Global Paraxylene Market By Purity Grade (Industrial Grade, Semiconductor Grade), By Application (Dimethyl Terephthalate (DMT), Purified Terephthalic acid (PTA), Others), By End Use (Plastics, Textile, Others), By Distribution Channel (Direct Sales, Distributor Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151591

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

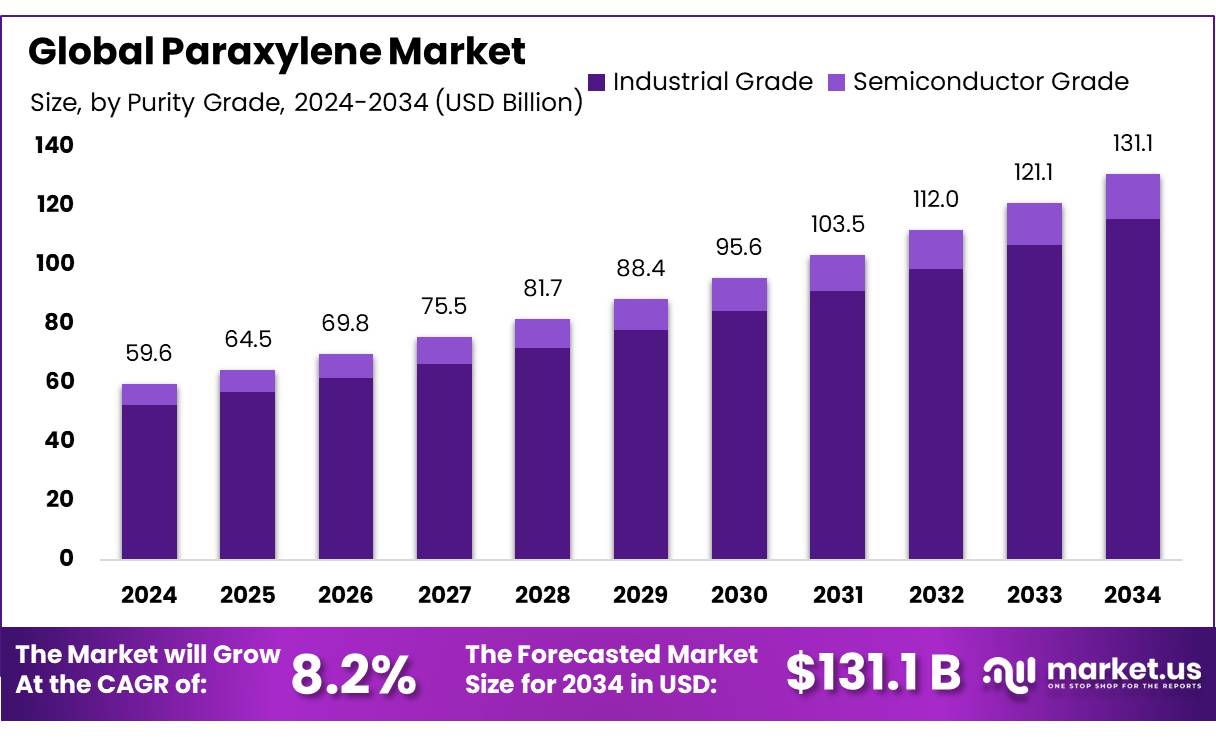

The Global Paraxylene Market size is expected to be worth around USD 131.1 Billion by 2034, from USD 59.6 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

Paraxylene (PX) is the high-purity aromatic isomer required to make purified terephthalic acid (PTA) and, ultimately, polyester fibres, films and PET bottles. It is produced by catalytic reforming and aromatics extraction within refineries and condensate splitters and is valued both as a chemical intermediate and as an octane-boosting gasoline blend component. The U.S. Energy Information Administration classifies PX among petroleum-derived xylenes used “as chemical intermediates and high-octane blending agents,” underscoring its dual role across petrochemicals and fuels.

