Global Orthopaedic Navigation Systems Market By Application (Knee, Hip and Spine) By Technology (Electromagnetic, Optical and Others) By End Use (Hospitals, Ambulatory Surgical Centers and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 35970

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

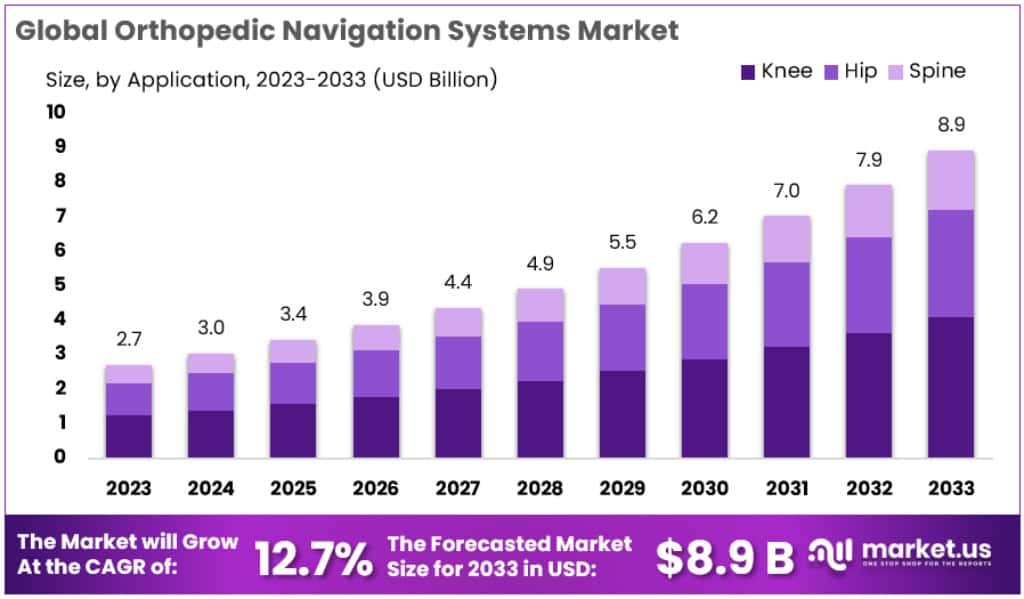

The Global Orthopedic Navigation Systems Market size is expected to be worth around USD 8.9 Billion by 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 12.7% during the forecast period from 2023 to 2033.

Orthopedic Navigation Systems are technologies used in orthopedic surgery to analyze pre-, intra- and/or postoperative data in multiple modalities and provide an augmented reality 3-D visualization environment to improve clinical outcomes of surgical orthopedic procedures. These systems enable surgeons to make precise decisions in the operating room by integrating surgical planning, instrument tracking, and intraoperative imaging.

Orthopedic Navigation Systems can be used in various orthopedic procedures such as knee, hip, spine, joint, and shoulder replacement. The system uses a real-time transformation sent by the tracking system to provide 2D and 3D views of the surgery location in the 3D CT scan, adjust the view orientation to match the tool’s orientation, and minimize display delays to allow high accuracy navigation.

Market growth is expected to be driven by rising geriatrics and joint reconstruction cases, increasing healthcare expenditure, and high awareness levels among patients, and healthcare professionals. There has been an increase in cases of osteoporosis and osteoarthritis. Rheumatoid arthritis is also on the rise. These diseases affect the body’s musculoskeletal system. This includes muscles, bones, joints, and nerves as well as cartilage, ligaments, and tendons. It causes a reduction of range, stiffness, swelling, and pain in the muscles, which can then lead to surgical treatment.

Key Takeaways

- The Orthopedic Navigation Systems Market is expected to grow from USD 2.7 Billion in 2023 to approximately USD 8.9 Billion by 2033.

- This growth represents a Compound Annual Growth Rate (CAGR) of 12.7% during the forecast period from 2023 to 2033.

