Global Pandemic Risk Insurance Market Size, Share and Analysis Report By Coverage Type (Business Interruption, Event Cancellation, Health & Life, Travel, Others), By End User (Individuals, SMEs, Large Enterprises, Government & Public Sector, Healthcare Providers, Others), By Distribution Channel (Direct Sales, Brokers & Agents, Bancassurance, Online Platforms, Others), By Industry Vertical (Healthcare, Hospitality, Retail, Manufacturing, Education, Entertainment & Events, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176529

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Coverage Type

- By End User

- By Distribution Channel

- By Industry Vertical

- Regional Perspective

- Emerging Trends Analysis

- Growth Factors Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

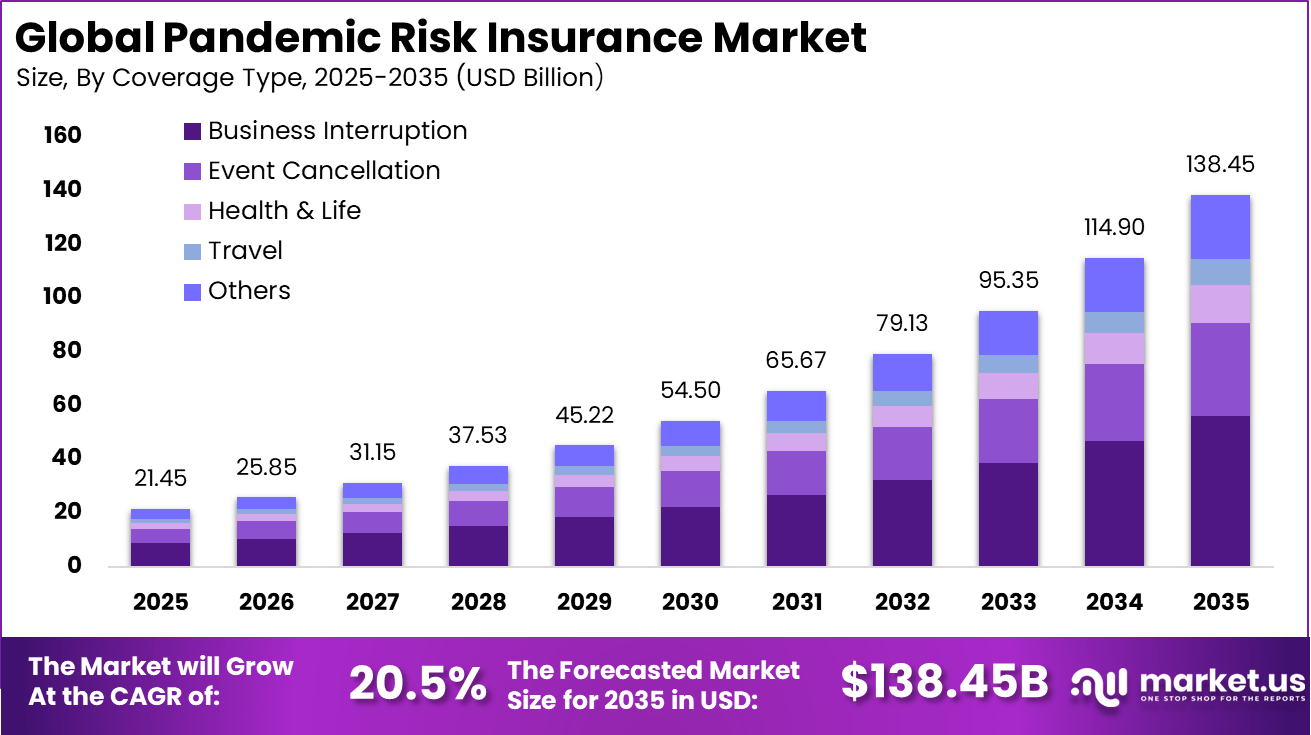

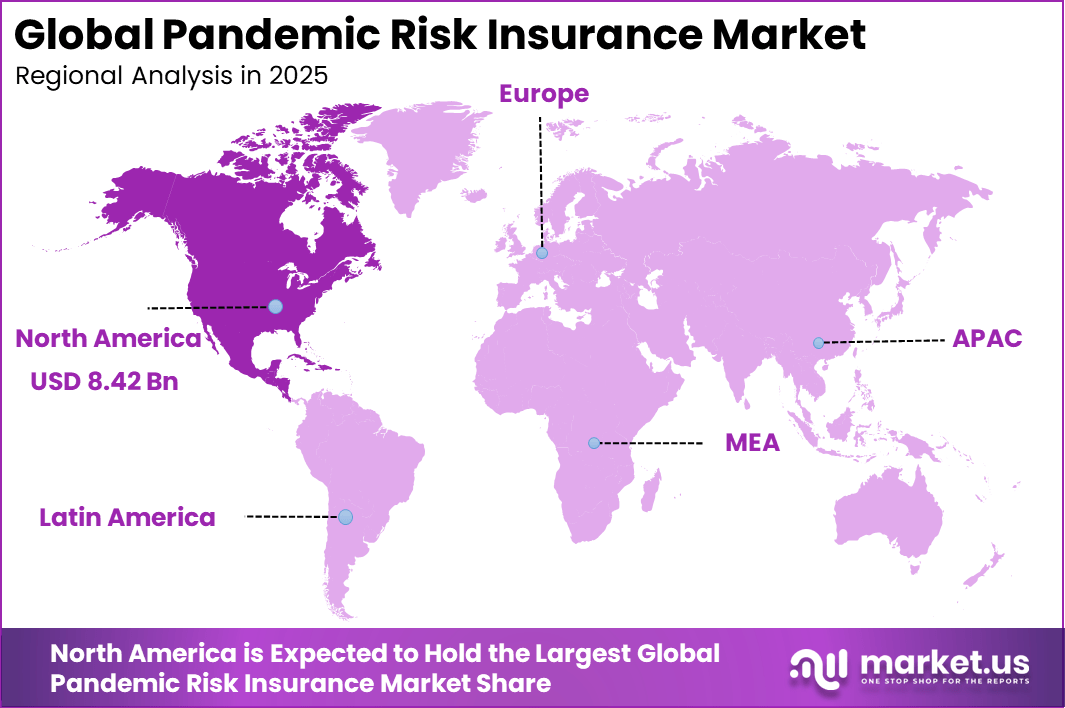

The Global Pandemic Risk Insurance Market size is expected to be worth around USD 138.45 billion by 2035, from USD 21.45 billion in 2025, growing at a CAGR of 20.5% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 39.3% share, holding USD 8.42 billion in revenue.

The pandemic risk insurance market focuses on coverage solutions designed to protect businesses and institutions against financial losses caused by widespread infectious disease outbreaks. These losses may arise from government mandated shutdowns, supply chain disruptions, workforce unavailability, and sharp declines in consumer demand. The market has gained strategic importance as pandemics are now recognized as systemic risks rather than isolated events.

For instance, in September 2025, Munich Re partnered with local firms to launch the Maldives’ first epidemic and pandemic insurance policy for tourism businesses, featuring a $5 million limit effective from September 15. This initiative bolsters resilience in a sector vital to the economy, mitigating revenue losses from future outbreaks.

Key driver factors shaping this market include heightened awareness of non traditional catastrophic risks, increased regulatory and governmental involvement in risk sharing frameworks, and growing demand from businesses for balance sheet protection against prolonged operational disruptions. Organizations now view pandemic risk insurance as part of broader enterprise risk management rather than an optional add on, especially in sectors heavily exposed to mobility and demand shocks.

Demand for pandemic risk insurance is strongest among sectors with high exposure to human mobility and congregation. These include travel, hospitality, events, healthcare services, and large employers. Prolonged shutdowns or capacity restrictions directly impact revenue and cash flow. Insurance demand increases as organizations seek financial stability during extended disruptions.

Key Takeaway

- In 2025, Business Interruption coverage emerged as the leading coverage type in the Pandemic Risk Insurance Market, accounting for 40.7% of overall demand.

