Global The Paperboard Partition Market Size, Share, Industry Analysis Report By Grade (Bleached, Unbleached), By Product (Brown Kraft, White Kraft), By End Use (Food & Beverage, Personal Care, Electronic Goods, Automotive, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165900

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

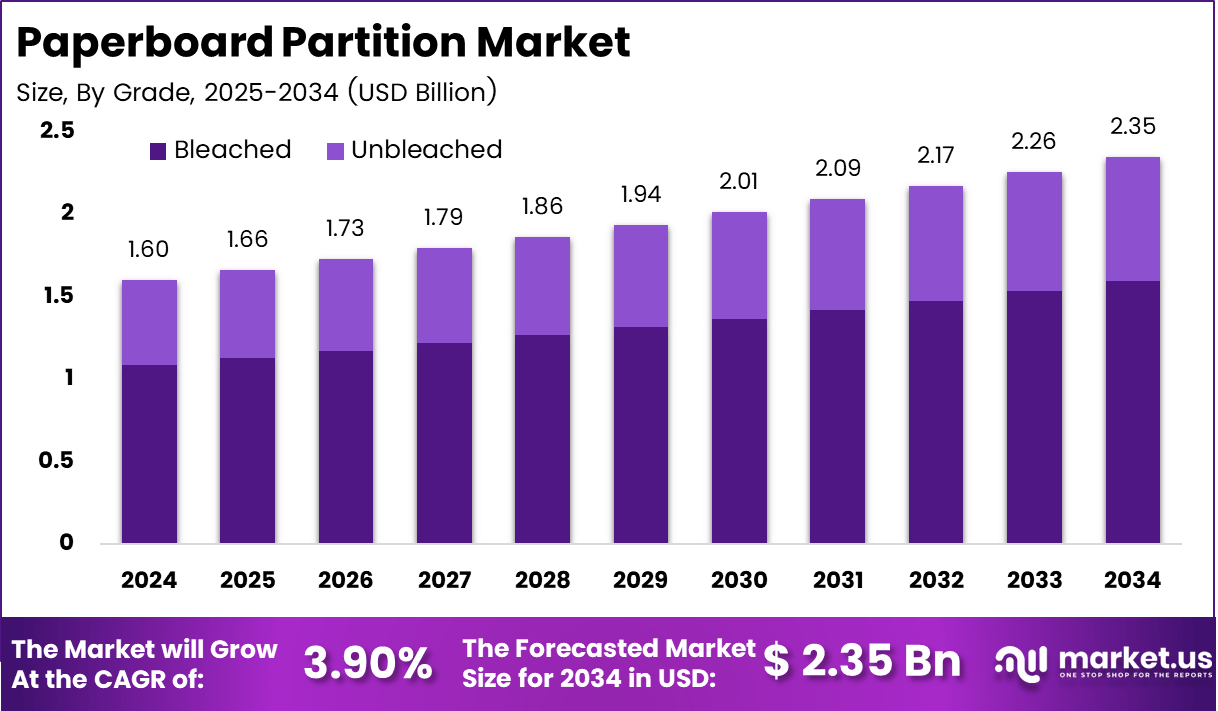

