Orthopedic Bone Cement Market By Product Type (Bone Cement Without Antibiotics and Antibiotic Loaded Bone Cement), By Material (Polymethyl Methacrylate (PMMA), Calcium Phosphate, and Glass Polyalkeonate), By End-user (Hospitals and Outpatient Facilities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145029

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

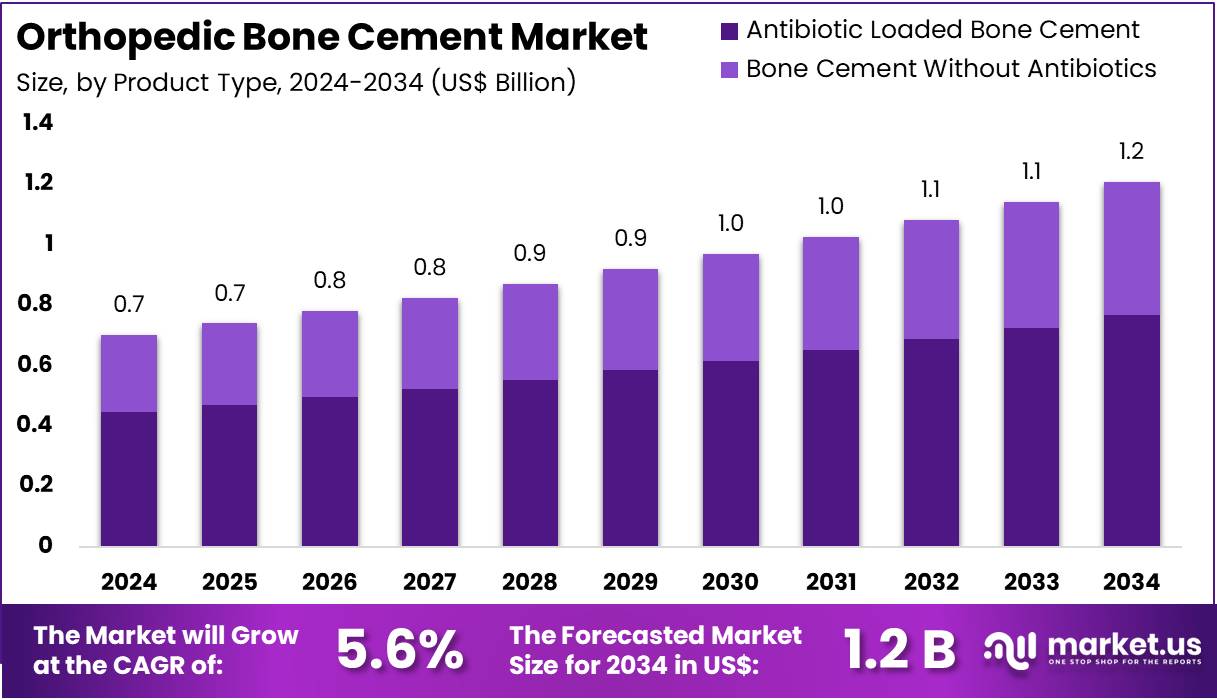

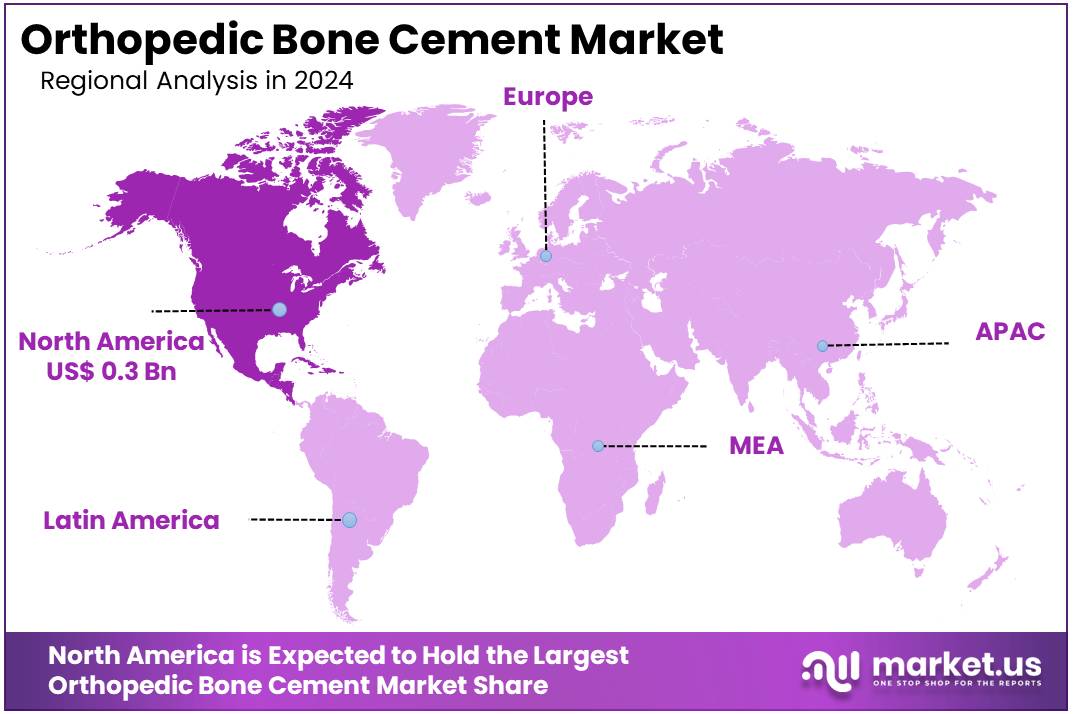

The Orthopedic Bone Cement Market Size is expected to be worth around US$ 1.2 billion by 2034 from US$ 0.7 billion in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.9% share and holds US$ 0.3 Billion market value for the year.

Increasing demand for orthopedic procedures, especially joint replacement surgeries, is driving the growth of the orthopedic bone cement market. Bone cement plays a vital role in stabilizing implants during orthopedic surgeries, ensuring proper fixation in procedures such as hip and knee replacements. Rising aging populations globally, with their increased susceptibility to bone-related diseases such as arthritis and osteoporosis, is a significant driver for this market.

Additionally, advancements in bone cement formulations, including the development of resorbable bone cement solutions, open new opportunities for growth. The market is also benefiting from the shift towards minimally invasive surgeries, which require advanced materials like high-performance bone cements for improved outcomes.

Recent trends indicate a growing focus on improving the mechanical properties and biocompatibility of bone cements to enhance the success rate of surgeries. In July 2022, GRAFTYS SA, a French company specializing in resorbable bone cement solutions, secured €2 million (around US$2.1 million) in funding to accelerate product commercialization and innovate in response to the orthopedic sector’s growing demand.

Key Takeaways

- In 2024, the market for Orthopedic Bone Cement generated a revenue of US$ 0.7 billion, with a CAGR of 5.6%, and is expected to reach US$ 1.2 billion by the year 2024.

- The product type segment is divided into bone cement without antibiotics and antibiotic loaded bone cement, with antibiotic loaded bone cement taking the lead in 2024 with a market share of 63.5%.

- Considering material, the market is divided into polymethyl methacrylate (PMMA), calcium phosphate, and glass polyalkenoate. Among these, polymethyl methacrylate (PMMA) held a significant share of 58.2%.

