Global Organic Fertilizers Market Size, Share Analysis Report By Source (Plant, Animal, Mineral), By Form (Dry, Liquid), By Crop Type (Cereals and Grains, Oilseed and Pulses, Fruits and Vegetables, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153514

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

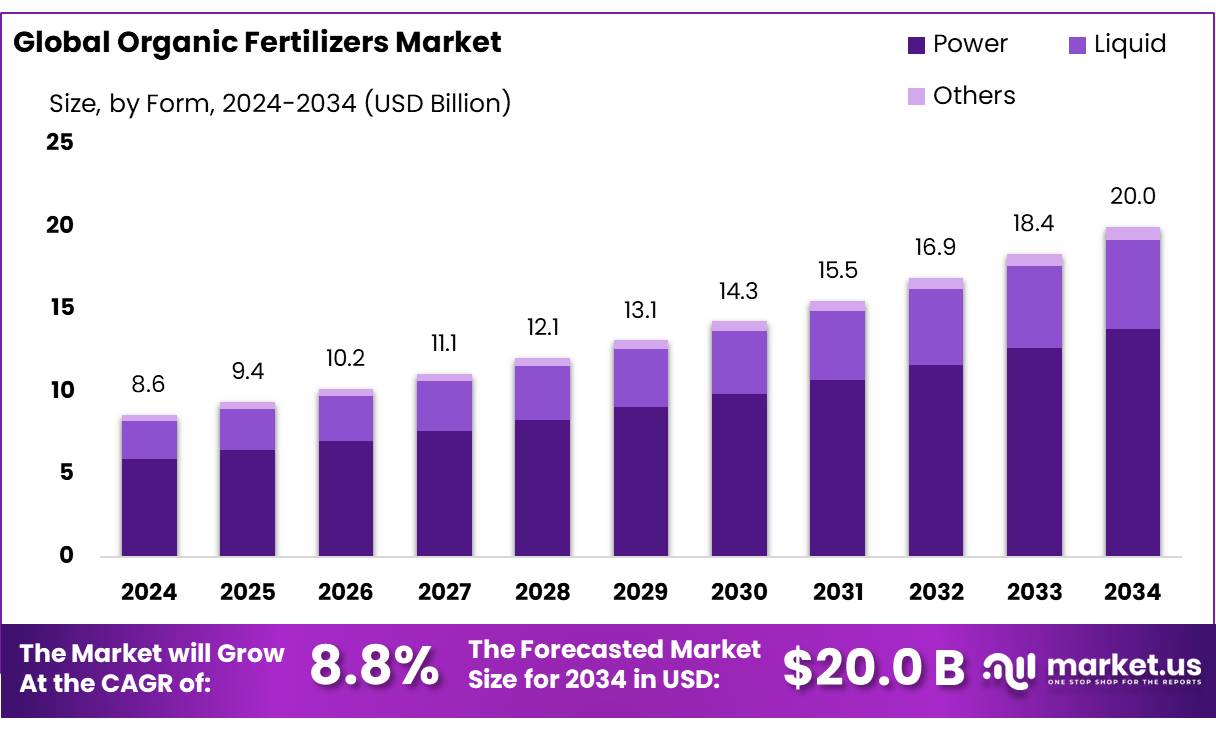

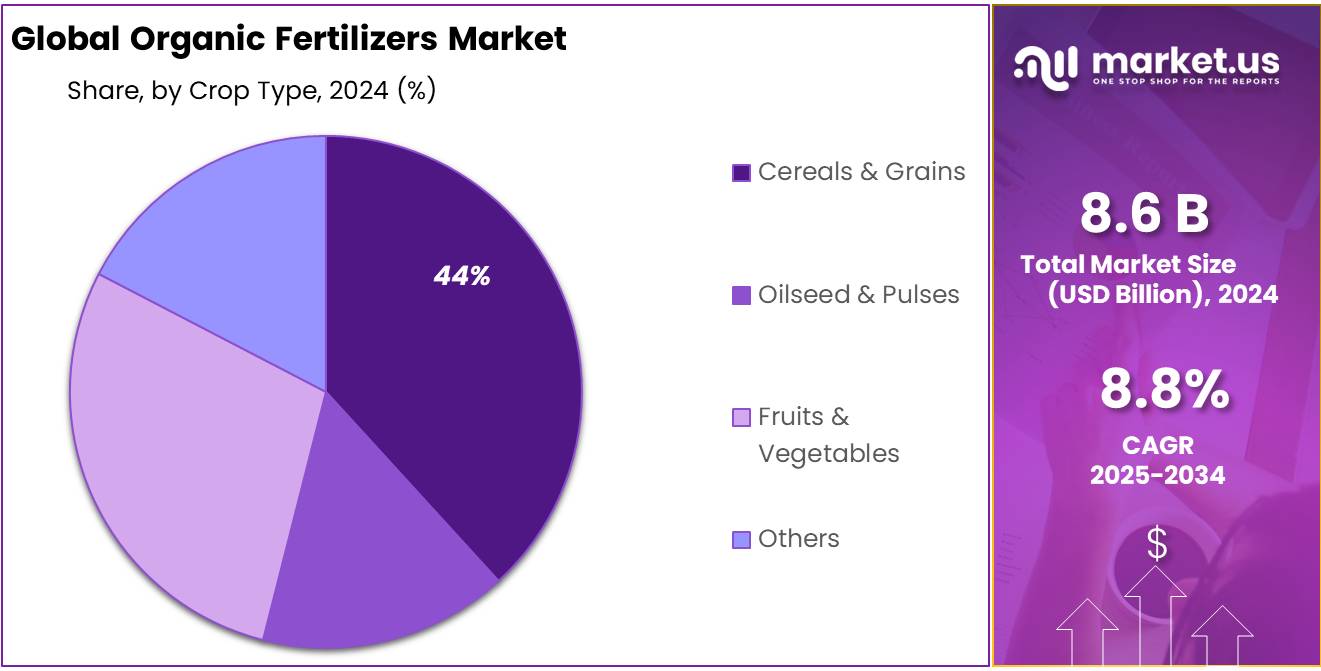

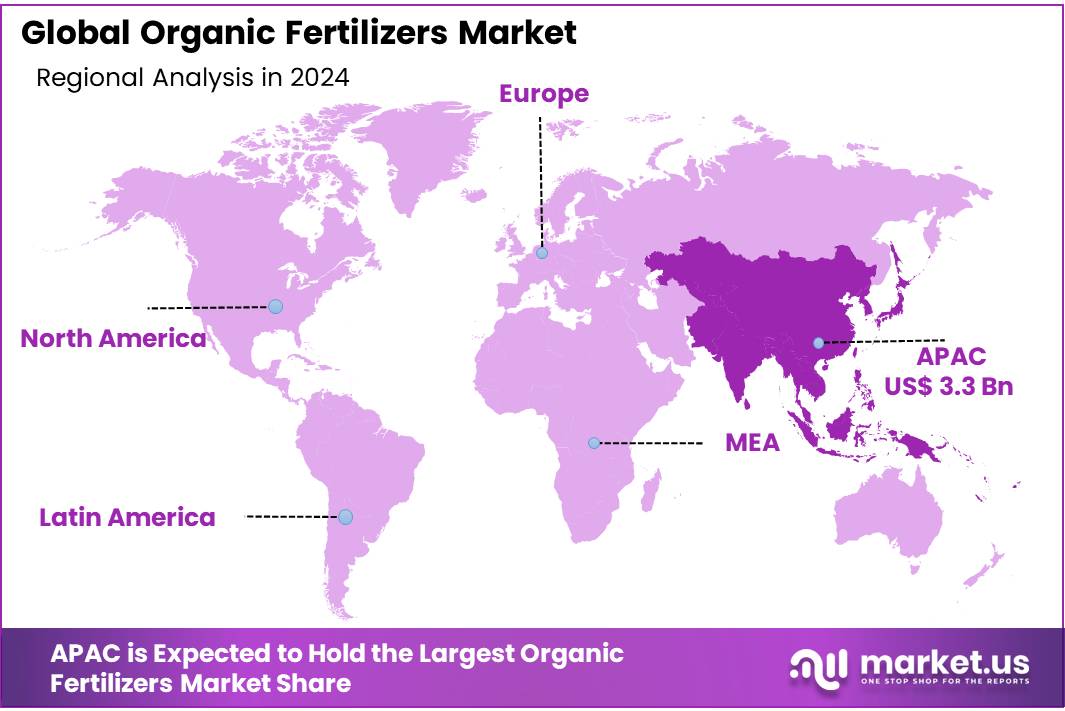

The Global Organic Fertilizers Market size is expected to be worth around USD 20.0 Billion by 2034, from USD 8.6 Billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.7% share, holding USD 3.3 Billion revenue.

The organic fertilizer concentrates industry comprises high-nutrient-density formulations derived from natural sources such as composted manure, vermicompost, bio-organic residues, and plant-based extracts. These concentrates are designed to meet specific soil and crop nutritional requirements, offering a sustainable alternative to conventional chemical fertilizers.

Techniques including aerobic composting, enzymatic decomposition, and vermiculture (worm-based composting) are commonly used to produce these concentrated products. The resultant formulations typically contain 10–20% organic matter and essential macro- and micronutrients vital for plant growth.

