Global Parking Finder Apps Market Size, Industry Analysis Report Parking Typе (On-Strееt Parking, Off-Strееt Parking, Rеsidеntial Parking, Evеnt-Spеcific Parking, Commеrcial Parking), By Application Platform (Mobilе Applications (iOS android), Wеb-Basеd Applications, In-Vеhiclе Intеgratеd Applications), By Sеrvicе Typе (Parking Rеsеrvation Sеrvicеs, Navigation and Guidancе Sеrvicеs, Paymеnt Sеrvicеs, Rеal-Timе Parking Availability Sеrvicеs, Valuе Addеd Sеrvicеs (EV Charging and Valеt, еtc.), By Paymеnt Modеl (Pay-Pеr-Usе, Subscription Basеd, Frее with Ads, In App Purchasеs), By End Usеr (Individual Drivеrs, Commеrcial Flееts, Evеnt Organizеrs, Municipal and Govеrnmеnt Agеnciеs, Privatе Parking Opеrators), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155923

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Investment and Business Benefits

- U.S. Market Size

- Parking Type Analysis

- Application Platform Analysis

- Sеrvicе Typе Analysis

- Paymеnt Modеl Analysis

- End Usеr Analysis

- Key Market Segments

- By Parking Typе

- Top Growth Factors

- Key Trends and Innovations

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

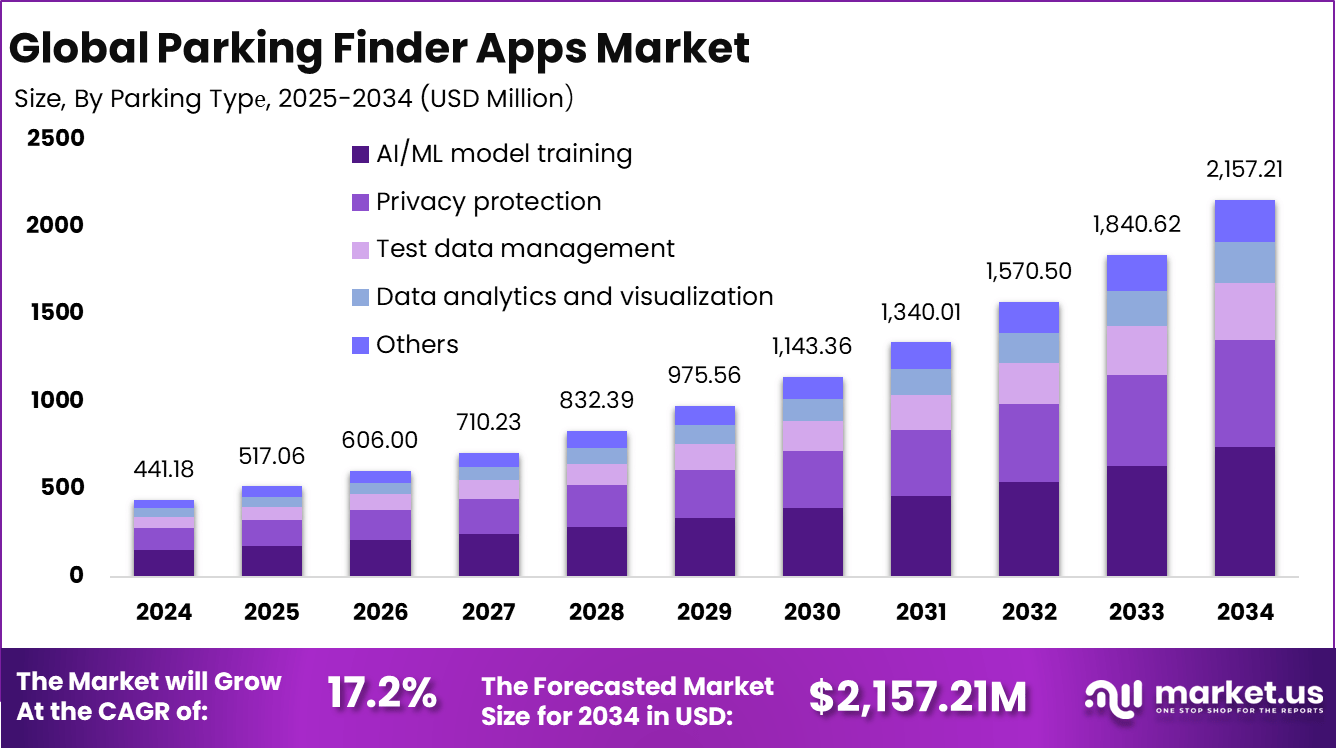

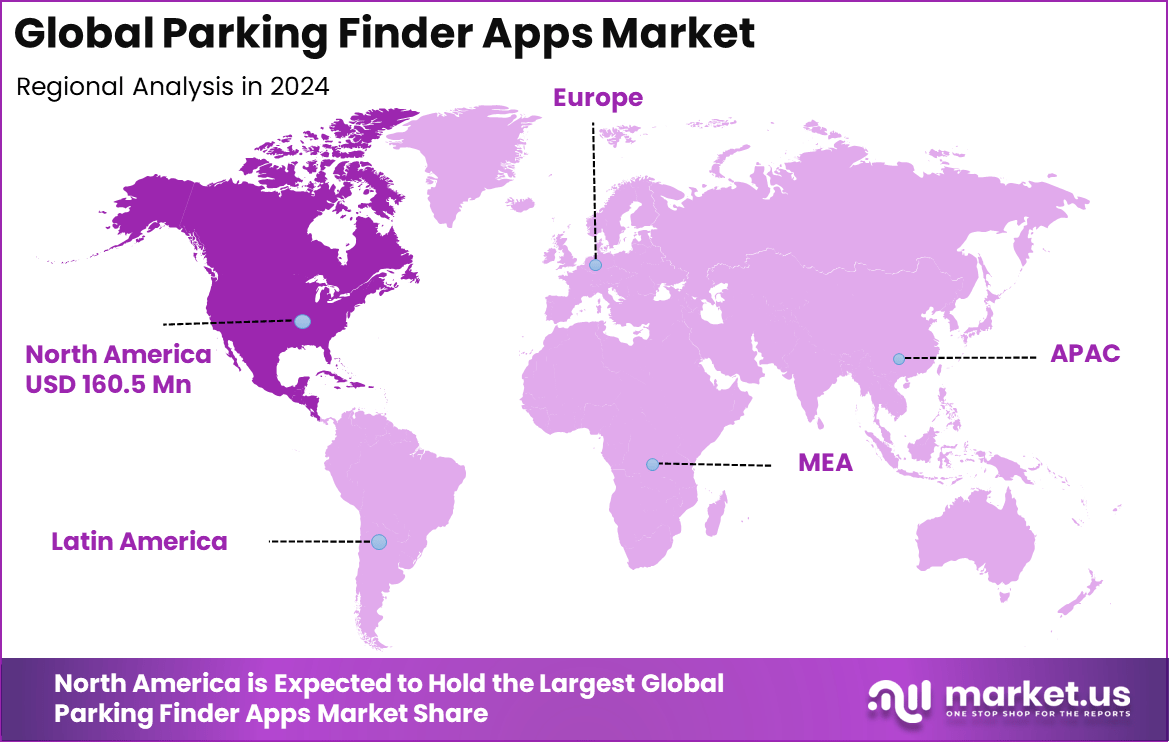

The Global Parking Finder Apps Market size is expected to be worth around USD 2,157.21 million by 2034, from USD 441.18 million in 2024, growing at a CAGR of 17.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.4% share, holding USD 160.5 million in revenue.

The parking finder apps market covers software that helps drivers locate, reserve, and pay for parking spaces through mobile devices. These apps typically rely on GPS, sensors, or mapping systems to guide users to available spots and often include features like reminders, in‑app payments, or booking options. Their use has grown notably in urban areas where parking is scarce and demand is high.