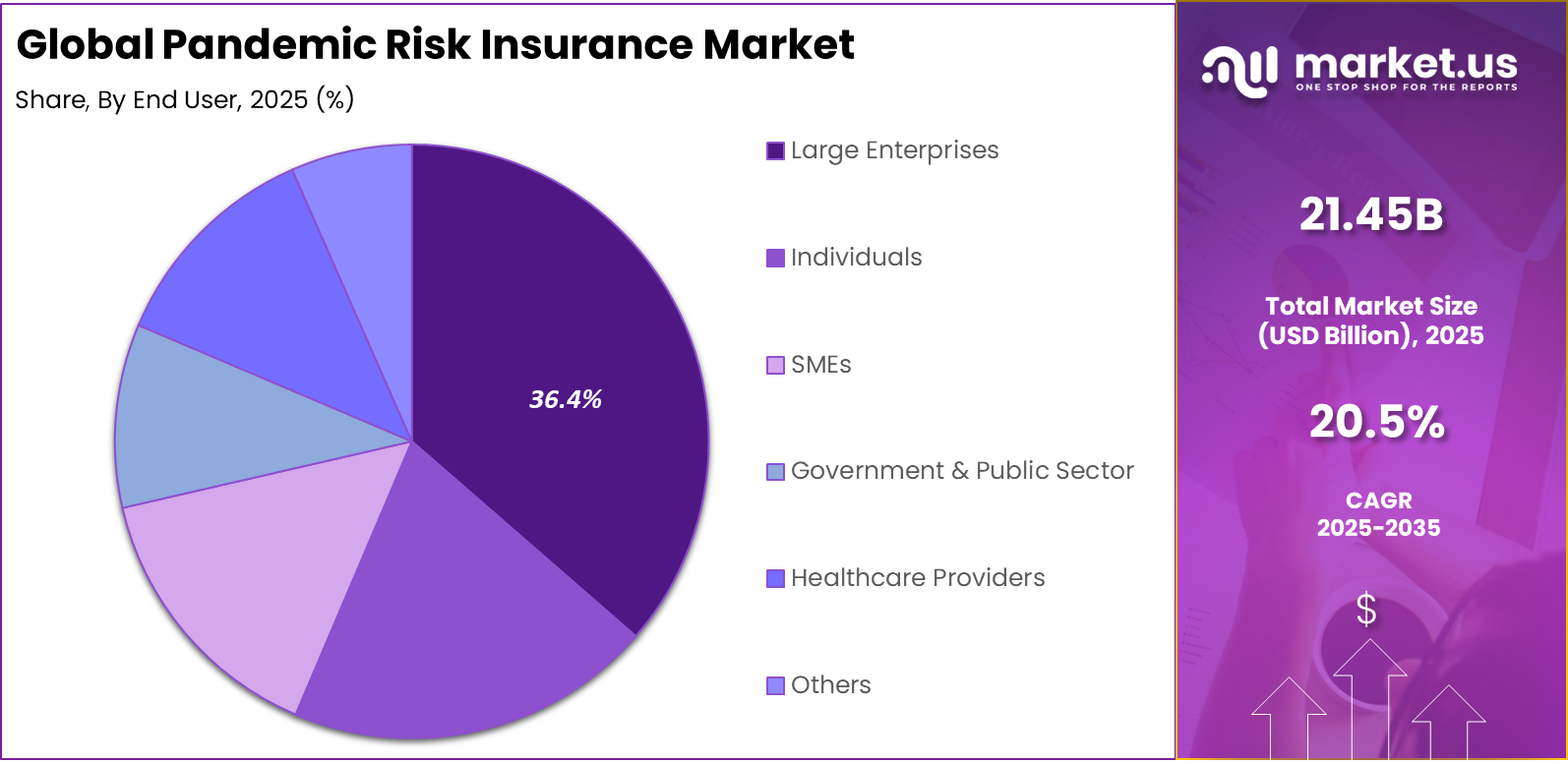

- In 2025, Large Enterprises represented the dominant end user segment, capturing a 36.4% share of the Pandemic Risk Insurance Market.

- In 2025, Direct Sales remained the primary distribution channel, holding a 39.2% share of total market activity.

- In 2025, the Healthcare sector led industry adoption, contributing 34.3% of the Pandemic Risk Insurance Market.

