady technology adoption.

Investment opportunities exist in next-generation card manufacturing and personalization technologies. Innovations that improve durability, security, and sustainability are increasingly valued. Issuers seek cards that last longer and support advanced features. This creates demand for specialized production capabilities.

There is also opportunity in software platforms that manage card lifecycle functions. These include activation, authentication, and transaction monitoring. Efficient lifecycle management reduces operational cost and improves service quality. Technology providers supporting these functions can capture long-term value.

Top Market Takeaways

- By component, hardware dominated the payment card technologies market with 62.7% share, providing chips, readers, and secure modules for transaction infrastructure.

- By technology type, contactless cards using NFC/RFID captured 52.8%, enabling fast tap-to-pay convenience in retail and transit.

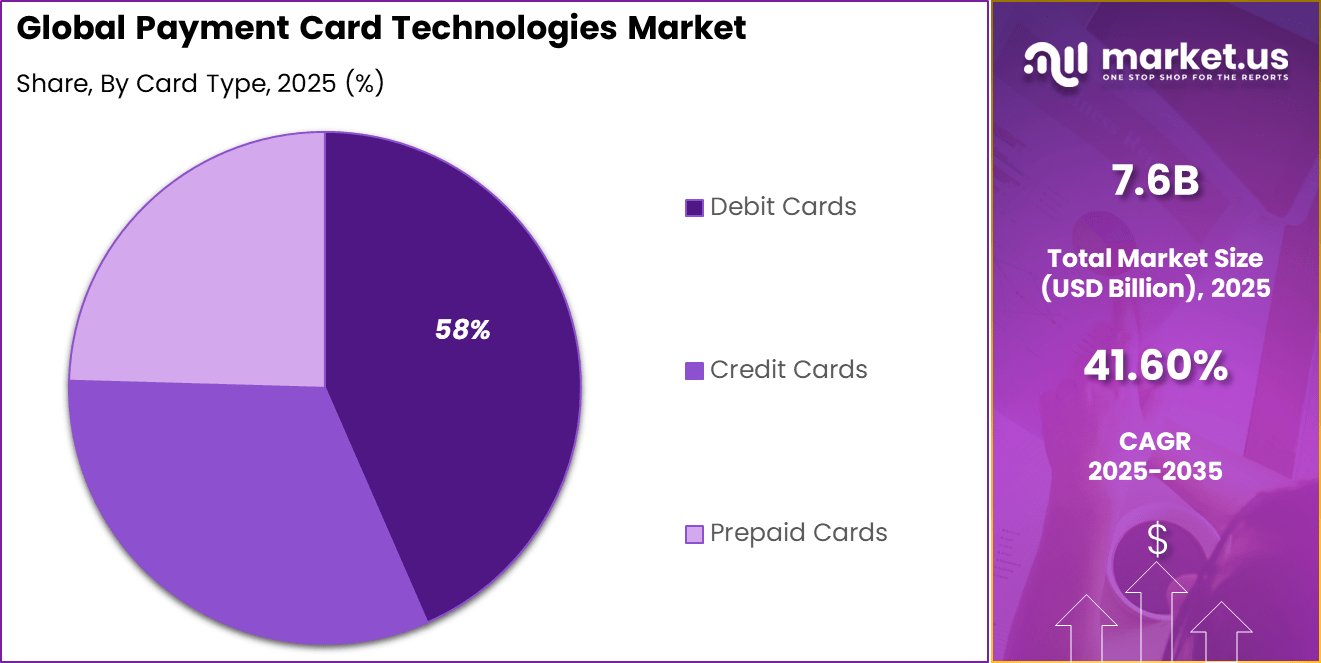

- By card type, debit cards led at 58.4%, favored for everyday spending and direct account-linked transactions.

- By end-user, banks and financial institutions held 71.6%, issuing advanced cards to enhance security and customer adoption.