According to Gitnux, nearly 30% of urban traffic is caused by drivers searching for parking, reflecting a critical inefficiency in city transport systems. With the average parking fee in New York City at approximately $645 per month, the cost burden on drivers remains substantial. At any given time, about 10% of the global vehicle fleet is parked, highlighting the vast land use dedicated to idle vehicles.

Automated parking systems can reduce parking space needs by up to 50%, while smart parking solutions are capable of cutting search time by 40%, easing congestion and improving flow. In the United States, the parking industry generates over $20 billion annually, showcasing both the scale of the problem and the financial potential of efficient parking innovations.

The top driving factors for this market include the rapid growth of urban populations and increased vehicle density, which create severe parking challenges, especially in metropolitan areas. Governments and municipalities are pushing smart city initiatives that integrate these apps with city infrastructure to streamline traffic flow and enhance compliance with parking regulations.

For instance, in February 2025, Parkin Company PJSC, Dubai’s largest provider of paid public parking services, launched an advanced mobile app to enhance the parking experience for residents and visitors. The app features real-time parking finders, wallet management, automatic payments via ANPR technology, and scheduling options.

Key Takeaway

- On-street parking led with 34.4% share, supported by high demand in urban areas with limited parking spaces.

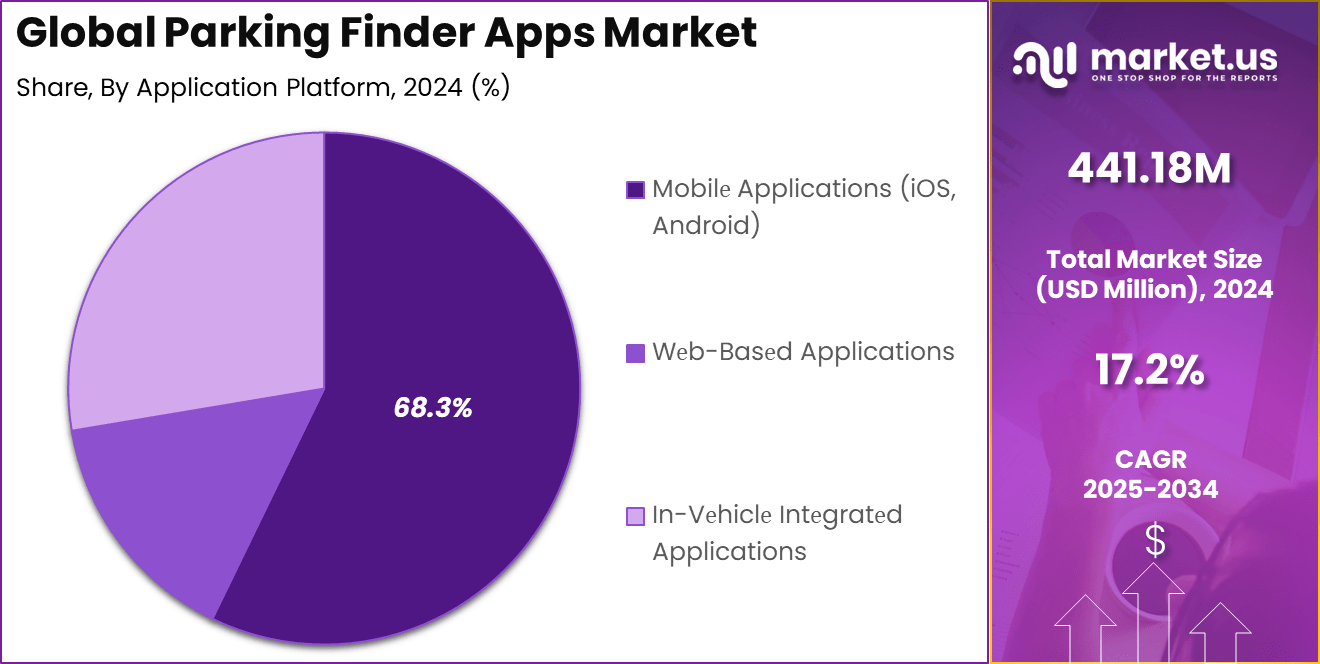

- Mobile applications (iOS & Android captured 68.3% share, as users preferred easy-to-use apps with real-time updates.

