Global Parallel Computing Market Size, Share, Growth Analysis By Type (Bit-level Parallelism, Instruction-level Parallelism, Task Parallelism, Others), By Architectures (Shared Memory, Distributed Memory, Hybrid memory, Specialized architectures), By End User (Smartphones, Blockchains, Laptop Computers, Internet of Things, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162358

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- AI Industry Adoption

- Analysts’ Viewpoint

- Emerging trends

- US Market Size

- Investment and Business Benefit

- By Type

- By Architectures

- By End User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

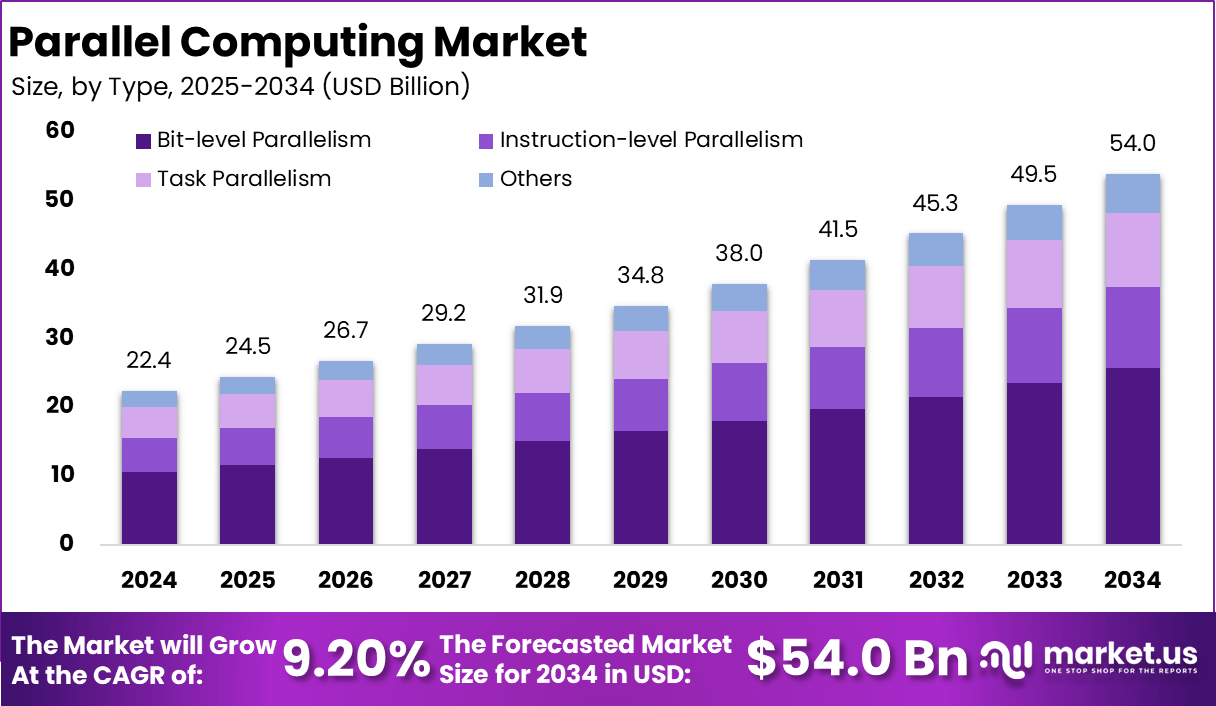

The global parallel computing market was valued at USD 22.4 billion in 2024 and is projected to reach USD 54.0 billion by 2034, growing at a robust CAGR of 9.2% during the forecast period. The market’s growth is driven by the increasing need for high-performance computing (HPC) solutions across industries such as defense, aerospace, automotive, healthcare, and finance.

Parallel computing enables simultaneous data processing across multiple processors, significantly reducing computation time for complex tasks like AI model training, big data analytics, and scientific simulations. The rapid advancement of GPU and multi-core processor architectures, coupled with the adoption of cloud-based HPC platforms, is further accelerating market expansion.

