Global Outdoor Lighting Market Size, Share, Growth Analysis By Type (LED Lights, Plasma Lamps, High-Intensity Discharge Lamps, Fluorescent Lights), By Application (Street Lighting, Highways, Stadiums, Parking Lots, Tunnel Lights, Parks, Others), By Distribution Channel (Retail, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174827

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

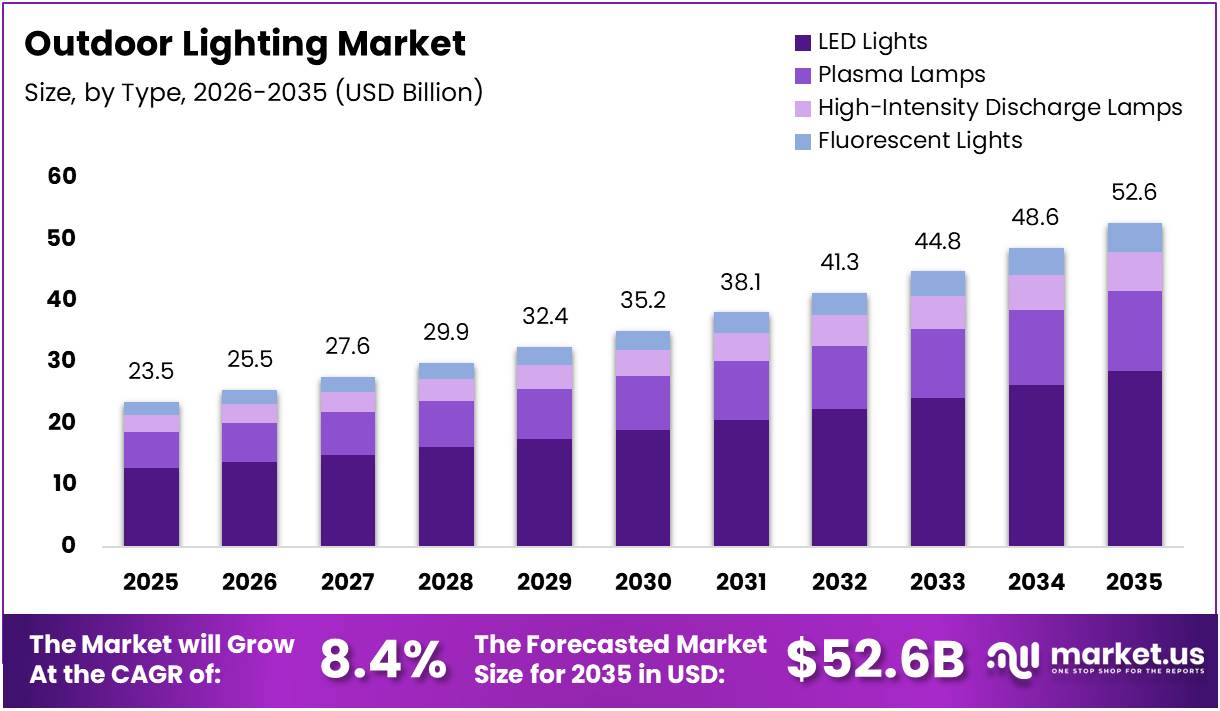

The Global Outdoor Lighting Market size is expected to be worth around USD 52.6 Billion by 2035, from USD 23.5 Billion in 2025, growing at a CAGR of 8.4% during the forecast period from 2026 to 2035.

The outdoor lighting market encompasses illumination solutions designed for exterior residential, commercial, and public spaces. These products include pathway lights, floodlights, landscape fixtures, and decorative lighting systems. Accordingly, the market serves functional safety requirements while simultaneously enhancing aesthetic appeal. Modern outdoor lighting integrates energy-efficient technologies like LED and solar-powered systems, addressing sustainability concerns while reducing operational costs.

Currently, the market demonstrates robust growth driven by urbanization and infrastructure development globally. Smart lighting adoption accelerates expansion, particularly as homeowners prioritize exterior aesthetics and security enhancements. Furthermore, rising disposable incomes enable consumers to invest in premium landscape lighting solutions. Commercial establishments increasingly recognize outdoor illumination’s role in customer attraction and brand visibility, thereby stimulating demand across segments.

