Global Oxygen Therapy Equipment Market By Product Type (Oxygen source equipment and Bag-valve mask), By Portability (Stationary devices and Portable devices), By Application (COPD, Asthma, Pneumonia, Cystic fibrosis and Others), By End-user (Hospitals & clinics, Home care settings, Ambulatory surgical centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176967

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

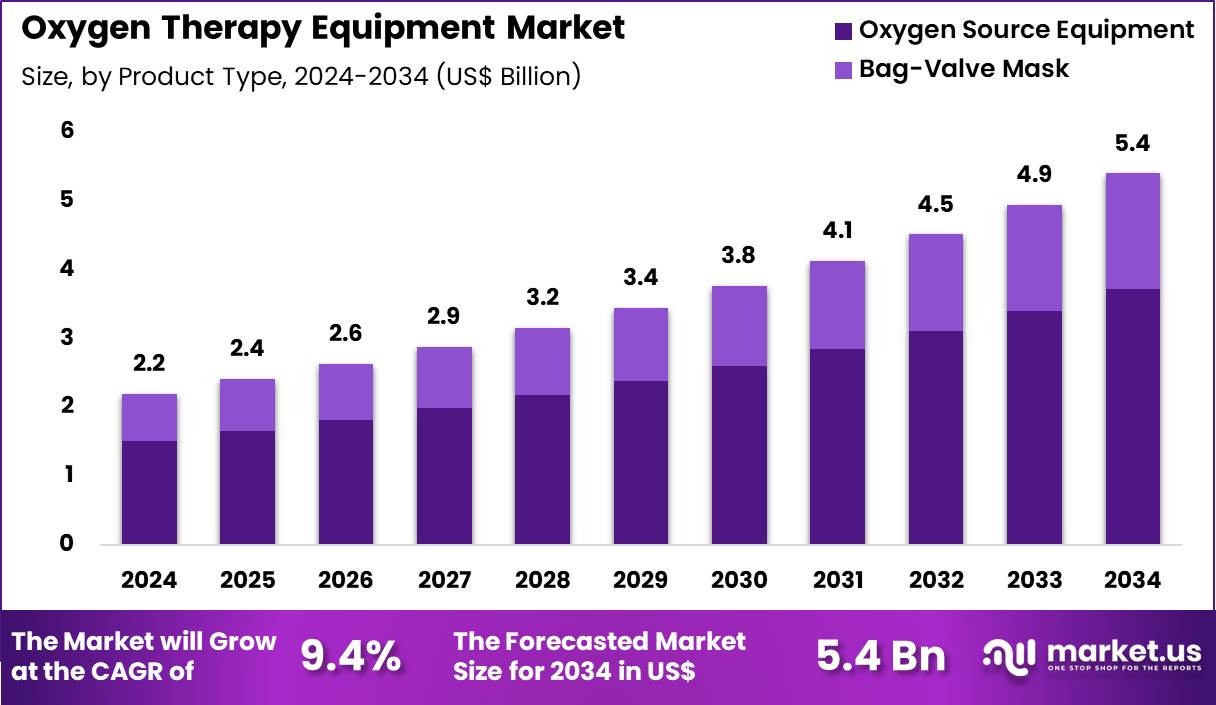

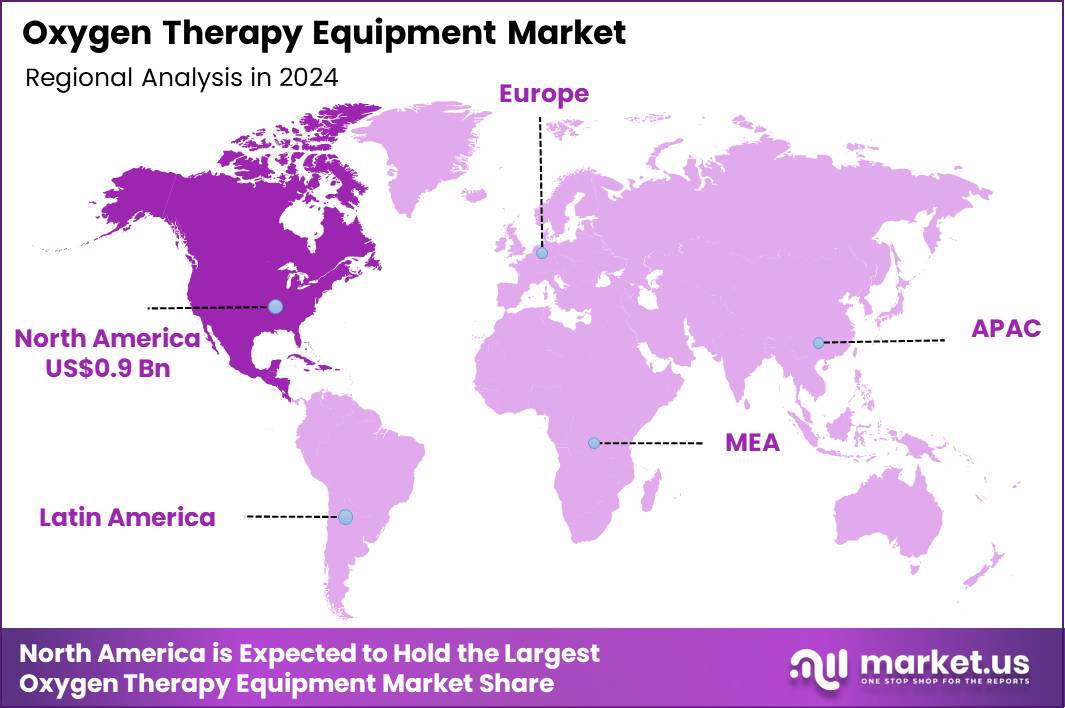

Global Oxygen Therapy Equipment Market size is expected to be worth around US$ 5.4 Billion by 2034 from US$ 2.2 Billion in 2024, growing at a CAGR of 9.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.4% share with a revenue of US$ 0.9 Billion.

Rising prevalence of chronic respiratory diseases and acute hypoxemic conditions accelerates the oxygen therapy equipment market as healthcare providers seek reliable solutions to maintain adequate oxygenation and improve patient outcomes. Pulmonologists increasingly prescribe long-term oxygen therapy via stationary concentrators for patients with severe chronic obstructive pulmonary disease, delivering continuous flow to alleviate dyspnea and enhance exercise tolerance.

These systems support portable oxygen concentrators in ambulatory settings, enabling patients with interstitial lung disease or pulmonary fibrosis to maintain mobility and quality of life during daily activities. Clinicians utilize high-flow nasal cannula devices in acute care for patients with acute respiratory distress syndrome or exacerbations of heart failure, providing warmed, humidified oxygen at high flow rates to reduce work of breathing and avoid intubation.

