Global Passenger Ferries Market By TypeHydrofoil, Catamaran, Cruiseferry, Hovercraft, Other Types), By Design(Monohull, Multihull), By End-Use(Commercial Use, Personal Use), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 51809

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

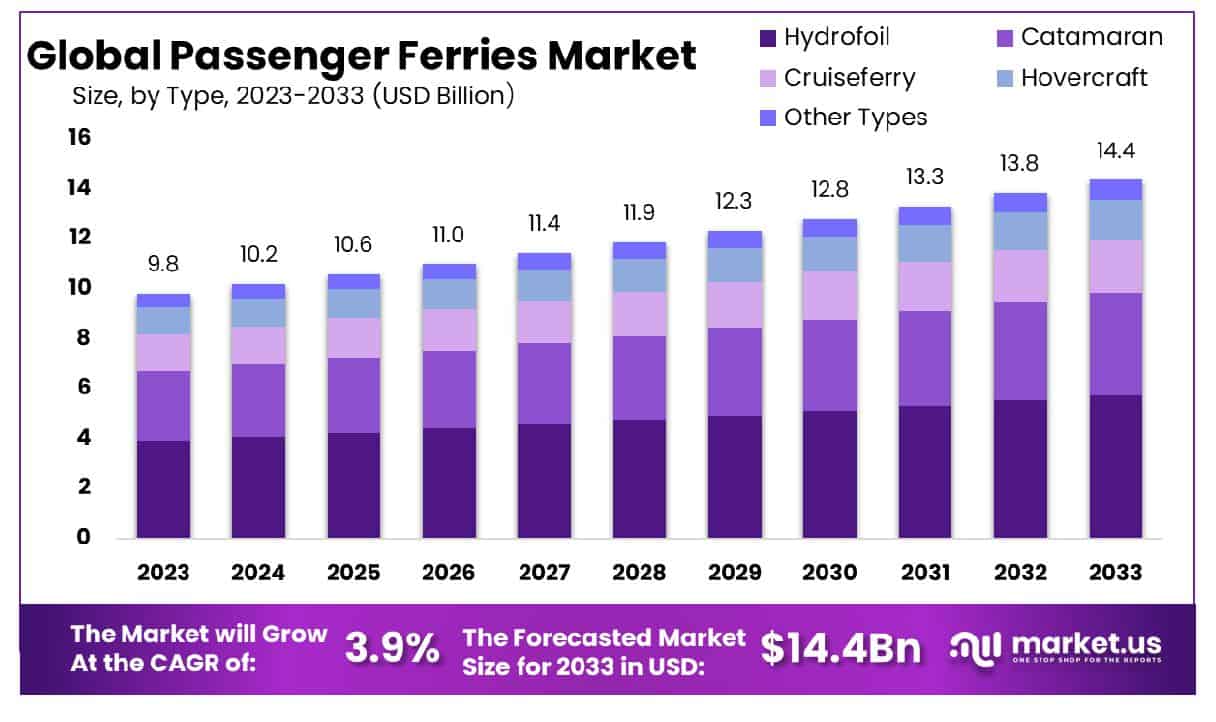

The Global Passenger Ferries Market size is expected to be worth around USD 14.4 Billion by 2033, From USD 9.8 Billion by 2023, growing at a CAGR of 3.90% during the forecast period from 2024 to 2033.

The Passenger Ferries Market encompasses a broad spectrum of maritime transportation services designed to carry individuals across water bodies, ranging from short river crossings to international voyages. This market segment is critical for facilitating global connectivity, enhancing trade and tourism, and providing essential commuting services in coastal and island regions. Operators within this sector deploy a variety of vessels, from high-speed hydrofoils to traditional ferryboats, catering to diverse passenger needs and preferences.

Strategic investments in this market are driven by advancements in safety, efficiency, and sustainability, aiming to meet the increasing demand for reliable and eco-friendly transportation solutions among passengers worldwide. Executives and product managers in the maritime, transportation, and tourism industries closely monitor developments within this market to identify growth opportunities, optimize operational efficiencies, and enhance the passenger experience.

