Global Packaging Primers Market Size, Share, Growth Analysis By Primer (Solvent-Based Coatings, Water-Based Coatings, Others), By Application (Film, Aluminium Makers, Paper and Aluminium Converting, Paper Coaters and Makers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157948

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

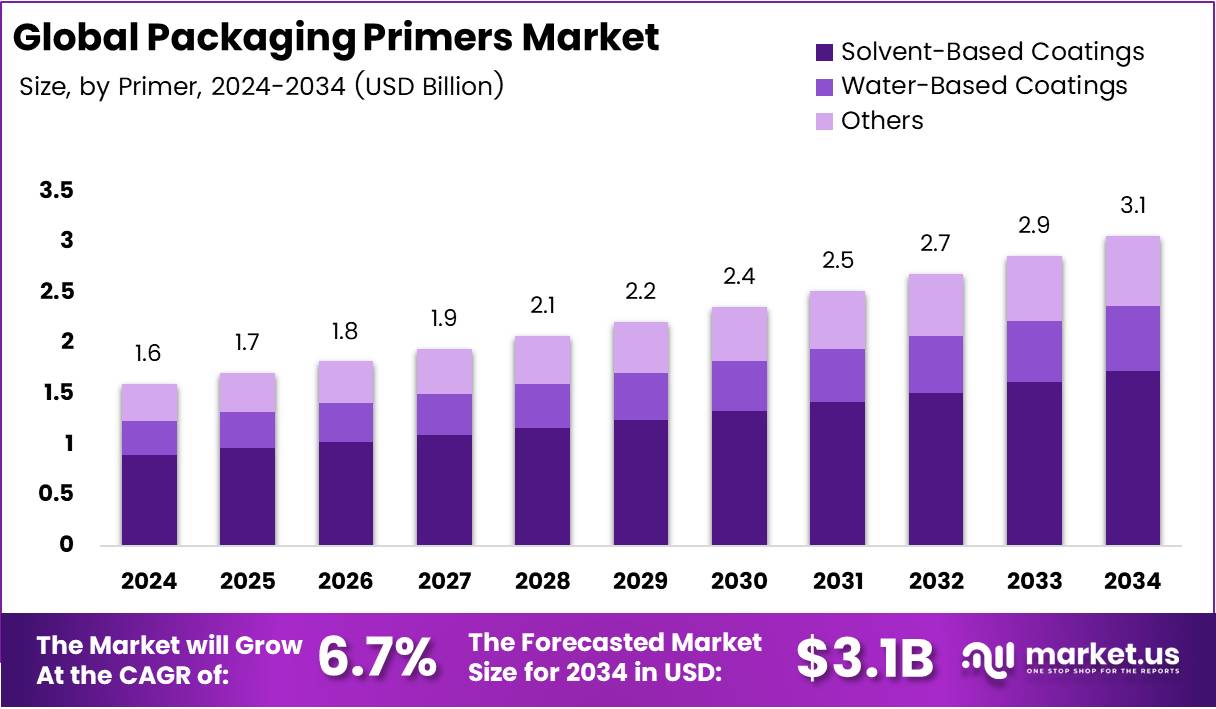

The Global Packaging Primers Market size is expected to be worth around USD 3.1 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

The packaging primers market is a crucial segment in the packaging industry, playing a key role in improving the adhesion properties of various substrates. These primers are essential in enhancing the bond between packaging materials and coatings, ensuring that the final product remains durable, aesthetically appealing, and functional. With continuous technological advancements, packaging primers are widely used in the food, beverage, pharmaceutical, and consumer goods industries.

The growth of the packaging primers market is primarily driven by increasing demand for high-performance coatings that offer improved durability and resistance to environmental factors. As industries aim for higher product quality and sustainability, packaging primers are evolving to meet these needs. New formulations, such as low-VOC and water-based primers, are gaining popularity due to their environmental benefits.

In addition, regulatory standards for packaging materials are becoming stricter, pushing companies to adopt eco-friendly solutions. Governments worldwide are emphasizing sustainability and reducing the carbon footprint of industrial processes. As a result, the demand for sustainable packaging solutions, including advanced packaging primers, is expected to rise significantly. This shift is also supported by consumer preference for greener products.

Investment in research and development is helping packaging primer manufacturers stay ahead of the curve. For example, in April 2024, Axalta won multiple Edison Awards for its innovative products, including the Low Carbon Footprint Sustainable Coating System featuring Hyperdur® Primer and Chromadyne® Colorcoat. Such investments highlight the growing focus on developing environmentally friendly and high-performance solutions.

