Paediatric & Neonatal Testing Kits Market By Product Type (Assay Kits & Reagents, Instrument and, Consumables), By Test Type (Newborn Screening Panels, Genetic, Infectious Disease Testing, Hearing Screening, Critical Congenital Heart Defect (CCHD) Screening and Others), By End-User (Hospitals (NICUs / PICUs), Diagnostic Laboratories, Maternity & Specialty Clinics, and Point-of-Care Settings), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167685

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

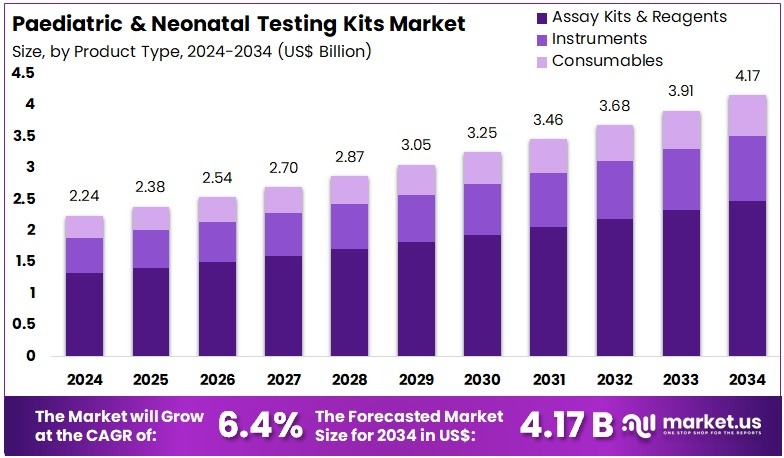

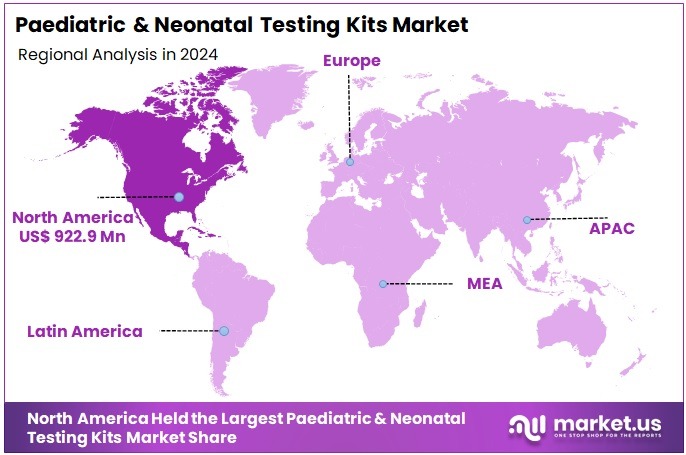

The Paediatric & Neonatal Testing Kits Market Size is expected to be worth around US$ 4.17 billion by 2034 from US$ 2.24 billion in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.2% share and holds US$ 922.9 Million market value for the year.

The Paediatric & Neonatal Testing Kits Market plays a critical role in early-life diagnostics, enabling rapid detection of metabolic disorders, infectious diseases, congenital anomalies, immune deficiencies, and genetic abnormalities in infants.

Early testing is considered one of the most impactful public-health interventions, improving survival and developmental outcomes by identifying conditions before symptoms emerge. Newborn heel-prick programs, molecular screening methods, and bedside monitoring kits for hearing and cardiac defects are now standard in many countries, while emerging economies continue scaling nationwide screening initiatives.

The market has evolved with technological advancements such as tandem mass spectrometry, PCR-based genetic panels, microfluidics, expanded metabolic screening kits, and pulse-oximetry systems for critical congenital heart defects. The increasing prevalence of neonatal sepsis, inherited metabolic disorders, congenital hearing loss, and immune-related complications has intensified demand for rapid, accurate, and minimally invasive testing solutions.

Digital and point-of-care kits are gaining adoption, enabling quicker diagnosis in NICUs, emergency units, maternity centres, and even home-based care. The integration of genomics, biosensors, and automated analyzers is further transforming neonatal diagnostics into a highly sensitive, data-driven ecosystem.

In April 2025, LaCAR MDx Technologies hosted a major regional event at the Hotel Abasto in Buenos Aires, bringing together LATAM distributors, end customers, and key opinion leaders (KOLs). The event focused on presenting the company’s latest fluorometry-based innovations in neonatal screening and reinforcing its commitment to expanding access to high-quality early diagnostic solutions across Latin America.

Key Takeaways

- In 2024, the market generated a revenue of US$ 24 billion, with a CAGR of 6.4%, and is expected to reach US$ 4.17 billion by the year 2034.