Emergency departments apply non-rebreather masks and bag-valve-mask systems during resuscitation of cardiac arrest or severe trauma, rapidly correcting hypoxemia while stabilizing patients for transport. Home care providers deploy liquid oxygen systems for patients requiring high-flow support, offering extended duration and quiet operation for overnight use in advanced lung disease.

Manufacturers pursue opportunities to develop smart oxygen delivery systems with integrated sensors that automatically adjust flow based on real-time oxygen saturation, expanding applications in sleep-disordered breathing and nocturnal hypoxemia management.

Developers advance lightweight, battery-efficient portable concentrators with pulse-dose technology, broadening utility for active patients with restrictive lung diseases and reducing dependency on bulky equipment. These innovations facilitate integration with telehealth platforms, allowing remote monitoring of adherence and saturation trends to optimize titration in chronic respiratory failure.

Opportunities emerge in non-invasive ventilators combined with oxygen supplementation for acute hypercapnic respiratory failure in COPD exacerbations, providing dual support without invasive intubation. Companies invest in eco-friendly concentrators that minimize energy consumption and noise, enhancing patient comfort in home settings.

Recent trends emphasize personalized therapy algorithms and connectivity features, positioning oxygen therapy equipment as a cornerstone of value-based respiratory care focused on improved adherence, reduced hospitalizations, and enhanced patient independence.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.2 Billion, with a CAGR of 9.4%, and is expected to reach US$ 5.4 Billion by the year 2034.

- The product type segment is divided into oxygen source equipment and bag-valve mask, with oxygen source equipment taking the lead with a market share of 68.9%.