Further, the market is witnessing consolidation among key players to boost operational efficiency. In June 2025, ACTEGA Terra GmbH merged with ACTEGA DS GmbH and ACTEGA Rhenania GmbH into the parent company, ACTEGA GmbH. This strategic move is aimed at improving collaboration and enhancing overall market positioning, making companies more competitive in the evolving packaging sector.

Key Takeaways

- The Global Packaging Primers Market size is expected to reach USD 3.1 Billion by 2034, growing at a CAGR of 6.7% from 2025 to 2034.

- Solvent-Based Coatings dominated the Primer Analysis segment in 2024 with a 56.3% share, reflecting the continued reliance on traditional formulations.

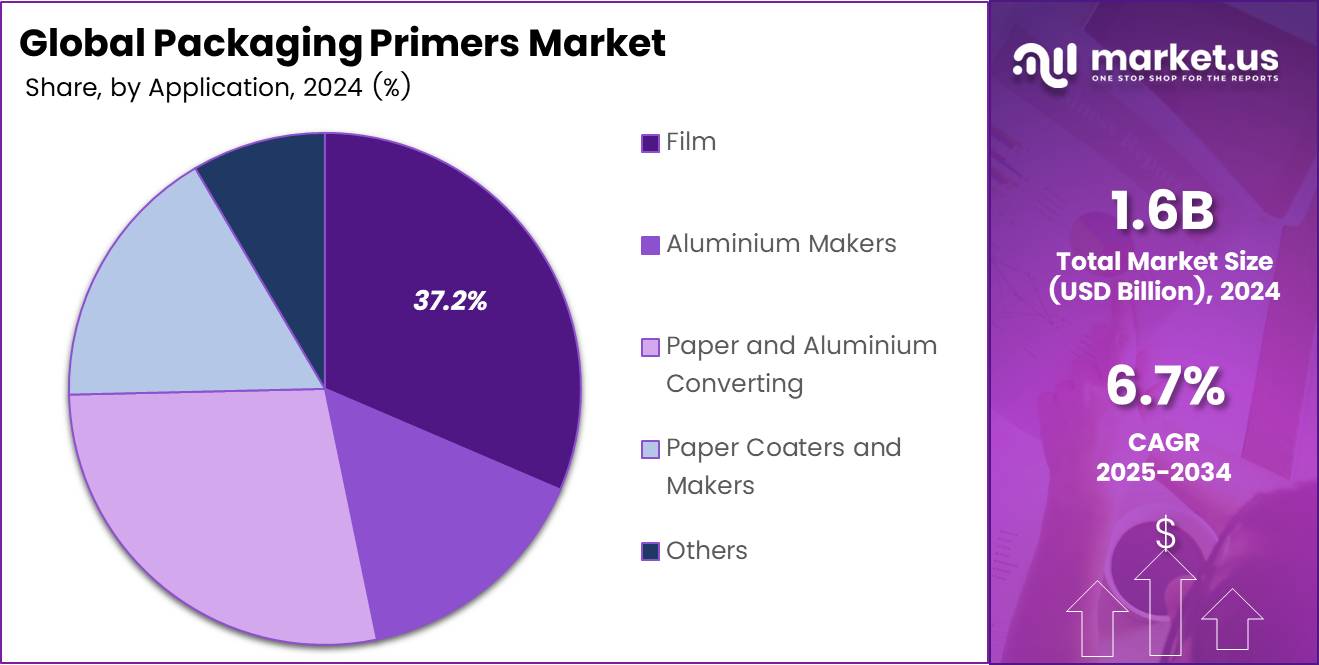

- Film led the Application Analysis segment in 2024 with a 37.2% share, highlighting the importance of flexible film packaging in consumer goods and industrial sectors.

