Global Outboard Engines Market Size, Share, Growth Analysis By Engine Type (4-stroke, 2-stroke, Electric), By Fuel Type (Gasoline, Diesel, Electric), By Power (Mid, Low, High), By Ignition Type (Electric, Manual), By Application (Recreational, Commercial, Military), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172945

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

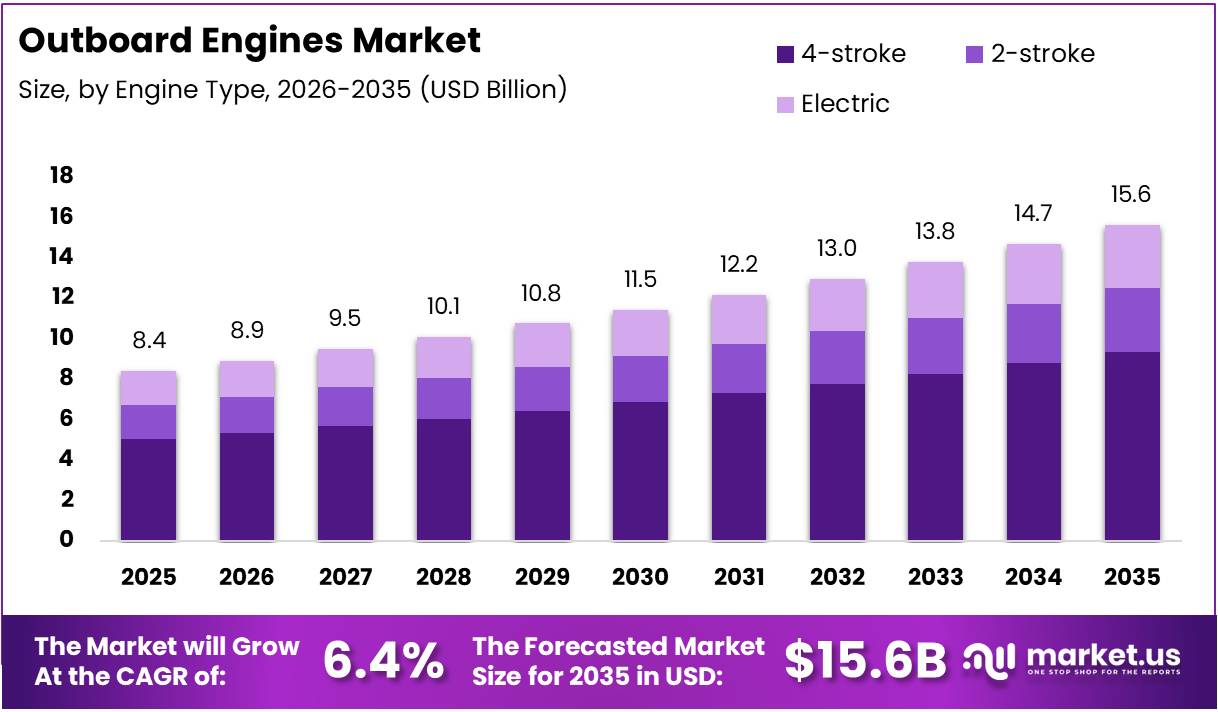

The Global Outboard Engines Market size is expected to be worth around USD 15.6 Billion by 2035, from USD 8.4 Billion in 2025, growing at a CAGR of 6.4% during the forecast period from 2026 to 2035.

The Outboard Engines Market is experiencing steady growth due to rising recreational boating activities and demand for reliable marine propulsion systems. Manufacturers are emphasizing lightweight designs, improved fuel efficiency, and enhanced performance. Consequently, increasing disposable income and leisure spending are driving adoption across global regions, supporting sustained market expansion.

Technological advancements, particularly in electric and hybrid outboard engines, are shaping market dynamics. Companies are focusing on improving torque, reducing emissions, and extending engine life. Government support for sustainable marine transport, coupled with stricter environmental regulations, is encouraging innovation and promoting the adoption of cleaner propulsion solutions worldwide.

Emerging markets offer significant growth opportunities as boating culture expands in developing regions. Tourism growth and waterfront development are boosting recreational boating, directly increasing demand for outboard engines. This trend is encouraging manufacturers to introduce versatile engines suitable for small and medium-sized vessels, capturing new customer segments.