The Passenger Ferries Market is experiencing a phase of transformation and growth, fueled by shifting consumer preferences and an increased emphasis on sustainable travel options. In the aftermath of the global pandemic, there has been a notable surge in family travel, with a remarkable 85% of families indicating plans to travel within the next 12 months.

This trend underscores a growing inclination towards leisure and exploration, with many families gravitating towards all-inclusive resorts as a means to efficiently manage travel budgets. Such dynamics suggest a broader recovery and expansion within the travel sector, with passenger ferries poised to play a pivotal role in facilitating these travel experiences.

Moreover, within the context of France, although waterway transport currently accounts for a modest share of less than 5% of the overall transport modal mix, it stands out as a significantly sustainable alternative. This modality is distinguished by its lower CO2 emissions and reduced environmental impact, marking it as a preferable option when contrasted with conventional road and rail transport methods.

The environmental advantages of waterway technology, coupled with growing consumer demand for eco-friendly travel solutions, signal a promising avenue for the expansion of the Passenger Ferries Market. This convergence of sustainability and consumer travel trends presents a unique opportunity for market players to innovate and capture value in a rapidly evolving landscape.

Key Takeaways

- Market Growth: Global Passenger Ferries Market size is expected to be worth around USD 14.4 Billion by 2033, From USD 9.8 Billion by 2023, growing at a CAGR of 3.90% during the forecast period from 2024 to 2033.

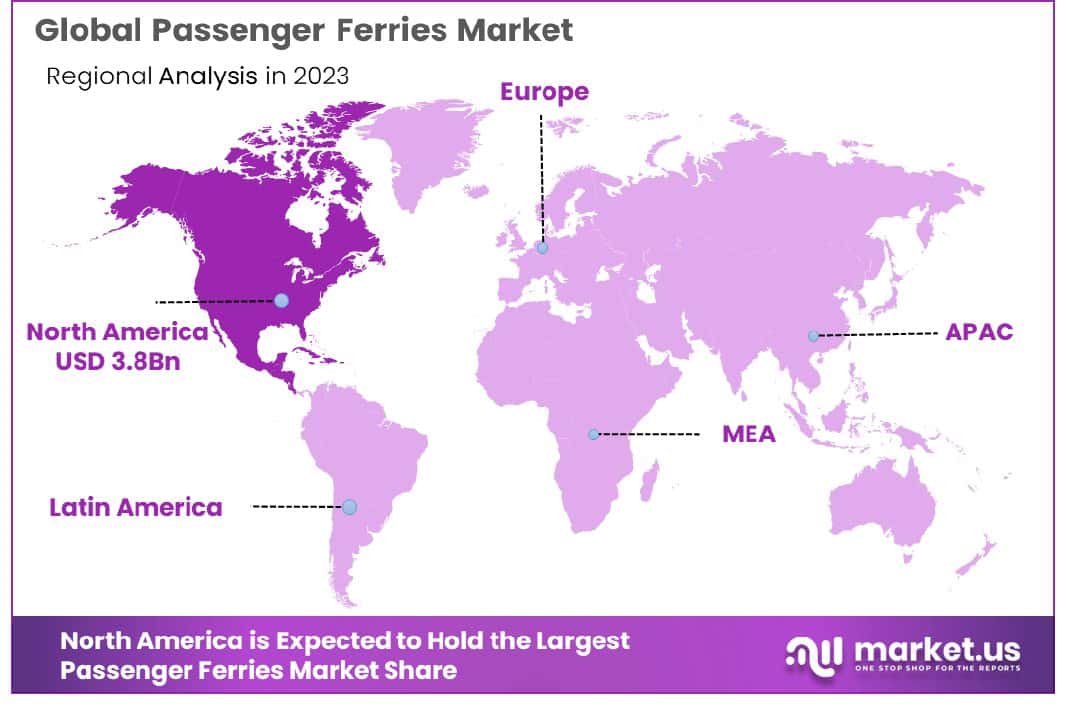

- Regional Dominance: North America holds a 39% market share in the passenger ferries market, leading globally.