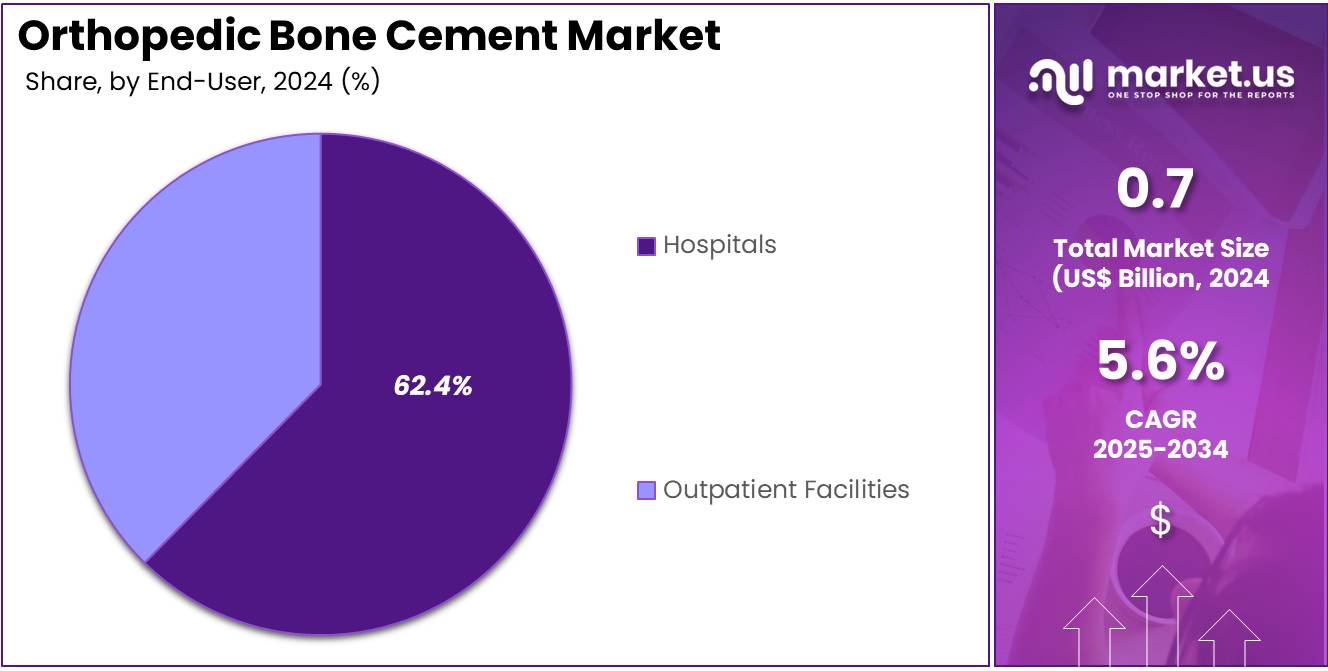

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and outpatient facilities. The hospitals sector stands out as the dominant player, holding the largest revenue share of 62.4% in the Orthopedic Bone Cement market.

- North America led the market by securing a market share of 41.9% in 2024.

Product Type Analysis

The antibiotic loaded bone cement segment led in 2024, claiming a market share of 63.5% owing to the rising demand for bone cements that offer both fixation and infection control. Antibiotic-loaded bone cement is designed to prevent post-surgical infections, which are a major concern in orthopedic surgeries such as hip and knee replacements.

The increasing focus on reducing surgical site infections (SSIs) and improving patient outcomes is anticipated to drive the growth of this segment. Additionally, as the elderly population rises and the demand for joint replacement surgeries increases, the use of antibiotic-loaded bone cement is projected to grow to reduce the risk of infection and improve the overall success of orthopedic procedures.

Material Analysis

The polymethyl methacrylate (PMMA) held a significant share of 58.2% as PMMA continues to be the most widely used material for bone cement due to its excellent mechanical properties and easy handling. PMMA-based bone cements offer high strength, stability, and ease of use, making them ideal for orthopedic surgeries.

The ongoing advancements in PMMA formulations, which improve its resistance to wear and its ability to provide better bone integration, are expected to drive further growth. As the demand for joint replacement surgeries and the need for effective fixation solutions increases, PMMA will likely remain the dominant material in the orthopedic bone cement market.

End-User Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 62.4% owing to the growing number of orthopedic surgeries performed in hospital settings. Hospitals continue to be the primary location for joint replacement surgeries, where orthopedic bone cement is widely used. With an aging global population and increasing incidences of orthopedic conditions such as osteoarthritis, the demand for joint replacement surgeries is expected to rise, further driving the use of orthopedic bone cement in hospitals.

Additionally, the availability of advanced surgical technologies and improved patient care practices is likely to fuel the growth of this segment, as hospitals continue to invest in high-quality orthopedic solutions to improve patient outcomes.