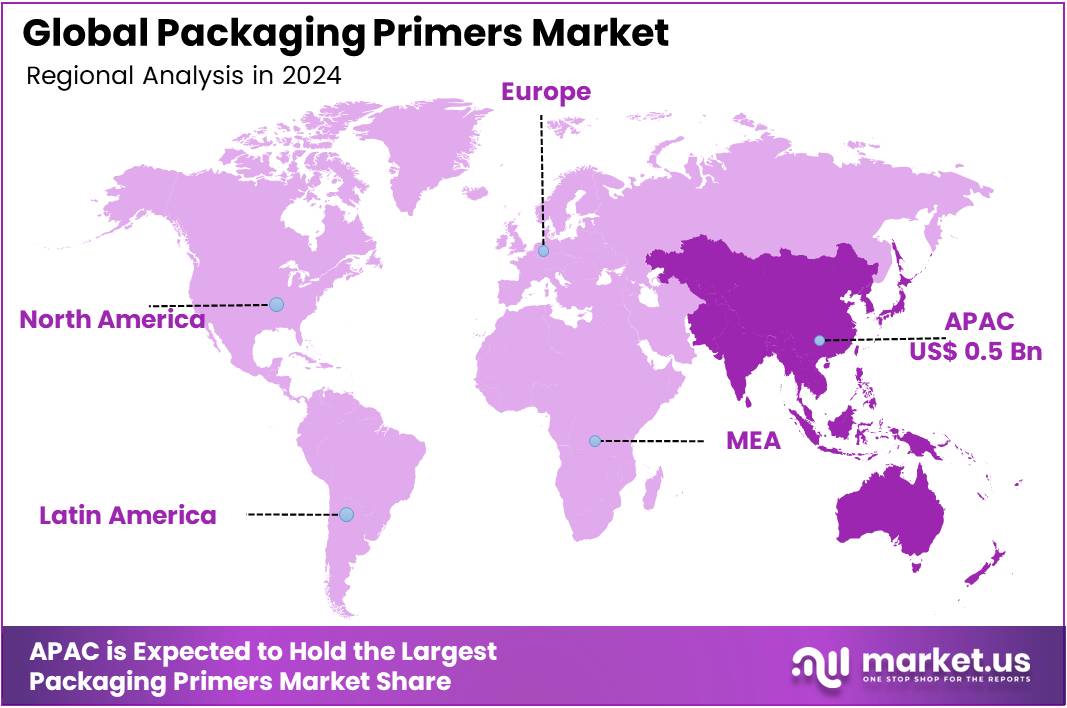

- Asia Pacific held the dominant market share in 2024 with a 37.3% share, valued at USD 0.5 Billion, driven by strong manufacturing activity in China and India.

Primer Analysis

Solvent-Based Coatings dominate with 56.3% due to their superior adhesion properties and versatility across applications.

In 2024, Solvent-Based Coatings held a dominant market position in the Primer Analysis segment of Packaging Primers Market, with a 56.3% share. This substantial market leadership reflects the coating industry’s continued reliance on traditional solvent-based formulations for their proven performance characteristics.

Solvent-based coatings maintain their competitive edge through exceptional substrate adhesion, rapid drying capabilities, and superior film formation properties. These coatings offer excellent chemical resistance and durability, making them particularly suitable for demanding packaging applications where performance cannot be compromised.

Water-Based Coatings represent the secondary segment, gaining traction due to increasing environmental regulations and sustainability initiatives. However, they still face technical limitations in certain high-performance applications compared to their solvent-based counterparts.

The Others category encompasses specialty coatings including UV-curable and powder-based formulations, which serve niche applications requiring specific performance attributes. While smaller in volume, these segments often command premium pricing due to their specialized nature and technical advantages in targeted applications.

Application Analysis

Film applications lead with 37.2% driven by flexible packaging growth and consumer convenience trends.

In 2024, Film held a dominant market position in the Application Analysis segment of Packaging Primers Market, with a 37.2% share. This leadership position underscores the critical role of flexible film packaging in modern consumer goods and industrial applications.

Film applications dominate due to the exponential growth in flexible packaging solutions across food, pharmaceutical, and consumer goods sectors. The demand for lightweight, barrier-enhanced films continues driving primer consumption as manufacturers seek improved adhesion between substrate layers and coating systems.

Aluminium Makers represent a significant secondary segment, focusing on beverage cans, food containers, and industrial packaging solutions. Paper and Aluminium Converting operations contribute substantially through value-added processing activities that require specialized primer formulations.

Paper Coaters and Makers maintain steady demand driven by sustainable packaging trends and the resurgence of paper-based solutions. The Others category includes emerging applications in smart packaging, biodegradable films, and specialty industrial uses, representing innovation opportunities within the broader packaging primers ecosystem.

Key Market Segments

By Primer

- Solvent-Based Coatings

- Water-Based Coatings

- Others

By Application

- Film

- Aluminium Makers

- Paper and Aluminium Converting

- Paper Coaters and Makers

- Others

Drivers

Increasing Demand for Eco-friendly Packaging Solutions Drives Market Growth

The packaging primers market is experiencing significant growth due to rising environmental consciousness among consumers and businesses. Companies are increasingly seeking eco-friendly packaging solutions to meet sustainability goals and reduce their carbon footprint. This shift is driving demand for packaging primers that work effectively with recyclable and biodegradable materials.