Significant opportunities emerge through technological innovation and sustainable product development within this sector. Solar-powered and IoT-enabled lighting systems attract environmentally conscious consumers seeking cost-effective alternatives. Additionally, retrofitting aging infrastructure presents substantial revenue potential for manufacturers and installers. The growing trend toward outdoor living spaces—including patios, gardens, and entertainment areas creates consistent demand for specialized lighting fixtures that blend functionality with design sophistication.

Government initiatives substantially influence market dynamics through infrastructure investments and regulatory frameworks promoting energy efficiency. Many jurisdictions mandate LED adoption in public lighting projects, accelerating technology transition across residential applications. Consequently, municipalities allocate budgets toward smart city developments, incorporating intelligent outdoor lighting networks. These regulatory environments encourage manufacturers to innovate while ensuring compliance with environmental standards and energy consumption benchmarks.

Consumer sentiment strongly supports market expansion, with compelling statistical evidence validating outdoor lighting’s perceived value. According to research, over 80% of respondents agree outdoor lighting significantly enhances a home’s overall ambiance and appeal. Meanwhile, 65% specifically acknowledge that garden lighting contributes substantially to residential atmosphere and livability.

Importantly, purchasing decisions reflect this preference, as 51% of surveyed consumers demonstrate higher likelihood of acquiring properties featuring front-entrance lighting, while 48% prioritize homes with established garden illumination systems. These behavioral insights confirm outdoor lighting’s transition from luxury enhancement to essential home feature consideration.

Key Takeaways

- The Global Outdoor Lighting Market is projected to grow from USD 23.5 Billion in 2025 to USD 52.6 Billion by 2035, at a CAGR of 8.4%.

- LED Lights dominate the market by type with a 54.2% share due to energy efficiency and long lifespan.

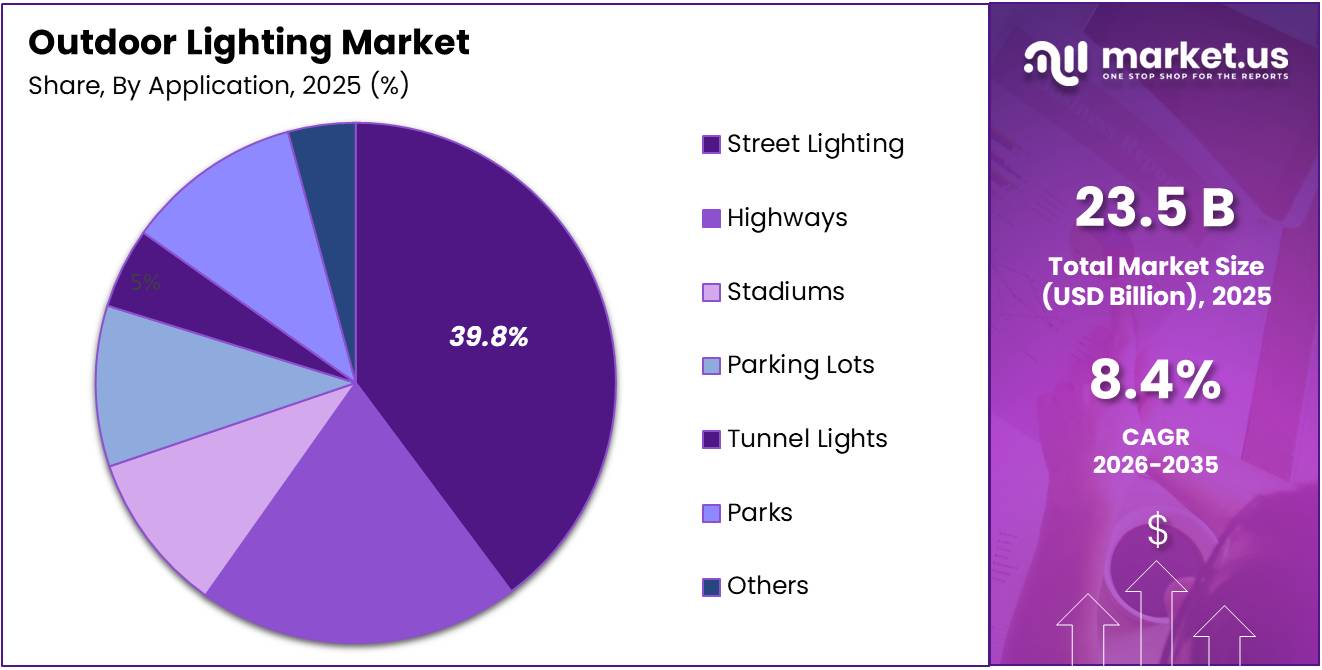

- Street Lighting holds the largest application segment with a 39.8% share, driven by urbanization and smart city initiatives.