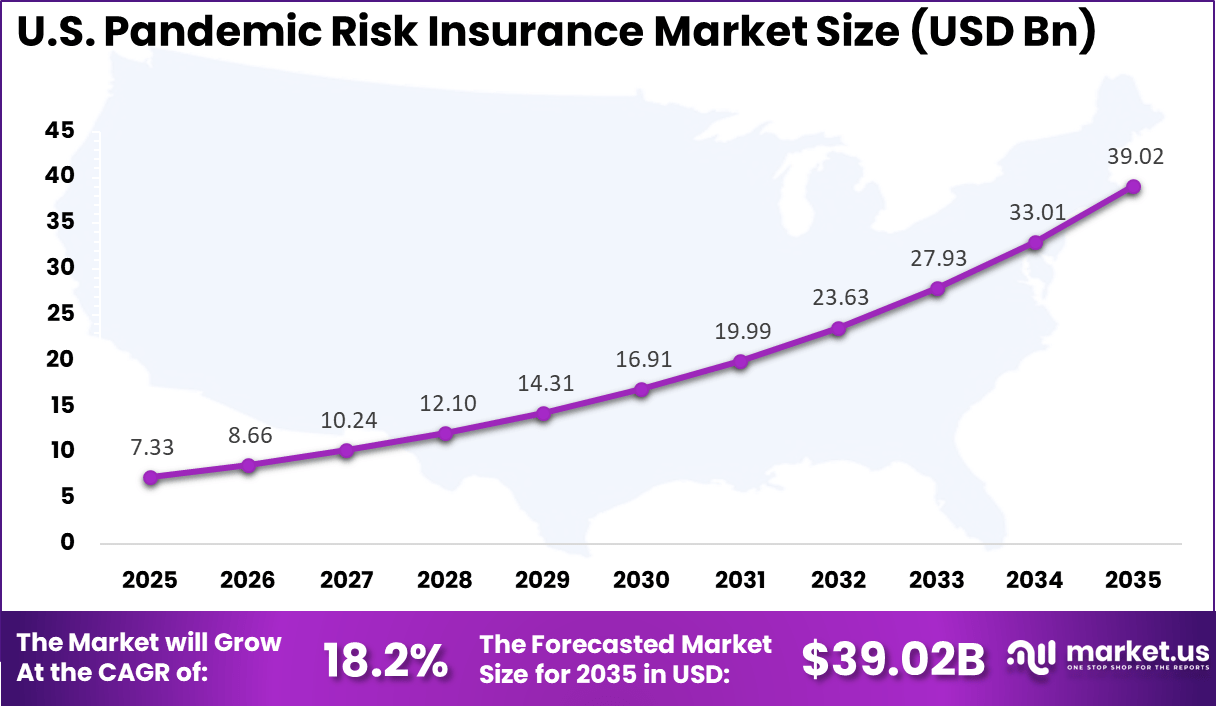

- In 2025, North America maintained a strong regional position with a 39.3% share, while the US market was valued at USD 7.33 billion and recorded a robust growth rate of 18.2%.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Heightened awareness of systemic pandemic-related business risks +6.2% Global Short term Government-backed pandemic risk sharing and insurance frameworks +5.1% North America, Europe Medium term Increased adoption of business interruption and contingency coverage +4.3% Global Short to medium term Expansion of coverage to supply chain and event disruption risks +3.1% North America, Europe, Asia Pacific Medium term Institutional demand for financial resilience and continuity planning +2.4% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High premium costs and limited affordability for SMEs -3.8% Global Short to medium term Uncertainty in loss modeling for pandemic-scale events -3.1% Global Medium term Dependence on government participation and backstop mechanisms -2.6% North America, Europe Medium term Limited historical claims data for underwriting accuracy -2.1% Global Medium term Regulatory complexity across jurisdictions -1.7% Asia Pacific, Latin America Medium to long term By Coverage Type

Business interruption coverage accounts for 40.7% of overall adoption in the Pandemic Risk Insurance Market. This dominance reflects the significant revenue losses experienced during widespread shutdowns and operational restrictions. Organizations prioritize protection against income disruption when normal business activities are suspended due to public health emergencies.

The importance of business interruption coverage is reinforced by lessons learned from recent global health crises. Extended closures and supply chain disruptions highlighted gaps in traditional insurance policies. As a result, this coverage type is increasingly viewed as essential for financial resilience.

For Instance, in October 2025, Gallagher created India’s first parametric pandemic policy reinsured by Munich Re for business interruption losses. It pays for revenue drops and extra costs from epidemics like COVID waves. Malls, hotels, and offices now have access to quick payouts to stay afloat during health crises.

By End User

Large enterprises represent 36.4% of total end user demand. These organizations operate complex business models with high fixed costs and global exposure. Prolonged operational disruption can lead to substantial financial impact, increasing reliance on pandemic specific insurance solutions.

Adoption among large enterprises is driven by structured risk management frameworks. Insurance coverage supports business continuity planning and stakeholder confidence. This sustains strong demand within the large enterprise segment.

For instance, in January 2026, Zurich Insurance Group bought AIG’s global travel business, boosting its reach to large enterprises needing pandemic add-ons. The deal combines Cover-More with Travel Guard, serving 20 million customers. Big firms get enhanced protection for employee trips and business continuity amid outbreaks.