- Knee navigation systems hold the largest market share in 2023, accounting for over 45.9% due to a surge in knee replacement surgeries.

- Hospitals are the primary end-users in 2023, holding more than a 56.2% market share due to comprehensive medical facilities.

- North America leads the market with a 45.1% share in 2023, driven by advanced healthcare infrastructure and high awareness.

- Asia Pacific is expected to experience the fastest growth with a CAGR of 13.7%, due to unmet clinical needs and government initiatives.

- The top five market players, including Stryker, Zimmer Biomet, Smith & Nephew, Medtronic, and NuVasive, collectively hold over 60% of the market share.

Application Analysis

Knee Navigation Systems

In 2023, Knee navigation systems held a dominant position in the market, capturing more than a 45.9% share. This leadership is due to rising knee replacement surgeries and advancements in knee navigation technology. The demand is driven by an aging population and increased awareness of new surgical options. Manufacturers are focusing on more precise and minimally invasive techniques, making knee navigation systems popular among orthopedic surgeons.

Hip Navigation Systems

Hip navigation systems have shown significant growth in the market. This segment benefits from technological innovations that enhance the accuracy and efficiency of hip replacement surgeries. The rise in hip dysplasia and osteoarthritis cases has also propelled the demand. These systems are increasingly adopted for their ability to reduce complications and revision surgery rates, making them a valuable tool in modern orthopedic practices.

Spine Navigation Systems

Spine navigation systems are rapidly gaining traction in the market. This growth is attributed to the increasing prevalence of spinal disorders and the need for precision in spinal surgeries. These systems provide real-time visualization and enhance the surgeon’s ability to place implants accurately, which is critical in spine surgery. The adoption of spine navigation systems is expected to increase with the ongoing improvements in technology and the growing emphasis on patient safety and outcomes.

Technology Analysis

Optical Navigation Systems

In 2023, Optical navigation systems held a dominant position in the market, capturing more than a 44.9% share. Their popularity stems from high accuracy and minimal interference with surgical instruments. Optical systems are widely used in complex surgeries for their reliability and precision. They use cameras and markers to guide surgeons, making them ideal for intricate orthopedic procedures. This segment’s growth is fueled by continuous technological advancements and a surge in demand for precise surgical outcomes.

Electromagnetic Navigation Systems

Electromagnetic navigation systems are also making a significant impact on the market. These systems are prized for their flexibility and ability to operate without line-of-sight restrictions, unlike optical systems. They use electromagnetic fields to track instruments, offering greater maneuverability in tight surgical spaces. This application is increasingly preferred in surgeries where space constraints and accuracy are crucial factors. The segment’s growth is driven by the rising adoption in hip and knee surgeries and the ongoing development of more advanced and user-friendly systems.

Other Navigation Systems

The ‘Others’ category in orthopedic navigation systems includes various emerging technologies like robotic-assisted navigation and computer-assisted surgery systems. Although they currently hold a smaller market share, these technologies are rapidly gaining attention for their potential to enhance surgical precision and patient outcomes. Innovations in this segment are focused on improving accuracy, reducing surgery times, and minimizing post-operative complications. The increasing investment in R&D and the growing acceptance of new technologies among orthopedic surgeons are expected to propel the growth of this segment in the coming years.

End-Use Analysis

Hospitals

In 2023, Hospitals held a dominant position in the orthopedic navigation systems market, capturing more than a 56.2% share. This dominance is primarily due to their comprehensive medical facilities and the high volume of orthopedic surgeries performed. Hospitals are often equipped with the latest navigation systems, attracting patients seeking advanced surgical care. This segment’s growth is fueled by increasing investments in healthcare infrastructure and the availability of skilled professionals in hospital settings.