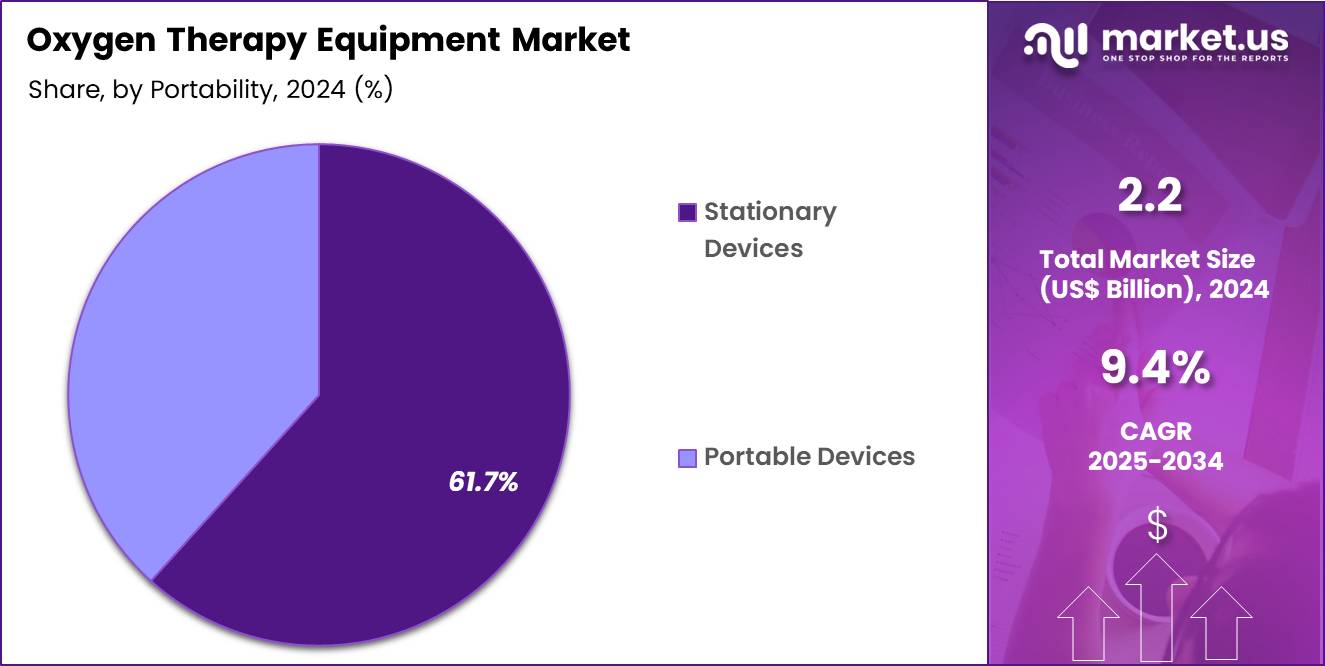

- Considering portability, the market is divided into stationary devices and portable devices. Among these, stationary devices held a significant share of 61.7%.

- Furthermore, concerning the application segment, the market is segregated into COPD, asthma, pneumonia, cystic fibrosis and others. The COPD sector stands out as the dominant player, holding the largest revenue share of 44.6% in the market.

- The end-user segment is segregated into hospitals & clinics, home care settings, ambulatory surgical centers and others, with the hospitals & clinics segment leading the market, holding a revenue share of 56.4%.

- North America led the market by securing a market share of 40.4%.

Product Type Analysis

Oxygen source equipment contributed 68.9% of growth within product type and led the oxygen therapy equipment market due to its central role in delivering continuous and controlled oxygen flow for acute and chronic respiratory care. Hospitals and clinics rely on concentrators, liquid oxygen systems, and cylinders to manage high patient volumes across emergency, inpatient, and critical care settings.

Rising prevalence of respiratory disorders increases baseline oxygen demand, which strengthens procurement of reliable source equipment. Clinical protocols prioritize consistent oxygen availability, reinforcing preference for dedicated oxygen generation and storage systems.

Growth strengthens as healthcare facilities upgrade infrastructure to support uninterrupted oxygen supply and pressure stability. Investments in backup systems and redundancy increase equipment counts per facility.

Oxygen source systems support long-duration therapy, which suits chronic disease management and postoperative recovery. Regulatory standards emphasize oxygen purity and delivery reliability, further reinforcing adoption. The segment is expected to remain dominant as respiratory care continues to depend on stable, high-capacity oxygen delivery solutions.