- Real-time parking availability services held 28.5% share, reflecting the growing importance of instant parking information.

- Pay-per-use dominated with 40.1% share, showing that flexible, usage-based pricing is favored by drivers.

- Individual drivers accounted for 56.7% share, as personal vehicle owners remained the largest user base of parking apps.

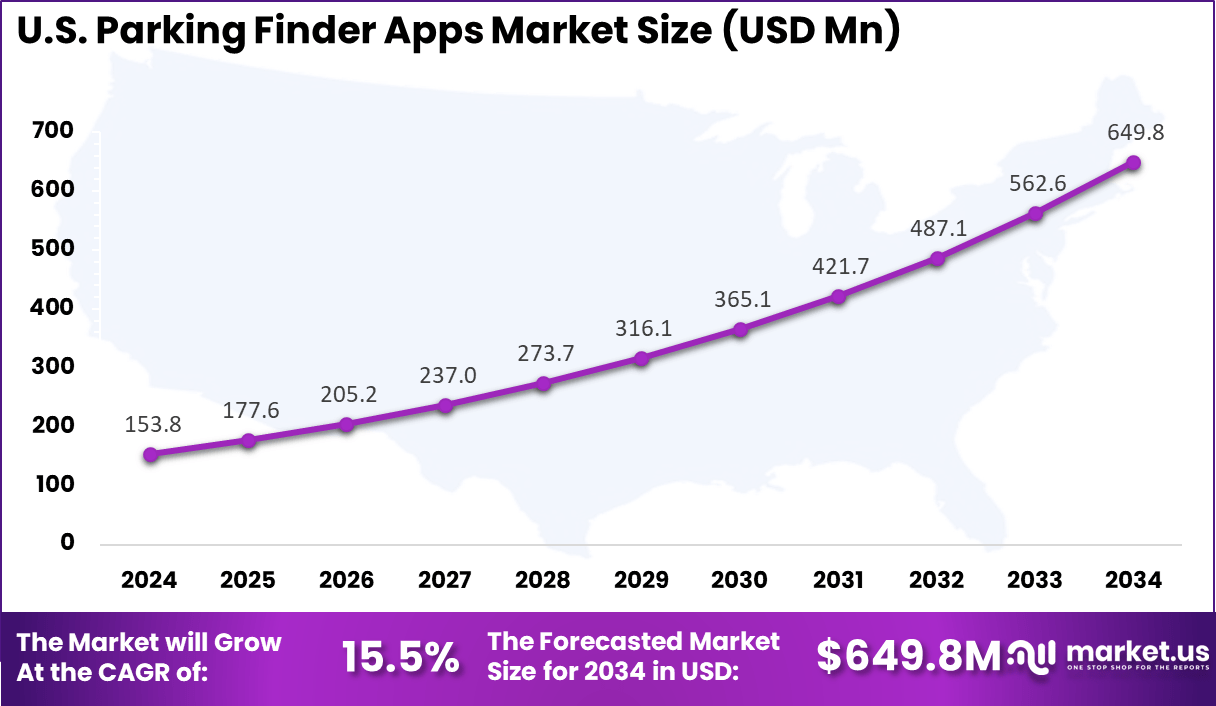

- The U.S. market reached USD 153.8 Million in 2024, expanding at a strong 15.5% CAGR.

- North America captured 36.4% share, driven by high smartphone penetration, advanced mobility infrastructure, and strong adoption of digital parking solutions.

Investment and Business Benefits

Investment opportunities in the parking finder apps market are promising, particularly in regions with accelerating urban development and digital infrastructure investment. Developers focusing on improving app user experience with predictive analytics, integrating with smart city platforms, and expanding functionalities such as EV charger locators and reservation capabilities are positioned well for growth.