- segmentation Insights:

- By Type: Hydrofoils dominate with a 40% market share in their category.

- By Design: Monohulls lead by design, holding a 64% market share.

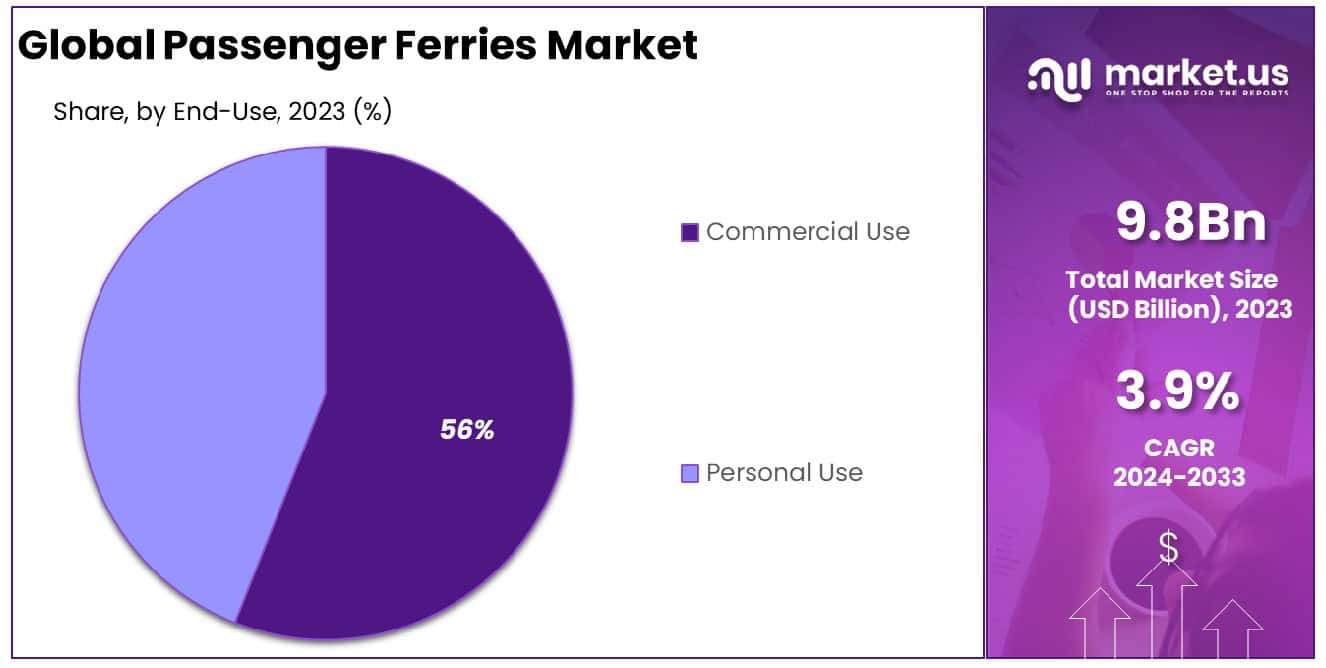

- By End-Use: Commercial use prevails, securing a 56% market share in end-use.

- Growth Opportunities: The electrification of passenger ferries and digital innovations are pivotal for sustainability and improving customer experiences, driving the sector’s growth through green technologies and enhanced operational efficiency.

Driving Factors

Sustainability and Environmental Concerns: Catalyzing Eco-Friendly Transportation

The global emphasis on sustainability and environmental concerns serves as a significant catalyst for the growth of the Passenger Ferries Market. With increasing awareness of carbon footprints and the urgent need to reduce greenhouse gas emissions, both consumers and governments are pivoting towards more eco-friendly modes of transportation. Passenger ferries, particularly those leveraging green technologies such as electric propulsion systems and LNG-fueled engines, offer a compelling alternative.

They not only contribute to a significant reduction in air and water pollution but also align with international environmental regulations and goals. This shift towards sustainable travel solutions drives demand for passenger ferries, as they become a preferred choice for eco-conscious travelers and policy-driven maritime transport strategies. The adoption of such technologies in ferries enhances their operational efficiency and environmental compatibility, positioning the market for robust growth as global sustainability efforts intensify.

