Global Organ Preservation Market Analysis By Preservation Technique (Static Cold Storage (SCS), Hypothermic Machine Perfusion (HMP), Normothermic Machine Perfusion (NMP)), By Organ Type (Kidney, Liver, Heart, Lung, Pancreas, Others), By Preservation Solution (University of Wisconsin (UW) Solution, Custodiol HTK, Perfadex, Others), By End-User (Organ Transplant Centers, Hospitals, Specialty Clinics) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160319

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

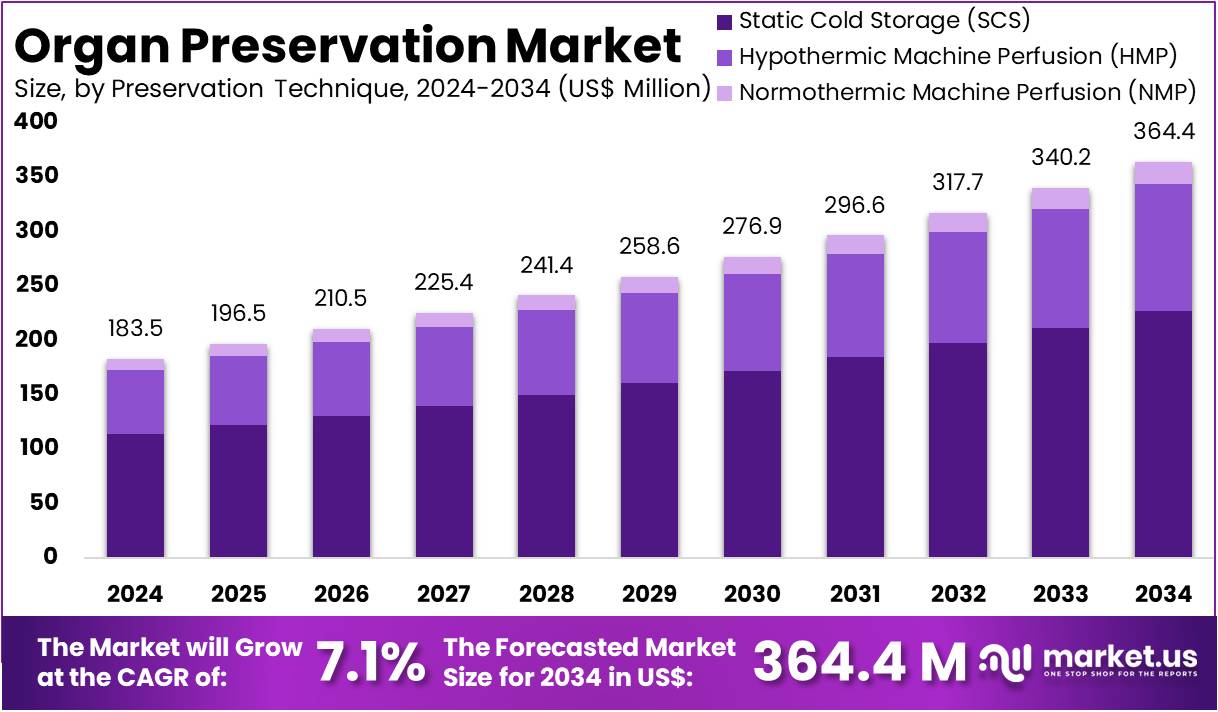

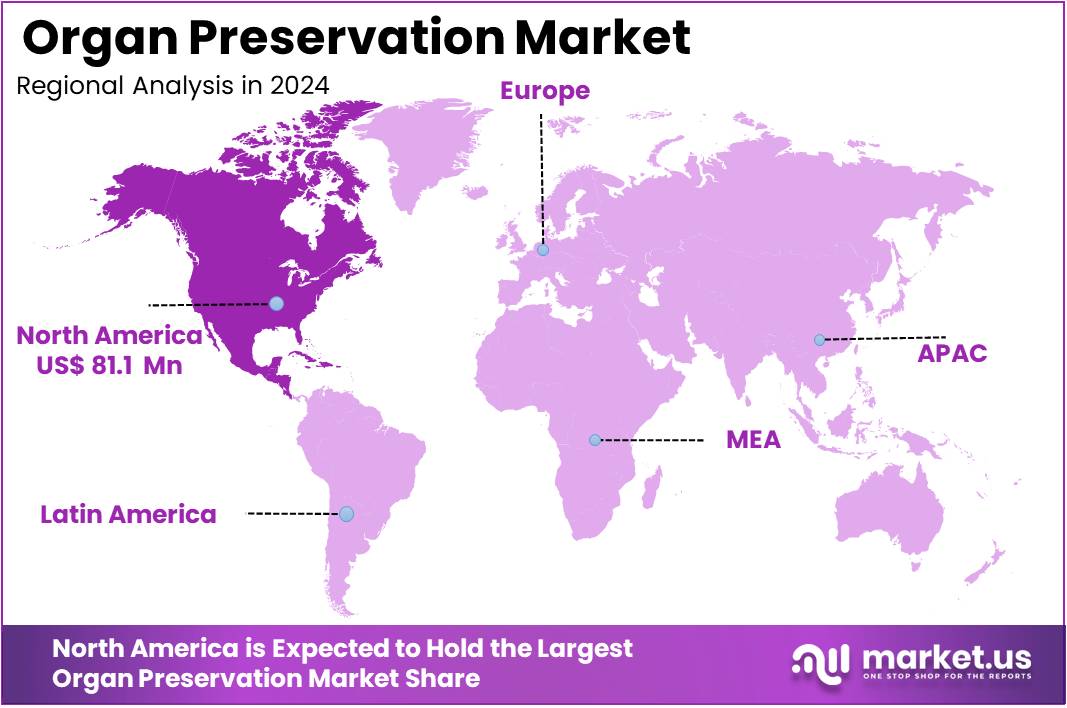

The Global Organ Preservation Market size is expected to be worth around US$ 364.4 Million by 2034, from US$ 183.5 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 44.2% share and holds US$ 81.107 Million market value for the year.

Organ preservation refers to medical methods and solutions designed to maintain the viability of organs outside the body, primarily before transplantation. Techniques include static cold storage, hypothermic machine perfusion, normothermic machine perfusion, and specialized preservation solutions. These approaches reduce ischemic injury, enhance graft survival, and ensure better transplant outcomes. The demand for these technologies is rising in parallel with growing transplant activity and national programs promoting organ donation worldwide.