The current industrial landscape is overwhelmingly Asia-centric. PTT Global Chemical notes that only 0.8 million t of fresh PX capacity will be commissioned worldwide in 2024—down sharply from 2023—because producers are pacing additions after a wave of large Chinese projects came onstream last year. Yet individual sites remain huge: Reliance Industries’ Jamnagar aromatics complex in India alone can make 4.1 million t per year, making it one of the world’s largest single-site PX producers.

Demand growth is still anchored in polyester. Even with downstream softness—Chinese PTA inventories hovered near 2.9 million t in mid-March 2024—Asian spot PX prices reached year-to-date highs, indicating that tight feedstock balances can override near-term textile sluggishness.

Structural drivers include expanding middle-class consumption of packaged beverages and fast-fashion textiles, plus the resilience of PET packaging in food-grade recycling schemes. On the supply side, mega-integrated complexes are reshaping cost curves: Saudi Aramco and Sinopec broke ground in November 2024 on a Fujian facility that will integrate a 2 million t per year PX unit with a 16 Mt / y refinery, promising competitive aromatics streams once it starts up before 2030.

Government policy adds further momentum. India’s revised Petroleum, Chemicals and Petrochemicals Investment Region (PCPIR) Policy 2020-35 targets a cumulative ₹10 lakh crore (≈ US $142 billion) capital inflow by 2025 to back large integrated aromatics platforms and downstream polyester value chains. At India Chem 2024, the Petroleum Minister projected US $87 billion of petrochemical investment over the next decade, stating that domestic PX-linked consumption could double as living standards rise.

Key Takeaways

- Paraxylene Market size is expected to be worth around USD 131.1 Billion by 2034, from USD 59.6 Billion in 2024, growing at a CAGR of 8.2%.

- Industrial Grade held a dominant market position, capturing more than an 88.2% share of the global paraxylene market.

- Dimethyl Terephthalate (DMT) held a dominant market position, capturing more than a 78.6% share of the global paraxylene market.

- Plastics held a dominant market position, capturing more than a 68.1% share of the global paraxylene market

- Direct Sales held a dominant market position, capturing more than a 64.4% share of the global paraxylene market

