Global Orthopedic Contract Manufacturing Market By Product Type (Implants, Trays, Instruments, and Cases), By Service (Forging/Casting, Spine & Trauma, Knee Machining & Finishing, Instrument Machining & Finishing, Hip Machining & Finishing, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145338

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

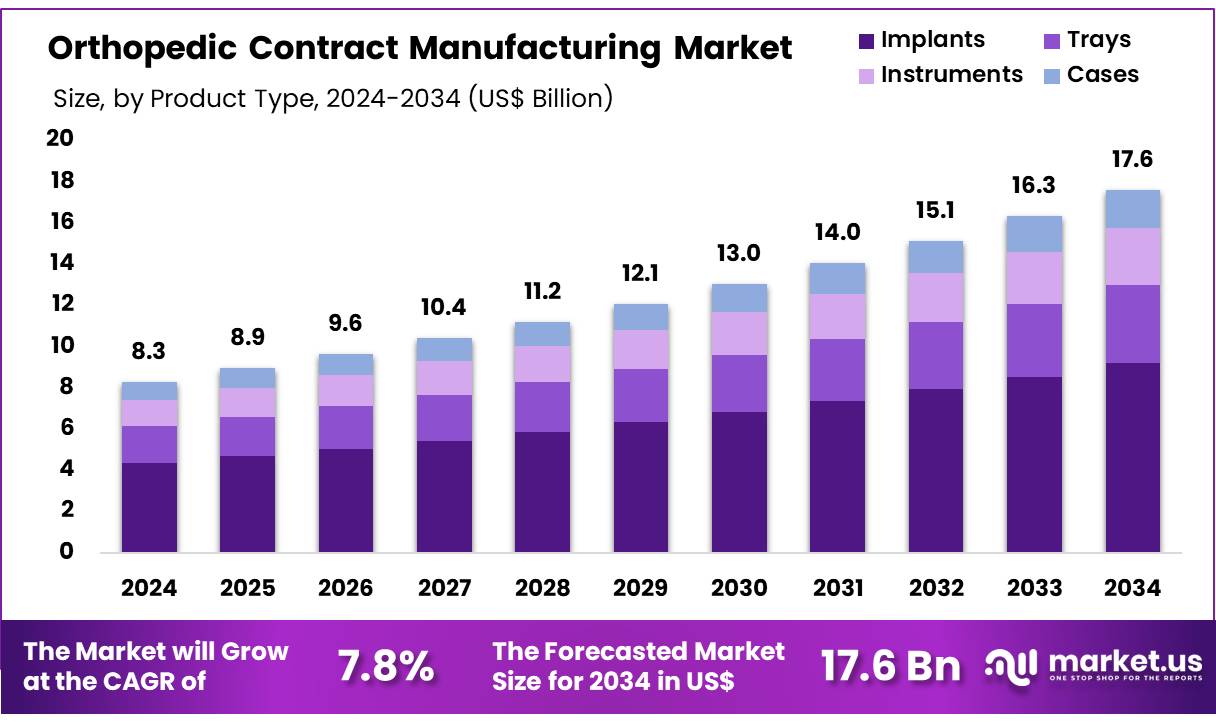

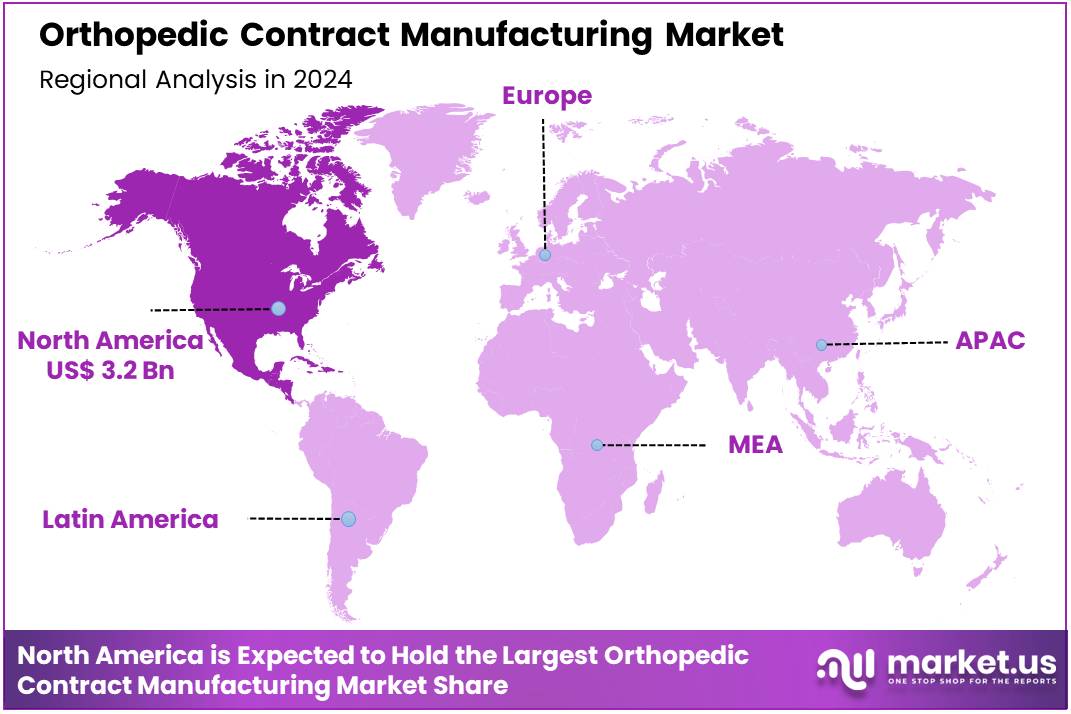

Global Orthopedic Contract Manufacturing Market size is expected to be worth around US$ 17.6 billion by 2034 from US$ 8.3 billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 3.2 Billion.

Growing demand for orthopedic implants, devices, and custom surgical solutions is driving the expansion of the orthopedic contract manufacturing market. Increasing healthcare investments and a rising number of orthopedic surgeries contribute to the market’s growth, as hospitals and healthcare providers seek cost-effective, high-quality products.

As the orthopedic industry continues to evolve, manufacturers are increasingly turning to specialized contract manufacturing services for the production of precise, durable, and customizable components. Orthopedic contract manufacturers provide essential services, including implant fabrication, device assembly, and packaging, catering to both large and small medical device companies.

Recent trends show a growing preference for contract manufacturers offering innovative design and prototyping services, as well as expertise in regulatory compliance. In November 2022, Marle Group strengthened its position in the orthopedic market by acquiring Elite Medical, an established orthopedic implants manufacturer. This acquisition enhances Marle Group’s precision instrument manufacturing capabilities, enabling the company to deliver comprehensive, high-quality solutions for the orthopedic sector.

Key Takeaways

- In 2024, the market for orthopedic contract manufacturing generated a revenue of US$ 8.3 billion, with a CAGR of 7.8%, and is expected to reach US$ 17.6 billion by the year 2033.

- The product type segment is divided into implants, trays, instruments, and cases, with implants taking the lead in 2024 with a market share of 52.3%.