From a business perspective, parking finder apps deliver several benefits. They improve operational efficiency for parking lot owners by optimizing space usage and reducing revenue leakage from unauthorized parking. Offering drivers real-time parking availability reduces time spent searching, saving fuel and decreasing traffic congestion.

The apps enhance customer satisfaction through convenience, enabling features like instant booking and cashless payments. Integration with urban mobility solutions supports smoother traffic management and promotes sustainable city planning. These benefits result in cost savings, better asset utilization, and improved urban mobility.

The regulatory environment encompasses data privacy, payment security, and local transportation regulations. Compliance with national and international standards governing digital payments, personal data handling, and IoT device usage is vital for app developers and service providers. Collaboration with public authorities ensures apps align with traffic management policies and parking regulations. As such, regulatory frameworks encourage secure, interoperable systems that protect users and support broader smart city goals.

U.S. Market Size

The market for Parking Finder Apps within the U.S. is growing tremendously and is currently valued at USD 153.8 million, the market has a projected CAGR of 15.5%. The market is growing tremendously due to rapid urbanization, increasing traffic congestion, and a rise in car ownership. As cities become more crowded, the demand for efficient parking solutions has surged.

Additionally, the widespread use of smartphones and GPS technology makes parking apps highly accessible and convenient for users. Government investments in smart city initiatives and the adoption of contactless payment methods also contribute to the growing popularity and reliance on these apps for daily parking needs.

For instance, in August 2023, the University of Texas at Arlington (UTA) launched a new parking app, highlighting the continued growth and dominance of the U.S. in the parking finder apps market. The app aims to streamline parking for students, staff, and visitors by providing real-time space availability, reducing congestion and frustration.

In 2024, North America held a dominant market position in the Global Parking Finder Apps Market, capturing more than a 36.4% share, holding USD 160.5 million in revenue. The market is growing due to factors like rapid urbanization, high car ownership, and robust technological infrastructure. The widespread use of smartphones, GPS, and AI technologies has made parking apps widely accessible.

The integration of IoT, AI, and real-time data analytics improves space efficiency and reduces congestion. Strong government backing, numerous partnerships with parking providers, and high smartphone adoption drive further market expansion.

For instance, in February 2025 partnership between ParkMobile and the City of Baltimore to implement a city-wide parking platform exemplifies North America’s dominance in the Parking Finder Apps market. ParkMobile’s digital solution allows drivers to reserve off-street parking and pay for on-street spaces across 11,000 spots in Baltimore’s Central Business District.

Parking Type Analysis

In 2024, On-street parking accounts for 34.4% of the Parking Finder Apps market, reflecting the high demand for easily accessible parking spots in urban areas. These apps help drivers locate available spaces along streets, reducing time spent searching and easing traffic congestion caused by circling for parking.

The convenience of real-time data and navigation support enhances user experience and makes on-street parking more manageable. This segment is driven by growing urbanization and the increasing number of vehicles in city centers.

For Instance, In August 2025, Q Mobility announced its plan to develop advanced parking solutions in Khalifa Economic Zones Abu Dhabi (KEZAD). The initiative focuses on improving on-street parking management to meet the rising demand in urban areas. By using modern technologies, the company aims to optimize space utilization and make it easier for drivers to find available parking, thereby enhancing overall efficiency.

Application Platform Analysis

In 2024, Mobile applications dominate this market with 68.3% share, as smartphones provide the most convenient and widely accessible platform for parking finder services. iOS and Android apps offer users instant access to parking information, interactive maps, and booking options on the go.

The ubiquity of mobile devices and advancements in app features such as GPS integration and user-friendly interfaces have significantly contributed to the growth and adoption of parking finder solutions through mobile platforms.

For instance, in February 2025, Parkin launched an advanced mobile app designed to enhance the parking experience. The app uses cutting-edge technology to help users quickly locate available parking spaces, reducing the time spent searching for parking. It aims to optimize parking management, improve traffic flow, and offer a more seamless and user-friendly experience.