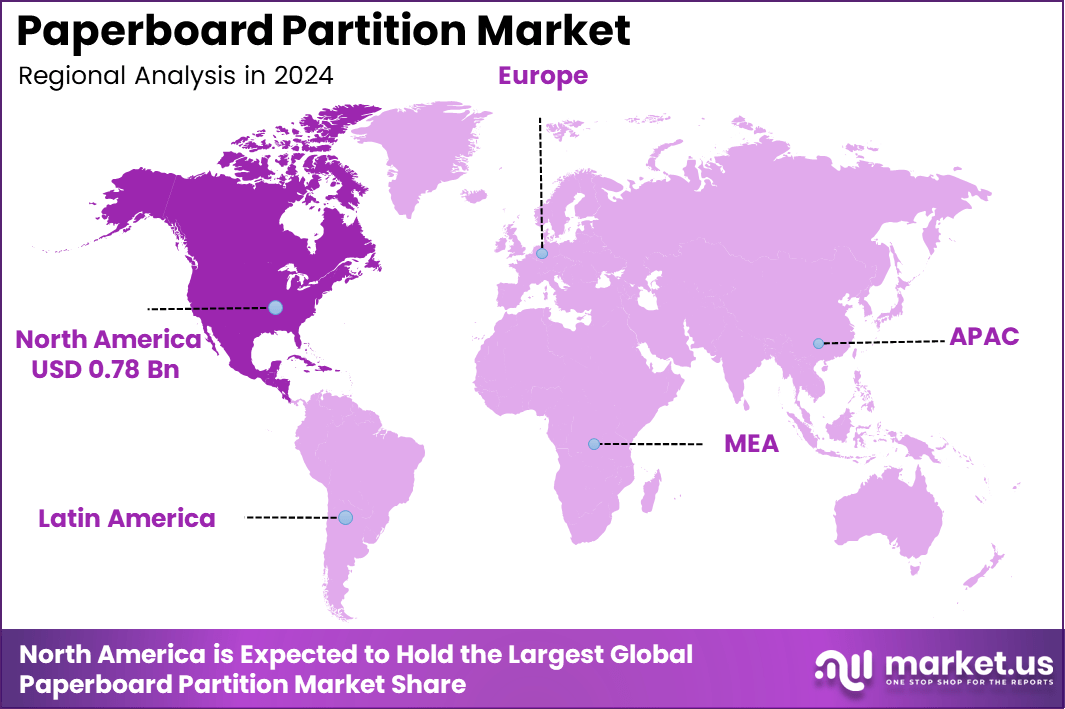

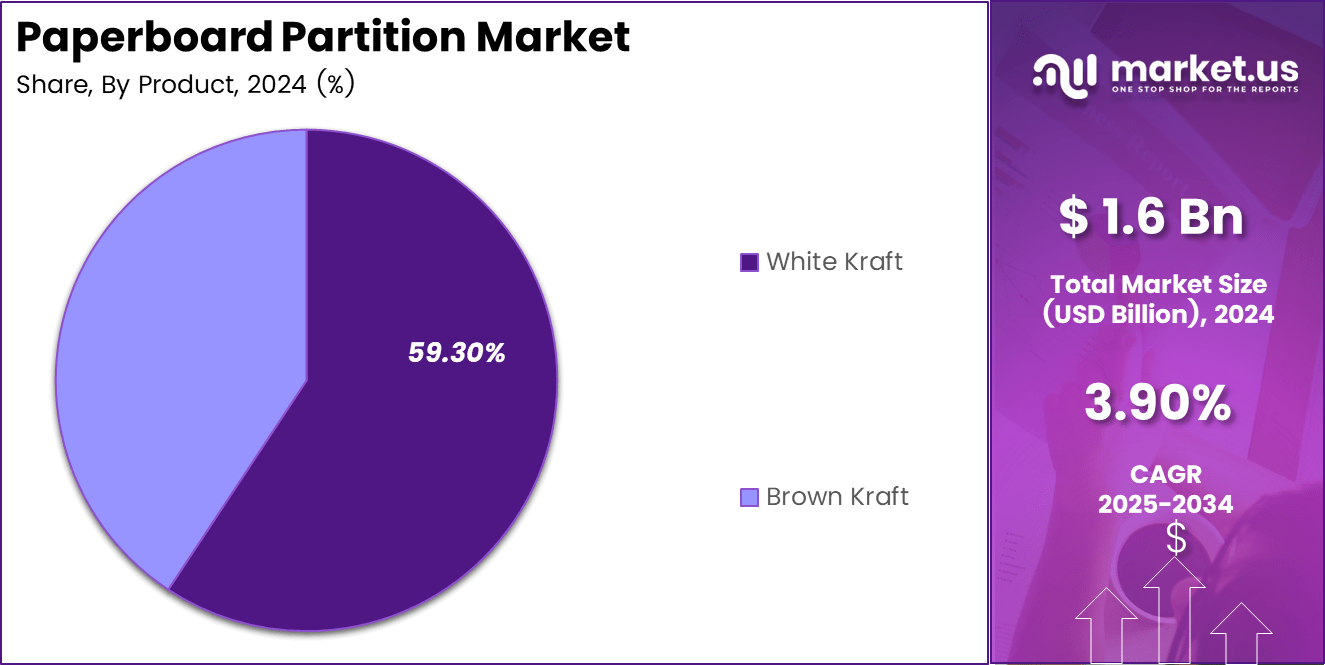

The Global Paperboard Partition Market is valued at USD 1.6 billion in 2024 toward an estimated USD 2.35 billion by 2034, supported by a CAGR of 3.9%. North America leads the market with a 48.9% share valued at USD 0.78 Billion, reflecting strong demand from packaging-intensive industries.

