Global Orthopedic Implants Market By Product Type (Knee Implants, Dental Implants, Hip Implants, Spinal Implants, and Other Product Types), By Material, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 103552

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

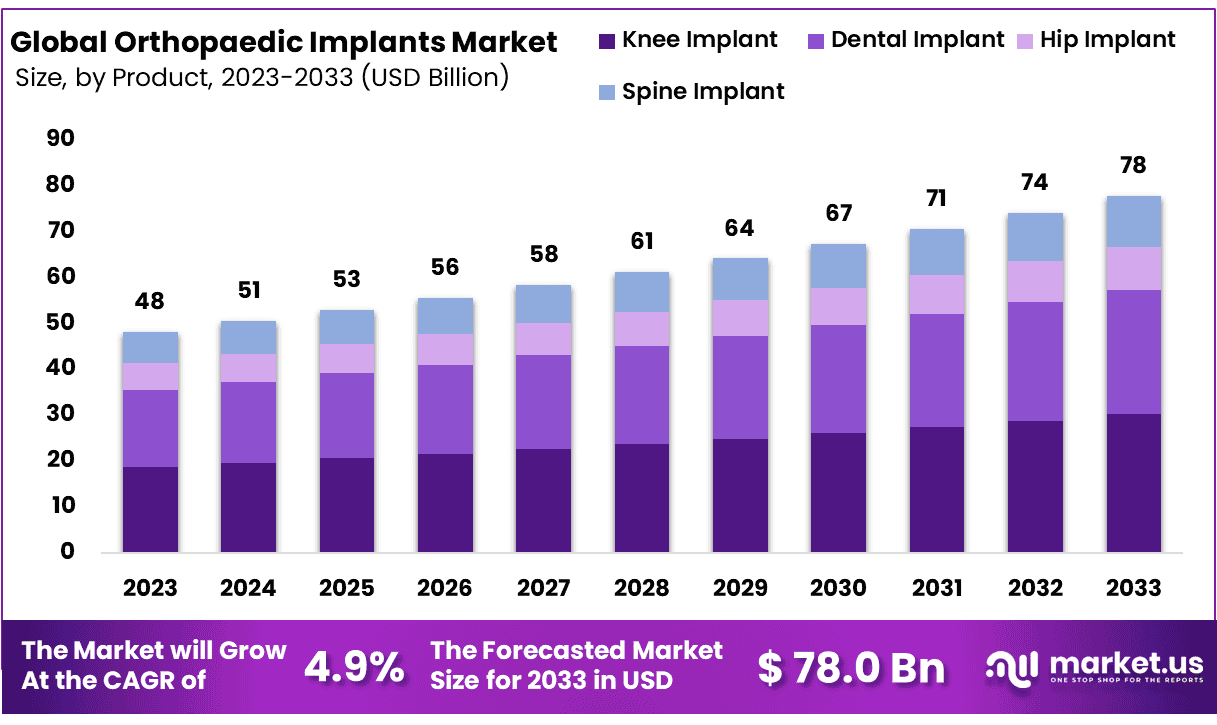

In 2023, the global Orthopedic Implants Market size was worth USD 48 billion, and it will grow by USD 78 billion by 2033. It is anticipated to grow a CAGR of 4.9% between 2024-2033.

Orthopedic implants are medical devices used to replace or support broken or diseased bones and joints. They are commonly used in orthopedic surgeries to treat various conditions such as joint replacements, fractures, spinal abnormalities, bone deformities, and more. These implants are typically made of biocompatible materials like titanium, stainless steel, cobalt-chromium alloys, ceramics, and polymers.

Different types of orthopedic implants are frequently utilized in joint replacement surgeries, including total hip replacement, complete knee replacement, and total shoulder replacement. These implants replace damaged joint surfaces with artificial components, reducing discomfort and improving joint function.

Orthopedic implants also play a crucial role in the treatment of bone tumors. The increasing elderly population and the growing prevalence of bone and musculoskeletal disorders are major factors driving the demand for orthopedic implants. Additionally, advancements in technology and the availability of advanced orthopedic implants are expected to contribute to the market’s growth over the forecast period.