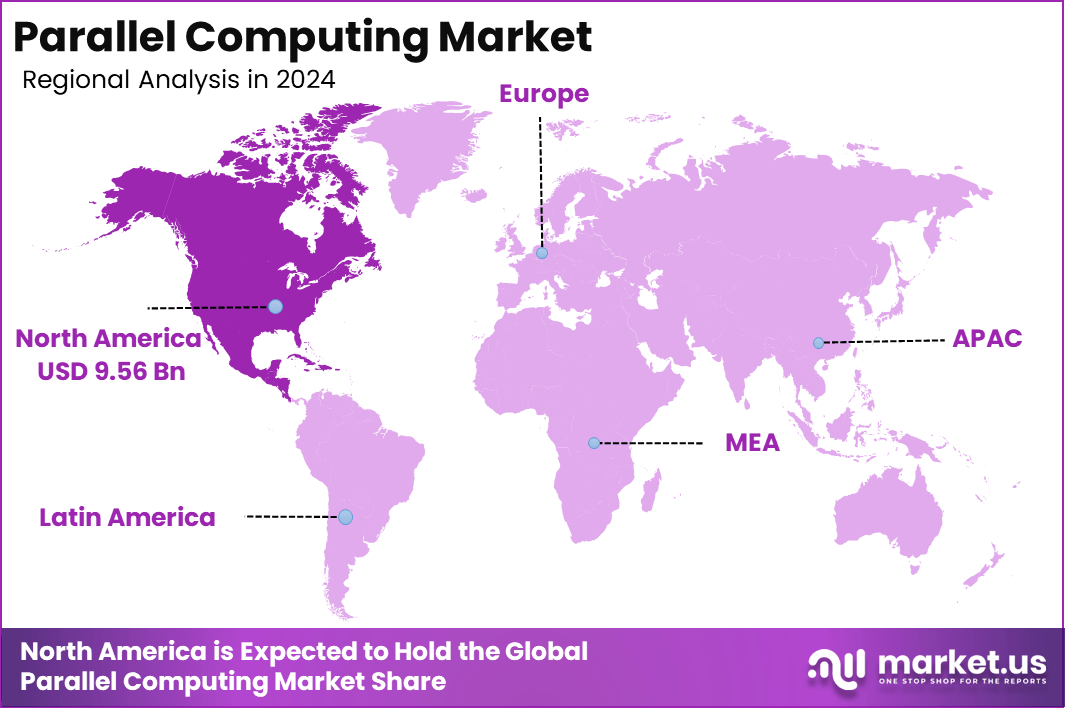

North America dominated the global market with a 42.7% share in 2024, valued at USD 9.56 billion, owing to the presence of major technology providers and strong government investments in supercomputing research and development.

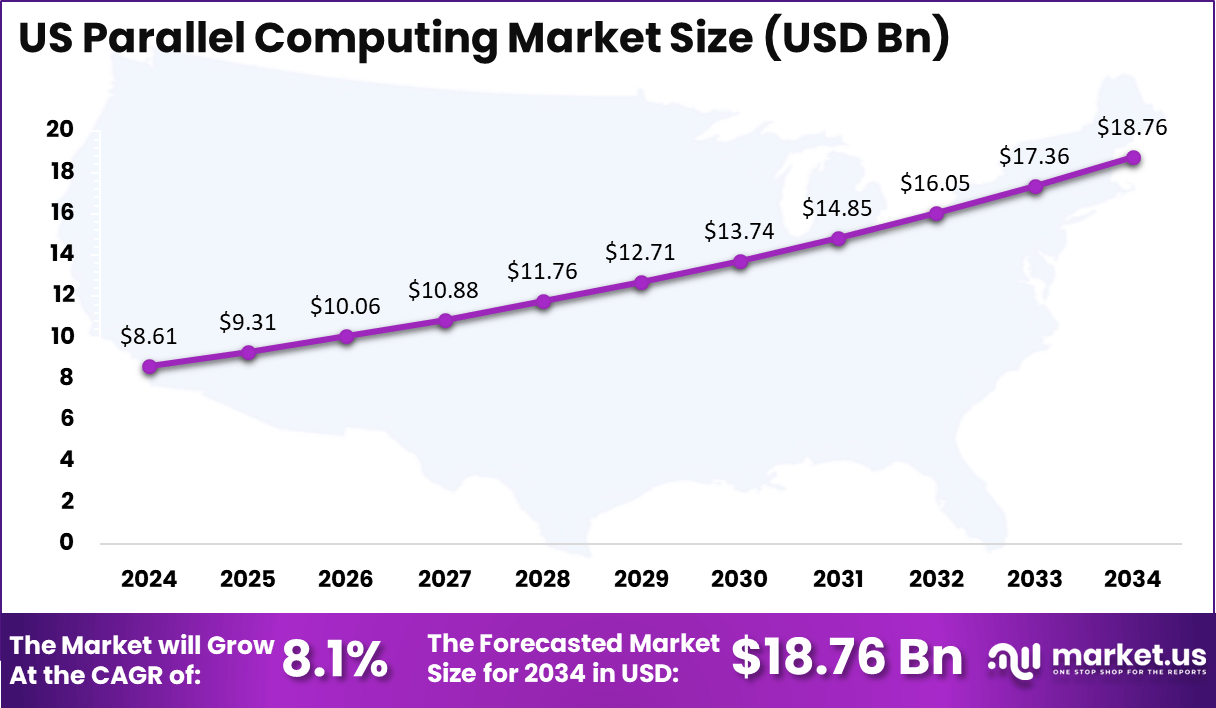

The US market, valued at USD 8.61 billion in 2024, is expected to reach USD 18.76 billion by 2034, expanding at a CAGR of 8.1%. This growth is supported by increasing integration of AI and parallel processing frameworks across defense research, advanced simulations, weather modeling, and data-intensive enterprise applications, reinforcing the US position as a global leader in high-performance computing innovation.