The prevailing industrial scenario is shaped by rising concerns over soil degradation, consumer demand for chemical-free produce, and increasingly stringent environmental regulations. Government initiatives have been instrumental in driving adoption. Under the Indian government’s National Mission for Sustainable Agriculture (NMSA)—a sub-mission of the National Action Plan for Climate Change—programs such as the Soil Health Card Scheme and Paramparagat Krishi Vikas Yojana provide funding and technical assistance for organic farming.

The introduction of PM Kusum offers solar energy subsidies (up to 60%) to enable renewable-energy–based water and input management on farms. Furthermore, the Godhan Nyay Yojana, initiated in July 2020 by Chhattisgarh state, compensates ₹2/kg for collected cow dung—resulting in payments of ₹5.59 crore to 162,497 livestock owners by October 2022—for the production of vermicompost and other organic concentrates.

At the state level, Andhra Pradesh has pursued a comprehensive transition toward organic and bio-fertilizers, aiming to reduce chemical fertilizer usage by 11% (equivalent to 400,000 tonnes). Its strategic approach includes replacing 100,000 tonnes of chemical inputs through farmer-led natural farming practices, 150,000 tonnes via organic manures such as vermicompost, with the remaining substitution through bio- and nano-fertilizers. Additionally, under the e-NAM (National Agricultural Market) digital trading platform, approximately ₹1.22 lakh crore (~USD 188 billion) of agro-commodity trading has occurred by early 2021, supporting enhanced market access for organic produce and its value-added by-products.

Key Takeaways

- The Organic Fertilizers Market is projected to reach USD 20.0 billion by 2034, growing from USD 8.6 billion in 2024, at a CAGR of 8.8%.

- Plant-based organic fertilizers led the market in 2024, accounting for more than 48.6% of the total market share.

- By form, dry organic fertilizers held a dominant position, capturing over 74.20% of the global market share.

- In terms of crop type, cereals and grains were the major application segment, representing more than 44.7% of the global market share.

- Regionally, Asia-Pacific (APAC) was the leading market in 2024, holding approximately 38.7% of the global share, valued at around USD 3.3 billion.

By Source Analysis

Plant-Based Organic Fertilizers Lead with 48.6% Market Share in 2024, Driven by Natural Sourcing and Easy Availability

In 2024, plant-based organic fertilizers held a dominant market position, capturing more than a 48.6% share of the overall organic fertilizers market by source state. This leadership can be attributed to the growing preference for sustainable and naturally sourced agricultural inputs. These fertilizers, derived from crop residues, green manure, composted plant waste, and other botanical materials, are widely accepted by both small and large-scale farmers due to their availability and compatibility with a range of crops.