E-commerce growth has created massive opportunities for packaging primer manufacturers. Online retailers need durable, attractive packaging that protects products during shipping while maintaining brand appeal. This surge in e-commerce activities requires specialized primers that ensure proper adhesion and print quality on various packaging substrates.

Consumer preference for sustainable materials is reshaping the packaging industry. Buyers now actively choose products with recyclable packaging, pushing manufacturers to adopt greener solutions. Packaging primers that enable high-quality printing on sustainable materials are becoming essential for brands wanting to meet consumer expectations.

Technological advancements in packaging printing have revolutionized the industry. Modern printing technologies require specialized primers that can handle high-speed processes and deliver superior print quality. These innovations allow for better color reproduction, faster production times, and improved durability, making packaging more attractive and functional for end-users.

Restraints

Regulatory Challenges and Compliance Issues Limit Market Expansion

The packaging primers market faces significant challenges from strict regulatory requirements and compliance issues. Different regions have varying standards for packaging materials, especially for food contact applications. These regulations create complexity for manufacturers who must ensure their primers meet specific safety and environmental standards across multiple markets.

Alternative packaging materials with superior performance characteristics pose a competitive threat to traditional primer-dependent solutions. Some new materials offer built-in properties that eliminate the need for primers, such as improved adhesion or printability. These alternatives can reduce production costs and simplify manufacturing processes for packaging companies.

Limited awareness of packaging primers in emerging markets restricts growth potential. Many manufacturers in developing countries lack knowledge about the benefits of using specialized primers for their packaging applications. This knowledge gap results in suboptimal packaging quality and missed opportunities for primer suppliers to expand their market presence.

Growth Factors

Expansion of the Food and Beverage Industry Creates New Growth Opportunities

The food and beverage industry’s expansion presents substantial growth opportunities for packaging primers manufacturers. Innovative packaging solutions are increasingly important for product differentiation and shelf appeal. Primers enable high-quality printing and coating adhesion on food packaging materials, supporting brands in creating attractive and functional packaging designs.

Digital printing technology innovations are transforming packaging primer applications. These advancements allow for shorter production runs, personalized packaging, and faster turnaround times. Primers specifically designed for digital printing processes are becoming essential for companies wanting to leverage these new capabilities and meet changing market demands.

Strategic partnerships between packaging companies and consumer goods brands are creating new market opportunities. These collaborations focus on developing customized packaging solutions that require specialized primers. Such partnerships drive innovation and create demand for high-performance primers that can meet specific brand requirements and application needs.

Smart packaging and intelligent labels represent emerging growth areas for primer manufacturers. These technologies require primers that work with electronic components and sensors while maintaining traditional packaging functions. The integration of smart features in packaging creates new technical requirements and market opportunities for specialized primer products.

Emerging Trends

Adoption of Biodegradable and Compostable Solutions Shapes Market Trends

The packaging primers market is witnessing a strong trend toward biodegradable and compostable packaging solutions. Environmental concerns and regulatory pressure are driving companies to adopt sustainable packaging options. This shift requires primers that are compatible with bio-based materials and can decompose safely without leaving harmful residues in the environment.

Pharmaceutical and healthcare sectors are increasingly using packaging primers for specialized applications. These industries require primers that meet strict regulatory standards for product safety and contamination prevention. The growth of healthcare packaging, including blister packs and medical device packaging, creates demand for high-performance primers with excellent barrier properties.

Customization and personalization trends are influencing packaging primer requirements. Brands want unique packaging designs to stand out in competitive markets. This demand drives the need for primers that can support various printing techniques, special effects, and custom colors while maintaining consistent quality across different production runs.

RFID and NFC technology integration in packaging represents a cutting-edge trend affecting primer development. These technologies require primers that don’t interfere with electronic signals while providing excellent adhesion for electronic components.

The growing adoption of smart packaging for inventory tracking and consumer engagement creates opportunities for specialized primer formulations that support these advanced applications.

Regional Analysis

Asia Pacific Dominates the Packaging Primers Market with a Market Share of 37.3%, Valued at USD 0.5 Billion

In 2024, Asia Pacific held the dominant market position in the Packaging Primers market, with a 37.3% share, valued at USD 0.5 Billion. This dominance is driven by the strong manufacturing base in countries like China and India, which are key consumers of packaging materials. The region is expected to maintain its leadership due to the growing demand for sustainable packaging and increasing industrial activities.

North America Packaging Primers Market Trends

North America holds a significant share in the Packaging Primers market, attributed to high demand from the food and beverage, pharmaceuticals, and personal care industries. The presence of established players and strict regulatory frameworks in the region ensures the widespread adoption of high-quality primers. North America’s market growth is further supported by innovations in packaging materials aimed at reducing environmental impact.

