Global Paper Towel Market Based on Product Type(Rolled Paper Towels, Folded Paper Towels), Based on Material(Virgin, Recycled, Bamboo), Based on End-User(Residential, Commercial), Based on the Distribution Channel(Online Platforms, Offline Stores), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 105032

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Product Type Analysis

- Based on Material Analysis

- Based on End-User Analysis

- Based on the Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

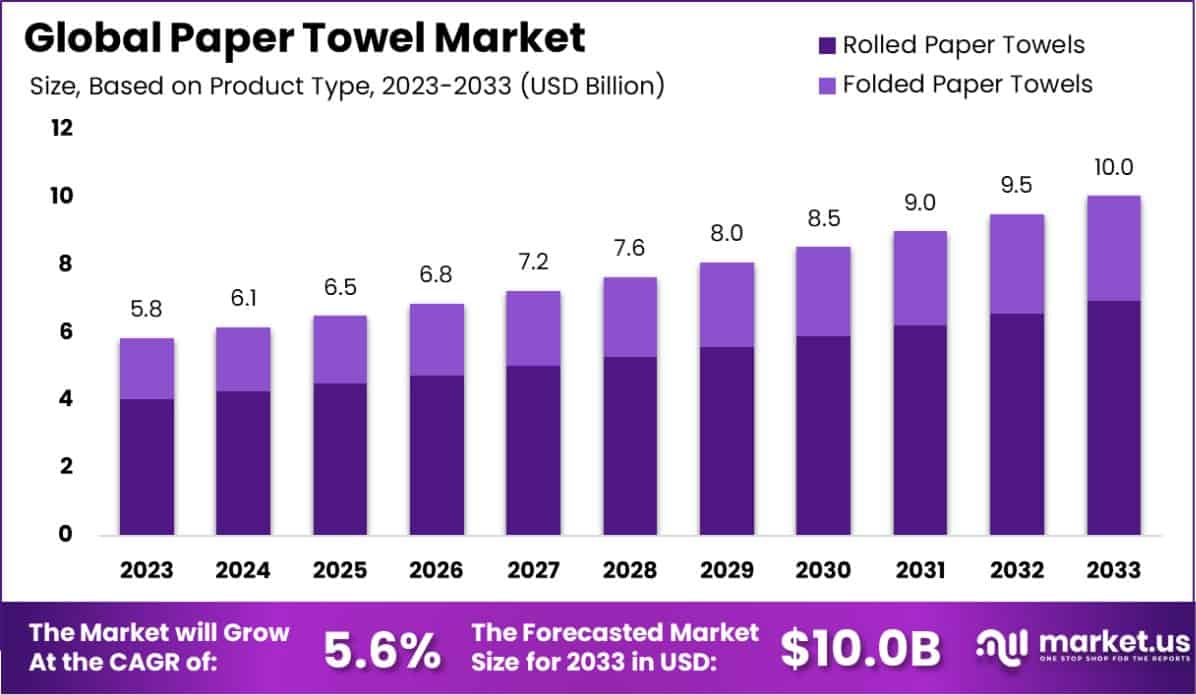

The Global Paper Towel Market is expected to be worth around USD 10.0 billion by 2033, up from USD 5.8 billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

A paper towel is a disposable product made from paper pulp that is primarily used for drying or cleaning. Its high absorbency and convenience make it suitable for various settings, including kitchens, bathrooms, and workplaces, enabling quick clean-ups and efficient hygiene maintenance.

The paper towel market comprises the production and sale of paper towels for both domestic and commercial use. The market is driven by the increasing demand for hygienic and disposable cleaning solutions in households, public restrooms, hospitals, and food service industries, reflecting a growing emphasis on sanitation and cleanliness.

The growth of the paper towel market is propelled by heightened awareness regarding hygiene practices, especially in the wake of health crises like the COVID-19 pandemic. This has spurred both household and industrial consumption, with businesses and healthcare facilities emphasizing more rigorous cleaning routines.

Demand for paper towels remains robust due to their convenience and effectiveness in infection control, which are critical in healthcare settings and food preparation areas. The shift towards more sanitary cleaning methods in public and private spaces continues to sustain market demand.

The market sees opportunities for product innovation, such as the development of eco-friendly paper towels made from recycled materials or new plant fibers, addressing environmental concerns. Additionally, the expansion of automatic dispensers and touchless delivery systems in restrooms offers growth avenues for higher-end, technologically integrated paper towel products.