According to the WHO–ONT Global Observatory, more than 172,000 organ transplants were conducted globally in 2023, reflecting a 9.5% increase compared with 2022. In the United States alone, 40,588 organs were transplanted from deceased donors in 2023, up from 37,316 the previous year. Furthermore, 16,335 deceased organ donors were reported in 2023, marking a 9.6% rise from 14,904 in 2022. This expanding donor base strengthens the addressable market for organ preservation systems.

In 2023, 59,115 organs were recovered in the U.S., showing a 10.2% increase from 53,666 in 2022. The trend continued in 2024, when the country recorded 48,149 total transplants—equivalent to nearly 132 procedures per day. Deceased-donor transplants accounted for 41,119 cases, while living-donor transplants reached 7,030. For example, kidney transplants alone achieved a record 27,759 in 2024. These figures illustrate how rising demand for multiple organ types is driving hospital investment in reliable storage and perfusion systems.

Data from OPTN indicates steady growth across different organs. In 2024, liver transplants rose from 10,688 to 11,458, representing a 7.5% increase, while lung transplants increased by 10.4%, from 3,026 to 3,340. Heart transplants remained stable at 4,572. In parallel, donation after circulatory death (DCD) has gained importance, with 5,896 DCD donors contributing 36% of total deceased donors in 2023. These shifts highlight the growing reliance on advanced preservation solutions for higher-risk and marginal organs.