The rising demand for chemical-free farming practices, supported by government-backed organic farming initiatives, has further pushed the usage of plant-derived fertilizers. Unlike animal or mineral-based alternatives, plant sources are easier to decompose, pose minimal risk of pathogens, and improve soil organic content more effectively. In 2025, this segment is expected to maintain its lead, driven by increasing consumer awareness of organic food and the expansion of certified organic farming areas in major agricultural economies.

By Form Analysis

Dry Organic Fertilizers Lead the Market with 74.20% Share in 2024 Due to Longer Shelf Life and Ease of Use

In 2024, dry organic fertilizers held a dominant market position, capturing more than a 74.20% share of the global organic fertilizers market by form. Their popularity is mainly due to their extended shelf life, ease of storage, and cost-effective transportation. Farmers widely prefer dry forms such as pellets, powders, and granules because they can be applied with standard farming tools, require no special handling, and provide a slow, consistent release of nutrients into the soil.

These fertilizers are especially useful for large-scale farming operations where uniform application is essential, and where moisture-sensitive products may degrade quickly. Additionally, dry formulations are better suited for bulk buying and long-term use, especially in regions with limited infrastructure for liquid storage or handling.

By Crop Type Analysis

Cereals & Grains Dominate Organic Fertilizers Market with 44.7% Share in 2024 Owing to Large-Scale Cultivation Demand

In 2024, cereals and grains held a dominant market position, capturing more than a 44.7% share of the global organic fertilizers market by crop type. This significant share reflects the vast global land area devoted to staple crops like wheat, rice, maize, and barley, which form the foundation of food security in many countries. Farmers cultivating these crops are increasingly adopting organic fertilizers to restore soil fertility, reduce dependence on chemical inputs, and meet the rising consumer demand for organic food products.

The large-scale and continuous nature of cereal and grain production requires nutrient-rich inputs that support soil health and long-term productivity. Organic fertilizers are favored in these systems for their ability to improve soil structure, enhance moisture retention, and support beneficial microbial activity, all of which are critical for high-yield field crops.

Key Market Segments

By Source

- Plant

- Animal

- Mineral

By Form

- Dry

- Liquid

By Crop Type

- Cereals & Grains

- Oilseed & Pulses

- Fruits & Vegetables

- Others

Emerging Trends

Shift Towards Sustainable and Eco-Friendly Organic Fertilizers

The organic fertilizers market is witnessing a notable trend towards sustainability and eco-friendly solutions as consumers and farmers increasingly prioritize environmental impact. According to the Food and Agriculture Organization (FAO), organic farming practices, which include the use of organic fertilizers, have grown by an average of 9% annually since 2015, with countries like India and Brazil leading the charge in adoption. This shift is largely due to growing concerns about soil degradation, water pollution, and the long-term effects of chemical fertilizers on both human health and the environment.

Governments across the globe are encouraging organic farming practices through subsidies, tax incentives, and awareness campaigns. For instance, the European Union’s Common Agricultural Policy (CAP) includes financial support for farmers who adopt organic farming methods, including organic fertilizers. Similarly, the Indian government has implemented programs like the National Mission on Sustainable Agriculture (NMSA) to promote the use of organic inputs, aiming to reduce dependency on chemical fertilizers by 2025.

The environmental benefits of organic fertilizers are clear. A report by the United States Department of Agriculture (USDA) found that organic fertilizers help reduce carbon footprints and enhance soil health, with long-term benefits like improved water retention and biodiversity. Moreover, the increasing availability of organic waste materials, such as compost, manure, and plant-based fertilizers, is contributing to this trend.