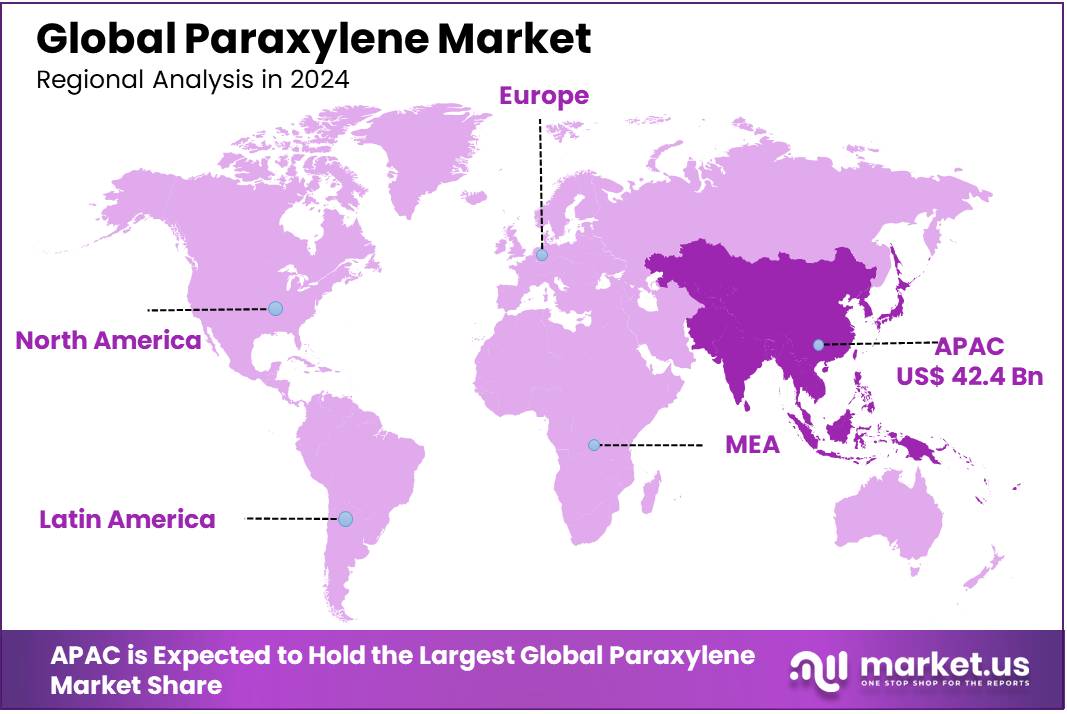

- Asia-Pacific (APAC) emerged as the dominant region in the global paraxylene market, capturing more than a 71.2% share, equivalent to approximately USD 42.4 billion.

By Purity Grade

Industrial Grade Paraxylene leads with 88.2% share in 2024 due to its wide usage in PTA production

In 2024, Industrial Grade held a dominant market position, capturing more than an 88.2% share of the global paraxylene market by purity grade. This overwhelming share reflects the crucial role of industrial-grade paraxylene as the primary raw material in the production of purified terephthalic acid (PTA), which is further used in polyester manufacturing. Major end-use applications such as polyester fibers, resins, and packaging materials rely heavily on consistent, high-purity paraxylene.

The preference for this grade is also driven by its compatibility with large-scale petrochemical processing, particularly in Asia, where integrated refinery-aromatic complexes are designed to optimize output for PTA and PET value chains. With no significant shift in downstream processing requirements expected in 2025, the dominance of industrial-grade paraxylene is projected to continue, supported by steady demand from polyester textile and packaging industries across China, India, and Southeast Asia.

By Application

Dimethyl Terephthalate dominates with 78.6% share in 2024 due to its strong role in polyester production

In 2024, Dimethyl Terephthalate (DMT) held a dominant market position, capturing more than a 78.6% share of the global paraxylene market by application. This significant share highlights the vital role of DMT as an intermediate chemical used to manufacture polyester fibers, resins, and films. Paraxylene serves as a key feedstock for producing DMT, which in turn is heavily used in the textile and packaging industries.

The demand for lightweight, durable, and recyclable polyester products has remained strong across both developed and emerging markets, especially in Asia-Pacific, where polyester manufacturing is highly concentrated. In 2025, this dominance is expected to continue, supported by consistent demand from fast-growing sectors like apparel, home textiles, and PET bottle manufacturing. The stable consumption pattern of DMT across industrial supply chains further reinforces paraxylene’s central importance in global synthetic fiber production.

