Global Partyline Intercom Systems Market By Type (Wired Partyline Intercom Systems, Wireless Partyline Intercom Systems), By Component (Hardware, Software, Services), By Application (Broadcast, Live Events, Security & Surveillance, Others), By End-User (Media & Entertainment, Corporate, Others), By Distribution Channel (Direct Sales, Distributors/Resellers, Online Stores, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169849

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Type

- By Component

- By Application

- By End-User

- By Distribution Channel

- Reasons for Adoption

- Key Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

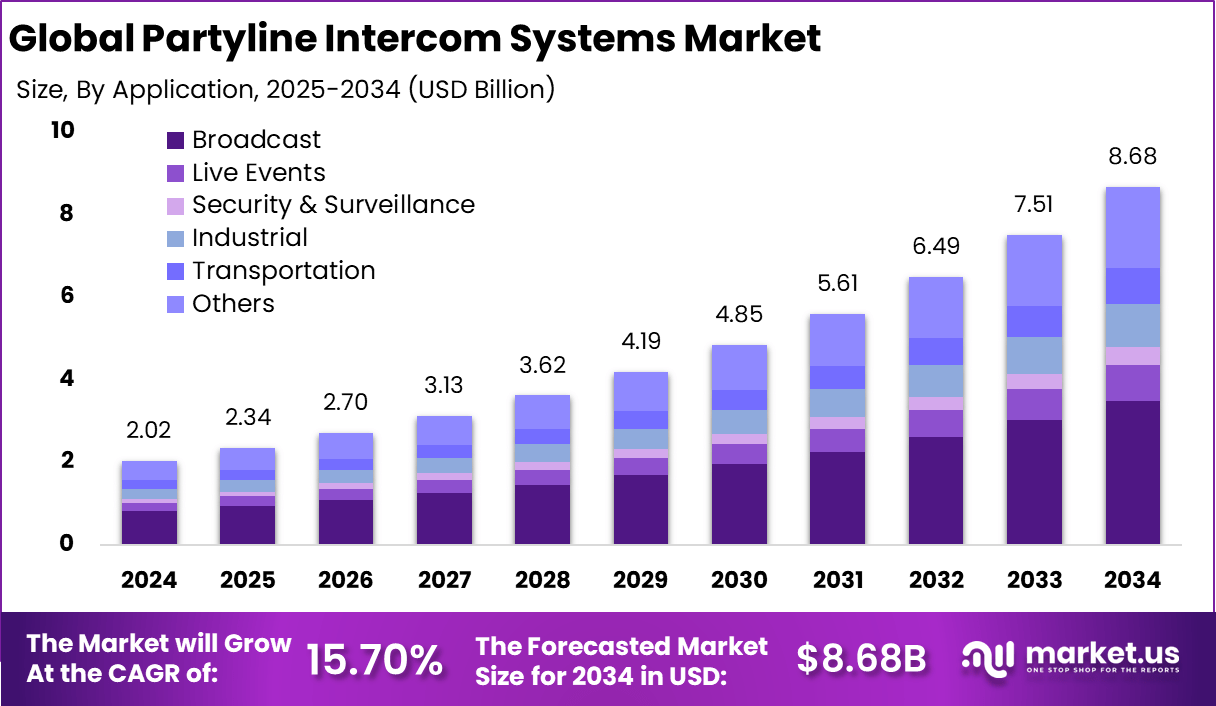

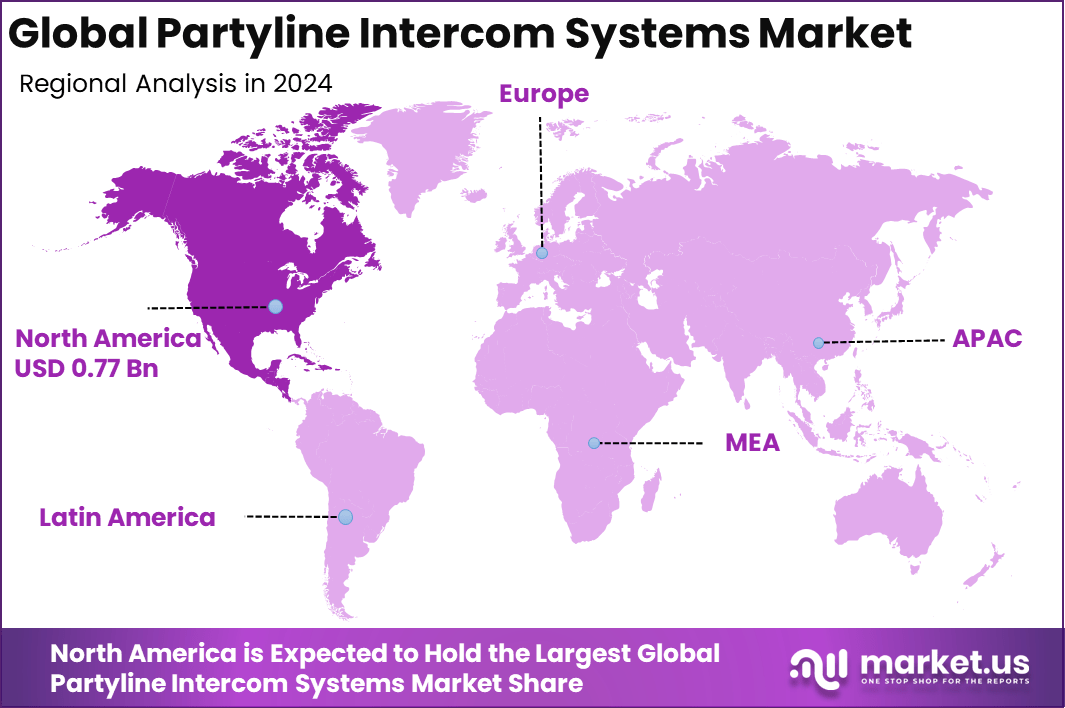

The Global Partyline Intercom Systems Market generated USD 2.02 billion in 2024 and is predicted to register growth from USD 2.34 billion in 2025 to about USD 8.68 billion by 2034, recording a CAGR of 15.70% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.6% share, holding USD 0.77 Billion revenue.

The partyline intercom systems market has grown as industries that depend on continuous group communication move from analog lines to digital and network based systems. Growth is linked to increasing use of coordinated team operations in broadcasting, live events, aviation, industrial plants and public safety environments. Partyline systems allow many users to speak and listen within the same communication loop without call setup delays.

The growth of the market can be attributed to rising demand for reliable team communication, expansion of live production activities and increasing adoption of hands free wired and wireless communication tools. Many industries require uninterrupted voice links where teams must coordinate tasks in real time. Partyline systems support this by delivering stable, low latency communication channels.

Demand is rising across broadcast studios, event production companies, theatres, airports, manufacturing lines, security services and emergency response teams. These users rely on partyline systems to maintain constant communication during operations that involve fast coordination. Markets with high activity in live entertainment and industrial operations show the strongest demand.

Key technologies supporting adoption include digital audio transport systems, wired and wireless belt pack devices, IP based intercom routing, noise cancelling microphones, group channel management software and low latency audio processing. These technologies allow systems to operate with clear voice quality even in loud environments. Network based intercom setups also allow wider coverage across large venues or facilities.

Top Market Takeaways

- By type, wired partyline intercom systems captured 60.5% of the market, favored for their reliability in high-stakes production environments.

- By component, hardware accounted for 48.2%, essential for durable belts, headsets, and base stations in live operations.

- By application, broadcast led with 40.2%, driven by demand for clear communication in television and radio productions.

- By end-user, media and entertainment held 38.7%, supporting live events, theater, and film set coordination.

- By distribution channel, direct sales represented 45.7%, enabling customized solutions for professional production teams.

- North America accounted for 38.6% of the global market, with the U.S. valued at USD 0.67 billion in 2025 and projected to grow at a CAGR of 12.5%.