Key Market Segments

By Product Type

- Bone Cement Without Antibiotics

- Antibiotic Loaded Bone Cement

By Material

- Polymethyl Methacrylate (PMMA)

- Calcium Phosphate

- Glass Polyalkeonate

By End-user

- Hospitals

- Outpatient Facilities

Drivers

Increasing Incidence of Orthopedic Surgeries is Driving the Market

The increasing number of orthopedic surgeries, particularly joint replacements, significantly drives the demand for orthopedic bone cement. The growing incidence of conditions such as osteoarthritis and degenerative joint diseases, especially in aging populations, has resulted in an increasing number of hip, knee, and spine surgeries. These surgeries require high-quality bone cement to secure prosthetic devices, ensuring their stability and longevity.

For example, in countries like the US and the UK, the number of knee and hip replacement surgeries has risen significantly over the years. This increase in orthopedic procedures contributes directly to the growing demand for bone cement. As the demand for joint replacements and other orthopedic surgeries rises, healthcare providers are increasingly relying on orthopedic bone cement to facilitate successful outcomes in these surgeries.

Restraints

High Costs and Regulatory Challenges are Restraining the Market

Despite the growth in the orthopedic bone cement market, high production costs and stringent regulatory requirements pose significant restraints. The production of orthopedic bone cement requires specialized raw materials and advanced manufacturing processes, which contribute to the high costs of these products. Additionally, regulatory hurdles, such as the need for clinical trials and certifications, slow down the introduction of new products to the market.

The US Food and Drug Administration (FDA) and other regulatory bodies around the world require manufacturers to undergo lengthy approval processes, making the development and distribution of new bone cement products a costly and time-consuming process. These factors limit market competition, increase the price of bone cement products, and restrict their widespread adoption, especially in developing countries with limited healthcare budgets.

Opportunities

Technological Advancements in Bone Cement Formulations are Creating Growth Opportunities

Technological innovations in bone cement formulations present significant opportunities for market growth. Manufacturers are increasingly focusing on improving the properties of bone cement to enhance its performance during orthopedic procedures. This includes developing cements that offer better biocompatibility, improved mechanical strength, and reduced risk of infection.

Some companies are also introducing bone cements with antibiotic additives to reduce post-surgical infections. These innovations aim to enhance patient outcomes by reducing complications and improving the longevity of prosthetic implants. As the global demand for orthopedic surgeries continues to grow, these technological advancements are expected to drive the adoption of improved bone cement formulations and stimulate market growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions and geopolitical factors significantly impact the orthopedic bone cement market. Economic downturns can result in reduced healthcare budgets, limiting the ability of hospitals and clinics to invest in advanced surgical materials, including bone cement. Conversely, periods of economic growth generally lead to increased healthcare spending, which boosts demand for medical products such as orthopedic bone cement.

Geopolitical factors, including trade policies and conflicts, can disrupt the supply chains of raw materials required for manufacturing bone cement. For example, trade restrictions or supply shortages could increase production costs and affect the availability of essential ingredients.

However, despite these challenges, the growing emphasis on improving healthcare outcomes, particularly in orthopedic surgeries, presents a positive outlook for the orthopedic bone cement market. As the global population continues to age and as demand for orthopedic surgeries increases, these factors create both challenges and opportunities for the market, ensuring its continued expansion in the coming years.

Latest Trends

Minimally Invasive Surgery Techniques are a Recent Trend

A significant recent trend in the orthopedic field is the growing preference for minimally invasive surgical techniques, which are also affecting the use of bone cement. Minimally invasive procedures, such as vertebroplasty and kyphoplasty, are becoming more common due to their benefits, including smaller incisions, reduced pain, and faster recovery times.

These procedures often require specialized bone cements designed to fit the needs of minimally invasive surgeries, driving demand for advanced formulations of bone cement. As healthcare providers and patients increasingly opt for less invasive surgery options, the demand for bone cement tailored to these procedures is growing. This trend is expected to continue, with more orthopedic surgeons adopting minimally invasive techniques for joint replacement and spinal surgeries, further boosting the demand for advanced bone cement products.

