Global Organic Pet Food Market By Pet Type (Dogs, Cats, and Others), By Food Type (Wet Food, Dry Food, and Frozen Food), By Distribution Channel (Supermarkets and Hypermarkets, Specialized Pet Shops, Online Channels, and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov 2023

- Report ID: 108239

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

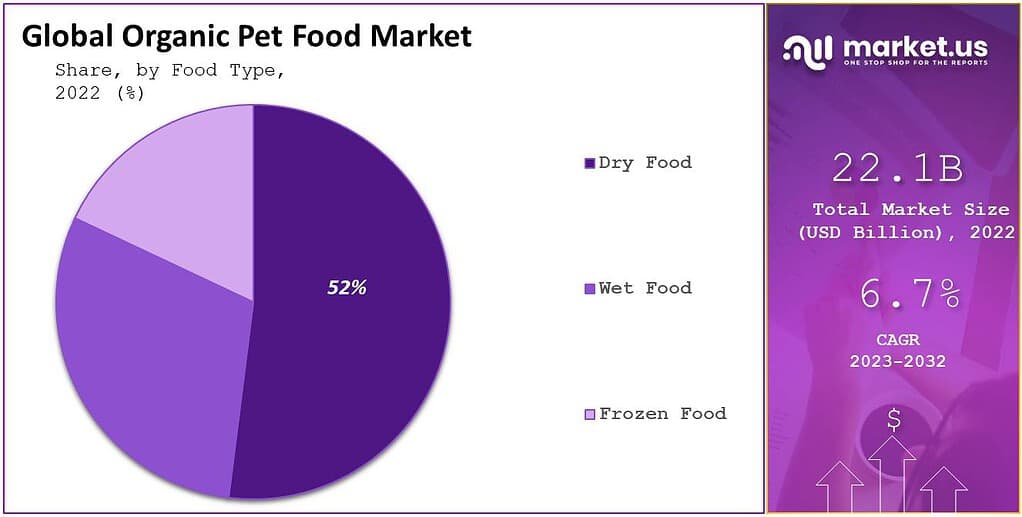

The global Organic Pet Food market size is expected to be worth around USD 41.6 billion by 2033, from USD 22.1 billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2023 to 2033.

Organic or Natural pet food is made up of ingredients grown without using fertilizers, pesticides, and herbicides. The food is also free of growth hormones, genetically modified organisms, and antibiotics. Various pet owners believe that organic food is better for pets’ health.

Organic food for pets can improve skin and coat appearance, have higher energy levels, and have healthier weights. Organic pet food contains amino acids, fatty acids, vitamins, and minerals. This food provides more health benefits than conventional food.

Driving Factors

Growing Pet Ownership Across Emerging Countries to Drive Market Growth

The rising amount of pet ownership worldwide, particularly across developing countries, is projected to drive market growth. The increasing development and pet humanization are inspiring pet owners to nutritious and quality food for pets, which further propels the market growth.

There is an increase in the popularity of organic food, Fuel the market growth of the organic pet food market.

Rising Customer’s Awareness Towards Pet Health to Fuel Market Growth

Customers spending on healthcare for their pets has increased, in current decades especially, as the humanization of pets grows. The rising per capita income of the customers is encouraging them to spend on healthy and organic food products for pet animals to benefit their health.

Additionally, the easy accessibility of products with different charge ranges is an encouraging growth factor for the global market. The key market players are focusing on launching a variety of food products for pets to address the demand for different types of animals belonging to various age groups. This is anticipated to drive the market growth of the organic pet food market.

Restraining Factors

High Costs of Organic Pet Food are a Main Factor Hindering the Market Growth

The high cost of organic food is a main factor restraining the market growth. These products are significantly more expensive than conventional pet food. The lack of consciousness about the aid of organic pet food is another major factor hampering the market growth.

Strict regulations related to pet food restrain the market growth. In the developing market, pet food is observed strictly at every stage, from the ingredients utilized in the food preparation to their marketing and sales.

By Pet Type Analysis

Dogs Segment to Witness Significant Growth

The global organic pet food market is segmented into dogs, cats, and others. The dog segment accounted for the highest market revenue share of 36.4% in 2022. This is owing to the increase in popularity of nuclear households and the rising preference of customers for dogs as security and companions. Dogs also need a variety of nutrients to stay healthy.