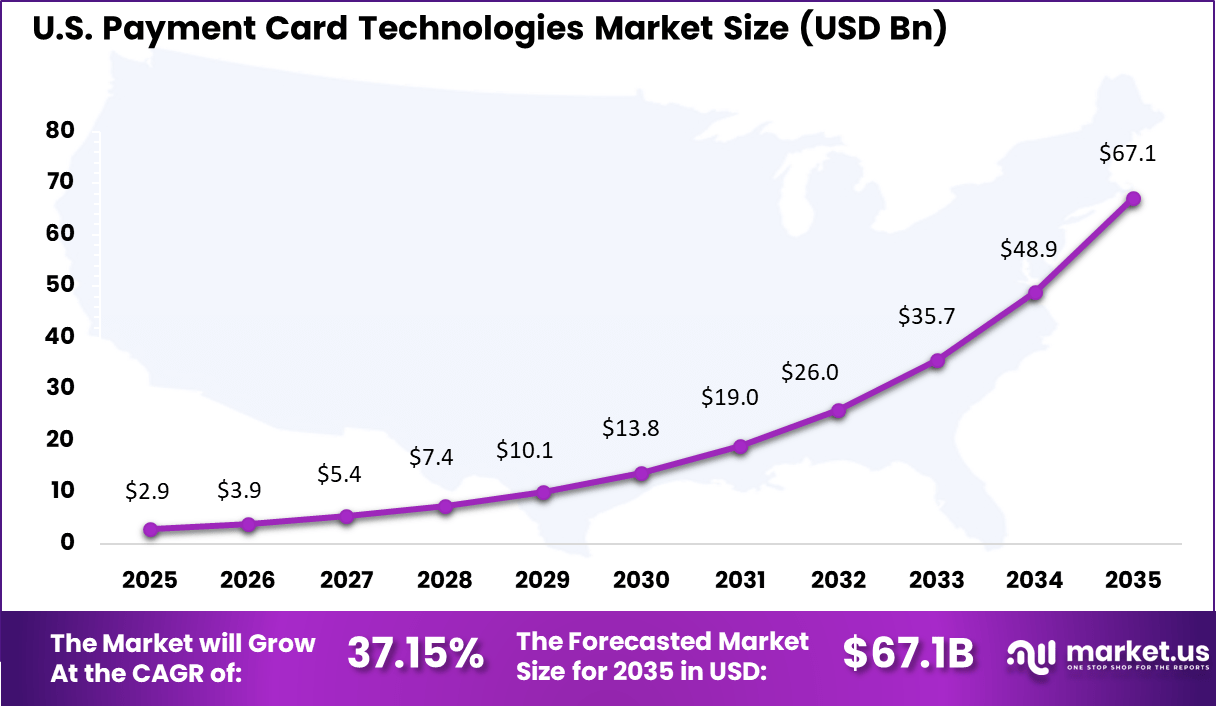

- North America accounted for 41.22% of the global market, with the U.S. valued at USD 2.85 billion and growing at a CAGR of 37.15%

Global Adoption Rates

- Around 5.2 to 5.6 billion people, close to two thirds of the global population, were using digital wallets by late 2025.

- In the US, adoption reached a mainstream level, with 90% of consumers having used a digital payment method at least once in the past year.

- In the UK, contactless payments accounted for 94.6% of all card present transactions by early 2025. Globally, 71% of consumers now prefer contactless payments over traditional insert methods.

Usage Statistics by Channel

- Digital wallets remain the leading online payment method, capturing over 50% of global e commerce transaction value in 2025. Credit cards follow with about 22% share.

- Physical cards still dominate in store payments, with credit cards at 42% and debit cards at 28%, while digital wallets account for roughly 15% to 32%, depending on the region.