By Distribution Channel

Direct sales account for 39.2% of policy distribution across the market. This channel is preferred due to the customized nature of pandemic risk coverage. Direct engagement allows insurers and clients to align policy terms with specific operational exposures and industry risks.

The use of direct sales is also supported by long term insurer relationships. Negotiated coverage structures provide clarity around triggers and exclusions. This strengthens the role of direct distribution within the market.

For Instance, in July 2025, Marsh & McLennan ramped up direct sales via digital platforms like Verisk’s Whitespace for pandemic risks. This cuts broker fees and speeds quotes for clients. Large brokers now push tailored direct deals, helping firms lock in coverage fast during threat alerts.

By Industry Vertical

Healthcare accounts for 34.3% of industry based demand in the Pandemic Risk Insurance Market. Healthcare providers face continuous exposure during public health emergencies while managing high operational costs. Insurance coverage helps mitigate financial strain caused by patient surges and service disruptions.

The reliance on pandemic risk insurance within healthcare is reinforced by regulatory obligations and service continuity requirements. Facilities must remain operational during crises. This drives consistent insurance adoption across the healthcare sector.

For Instance, in January 2023, Tokio Marine HCC rolled out healthcare-focused pandemic solutions covering medical stop loss and contingency. Providers buy direct for staff absences and facility risks during surges. It addresses the COVID census drops, helping hospitals maintain operations.

Regional Perspective

North America holds a leading position in the Pandemic Risk Insurance Market, accounting for 39.3% of total activity. The region benefits from strong insurance infrastructure, high awareness of pandemic related risks, and advanced risk transfer mechanisms.

Businesses actively seek coverage to manage uncertainty. The legal and regulatory environment further supports insurance adoption. Organizations prioritize protection against large scale disruption. These factors sustain North America’s strong regional role.

For instance, in October 2025, AIG reported strong third-quarter results with AATI per diluted common share of $2.20, demonstrating resilience in its U.S.-based operations from New York City. The performance highlights AIG’s robust position in managing pandemic-related exposures and broader commercial risks, maintaining North America’s leadership in the pandemic risk insurance market through strategic underwriting and risk transfer capabilities.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 7.33 Bn and a growth rate of 18.2% CAGR. Expansion is supported by increased corporate focus on resilience and crisis preparedness. Pandemic risk insurance is increasingly integrated into enterprise risk portfolios.

Insurance adoption in the U.S. is influenced by economic exposure and regulatory expectations. Large enterprises and healthcare organizations lead coverage demand. These dynamics collectively support strong growth within the U.S. market segment.

For instance, in October 2025, Chubb reinforced U.S. leadership in pandemic risk insurance by advancing its Pandemic Business Interruption Program, featuring government-backed reinsurance for small and large businesses. The program provides immediate cash infusions and claims adjudication for pandemic-related losses, demonstrating Chubb’s innovative risk-sharing model.

Emerging Trends Analysis

An emerging trend in the pandemic risk insurance market is the use of parametric structures. These policies trigger payouts based on predefined indicators such as official outbreak declarations or infection thresholds. Parametric designs reduce claims complexity and enable faster disbursement of funds. This approach is gaining attention as a way to address traditional loss assessment challenges.

Another trend is increased collaboration between insurance providers and public health data organizations. Improved access to real time epidemiological data supports better risk monitoring and policy design. Data driven approaches enhance transparency and support more responsive coverage models. These trends are shaping next generation pandemic insurance solutions.

Growth Factors Analysis

One of the key growth factors for the pandemic risk insurance market is the long term impact of global interconnectedness. International travel, dense urbanization, and complex supply chains increase vulnerability to disease spread. As these structural factors persist, demand for financial protection against pandemic disruptions remains relevant. This structural exposure supports sustained market interest.

Another growth factor is the expansion of regulatory and policy discussions around systemic risk protection. Governments and international organizations increasingly recognize the economic cost of uninsured pandemic losses. Policy initiatives aimed at strengthening national resilience frameworks indirectly support the development of pandemic risk insurance markets. This policy alignment encourages innovation and gradual market expansion.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Reinsurance providers Very High High Global Central role in risk pooling Government-backed insurance programs High Medium North America, Europe Stable long-term participation Large commercial insurers Medium Medium Global Portfolio diversification Private equity firms Medium Medium North America, Europe Structured risk-transfer vehicles Venture capital investors Low High North America Limited to analytics and modeling tools Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Advanced catastrophe and epidemiological risk modeling +4.6% Loss estimation and pricing Global Short to medium term Big data analytics for mobility and outbreak tracking +3.8% Risk forecasting North America, Europe Medium term Scenario simulation and stress-testing platforms +3.2% Capital planning Global Medium term Automated policy administration and claims triggers +2.6% Faster payouts Global Medium to long term Integration with public health and government data sources +2.1% Real-time risk updates Europe, North America Long term Key Market Segments