The paper towel market is experiencing significant traction, driven primarily by an increasing global emphasis on hygiene and cleanliness across various sectors, including residential, healthcare, and food service industries. This demand is further accentuated by the ongoing public health discourse that prioritizes sanitary practices.

In this context, the recent $10 million funding acquired by Beco, a home and personal care brand, as reported by Economic Times and CNBC TV18, marks a pivotal development in the market.

This investment, led by Tanglin Venture Partners with contributions from notable entities such as Titan Capital Winners Fund, Asian Paints promoter Manish Choksi, Rukam Capital, and Synergy Capital, underscores growing investor confidence in sustainable and eco-friendly products within the hygiene sector.

Beco’s successful funding round not only reflects the market’s positive response to eco-conscious products but also signals robust growth prospects for similar brands. The market is poised for expansion as consumers increasingly favor products that align with environmental sustainability alongside functional efficiency.

As businesses continue to innovate and focus on eco-friendly solutions, the paper towel market is expected to maintain its upward trajectory, bolstered by both consumer preferences and substantial investment flows. This trend is likely to catalyze further advancements in product development and market penetration strategies, enhancing overall market dynamics.

Key Takeaways

- The Global Paper Towel Market is expected to be worth around USD 10.0 billion by 2033, up from USD 5.8 billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

- In 2023, Rolled Paper Towels held a dominant market position Based on the Product Type segment of the Paper Towel Market.

- In 2023, Virgin held a dominant market position in the Based on Material segment of the Paper Towel Market.

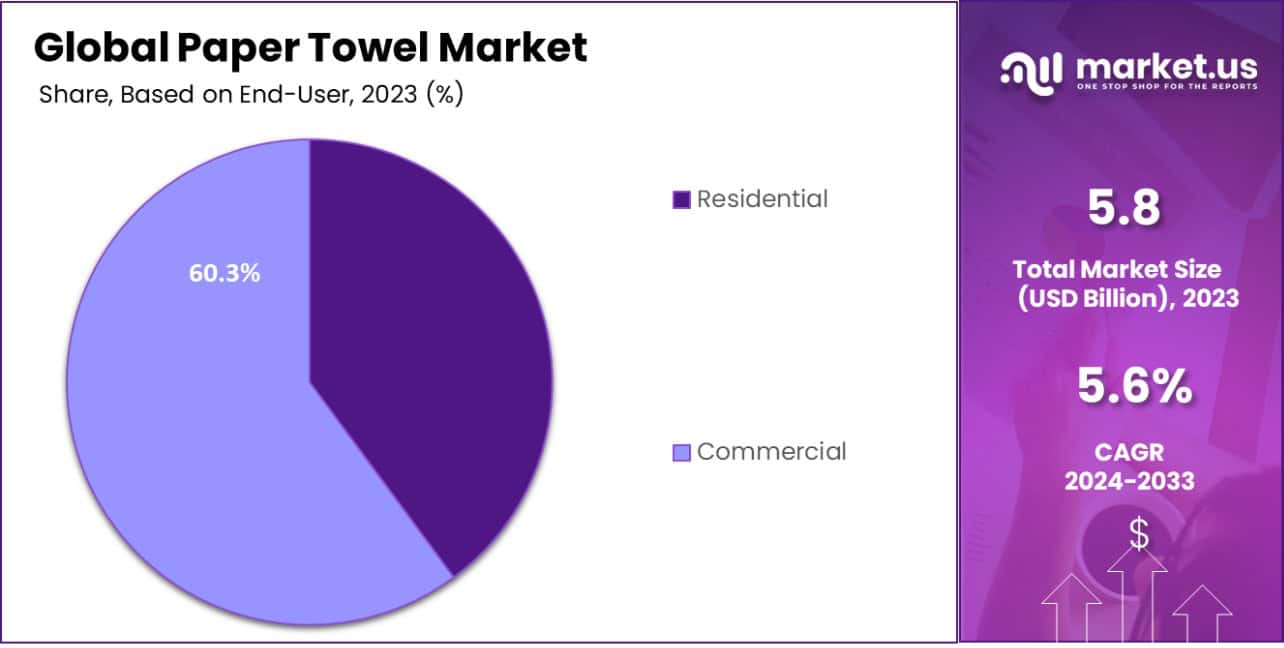

- In 2023, Commercial held a dominant market position in the Based on End-User segment of the Paper Towel Market, with a 60.3% share.