Ambulatory Surgical Centers

Ambulatory Surgical Centers (ASCs) have also emerged as key end-users in this market. These centers are favored for their cost-effectiveness and efficiency in handling elective surgeries, including orthopedic procedures. The adoption of navigation systems in ASCs is driven by the growing trend of outpatient surgeries and the centers’ emphasis on minimizing hospital stays. ASCs are increasingly equipped with modern navigation systems to enhance surgical precision and patient turnover, supporting their growing market share.

Other End-Users

The ‘Others’ category in the orthopedic navigation systems market encompasses specialized clinics, research institutions, and private practices. While this segment currently holds a smaller market share, it is gaining momentum due to the personalized care and specialized services offered. These settings are adopting navigation systems to cater to niche markets and specific patient needs. The growth in this segment is supported by technological advancements and the increasing preference for specialized orthopedic care in non-hospital settings.

Key Market Segments

Application

- Knee

- Hip

- Spine

Technology

- Electromagnetic

- Optical

- Others

End Use

- Hospitals

- Ambulatory Surgical Centers

- Other End-users

Drivers

- Increasing Orthopedic Disorders: With conditions like osteoarthritis on the rise, the demand for precise surgeries is growing. For example, the CDC reports that 32.5 million U.S. adults suffer from osteoarthritis.

- Technological Advancements: Innovations in 3D imaging and augmented reality enhance surgical accuracy, making these systems more appealing.

- Minimally Invasive Surgery Trend: Patients and doctors are leaning towards less invasive procedures, which these systems support, for quicker recovery and less pain.

- Aging Population: The elderly are more prone to orthopedic issues. By 2030, 1 in 6 people globally will be over 60, nearly doubling the elderly population by 2050.

Restraints

- High Costs: The expense of these advanced systems can be a barrier, especially in less developed regions.

- Complexity and Training Needs: These systems require specialized training, which can slow down their adoption.

- Privacy and Cybersecurity Concerns: Some healthcare providers might be hesitant to fully adopt these systems due to potential data breaches.

- Regulatory Challenges: Approvals for new technologies can delay market entry.

- Alternative Treatments: Availability of other treatment options poses competition.

Opportunities

- Cost-Effective and User-Friendly Systems: As technology evolves, there’s a chance to make these systems more affordable and easier to use.

- Personalized Medicine: Growing demand for patient-specific treatments opens up new avenues for tailored surgical approaches using navigation systems.

- Elderly Population: The increasing number of older adults worldwide presents an expanding market for orthopedic treatments.

Challenges

- Adapting to Rapid Technological Changes: Keeping up with the pace of technological advancements can be challenging for healthcare providers.

- Market Saturation: With many players in the market, standing out and capturing market share can be tough.

- Balancing Cost and Quality: Providing high-quality systems at an affordable cost is a key challenge.

Trends

- Knee Surgery Dominance: The knee surgery segment is expected to maintain a significant market share, with an increasing number of minimally invasive knee surgeries.

- Rising Geriatric Population: With a growing elderly population, demand for joint replacement surgeries, particularly knee replacements, is set to increase.

- Advancements by Key Players: Companies like DePuy Synthes are launching new solutions like the VELYS Robotic-Assisted Solution, indicating a trend towards more technologically advanced offerings.

Regional Analysis

North America’s Dominance in the Orthopedic Navigation Systems Market

In 2023, North America continues to lead the Orthopedic Navigation Systems Market with a commanding 45.1% share, amounting to USD 1.21 Billion. This dominance is rooted in the region’s advanced healthcare infrastructure and high awareness about orthopedic navigation systems. Several factors, such as a growing elderly population, substantial healthcare spending by the government, and a robust reimbursement system, contribute significantly to this growth.

The region is home to many established manufacturers, further boosting the market. Moreover, collaborations between government bodies like the American Board of Orthopedic Surgeries and educational institutes are enhancing skill-based education in this sector, promoting the growth of orthopedic navigation systems.