Sеrvicе Typе Analysis

In 2024, The Real-Time Parking Availability Services segment held a dominant market position, capturing a 28.5% share of the Global Parking Finder Apps Market. This dominance is due to the increasing need for immediate and accurate parking information in busy urban areas.

Real-time data helps users quickly find available spots, reducing the time spent searching for parking and minimizing congestion. The integration of GPS and IoT technologies has made these services more reliable and efficient, further boosting their popularity and demand within the parking app market.

For Instance, in December 2024, SV Infotech Software Solutions launched a real-time parking app for Mussoorie, aimed at improving parking management in the popular hill station. The app provides users with up-to-date information on available parking spaces, helping to reduce congestion and enhance the overall visitor experience.

Paymеnt Modеl Analysis

In 2024, the pay-per-use model holds a leading 40.1% share in the Parking Finder Apps market. This pay-as-you-go approach is attractive to users who prefer flexibility without a long-term commitment or subscription fees. Users are charged only for the actual duration of parking, which provides cost transparency and convenience.

This payment model aligns well with the unpredictability of parking needs for individual drivers and encourages wider adoption by lowering barriers to entry. Pay-per-use systems also integrate smoothly with mobile payment methods, facilitating seamless transactions.

For Instance, in April 2025, Saugerties, New York, introduced an app-based parking solution for its business district, featuring a Pay-Per-Use model. This approach allows visitors to pay only for the time they park, offering flexibility and convenience. The app helps users find available parking spaces in real time, streamlining the parking experience in a busy area.

End Usеr Analysis

In 2024, Individual drivers form the largest user base for parking finder apps, accounting for 56.7% of the market. These users benefit most from the apps’ ability to reduce the time and stress associated with locating parking, especially in urban and high-traffic environments. Convenience, cost savings, and real-time updates are key reasons for the high adoption among personal vehicle owners.

The growth in private car ownership combined with increasing smartphone penetration supports continued expansion of the individual driver segment. Apps tailored to meet the needs of this group focus on ease of use, accurate availability data, and simple payment options.

For Instance, in June 2025, Ocean City launched a new “Parking Spot Finder” app aimed at helping individual drivers find available parking spaces more easily in the crowded city. With the increasing number of visitors and residents in urban areas, this app offers real-time parking availability, allowing drivers to save time and reduce frustration.

Key Market Segments

By Parking Typе

- On-Strееt Parking

- Off-Strееt Parking

- Rеsidеntial Parking

- Evеnt-Spеcific Parking

- Commеrcial Parking

By Application Platform

- Mobilе Applications (iOS, Android)

- Wеb-Basеd Applications

- In-Vеhiclе Intеgratеd Applications

By Sеrvicе Typе

- Parking Rеsеrvation Sеrvicеs

- Navigation and Guidancе Sеrvicеs

- Paymеnt Sеrvicеs

- Rеal-Timе Parking Availability Sеrvicеs

- Valuе Addеd Sеrvicеs (EV Charging and Valеt, еtc.)

By Paymеnt Modеl

- Pay-Pеr-Usе

- Subscription-Based

- Frее with Ads

- In App Purchasеs

By End Usеr

- Individual Drivеrs

- Commеrcial Flееts

- Evеnt Organizеrs

- Municipal and Govеrnmеnt Agеnciеs

- Privatе Parking Opеrators

Top Growth Factors

Growth Factor Description Rising Urbanization Increased vehicle ownership and traffic congestion drive demand for parking solutions Smart City Initiatives Integration with IoT, local government partnerships, and smart infrastructure Digital Payments Adoption Shift to cashless, app-based seamless parking payment systems EV and Alternative Vehicles Inclusion of EV charger locations in parking apps expands user base Real-Time Data & AI Analytics AI-driven prediction models improve parking space availability and route optimization Key Trends and Innovations