Regional Analysis

North America is leading the Orthopedic Bone Cement Market

North America dominated the market with the highest revenue share of 41.9% owing to several key factors. The aging population in the US and Canada led to a higher incidence of orthopedic disorders, increasing the demand for joint replacement surgeries. The US Centers for Disease Control and Prevention (CDC) reported that chronic diseases accounted for 90% of the country’s annual healthcare expenditure in 2023, highlighting the growing need for orthopedic interventions.

Technological advancements in bone cement formulations, such as the development of antibiotic-loaded variants, further fueled market expansion. Major companies like Stryker Corp and Zimmer Biomet Holdings Inc. introduced innovative products, contributing to market growth. Additionally, the Canadian Institute for Health Information (CIHI) noted a 15% increase in surgical procedures in 2022, directly boosting the demand for surgical supplies, including bone cement. These factors collectively enhanced the market’s value, making the orthopedic bone cement market a key sector in North America’s healthcare industry.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to an increasing number of orthopedic surgeries and a rising aging population. The Indian Ministry of Health and Family Welfare reported a 20% increase in funding for digital health initiatives in 2023, aiming to enhance healthcare infrastructure, including orthopedic services.

Innovations in bone cement formulations, such as the adoption of antibiotic-loaded and biodegradable variants, are projected to further drive market growth. The growing prevalence of joint disorders in countries like China, India, and Japan is also contributing to the demand for orthopedic interventions and bone cement.

Governments in the region are making significant investments to upgrade healthcare infrastructure, which will likely accelerate the adoption of orthopedic products. These developments, combined with increasing healthcare access and advancements in treatment, are expected to drive the demand for orthopedic bone cement in the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the orthopedic bone cement market focus on product innovation, expanding their geographic reach, and improving manufacturing processes to drive growth. They invest in developing advanced bone cements with improved handling characteristics, faster setting times, and better mechanical strength to meet the evolving needs of orthopedic surgeries.

Companies also work to expand their portfolios by offering products for various applications, such as joint replacement and spinal surgeries. Collaborations with hospitals, orthopedic surgeons, and research institutions help drive product adoption. Additionally, targeting emerging markets with increasing healthcare needs provides significant growth opportunities.

Stryker Corporation, headquartered in Kalamazoo, Michigan, is a leading global provider of medical technologies, including orthopedic bone cement products. The company offers a range of bone cements used in joint replacement surgeries to enhance the stability and longevity of implants.

Stryker focuses on innovation, developing bone cements with advanced formulations to improve patient outcomes and simplify surgical procedures. With a strong presence in over 100 countries, Stryker continues to expand its market leadership through strategic acquisitions, product innovation, and a commitment to advancing orthopedic care.

Top Key Players in the Orthopedic Bone Cement Market

- Zimmer Biomet

- Stryker

- Smith & Nephew

- KPower Bhd

- Heraeus Medical GmbH

- DJO Global Inc. (Enovis)

- DePuy Synthes

- Cardinal Health

Recent Developments

- In January 2024, Enovis made a strategic move to enhance its orthopedic portfolio by acquiring LimaCorporate S.p.A., a leading provider of orthopedic implants based in Italy. This acquisition reinforces Enovis’ position in the global orthopedic reconstruction market by incorporating Lima’s cutting-edge surgical technologies into its offerings.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 billion Forecast Revenue (2034) US$ 1.2 billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bone Cement Without Antibiotics and Antibiotic Loaded Bone Cement), By Material (Polymethyl Methacrylate (PMMA), Calcium Phosphate, and Glass Polyalkeonate), By End-user (Hospitals and Outpatient Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet, Stryker, Smith & Nephew, KPower Bhd, Heraeus Medical GmbH, DJO Global Inc. (Enovis), DePuy Synthes, and Cardinal Health. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Orthopedic Bone Cement MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Orthopedic Bone Cement MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zimmer Biomet

- Stryker

- Smith & Nephew

- KPower Bhd

- Heraeus Medical GmbH

- DJO Global Inc. (Enovis)

- DePuy Synthes

- Cardinal Health