- Retail is the leading distribution channel with a 39.1% share, offering extensive product access and consumer convenience.

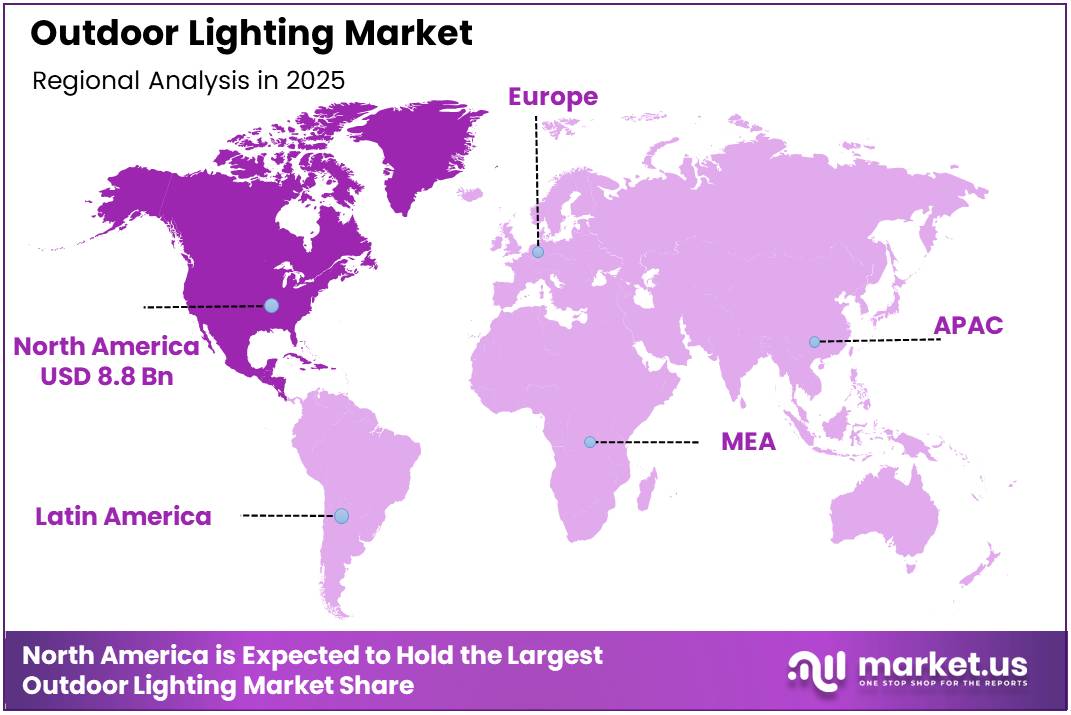

- North America leads regionally with 37.5% market share, valued at USD 8.8 Billion, supported by LED adoption and smart city investments.

Type Analysis

LED Lights held a dominant market position in the By Type Analysis segment of Outdoor Lighting Market, with a 54.2% share.

In 2025,LED Lights command the outdoor lighting market through exceptional energy efficiency and extended lifespan. These fixtures consume significantly less power while delivering superior illumination quality. Moreover, LED technology offers versatile design options and minimal maintenance requirements. Their ability to withstand harsh weather conditions and provide instant brightness strengthens their dominance across residential, commercial, and municipal sectors.

Plasma Lamps represent innovative lighting solutions offering exceptional color rendering and uniform light distribution. These systems utilize ionized gas to produce bright, consistent illumination for large outdoor areas. Despite advanced technology and impressive performance, plasma lamps face adoption challenges due to higher initial costs. Nevertheless, they continue gaining traction in specialized applications requiring superior light quality.

High-Intensity Discharge Lamps remain prevalent in industrial and large-scale outdoor installations delivering powerful illumination across expansive areas. However, their declining market share reflects growing concerns about energy consumption and mercury content. Additionally, longer warm-up times and frequent maintenance requirements push end-users toward more sustainable alternatives in modern applications.