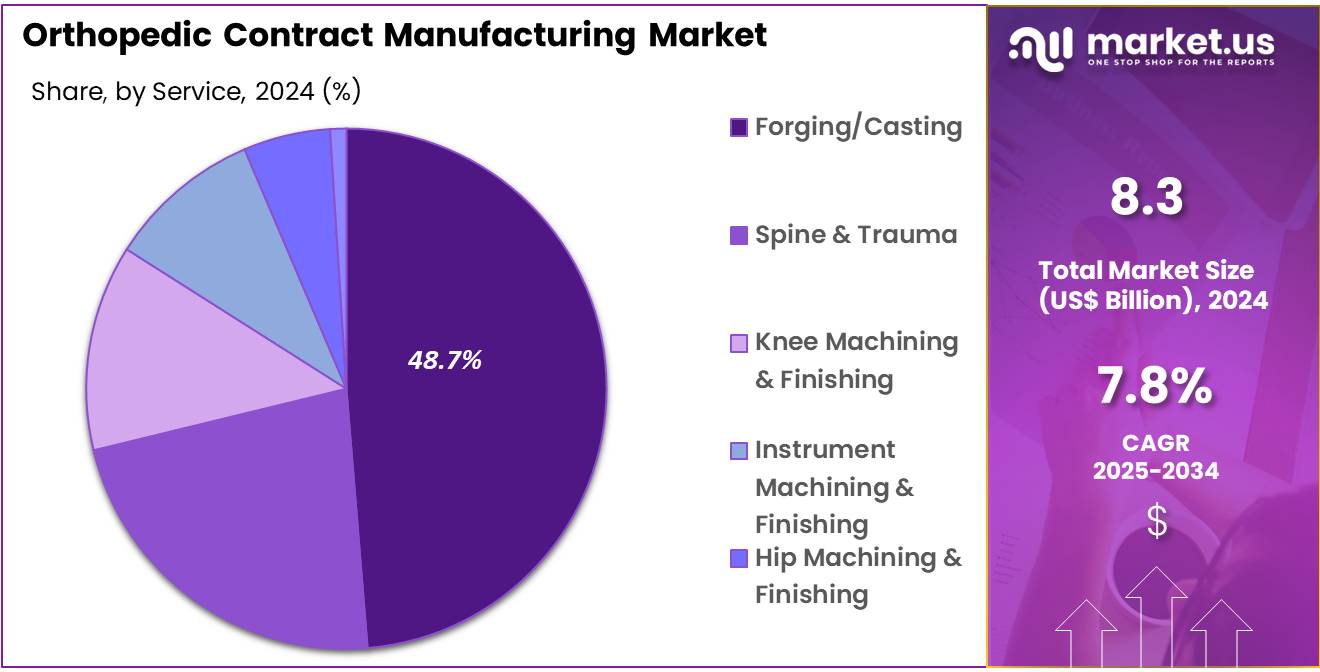

- Considering service, the market is divided into forging/casting, spine & trauma, knee machining & finishing, instrument machining & finishing, hip machining & finishing, and others. Among these, forging/casting held a significant share of 48.7%.

- North America led the market by securing a market share of 38.4% in 2024.

Product Type Analysis

The implants segment led in 2024, claiming a market share of 52.3% owing to the increasing demand for orthopedic surgeries, particularly joint replacements. With an aging global population and a rise in musculoskeletal disorders, the demand for high-quality implants such as hip and knee replacements is projected to grow.

Orthopedic implants require advanced manufacturing processes to ensure precision, reliability, and durability, driving the need for specialized contract manufacturers. As healthcare systems continue to prioritize efficient and cost-effective surgical solutions, the growth of the implants segment is anticipated to continue, with increasing investments in research and development of new implant materials and designs to meet the needs of patients.

Service Analysis

The forging/casting held a significant share of 48.7% as orthopedic devices require highly specialized processes for precision and strength. Forging and casting are critical techniques used to create strong, durable parts for implants, instruments, and other orthopedic products. As the demand for customized and high-performance orthopedic solutions increases, the need for advanced forging and casting services will rise.

These techniques offer benefits like superior material properties and the ability to produce complex shapes, making them essential for orthopedic manufacturers. The continuous advancements in technology and the increasing focus on improving the efficiency and quality of orthopedic devices are expected to drive the growth of the forging/casting segment in the orthopedic contract manufacturing market.

Key Market Segments

By Product Type

- Implants

- Trays

- Instruments

- Cases

By Service

- Forging/Casting

- Spine & Trauma

- Knee Machining & Finishing

- Instrument Machining & Finishing

- Hip Machining & Finishing

- Others

Drivers

Increasing Demand for Minimally Invasive Surgeries is Driving the Market

The orthopedic contract manufacturing market is experiencing significant growth due to the rising popularity of minimally invasive surgeries (MIS). These advanced surgical techniques offer numerous benefits over traditional open procedures, including smaller incisions, reduced blood loss, faster recovery times, and lower risk of complications.

As patient preference shifts toward these less invasive options, hospitals and surgical centers are demanding more specialized instruments and implants designed specifically for MIS applications. Leading medical device companies like Stryker have reported substantial growth in their MIS-related product lines, with their segment revenue increasing by 9% in 2022 alone.