- The Product Type segment is divided into Assay Kits & Reagents, Instruments, and Consumables, with Assay Kits & Reagents taking the lead in 2024 with a market share of 59.4%

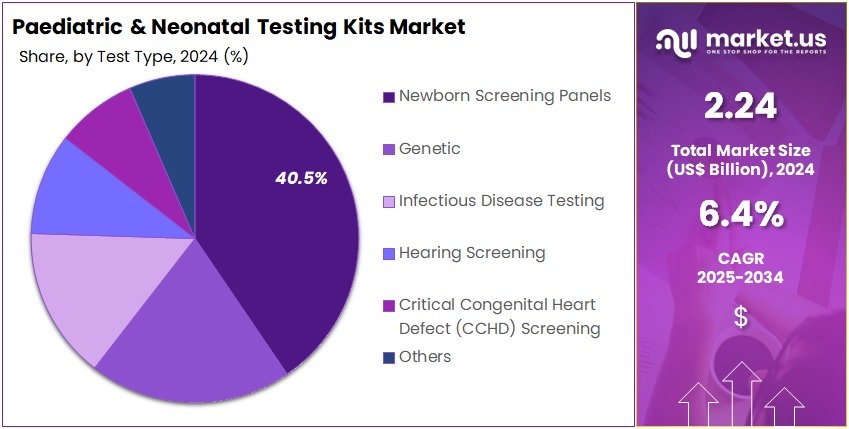

- The Test Type segment is divided into Newborn Screening Panels, Genetic, Infectious Disease Testing, Hearing Screening, Critical Congenital Heart Defect (CCHD) Screening, and Others, with Newborn Screening Panels taking the lead in 2024 with a market share of 40.5%.

- The End-User segment is divided Hospitals (NICUs / PICUs), Diagnostic Laboratories, Maternity & Specialty Clinics, and Point-of-Care Settings, with Hospitals (NICUs / PICUs) taking the lead in 2024 with a market share of 53.4%.

- North America led the market by securing a market share of 41.2% in 2024.

Product Type Analysis

Assay kits and reagents account for the majority share of 59.4% of testing volume due to their central role in newborn metabolic screening, infectious disease detection, bilirubin testing, genetic assays, and immune-response evaluations. Heel-prick dried blood spot cards, G6PD deficiency test kits, tandem MS/MS reagents, rapid antigen kits, enzyme assays, and PCR-based panels are required frequently and repeatedly in neonatal care.

For example, G6PD deficiency affects around 4.9% of the global population, with higher rates in Asia and Africa, driving need for enzymatic test kits in neonatal units. As newborn screening programs expand to include 30–60 conditions in many countries, routine reagent use increases proportionally. Their recurring consumption makes this the dominant product category. Instruments include tandem mass spectrometers, PCR analyzers, microfluidic analyzers, portable audiometers, pulse oximeters, bilirubin meters, and immunoassay analyzers.

Test Type Analysis

Newborn screening is the most critical area of neonatal diagnostics which accounted for 40.5% market share and typically includes conditions like congenital hypothyroidism, PKU, MCAD deficiency, cystic fibrosis, sickle cell disease, and metabolic disorders. Many countries have expanded their screening lists significantly; for instance, some US states test for more than 30–50 disorders. Early detection prevents severe neurological impairment, organ failure, or death. With ~140 million babies born globally each year, screening coverage is expanding, driving demand for metabolic and endocrine assay kits.

In October 2025, the New York State Department of Health emphasized the vital role of newborn screening in identifying serious yet treatable health conditions in infants. Each year, more than 205,000 newborns in New York State are screened shortly after birth for over 50 rare but serious disorders, including metabolic and endocrine conditions, hemoglobinopathies, infectious diseases, and other genetic abnormalities. Early identification allows timely treatment to prevent severe illness, developmental challenges, or even death. In 2024, 671 infants were confirmed to have one of the screened conditions.

End-User Analysis

Hospitals—particularly NICUs and PICUs—are the primary users of paediatric and neonatal testing kits due to high patient acuity and the need for rapid, 24/7 diagnostic support. NICUs manage premature infants, sepsis cases, congenital defects, respiratory distress, and metabolic disorders. A newborn in NICU may undergo multiple tests within the first 24 hours of life, making these units the dominant consumer of metabolic kits, infectious disease panels, bilirubin tests, and genomic screening kits.

Large centralized labs perform high-volume newborn screening, genetic testing, and confirmatory tests for national screening programs. They use advanced MS/MS, PCR, and genomic analyzers, supporting hospitals through regional programs.