By Type

Wired partyline intercom systems account for 60.5% of the total market share, showing their strong presence across professional communication environments. This dominance is mainly supported by their stable signal quality, low interference, and reliable performance in continuous operations. These systems are widely used in broadcast studios, live events, theaters, and control rooms where uninterrupted communication is essential.

Another major factor supporting wired systems is their cost efficiency and long operational life. Once installed, these systems require limited maintenance and offer consistent audio clarity. Many production houses and event operators continue to prefer wired solutions due to their predictable performance, especially in indoor and fixed-location setups.

By Component

The hardware segment holds a 48.2% share of the market, driven by strong demand for core communication equipment such as headsets, belt packs, power supplies, and base stations. These physical components form the backbone of partyline intercom systems and are essential for system functionality and signal transmission.

Growth in this segment is also supported by frequent equipment upgrades and replacements in media production environments. As production quality standards continue to rise, demand for noise-canceling headsets, durable connectors, and compact communication units is increasing. Hardware reliability remains a critical buying factor for professional users.

By Application

Broadcast applications represent 40.2% of total market usage, making it the largest application segment. Partyline intercom systems are widely used in television studios, live news production, sports broadcasting, and outside broadcast vans. These systems enable smooth real-time coordination among directors, camera operators, sound engineers, and production teams.

The growing number of live broadcasts, sports events, and digital streaming channels continues to support this segment. As content production becomes faster and more complex, reliable voice communication systems remain essential for maintaining production efficiency and reducing on-air errors.