The global parallel computing market is witnessing significant growth as industries increasingly adopt high-performance computing (HPC) technologies to manage large-scale data processing and complex computational workloads.

Parallel computing allows multiple processors to perform tasks simultaneously, dramatically improving speed, efficiency, and performance in applications such as artificial intelligence (AI), machine learning (ML), big data analytics, scientific simulations, and 3D modeling. The growing demand for real-time data processing, advancements in GPU and multi-core processor architectures, and the rising adoption of cloud-based HPC solutions are major factors fueling market expansion.

Industries such as defense, aerospace, finance, healthcare, and automotive are integrating parallel computing frameworks to enhance operational accuracy and reduce analysis time for high-intensity computing tasks. Governments and research institutions are also investing heavily in supercomputing infrastructure to drive innovation in areas like climate modeling, genomics, and energy research.

North America remains a dominant region due to its mature technological ecosystem and strong investments in AI-driven computing systems. The market’s evolution is further supported by the growing collaboration between hardware manufacturers and cloud service providers to deliver scalable, energy-efficient, and cost-effective parallel processing solutions, marking a new era in computational performance and data intelligence.

On the M&A front, major acquisitions have influenced the parallel computing landscape, with notable tech deals affecting related sectors. Hewlett Packard Enterprise completed a $14 billion acquisition of Juniper Networks, enhancing its capabilities in cloud and advanced computing. Google made headlines with a $32 billion acquisition of cloud security firm Wiz, which ties into cloud-dependent parallel processing services. Major players continue to invest heavily in research and development to push parallel computing innovations.

New product launches have also shaped the market, such as Parallel Works launching Activate AI, a control platform designed to simplify AI and ML workload deployment across hybrid and multi-cloud computing environments with integrated Kubernetes support. AWS has enhanced its Parallel Computing Service (PCS) with features like cluster secret key rotation and support for Slurm v25.05, streamlining cluster management for enterprise users.

Funding trends show strong support from governments and private sectors alike. For example, U.S. federal funding for computer science research, including HPC and AI-enhanced workflows, increased from about $60.7 million in 2023 to a requested $86.7 million in 2025. This supports innovations in software, hardware accelerators, and next-generation technologies like quantum networking.

Key Takeaways

- The global parallel computing market was valued at USD 22.4 billion in 2024 and is projected to reach USD 54.0 billion by 2034, expanding at a strong CAGR of 9.2% during the forecast period. Growth is driven by increasing demand for high-performance computing (HPC) in AI, data analytics, and scientific research.

- North America dominated the market with a 42.7% share in 2024, representing a value of USD 9.56 billion, supported by robust technological infrastructure and government funding for supercomputing research and defense applications.

- The US market accounted for USD 8.61 billion in 2024 and is projected to reach USD 18.76 billion by 2034, growing at a CAGR of 8.1%, driven by strong adoption across aerospace, healthcare, and AI-driven industries.

- By Type, Bit-level Parallelism led the market with a 47.5% share, supported by its efficiency in executing low-level data operations and optimizing computational performance in AI and simulation workloads.