Key Takeaways

- In 2023, the worldwide Orthopedic Implants Market was valued at USD 48 billion.

- The market is projected to grow by around USD 78 billion in 2033.

- The Compound Annual Growth Rate of the market between 2023-2032 is 4.9%.

- By 2050, 1/6th of the global population will be over 65 years old.

- In Northern America and Europe, 40% of the population could be over 65 years old by 2050.

- Approximately 1.71 billion individuals globally were affected by musculoskeletal illnesses in 2022.

- In the UK, over 20 million people suffer from musculoskeletal diseases.

- The first wave of the COVID-19 pandemic led to a 68.4% decline in orthopedic surgery in the US.

- In 2023, knee implants had a revenue share of 38.8% in the Orthopedic Implants Market.

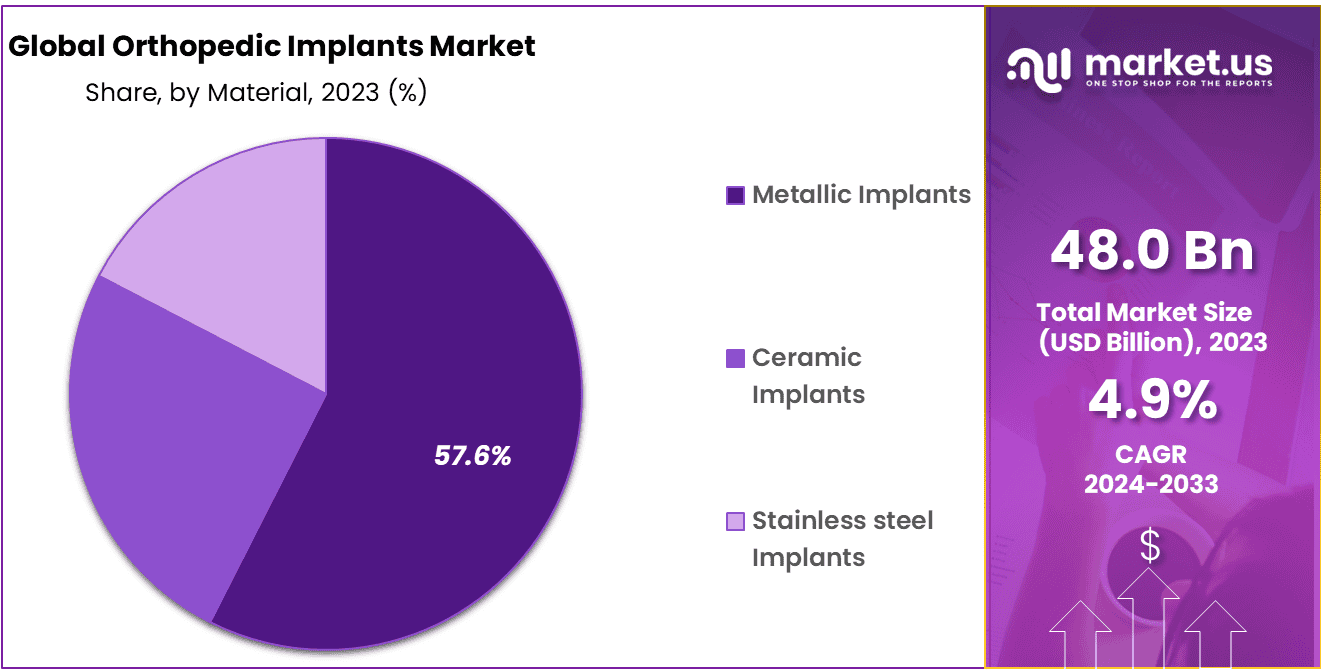

- Metallic implants accounted for a revenue share of 57.6% in 2023.

- Hospitals and clinics dominated the market with a revenue share of 62.9%.