Growth in Coastal and River Tourism: Boosting Demand for Passenger Ferries

The expansion of coastal and river tourism acts as a vital engine for the growth of the Passenger Ferries Market. With the global tourism industry witnessing a surge in demand for unique and accessible travel experiences, coastal and river destinations have emerged as attractive options for travelers seeking natural beauty, cultural richness, and recreational activities. This trend has led to an increased utilization of passenger ferries, serving as both a primary mode of transport to these destinations and a unique tourism experience in itself. Ferries provide an unrivaled opportunity to explore scenic waterways, coastal cities, and islands, making them integral to the tourism value chain.

As destinations invest in enhancing their tourism infrastructure and marketing their unique offerings, the demand for passenger ferries is expected to rise, further fueling market growth. This synergy between the growth in coastal and river tourism and the passenger ferry market underscores the importance of integrated transport and tourism planning to capitalize on this upward trajectory.

Restraining Factors

High Operational and Maintenance Costs

High operational and maintenance costs significantly restrain the growth of the Passenger ferry market. Operating passenger ferries involves substantial expenditures, including fuel consumption, crew salaries, maintenance, and compliance with safety and environmental regulations.

Modernizing fleets to meet environmental standards and incorporating advanced technologies for improved efficiency entails considerable investment. These high costs can limit the expansion and operational capabilities of ferry operators, particularly in regions where financial resources are scarce or where there is intense competition from alternative modes of transport.

Regulatory and Safety Challenges

The Passenger Ferries Market faces challenges related to stringent regulatory and safety requirements. Compliance with international maritime safety standards, environmental regulations, and local operational guidelines can be complex and costly. Incidents involving ferry safety have heightened

public and regulatory scrutiny, leading to more stringent enforcement of regulations. This scenario necessitates significant investment in safety measures, training, and equipment, which can be a barrier to entry for new players and a financial burden for existing operators.

By Type Analysis

The hydrofoil segment boasts a 40% market share, highlighting its significant impact on the industry.

In 2023, the Passenger ferry market witnessed a significant distribution of market shares among various types of ferries, with Hydrofoil, Catamaran, Cruiseferry, Hovercraft, and Other Types constituting the primary categories. Hydrofoil emerged as a dominant force in the “By Type” segment, capturing more than a 40% share of the market. This prominence can be attributed to its advanced technology that allows for higher speeds and reduced travel times, appealing to a broad spectrum of passengers seeking efficiency and convenience in maritime transport.

Catamarans, known for their stability and speed, also secured a substantial portion of the market, leveraging their dual-hull design to cater to passengers prioritizing comfort alongside quick travel times. Cruise ferry, offering amenities that blend transportation with leisure, attracted customers interested in more scenic and leisurely voyages, contributing to its share in the market.

Hovercraft, though a niche segment, appealed to consumers requiring access to areas where traditional ferries might not operate effectively, highlighting its unique value proposition in providing versatility and access across varied terrains. The “Other Types” category, encompassing a range of specialized ferry types, accounted for the remainder of the market share, indicating a diversity of consumer preferences and needs within the Passenger Ferries Market.

The market dynamics of the Passenger Ferries Market in 2023 underline the importance of technological innovation, passenger comfort, and operational efficiency in shaping consumer preferences and competitive positioning within the industry.

By Design Analysis

With a 64% market share, the monohull design dominates the sector, reflecting widespread preference.

In 2023, the Passenger Ferries Market witnessed a distinctive segmentation by design, with Monohull and Multihull as the primary categories. Monohull held a dominant market position in the By Design segment, capturing more than a 64% share. This significant market dominance can be attributed to the Monohull design’s proven reliability, efficiency in operations, and favorable performance in diverse maritime conditions. The inherent stability and speed offered by Monohull ferries have reinforced their preference among ferry operators and passengers alike, driving their adoption across global ferry routes.