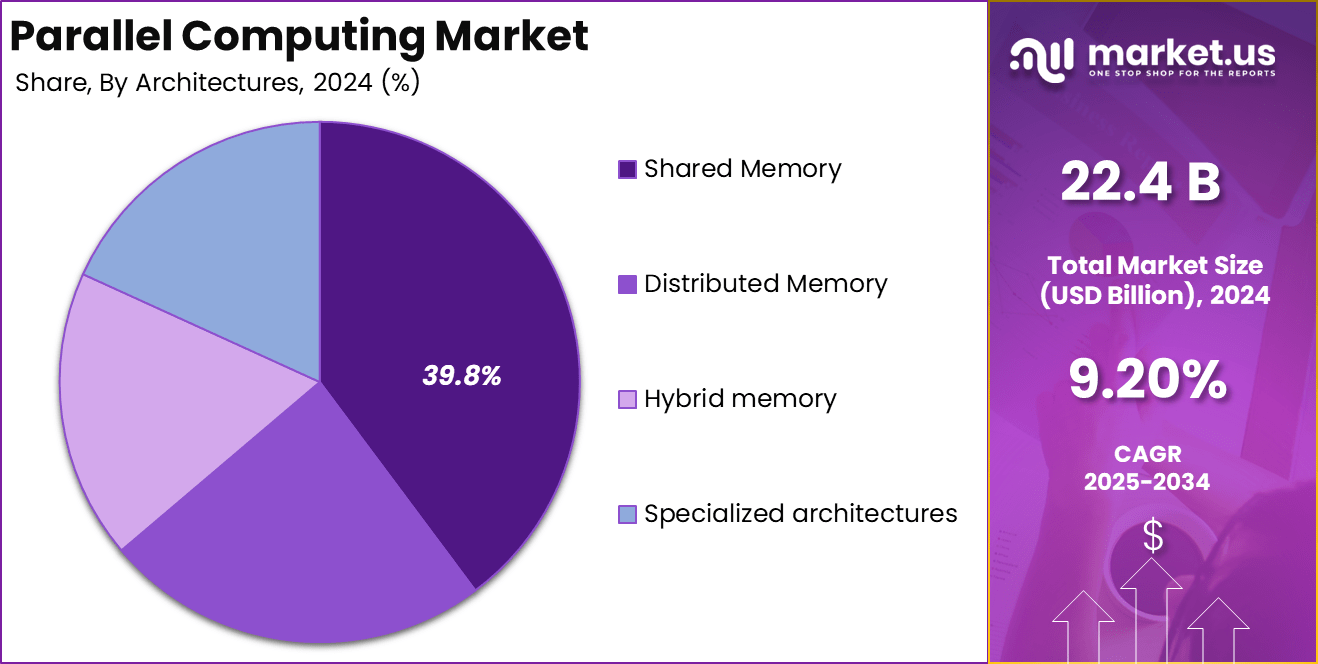

- By Architecture, Shared Memory systems accounted for 39.8% share, favored for their simplicity in data access and suitability for multi-core processing in research and enterprise applications.

- By End User, Laptop Computers held the largest share of 32.6%, driven by the growing integration of multi-core processors and GPUs that enable faster parallel computation for consumer and professional workloads.

Role of AI

Artificial intelligence plays a transformative role in the parallel computing market, enhancing computational efficiency, scalability, and automation across diverse applications. AI algorithms are inherently data-intensive and require high-speed processing capabilities that parallel computing provides through simultaneous multi-core execution.

In turn, AI optimizes parallel computing frameworks by improving task scheduling, load balancing, and resource utilization, ensuring maximum performance with minimal latency. This symbiotic relationship between AI and parallel computing has become the foundation for advancements in high-performance computing (HPC), big data analytics, and scientific modeling.

AI-driven optimization tools are now used to predict system behavior, allocate resources dynamically, and reduce computation times in large-scale simulations and machine learning training models. The integration of AI with GPU-accelerated parallel systems is revolutionizing fields such as autonomous systems, drug discovery, and weather forecasting by enabling faster data processing and real-time analysis.

Furthermore, AI enhances fault detection and system reliability by learning from operational data to identify bottlenecks or performance degradation. As industries increasingly rely on AI-enabled analytics and automation, the demand for efficient parallel computing infrastructure continues to rise. This convergence of AI and parallel computing is shaping the next generation of intelligent, high-speed, and adaptive computational environments.