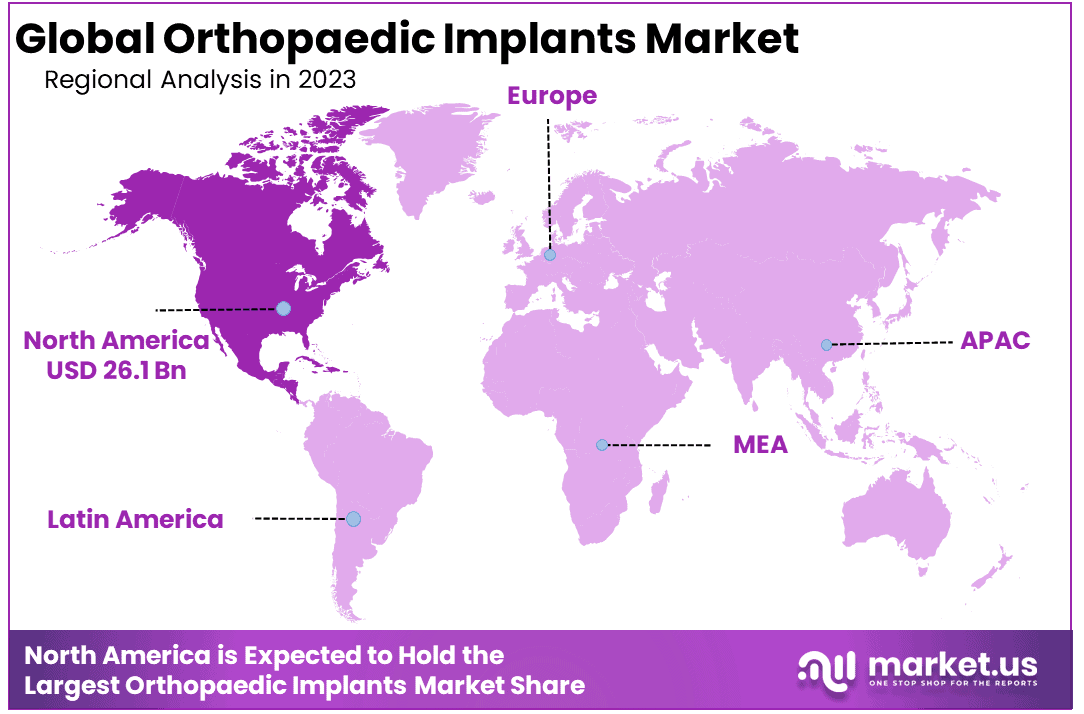

- North America holds a 52% share in the Orthopedic Implants Market.

- Knee implants are in the highest demand in the Orthopedic Implants Market.

- The Orthopedic Implants market consists of a few major market players, making it moderately competitive.

- Key partnerships, investments in technology, and the launch of new products will contribute to the market’s growth in the upcoming years.

Driving Factors

Rising Geriatric Population

Concerns regarding the aging population are on the rise in many countries worldwide. According to the World Population Prospects, it is estimated that by 2050, 1/6th of the global population will be over 65 years old, compared to one in every eleven in 2019. In Northern America and Europe, 40% of the population could be over 65 years old by 2050.

As people age, their bones become weaker and more fragile, making them more susceptible to various bone-related issues. This factor is expected to drive the demand for orthopedic implants during the forecast period.

Increasing Prevalence of Bone & Musculoskeletal Disorders

The prevalence of bone and musculoskeletal disorders is increasing worldwide. In 2022, it is estimated that around 1.71 billion individuals globally will be affected by musculoskeletal illnesses, as reported by the World Health Organization.

Musculoskeletal disorders are a leading cause of disabilities globally, with low back pain being the most common. These conditions severely limit movement and dexterity, leading to early retirement, reduced well-being, and decreased social participation. In the UK alone, more than 20 million people (almost one-third of the population) suffer from musculoskeletal diseases like arthritis and low back pain. The rising prevalence of these disorders is expected to drive the demand for orthopedic implants during the projected period.

Restraining Factors

Risks associated with the use of orthopedic implants

Some individuals may experience allergic reactions to the materials used in orthopedic implants, such as nickel or cobalt. These reactions can result in localized inflammation, pain, or discomfort around the implant site. Implants also increase the risk of infection as bacteria can adhere to the implant surface and form a biofilm, making it challenging to eradicate the infection.