This surge in demand is compelling contract manufacturers to expand their production capabilities and invest in new technologies to meet the evolving needs of surgeons and healthcare providers. The trend toward minimally invasive techniques shows no signs of slowing down, positioning it as a key driver of market expansion in the coming years.

Restraints

Stringent Regulatory Requirements are Restraining the Market

While the orthopedic contract manufacturing market offers significant opportunities, it faces considerable challenges from increasingly strict regulatory environments. Government agencies like the FDA and the European Union’s Medical Device Regulation (MDR) have implemented rigorous approval processes that require extensive clinical testing, detailed documentation, and comprehensive quality control measures.

These requirements often lead to delays in product launches and substantially increase development costs for manufacturers. Smith+Nephew, for example, reported a 5% increase in its R&D expenditures in 2023 specifically to address these heightened regulatory standards.

Smaller manufacturers and new market entrants face particular difficulties in navigating this complex landscape, as they often lack the resources to manage prolonged approval timelines and compliance costs. These regulatory hurdles are slowing innovation and limiting market growth, particularly for companies operating across multiple international jurisdictions with varying requirements.

Opportunities

Growing Adoption of 3D Printing is Creating Growth Opportunities

The orthopedic manufacturing sector is undergoing a transformation thanks to the rapid adoption of 3D printing technology. This innovative manufacturing approach enables the production of highly customized implants tailored to individual patient anatomy, while also reducing material waste and shortening production lead times.

The technology’s ability to create complex geometries that are impossible with traditional manufacturing methods is particularly valuable for orthopedic applications. Major industry players like Johnson & Johnson’s DePuy Synthes have embraced this shift, reporting a 20% increase in sales of 3D-printed implants in 2023.

Contract manufacturers are actively forming partnerships with technology providers to integrate additive manufacturing into their operations, allowing them to offer more advanced solutions to their clients. As the technology continues to mature and become more cost-effective, its adoption is expected to accelerate, opening up new possibilities for patient-specific implants and innovative surgical solutions.

Impact of Macroeconomic / Geopolitical Factors

The orthopedic manufacturing sector is navigating a complex landscape shaped by significant macroeconomic and geopolitical forces. Rising inflation rates across major economies have driven up the costs of critical raw materials like titanium and stainless steel, squeezing profit margins throughout the supply chain.

Simultaneously, ongoing trade tensions, particularly between the US and China, have forced companies to reevaluate and often restructure their global supply networks, adding complexity to operations. The conflict in Ukraine has further disrupted European logistics and material flows, though manufacturers have shown resilience by relocating some production to more stable regions.

On a positive note, government initiatives such as the US CHIPS and Science Act are supporting domestic manufacturing capabilities, helping to reduce reliance on foreign suppliers for critical components. Despite these challenges, fundamental demographic trends including global population aging and increasing prevalence of musculoskeletal disorders continue to drive strong underlying demand for orthopedic solutions. The industry’s ability to leverage technological innovations and optimize global production networks positions it well for sustained growth despite the current turbulent economic environment.

Latest Trends

Rising Outsourcing to Low-Cost Regions is a Recent Trend

A significant trend reshaping the orthopedic manufacturing landscape is the growing movement of production to cost-competitive regions such as Asia and Eastern Europe. Countries including India, China, and Poland have become attractive destinations for outsourcing due to their combination of skilled labor, advanced manufacturing infrastructure, and significantly lower operating costs compared to Western markets. This shift allows companies to reduce production expenses by substantial margins while maintaining high quality standards.

Medtronic’s financial reports highlight this trend, showing an 8% increase in their orthopedic outsourcing expenditures in 2023. The strategy not only helps manufacturers control costs but also enables them to scale operations more efficiently to meet global demand. However, this trend also introduces challenges related to supply chain management and quality oversight that companies must carefully navigate to maintain product consistency and regulatory compliance across different geographic locations.

Regional Analysis

North America is leading the Orthopedic contract manufacturing Market

North America dominated the market with the highest revenue share of 38.4% owing to rising demand for joint replacements, trauma implants, and advanced surgical tools. The US Food and Drug Administration (FDA) reported a 12% increase in 510(k) clearances for orthopedic devices in 2023, reflecting higher production needs.