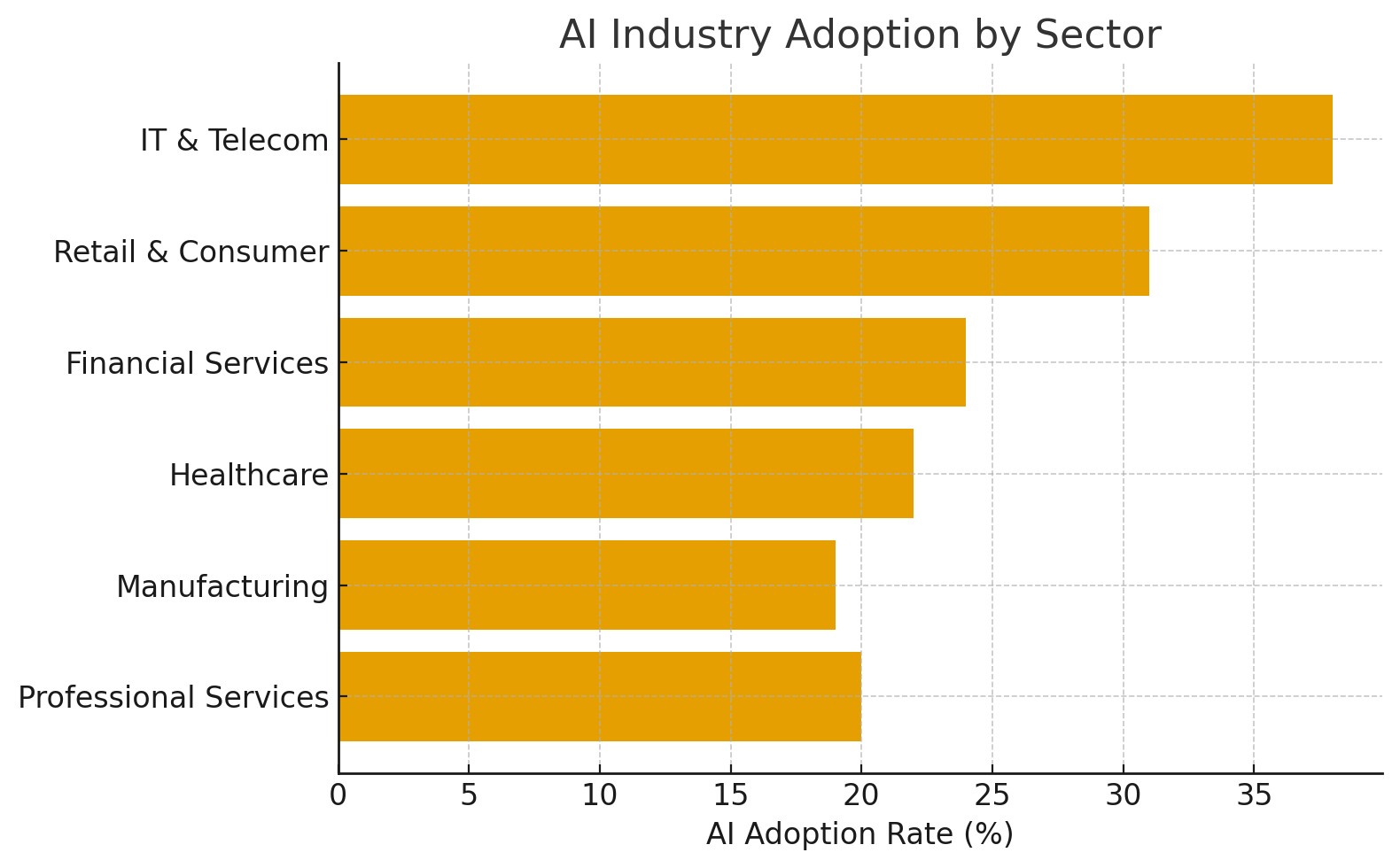

AI Industry Adoption

The adoption of artificial intelligence across industries is accelerating as companies recognize its value in enhancing productivity, decision-making, and operational efficiency. Sectors such as IT & Telecom and Retail & Consumer are at the forefront due to their high digital maturity and reliance on real-time analytics.

Financial services are rapidly adopting AI for fraud detection, algorithmic trading, and personalized banking solutions. Healthcare is leveraging AI for diagnostics, predictive analytics, and drug discovery, while manufacturing integrates it for predictive maintenance and quality control. Professional services, including consulting and legal sectors, are also adopting AI to automate data management and optimize workflows.

This growing adoption is driven by advancements in machine learning, natural language processing, and cloud computing, which enable scalable and cost-effective AI deployment. However, challenges such as data privacy, infrastructure costs, and workforce readiness still influence adoption rates across industries. Overall, AI is evolving from an experimental tool to a strategic necessity, shaping a new era of intelligent automation and data-driven decision-making across global enterprises.

Analysts’ Viewpoint

Analysts observe that the market for parallel computing is transitioning from niche high-performance applications toward becoming a foundational infrastructure for data-intensive enterprise and AI workloads. They note that as organizations move beyond isolated use-cases (such as scientific simulation or academic research), the demand is expanding into broader commercial, cloud, and edge-enabled environments. This shift is underscored by increased investments in scalable and heterogeneous architectures that combine CPUs, GPUs, accelerators, and even emerging quantum/neuromorphic platforms.

From an investment angle, analysts highlight that the convergence of artificial intelligence (AI) and parallel computing is creating a compounding effect — as AI/ML models grow larger and more complex, their need for parallel processing rises, which in turn is driving demand for parallel computing infrastructure. Thus, vendors offering integrated hardware-software stacks and cloud-based parallel processing services are viewed as strategically positioned.

However, analysts also caution that while the growth trajectory is strong, it is not without hurdles. High initial capital expense, skill shortages in parallel programming and system deployment, and ongoing energy consumption and thermal challenges are identified as key inhibitors. Moreover, the pace of hardware innovation may outstrip the ability of software and applications to fully exploit that performance, limiting near-term returns.

Overall, the analytical consensus is that parallel computing represents a compelling long-term growth opportunity — especially for firms that can enable scalability, cost-efficiency, and ease of adoption — while requiring realistic expectation-setting around deployment times and ROI.

Emerging trends

Heterogeneous and accelerator-driven architectures

The shift towards combining CPUs, GPUs, TPUs, and other specialized accelerators is gaining momentum. Traditional parallel systems are evolving into heterogeneous platforms where different processing units share workloads depending on the nature of the computation (e.g., matrix operations, AI training, simulation). This trend enables higher throughput, lower latency, and better energy efficiency.Cloud-native and distributed parallel computing.