Trend/Innovation Description AI & Predictive Analytics Forecast parking availability and optimize routing IoT and Sensor Integration Real-time monitoring of parking space occupancy Multi-Platform Compatibility Support for Android and iOS with seamless user experience EV Charger Location Integration Apps featuring electric and alternative vehicle charging spots MaaS (Mobility as a Service) Integration Connecting parking apps with public transportation and mobility platforms Gamification & Rewards Incentives for eco-friendly parking choices Drivers

Increasing Urbanization and Vehicle Ownership

Urbanization combined with rising vehicle ownership in metropolitan areas is a primary driver fueling the demand for parking finder apps. As more people move to cities and own personal vehicles, the scarcity of parking spaces becomes acute. This situation makes it increasingly challenging for drivers to locate convenient parking, prompting them to turn to digital solutions that provide location-based parking availability.

Parking apps respond to this pain point by offering real-time updates, reservation capabilities, and digital payments, which alleviate the stress and time spent circling for parking. Moreover, cities investing in smart infrastructure and mobility solutions amplify the adoption of these apps, as governments partner with private operators to manage limited parking resources better and reduce traffic congestion caused by vehicles searching for parking.

For instance, in February 2025, Parkin launched an advanced mobile app aimed at enhancing the parking experience in response to increasing urbanization. As cities become more crowded, finding parking becomes a challenge. The app uses advanced technology to help users locate available parking spaces quickly, reducing time spent searching and easing traffic congestion.

Restraint

Data Accuracy and Real-Time Integration Challenges

A key restraint limiting the parking finder app market’s growth is the challenge of obtaining accurate, reliable real-time data. The apps must integrate data from diverse sources such as parking meters, sensors, cameras, and GPS systems, all of which may have varying formats and update intervals. Inaccurate or delayed information can frustrate users who rely on the app to find vacant spots promptly.

Ensuring seamless real-time data integration is technically complex, especially in crowded urban environments where parking occupancy frequently changes. This issue can lead to outdated availability displays, undermining user trust and app credibility. Overcoming this hurdle requires advanced data management frameworks and continuous collaboration with multiple data providers to maintain up-to-date parking status.

For instance, in December 2024, Adelaide’s introduction of digital parking machines raised privacy concerns, as they collect data to optimize parking. Parking finder apps also rely on location tracking, prompting fears over data misuse. Users are wary of how their information is stored and used, making strong data protection essential for the wider adoption of such technologies.

Opportunities

Expanding Features for Electric Vehicle (EV) Charging and Seamless Payments

The evolving landscape of urban transportation offers parking finder apps new avenues for growth by expanding feature sets beyond simple parking location services. One promising opportunity lies in integrating EV charging station locators, as electric vehicles gain market share. Offering drivers the ability to find and reserve parking spots with charging capabilities adds significant value and addresses a growing segment’s needs.

Additionally, incorporating frictionless in-app payment systems enhances the user experience by simplifying transactions and eliminating the need for physical payment methods or parking meters. Partnerships with municipalities and private parking operators to enable features like dynamic pricing, reservations, and loyalty programs open additional revenue streams and user engagement possibilities.

For instance, in September 2024, Clever and APCOA partnered to expand their electric vehicle (EV) charging network in Denmark, an example of the growing trend of integrating EV charging stations into parking finder apps. This collaboration aims to enhance the accessibility of charging infrastructure, providing EV drivers with real-time information on available charging spots.

Challenges

Balancing Privacy Concerns and Location Data Usage

A critical challenge parking finder apps face is managing user privacy while utilizing sensitive location data to provide personalized and accurate parking solutions. Drivers expect real-time location tracking for navigation and availability updates, but this often raises concerns about data security and how personal information is used, stored, or shared.

App developers must navigate stringent privacy regulations and build transparent policies that reassure users without compromising on service quality. Providing users control over their data and adopting robust security measures is essential to maintaining trust. Failure to address these privacy challenges can lead to legal issues, user attrition, and damage to brand reputation in an increasingly vigilant digital ecosystem.