- In 2023, Offline Stores held a dominant market position in Based on the Distribution Channel segment of Paper Towel Market.

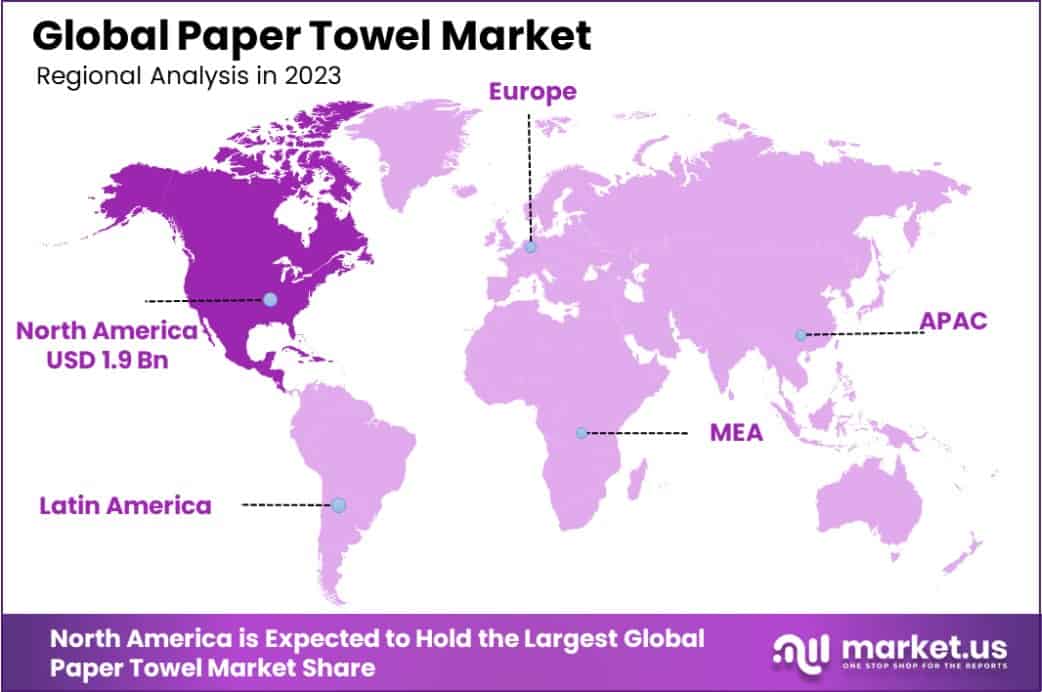

- North America dominated a 33.4% market share in 2023 and held USD 1.9 Billion in revenue from the Paper Towel Market.

Based on Product Type Analysis

In 2023, Rolled Paper Towels held a dominant market position in the “Based on Product Type” segment of the Paper Towel Market. This segment includes both Rolled and Folded Paper Towels, with Rolled Paper Towels capturing a larger share due to their widespread use in both commercial and residential settings.

The preference for rolled paper towels can be attributed to their convenience and cost-effectiveness, which make them a practical choice for continuous usage areas such as public restrooms, kitchens, and healthcare facilities.

The market for Folded Paper Towels also exhibits substantial demand, driven by their application in environments that require single-use solutions for maintaining hygiene standards, such as clinics and food service locations. However, the versatility and ease of dispensing associated with Rolled Paper Towels continue to make them more appealing to a broader consumer base.

The ongoing innovations in the paper towel industry, focusing on sustainability and enhanced absorbency, are expected to further influence the dynamics within this segment. Brands are increasingly investing in eco-friendly production practices and materials, responding to consumer demand for products that align with environmental sustainability goals.

This trend is particularly pronounced in the Rolled Paper Towel sub-segment, where manufacturers are exploring new materials and technologies to improve product efficiency and environmental impact.

Based on Material Analysis

In 2023, Virgin paper towels held a dominant market position in the “Based on Material” segment of the Paper Towel Market. This category includes Virgin, Recycled, and Bamboo paper towels, with Virgin paper towels capturing the largest market share.