Regions such as APAC and Europe are anticipated to witness significant opportunities driven by manufacturing expansion, export growth, and rising sustainability mandates, positioning paperboard partitions as an essential component of modern protective packaging solutions.

The paperboard partition market is driven by the growing requirement for protective, lightweight, and efficient packaging solutions across a wide range of industries. As companies continue shifting toward sustainable and recyclable materials, paperboard partitions are becoming a preferred option due to their structural strength, versatility, and environmental advantages.

The Paperboard Partition market benefits from increasing product movement in sectors such as food and beverages, consumer goods, automotive components, and industrial shipments, all of which rely on protective packaging to prevent damage during handling and transportation. Advancements in paperboard quality, improved manufacturing techniques, and the rising emphasis on reducing plastic usage are expected to enhance the adoption of fiber-based partition solutions.

Global packaging trends increasingly focus on durability, customization, and cost-optimized designs, supporting the wider use of paperboard dividers in both small-scale and large-scale distribution networks. Overall, the sector continues to evolve in line with sustainability goals, material innovation, and changing consumer expectations.

Key Takeaways

- North America leads the market with a 48.9% share valued at USD 0.78 Billion, reflecting strong demand from packaging-intensive industries.

- The global Paperboard Partition market is expected to grow at a 3.9% CAGR from 2025–2034, supported by rising demand for sustainable and protective packaging solutions.

- The overall Paperboard Partition market size is projected to reach USD 2.35 billion by 2034, driven by steady adoption across major industries.

- The bleached grade segment recorded the largest share at 67.9%, supported by premium appearance, higher strength, and suitability for commercial packaging.

- White Kraft dominated the product category with 59.3% share, mainly due to its printability and preference in branded packaging.

- Food & beverage remained the leading end-use segment with 39.4% share, supported by rising beverage packaging, bottle protection, and transport-ready cartons.

- The gradual rise in both bleached and unbleached volumes from 2025 to 2034 indicates consistent, stable market expansion.

Analysts Viewpoint

The landscape of the paperboard partition market in 2024 features strong performances and strategic positioning across major players. WestRock Company leverages its extensive North American manufacturing footprint and integrated fibre-supply chain to meet higher demand from e-commerce, beverage and industrial packaging segments, giving it a cost and logistics advantage.

Mondi plc focuses its efforts on sustainability and smart converting capabilities in Europe and emerging markets, enabling it to serve premium white-kraft applications and brand-sensitive end-uses with agility. DS Smith plc benefits from its expertise in engineered fibre solutions and design-led protective partitions, allowing it to support electronics, personal care, and high-value consumer goods where segmentation and premiumity matter.

International Paper brings scale, global reach, and strong access to both bleached and unbleached board grades, positioning it to capture broad volume across food & beverage, automotive, and industrial end-uses while maintaining supply stability and cost-efficiencies.

Emerging Trends

Emerging trends in the paperboard partition market reflect a strong global transition toward sustainable and fiber-based packaging. Brands are prioritizing recyclable materials as regulations tighten against plastics and non-renewable substrates.

E-commerce growth is accelerating the need for protective partitions that safeguard fragile items during long-distance transportation. Manufacturers are also adopting advanced die-cutting and precision-forming technologies, allowing higher customization and stronger structural integrity. Premium packaging trends are increasing the use of smooth, printable white kraft for branded applications.

Growth Factors

Key growth factors include rising consumer preference for environmentally responsible packaging solutions and the expanding application of paperboard partitions across food, beverages, pharmaceuticals, electronics, and personal care goods.

Lightweight design supports lower logistics costs, encouraging higher adoption among exporters and bulk shippers. Strength improvements in bleached and unbleached grades are supporting wider industrial usage. Growing product movement in organized retail, combined with global sustainability initiatives, continues to strengthen market demand over the coming decade.