In certain cases, the implant may need to be removed to treat the infection effectively. The implantation of orthopedic devices involves surgery, which carries its own risks such as bleeding, anesthesia complications, blood clots, or damage to surrounding tissues. Additionally, the implantation procedure itself may require a longer recovery period and rehabilitation. Thus, the risks associated with orthopedic implants may limit the market’s growth during the projected period.

High Cost of Orthopedic Implants

Orthopedic implants can be costly, encompassing the cost of the implant itself, the surgical procedure, hospital stay, and follow-up visits. This financial burden can be significant, especially for individuals without adequate insurance coverage. As a result, the high cost of orthopedic implants is expected to impact market growth over the forecasted period negatively.

By Product Type Analysis

Knee implants are witnessing the highest demand in the market.

Knee implants are experiencing the highest demand in the market. In 2023, the knee implants segment dominated the Orthopedic Implants Market with a revenue share of 38.8%. The increasing prevalence of obesity and diabetes, along with the rising geriatric population, has led to a high demand for knee implants.

Moreover, manufacturers are focusing on developing new materials resistant to corrosion and offering high strength due to the significant demand for knee implants. This development is expected to fuel the growth of the knee implants segment during the projection period. Additionally, dental implants are expected to witness high growth over the forecast period. The rise in dental injuries resulting from sports injuries and car accidents is a key factor expected to drive the segment’s growth.

By Material Analysis

Metallic implants dominate the market.

Metallic implants dominate the market. In 2023, the metal segment accounted for a revenue share of 57.6% in the Orthopedic Implants Market. Metals offer key advantages such as affordability, lower corrosiveness, and the ability to provide rigid support for fractures, driving the demand for metallic implants.

Furthermore, ceramic implants are anticipated to experience high growth during the projection period. These implants can be used for patients allergic to metals and are widely used in various dental procedures. Technological advancements in dentistry are expected to stimulate the demand for ceramic materials in orthopedic implants.

By End-User Analysis

Hospitals and clinics are the leading segment.

Hospitals & clinics lead the market. Throughout the forecast period, hospitals & clinics are expected to dominate the Orthopedic Implants Market with a revenue share of 62.9%. The rising demand for orthopedic implants in hospitals, driven by the increasing incidence of musculoskeletal disorders, is a key factor contributing to the segment’s growth.

Additionally, increasing healthcare expenditure in developing nations and favorable reimbursement scenarios in hospitals will further drive the segment’s growth. Orthopedic clinics are also expected to witness high growth during the projection period. The rise in orthopedic surgeries due to sports injuries, road accidents, and the demand for minimally invasive surgical procedures are key factors stimulating the growth of the orthopedic clinics segment.

Market Segments

Product Type

- Knee Implants

- Dental Implants

- Hip Implants

- Spinal Implants

- Other Product Types

Material

- Metallic

- Ceramic

- Other Materials

End-User

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

- Other End-Users

Opportunity

Initiatives and campaigns spreading awareness regarding bone and musculoskeletal disorders.

Numerous initiatives and campaigns are being launched to raise awareness about bone and musculoskeletal disorders. One such campaign is the Healthy Workplaces Lighten the Load initiated by the European Agency for Safety and Health at Work (EU-OSHA). It aims to educate the public about musculoskeletal disorders (MSDs) and their impact on individuals, businesses, and society.

The campaign emphasizes the need for collaboration among employers, managers, and workers to address MSDs. Additionally, the European Space Agency (ESA), Samantha Cristoforetti, and the International Osteoporosis Foundation have partnered to launch the #LiftOffForBoneHealth campaign. Samantha Cristoforetti promotes bone health through this initiative, encouraging people to engage in weight-bearing and resistance activities for strong and healthy bones. These campaigns create new opportunities for the Orthopedic Implants Market.

Trending Factors

Key collaborations and partnerships

Key collaborations and partnerships are driving innovation in orthopedic implants. For instance, 4WEB Medical introduced a range of hyperlordotic lateral implants in February 2022. These implants, in conjunction with the Lumbar Spine Plating Solution, offer more affordable treatment options and reduce the need for invasive posterior correction procedures. Such product launches contribute to the development of improved orthopedic implants, a positive trend that will likely fuel the growth of the Orthopedic Implants Market.

Regional Analysis

North America leads the market by holding a major revenue share in the account.