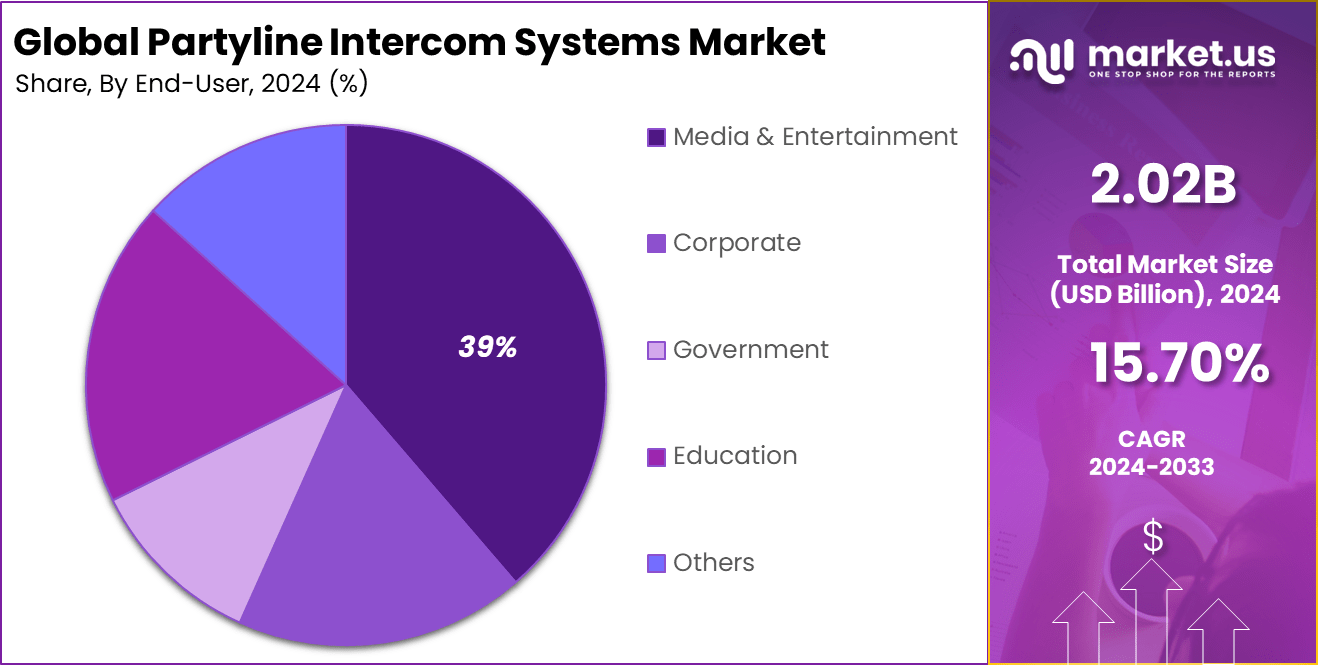

By End-User

Media and entertainment users account for 39% of the end-user share, making them the largest customer group in the market. Production houses, film studios, event management companies, and theater operators rely heavily on partyline intercom systems for smooth backstage and front-stage coordination.

Demand in this segment is further supported by the expansion of live concerts, stage shows, film production, and digital content creation. As production teams grow in size and complexity, the need for easy-to-use and dependable communication tools continues to rise across this sector.

By Distribution Channel

Direct sales contribute 45.7% of the total distribution share, showing a strong preference among buyers for direct engagement with manufacturers. Large buyers such as broadcasters and production companies often purchase directly to receive customized system setups, technical support, and installation services.

Another key advantage of direct sales is better control over pricing, warranties, and after-sales service. Customers benefit from product training, system integration support, and faster maintenance solutions. This channel remains the preferred choice for large-scale and professional buyers seeking long-term operational reliability.

Reasons for Adoption

- Broadcasters and live event organizers adopt partyline intercoms to keep entire crews on a shared channel, so everyone hears the same cues at the same time.

- These systems are attractive because they use simple cabling and hardware, which keeps upfront costs low and setup quick for production teams.

- The market grows as venues upgrade communication infrastructure and want reliable, full‑duplex voice links that work in noisy, time‑critical environments.

- Corporate facilities and industrial sites use partyline solutions to coordinate security, maintenance, and operations staff across large campuses.

- Hybrid digital and IP partyline products fit into modern broadcast and events workflows, allowing gradual migration from legacy analog setups.

Key Benefits

- Crews gain continuous, hands‑free communication, which reduces missed cues and improves timing during complex shows or sports events.

- Simple user interfaces and belt packs mean minimal training, so freelancers and rotating staff can plug in and work immediately.

- Systems are scalable, allowing additional stations or beltpacks to be added without redesigning the whole communications layout.

- Robust design and proven reliability lower the risk of downtime during live broadcasts, where communication failures are costly.

- Integration with wireless intercoms, walkie‑talkies, and IP networks lets teams blend fixed and mobile roles under a single communication layer.

Usage

- Live performance venues such as theaters, concerts, and opera houses use partyline channels to link directors, stage managers, lighting, and sound.

- Sports broadcasters rely on these systems to connect camera operators, replay operators, and producers across stadiums and mobile trucks.

- Corporate events and conferences use partyline intercoms to coordinate staging, presenters, technical crews, and floor managers.

- Industrial plants and large campuses deploy them for safety coordination, routine operations, and emergency response communication.

- Remote production and hybrid workflows use partyline-style links over IP to keep on‑site and central control room teams in constant contact.

Emerging Trends

Key Trend Description Shift to Digital IP Partyline Migration from analog to digital and IP-based partyline systems improves audio quality, scalability, and integration with broadcast and production networks. Hybrid Wired-Wireless Setups Demand grows for systems that blend traditional wired reliability with wireless belt packs and mobile apps for crowd mobility at large venues and events. Cloud-Enabled and Remote Workflows Cloud-based intercom and virtual partyline solutions support remote and distributed production teams, especially in live broadcasting and hybrid events. Integration with IP Video and IT Networks Partyline intercoms increasingly run over standard IT and IP video infrastructures, simplifying deployment and enabling centralized control and monitoring. Advanced Software-Defined Intercom Software-centric platforms add features such as live routing, recording, and multi-channel comms on a single device with unified control interfaces. Growth Factors