Portability Analysis

Stationary devices accounted for 61.7% of growth within portability and dominated the oxygen therapy equipment market due to their suitability for continuous, high-flow oxygen delivery in fixed care environments. Hospitals favor stationary systems for wards, ICUs, and procedure rooms where patients require sustained oxygen support.

These devices offer higher output capacity and consistent performance compared to portable alternatives. Infrastructure integration with wall outlets and central supply systems strengthens utilization.

Growth accelerates as inpatient respiratory admissions rise and average length of stay increases for severe cases. Stationary devices support advanced monitoring and alarm features that align with hospital safety protocols. Maintenance efficiency and long operational lifespans improve cost predictability. Clinical staff familiarity further supports routine use. The segment is projected to maintain leadership as institutional care settings continue to require dependable, non-mobile oxygen solutions.

Application Analysis

COPD generated 44.6% of growth within application and emerged as the leading segment due to the chronic and progressive nature of the disease. Patients with COPD often require long-term oxygen therapy to manage hypoxemia and improve quality of life.

Aging populations and smoking-related lung damage increase diagnosis rates, which directly expands oxygen therapy demand. Clinicians integrate oxygen support into standard COPD management to reduce exacerbations and hospital readmissions.

Growth strengthens as disease awareness and early diagnosis improve across healthcare systems. Long-term therapy protocols increase equipment utilization duration per patient. Home-to-hospital care continuity reinforces consistent oxygen requirements. Pulmonary rehabilitation programs further support oxygen usage. The segment is anticipated to remain dominant as COPD continues to represent a major share of global respiratory disease burden.

End-User Analysis

Hospitals and clinics contributed 56.4% of growth within end-user and dominated the oxygen therapy equipment market due to their role in managing acute respiratory conditions and complex chronic cases. Emergency departments, ICUs, and inpatient wards depend on oxygen therapy as a frontline intervention. High patient throughput and critical care needs drive sustained equipment utilization. Centralized procurement and standardized protocols increase consistent demand.

Growth continues as hospitals expand respiratory and critical care capacity. Infection-related respiratory complications increase oxygen dependence during treatment. Accreditation requirements emphasize oxygen availability and monitoring. Teaching hospitals further increase utilization through training and research activity. The segment is expected to remain the primary growth driver as hospitals and clinics continue to anchor respiratory care delivery.

Key Market Segments

By Product Type

- Oxygen source equipment

- Bag-valve mask

By Portability

- Stationary devices

- Portable devices

By Application

- COPD

- Asthma

- Pneumonia

- Cystic fibrosis

- Others

By End-user

- Hospitals & clinics

- Home care settings

- Ambulatory surgical centers

- Other

Drivers

Increasing prevalence of COPD is driving the market.

The rising incidence of chronic obstructive pulmonary disease globally has substantially increased the need for oxygen therapy equipment to manage symptoms and improve quality of life in affected patients. Advanced diagnostic methods and greater awareness have contributed to higher detection rates, expanding the application of concentrators and masks in treatment protocols.

Healthcare providers are increasingly recommending these devices for home and clinical use to support respiratory function in COPD cases. According to the Centers for Disease Control and Prevention, the age-adjusted prevalence of diagnosed COPD among adults aged 18 and older was 3.8% in 2023. This percentage emphasizes the ongoing health issue and the essential role of supplemental oxygen in preventing exacerbations.

Oxygen therapy equipment facilitates better oxygenation, reducing hospitalization risks for individuals with progressive lung conditions. National health strategies focus on chronic disease management, promoting the integration of reliable therapy solutions.

Prominent suppliers are developing user-friendly systems to address this growing patient demographic. This driver interconnects with aging populations more susceptible to respiratory impairments. Altogether, the COPD escalation strengthens market advancement in supportive medical technologies.

Restraints

High cost of advanced oxygen therapy equipment is restraining the market.

The significant pricing of state-of-the-art oxygen therapy systems, such as high-flow concentrators, restricts their uptake in facilities with budgetary limitations. Elaborate production techniques for efficient filtration and delivery components elevate overall manufacturing outlays. Modest healthcare centers often confront obstacles in validating costs against usage projections.