- Global RTP adoption grew by 42% year over year by 2025, with systems such as India’s UPI and Brazil’s Pix setting benchmarks for fast, card free transactions.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rapid global shift toward cashless and digital payments +9.2% Global Short to medium term Strong adoption of contactless and NFC-enabled cards +8.4% Europe, Asia Pacific, North America Short term Rising payment fraud driving demand for secure card technologies +7.6% Global Medium term Expansion of e-commerce and card-not-present transactions +6.9% Global Medium term Government and banking push for financial inclusion +5.1% Asia Pacific, Africa, Latin America Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High cost of advanced chip and biometric cards -5.6% Emerging Markets Short to medium term Infrastructure readiness gaps in developing economies -4.8% Africa, Latin America Medium term Interoperability challenges across payment ecosystems -4.1% Global Medium term Longer replacement cycles for legacy magnetic stripe cards -3.5% Emerging Markets Medium term Regulatory and certification complexity -2.7% Europe, North America Medium to long term Component Analysis

Hardware accounts for 62.7% of the Payment Card Technologies market, showing that physical card infrastructure remains the backbone of payment systems. This includes card chips, magnetic stripes, antennas, and secure elements embedded within payment cards.

Hardware components are essential for enabling secure transactions and supporting different payment technologies such as contactless and chip-based payments. Strong demand for durable and secure card components continues to drive this segment.

From an operational perspective, hardware ensures transaction reliability and long card lifespan. Banks and issuers prioritize high-quality hardware to reduce card failure rates and security risks. The strong share of this segment reflects continued reliance on physical card technology despite growth in digital and mobile payments.

Technology Type Analysis

Contactless card technology accounts for 52.8% of the market, making it the most widely adopted payment technology. NFC and RFID enable fast and convenient tap-and-go transactions, which improve checkout speed and user experience. Consumers prefer contactless payments due to ease of use and reduced physical contact during transactions.

For issuers and merchants, contactless technology supports higher transaction throughput and customer satisfaction. It also aligns with modern payment infrastructure upgrades. The strong share of this segment reflects widespread acceptance of contactless payments across retail, transit, and service sectors.

Card Type Analysis

Debit cards represent 58% of the card type segment, making them the most commonly used payment cards. Debit cards allow users to access funds directly from their bank accounts, offering better spending control. They are widely issued by banks and used for everyday transactions such as shopping and bill payments.

From a market perspective, debit cards support financial inclusion and high transaction volumes. They are accepted globally and require lower credit risk management compared to credit cards. The strong presence of this segment reflects continued consumer preference for direct and convenient payment methods.

End-User Analysis

Banks and financial institutions account for 71.6% of end-user adoption, making them the primary stakeholders in payment card technologies. These institutions issue cards, manage accounts, and ensure transaction security. Investment in advanced card technologies helps banks improve service quality and customer trust.

Banks also play a key role in upgrading payment infrastructure and adopting new technologies. Secure and reliable card systems are essential for compliance and fraud prevention. The strong share of this segment reflects the central role of banks and financial institutions in the global payment card ecosystem.

Key Reasons for Adoption

- Digital and cashless payment adoption is increasing across global markets

- Security expectations are rising for both physical and digital card transactions

- Consumer demand is growing for faster and more convenient payment experiences

- Financial institutions are upgrading legacy card infrastructure

- Retail and service sectors require reliable and widely accepted payment methods

Benefits

- Transaction security is strengthened through advanced card technologies

- Payment speed is improved for both in-store and online purchases

- Fraud prevention capabilities are enhanced across payment channels

- Customer convenience is increased through contactless and digital features

- Payment acceptance reliability is improved across different environments

Usage

- Used in retail stores for everyday consumer purchases

- Applied in online commerce for secure card-based payments

- Deployed in banking systems for issuing and managing cards

- Utilized in transportation systems for fare collection

- Integrated with digital wallets and mobile payment platforms

Emerging Trends Analysis

An emerging trend in the payment card technologies market is the increased adoption of contactless payments for low value and high frequency transactions. Contactless cards reduce transaction time and physical contact, making them suitable for public transport, retail, and quick service environments. This trend is supported by consumer preference for faster and hygienic payment options.