Regulatory frameworks aimed at reducing emissions are accelerating the shift toward electric and low-emission outboard motors. Policies supporting zero-emission marine transport create a favorable environment for clean propulsion technologies. Compliance with safety and performance standards also enhances consumer confidence and market credibility.

Electric outboard motors typically feature 0.5- to 4-kilowatt DC motors operating at 12 to 60 volts DC. These engines provide quiet, low-maintenance operation and are ideal for leisure and small-scale commercial applications, supporting the growing trend toward environmentally friendly boating solutions.Performance remains a key differentiator, with most engines achieving maximum RPM between 5,000 and 6,000 at full throttle. This ensures efficient propulsion, responsive handling, and reliable performance across diverse water conditions, driving adoption among recreational and professional users alike.

Key Takeaways

- The Global Outboard Engines Market is expected to reach USD 15.6 Billion by 2035 from USD 8.4 Billion in 2025, growing at a CAGR of 6.4%.

- In By Engine Type Analysis, 4-stroke engines dominated with a 57.2% market share in 2025.

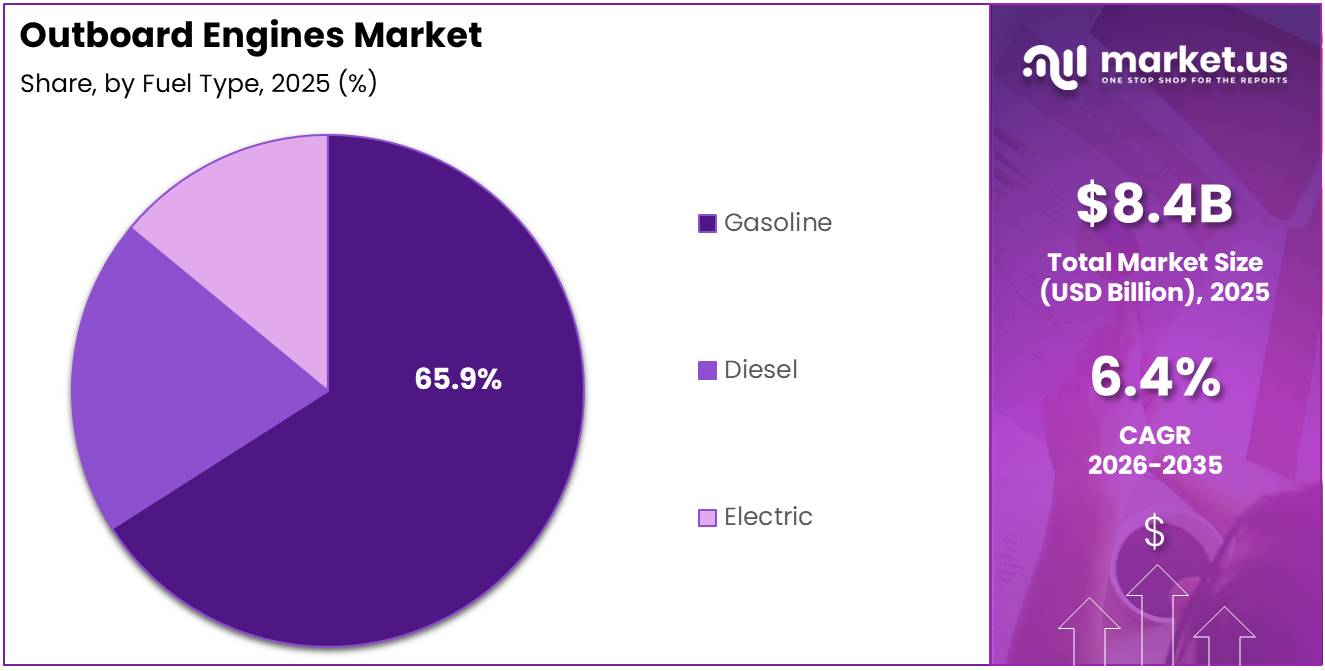

- In By Fuel Type Analysis, Gasoline engines led the segment with a 65.9% share.

- In By Power Analysis, Mid-powered engines held a 52.6% share, balancing performance and efficiency.

- In By Ignition Type Analysis, Electric ignition systems dominated with a 77.1% share.

- In By Application Analysis, Recreational use accounted for the largest share at 59.3%.