North America dominates the market, holding the largest revenue share. With a share of 54.5% in the Orthopedic Implants Market, North America is expected to lead during the forecast period. The region’s growth is driven by factors such as a growing geriatric population, increasing prevalence of bone and musculoskeletal disorders, and advancements in orthopedic surgery.

Additionally, the region benefits from a rise in joint surgical procedures and favorable regulatory environments. The Asia-Pacific region is also projected to experience significant growth. This can be attributed to the rising prevalence of osteoarthritis, osteoporosis, and bone injuries, along with a growing geriatric population in countries like Japan and China. Increased healthcare spending and infrastructure development further contribute to the expansion of the Orthopedic Implants Market in the region.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Orthopedic Implants market is moderately competitive and consists of a few major market players. The market is expected to grow at a high rate during the projection period due to the increasing demand for orthopedic implants in the treatment of several bone and musculoskeletal disorders. Additionally, investments in technology, the launch of new products, and key partnerships and collaborations are likely to contribute to market growth in the upcoming years.

Top Key Players

- Smith and Nephew Plc.

- Stryker Corporation

- Medtronic Plc.

- Arthrex, Inc.

- DePuySynthes

- NuVasive Inc.

- Orthopedic Implant Company

- Evonik

- Health Canada

- Wright Medical Group N.V

- Kyocera Medical Technologies Inc.

- Other Key Players

Recent Developments

- In April 2022, the United States Food and Drug Administration or FDA granted authorization to the Orthopaedic Implant Company’s (OIC) dorsal spanning plate. The now commercially available DRPx wrist fracture plating system from OIC can be regarded as a cost-effective alternative to other high-priced plating systems.

- In February 2022, CrossRoads Extremity Systems was purchased by DePuy Synthes, a Johnson & Johnson subsidiary company. For lower extremities, CrossRoads offered a comprehensive selection of procedure-specific, sterile-packed implants and equipment.

Report Scope

Report Features Description Market Value (2023) USD 48 Billion Forecast Revenue (2033) USD 78 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Knee Implants, Dental Implants, Hip Implants, Spinal Implants, and Other Product Types, By Material- Metal, Bioabsorbable material, Ceramics, and Other Materials; and By End-User- Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smith and Nephew Plc., Stryker Corporation, Medtronic Plc., Arthrex, Inc., DePuySynthes, NuVasive Inc., Orthopedic Implant Company, Evonik, Health Canada, Wright Medical Group N.V, Kyocera Medical Technologies Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are orthopedic implants, and what is their significance in the healthcare industry?Orthopedic implants are medical devices designed to replace or support damaged or missing bone and joint structures. They play a crucial role in enhancing the quality of life for individuals with musculoskeletal conditions.

How big is the Orthopedic Implants Market?The global Orthopedic Implants Market size was estimated at USD 48 Billion in 2023 and is expected to reach USD 78 Billion in 2033.

What is the Orthopedic Implants Market growth?The global Orthopedic Implants Market is expected to grow at a compound annual growth rate of 4.9%. From 2024 To 2033

Who are the key companies/players in the Orthopedic Implants Market?Some of the key players in the Orthopedic Implants Markets are Smith and Nephew Plc., Stryker Corporation, Medtronic Plc., Arthrex, Inc., DePuySynthes, NuVasive Inc., Orthopedic Implant Company, Evonik, Health Canada, Wright Medical Group N.V, Kyocera Medical Technologies Inc., and Other Key Players.

What is the global outlook for the orthopedic implants market in the coming years?The global orthopedic implants market is expected to witness steady growth, driven by an aging population and increasing orthopedic conditions. However, it will also require addressing regulatory changes and cost pressures.

What challenges does the orthopedic implants industry face?Challenges include regulatory complexities, reimbursement issues, and the need for continuous research and development to improve implant performance and longevity.

-

-

- Smith and Nephew Plc.

- Stryker Corporation

- Medtronic Plc.

- Arthrex, Inc.

- DePuySynthes

- NuVasive Inc.

- Orthopedic Implant Company

- Evonik

- Health Canada

- Wright Medical Group N.V

- Kyocera Medical Technologies Inc.

- Other Key Players