Europe Packaging Primers Market Trends

Europe follows closely with a robust market presence, driven by stringent environmental regulations and growing sustainability concerns. The demand for eco-friendly packaging is expected to continue rising, fostering innovations in primer formulations that are both high-performing and low in volatile organic compounds (VOCs). Countries like Germany, the UK, and France lead in market activities, with ongoing regulatory support promoting sustainable packaging solutions.

Middle East and Africa Packaging Primers Market Trends

The Middle East and Africa region is witnessing steady growth in the Packaging Primers market, with an increasing focus on packaging solutions in industries like food and beverages, cosmetics, and chemicals. Economic diversification efforts in the region are supporting the expansion of manufacturing sectors, boosting the demand for high-quality primers for packaging materials. However, growth is slower compared to other regions due to economic and infrastructural challenges.

Latin America Packaging Primers Market Trends

Latin America is expected to experience gradual growth in the Packaging Primers market, primarily due to the expansion of the food and beverage industry in countries like Brazil and Mexico. The region is also benefiting from increasing industrialization and the demand for sustainable packaging solutions. However, the growth is tempered by economic volatility and the need for infrastructure development to support larger-scale manufacturing activities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Packaging Primers Company Insights

In 2024, the global Packaging Primers Market is shaped by several key players who are driving the industry’s growth and innovation.

Axalta Coating Systems is a significant player, known for its comprehensive portfolio of coating solutions. The company’s focus on sustainable products, including waterborne and low-VOC primers, aligns with the increasing demand for environmentally friendly solutions in the packaging industry.

ACTEGA Terra GmbH is a leader in providing specialized coatings for the packaging sector. Their innovative range of primers, including those designed for direct food contact, is expected to enhance their market position as consumer demand for safe, functional packaging continues to rise.

Akzo Nobel N.V. brings decades of experience in coatings and paint products. The company’s strong presence in the packaging industry is bolstered by its commitment to sustainability, offering primers that meet regulatory requirements and support eco-friendly packaging solutions.

National Paints Factories Co. Ltd. continues to expand its footprint in the packaging primer market. Their broad product range, combined with a focus on high-performance and durable primers, makes them a key contender in meeting the increasing demand for robust packaging coatings in various industries.

These companies are expected to continue their influence in the market as the demand for high-quality, environmentally compliant packaging primers grows.

Top Key Players in the Market

- Axalta Coating Systems

- ACTEGA Terra GmbH

- Akzo Nobel N.V.

- National Paints Factories Co. Ltd.

- KANGNAM JEVISCO CO., LTD.

- Paramelt B.V.

- Coim Group

- The Sherwin-Williams Company

- PPG Industries, Inc.

- DIC Corporation

- BASF SE

Recent Developments

- In July 2024, ACTEGA introduced several new products designed to enhance sustainable packaging solutions and meet evolving regulatory standards. These products were highlighted at major industry trade shows, showcasing the company’s commitment to eco-friendly packaging innovations.

- In July 2024, AkzoNobel unveiled the Securshield™ 500 Series, a next-generation PVC-free and Bisphenol-free coating for beverage cans. This launch reinforces AkzoNobel’s leadership in producing environmentally conscious solutions for the packaging industry.

- In 2024, Coim Group introduced a new line of Cold Seal Coatings at Drupa 2024. These coatings are designed for rapid product packaging and sealing, catering to a variety of sectors including food and detergent industries, addressing both convenience and sustainability.

- In 2024, Coim Group’s NOVACOTE adhesive line received five Recyclass approvals, further validating the brand’s commitment to sustainable packaging practices. Additionally, COIM Italy achieved ZDHC Level 1 certification, highlighting its dedication to sustainable chemical management.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.1 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Primer (Solvent-Based Coatings, Water-Based Coatings, Others), By Application (Film, Aluminium Makers, Paper and Aluminium Converting, Paper Coaters and Makers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Axalta Coating Systems, ACTEGA Terra GmbH, Akzo Nobel N.V., National Paints Factories Co. Ltd., KANGNAM JEVISCO CO., LTD., Paramelt B.V., Coim Group, The Sherwin-Williams Company, PPG Industries, Inc., DIC Corporation, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Axalta Coating Systems

- ACTEGA Terra GmbH

- Akzo Nobel N.V.

- National Paints Factories Co. Ltd.

- KANGNAM JEVISCO CO., LTD.

- Paramelt B.V.

- Coim Group

- The Sherwin-Williams Company

- PPG Industries, Inc.

- DIC Corporation

- BASF SE