On the other hand, the Multihull segment, although occupying a smaller portion of the market, has shown growth potential. This design is favored for its enhanced stability and spaciousness, which translates to higher passenger comfort levels and the capability to operate in varying sea conditions with reduced motion sickness. However, the higher initial construction and maintenance costs associated with Multihull designs have somewhat restrained their market penetration compared to Monohulls.

The market dynamics of the Passenger Ferries Market are influenced by factors such as technological advancements, environmental regulations, and evolving passenger preferences. The ongoing shift towards sustainability and the adoption of greener propulsion technologies are expected to impact future design preferences and market shares within the Passenger Ferries sector. As the industry moves forward, both Monohull and Multihull designs are anticipated to undergo innovations aimed at enhancing energy efficiency, reducing operational costs, and meeting stringent environmental standards, potentially altering their current market shares.

By End-Use Analysis

Commercial use leads in end-use categories, securing a 56% market share, indicating robust demand.

In 2023, the Passenger Ferries Market was significantly segmented by End-Use, with Commercial Use and Personal Use as the primary categories. Commercial Use held a dominant market position, capturing more than a 56% share. This substantial proportion underscores the pivotal role of passenger ferries in commercial transportation, facilitating not only the movement of individuals but also serving as a crucial link in the logistics and supply chains for various businesses and regions. On the other hand, Personal Use, although smaller in comparison, represented an essential segment, reflecting the growing interest in private ferry operations for leisure, tourism, or exclusive transport services.

The prominence of Commercial Use can be attributed to several factors. Firstly, the increasing global tourism and the inherent need for efficient and accessible transport options have bolstered the demand for commercial ferry services. Furthermore, the strategic emphasis on sustainable and eco-friendly transportation methods has propelled the adoption of passenger ferries, known for their lower carbon footprint relative to other transportation modalities. Additionally, government initiatives and investments in maritime infrastructure have significantly facilitated this segment’s growth, enhancing service availability and operational efficiency.

Conversely, the Personal Use segment, while smaller, indicates a niche but growing interest among individuals and private entities. This interest is driven by the desire for personalized travel experiences, the luxury of private transport, and in some cases, the operational flexibility offered by owning or chartering personal ferries. As environmental consciousness and the value of unique travel experiences continue to rise, this segment is poised for gradual growth.

Key Market Segments

By Type

- Hydrofoil

- Catamaran

- Cruiseferry

- Hovercraft

- Other Types

By Design

- Monohull

- Multihull

By End-Use

- Commercial Use

- Personal Use

Growth Opportunities

Electrification and Sustainable Innovations

The push towards sustainability and reduced carbon emissions has placed the electrification of passenger ferries at the forefront of growth opportunities. Innovations in electric propulsion technologies are not only enhancing operational efficiency but also aligning with global environmental regulations and consumer preferences for greener alternatives. Investment in electric and hybrid ferries, coupled with the development of charging infrastructure at ports, is poised to redefine maritime transport.

This shift towards sustainability can be attributed to increasing regulatory pressures and a growing societal commitment to environmental stewardship. Companies that leverage these trends by innovating in electric ferries and sustainability practices are expected to gain a competitive edge.

Enhanced Customer Experience through Digitalization

The digital transformation within the passenger ferries sector presents a significant opportunity to enhance the customer experience and operational efficiency. Implementing advanced digital solutions such as online ticketing systems, onboard connectivity, and real-time tracking technologies not only meets the evolving expectations of passengers but also optimizes fleet management and operations.

The integration of Internet of Things (IoT) devices and data analytics can further streamline operations and personalize the passenger experience. The growth of the market can be attributed to the increasing demand for convenience and efficiency by passengers, which, in turn, drives the adoption of digital technologies in the maritime industry.

Latest Trends

Electrification and Sustainable Practices

The global passenger ferries market has witnessed a significant shift towards sustainability, underscored by the growing adoption of electrification and green technologies. This trend is driven by escalating environmental concerns and stringent regulatory standards aimed at reducing carbon emissions.