Policy, Technology, and Market Drivers

Policy support is shaping the future of organ preservation. In May–June 2024, the World Health Assembly adopted Resolution 77.4, urging countries to expand transplant programs, strengthen oversight, and integrate donation into end-of-life care. Such policies are expected to increase demand for training, logistics, and preservation technologies. In Europe, initiatives promoting cross-border organ exchange also rely on dependable preservation methods to ensure graft quality during extended transport.

Technological adoption is accelerating. Machine perfusion—both hypothermic and normothermic—is increasingly integrated into routine clinical practice. According to clinical studies, these methods not only extend preservation time but also enable viability testing before transplantation. This is particularly relevant for donation-after-circulatory-death (DCD) and higher-risk organs, where preservation quality directly determines graft utilization. Regulatory guidance is also improving clarity for developers, reducing uncertainty and supporting faster adoption of innovative devices.

National allocation systems further boost market importance. For instance, the U.S. OPTN/HRSA platforms enable real-time allocation and performance tracking, supporting wider distribution of organs over longer distances. Similarly, Eurotransplant reported 6,815 transplants in 2023, with nearly one-fifth of organs exchanged across member states. This regional collaboration underscores the role of preservation in enabling cross-border transfers, ensuring that grafts remain viable for longer travel times.

Despite rising transplant activity, unmet demand remains substantial. The U.S. waiting list in 2024 included about 107,179 candidates, of which 60,408 were active. Kidneys accounted for approximately 86% of the demand, followed by liver (9%), heart (3%), lungs (1%), and pancreas (1%). Public engagement and donor programs continue to raise awareness, reinforcing funding and infrastructure. As more donors are realized and waiting lists remain long, preservation technology becomes essential in improving graft success and reducing discard rates worldwide.

Key Takeaways

- The Global Organ Preservation Market is projected to grow from US$ 183.5 Million in 2024 to US$ 364.4 Million by 2034.

- The market expansion will be driven at a steady CAGR of 7.1% during the forecast period from 2025 to 2034.

- In 2024, the Opioids segment dominated the Drug Class segment of Organ Preservation, capturing over 48.5% of the overall market share.