Key Factors Description Expansion of Live Events and Broadcasting Growth in sports, concerts, esports, and live TV production increases demand for reliable partyline communication across technical crews. Adoption of IP and Digital Communication Broadcasters and venues modernize legacy analog systems, creating replacement demand for IP-based digital partyline intercoms. Remote and Distributed Production Models Hub-and-spoke and remote production workflows require flexible, networked intercom solutions connecting teams across locations. Smart Venues and Infrastructure Investment Investments in smart stadiums, theaters, and corporate campuses drive deployment of integrated intercom as part of safety and operations systems. Need for Operational Efficiency and Safety Clear crew communication reduces operational errors and improves safety in mission-critical production environments. Key Market Segments

By Type

- Wired Partyline Intercom Systems

- Wireless Partyline Intercom Systems

By Component

- Hardware

- Software

- Services

By Application

- Broadcast

- Live Events

- Security & Surveillance

- Industrial

- Transportation

- Others

By End-User

- Media & Entertainment

- Corporate

- Government

- Education

- Others

By Distribution Channel

- Direct Sales

- Distributors/Resellers

- Online Stores

- Others

Regional Analysis

North America captures 38.6% of the global Partyline Intercom Systems market, fueled by a mature broadcasting sector, vibrant live events ecosystem, and substantial defense investments that demand reliable real-time communication. The U.S. leads as a hub for technological innovation, with major venues, studios, and military operations adopting wired and wireless solutions for seamless team coordination during stringent safety regulations.

The U.S. Partyline Intercom Systems market stands at USD 0.67 billion, growing at a CAGR of 12.5%, driven by high adoption in broadcast, theatre, sports arenas, and defense applications requiring low-latency group communications. Leading providers like Clear-Com and RTS supply IP-enabled systems integrated with IoT for large-scale events and industrial sites, supported by early wireless technology uptake. Regulatory mandates for secure operations in transportation and security sectors enhance platform deployment nationwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A primary driver is the need for uninterrupted and simultaneous communication among groups. Unlike point-to-point communication tools, partyline systems allow entire teams to listen and speak within shared channels. This supports faster decision making and reduces delays during complex tasks such as event production, facility maintenance or emergency management.

Another driver is the reliability of dedicated audio channels. Partyline systems are valued for stable performance, even in environments with limited network access or high electromagnetic interference. Many organizations continue to choose these systems because they offer predictable communication without relying on internet or cellular connections.

Restraint Analysis

A significant restraint is the cost of upgrading older analog installations to modern digital or wireless systems. Many venues and industrial sites operate legacy intercom setups. Replacing headsets, base stations and wiring can be expensive. This cost slows down adoption for smaller operators or low-budget productions.

Another restraint is limited flexibility in traditional wired partyline systems. Cabled setups restrict user movement and require time-consuming installation. This can be a drawback for temporary or fast-moving operations that need rapid deployment or frequent changes in layout.

Opportunity Analysis

There is a strong opportunity in hybrid systems that combine wired and wireless features. Many organizations seek systems that offer the reliability of wired communication with the mobility of wireless units. Providers who offer scalable hybrid platforms can appeal to a wide range of customers, from theatres to industrial facilities.

Another opportunity lies in integrating partyline systems with modern IP-based communication networks. As more venues adopt IP infrastructure, intercom systems that support IP connectivity can simplify installation and allow remote management. This capability also enables integration with other tools such as video production systems, networked audio, building control systems and safety platforms.

Competitive Analysis

Clear-Com, RTS Intercom Systems, and Riedel Communications lead the partyline intercom systems market with robust wired and wireless communication platforms used in broadcast, live events, and theater production. Their systems provide low-latency audio, high channel reliability, and scalable configurations for complex event environments. These companies focus on signal stability, rugged hardware, and seamless integration with digital audio networks.

HME, ASL Intercom, Bose, Audio-Technica, Beyerdynamic, Williams Sound, Altair, Green-GO, Eartec, and Telex strengthen the market with flexible, cost-effective intercom solutions suited for mid-sized events, houses of worship, education, and corporate AV. Their platforms support wired belt packs, wireless headsets, and IP-based communication. These providers emphasize clear audio quality, ease of deployment, and modular expansion.