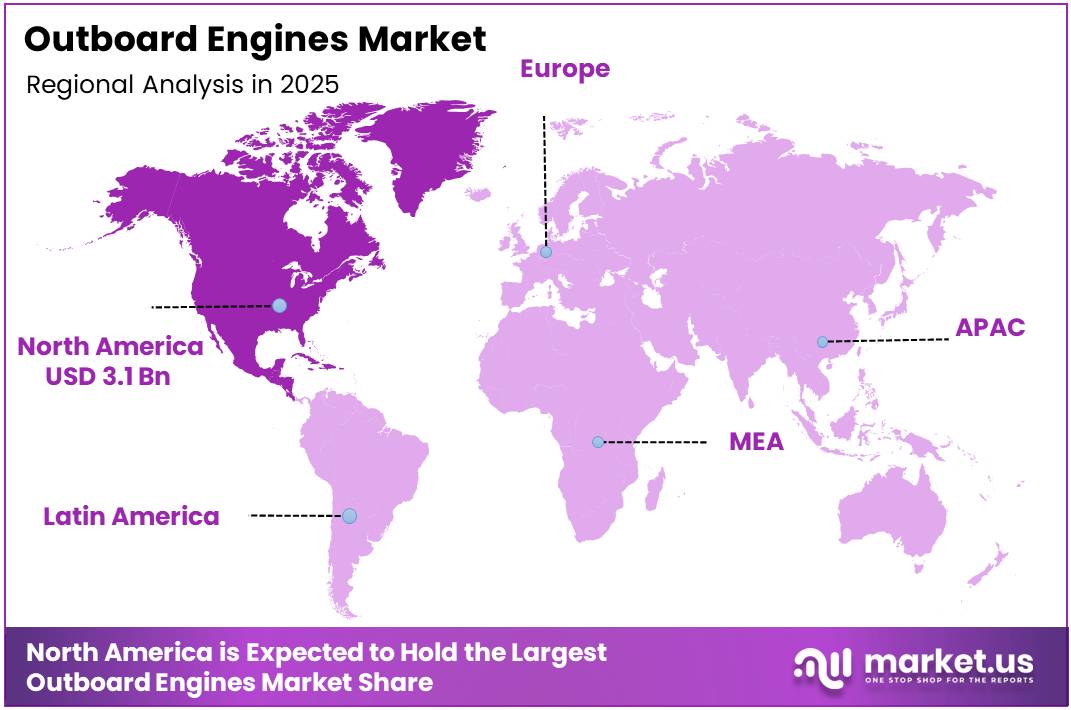

- North America dominated the regional market with a 37.4% share, valued at USD 3.1 Billion.

By Engine Type Analysis

4-stroke held a dominant market position in the By Engine Type Analysis segment of Outboard Engines Market, with a 57.2% share.

In 2025, 4-stroke engines are highly favored for fuel efficiency and long-term reliability. They generate lower emissions, meeting environmental regulations. Smooth and quiet operation enhances boating comfort. Manufacturers focus on innovation in design to improve lifespan and performance. This segment is widely adopted across recreational and commercial vessels. Continuous technological improvements support its dominance. Consumer preference and regulatory compliance strengthen growth.

2-stroke engines remain important for performance-focused applications. They are lightweight and provide a superior power-to-weight ratio. Speed advantages make them popular in small boats and competitive boating. However, higher fuel consumption and emissions limit mass adoption. Manufacturers are investing in cleaner 2-stroke solutions to comply with regulations. Niche applications help maintain steady demand. Market relevance is sustained in specialized segments.

Electric engines are emerging as eco-friendly alternatives. They offer silent operation and zero emissions. Ideal for smaller recreational boats and short-distance trips. Battery limitations and higher costs slow adoption. Technological advancements in battery capacity and charging infrastructure gradually increase appeal. Adoption is growing with environmentally conscious consumers. The segment shows high potential for future expansion.

By Fuel Type Analysis

Gasoline held a dominant market position in the By Fuel Type Analysis segment of Outboard Engines Market, with a 65.9% share.

In 2025, Gasoline fuel engines are widely preferred due to affordability and easy maintenance. Performance is reliable across recreational and commercial vessels. Broad availability of fuel supports consumer adoption. Manufacturers focus on improving efficiency and durability. Familiarity and existing service networks reinforce preference. Consistent demand drives continued market leadership. Gasoline engines remain the first choice for most users.