Drivers

Growing Demand for Sustainable Farming Practices

One of the key driving factors for the organic fertilizers market is the increasing demand for sustainable and environmentally friendly farming practices. As the global population grows, there is a heightened awareness about the harmful environmental impacts of chemical fertilizers. Farmers, agricultural companies, and governments are turning to organic fertilizers to mitigate these effects and promote soil health, biodiversity, and long-term agricultural sustainability.

- According to the United Nations Food and Agriculture Organization (FAO), the shift toward organic farming has been gaining momentum, with organic agricultural land worldwide increasing by nearly 9.5% annually. The FAO reports that organic farming is growing faster than conventional farming, with over 71 million hectares of organic land globally in 2020.

Governments worldwide are supporting this transition with policies that encourage sustainable farming practices. For example, the European Union has been promoting organic farming through initiatives like the EU Organic Action Plan, which aims to increase organic farming land in the EU to 25% by 2030. This policy is expected to drive further demand for organic fertilizers to meet the needs of organic farmers.

In the U.S., the Department of Agriculture (USDA) provides certification programs and funding to help farmers transition to organic farming. In 2020, the USDA allocated US$ 60 million to support the growth of organic agriculture, which includes providing subsidies for organic fertilizers. As the organic sector grows, the demand for organic fertilizers, which enhance soil fertility without harmful chemicals, is expected to rise significantly.

Restraints

High Cost of Organic Fertilizers

A significant restraining factor for the organic fertilizers market is their high cost compared to conventional chemical fertilizers. Organic fertilizers are often more expensive to produce, primarily due to the sourcing of raw materials and the labor-intensive production process. This price discrepancy can discourage farmers, especially small-scale operators in developing countries, from adopting organic fertilizers despite their environmental benefits.

According to the U.S. Department of Agriculture (USDA), organic fertilizers can be up to 30-50% more expensive than synthetic fertilizers. This price difference stems from the longer production times and the need for more complex processing methods.

Organic fertilizers also require large quantities of raw organic matter, such as animal manure, plant residues, and other biodegradable materials, which can be harder to source in some regions. In 2020, the USDA reported that the cost of organic fertilizer inputs made up 20-30% of the total production costs for organic farms.

Additionally, the limited availability of organic fertilizers in certain regions, due to the specialized manufacturing processes, contributes to their higher costs. Governments in several countries are aware of this challenge, and initiatives are being introduced to alleviate it.

For example, the European Union has introduced subsidies and grants under its Common Agricultural Policy (CAP) to help offset the cost of transitioning to organic farming. In 2020, CAP allocated approximately €2.5 billion to support organic farming practices, including reducing the price gap between organic and conventional fertilizers.

Opportunity

Government Initiatives Fueling Organic Fertilizer Growth

The organic fertilizer sector in India is experiencing significant growth, largely driven by robust government support aimed at promoting sustainable agriculture. Recognizing the environmental and health benefits of organic farming, the Indian government has implemented several initiatives to encourage the adoption of organic fertilizers among farmers.

One of the key programs is the Paramparagat Krishi Vikas Yojana (PKVY), which promotes organic farming through cluster-based approaches. Under PKVY, farmers receive financial assistance of ₹20,000 per acre over three years to cover the costs of organic inputs and certification. This initiative has successfully established numerous organic farming clusters across the country, enhancing soil health and reducing dependency on chemical fertilizers.

Additionally, the Market Development Assistance (MDA) scheme provides a subsidy of ₹1,500 per metric ton for fermented organic manure and liquid organic manure. This subsidy aims to make organic fertilizers more affordable and accessible to farmers, thereby promoting their widespread use.

The National Mission on Natural Farming (NMNF) further complements these efforts by focusing on chemical-free farming methods. The mission supports the promotion of bio-fertilizers, green manures, and other organic inputs, aiming to reduce chemical fertilizer usage and enhance soil fertility.

Regional Insights

The Asia-Pacific (APAC) region is a dominant force in the global organic fertilizer market, accounting for approximately 38.7% of the market share, valued at USD 3.3 billion. This leadership is underpinned by robust agricultural activities, government initiatives, and a growing shift towards sustainable farming practices.