Fluorescent Lights continue serving budget-conscious outdoor lighting applications despite facing strong competition from LED alternatives. These fixtures offer reasonable efficiency for parking areas and security lighting. Nevertheless, their market presence diminishes steadily as environmental regulations tighten. The fragility of fluorescent tubes and temperature sensitivity further limit their outdoor potential.

By Application Analysis

Street Lighting held a dominant market position in the By Application Analysis segment of Outdoor Lighting Market, with a 39.8% share.

In 2025,Street Lighting dominates outdoor lighting applications as municipalities worldwide prioritize public safety and urban infrastructure development. Governments increasingly invest in smart street lighting systems featuring automated controls and remote monitoring. Furthermore, ongoing urbanization drives demand for efficient lighting networks reducing energy costs.

Highways require robust lighting solutions ensuring driver safety during nighttime travel and adverse weather conditions. Highway installations demand high-intensity fixtures illuminating long stretches effectively while minimizing maintenance interventions. Transportation authorities favor durable systems with extended lifespans.

Stadiums necessitate specialized lighting systems delivering uniform illumination for sporting events and entertainment activities. These installations must meet stringent requirements regarding brightness levels, color rendering, and glare control. Modern stadium lighting increasingly incorporates LED technology enabling instant switching and dynamic control.

Parking Lots benefit from strategic lighting placement enhancing security while facilitating safe vehicular movement and pedestrian navigation. Property owners prioritize cost-effective solutions balancing adequate illumination with manageable energy expenses. LED fixtures with motion sensors and dimming capabilities optimize parking lot lighting by adjusting brightness based on occupancy.

Tunnel Lights present unique challenges requiring specialized fixtures providing consistent illumination throughout enclosed spaces. These systems must address the transition between outdoor daylight and tunnel darkness to prevent driver vision adjustment issues. Tunnel lighting designs incorporate threshold zones with graduated brightness levels.

Parks utilize outdoor lighting to extend usability hours while creating safe, welcoming environments for recreational activities. Park lighting balances functional illumination with aesthetic considerations, preserving natural ambiance while ensuring visitor safety. Sustainable lighting solutions with minimal light pollution gain preference among park administrators.

Others encompass diverse outdoor lighting applications including architectural illumination, security lighting, and industrial facilities. These specialized segments demand customized solutions addressing specific environmental conditions and performance requirements. Emerging applications such as marina lighting, airport aprons, and outdoor entertainment venues contribute to market growth.

By Distribution Channel Analysis

Retail held a dominant market position in the By Distribution Channel Analysis segment of Outdoor Lighting Market, with a 39.1% share.

In 2025,Retail channels dominate outdoor lighting distribution through extensive networks of physical stores and online platforms reaching diverse customer segments. Hardware stores, home improvement centers, and specialized lighting retailers provide convenient access to various products. Additionally, retail environments enable customers to examine products physically and compare specifications.

Commercial distribution channels serve businesses, contractors, and institutional buyers requiring bulk purchases and specialized product solutions. These channels provide professional-grade outdoor lighting systems through electrical wholesalers and distributor networks. Commercial buyers benefit from technical consultation, project-specific recommendations, and volume pricing advantages.

Key Market Segments

By Type

- LED Lights

- Plasma Lamps

- High-Intensity Discharge Lamps

- Fluorescent Lights

By Application

- Street Lighting

- Highways

- Stadiums

- Parking Lots

- Tunnel Lights

- Parks

- Others

By Distribution Channel

- Retail

- Commercial

Drivers

Rising Adoption of Energy-Efficient LED Solutions Drives Outdoor Lighting Market Growth

The outdoor lighting market is experiencing significant momentum as consumers and municipalities increasingly shift toward energy-efficient LED technology. LEDs consume substantially less power compared to traditional lighting options, resulting in lower electricity bills and reduced carbon footprints. This transition is particularly evident in street lighting and public infrastructure projects where operational costs matter considerably.

Smart and IoT-enabled outdoor lighting systems are gaining traction as connectivity becomes essential for modern infrastructure. These intelligent solutions allow remote monitoring, automated scheduling, and real-time adjustments based on environmental conditions. Cities and businesses appreciate the convenience and cost savings these technologies deliver through optimized energy usage.