Parallel computing is no longer confined to on-premises supercomputers. With the rise of cloud infrastructure, services now offer scalable parallel processing as a utility. This means organizations can spin up massive parallel jobs on demand rather than maintaining dedicated clusters. The market report notes this as a key growth driver.Integration with AI/ML workloads and high-performance data pipelines

As AI, deep learning, and big data analytics demand more compute, parallel computing is increasingly being optimized for such workloads. The interplay between parallel frameworks and AI/ML model training, inference, and real-time analytics is a major trend.Energy efficiency, domain-specific systems, and edge parallelism

With compute demands rising, focus is shifting to energy-efficient designs, domain-specific architectures (e.g., for scientific simulation, genomics), and parallelism at the edge (closer to data sources). These help reduce latency, bandwidth cost, and power consumption.Software innovation in parallel programming models and abstraction layers

Developing parallel programs remains complex; thus, there’s a rise in new programming models, abstraction frameworks, and libraries that make exploiting parallelism easier. This trend is crucial for broader adoption.US Market Size

The US parallel computing market is projected to experience strong and sustained growth, expanding from USD 8.61 billion in 2024 to approximately USD 18.76 billion by 2034, at a compound annual growth rate of 8.1%. This growth is driven by the country’s increasing reliance on high-performance computing (HPC) for data-intensive applications such as artificial intelligence (AI), machine learning (ML), scientific modeling, and financial analytics.

The widespread adoption of parallel computing frameworks across sectors, including defense, aerospace, healthcare, and academic research, reflects the country’s strategic commitment to advancing computational efficiency and innovation. Investments by major technology companies and government agencies in supercomputing infrastructure are further fueling market expansion.

The integration of GPU-based and multi-core processing architectures has enabled US enterprises to accelerate simulation workloads, deep learning models, and data analytics. Cloud service providers are also introducing scalable, on-demand HPC platforms, allowing small and medium enterprises to access parallel computing power without the need for extensive infrastructure investment.

Additionally, the rising focus on quantum computing, real-time data visualization, and AI-driven automation is reinforcing the importance of parallel computing across industries. With robust technological capabilities and strong institutional support, the US remains at the forefront of innovation in the global parallel computing ecosystem.

Investment and Business Benefit

Investment in parallel computing presents both strong business benefits and justifiable risk, particularly as enterprises strive to harness high-performance systems for competitive advantage. On the investment side, firms are channeling capital into multi-core CPUs, GPU/accelerator architectures, and cloud-based HPC services to scale compute resources efficiently.

These investments are increasingly justified by the growing demands of AI and large-scale data workloads: as one market analysis notes, “the proliferation of big data necessitates high-throughput computing, fueling demand for parallel processing,” and the expansion of cloud-based, scalable resources makes deployment more accessible.

From a business benefit perspective, parallel computing enables dramatic reductions in processing time for complex simulations, model training, and large-volume analytics—turning months of computation into hours or days. This translates into faster time to value, better decision-making, and improved innovation cycles.

For example, companies deploying parallel systems can more rapidly simulate product designs, respond to market changes in real-time, and extract actionable insights from data volumes that would otherwise be infeasible.

In short, investment in parallel computing is not simply an IT cost, but a strategic spending decision—one that enables firms to convert computing horsepower into business outcomes such as reduced time-to-market, enhanced modeling accuracy, cost efficiency, and competitive differentiation.

By Type

Bit-level parallelism accounted for 47.5% of the global parallel computing market in 2024, emerging as the dominant type due to its efficiency in improving processor performance at the hardware level. This form of parallelism enhances computational speed by allowing processors to execute multiple bits of an instruction simultaneously, significantly reducing the number of required operations.

The growing demand for high-performance computing in AI, machine learning, and cryptographic applications is fueling the adoption of bit-level architectures. Semiconductor advancements, such as the integration of 64-bit and 128-bit processors, are enabling faster execution of arithmetic and logical operations, particularly in data-intensive and simulation-based workloads.

Instruction-level parallelism is also gaining traction, supported by modern CPUs capable of executing multiple instructions within a single clock cycle, optimizing throughput in data analytics and gaming applications. Task parallelism plays a crucial role in distributed systems and cloud environments, where multiple computational tasks are executed concurrently to enhance resource utilization and minimize latency.

The other category, including pipeline and data-level parallelism, contributes to specialized applications in scientific research and visualization. Collectively, these parallel computing types are enabling the next generation of performance-driven computing systems across industries requiring real-time data analysis and advanced computational modeling.

By Architectures

Shared memory architecture accounted for 39.8% of the global parallel computing market in 2024, establishing itself as the leading architectural model due to its simplicity, efficiency, and suitability for multi-core processing. In this model, multiple processors access a common memory space, enabling faster data sharing and synchronization between tasks.