Accreditation standards for therapeutic efficacy amplify additional fees in rollout stages. Within communal medical structures, asset assignments favor elementary necessities over elaborate instruments. Administrators might defer enhancements owing to the considerable preliminary and servicing disbursements involved. This restraint affects circulation, particularly in nascent areas with sparse provisions.

Sector initiatives to craft budget-friendly archetypes aim to offset these obstacles incrementally. Notwithstanding operational virtues, monetary aspects impede comprehensive deployment. Alleviating acquisition through inducements is crucial to surmounting this market hindrance.

Opportunities

Growth in portable oxygen concentrator revenues is creating growth opportunities.

The ascending fiscal results in portable concentrator divisions among principal fabricators indicate potentials for heightened deployment of oxygen therapy equipment in ambulatory contexts. Augmented allocations to homecare divisions reinforce the fusion of mobile modalities for accurate oxygen provision. Inogen reported total revenue of $335.7 million in 2024, reflecting a 6.4% increase from $315.7 million in 2023.

This augmentation signifies persistent requisition that stretches to versatile therapy resolutions in domestic and travel scenarios. Cooperative enterprises with care alliances hasten the positioning of lightweight concentrators in prolific outpatient hubs. The extensive functional groundwork in advanced economies elevates vistas for apparatus improvements.

Alterations in therapeutic compensation fortify structural progressions. Paramount entities embark on territorial proliferations to exploit fiscal rebounds. This prospect synchronizes with undertakings to exalt criteria in patient-centric care. Directed methodologies can engender conspicuous headways in mobility-focused segments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the oxygen therapy equipment market through healthcare spending levels, reimbursement discipline, and provider cash flow management. Inflation and higher interest rates raise production, logistics, and financing costs, which slows replacement cycles for concentrators, cylinders, and delivery devices.

Geopolitical tensions disrupt supplies of electronic components, compressors, and medical grade plastics, increasing lead times and procurement risk. Current US tariffs on imported equipment and subassemblies increase landed costs for manufacturers and distributors, which tightens margins and pressures pricing strategies. These challenges affect smaller home care providers and hospitals with limited budgets.

On the positive side, trade pressure encourages domestic manufacturing, regional service networks, and supplier diversification. Rising prevalence of respiratory diseases and expanding home care adoption sustain consistent demand. With disciplined sourcing, product innovation, and service focused models, the market remains positioned for resilient and confident growth.

Latest Trends

Launch of innovative portable concentrators is a recent trend in the market.

In 2024, the unveiling of cutting-edge portable oxygen concentrators has elevated therapeutic options for respiratory support in active lifestyles. These apparatuses incorporate refined battery systems to prolong operational durations without compromising output. Producers have prioritized ergonomic designs to enhance portability during daily activities.

Clinical utilizations span chronic management where mobility remains paramount for patient adherence. In October 2024, Inogen launched the Rove 4 portable oxygen concentrator, offering up to 840 ml/min in a sub-3-pound configuration. This initiative targets immunology equipment amalgamation to boost diagnostic precision.

Contract associates integrate automated mechanisms to refine reagent assembly and evaluation. The inclination prioritizes scalability for substantial outputs in pulmonary and infectious panels. Supervisory endorsements in 2024 for collaborative commodities have expedited bazaar introductions. Sector synergies concentrate on optimizing compositions for minimal specimen inputs.

Regional Analysis

North America is leading the Oxygen Therapy Equipment Market

North America holds a 40.4% share of the global Oxygen Therapy Equipment market, experiencing marked expansion in 2024 propelled by a heightened focus on managing chronic obstructive pulmonary disease and other respiratory ailments through advanced home-based solutions.

Established companies such as Philips Respironics and Invacare Corporation have rolled out lightweight portable concentrators with extended battery life, allowing patients greater mobility while ensuring consistent oxygen delivery for daily activities. The region’s well-developed homecare infrastructure has encouraged shifts from hospital-based treatments to outpatient models, supported by telemedicine platforms that monitor compliance and adjust flows remotely.

Federal agencies have promoted awareness campaigns on hypoxia risks, leading to broader prescriptions for supplemental oxygen in geriatric populations facing post-COVID complications. Growing collaborations between insurers and device makers have lowered out-of-pocket costs, stimulating uptake among low-income groups with limited access to inpatient care.