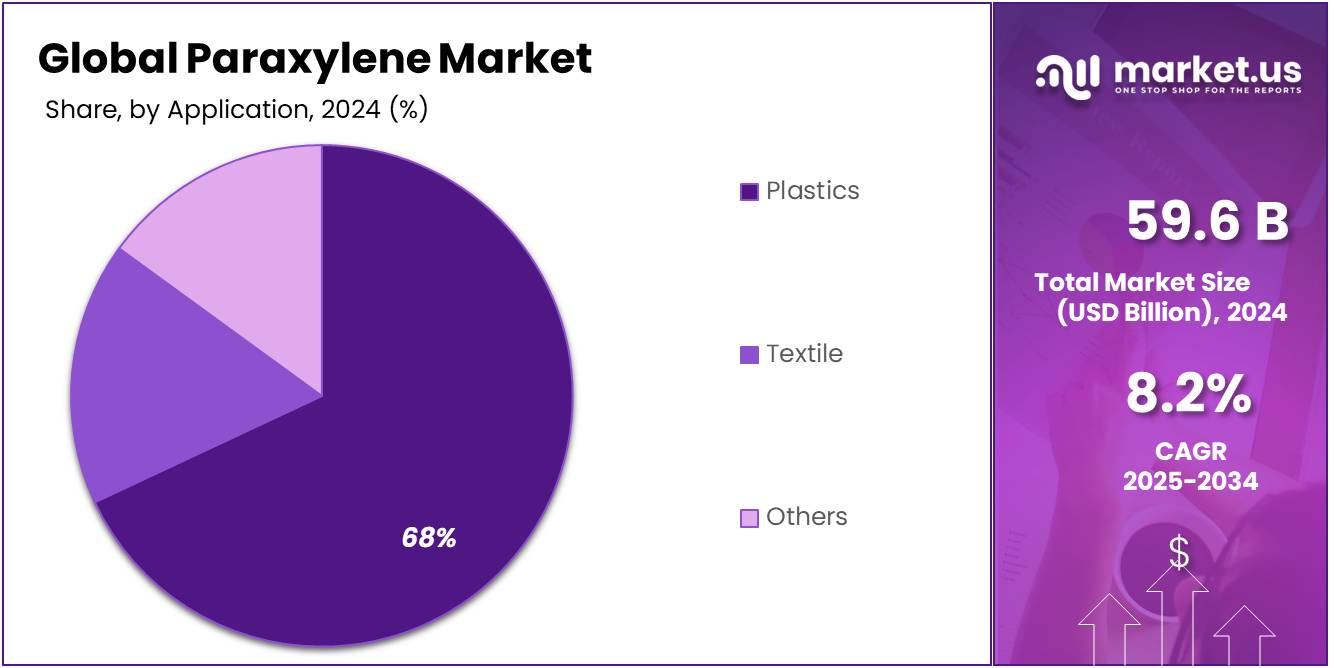

By End Use

Plastics dominate with 68.1% share in 2024 driven by high polyester and PET usage

In 2024, Plastics held a dominant market position, capturing more than a 68.1% share of the global paraxylene market by end use. This leading share reflects the strong dependence of plastic production, especially polyester and polyethylene terephthalate (PET), on paraxylene as a key raw material. PET plastics are widely used in packaging, particularly for bottled beverages, food containers, and films due to their lightweight, durability, and recyclability.

The growing global demand for affordable and sustainable packaging solutions, combined with the rise in consumption of convenience foods and bottled drinks, has kept paraxylene consumption high within the plastics segment. In 2025, this trend is expected to hold steady, as industries continue to favor PET-based materials for both environmental and performance advantages. The plastics segment will likely remain the key driver of paraxylene demand, supported by ongoing developments in food-grade recycling and circular economy initiatives.

By Distribution Channel

Direct Sales leads with 64.4% share in 2024 due to strong supplier-buyer integration in bulk trade

In 2024, Direct Sales held a dominant market position, capturing more than a 64.4% share of the global paraxylene market by distribution channel. This high share can be attributed to the nature of paraxylene as a bulk commodity typically traded in large volumes between integrated producers and downstream manufacturers, such as PTA and DMT facilities. Direct sales allow for better control over supply chains, stable pricing agreements, and reliable logistics—factors that are critical in the petrochemical sector.

Many large-scale paraxylene producers operate within integrated refining and chemical complexes, enabling them to supply directly to affiliated or contracted partners. This model reduces the need for intermediaries and ensures efficiency in meeting the constant demand from polyester and plastic industries. In 2025, direct sales are expected to continue dominating, especially in Asia-Pacific and the Middle East, where most of the world’s paraxylene capacity is concentrated and long-term supply agreements are common practice.

Key Market Segments

By Purity Grade

- Industrial Grade

- Semiconductor Grade

By Application

- Dimethyl Terephthalate (DMT)

- Purified Terephthalic acid (PTA)

- Others

By End Use

- Plastics

- Textile

- Others

By Distribution Channel

- Direct Sales

- Distributor Sales

Drivers

Surge in Food & Beverage Packaging Demand

One of the most significant factors driving the growth of the paraxylene market is the escalating demand for food and beverage packaging, particularly in emerging economies like India and China. Paraxylene is a key raw material in producing polyethylene terephthalate (PET), which is extensively used in manufacturing plastic bottles and containers for beverages such as water, soft drinks, and juices.