Diesel fuel engines provide high torque and fuel efficiency for heavy-duty applications. They are preferred in commercial boats and long-distance operations. Higher initial costs and increased weight are challenges. Diesel engines are critical for reliability in endurance-based marine operations. Specialized applications ensure steady adoption. Manufacturers optimize performance to enhance market relevance. This segment is essential for specific industrial and commercial uses.

Electric fuel types are increasingly considered for eco-conscious boating. They offer quiet operation and zero emissions. Popular among recreational users for short trips. Limited charging infrastructure and battery range restrict wider adoption. Technological improvements in energy density and charging speed support growth. Consumer awareness is gradually increasing. The segment shows strong potential for sustainable boating trends.

By Power Analysis

Mid held a dominant market position in the By Power Analysis segment of Outboard Engines Market, with a 52.6% share.

In 2025, Mid-powered engines provide an ideal balance of performance and efficiency. Suitable for recreational, commercial, and small industrial applications. Consumers prefer reliability, moderate speed, and fuel savings. Manufacturers focus on power-to-weight optimization and operational efficiency. This segment is versatile and widely applicable. Consistent consumer preference ensures dominance. It drives overall growth in the power-based market.

Low-powered engines are mainly used in small boats and fishing vessels. Cost-effectiveness and simple maintenance attract budget-conscious users. Speed limitations reduce appeal for larger boats or commercial use. Popular in leisure and entry-level boating markets. Easy to operate and maintain, ensuring steady niche adoption. Small-scale commercial and recreational segments sustain relevance. Operational simplicity remains a key advantage.

High-powered engines deliver high speed, torque, and premium performance. Used in large vessels, racing boats, and military applications. Fuel consumption and maintenance requirements are higher. Adoption is limited to specialized segments. Manufacturers focus on reliability and advanced technology for performance users. Niche demand ensures stable market presence. Critical for high-performance boating and defense applications.

By Ignition Type Analysis

Electric held a dominant market position in the By Ignition Type Analysis segment of Outboard Engines Market, with a 77.1% share.

In 2025, Electric ignition systems are convenient, reliable, and reduce maintenance needs. They ensure consistent starting performance. Preferred across recreational and commercial vessels. Downtime is minimized, increasing operational efficiency. Manufacturers incorporate electric ignition in modern designs. Growing adoption is driven by ease of use and efficiency. Market dominance remains strong due to convenience and reliability.

Manual ignition systems are simple and low-cost alternatives. Common in basic or older engine models. Easy to repair and maintain without advanced tools. Declining convenience and slower starting limit adoption. Electric ignition is gradually replacing manual systems. The segment maintains a small, shrinking share. It continues to serve niche or budget-conscious applications.

By Application Analysis

Recreational held a dominant market position in the By Application Analysis segment of Outboard Engines Market, with a 59.3% share.

In 2025, Recreational applications drive market growth due to leisure, tourism, and personal watercraft usage. Reliability, ease of use, and performance are top priorities. Manufacturers design engines for comfort, efficiency, and safety. Growing interest in boating and water sports supports demand. Recreational boating trends continue to rise globally. Innovation and enhanced features attract consumers. This segment dominates outboard engine applications.

Commercial applications include transport, fishing, and service vessels. Durability, fuel efficiency, and cost-effectiveness are essential. Smaller fleet sizes limit market scale. Budget constraints and operational efficiency influence adoption. Manufacturers offer specialized solutions for commercial operations. Steady adoption persists in specific industries. Commercial applications remain secondary but significant in market revenue.

Military applications require high-performance, robust engines for defense operations. Reliability, endurance, and adaptability are crucial. Government procurement cycles are specialized and periodic. Niche adoption limits overall market share. Strategic operations prioritize operational readiness. Manufacturers focus on advanced technologies for military use. Military applications remain important but occupy a small, specialized market segment.

Key Market Segments

By Engine Type

- 4-stroke

- 2-stroke

- Electric

By Fuel Type

- Gasoline

- Diesel

- Electric

By Power

- Mid

- Low

- High

By Ignition Type

- Electric

- Manual

By Application

- Recreational

- Commercial

- Military

Drivers

Rising Demand for Recreational Boating and Water Sports Activities Drives Market Growth

The growing interest in recreational boating and water sports is a key factor boosting the outboard engines market. More people are participating in leisure activities on water, which increases the need for reliable and efficient outboard engines. This trend is particularly strong in regions with easy access to lakes, rivers, and coastal areas. Manufacturers are seeing higher demand for consumer-friendly marine engines.