The Centers for Medicare & Medicaid Services (CMS) noted an 8% rise in orthopedic procedure volumes in 2023, further accelerating demand for outsourced manufacturing. Major medical device companies, including Stryker and Zimmer Biomet, expanded their reliance on third-party manufacturers, with Stryker’s annual report citing a 15% increase in contract manufacturing expenditures.

Additionally, the American Academy of Orthopaedic Surgeons (AAOS) observed a 20% growth in robotic-assisted surgeries in 2023, increasing the need for precision-engineered orthopedic components. These factors, combined with strong US medical device exports, have solidified North America’s position as a key hub for orthopedic manufacturing.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to improving healthcare systems, cost advantages, and government support. India’s Department of Pharmaceuticals reported a 22% increase in medical device production in 2023, supported by policies like the Production Linked Incentive (PLI) scheme. China’s National Medical Products Administration (NMPA) approved 18% more orthopedic implants in 2023 compared to the previous year, indicating rising manufacturing activity.

Japan’s Ministry of Health, Labour and Welfare documented a 10% increase in orthopedic surgeries in 2023, further driving production demand. Countries like Thailand and Vietnam saw a 13% growth in medical exports in 2023, as per World Bank trade data, attracting more outsourcing from global firms. Australia’s Therapeutic Goods Administration (TGA) also accelerated approvals, with a 25% rise in orthopedic device clearances in 2023. These trends suggest sustained growth, supported by regional investments in medical technology and streamlined regulatory processes.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the orthopedic contract manufacturing market focus on strategic partnerships, technological advancements, and expanding production capacities to drive growth. They invest in advanced manufacturing technologies, such as additive manufacturing and precision machining, to produce high-quality, cost-effective orthopedic implants and instruments.

Companies also work to improve supply chain management and regulatory compliance to ensure timely delivery and meet industry standards. Expanding their presence in emerging markets with growing demand for orthopedic products offers new opportunities. Additionally, they foster long-term collaborations with medical device companies to enhance their service offerings and strengthen their market position.

Integra LifeSciences, headquartered in Princeton, New Jersey, is a global leader in medical technology, offering contract manufacturing services for orthopedic products. The company specializes in producing custom implants and surgical instruments for joint replacement and spinal surgery.

Integra focuses on precision manufacturing and regulatory compliance, ensuring that its products meet the highest industry standards. With a robust global network and a commitment to innovation, Integra continues to expand its presence in the orthopedic contract manufacturing market through strategic partnerships and cutting-edge production technologies.

Top Key Players

- Viant

- Tecomet, Inc

- Paragon Medical

- Orthofix Medical Inc

- LISI Medical

- Cretex companies

- Avalign Technologies

- ARCH Medical Solutions Corp

Recent Developments

- In October 2023, Orthofix Medical Inc. obtained 510(k) clearance for its new bioactive synthetic graft, OsteoCove, designed to enhance orthopedic treatments. This approval enables contract manufacturers to support large-scale production, driving further growth and innovation in the orthopedic sector.

- In June 2023, a collaborative partnership was formed among EOS, Tecomet Inc., Orthopaedic Innovation Centre (OIC), and Precision ADM to provide a comprehensive approach to additive manufacturing (AM) for medical devices. The collaboration integrates a range of services, including design, engineering, machine validation, regulatory approvals, pre-clinical testing, and the commercialization of orthopedic devices, fostering streamlined production processes in the industry.

Report Scope

Report Features Description Market Value (2024) US$ 8.3 billion Forecast Revenue (2034) US$ 17.6 billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Implants, Trays, Instruments, and Cases), By Service (Forging/Casting, Spine & Trauma, Knee Machining & Finishing, Instrument Machining & Finishing, Hip Machining & Finishing, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Viant, Tecomet, Inc, Paragon Medical, Orthofix Medical Inc, LISI Medical, Cretex companies, Avalign Technologies, ARCH Medical Solutions Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Orthopedic Contract Manufacturing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Orthopedic Contract Manufacturing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Viant

- Tecomet, Inc

- Paragon Medical

- Orthofix Medical Inc

- LISI Medical

- Cretex companies

- Avalign Technologies

- ARCH Medical Solutions Corp