Sonifex, Datavideo, Yamaha, Hollyland Technology, Pliant Technologies, Vega Global, Sennheiser, and other participants expand the ecosystem with advanced digital intercom features, expanded wireless ranges, and integration with unified communication systems. Their solutions cater to studios, e-sports, remote production, and security operations. These companies focus on enhanced audio processing, network compatibility, and multi-channel coordination.

Top Key Players in the Market

- Clear-Com

- RTS Intercom Systems

- Riedel Communications

- HME (HM Electronics)

- ASL Intercom

- Bose Corporation

- Audio-Technica

- Beyerdynamic

- Williams Sound

- Altair

- Green-GO

- Eartec

- Telex

- Sonifex

- Datavideo

- Yamaha Corporation

- Hollyland Technology

- Pliant Technologies

- Vega Global

- Sennheiser Electronic

- Others

Future Outlook

The Partyline Intercom Systems market is expected to progress as live events, broadcast productions, houses of worship, theaters, and industrial sites rely more on reliable group communication for complex operations.

Demand is shifting from purely analog lines to hybrid and digital partyline systems that work over IP networks, connect with matrix platforms, and integrate wireless beltpacks, helping crews coordinate across larger venues and multi-site productions.

Vendors are focusing on flexible, app-connected solutions that tie partyline channels into broader AV and IT infrastructures, allowing users to reuse legacy gear while gradually moving toward software-driven and cloud-linked workflows for remote production and hybrid events.

Opportunities lie in

- Development of IP-based and hybrid partyline solutions that bridge analog stations, digital matrices, and wireless systems for large live events and sports venues.

- Offering scalable systems and rental-focused packages for touring productions, festivals, and temporary installations that need fast setup and easy expansion.

- Creating software and mobile app layers on top of partyline hardware to enable remote participation, monitoring, and control for distributed production teams.

Recent Developments

- In February 2025, Clear‑Com introduced the FreeSpeak Icon beltpack and an EHX v14 software update, reinforcing a portfolio that now spans classic analog Encore partyline through to FreeSpeak wireless and Arcadia IP platforms, all designed to coexist in hybrid productions.

- In April 2025, RTS launched the NOMAD Wireless Intercom and RVOC Hybrid Cloud Solution at NAB, combining DECT‑based wireless for on‑site crews with a cloud intercom layer that can host thousands of soft keypanel and partyline users over IP, cellular or satellite links, secured with AES‑256 encryption.

Report Scope

Report Features Description Market Value (2024) USD 2.02 Bn Forecast Revenue (2034) USD 8.68 Bn CAGR(2025-2034) 15.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Wired Partyline Intercom Systems, Wireless Partyline Intercom Systems), By Component (Hardware, Software, Services), By Application (Broadcast, Live Events, Security & Surveillance, Others), By End-User (Media & Entertainment, Corporate, Others), By Distribution Channel (Direct Sales, Distributors/Resellers, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Clear-Com, RTS Intercom Systems, Riedel Communications, HME (HM Electronics), ASL Intercom, Bose Corporation, Audio-Technica, Beyerdynamic, Williams Sound, Altair, Green-GO, Eartec, Telex, Sonifex, Datavideo, Yamaha Corporation, Hollyland Technology, Pliant Technologies, Vega Global, Sennheiser Electronic, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Partyline Intercom Systems MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Partyline Intercom Systems MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Clear-Com

- RTS Intercom Systems

- Riedel Communications

- HME (HM Electronics)

- ASL Intercom

- Bose Corporation

- Audio-Technica

- Beyerdynamic

- Williams Sound

- Altair

- Green-GO

- Eartec

- Telex

- Sonifex

- Datavideo

- Yamaha Corporation

- Hollyland Technology

- Pliant Technologies

- Vega Global

- Sennheiser Electronic

- Others