China and India are at the forefront of this transformation. China, with over 1.6 million hectares dedicated to organic farming, and India, with around 1 million hectares, collectively represent a significant portion of Asia’s organic agricultural land. In India, states like Sikkim have achieved 100% organic certification, setting a precedent for nationwide adoption.

The market is characterized by a diverse product landscape, with manure-based fertilizers leading in popularity due to their cost-effectiveness and availability. Row crops dominate the application segment, comprising approximately 80% of the market value in 2024. However, the cash crops segment is projected to exhibit the strongest growth between 2024 and 2029, driven by rising international demand for organic commodities like sugar and tea.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

KRIBHCO is a prominent Indian cooperative society under the Ministry of Cooperation, Government of India. Established in 1980, it manufactures a range of fertilizers, including organic options like Liquid Bio-Fertilizers, Compost, Natural Potash, Sivarika, and Rhizosuper. The cooperative operates multiple biofertilizer plants across India, promoting sustainable agricultural practices.

Hello Nature International, formerly known as Italpollina, is a global leader in producing organic fertilizers, 100% vegetal-based biostimulants, and beneficial microbials. Operating in over 80 countries, the company has five production sites, three R&D centers, and 14 commercial offices . Their products are derived from carefully selected organic substances, ensuring sustainability and efficacy.

Sustane Natural Fertilizer Inc., based in Cannon Falls, Minnesota, is recognized as a leading manufacturer-exporter of organic and natural base slow-release nitrogen fertilizers. Their products, such as Suståne 8-2-4, are derived from biologically stable compost and are certified for organic crop production, greenhouse plants, and turf, offering a combination of plant nutrients and organic substances.

Top Key Players Outlook

- The Scotts Miracle-Gro Company

- KRIBHCO

- Hello Nature International

- Sustane Natural Fertilizer Inc.

- True Organic Products Inc.

- California Organic Fertilizers Inc.

- ILSA S.p.A

- Coromandel International Limited

- PT Pupuk Kalimantan Timur

- T Stanes & Company Limited

- Madras Fertilizers Limited

- Midwestern BioAg

- NatureSafe

- Biolchim Spa

- Rizobacter Argentina S.A.

Recent Industry Developments

In 2024 Suståne Natural Fertilizer, Inc., received a USDA grant of approximately $2.4 million to enhance and expand its facility, aiming to increase production capacity and meet the growing demand for sustainable agricultural inputs.

In fiscal year 2024 The Scotts Miracle-Gro Company, reported total revenue of approximately $3.55 billion, with its U.S. consumer segment—encompassing lawn and garden products—accounting for about 85% of this total.

Report Scope

Report Features Description Market Value (2024) USD 8.6 Bn Forecast Revenue (2034) USD 20.0 Bn CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant, Animal, Mineral), By Form (Dry, Liquid), By Crop Type (Cereals and Grains, Oilseed and Pulses, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Scotts Miracle-Gro Company, KRIBHCO, Hello Nature International, Sustane Natural Fertilizer Inc., True Organic Products Inc., California Organic Fertilizers Inc., ILSA S.p.A, Coromandel International Limited, PT Pupuk Kalimantan Timur, T Stanes & Company Limited, Madras Fertilizers Limited, Midwestern BioAg, NatureSafe, Biolchim Spa, Rizobacter Argentina S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Fertilizers MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Organic Fertilizers MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Scotts Miracle-Gro Company

- KRIBHCO

- Hello Nature International

- Sustane Natural Fertilizer Inc.

- True Organic Products Inc.

- California Organic Fertilizers Inc.

- ILSA S.p.A

- Coromandel International Limited

- PT Pupuk Kalimantan Timur

- T Stanes & Company Limited

- Madras Fertilizers Limited

- Midwestern BioAg

- NatureSafe

- Biolchim Spa

- Rizobacter Argentina S.A.