Technological integrations like app-connected cannulas have enabled data-driven adjustments, reducing emergency visits for exacerbations. Furthermore, clinical guidelines from professional societies have endorsed non-invasive ventilation add-ons, expanding applications in sleep apnea management. According to the American Lung Association, 35.2 million people in America lived with chronic lung disease in 2023, underscoring the demand for reliable therapeutic tools.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts anticipate vigorous advancement in the respiratory aid industry throughout Asia Pacific over the forecast period, as health ministries enhance funding for infrastructure to combat escalating pollution-driven ailments. Firms in China and India engineer compact flow regulators that integrate with solar-powered units, while clinicians in Indonesia prioritize nasal interfaces for pediatric applications in humid settings.

Providers in Vietnam establish distribution channels that deliver masks and tubing to remote villages, addressing hypoxemia in high-altitude regions. Backers in Cambodia subsidize community hubs equipped with concentrator stations, enabling shared access for chronic sufferers amid limited hospital beds.

Authorities in Brunei introduce training modules that certify nurses in device maintenance, ensuring sustained functionality during monsoon disruptions. Specialists in Bhutan adapt humidifiers to local water quality, optimizing comfort for elderly patients with bronchitis.

Manufacturers in Fiji collaborate on durable cylinders resistant to corrosion, supporting maritime healthcare needs. India’s Ministry of Health allocated INR 2,000 crores in 2022 for the Oxygen Strengthening Initiative to upgrade generation systems in district hospitals.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the oxygen therapy equipment market strengthen growth by enhancing product portfolios with portable concentrators, high-efficiency masks, and smart monitoring systems that improve patient mobility and clinical outcomes. They also expand channel reach through strong partnerships with home healthcare providers, hospitals, and national distributors to capture steady demand across acute and chronic respiratory care settings.

Firms invest in digital and connected solutions that allow remote monitoring and real-time adherence tracking, reinforcing long-term user engagement. Strategic geographic expansion into Europe, North America, and fast-growing Asia Pacific diversifies revenue streams and responds to rising prevalence of respiratory illnesses and aging populations.

Philips Healthcare exemplifies a diversified medical technology leader with a broad suite of respiratory care devices, strong global sales operations, and dedicated service support that underpins clinical trust. The company drives market performance through disciplined research and development investment, targeted collaborations, and a commercialization approach that aligns innovation with evolving care delivery models.

Top Key Players

- Philips Healthcare

- ResMed

- Invacare

- Drive DeVilbiss Healthcare

- Fisher and Paykel Healthcare

- Medtronic

- Air Liquide Medical Systems

- Linde Healthcare

- Chart Industries

- Inogen

Recent Developments

- In June 2025, Inogen launched the Voxi 5 stationary oxygen concentrator, a compact system engineered to deliver continuous oxygen flow ranging from 1 to 5 liters per minute with low operating noise. Designed for home-care use, the device features lockable caster wheels for mobility and is supported by a three-year sieve bed warranty, marking a strategic expansion of Inogen’s portfolio beyond portable oxygen concentrators.

- In April 2025, the UK’s Defence Science and Technology Laboratory, working alongside Defence Medical Services, introduced a lightweight portable oxygen solution weighing approximately 5 kilograms. Developed for military and emergency response scenarios, the system enables reusable and safe oxygen delivery while avoiding the logistical and safety challenges associated with traditional oxygen cylinders.

Report Scope

Report Features Description Market Value (2024) US$ 2.2 Billion Forecast Revenue (2034) US$ 5.4 Billion CAGR (2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oxygen source equipment and Bag-valve mask), By Portability (Stationary devices and Portable devices), By Application (COPD, Asthma, Pneumonia, Cystic fibrosis and Others), By End-user (Hospitals & clinics, Home care settings, Ambulatory surgical centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Philips Healthcare, ResMed, Invacare, Drive DeVilbiss Healthcare, Fisher and Paykel Healthcare, Medtronic, Air Liquide Medical Systems, Linde Healthcare, Chart Industries, Inogen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oxygen Therapy Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Oxygen Therapy Equipment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Philips Healthcare

- ResMed

- Invacare

- Drive DeVilbiss Healthcare

- Fisher and Paykel Healthcare

- Medtronic

- Air Liquide Medical Systems

- Linde Healthcare

- Chart Industries

- Inogen