Regional Analysis

The paperboard partition market shows steady expansion, supported by rising demand for sustainable and protective packaging across key industries. In 2024, North America led the global Paperboard Partition market with a 48.9% share, valued at USD 0.78 Billion, driven by strong manufacturing output, high packaging consumption, and rapid adoption of fiber-based solutions. Europe continues to demonstrate stable growth, supported by strict sustainability regulations and increasing replacement of plastic separators.

The APAC region is emerging as a high-potential market due to strong industrial production, rising exports, and expanding food and beverage packaging needs. Latin America and the Middle East & Africa contribute moderately, supported by growing logistics activity and gradual adoption of eco-friendly packaging materials.

The overall regional landscape reflects expanding opportunities, with developed markets maintaining dominance and emerging regions gaining momentum as global packaging preferences shift toward recyclable and cost-efficient paperboard partition formats.

The paperboard partition market continues to grow steadily as demand rises for durable, sustainable packaging solutions. North America remains the leading region, while Europe shows consistent adoption supported by sustainability regulations. APAC is emerging rapidly with expanding manufacturing activity, and Latin America and MEA contribute moderate growth driven by increasing logistics and packaging needs.

By Grade

The grade segmentation of the paperboard partition market is led by the bleached category, accounting for 67.9% due to its superior strength, cleaner surface, and suitability for premium and visually appealing packaging applications. Bleached partitions are widely used in beverages, pharmaceuticals, and high-value consumer products where branding and protection are equally important.

Unbleached partitions hold the remaining share and are preferred for cost-efficient, industrial, and bulk-shipping requirements. Their natural appearance, lower processing needs, and adequate strength make them ideal for rugged use. Together, both grades support diverse packaging demands across protective, sustainable, and lightweight applications.

By Product

Product segmentation is dominated by white kraft, holding 59.3% share due to its smooth texture, excellent printability, and suitability for branding-focused packaging formats. White kraft partitions are widely used in premium consumer goods, beverages, cosmetics, and electronics, where aesthetics and presentation add value. Brown Kraft occupies the remaining share, primarily serving protective and industrial requirements where durability outweighs visual appeal.

Its natural, unbleached structure makes it suitable for heavy-duty cartons, logistics operations, and bulk packaging. Together, white and brown kraft products offer a balance of strength, sustainability, and cost efficiency across modern protective packaging applications.

By End Use

End-use segmentation is led by the food & beverage sector, contributing 39.4% driven by the high demand for safe, durable partitions for bottles, cans, jars, and fragile consumables. The sector relies heavily on paperboard partitions to prevent damage during transportation and storage while supporting eco-friendly packaging initiatives.

Beyond this dominant category, personal care applications use partitions for delicate cosmetic containers, while electronics depend on them for shock absorption and component protection. Automotive and pharmaceutical industries also utilize paperboard dividers for precision parts and medical products. Other segments include general industrial goods, reflecting diverse and growing adoption.

Key Market Segments

By Grade

- Bleached

- Unbleached

By Product

- Brown Kraft

- White Kraft

By End Use

- Food & Beverage

- Personal Care

- Electronic Goods

- Automotive

- Pharmaceuticals

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expansion of E-Commerce and Protective Packaging Demand

The rise of online shopping and global logistics is expected to significantly boost demand for partitioned paperboard packaging. With more products shipped across regions, manufacturers need internal dividers to protect fragile goods during transit, and paperboard partitions fit this requirement by offering strength, separation, and recyclability. Reports note that increasing e-commerce activity is a key supportive factor for the paperboard partition segment.

In addition, end-use industries such as electronics, food & beverage, and pharmaceuticals are moving toward packaging formats that offer both protection and sustainability, which aligns with the Paperboard Partition market. Manufacturers are therefore investing in higher-quality, custom partitions, further stimulating volume and innovation in the market.

Restraint

Volatility in Raw Material Costs and Supply Chains

Fluctuating prices of pulp, paperboard and other raw materials have placed pressure on margin structures in the partition manufacturing industry. Sources indicate that volatility in these inputs acts as a significant growth-limiting factor for the broader paperboard materials sector.