For instance, in China, the consumption of polyester reached 37.04 million tons in 2015, with a significant portion used in beverage packaging. Despite environmental concerns leading to public protests against paraxylene (PX) projects in cities like Dalian and Xiamen, the demand for PX in the PTA sector for PET production remains robust .

Similarly, in Brazil, the packaging industry is experiencing growth, driven by the increasing demand for packaged foods and beverages. The Brazilian Health Regulatory Agency (ANVISA) oversees the regulation of food contact materials, ensuring that packaging materials comply with safety standards.

Restraints

Regulatory Pressures on Food Packaging Materials

The paraxylene market faces significant challenges due to stringent regulations concerning food packaging materials. Paraxylene is a critical raw material in producing polyethylene terephthalate (PET), commonly used in food and beverage packaging. However, growing environmental concerns and health risks associated with chemical migration from packaging into food have led to stricter regulations globally.

In the United States, the Food and Drug Administration (FDA) regulates food contact substances, including those used in packaging. The FDA’s guidelines ensure that materials used in packaging do not pose a risk to human health. For instance, the FDA has set limits on the migration of substances like bisphenol A (BPA) from packaging into food, prompting manufacturers to seek alternative materials.

Similarly, in the European Union, regulations such as Commission Regulation (EU) 2022/1616 focus on the safety of recycled plastic materials intended to come into contact with food. These regulations require comprehensive risk assessments and safety evaluations, which can be resource-intensive for manufacturers.

These regulatory pressures are prompting companies to explore sustainable and safer alternatives to paraxylene-based PET. The shift towards bio-based and biodegradable materials is gaining momentum as industries aim to comply with environmental standards and consumer demand for eco-friendly products.

Opportunity

Government Support for Bio-Based Paraxylene

A significant growth opportunity for the paraxylene market lies in the increasing government support for bio-based alternatives. Bio-based paraxylene (Bio-PX), derived from renewable resources like sugarcane and corn, offers a sustainable substitute to traditional paraxylene, which is produced from petroleum. This shift aligns with global efforts to reduce carbon footprints and reliance on fossil fuels.

In India, the government’s emphasis on sustainable development has led to initiatives promoting green technologies. Policies encouraging the use of renewable resources and the reduction of plastic waste are fostering an environment conducive to the growth of the bio-based paraxylene market. Companies like Reliance Industries and Indian Oil are investing in bio-based chemical innovations, aiming to meet the rising demand for eco-friendly materials in textiles and packaging.

Similarly, in Japan, the government’s “Society 5.0” initiative, which integrates digital transformation with social innovation, is creating avenues for smart solutions and AI-based applications. This commitment to achieving carbon neutrality by 2050 is driving investments in green technologies, including bio-based paraxylene.

Trends

Surge in Bio-Based Paraxylene Adoption

A notable trend in the paraxylene market is the increasing adoption of bio-based paraxylene (Bio-PX), driven by environmental concerns and regulatory pressures. Bio-PX is derived from renewable resources like sugarcane and corn, offering a sustainable alternative to traditional paraxylene sourced from petroleum.

Government initiatives play a pivotal role in this transition. For instance, the European Union’s Carbon Border Adjustment Mechanism (CBAM), effective from 2026, imposes tariffs on carbon-intensive imports, encouraging industries to adopt low-carbon alternatives like Bio-PX . Similarly, in the United States, the Environmental Protection Agency (EPA) provides renewable identification numbers (RINs) under the Renewable Fuel Standard, incentivizing the production of bio-based chemicals.

The shift towards Bio-PX is also supported by advancements in biotechnology and bioprocessing, which have made its production more efficient and cost-effective. Companies are investing in research and development to scale up production and meet the growing demand for sustainable materials.

Regional Analysis

In 2024, Asia-Pacific (APAC) emerged as the dominant region in the global paraxylene market, capturing more than a 71.2% share, equivalent to approximately USD 42.4 billion in value. This regional dominance is largely attributed to the concentration of large-scale paraxylene production facilities and massive downstream demand from the polyester and PET packaging industries. Countries such as China, India, South Korea, and Japan continue to lead both in terms of capacity expansion and consumption volumes.