Market leaders are increasingly investing in electric ferries and hybrid models, leveraging advances in battery technology and renewable energy integration. The adoption of sustainable practices not only enhances operational efficiency but also positions companies as responsible stewards of the environment. Consequently, the market is experiencing a paradigm shift, with sustainability becoming a core component of competitive strategy and consumer preference.

Digitalization and Enhanced Passenger Experience

In parallel, the industry is embracing digitalization, reshaping the passenger experience through technological innovations. The integration of advanced digital platforms for mobile ticketing, onboard services, and real-time tracking systems has elevated the consumer experience, offering convenience and efficiency.

Furthermore, the deployment of Internet of Things (IoT) technology and data analytics tools enables operators to optimize route planning, maintenance schedules, and operational efficiency. This trend reflects a broader industry movement towards customer-centric solutions, where technological advancements are leveraged to meet evolving passenger expectations and operational challenges.

Regional Analysis

North America holds a 39% market share in the passenger ferries market.

The global passenger ferries market exhibits significant regional diversity, influenced by geographic, economic, and infrastructural factors across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In North America, the market commands a dominant 39% share, propelled by extensive coastal areas, significant investments in green ferry technologies, and a robust tourism sector. Europe follows closely, with a strong emphasis on sustainable and efficient maritime transport, driven by stringent environmental regulations and the high density of navigable rivers and seas.

The Asia Pacific region is witnessing rapid growth due to escalating urbanization, increasing disposable incomes, and substantial government investments in maritime infrastructure. The proliferation of high-speed ferries and the enhancement of regional connectivity underscore this region’s expansion. Meanwhile, the Middle East & Africa region, though smaller in comparison, is experiencing growth through strategic developments aimed at boosting tourism and improving interconnectivity among the Gulf countries. Latin America, with its extensive river systems and coastal cities, presents a growing market, albeit with challenges related to infrastructure and economic variability.

The dominance of North America in the market can be attributed to advanced technological adoption and a high volume of passenger traffic, which are essential drivers. Europe’s focus on sustainability positions it as a critical player, reflecting the global shift towards environmentally friendly transport solutions. The Asia Pacific’s significant growth potential indicates a future shift in market dynamics, potentially challenging North America’s leading position. Collectively, these regional markets contribute to a diverse and dynamic global landscape, reflecting varied growth drivers and opportunities within the passenger ferries sector.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global passenger ferries market showcased significant developments, largely influenced by the operational strategies and innovations of key players. Mitsubishi Shipbuilding Co., Ltd., renowned for its technological prowess and sustainable shipbuilding practices, continued to set standards in the production of eco-friendly and energy-efficient ferries. This aligns with the industry’s shift towards greener solutions in response to global environmental concerns.

MEYER WERFT GmbH & Co. KG, with its rich heritage and forward-looking approach, emphasized custom-built, high-tech passenger ferries. Their focus on digital innovation and passenger comfort has enabled them to maintain a competitive edge in the luxury segment of the market.

HD Hyundai Heavy Industries Co., Ltd., part of the HD Hyundai group, leveraged its extensive experience in shipbuilding to enhance its offerings in the ferry market. The company’s focus on smart ship solutions represents a significant step towards the digitization of maritime transport.

Fincantieri S.p.A., an Italian shipbuilding giant, continued to expand its global footprint with its wide range of high-capacity and sophisticated ferries. Their commitment to research and development has been pivotal in advancing ferry design and functionality.

Damen Shipyards Group recognized for its modular shipbuilding approach, offered flexible and cost-effective solutions that cater to the diverse needs of ferry operators. Their ability to deliver customized ferries swiftly has bolstered their market position.

Samsung Heavy Industries Co., Ltd., and STX France, both exhibited robust capabilities in constructing large and technologically advanced ferries, indicating their strategic emphasis on innovation and safety.

Austal Limited, specializing in aluminum ships, capitalized on the growing demand for high-speed and lightweight ferries. Their expertise in trimaran technology has set new benchmarks for efficiency and performance in the sector.

Navantia and EFINOR ALLAIS, although smaller compared to their counterparts, demonstrated remarkable agility and specialization in serving niche markets within the passenger ferries segment.