Moreover, supply chain disruptions—such as changes in trade policy or availability of recycled content—may delay production or force manufacturers to use costlier alternatives. These issues may restrict adoption of partitions in some cost-sensitive applications, especially when simpler packaging substitute options remain cheaper.

Opportunity

Growth of Sustainable and Fiber-Based Packaging Solutions

The global push toward green packaging and stricter regulatory frameworks on single-use plastics presents a strong opportunity for the paperboard partition segment. Paperboard partitions offer an eco-friendly alternative to plastic or foam inserts, which align with sustainability goals and consumer preference trends. Analysts highlight sustainability as a major catalyst for growth.

Additionally, because paperboard partitions can be custom-designed and printed, brands seeking premium presentation and protection are likely to adopt them. This opens up opportunities in premium segments such as cosmetics, high-value electronics, and branded food packaging, enabling suppliers to capture higher value per unit.

Challenge

Competition from Alternative Materials and Changing Design Requirements

Despite the benefits of paperboard partitions, competition from alternative materials such as plastic, foam, and moulded fibre remains a key challenge. These substitutes sometimes offer lower cost, easier manufacturing, or more extreme protection, making customers hesitant to switch entirely. Industry commentary notes that alternative packaging remains a barrier to broader adoption.

Further, evolving design needs—such as ultra-lightweight packaging, smaller packaging footprints, and more intricate internal geometries—demand advanced manufacturing capabilities. Suppliers who cannot keep up with the customization, strength, and weight requirements may find themselves under pressure, limiting their ability to scale in this market.

Key Players Analysis

The global paperboard partition market in 2024 is shaped strongly by the strategies and capabilities of leading manufacturers, with each player bringing a distinct advantage to the competitive landscape. WestRock Company continues to strengthen its position by using its integrated fibre network and advanced converting facilities, allowing it to serve large beverage and industrial clients with consistent quality and supply reliability.

Mondi plc stands out for its strong sustainability approach and innovative design strengths, enabling it to support premium white-kraft applications and emerging eco-focused brands. DS Smith plc plays an important role through its experience in engineered fibre solutions, offering custom protective designs suited for electronics, personal care, and high-value consumer goods. International Paper contributes scale and stability, supported by its global board production and strong presence in bleached and unbleached grades, ensuring steady availability for heavy-duty and high-volume applications across regions.

Top Key Players in the Market

- Mondi plc

- DS Smith plc

- International Paper

- WestRock Company

- Stora Enso Oyj

- M & M Box Partitions Co.

- NIPPON PAPER INDUSTRIES CO., LTD.

- Smurfit Kappa Group plc

- Innerpak Of Wisconsin, Inc.

- Multicell Packaging Inc.

- NEFAB GROUP

Recent Developments

- September 2024 – Colpac Packaging

Colpac introduced its Stagione Light range, a lighter paperboard food container series designed to reduce material weight while improving recyclability. The launch includes new 500 ml, 750 ml, and 1000 ml formats. For instance, this development shows how manufacturers are shifting to lightweight board solutions aligned with food and beverage packaging needs. - April 2025 – International Paper

International Paper completed the divestment of several European plants as part of regulatory approvals after the DS Smith merger. For instance, these structural adjustments are expected to reshape production capacity and influence the regional availability of paperboard materials used for partition packaging.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion

Forecast Revenue (2034) USD 2.35 Billion CAGR(2025-2034) 3.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Grade (Bleached, Unbleached), By Product (Brown Kraft, White Kraft), By End Use (Food & Beverage, Personal Care, Electronic Goods, Automotive, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mondi plc, DS Smith plc, International Paper, WestRock Company, Stora Enso Oyj, M & M Box Partitions Co., NIPPON PAPER INDUSTRIES CO., LTD., Smurfit Kappa Group plc, Innerpak Of Wisconsin, Inc., Multicell Packaging Inc., NEFAB GROUP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Paperboard Partition MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Paperboard Partition MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mondi plc

- DS Smith plc

- International Paper

- WestRock Company

- Stora Enso Oyj

- M & M Box Partitions Co.

- NIPPON PAPER INDUSTRIES CO., LTD.

- Smurfit Kappa Group plc

- Innerpak Of Wisconsin, Inc.

- Multicell Packaging Inc.

- NEFAB GROUP