Shared memory systems are widely adopted in scientific computing, simulation, and enterprise workloads where communication speed and coordination between processors are critical. The rise of multi-core CPUs and GPU-based systems in both consumer and enterprise environments has significantly contributed to the segment’s dominance, offering a cost-effective and energy-efficient solution for parallel computation.

Distributed memory architectures are gaining importance in large-scale data centers and high-performance computing clusters, where each processor has its own local memory and communicates through message passing. This model is ideal for handling massive datasets in AI training, weather forecasting, and computational chemistry.

Hybrid memory architectures, combining the advantages of shared and distributed systems, are emerging as a preferred choice for modern HPC applications requiring scalability and flexibility. Meanwhile, specialized architectures, such as those designed for quantum computing and neuromorphic processing, are in the early stages of adoption, representing the next frontier in parallel computing innovation and performance optimization.

By End User

Laptop computers accounted for 32.6% of the global parallel computing market in 2024, representing the largest end-user segment. The dominance of this category is driven by the widespread integration of multi-core processors, graphics processing units (GPUs), and advanced chip architectures that enable parallel task execution within compact devices.

Laptops used for gaming, content creation, engineering simulations, and AI-driven applications rely heavily on parallel computing to deliver high performance, energy efficiency, and multitasking capabilities. The growing demand for portable, high-performance systems among students, professionals, and enterprises continues to support market growth, while innovations in CPU-GPU co-processing and integrated memory architectures are further enhancing laptop computing power.

Smartphones are emerging as another fast-growing end-user segment, with AI-based processing and real-time analytics relying increasingly on parallel execution across multiple cores. Blockchains utilize parallel computing to accelerate cryptographic computations and transaction validation, supporting faster consensus mechanisms in decentralized systems.

The Internet of Things (IoT) segment benefits from distributed parallel frameworks that enable edge devices to process data locally, reducing latency and dependence on cloud infrastructure. Others, including wearable and embedded systems, leverage parallel architectures for applications like autonomous control and predictive maintenance, collectively contributing to the global expansion of parallel computing adoption.

Key Market Segments

By Type

- Bit-level Parallelism

- Instruction-level Parallelism

- Task Parallelism

- Others

By Architectures

- Shared Memory

- Distributed Memory

- Hybrid memory

- Specialized architectures

By End User

- Smartphones

- Blockchains

- Laptop Computers

- Internet of Things

- Others

Regional Analysis

The regional analysis of the Parallel Computing Market reveals a markedly uneven global footprint, with one region markedly ahead while others rapidly gain ground. In 2024, North America held approximately 42.7% of the global market, equivalent to about USD 9.56 billion, underscoring the region’s dominant position thanks to its mature technology ecosystem, substantial R&D investments, and strong demand for high-performance computing.

This leadership is driven by factors such as advanced infrastructure, widespread adoption of multi-core, GPU/accelerator-based architectures, and significant public and private spending on supercomputing, artificial intelligence, and large-scale simulation projects.

Meanwhile, other regions like Europe and the Asia Pacific region are emerging strongly: Europe leverages regulatory frameworks, research investment, and industrial digitalisation, while Asia Pacific is characterised by rapid growth, expanding enterprise and government computing demand, and increasing cloud and HPC deployments.

For market participants, this means that while North America will remain the largest single regional market, substantial growth opportunities lie in the Asia Pacific and other developing regions — driven by rising computing needs, digital transformation, and infrastructural upgrades.

The regional variation also implies that vendors and service providers must tailor offerings: in North America, focus may be on cutting-edge hardware, services, and optimisation, whereas in other regions, market entrants may emphasise cost-effective, cloud-based, and scalable solutions to meet growing demand.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

- The parallel computing market is propelled by several strong drivers. First, the exponential increase in data generation across enterprises, research institutions, and scientific domains demands faster processing speeds — parallel architectures deliver this by distributing workloads across multiple cores/processors.

- Second, the rising adoption of AI, machine learning, and large-scale analytics is placing heavy computational loads that traditional serial computing cannot handle efficiently.

- Third, cloud infrastructure and on-demand HPC services are making parallel processing more accessible, allowing organizations to scale compute resources without massive on-premises investments.

- Fourth, industries such as aerospace, automotive, healthcare, and scientific research are increasingly deploying simulation, modelling, and real‐time data analysis — all of which benefit from parallel computing. Finally, government initiatives and research funding in supercomputing and national HPC infrastructure underpin growth by reducing adoption barriers and stimulating new use-cases.

Restraint Factors

- Despite strong tailwinds, the market is subject to notable restraints. A major barrier is the high initial cost of infrastructure — multi-core processors, GPUs, high-speed interconnects, cooling, and facility requirements make parallel systems expensive, especially for smaller organizations.

- Another restraint is the complexity of programming parallel systems: developing, debugging, and optimizing parallel applications remains technically challenging and requires specialist skills.