Urbanization continues accelerating globally, with more people moving to cities each year. This demographic shift creates substantial demand for outdoor lighting infrastructure across residential, commercial, and public spaces. Smart city initiatives further amplify this trend, as governments invest in advanced lighting networks that enhance safety, efficiency, and quality of life for urban residents.

Restraints

Technical Challenges in Integration Restrain Outdoor Lighting Market Expansion

Integrating modern outdoor lighting systems with existing infrastructure presents considerable technical obstacles. Many older installations lack the necessary wiring, control systems, or power capacity to support advanced LED and smart lighting technologies. Retrofitting these systems requires significant investment and planning, which can delay adoption and discourage potential buyers.

Compatibility issues between new lighting solutions and legacy infrastructure create additional complexity. Municipalities and property owners often face decisions about whether to upgrade incrementally or undertake complete system overhauls. These technical hurdles slow market penetration, particularly in regions with aging infrastructure.

Limited awareness about advanced outdoor lighting solutions remains a significant barrier in certain geographical markets. Many consumers and decision-makers in developing regions lack knowledge about the long-term benefits of LED lighting and smart lighting technologies. This information gap results in continued reliance on conventional lighting methods.

Growth Factors

Expansion of Solar-Powered Solutions Creates Growth Opportunities in Outdoor Lighting Market

Solar-powered outdoor lighting presents tremendous opportunities, especially in remote and off-grid locations. These self-sufficient systems eliminate electricity costs and installation complexity associated with traditional wired lighting. Rural communities, parks, and isolated facilities increasingly adopt solar solutions for reliable illumination without infrastructure dependencies.

Commercial and recreational development projects are driving substantial demand for landscape lighting. Hotels, resorts, shopping centers, and entertainment venues invest heavily in outdoor lighting to enhance ambiance and safety. These projects prioritize aesthetic appeal alongside functionality, creating opportunities for specialized lighting products and design services.

Consumer preference for decorative and aesthetic outdoor lighting continues strengthening across residential and commercial segments. Homeowners seek attractive lighting fixtures that complement architectural styles while providing functional illumination. This trend encourages manufacturers to develop diverse product ranges featuring various designs, colors, and customization options.

Emerging Trends

Surge in Motion-Sensor Technologies Shapes Outdoor Lighting Market Trends

Motion-sensor and adaptive lighting technologies are transforming outdoor illumination practices. These intelligent systems activate only when needed, significantly reducing energy consumption while maintaining security. Commercial properties, parking facilities, and residential areas increasingly implement sensor-based lighting for cost efficiency and environmental benefits.

Smart streetlights equipped with automated controls represent a major trending factor in urban infrastructure. These connected systems adjust brightness based on time, weather, and traffic conditions automatically. Municipalities appreciate the operational savings and improved management capabilities these technologies provide through centralized control platforms.

Color-changing and customizable LED fixtures are gaining popularity among consumers seeking personalized outdoor environments. These versatile products allow users to modify lighting colors and patterns according to occasions, seasons, or preferences. Entertainment venues, hospitality businesses, and homeowners embrace this flexibility for creating distinctive atmospheres.

Regional Analysis

North America Dominates the Outdoor Lighting Market with a Market Share of 37.5%, Valued at USD 8.8 Billion

North America holds the leading position in the global outdoor lighting market, accounting for 37.5% of the market share and valued at USD 8.8 billion. The region’s dominance is driven by stringent energy efficiency regulations, widespread LED adoption, and substantial investments in smart city infrastructure. The United States leads the market with extensive government initiatives promoting sustainable lighting solutions across commercial, residential, and municipal applications.

Europe Outdoor Lighting Market Trends

Europe maintains a significant market presence, characterized by aggressive sustainability targets and comprehensive environmental regulations. The region’s growth is fueled by smart city projects across Western Europe and extensive retrofitting activities replacing conventional lighting with LED alternatives. Government subsidies supporting green infrastructure continue to accelerate intelligent outdoor lighting adoption across various applications.

Asia Pacific Outdoor Lighting Market Trends

The Asia Pacific region is experiencing rapid expansion driven by accelerated urbanization, infrastructure development, and rising disposable incomes. Countries like China, India, and Japan are investing heavily in urban development projects and smart lighting systems. Growing awareness of energy conservation and supportive government policies promoting LED technology are propelling market growth across the region.