Another trend is the integration of advanced authentication methods into card transactions. Technologies such as dynamic security codes and biometric verification are being explored to strengthen protection. These methods reduce reliance on static card details and improve resistance to fraud. Continued innovation in authentication is shaping the next phase of card security.

Growth Factors Analysis

One of the key growth factors for the payment card technologies market is the steady expansion of global retail and e-commerce activity. As transaction volumes increase, the need for reliable and scalable payment methods grows. Payment cards remain a trusted option for both in store and online purchases. This consistent usage supports ongoing investment in card technology upgrades.

Another growth factor is regulatory emphasis on secure electronic payments. Payment security standards and consumer protection rules encourage adoption of advanced card technologies. Compliance requirements push issuers and merchants to replace outdated systems. This regulatory influence continues to support modernization across the payment ecosystem.

Key Market Segments

By Component

- Hardware

- Software & Solutions

- Services

By Technology Type

- Contactless Cards (NFC/RFID)

- EMV Chip Cards

- Dual-Interface Cards

- Biometric Cards

By Card Type

- Credit Cards

- Debit Cards

- Prepaid Cards

By End-User

- Banks & Financial Institutions

- Retail & Hospitality

- Corporates

- Government & Public Sector

Regional Analysis

North America accounted for 36.1% share, supported by strong demand for secure digital onboarding and identity authentication across banking, fintech, healthcare, government, and online services. Digital identity verification solutions have been widely adopted to prevent fraud, ensure regulatory compliance, and improve customer onboarding experiences.

Demand has been driven by growth in digital transactions, remote account opening, and stricter know your customer and anti money laundering requirements. Organizations in the region have increasingly relied on automated identity checks to balance security with user convenience.

The U.S. market reached USD 4.04 Bn and is projected to grow at a 12.59% CAGR, reflecting steady expansion across financial services, eCommerce, and public sector applications. Adoption has been driven by the need to reduce identity fraud, improve compliance efficiency, and support fully digital customer journeys. Digital identity verification tools have helped U.S. organizations accelerate onboarding while maintaining high security standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Strong Demand for Secure and Smart Payment Cards

The payment card technologies market is being driven by the growing need for security and enhanced functionality in everyday transactions. Smart chip cards, which follow global standards such as EMV, store data in a microprocessor rather than a magnetic stripe and are widely used to protect against fraud and unauthorized access.

Financial institutions and merchants continue to adopt these technologies to offer safer transaction experiences in retail and online environments. This demand reflects a broader shift to digital payments and contactless acceptance, where consumers and businesses expect fast and reliable methods that protect their financial information.

Restraint Analysis

High Implementation Costs and Fee Pressures

A key restraint on the payment card technologies market comes from the high costs associated with implementation and ongoing transaction fees. Upgrading systems to support advanced chip technologies, contactless interfaces, and tokenisation involves investment in infrastructure, hardware, software, and staff training. These costs can be particularly heavy for smaller banks and merchants that operate on narrow margins.

In addition to technology investments, merchants often face fees charged by networks and issuing banks for processing card transactions. These fees can reduce profit margins and make alternative payment methods more appealing for cost-sensitive businesses. Regulatory efforts to cap interchange fees in some regions have addressed parts of this issue, but fee pressures remain a deterrent in markets without such protections.

Opportunity Analysis

Growth of Contactless and Mobile Payment Solutions

The payment card technologies market has a significant opportunity in the expanding use of contactless and mobile payment solutions. Mobile wallet integrations and near field communication (NFC) technologies allow consumers to make payments quickly by tapping cards or phones at the point of sale. This convenience is encouraging wider adoption of digital payment cards and supporting the transition to more seamless checkout experiences.

Payment networks and card issuers are also enhancing tokenisation and mobile-first acceptance, which reduces fraud risk and makes digital interactions more reliable. These advancements open opportunities for technology providers to develop new products that link traditional cards with emerging payment platforms, strengthening the overall appeal of card-based transactions.