Market Key Players

- Mitsubishi Shipbuilding Co., Ltd.

- MEYER WERFT GmbH & Co. KG

- HD Hyundai Heavy Industries Co., Ltd.

- Fincantieri S.p.A.

- Damen Shipyards Group

- Samsung Heavy Industries Co., Ltd.

- STX France

- Austal Limited

- Navantia

- Mitsubishi Shipbuilding Co., Ltd.

- EFINOR ALLAIS

Recent Development

- In March 2024, HAV Design won a contract to develop four zero-emission, autonomous ferries for Fjord1, enhancing Norway’s green ferry industry with innovative technology for the Lavik–Oppedal route.

- In March 2024, The Isle of Man Steam Packet Company announced planned servicing for the Manxman ferry’s evacuation system, affecting its schedule, with the Ben-my-Chree or Manannan as replacements during March and April.

- In February 2024, The Maritime Industry Authority (Marina) celebrates its 50th anniversary with the Marina Boat Design Contest to innovate ferry designs for Laguna Lake, Pasig River, and Manila Bay, enhancing Philippine maritime efficiency and sustainability.

- In February 2024, The Washington State Department of Transportation (WSDOT) oversees the evolution of public transportation, focusing on modernization, integration, and sustainability across buses, ferries, light rail, and more, addressing challenges with innovative solutions.

- In February 2024, Associated British Ports (ABP) secured a marine license for a cutting-edge passenger boarding facility at Plymouth’s Millbay Ferry Terminal, combining engineering innovation with environmental stewardship to protect the Allis Shad species.

- In December 2023, AYK Marine Batteries, led by Chris Kruger, achieved success with innovative LFP technology, securing major contracts with Wärtsilä and Siemens, expanding production in China, and planning U.S. and European factory expansions.

Report Scope

Report Features Description Market Value (2023) USD 9.8 Billion Forecast Revenue (2033) USD 14.4 Billion CAGR (2024-2033) 3.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type Hydrofoil, Catamaran, Cruiseferry, Hovercraft, Other Types), By Design(Monohull, Multihull), By End-Use(Commercial Use, Personal Use) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Mitsubishi Shipbuilding Co., Ltd., MEYER WERFT GmbH & Co. KG, HD Hyundai Heavy Industries Co., Ltd., Fincantieri S.p.A., Damen Shipyards Group, Samsung Heavy Industries Co., Ltd., STX France, Austal Limited, Navantia, Mitsubishi Shipbuilding Co., Ltd., EFINOR ALLAIS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Passenger Ferries Market in 2023?The Passenger Ferries Market size is USD 9.8 Billion in 2023.

What is the projected CAGR at which the Passenger Ferries Market is expected to grow at?The Passenger Ferries Market is expected to grow at a CAGR of 3.90% (2024-2033).

List the segments encompassed in this report on the Passenger Ferries Market?Market.US has segmented the Passenger Ferries Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type Hydrofoil, Catamaran, Cruiseferry, Hovercraft, Other Types), By Design(Monohull, Multihull), By End-Use(Commercial Use, Personal Use)

List the key industry players of the Passenger Ferries Market?Mitsubishi Shipbuilding Co., Ltd., MEYER WERFT GmbH & Co. KG, HD Hyundai Heavy Industries Co., Ltd., Fincantieri S.p.A., Damen Shipyards Group, Samsung Heavy Industries Co., Ltd., STX France, Austal Limited, Navantia, Mitsubishi Shipbuilding Co., Ltd., EFINOR ALLAIS

Name the key areas of business for Passenger Ferries Market?The US, Canada, Mexico are leading key areas of operation for Passenger Ferries Market.

-

-

- Mitsubishi Shipbuilding Co., Ltd.

- MEYER WERFT GmbH & Co. KG

- HD Hyundai Heavy Industries Co., Ltd.

- Fincantieri S.p.A.

- Damen Shipyards Group

- Samsung Heavy Industries Co., Ltd.

- STX France

- Austal Limited

- Navantia

- Mitsubishi Shipbuilding Co., Ltd.

- EFINOR ALLAIS