By Coverage Type

- Business Interruption

- Event Cancellation

- Health & Life

- Travel

- Others

By End User

- Large Enterprises

- Individuals

- SMEs

- Government & Public Sector

- Healthcare Providers

- Others

By Distribution Channel

- Direct Sales

- Brokers & Agents

- Bancassurance

- Online Platforms

- Others

By Industry Vertical

- Healthcare

- Hospitality

- Retail

- Manufacturing

- Education

- Entertainment & Events

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global reinsurers such as Munich Re, Swiss Re, Hannover Re, SCOR SE, and Everest Re Group form the backbone of pandemic risk capacity. Their role focuses on absorbing systemic losses and structuring risk-sharing mechanisms. Advanced catastrophe modeling and scenario analysis support underwriting decisions. These players work closely with governments to design public–private frameworks.

Primary insurers and specialty markets such as AXA XL, Chubb, AIG, Zurich Insurance Group, Allianz, and Beazley provide tailored covers for business interruption and event disruption. Lloyd’s of London adds flexible capacity through syndicates. These insurers emphasize parametric triggers, sublimits, and exclusions to manage exposure. Adoption is strongest among large enterprises and critical sectors seeking balance-sheet protection.

Brokers and risk advisors such as Marsh & McLennan and Willis Towers Watson play a central role in program design and placement. Specialty carriers including Tokio Marine HCC, Sompo International, CNA Financial, QBE Insurance Group, and Mapfre expand regional options. Other participants enhance competition and innovation, supporting more resilient pandemic risk transfer solutions.

Top Key Players in the Market

- Munich Re

- Swiss Re

- AXA XL

- Lloyd’s of London

- Chubb

- AIG (American International Group)

- Zurich Insurance Group

- Berkshire Hathaway

- Allianz

- Marsh & McLennan

- Willis Towers Watson

- Beazley

- Tokio Marine HCC

- Sompo International

- Hannover Re

- SCOR SE

- Everest Re Group

- Mapfre

- CNA Financial

- QBE Insurance Group

- Others

Recent Developments

- In December 2025, Zurich Insurance Group proposed a federal reinsurance pool modeled on U.S. crop insurance for pandemic risks, allowing insurers to cede 100% or partial risk to government backing. This innovative framework aims to make pandemics insurable, demonstrating Zurich’s leadership in addressing systemic risks through public-private partnerships.

- In November 2025, Chubb unveiled an AI-powered optimization engine in Chubb Studio at Singapore Fintech Festival, enabling real-time personalized embedded insurance, including health protection. This tech-driven launch enhances pandemic-related coverage delivery, solidifying Chubb’s position in dynamic risk transfer solutions.

Report Scope

Report Features Description Market Value (2025) USD 21.4 Billion Forecast Revenue (2035) USD 138.4 Billion CAGR(2025-2035) 20.5% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Business Interruption, Event Cancellation, Health & Life, Travel, Others), By End User (Individuals, SMEs, Large Enterprises, Government & Public Sector, Healthcare Providers, Others), By Distribution Channel (Direct Sales, Brokers & Agents, Bancassurance, Online Platforms, Others), By Industry Vertical (Healthcare, Hospitality, Retail, Manufacturing, Education, Entertainment & Events, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Munich Re, Swiss Re, AXA XL, Lloyd’s of London, Chubb, AIG (American International Group), Zurich Insurance Group, Berkshire Hathaway, Allianz, Marsh & McLennan, Willis Towers Watson, Beazley, Tokio Marine HCC, Sompo International, Hannover Re, SCOR SE, Everest Re Group, Mapfre, CNA Financial, QBE Insurance Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pandemic Risk Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Pandemic Risk Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Munich Re

- Swiss Re

- AXA XL

- Lloyd’s of London

- Chubb

- AIG (American International Group)

- Zurich Insurance Group

- Berkshire Hathaway

- Allianz

- Marsh & McLennan

- Willis Towers Watson

- Beazley

- Tokio Marine HCC

- Sompo International

- Hannover Re

- SCOR SE

- Everest Re Group

- Mapfre

- CNA Financial

- QBE Insurance Group

- Others