The preference for Virgin paper towels is largely due to their superior absorbency and strength, which make them highly effective for cleaning and drying applications across both residential and commercial settings.

Despite the dominance of Virgin paper towels, there is a noticeable shift towards more sustainable alternatives such as Recycled and Bamboo paper towels. Recycled paper towels are gaining traction due to increasing consumer awareness of environmental issues and the push for sustainable consumption practices. These towels appeal particularly to eco-conscious consumers and businesses looking to reduce their environmental footprint.

Bamboo paper towels represent a niche but growing segment. They are prized for their sustainability, as bamboo is a fast-renewing resource that requires less water and no pesticides to grow. The softness and antibacterial properties of bamboo paper towels make them a compelling choice for consumers prioritizing both environmental impact and product functionality.

As market dynamics evolve, these eco-friendly alternatives are expected to challenge the dominance of Virgin paper towels by appealing to the rising consumer demand for sustainable products.

Based on End-User Analysis

In 2023, Commercial usage held a dominant market position in the “Based on End-User” segment of the Paper Towel Market, commanding a 60.3% share. This segment includes both Residential and Commercial applications, with Commercial end-users prevailing due to extensive utilization across various industries such as hospitality, healthcare, and education.

The high demand in Commercial settings is driven by the essential need for high hygiene standards and frequent cleaning protocols, which necessitate the bulk use of paper towels.

On the other hand, the Residential sector, while smaller in comparison, also showcases significant consumption. This is primarily influenced by the rising awareness of hygiene at home, especially in the wake of public health concerns.

However, the market share remains relatively lower due to the periodic nature of usage and the increasing competition from reusable alternatives that are more cost-effective and environmentally friendly for home users.

The ongoing trend in the Commercial segment towards more sustainable and efficient cleaning solutions continues to drive innovation and growth in the paper towel market.

Manufacturers are increasingly focusing on developing high-efficiency and eco-friendly paper towels to meet the stringent environmental and performance criteria expected by commercial entities, potentially increasing market share in this dominant segment over time.

Based on the Distribution Channel Analysis

In 2023, Offline Stores held a dominant market position in the “Based on the Distribution Channel” segment of the Paper Towel Market. This segment encompasses both Online Platforms and Offline Stores, with Offline Stores capturing a larger market share due to their established presence and consumer preference for tactile purchasing experiences.

The dominance of offline stores is particularly marked in areas where consumers value immediate availability and the ability to physically assess product quality before purchase.

Despite the strength of offline channels, Online Platforms are rapidly gaining ground, propelled by the convenience of home delivery and the increasing penetration of e-commerce in consumer goods.

The growth in online sales is further boosted by the digital transformation trends across retail sectors and the enhanced logistic capabilities that reduce delivery times, making online purchases more appealing.

The dynamic between these distribution channels is influenced by consumer behaviors and technological advancements. While offline stores continue to appeal due to their accessibility and instant gratification, online platforms are expected to increase their market share.

As shopping habits evolve and as consumers become more comfortable with purchasing everyday items like paper towels through digital channels. This trend suggests a possible shift in dominance over the coming years as market conditions continue to change.

Key Market Segments

Based on Product Type

- Rolled Paper Towels

- Folded Paper Towels

Based on Material

- Virgin

- Recycled

- Bamboo

Based on End-User

- Residential

- Commercial

Based on the Distribution Channel

- Online Platforms

- Offline Stores

Drivers

Key Drivers of the Paper Towel Market

The growth of the paper towel market is primarily driven by increasing hygiene awareness and rising disposable incomes worldwide, which boost consumer spending on cleaning products.

The convenience and efficiency of paper towels in household and commercial settings, particularly in kitchens and restrooms, contribute to their widespread use. Additionally, the ongoing advancements in product innovation, such as enhanced absorbency and eco-friendly materials, attract environmentally conscious consumers, further propelling market expansion.

The COVID-19 pandemic also significantly influenced the market by heightening the focus on cleanliness and sanitation, leading to a surge in demand for disposable hygiene products, including paper towels.

Restraint

Challenges Impacting the Paper Towel Market

The primary restraint in the paper towel market is the growing environmental concern over deforestation and waste generation associated with paper products. As consumers become more environmentally aware, the demand for sustainable alternatives, such as reusable cloths and biodegradable options, increases, posing a challenge to traditional paper towel sales.