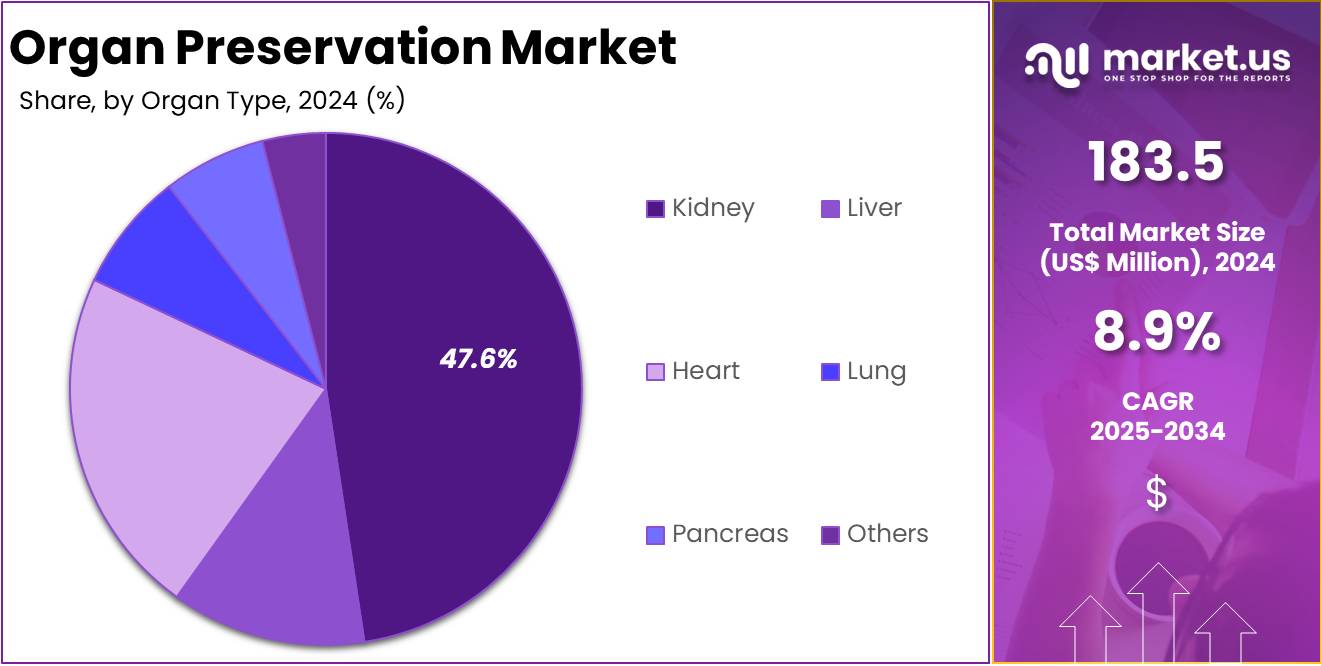

- The Kidney segment led the Organ Type category in 2024, accounting for more than 47.6% of the Organ Preservation Market share.

- The University of Wisconsin (UW) Solution was the leading Preservation Solution in 2024, holding over 47.5% of the total segment share.

- Organ Transplant Centers were the largest end-users in 2024, securing a dominant position with more than 42.8% of the market share.

- North America led the global Organ Preservation Market in 2024, with a commanding 44.2% share, valued at US$ 81.107 Million.

Preservation Technique Analysis

In 2024, the Opioids segment held a dominant market position in the Drug Class Segment of the Organ Preservation, capturing more than a 48.5% share. The Static Cold Storage (SCS) section was observed as the leading preservation technique, representing over 62.25% of the market. This dominance was attributed to its affordability, simplicity, and clinical reliability. SCS remained the preferred method for kidney and liver preservation, especially in emerging economies where healthcare systems prioritize cost-effective solutions and accessible technologies for transplantation procedures.

The Hypothermic Machine Perfusion (HMP) technique secured a notable market presence, supported by its ability to reduce ischemic injury and improve graft survival rates. Analysts reported that transplant centers in developed nations increasingly adopted HMP due to favorable outcomes in high-risk and marginal donor organs. The segment’s growth was further driven by expanding clinical evidence, investments in advanced perfusion systems, and supportive guidelines encouraging the use of technologies that enhance organ viability before transplantation.

The Normothermic Machine Perfusion (NMP) technique demonstrated strong potential for rapid growth. Market experts highlighted that NMP enables real-time organ assessment and provides superior graft function post-transplant. Its role in minimizing complications and expanding the available donor pool was recognized as a key advantage. However, adoption has been limited by high equipment costs and operational complexity. Despite these challenges, ongoing trials, technological innovations, and rising healthcare budgets are expected to strengthen the market share of NMP over the forecast period.

Organ Type Analysis

In 2024, the Kidney section held a dominant market position in the Organ Type segment of the Organ Preservation Market, and captured more than a 47.6% share. The dominance of this section was linked to the growing number of kidney transplant procedures. Rising kidney failure cases and chronic diseases have pushed demand for effective preservation techniques. The kidney donor-recipient gap was also highlighted as a key factor that reinforced the need for improved storage solutions.

The Liver segment was reported as the second-largest contributor to the market. Growth in this section was influenced by an increasing burden of liver-related diseases such as cirrhosis, fatty liver, and cancer. The introduction of new preservation approaches, including hypothermic and normothermic machine perfusion, was observed to enhance outcomes. Market analysts emphasized that these advanced techniques not only improved survival rates but also extended preservation time, which supported the expanding application of liver transplant procedures.

The Heart and Lung segments were both identified as important growth drivers. Heart transplants increased due to the higher incidence of heart failure, supported by innovations in ex-vivo perfusion technologies. Lung transplants also rose in demand, driven by chronic conditions like COPD and pulmonary fibrosis. The Pancreas segment, though smaller, showed strong potential due to the rising prevalence of type 1 diabetes. Other organs, including intestines, were noted as niche areas. Their growth was attributed to ongoing research efforts and clinical trials aimed at refining preservation protocols.