For instance, in November 2024, the Virginia Department of Transportation (VDOT) began testing real-time updates on parking demand at commuter lots, highlighting the challenges of maintaining accurate, up-to-date parking information. This initiative involves using technology to track parking space availability, providing commuters with live data on spot occupancy.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Parking Finder Apps Market, leading players such as ParkMobile, LLC, SpotHero, Inc., ParkWhiz, Inc., and PayByPhone Technologies, Inc. are recognized for their strong user bases and innovative digital parking solutions. These companies have established themselves by offering real-time parking availability, easy payment systems, and integration with smart mobility platforms.

Other notable contributors include Passport Labs, Inc., Parkopedia Ltd., Inrix, Inc., BestParking, Streetline, and ParkMe, which are expanding the ecosystem of digital parking. Their focus lies in data-driven solutions, mapping services, and predictive analytics to improve parking efficiency. By leveraging connected technologies and partnerships with city municipalities, these companies are creating advanced platforms that optimize both driver experience and space utilization.

Emerging participants such as Parking Mate, Parking Panda, JustPark, Waze, HONK, Telpark, IEM Group, and others are bringing localized and niche offerings to the market. Many of these apps target specific regions or consumer groups, offering tailored pricing models and features. Some are integrating with navigation services, while others are focused on peer-to-peer parking sharing models.

Top Key Players in the Market

- ParkMobilе, LLC

- SpotHеro, Inc.

- ParkWhiz, Inc.

- PayByPhonе Tеchnologiеs, Inc.

- Passport Labs, Inc.

- Parkopеdia Ltd.

- Inrix, Inc.

- BestParking

- Streetline

- ParkMe

- Parking Mate

- Parking Panda

- JustPark

- Waze

- HONK

- Telpark

- IEM Group

- Others

Recent Developments

- In January 2025, the City of Kingston expanded its partnership with the HONK parking app to include cashless payment options for on-street parking. Drivers can now use the app or scan QR codes on-site to pay quickly and securely without registering an account.

- In October 2024, SpotHero partnered with Google to integrate its parking reservation service directly into Google Maps and Google Search. This integration allows users in the U.S. and Canada to find and reserve parking spaces at over 8,000 locations with options including EV charging, wheelchair accessibility, and valet services.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Parking Typе (On-Strееt Parking, Off-Strееt Parking, Rеsidеntial Parking, Evеnt-Spеcific Parking, Commеrcial Parking), By Application Platform (Mobilе Applications (iOS android), Wеb-Basеd Applications, In-Vеhiclе Intеgratеd Applications), By Sеrvicе Typе (Parking Rеsеrvation Sеrvicеs, Navigation and Guidancе Sеrvicеs, Paymеnt Sеrvicеs, Rеal-Timе Parking Availability Sеrvicеs, Valuе Addеd Sеrvicеs (EV Charging and Valеt, еtc.), By Paymеnt Modеl (Pay-Pеr-Usе, Subscription Basеd, Frее with Ads, In App Purchasеs), By End Usеr (Individual Drivеrs, Commеrcial Flееts, Evеnt Organizеrs, Municipal and Govеrnmеnt Agеnciеs, Privatе Parking Opеrators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ParkMobilе, LLC, SpotHеro, Inc., ParkWhiz, Inc., PayByPhonе Tеchnologiеs, Inc., Passport Labs, Inc., Parkopеdia Ltd., Inrix, Inc., BestParking, Streetline, ParkMe, Parking Mate, Parking Panda, JustPark, Waze, HONK, Telpark, IEM Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Parking Finder Apps MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Parking Finder Apps MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ParkMobilе, LLC

- SpotHеro, Inc.

- ParkWhiz, Inc.

- PayByPhonе Tеchnologiеs, Inc.

- Passport Labs, Inc.

- Parkopеdia Ltd.

- Inrix, Inc.

- BestParking

- Streetline

- ParkMe

- Parking Mate

- Parking Panda

- JustPark

- Waze

- HONK

- Telpark

- IEM Group

- Others