Additionally, advancements in electric hand dryers, offering more energy-efficient and less wasteful solutions in public facilities, further reduce the reliance on disposable paper towels.

Economic downturns can also lead to budget constraints in households and businesses, prompting consumers to seek more cost-effective and long-lasting cleaning methods, which can negatively impact the market for disposable paper towels.

Opportunities

Expanding Opportunities in the Paper Towel Market

The paper towel market presents several growth opportunities, particularly through the development of eco-friendly products that cater to increasing consumer demand for sustainable living practices. Innovations such as bamboo-based and recycled paper towels are gaining traction, providing a greener alternative to traditional wood pulp versions.

There is also potential to expand into emerging markets where awareness and spending on hygiene products are on the rise due to improving living standards and health awareness. The trend towards premiumization, with features like enhanced absorbency and attractive designs, offers an opportunity to tap into the higher-end segment of the market.

Furthermore, strategic partnerships with businesses in the hospitality and healthcare sectors could drive bulk purchases and establish stable demand channels.

Challenges

Key Challenges Facing Paper Towel Market

The paper towel market faces significant challenges that could hinder its growth. One of the major issues is the increasing regulatory pressures related to environmental sustainability.

Governments and environmental organizations are advocating for stricter waste management practices and reductions in single-use paper products, which directly impacts market operations.

Additionally, the rising competition from alternative products, such as electric hand dryers and reusable cloths, offers consumers durable and cost-effective options, thereby decreasing reliance on disposable paper towels. Market volatility in raw material prices, especially pulp, also poses a financial challenge, affecting production costs and profit margins.

Furthermore, changing consumer behaviors towards more sustainable lifestyles can shift preferences away from paper towels, urging companies to innovate or risk losing market share.

Growth Factors

Driving Growth in the Paper Towel Market

The paper towel market is experiencing growth due to several key factors. The primary driver is the heightened emphasis on hygiene and sanitation, especially in the aftermath of global health crises such as the COVID-19 pandemic, which has led to increased consumer and institutional demand for disposable cleaning solutions.

The convenience and effectiveness of paper towels in quickly dealing with spills and maintaining cleanliness in homes and public places like restaurants and offices also contribute to their continued popularity. Additionally, innovations in product design, such as improved absorbency and strength, and the introduction of customizable and scented varieties, are appealing to a broader consumer base.

The expansion of distribution channels, including online retail, which offers easy access to a wide range of products, further supports market growth by reaching more customers worldwide.

Emerging Trends

Emerging Trends in Paper Towel Market

Emerging trends in the paper towel market are shaped by consumer preferences toward sustainability and innovation. There’s a noticeable shift towards eco-friendly products, with manufacturers developing paper towels from recycled materials and sustainable sources like bamboo and sugarcane, which reduce environmental impact.

Additionally, customization is becoming popular, with products featuring various textures, patterns, and scents to enhance user experience and aesthetic appeal in both household and commercial spaces.

Technological advancements are also leading to the production of more durable and absorbent paper towels that require fewer sheets per use, promoting cost-effectiveness and waste reduction.

Furthermore, the rise of e-commerce platforms facilitates direct-to-consumer marketing strategies and subscription services, making it convenient for consumers to receive products tailored to their preferences and usage patterns, boosting market engagement and loyalty.

Regional Analysis

The paper towel market exhibits distinct regional dynamics, reflecting varying consumer behaviors and economic conditions. North America leads the market, holding a 33.4% share with a value of USD 1.9 billion, driven by high hygiene standards and substantial consumer spending power.

The widespread adoption of paper towels in household and commercial settings, coupled with advanced product offerings, supports this dominance.

In Europe, environmental concerns and stringent regulations drive the demand for sustainable and recyclable paper towel products, aligning with the region’s commitment to reducing environmental footprints. This shift is reshaping market offerings and consumer preferences.

The Asia Pacific region is experiencing rapid growth due to rising urbanization and increased awareness of hygiene practices, particularly in emerging economies such as China and India. The expansion of retail infrastructure and the burgeoning middle class contribute to the growing market penetration.

Meanwhile, the Middle East & Africa, and Latin America are emerging as potential growth areas. Economic development and urbanization are increasing consumer access to and demand for disposable hygiene products, though market penetration remains lower than in more developed regions.