Preservation Solution Analysis

In 2024, the University of Wisconsin (UW) Solution section held a dominant market position in the Preservation Solution segment of the Organ Preservation Market, and captured more than a 47.5% share. This solution gained strong acceptance because of its effectiveness in preserving organs during transplantation. It was widely used for liver and pancreas procedures, which reinforced its market leadership. Its clinical reliability and consistent outcomes positioned it as the preferred choice for many global transplant centers.

The Custodiol HTK solution represented another important part of the market. It was commonly chosen for kidney and heart preservation due to its low viscosity. This feature allowed better perfusion and longer ischemic times. Many European and Asian transplant programs favored this solution for its cost benefits and practicality. Its increasing adoption reflected strong confidence among healthcare providers who required safe and efficient preservation for multiple organ types across different regions.

Perfadex solution showed steady growth, particularly in lung transplantation procedures. Its performance in maintaining oxygen delivery and lowering vascular resistance made it essential in advanced clinical practices. This solution gained strong use in developed regions where lung transplant activity is high. The Others category included newer and region-specific formulations. These solutions were mainly used in research and specialized cases. Innovations in perfusion technologies and custom formulations were expected to support gradual expansion of this segment in the near future.

End-User Analysis

In 2024, the Organ Transplant Centers Section held a dominant market position in the End-User Segment of the Organ Preservation Market, and captured more than a 42.8% share. This position was attributed to the rising number of transplant procedures worldwide. The growing demand for preserved donor organs also played a crucial role. Advanced technologies for cold and normothermic preservation supported the segment. Additionally, the presence of skilled professionals and specialized infrastructure made transplant centers the leading contributors.

Hospitals represented the second-largest share in the organ preservation market. Their role in conducting both emergency and planned transplants positioned them as key users. These institutions benefited from intensive care units, advanced surgical expertise, and government-backed transplant initiatives. Hospitals often acted as the central hub for organ allocation and preservation procedures. Their ability to integrate preservation systems within broader healthcare settings strengthened their importance. This combination of resources and regulatory support boosted their market contribution.

Specialty clinics showed gradual growth within the end-user landscape. Their market share remained smaller compared to hospitals and transplant centers. However, these facilities played a significant role in providing focused transplant services. Investment in private healthcare and expansion of clinical networks supported their growth. Specialty clinics also enhanced access to transplant care in underserved regions. While their capacity is limited, their adoption of modern preservation techniques is rising. This trend ensures that specialty clinics will continue to supplement demand in the overall market.

Key Market Segments

By Preservation Technique

- Static Cold Storage (SCS)

- Hypothermic Machine Perfusion (HMP)

- Normothermic Machine Perfusion (NMP)

By Organ Type

- Kidney

- Liver

- Heart

- Lung

- Pancreas

- Others

By Preservation Solution

- University of Wisconsin (UW) Solution

- Custodiol HTK

- Perfadex

- Others

By End-User

- Organ Transplant Centers

- Hospitals

- Specialty Clinics

Drivers

Rising Initiatives for Organ Donation and Transplantation

Government and non-government organizations are increasingly launching campaigns to raise awareness about organ donation. These initiatives are supported by large-scale public health programs that encourage voluntary participation. Educational drives and outreach activities are helping to inform people about the importance of donation. This awareness is expanding the pool of available organs for transplantation. As a result, the demand for advanced preservation methods is increasing, as more organs require safe storage and transportation.

Additionally, public health funding and institutional support are reinforcing transplantation programs worldwide. Governments are allocating resources to strengthen organ banks and healthcare facilities. Grants and subsidies are provided to medical institutions for improving preservation infrastructure. Non-governmental organizations are also contributing to this effort by funding awareness campaigns and training activities. This combined support is enabling hospitals and clinics to adopt modern organ preservation technologies. The growth of such structured programs is creating a stable demand for innovative solutions.