China, in particular, has built extensive integrated refining and chemical complexes, enabling domestic production to meet the surging demand for purified terephthalic acid (PTA), a key derivative of paraxylene used in textile manufacturing. According to the Indian Ministry of Commerce, India alone exported paraxylene worth over ₹17,000 crore in FY 2022–23, while still importing significant volumes to meet internal processing requirements, highlighting strong bilateral trade flows within the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CNPC plays a crucial role in China’s paraxylene market through its subsidiaries like PetroChina, operating several aromatics units across the country. The company supports domestic PTA production by supplying paraxylene from integrated sites such as Dalian and Urumqi. CNPC has focused on upgrading its refineries for higher aromatics yields, aligning with China’s downstream polyester sector growth. Its extensive pipeline and logistics network also enhance supply chain efficiency across China’s eastern and central industrial belts.

Reliance operates one of the world’s largest paraxylene complexes at Jamnagar, India, with a production capacity exceeding 4 million tonnes per annum. The facility is fully integrated with PTA and polyester units, giving Reliance strong control over the downstream value chain. The company exports large PX volumes to Asia-Pacific markets while meeting substantial domestic demand. Reliance’s continued investments in efficiency and environmental controls reflect its strategic position as a global PX supplier and value-added chemical manufacturer.

NPC Iran is a state-owned enterprise that oversees the country’s petrochemical operations, including paraxylene production. Iran’s PX capacity is centered in the Mahshahr and Assaluyeh industrial zones, where integrated petrochemical hubs export to Asian and European markets. Despite facing export constraints due to international sanctions, NPC has expanded its production to support regional PTA and textile industries. The company’s PX output plays a vital role in Iran’s non-oil revenue diversification strategy within the Middle East.

Top Key Players in the Market

- Sinopec

- CNPC

- Reliance

- NPC Iran

- GS Caltex

- ONGC

- Orpic, Oman Oil Refineries and Petroleum Industries Company

- Jurong Aromatics Corp

- China National Offshore Oil Corporation (CNOOC)

- Lotte KP Chemical

- ExxonMobil

- Saudi Aramco

- Dalian Fujia Dahua

- Idemitsu Kosan Co.Ltd.

- Toyo

- Teijin Fibers

Recent Developments

In 2024, GS Caltex stood as a leading producer in the paraxylene (PX) market, operating from its Yeosu complex in South Korea with an annual aromatics capacity of 2.8 million tonnes, including 1.35 million tonnes of paraxylene alone.

In 2024, NPC Iran (National Petrochemical Company) oversaw a petrochemical production capacity reaching approximately 100 million tonnes per annum, with around 70 active plants contributing to national output.

Report Scope

Report Features Description Market Value (2024) USD 59.6 Bn Forecast Revenue (2034) USD 131.1 Bn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Grade (Industrial Grade, Semiconductor Grade), By Application (Dimethyl Terephthalate (DMT), Purified Terephthalic acid (PTA), Others), By End Use (Plastics, Textile, Others), By Distribution Channel (Direct Sales, Distributor Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sinopec, CNPC, Reliance, NPC Iran, GS Caltex, ONGC, Orpic, Oman Oil Refineries and Petroleum Industries Company, Jurong Aromatics Corp, China National Offshore Oil Corporation (CNOOC), Lotte KP Chemical, ExxonMobil, Saudi Aramco, Dalian Fujia Dahua, Idemitsu Kosan Co.Ltd., Toyo, Teijin Fibers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sinopec

- CNPC

- Reliance

- NPC Iran

- GS Caltex

- ONGC

- Orpic, Oman Oil Refineries and Petroleum Industries Company

- Jurong Aromatics Corp

- China National Offshore Oil Corporation (CNOOC)

- Lotte KP Chemical

- ExxonMobil

- Saudi Aramco

- Dalian Fujia Dahua

- Idemitsu Kosan Co.Ltd.

- Toyo

- Teijin Fibers