As a result, dog owners have been focused on giving their pets better pet food with essential nutrients to keep them healthy. Additionally, the high expenditure related to the well-being and maintenance of dogs is propelling the market for organic dog food. Because of the increased customer awareness of pet health concerns, dog weight control, and improvement have gained attention.

The cat segment dominated during the historical period and is estimated to hold the second-largest market share as they are low-maintained animals and human-friendly.

By Food Type Analysis

The Dry Food Segment Dominates the Market Growth of the Organic Pet Food Market

Based on food type, the global organic pet food market is divided into wet food, dry food, and frozen food. The dry food segment registered the highest market revenue share of 52% in 2022. Dry pet food has experienced significant development owing to factors such as the increased importance of dry premiumization by industrialists of pet food.

Additionally, the leading competitors in the dry food segment have a significant market opportunity owing to the rising tendency of customers to consider dogs and an increase in investments in high-quality pet food products along with novel product developments. Dry food is the most preferred option for dogs as it is cheap and affordable for many dog owners. The wet food segment is anticipated to witness the fastest growth rate during the forecast period.

By Distribution Channel Analysis

The Supermarkets and Hypermarkets Segment Dominated the Organic Pet Food Market

Based on distribution channels, the global organic pet food market is classified into supermarkets and hypermarkets, specialized pet shops, online media, and others. The supermarkets and hypermarkets segment registered the highest CAGR during the forecast period.

They are attributed to the increased customer inclination to purchase products from large retail stores, where they offer a number of choices related to prices and brands.

The online channel segment registers a CAGR of 7.1% in the pet oral care products market due to the increasing permeation and a rise in several online channels such as Flipkart, Amazon, and others. Consumers across the world may access various products through e-commerce sites. Consumers can buy products of their choice while sitting in their offices and homes.

Key Market Segments

By Pet Type

- Dogs

- Cats

- Other Pet Types

By Food Type

- Wet Food

- Dry Food

- Frozen Food

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialized Pet Shops

- Online Channel

- Other Distribution Channels

Growth Opportunity

Increased Requirements for Organic Pet Food

Organic pet food is gaining well-known popularity worldwide. Rising health consciousness amongst individuals. Better knowledge sharing across social media platforms associated with the possible harmfulness of synthetic chemicals and other harmful materials also inspires organic pet food sales.

The increase in the advantages of natural and healthy food, with food security being the priority, may propel pet food sales with higher growth rates.

Latest Trends

Increasing Personalized Pet Food in Achieving Traction is the Trend in the Global Market

The concept of personalized food products for pets is becoming abundant across developed markets and is anticipated to become popular across developing markets in the upcoming years. Personalization of foodstuffs for pet animals has a lot of perspectives to grow, mainly as pet owners are becoming increasingly aware of the food they are feeding their pets.

Approval of pets is the most popular trend worldwide, owing to the dietary benefits of organic food. Consumers are growing increasingly interested in health and wellness, and they want the same for their pets.