Moreover, the rising adoption of transplantation procedures is directly linked to these awareness initiatives. Increased availability of preserved organs is driving healthcare providers to seek reliable preservation technologies. Manufacturers of organ preservation products are responding by developing advanced solutions. The growing trust in organized programs is fostering greater public participation. This is leading to a continuous rise in the number of transplant surgeries. Consequently, the market for organ preservation solutions is expanding steadily, supported by government and NGO-led initiatives.

Restraints

High Cost and Limited Adoption of Advanced Organ Preservation Systems

The high cost of advanced organ preservation systems such as machine perfusion devices remains a significant restraint for the global organ preservation market. These technologies provide superior preservation outcomes compared to conventional cold storage, but their adoption is hindered by financial barriers. The initial investment, operational expenses, and maintenance requirements make them less accessible, particularly for healthcare facilities with limited budgets. As a result, many centers continue to depend on traditional methods, despite the potential benefits of newer technologies.

Limited adoption in low- and middle-income countries further restricts market growth. Many transplant centers in these regions lack the financial resources and infrastructure required to implement advanced preservation systems. The availability of trained personnel and supportive facilities is also insufficient, which creates additional hurdles. Consequently, reliance on conventional cold storage remains dominant in these regions, slowing the overall advancement and global reach of innovative preservation techniques.

This cost-related restraint has a direct impact on the equity of healthcare outcomes. Patients in advanced healthcare systems may benefit from better preservation solutions, while those in resource-constrained regions face limited options. This disparity influences global organ transplant success rates and hampers broader acceptance of innovative methods. Unless cost-effective solutions and supportive funding mechanisms are introduced, the growth of advanced preservation technologies will remain restricted across large segments of the global healthcare market.

Opportunities

Expanding Role of Preservation in Next-Generation Transplantation

The expansion of research in xenotransplantation and bioengineered organs is expected to open significant avenues for organ preservation companies. These advancements require advanced preservation technologies to maintain the viability of genetically modified or laboratory-grown organs. As the demand for artificial or modified organs rises, preservation solutions will become essential to ensure stability and safety until transplantation. This creates a clear opportunity for companies to position themselves as integral players in the broader regenerative medicine and transplantation ecosystem.

Organ preservation will hold a vital role in supporting breakthroughs in bioengineered organ development. Transplant-ready organs, whether grown in laboratories or derived from animal sources, must be sustained under precise conditions before surgery. Preservation companies that provide reliable solutions can become indispensable partners to biotechnology firms and research institutions. This integration will enhance the reliability of transplantation procedures while also creating new revenue streams. The growing collaboration between preservation specialists and biotech innovators will drive the market forward.

Future demand for organ transplantation is anticipated to increase due to rising incidences of chronic diseases and organ failures. In this context, xenotransplantation and engineered organs will offer alternatives to overcome shortages. Preservation technologies will serve as the link between organ creation and successful transplantation. Companies focusing on innovation in temperature regulation, storage media, and transport systems will capture opportunities in this evolving landscape. The ability to maintain organ integrity for longer durations will define competitive advantage in the organ preservation market.

Trends

Portable Preservation Devices for Organ Transplantation

The organ preservation market is witnessing a rising trend in portable and transport-friendly preservation devices. These innovations are designed to maintain the viability of organs during long-distance travel. Their use enables the safe transfer of organs across countries and continents. As a result, medical teams are able to ensure organ stability while minimizing ischemic damage. This progress is strengthening global transplant systems and supporting broader adoption of advanced preservation technologies.

The adoption of transport-ready preservation devices is transforming organ sharing networks. By making long-distance transportation more reliable, such devices allow healthcare systems to extend donor availability beyond local boundaries. This integration supports efficient organ allocation and expands access for patients in regions facing donor shortages. The resulting improvement in logistics is expected to reduce waitlist times and enhance survival outcomes. This trend aligns with the industry’s broader focus on equity and global collaboration in organ transplantation.