Key Market Segments

By Product Type

- Assay Kits & Reagents

- Instruments

- Consumables

By Test Type

- Newborn Screening Panels

- Genetic

- Infectious Disease Testing

- Hearing Screening

- Critical Congenital Heart Defect (CCHD) Screening

- Others

By End-User

- Hospitals (NICUs / PICUs)

- Diagnostic Laboratories

- Maternity & Specialty Clinics

- Point-of-Care Settings

Drivers

Expanded newborn screening programs and early-life diagnostic access

Early diagnostic testing in infants and neonates is increasingly adopted worldwide, strengthening the driver for paediatric and neonatal testing kits. For example, a study in Brazil found that only ~80.6% of newborns received the full panel of five screening tests for newborns in a given hospital setting, and coverage gaps were strongly associated with institutional factors and regional inequities. In another review, newborn screening is described as “a far-reaching public health initiative that has reduced infant mortality and morbidity” through heel-prick blood sampling detecting endocrine, metabolic, genetic, hematologic and hearing disorders early.

The presence of such screening programs creates demand for kits tailored to newborns and children, such as dried blood-spot panels, hearing screening devices, congenital heart defect sensing tools, and rapid molecular or immunoassays for inherited disorders. Because early detection often leads to better outcomes (for example cognitive normalisation in children with PKU or congenital hypothyroidism when screened early) the clinical impetus for comprehensive kit availability is strong. As national health systems expand screening mandates and parents become more aware, this driver continues pushing kit adoption in hospitals, labs and point-of-care settings.

Restraints

High investment and operational costs for advanced paediatric/neonatal diagnostic tests

While technological advances enable sophisticated paediatric and neonatal testing kits (genetic panels, tandem mass spectrometry, multiplex assays), these advances come with significant cost burdens that restrain widespread uptake. For instance, expanding screening panels demands investment in specialized consumables, reagents, genetic sequencing, instrumentation and trained personnel.

In low- and middle-income countries in particular, institutional constraints were found to reduce full coverage of newborn screening: the Brazilian study showed that institutional factors such as low complexity hospitals, fewer professionals per bed and location outside state capitals reduced the prevalence of full screening (PR = 1.36 for capital city residence; 95 % CI = 1.18–1.56).

Moreover, many neonatal testing kits require sensitive instrumentation, stringent quality controls, and adherence to regulatory standards which raise operational costs and sometimes limit access. In less-resourced settings the shortfall of skilled molecular diagnostic professionals and infrastructure delays roll-out of advanced kits. These cost and implementation hurdles form a meaningful restraint in the market’s expansion.

Opportunities

Rise of digital and point-of-care neonatal testing enabling decentralized diagnostics

There is a significant opportunity for paediatric and neonatal testing kits through the expansion of point-of-care (POC) testing and digital/remote diagnostics. For example, between 2020 and 2024 there has been increased frequency of newborn screening programs coming to market in developed nations, with the COVID-19 pandemic accelerating investments in diagnostic capability including home-based systems and neonatal testing solutions with telehealth support.

This trend opens opportunity for kit manufacturers to develop compact, rapid, low-complexity testing systems (e.g., dried-blood-spot home kits, handheld hearing screening devices, portable CCHD oxygen-saturation monitors) integrated with digital platforms. For example, screening programs in Australia expanded genetic testing conditions via heel-prick tests in 2023 across ~60,600 newborns in Queensland detecting ~60 conditions. Such decentralised diagnostics reduce dependency on large lab infrastructure, enable earlier interventions, improve access in rural areas, and foster adoption of subscription or remote-monitoring models. Kit suppliers that align with this trend can capture new segments and geographic markets.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical shifts significantly influence the availability, affordability, and adoption of paediatric and neonatal testing kits worldwide. Economic downturns often lead to reduced healthcare spending, slowing procurement of advanced newborn screening instruments such as mass spectrometers, PCR analyzers, and handheld diagnostic devices.

Inflation-driven increases in manufacturing inputs—enzymes, reagents, microfluidic cartridges, sterile consumables, and plastics—raise the overall cost of newborn testing panels, particularly in resource-limited regions. Supply chain disruptions, seen prominently during global geopolitical tensions and public health emergencies, directly affect availability of critical materials like dried blood spot cards, neonatal lancets, and PCR reagents.

Geopolitical conflicts can disrupt cross-border transport routes, delaying shipments of molecular consumables and limiting access to imports needed for genetic and metabolic screening. Currency fluctuations affect procurement budgets for countries dependent on imported diagnostic technologies.

Additionally, global migration and refugee crises increase the burden of congenital infections, malnutrition-related neonatal complications, and perinatal disorders, elevating the need for accessible infant testing solutions. In contrast, strengthened government-backed newborn screening initiatives during stable periods can accelerate modernization of neonatal diagnostic infrastructure.

Latest Trends

Multi-modal and genomics-enhanced neonatal screening profiles

An emerging trend in the paediatric and neonatal testing kits segment is the move toward multi-modal (multi-omic) screening profiles and expanded condition panels. For instance, newborn screening panels have grown in number of conditions; a review noted the number of conditions included in U.S. newborn screening programs increased rapidly over the past decade. Another study emphasized that the prevalence of congenital disorders is substantial: globally ~6 % of children are born with birth defects annually, the majority in low- and middle-income countries.