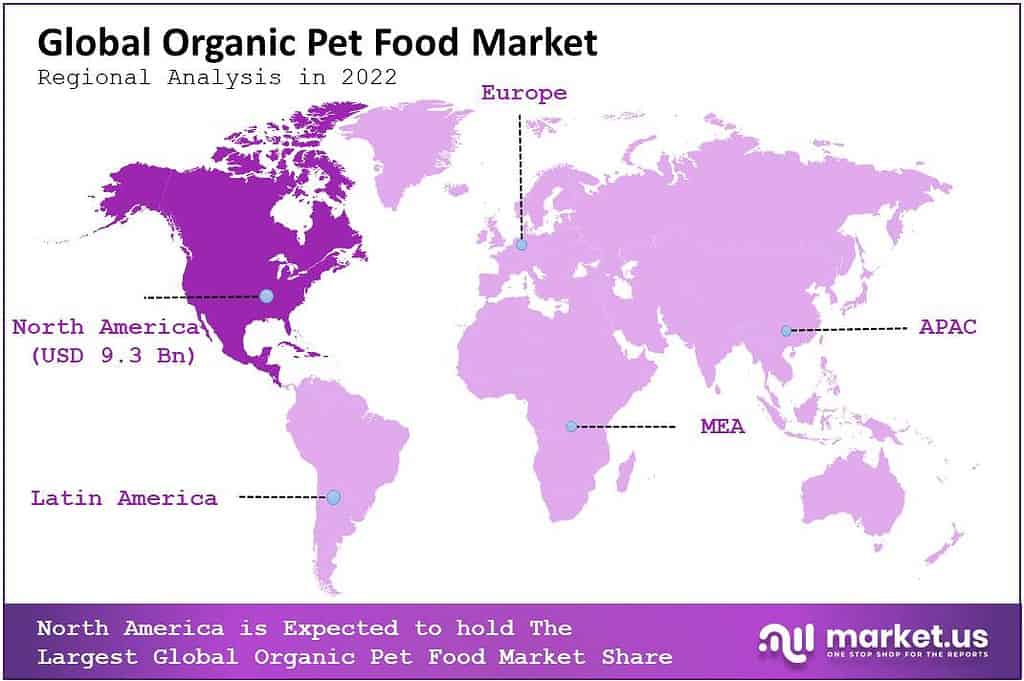

Regional Analysis

North America Dominates the Global Organic Pet Food Market During the Forecast Period

North America accounted for a significant organic pet food products market revenue share of 42.5%. The increase in pet ownership and customer knowledge of pet health can be attributable to the rising demand for organic food.

The high approval of pets in North American households is one of the significant reasons for dominance in the region. The positive attitude of North American customers towards humanization and its wide-ranging approval are boosting the market growth of food products for pet animals.

Europe holds the second-largest revenue share during the forecast period due to the high spending on sustainable and safe organic pet food. Additionally, pet owners in the European region demand more transparency in pet food product ingredients.

Further, the tendency of Europe pet owners to buy premium and natural pet food products also propels the high utilization of pet food. The Asia-Pacific market is expected to grow significantly due to the increasing pet population and demand for pet food.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The key market players focus on new product launches to achieve a prominent share. Mars Incorporated holds the majority of share in the world, along with various other regional markets. The key players are adopting various strategies such as partnerships, mergers & acquisitions, innovative product launches, and online product distribution to increase their consumer base and lead the global market.

Some of the prominent key players in the organic pet food market include Nestle SA, Primal Pet Foods, Mars Incorporated, Hill’s Pet Nutrition, Inc., Diamond Pet Foods, PetGuard Holdings, LLC, WellPet LLC, and other key players.

Top Key Players

- Nestle SA

- Primal Pet Foods

- Mars Incorporated

- Hill’s Pet Nutrition, Inc.

- Diamond Pet Foods

- PetGuard Holdings, LLC

- Castor & Pollux

- Merrick Pet Care, Inc.

- WellPet LLC

- Other Key Players

Recent Development

- June 2022-Mars Incorporated introduced that it has achieved its target to source fish in its pet products.

- October 2020- V-planet introduced the addition of dog treats and dental chews to its portfolio, which is expressed with USFDA-organic superfoods. The treats, named Wiggle Biscuits, are in flavors of blueberry and peanut butter.

Report Scope

Report Features Description Market Value (2022) US$ 22.1 Bn Forecast Revenue (2032) US$ 41.6 Bn CAGR (2023-2032) 6.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Pet Type- Dogs, Cats, and Other Pet Types; By Food Type-Wet Food, Dry Food, and Frozen Food; By Distribution Channel-Supermarkets and Hypermarkets, Specialized Pet Shops, Online Channels, and Other Distribution Channels Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestle SA, Primal Pet Foods, Mars Incorporated, Hill’s Pet Nutrition, Inc., Diamond Pet Foods, PetGuard Holdings, LLC, Castor & Pollux, Merrick Pet Care, Inc., WellPet LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestle SA

- Primal Pet Foods

- Mars Incorporated

- Hill's Pet Nutrition, Inc.

- Diamond Pet Foods

- PetGuard Holdings, LLC

- Castor & Pollux

- Merrick Pet Care, Inc.

- WellPet LLC

- Other Key Players