- Additionally, power consumption and thermal management pose concerns – high-performance parallel rigs consume large amounts of energy and thus incur operational costs and sustainability issues.

- Furthermore, the skills shortage means many organizations lack in-house capabilities to exploit parallel architectures fully. And finally, legacy infrastructure and compatibility issues can hinder the transition from serial to parallel models, particularly in established enterprises.

Growth Opportunities

- The parallel computing market offers several promising growth avenues. With the continued expansion of AI/ML workloads — including deep learning and real‐time analytics — the demand for large-scale parallel systems continues to escalate.

- The cloud-based parallel computing model (HPC as a service) presents a major opportunity: organizations can access parallel computing without full CAPEX, making the technology more accessible.

- Also, emerging markets such as IoT, edge computing, and smart infrastructure require distributed parallel frameworks closer to data sources, presenting new verticals.

- Moreover, the growth of hybrid and heterogeneous computing architectures (CPUs + GPUs + accelerators) opens a path for vendors to innovate specialised solutions for specific domains (e.g., genomics, meteorology).

- Deployment in underserved geographies — Asia-Pacific, Latin America, and emerging economies — also offers manifold growth, as digital transformation ramps up in those regions.

Challenging Factors

- While opportunities abound, the market faces several key challenges. One is software and algorithmic maturity: many parallel systems underutilize their potential because the software stack, libraries, and programming models aren’t yet optimized for all workloads.

- The heterogeneity of hardware (various processors, accelerators) adds integration complexity and raises challenges for developers to ensure compatibility and efficient resource use.

- Another challenge is the scalability of infrastructure: as demand grows, interconnects, memory hierarchies, and data movement become bottlenecks (e.g., interconnect bottleneck issues).

- Security, data privacy, and regulatory compliance in distributed parallel systems also pose risks.

- Finally, achieving sustainable business models is difficult: balancing CAPEX/OPEX, energy use, maintenance, and ROI remains a key concern for adopters.

Competitive Analysis

The competitive landscape of the parallel computing market features prominent global technology players, each leveraging distinct strengths to capture market share. Dell Technologies has established itself in the HPC arena by delivering validated server configurations optimized for parallel computing and AI workloads, such as its PowerEdge XE9680 with high-performance GPUs. Hewlett Packard Enterprise (HPE), known for its Cray acquisitions and large HPC system credentials, competes on large-scale enterprise and government deployments.

Amazon Web Services (AWS) and Microsoft Corporation extend the market into cloud-based parallel compute services, enabling scalability and on-demand access beyond traditional hardware models. Regional hardware leaders such as Lenovo, Sugon, and Inspur—particularly in Asia-Pacific—are capitalizing on domestic HPC demand and emerging architectures. According to market analysis, these vendors account for the major share of installations worldwide.

Strategically, differentiation hinges on three core vectors: hardware performance (accelerators, memory, interconnects), software stack maturity (parallel programming frameworks, AI integration), and service model flexibility (on-premises vs. cloud vs. hybrid HPC). Vendors that can offer seamless integration of heterogeneous architectures, simplified parallel programming, and scalable deployment are best positioned. As such, this competitive dynamic underscores a transition from pure hardware competition to value-added ecosystem leadership in parallel computing.

Top Key Players in the Market

- Dell

- Hewlett Packard Enterprise (HPE)

- Amazon (AWS)

- Lenovo

- IBM

- Sugon

- Inspur

- Microsoft

- Atos

- Huawei

- Alibaba Cloud

- Others

Major Developments

- March 31, 2025: Parallel Works unveiled a new advisory board focused on pushing enterprise AI and HPC workflows, citing partnerships that enable users to run large-scale GPU-based parallel jobs “wherever compute is available” and removing latency barriers for distributed infrastructures.

- October 18, 2025: NVIDIA announced a strategic collaboration with Samsung Foundry to develop custom non-x86 CPUs and XPUs, thereby strengthening Nvidia’s ecosystem for high-performance, parallel-computing data center infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 22.4 Billion Forecast Revenue (2034) USD 54.0 Billion CAGR(2025-2034) 9.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (Bit-level Parallelism, Instruction-level Parallelism, Task Parallelism, Others), By Architectures (Shared Memory, Distributed Memory, Hybrid memory, Specialized architectures), By End User (Smartphones, Blockchains, Laptop Computers, Internet of Things, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dell, Hewlett Packard Enterprise (HPE), Amazon (AWS), Lenovo, IBM, Sugon, Inspur, Microsoft, Atos, Huawei, Alibaba Cloud, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Dell

- Hewlett Packard Enterprise (HPE)

- Amazon (AWS)

- Lenovo

- IBM

- Sugon

- Inspur

- Microsoft

- Atos

- Huawei

- Alibaba Cloud

- Others