Overall, while North America continues to lead, shifts in consumer preferences and economic growth in developing regions suggest dynamic changes in the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global paper towel market has seen significant contributions from key players such as SCA Group, Kruger Inc., and Solaris Paper, each strategically enhancing their market positions through diversified product offerings and robust distribution networks.

SCA Group has been a dominant force, leveraging its extensive portfolio and sustainability initiatives to appeal to environmentally conscious consumers. The company’s focus on eco-friendly smart manufacturing processes and the use of recycled materials has been instrumental in solidifying its leadership in the market.

SCA Group’s strategic expansion into emerging markets has further propelled its growth, capitalizing on increasing hygiene awareness and disposable income levels.

Kruger Inc. has made notable advancements by enhancing its operational efficiencies and product quality. The company’s investment in state-of-the-art technology for production facilities underscores its commitment to meeting the rising demand for high-caliber products.

Kruger’s strong focus on customer-centric solutions and its agile response to market dynamics has enabled it to maintain a competitive edge. Moreover, Kruger’s marketing strategies, emphasizing the strength and absorbency of its paper towels, resonate well with its target audience, driving sales and customer loyalty.

Solaris Paper has distinguished itself with innovative product designs and packaging that cater to both institutional and residential segments. The introduction of dispenser-compatible rolls and select-a-size sheets by Solaris has addressed the growing demand for convenience and cost-effectiveness in usage.

The company’s strategic partnerships and promotional activities have effectively enhanced its visibility and market reach, making it a formidable player in the industry.

Overall, these companies continue to drive the global paper towel market’s growth through innovation, sustainability, and strategic market expansion efforts.

Top Key Players in the Market

- Procter & Gamble (P&G)

- Kimberly-Clark Corp.

- Georgia-Pacific LLC

- SCA Group

- Kruger Inc.

- Solaris Paper

- Wausau Paper (part of SCA Group)

- Essity Operations Mannheim GmbH

- Solaris Paper

- Clearwater Paper Corporation

- Soundview Paper Company

- Hygieneprodukte GmbH

- WEPA Hygieneprodukte GmbH

- Seventh Generation Inc.

- Cascades Inc.

- American Specialties Inc.

- Other Key Players

Recent Developments

- In June 2024, Georgia-Pacific introduced a technologically advanced paper towel that features enhanced absorbency and durability. The product uses a new, patented technology that allows consumers to use fewer sheets per task, promoting both cost-effectiveness and waste reduction.

- In March 2024, Kimberly-Clark Corp. acquires a smaller competitor, enhancing its market share and distribution capabilities. This strategic acquisition has not only expanded its product portfolio but also strengthened its foothold in strategic markets, particularly in the rapidly growing Asia-Pacific region.

- In January 2024, Procter & Gamble launched a new line of eco-friendly paper towels, aiming to reduce environmental impact. The product is designed to provide superior absorbency and strength while being made from 100% recycled materials. This move aligns with the company’s broader sustainability goals and targets eco-conscious consumers.

Report Scope

Report Features Description Market Value (2023) USD 5.8 Billion Forecast Revenue (2033) USD 10.0 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Product Type(Rolled Paper Towels, Folded Paper Towels), Based on Material(Virgin, Recycled, Bamboo), Based on End-User(Residential, Commercial), Based on the Distribution Channel(Online Platforms, Offline Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter & Gamble (P&G), Kimberly-Clark Corp., Georgia-Pacific LLC, SCA Group, Kruger Inc., Solaris Paper, Wausau Paper (part of SCA Group), Essity Operations Mannheim GmbH, Solaris Paper, Clearwater Paper Corporation, Soundview Paper Company, Hygieneprodukte GmbH, WEPA Hygieneprodukte GmbH, Seventh Generation Inc., Cascades Inc., American Specialties Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble (P&G)

- Kimberly-Clark Corp.

- Georgia-Pacific LLC

- SCA Group

- Kruger Inc.

- Solaris Paper

- Wausau Paper (part of SCA Group)

- Essity Operations Mannheim GmbH

- Solaris Paper

- Clearwater Paper Corporation

- Soundview Paper Company

- Hygieneprodukte GmbH

- WEPA Hygieneprodukte GmbH

- Seventh Generation Inc.

- Cascades Inc.

- American Specialties Inc.

- Other Key Players