Technological advancements in fuel-efficient and eco-friendly outboard engines are further supporting market growth. Manufacturers are focusing on engines that reduce fuel consumption and emissions, meeting environmental regulations. These innovations attract environmentally conscious consumers and improve the overall performance of marine engines. This is encouraging companies to invest more in research and development.

Another important driver is the increasing adoption of lightweight and high-performance marine engines. Modern engines are designed to be compact without compromising power, allowing boats to achieve higher speeds and better maneuverability. This appeals to recreational users and professional boaters alike. Such engines also make boating more accessible to a wider audience.

Restraints

Stringent Environmental Regulations Drive Market Restraints

Stringent environmental regulations on emissions and noise pollution are one of the major restraints for the outboard engines market. Governments across the globe are enforcing tighter standards to reduce air and water pollution, especially in coastal and inland waterways. Compliance requires manufacturers to invest heavily in research, redesign engines, and adopt cleaner technologies. These upgrades increase production costs, which are often passed on to consumers, limiting affordability and adoption, particularly in cost-sensitive regions.

High-powered engines face even stricter rules due to their significant emissions, which may slow their deployment for commercial and recreational purposes. Additionally, engine testing and certification processes can be time-consuming and expensive, creating barriers for smaller manufacturers who cannot easily absorb these costs.

Another significant challenge is the limited availability of skilled technicians for maintenance and repair. Outboard engines require specialized knowledge to handle mechanical, electronic, and smart engine systems. Many emerging markets lack trained personnel, resulting in delayed service, operational downtime, and higher maintenance costs. This can discourage potential buyers, especially recreational boat owners, from purchasing advanced or high-tech engines.

Growth Factors

Expansion in Emerging Markets Drives Growth Opportunities

Emerging markets with growing coastal tourism present a significant opportunity for the outboard engines market. Countries with expanding waterfronts, lakes, and rivers are seeing increased boating activities, both recreational and commercial. This trend drives demand for versatile and reliable outboard engines, allowing manufacturers to capture new customer segments and strengthen their global footprint.

Integration of smart and IoT-enabled marine engine systems is another key growth driver. These advanced engines provide real-time performance monitoring, predictive maintenance, and fuel efficiency tracking, which appeals to tech-savvy consumers and commercial operators seeking operational efficiency. Adoption of connected solutions enhances user convenience and reduces unexpected downtime, further encouraging engine upgrades.

The rising popularity of electric and hybrid outboard engines also offers substantial growth potential. Eco-conscious consumers and regulations promoting low-emission technologies are accelerating the shift from traditional gasoline engines. Electric engines are quieter, more efficient, and require less maintenance, making them attractive for recreational boating and eco-friendly commercial operations.

Emerging Trends

Shift Toward Sustainable Solutions Drives Trending Factors

The shift toward low-emission and sustainable marine propulsion solutions is shaping the trends in the outboard engines market. Consumers are increasingly prioritizing environmental responsibility, encouraging manufacturers to develop cleaner and more efficient engines. This trend aligns with global policies targeting reduced marine pollution and promotes adoption of modern, eco-friendly technologies.

Consumer preference is also moving toward portable and compact outboard engines. Smaller, lightweight engines are easier to transport, install, and maintain, making them ideal for recreational boating, fishing, and small commercial operations. Convenience and flexibility are now important decision factors for buyers, driving demand for compact designs without compromising performance.

Collaboration between marine engine manufacturers and technology companies is fueling innovation. Partnerships enable integration of advanced electronics, IoT systems, and smart monitoring solutions, improving fuel efficiency, engine durability, and user experience. These collaborations accelerate development cycles and help companies bring new solutions to market faster.

Regional Analysis

North America Dominates the Outboard Engines Market with a Market Share of 37.4%, Valued at USD 3.1 Billion

In 2025, North America held a dominant position in the Outboard Engines Market, accounting for a market share of 37.4% and valued at USD 3.1 Billion. The region’s growth is driven by increasing recreational boating activities and rising demand for high-performance marine engines. Strong infrastructure, well-established marine tourism, and easy access to skilled technicians further support market expansion in this region.

Europe Outboard Engines Market Trends

Europe demonstrates steady growth in the outboard engines segment, supported by increasing water sports activities and government initiatives promoting eco-friendly engines. Countries with extensive coastlines show higher adoption of advanced engine technologies, reflecting a preference for fuel-efficient and low-emission engines. The market here benefits from robust marine leisure culture and organized boating events.