Challenge Analysis

Balancing Security and System Complexity

A persistent challenge for payment card technologies is balancing the need for robust security with the complexity of system integration and compliance. Advanced security features such as dynamic data authentication, tokenisation, and chip encryption require careful design and coordination with payment networks, issuing banks, acquirers, and merchants.

These layers of complexity increase implementation time and demand specialised expertise. At the same time, maintaining compliance with global security standards such as PCI-DSS is essential to protect cardholder data and preserve consumer trust.

Variations in enforcement and understanding of these standards can lead to gaps in protection or inconsistent adoption. Providers and users of payment card technologies must continually update systems and practices to defend against sophisticated threats while keeping the user experience smooth and friction-free.

Competitive Analysis

Leading security and card manufacturing providers such as Thales, IDEMIA, and Giesecke+Devrient play a central role in payment card technologies. Their portfolios cover EMV chips, card operating systems, and personalization services. Strong expertise in cryptography and secure elements supports compliance with global payment standards. These players benefit from long-term relationships with banks and card issuers.

Card networks and ecosystem enablers such as Visa, Mastercard, American Express, and Discover define interoperability and security frameworks. Their standards guide tokenisation, authentication, and fraud prevention across card payments. Collaboration with issuers and technology vendors strengthens ecosystem adoption. These networks support innovation in contactless, mobile-linked, and virtual card solutions.

Payment processing and terminal providers such as Fiserv, FIS, and Global Payments integrate card technologies into acquiring systems. Diebold Nixdorf, NCR, and Ingenico support acceptance infrastructure. Other vendors add regional depth and customization. This competitive landscape supports secure, scalable, and evolving payment card ecosystems.

Top Key Players in the Market

- Thales

- IDEMIA

- Giesecke+Devrient

- Gemalto

- CPI Card Group

- Visa

- Mastercard

- American Express

- Discover

- Fiserv

- FIS

- Global Payments

- Diebold Nixdorf

- NCR

- Ingenico

- Others

Future Outlook

Growth in the Payment Card Technologies market is expected to remain steady as cashless transactions continue to increase worldwide. Advancements in chip cards, contactless features, and security standards are improving transaction speed and safety.

Banks and payment networks are upgrading card infrastructure to support digital wallets and new authentication methods. Over time, stronger security, better interoperability, and integration with digital payment ecosystems are likely to support ongoing innovation and adoption.

Recent Developments

- May 2025 – Thales promoted its EMV biometric payment card with an on-card fingerprint sensor for contact and contactless payments without PIN limits. The card works with existing EMV terminals and removes contactless caps. Thales also rolled out biometric cards with Bank Pocztowy in Poland for higher security and convenience.

- January 2026 – FIS launched an industry-first platform to help issuing banks support “agentic commerce” with Visa and Mastercard. The tool lets issuers safely use AI agents with card data, aiming to cut chargebacks and false declines. It will be available to issuing clients by the end of Q1 2026.

Report Scope

Report Features Description Market Value (2025) USD 7.6 Billion Forecast Revenue (2035) USD 246.9 Billion CAGR(2025-2035) 41.60% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software & Solutions, Services), By Technology Type (Contactless Cards (NFC/RFID), EMV Chip Cards, Dual-Interface Cards, Biometric Cards), By Card Type (Credit Cards, Debit Cards, Prepaid Cards), By End-User (Banks & Financial Institutions, Retail & Hospitality, Corporates, Government & Public Sector) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thales, IDEMIA, Giesecke+Devrient, Gemalto, CPI Card Group, Visa, Mastercard, American Express, Discover, Fiserv, FIS, Global Payments, Diebold Nixdorf, NCR, Ingenico, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Payment Card Technologies MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Payment Card Technologies MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thales

- IDEMIA

- Giesecke+Devrient

- Gemalto

- CPI Card Group

- Visa

- Mastercard

- American Express

- Discover

- Fiserv

- FIS

- Global Payments

- Diebold Nixdorf

- NCR

- Ingenico

- Others