Asia Pacific’s Rapid Market Growth

The Asia Pacific region is forecasted to experience the fastest growth in the Orthopedic Navigation Systems Market, with a CAGR of 13.7%. This surge is due to unmet clinical needs, increased government initiatives to raise awareness about minimally invasive procedures, and investments by manufacturers to produce cost-effective orthopedic navigation systems.

The region’s large elderly population, especially in China, Japan, and India, presents a significant target market. For instance, Exactech’s plan to expand its Newton knee technique in Asia Pacific in May 2023 highlights the region’s growing importance in this market. Such developments signal a strong future demand for orthopedic navigation systems in Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Key Players

- B. Braun Melsungen AG

- Zimmer Biomet

- Stryker Corporation

- Amplitude Surgical

- Medtronic Plc

- Kinamed Inc.

- Smith & Nephew Plc

- Medical Device Business Services, Inc.

- Globus Medical

- Other Key Players

Recent Developments

- October 2023: Stryker Corporation announced the launch of its Mako Total Knee System, a robotic-assisted surgery (RAS) system for total knee arthroplasty (TKA). The Mako Total Knee System is designed to enhance the accuracy and precision of TKA, while also reducing procedure time and improving patient outcomes.

- September 2023: Zimmer Biomet announced the launch of its ROSA XL robotic-assisted surgery (RAS) system for total hip arthroplasty (THA). The ROSA XL system is designed to provide surgeons with enhanced visualization and control during THA procedures.

- August 2023: Smith & Nephew announced the launch of its NAVIO robotic-assisted surgery (RAS) system for partial knee arthroplasty (PKA). The NAVIO system is designed to improve the accuracy and precision of PKA procedures, while also reducing procedure time and improving patient outcomes.

- July 2023: Medtronic announced the launch of its O-arm Imaging System, a new generation of intraoperative imaging system for spine surgery. The O-arm Imaging System is designed to provide surgeons with real-time, high-resolution 3D images of the spine during surgery.

- June 2023: NuVasive announced the launch of its XLIF Lateral Expandable Interbody System, a new minimally invasive (MIS) surgical system for lumbar spinal fusion. The XLIF Lateral Expandable Interbody System is designed to provide surgeons with a more minimally invasive option for lumbar spinal fusion procedures.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Billion Forecast Revenue (2033) USD 8.9 Billion CAGR (2023-2032) 12.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Knee, Hip and Spine) By Technology (Electromagnetic, Optical and Others) By End Use (Hospitals, Ambulatory Surgical Centers and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape B. Braun Melsungen AG, Zimmer Biomet, Stryker Corporation, Amplitude Surgical, Medtronic Plc, Kinamed Inc., Smith & Nephew Plc, Medical Device Business, Services Inc., Globus Medical and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Orthopedic Navigation Systems Market in 2023?The Orthopedic Navigation Systems Market size is USD 2.7 Billion in 2023.

What is the projected CAGR at which the Orthopedic Navigation Systems Market is expected to grow at?The Orthopedic Navigation Systems Market is expected to grow at a CAGR of 12.7% (2023-2033).

List the segments encompassed in this report on the Orthopedic Navigation Systems Market?Market.US has segmented the Orthopedic Navigation Systems Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application (Knee, Hip and Spine) By Technology (Electromagnetic, Optical and Others) By End Use (Hospitals, Ambulatory Surgical Centers and Others).

List the key industry players of the Orthopedic Navigation Systems Market?B. Braun Melsungen AG, Zimmer Biomet, Stryker Corporation, Amplitude Surgical, Medtronic Plc, Kinamed Inc., Smith & Nephew Plc, Globus Medical, and Other Key Players are engaged in the Orthopedic Navigation Systems market.

Orthopedic Navigation Systems MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Orthopedic Navigation Systems MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- B. Braun Melsungen AG

- Zimmer Biomet

- Stryker Corporation

- Amplitude Surgical

- Medtronic Plc

- Kinamed Inc.

- Smith & Nephew Plc

- Medical Device Business Services, Inc.

- Globus Medical

- Other Key Players