This drives development of kits capable of simultaneously detecting metabolic, endocrine, hematologic, hearing, cardiac and genetic disorders in newborns. Furthermore, screening now often includes DNA-based assays, enzyme-based tests, mass spectrometry for metabolic disorders, and integrated immunoassays for a broad range of conditions. The increase in screening breadth and diagnostic depth fosters demand for kits with multiplex capability and high fidelity, creating a trend toward more sophisticated testing formats in paediatric and neonatal health.

Regional Analysis

North America is leading the Paediatric & Neonatal Testing Kits Market

North America leads the market with 41.2% market share due to highly advanced NICU infrastructure, mandatory newborn screening policies, extensive genetic testing adoption, and strong clinical guidelines for infectious disease testing in neonates.

High awareness and early-life health-prioritization reinforce demand for specialized neonatal kits is the driving factor in the region. Illumina, Inc. highlighted that global newborn screening programmes are moving toward genome sequencing (NGS) pilots, citing screening of ~14,000+ newborns in the GUARDIAN programme and expansion of conditions screened.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expanding quickly driven by rising birth rates, government-funded newborn screening initiatives, improved neonatal intensive care facilities, and increased burden of congenital disorders. Rapid urbanization and investment in NICUs accelerate adoption of advanced neonatal testing kits across China, India, Japan, and South Korea.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Bio-Rad Laboratories, PerkinElmer Inc., Abbott Laboratories, Thermo Fisher Scientific Inc., Danaher Corporation, Agilent Technologies Inc., Roche Diagnostics, Becton, Dickinson and Company (BD), bioMérieux SA, Siemens Healthineers, Natus Medical Incorporated, Trivitron Healthcare, and Others.

Bio-Rad Laboratories, PerkinElmer Inc., and Abbott Laboratories are among the leading contributors to paediatric and neonatal diagnostics. Bio-Rad supports newborn health through immunoassay systems, quality-control materials, and molecular kits used in neonatal infection and metabolic screening workflows.

PerkinElmer (now Revvity) is a global pioneer in newborn screening, offering MS/MS metabolic panels, genetic assay kits, and dried blood spot solutions widely adopted across national screening programs. Abbott contributes through rapid neonatal infection tests, point-of-care glucose and bilirubin analyzers, and PCR-based pathogen detection systems designed for NICUs and maternity centres.

Top Key Players in the Paediatric & Neonatal Testing Kits Market

- Bio-Rad Laboratories

- PerkinElmer Inc.

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Roche Diagnostics

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Siemens Healthineers

- Natus Medical Incorporated

- Trivitron Healthcare

- Others

Recent Developments

- In August 2025: Rady Children’s Institute for Genomic Medicine / BeginNGS® – international collaborated with Sidra Medicine (Qatar) to implement genome-based newborn screening for over 1,000 treatable genetic disorders. This expands the geographical footprint of genome-screening newborn care.

- In November 2025: Corza Medical announced the commercial launch of its SensorTek ROP Kit, a single-use solution that includes a diagnostic lens designed for retinopathy of prematurity (ROP) examinations. The company noted that this is the first and only single-use kit available on the market that incorporates a diagnostic lens for ROP assessment.

- In December 2023: Revvity launched its EONIS Q system, a CE-IVD declared platform enabling laboratories in countries that accept the CE marking to adopt molecular testing for spinal muscular atrophy (SMA) and severe combined immunodeficiency (SCID) in newborns.

Report Scope

Report Features Description Market Value (2024) US$ 2.24 Billion Forecast Revenue (2034) US$ 4.17 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Assay Kits & Reagents, Instrument and, Consumables), By Test Type (Newborn Screening Panels, Genetic, Infectious Disease Testing, Hearing Screening, Critical Congenital Heart Defect (CCHD) Screening and Others), By End-User (Hospitals (NICUs / PICUs), Diagnostic Laboratories, Maternity & Specialty Clinics, and Point-of-Care Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bio-Rad Laboratories, PerkinElmer Inc., Abbott Laboratories, Thermo Fisher Scientific Inc., Danaher Corporation, Agilent Technologies Inc., Roche Diagnostics, Becton, Dickinson and Company (BD), bioMérieux SA, Siemens Healthineers, Natus Medical Incorporated, Trivitron Healthcare, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Paediatric & Neonatal Testing Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Paediatric & Neonatal Testing Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bio-Rad Laboratories

- PerkinElmer Inc.

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Roche Diagnostics

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Siemens Healthineers

- Natus Medical Incorporated

- Trivitron Healthcare

- Others