Asia Pacific Outboard Engines Market Trends

Asia Pacific is witnessing rapid adoption of outboard engines due to rising disposable income, growing domestic tourism, and expanding coastal infrastructure. Nations in Southeast Asia and Oceania lead the regional demand, with boating becoming more accessible to middle-class consumers. Government incentives for sustainable marine engines are further boosting market growth across this region.

Middle East and Africa Outboard Engines Market Trends

The Middle East and Africa region shows moderate growth, primarily driven by luxury yacht tourism and recreational boating in coastal nations. Rising investments in marine infrastructure and increasing water sports popularity are supporting demand for reliable outboard engines. However, limited skilled labor and high maintenance costs pose challenges to rapid adoption.

Latin America Outboard Engines Market Trends

Latin America’s outboard engines market is expanding gradually, with Brazil and Argentina being key contributors. Growth is fueled by the increasing recreational boating community and government efforts to improve marine transportation safety. However, economic fluctuations and limited local manufacturing capacities may slightly hinder faster growth in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Outboard Engines Company Insights

Camfil is emerging from a non‑traditional background with its advanced filtration and air management expertise, positioning the company to support engine manufacturers in optimizing performance and emissions compliance. Its strategic focus on aftermarket support and filtration systems enhances engine reliability and uptime, which is increasingly valued by OEMs and end users seeking durable solutions for varied marine environments.

Cox Powertrain, differentiation in 2025 centers on its innovative application of diesel and alternative fuel technologies to outboard platforms. The company’s engineering emphasis on fuel efficiency and torque delivery enables it to appeal to commercial operators and recreational boaters alike, who prioritize cost‑effective operation over extended usage cycles. Continued R&D investments and partnerships with hull builders further strengthen Cox’s relevance as market demand diversifies.

Elco Motor Yachts in the outboard segment leverages its heritage in electric propulsion and integrated marine solutions. In 2025, the company is capitalizing on the transition toward electrification and hybrid systems by offering scalable outboard packages compatible with its broader marine ecosystem. This alignment with sustainability trends and lifestyle boating preferences supports Elco’s ability to capture share among eco‑conscious consumers and premium market niches.

Evinrude remains a recognizable name in marine propulsion, with a reputation for robust performance and marine‑centric engineering. The brand’s legacy in two‑stroke technology and commitment to responsive power delivery help maintain its foothold among traditional boating segments. Evinrude’s continued focus on dealer support and parts availability reinforces customer confidence in serviceability and long‑term ownership value.

Top Key Players in the Market

- Camfil

- Cox Powertrain

- Elco Motor Yachts

- Evinrude

- Honda Motor Co., Ltd

- LEHR LLC

- Mercury Marine, Inc

- Mudd Hog Mud Motors, LLC

- Suzuki Marine

- Tohatsu Corporation

- Volvo Penta

Recent Developments

- In March 2025, Raider Outboards, Inc., a family-owned company specializing in advanced outboard motor technology, completed the acquisition of the electric outboard motor operations of Pure Watercraft Inc. based in Seattle, Washington, strengthening its presence in the electric marine propulsion segment.

- In January 2024,Yamaha Motor acquired the electric marine propulsion manufacturer Torqeedo, marking a strategic move to expand its portfolio in the growing electric outboard motor market worldwide.

Report Scope

Report Features Description Market Value (2025) USD 8.4 Billion Forecast Revenue (2035) USD 15.6 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Engine Type (4-stroke, 2-stroke, Electric), By Fuel Type (Gasoline, Diesel, Electric), By Power (Mid, Low, High), By Ignition Type (Electric, Manual), By Application (Recreational, Commercial, Military) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Camfil, Cox Powertrain, Elco Motor Yachts, Evinrude, Honda Motor Co., Ltd, LEHR LLC, Mercury Marine, Inc, Mudd Hog Mud Motors, LLC, Suzuki Marine, Tohatsu Corporation, Volvo Penta Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Camfil

- Cox Powertrain

- Elco Motor Yachts

- Evinrude

- Honda Motor Co., Ltd

- LEHR LLC

- Mercury Marine, Inc

- Mudd Hog Mud Motors, LLC

- Suzuki Marine

- Tohatsu Corporation

- Volvo Penta