Middle East and Africa Outdoor Lighting Market Trends

The Middle East and Africa region shows promising growth potential with increasing infrastructure investments, particularly in Gulf Cooperation Council countries. Major construction projects, tourism development initiatives, and smart city programs are driving demand for advanced outdoor lighting solutions. The region’s focus on energy diversification and sustainable development is encouraging adoption of solar-powered and energy-efficient lighting technologies.

Latin America Outdoor Lighting Market Trends

Latin America presents moderate but steady growth in the outdoor lighting market, supported by urban expansion and infrastructure modernization programs. Brazil and Mexico lead regional demand with government initiatives focused on public lighting upgrades and energy efficiency improvements. Growing urbanization, rising safety concerns, and increasing adoption of LED technology are key factors contributing to market development in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Outdoor Lighting Company Insights

The global outdoor lighting market in 2025 is characterized by intense competition among established players who are driving innovation through smart lighting solutions, energy-efficient technologies, and sustainable practices.

Signify Holding, formerly known as Philips Lighting, maintains its position as a market leader through its comprehensive portfolio of connected lighting systems and IoT-enabled solutions that cater to smart city initiatives worldwide. The company’s focus on LED technology and intelligent controls has enabled it to capture significant market share across residential, commercial, and municipal outdoor lighting applications.

ACUITY BRANDS, INC. has distinguished itself through its advanced lighting and building management solutions, leveraging digital technology to provide integrated outdoor lighting systems that enhance energy efficiency and reduce operational costs. Their strategic investments in smart infrastructure and data-driven lighting solutions position them as a formidable competitor in the North American market.

Hubbell continues to strengthen its market presence through innovative outdoor lighting products that combine durability with cutting-edge LED technology, serving diverse sectors including transportation, industrial, and commercial spaces. The company’s emphasis on robust manufacturing capabilities and customer-centric solutions has solidified its reputation as a reliable supplier.

Zumtobel Group has carved out a strong position in the premium outdoor lighting segment, offering sophisticated architectural lighting solutions that blend aesthetics with functionality. Their expertise in creating customized lighting experiences for urban spaces, facades, and public areas demonstrates their commitment to elevating outdoor environments through intelligent design and advanced photometric engineering.

Top Key Players in the Market

- Signify Holding

- ACUITY BRANDS, INC.

- Hubbell

- Zumtobel Group

- ams-OSRAM AG

- Outdoor Lighting Perspectives

- GE Lighting

- Cree LED

- SYSKA

- Virtual Extension

Recent Developments

- In January 2026, Feit Electric acquired Good Earth Lighting to expand its portfolio of decorative and functional lighting solutions, strengthening its position across residential and commercial segments.

- In July 2025, LED Roadway Lighting Ltd. acquired Evluma, enhancing its capabilities in advanced outdoor and infrastructure lighting technologies for municipal and industrial applications.

- In April 2025, Fusion Optix acquired LEDdynamics, Prolume Lighting, and LEDSupply, reinforcing its U.S. LED market presence through expanded product breadth and integrated lighting solutions.

- In January 2025, Tonka Bay Equity Partners LLC invested in LightMart Holdings LLC to support growth in value-added distribution of outdoor industrial and commercial lighting products and accessories.

Report Scope

Report Features Description Market Value (2025) USD 23.5 Billion Forecast Revenue (2035) USD 52.6 Billion CAGR (2026-2035) 8.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (LED Lights, Plasma Lamps, High-Intensity Discharge Lamps, Fluorescent Lights), By Application (Street Lighting, Highways, Stadiums, Parking Lots, Tunnel Lights, Parks, Others), By Distribution Channel (Retail, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Signify Holding, ACUITY BRANDS, INC., Hubbell, Zumtobel Group, ams-OSRAM AG, Outdoor Lighting Perspectives, GE Lighting, Cree LED, SYSKA, Virtual Extension Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Signify Holding

- ACUITY BRANDS, INC.

- Hubbell

- Zumtobel Group

- ams-OSRAM AG

- Outdoor Lighting Perspectives

- GE Lighting

- Cree LED

- SYSKA

- Virtual Extension