In addition, portable preservation devices contribute to the development of international organ-sharing platforms. These solutions enable rapid cross-border coordination, ensuring that suitable organs reach patients regardless of geography. Market growth is therefore driven by the need for flexible, mobile solutions that address global disparities in organ access. This reflects a strategic shift from localized organ use toward international networks. With demand rising, companies are investing in advanced designs that combine safety, portability, and real-time monitoring to support long-distance transplant logistics.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 44.2% share and holds US$ 81.107 Million market value for the year. This strong position was supported by the presence of advanced healthcare infrastructure. The region benefited from a high volume of organ transplantation procedures. Well-established transplant centers, coupled with high healthcare spending, played a major role. Rising cases of organ failure also increased the demand for effective preservation techniques across the region.

The region’s growth was further enhanced by favorable regulatory approvals and strong availability of skilled professionals. Continuous investments by governments and private entities created better access to advanced technologies. Collaborations between research institutes, biotechnology firms, and hospitals strengthened innovation. These partnerships allowed faster adoption of new preservation methods. Public awareness campaigns and supportive reimbursement policies also encouraged the use of preservation solutions, which increased adoption rates across multiple transplant centers in the region.

The dominance of North America was also driven by increasing cases of kidney, liver, and heart transplants. These medical needs reinforced the importance of reliable organ preservation systems. High focus on innovation, combined with significant patient demand, positioned the region ahead of others. Continuous support from healthcare systems created a stable base for growth. As a result, North America remained the global leader in organ preservation. This leadership is expected to continue, supported by healthcare infrastructure and rising patient needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The organ preservation market is experiencing a transition from static cold storage toward machine perfusion technologies. XVIVO Perfusion AB is positioned strongly with its ex-vivo machine perfusion platforms, covering both normothermic and hypothermic approaches. Its scientific partnerships and clinical focus support adoption across transplant centers. With a strong European base and global distribution growth, XVIVO stands out. However, risks exist from larger multi-organ competitors and price-sensitive procurement. The opportunity remains to broaden indications and add digital analytics for viability assessment in emerging markets.

TransMedics, Inc. holds a leading position with its Organ Care System (OCS), which supports heart, lung, and liver preservation in near-physiologic states. Its platform is one of the most clinically validated in the sector, offering strong recognition among surgeons and diversified organ coverage. Revenue growth has been driven by adoption in liver transplantation, enhancing investor confidence. Nonetheless, high unit costs and reimbursement issues pose risks. TransMedics remains a strong competitor due to its commercial scale, diversified applications, and brand recognition in machine perfusion solutions.

Paragonix Technologies, Inc. plays a critical role in organ transport with its controlled-temperature devices such as SherpaPak and Baroguard. These solutions standardize transit conditions, minimizing ischemia-related risks. The company has gained strong commercial traction, supported by evidence of reduced graft dysfunction. While its product scope remains narrower than full perfusion systems, strategic value was enhanced by its acquisition by Getinge in 2024. This integration into a global hospital equipment portfolio is expected to accelerate its reach and strengthen its competitive positioning in transport and logistics.

OrganOx Limited and Bridge to Life Ltd. continue to influence specific niches. OrganOx has become a leader in liver normothermic machine perfusion through its metra system, supported by a strong evidence base that expands donor liver utilization. Bridge to Life remains entrenched in preservation solutions, offering proven fluids and consumables while exploring bundled approaches with perfusion platforms. Additionally, Organ Recovery Systems maintains leadership in kidney perfusion through LifePort, while Dr. Franz Köhler Chemie and Essential Pharmaceuticals anchor the chemical preservation segment with Custodiol HTK, despite increasing competition from machine perfusion approaches.

Market Key Players

- XVIVO Perfusion AB

- TransMedics Inc.

- Paragonix Technologies Inc.

- OrganOx Limited

- Bridge to Life Ltd.

- Dr. Franz Köhler Chemie GmbH

- Essential Pharmaceuticals LLC

- Organ Recovery Systems

- BioLife Solutions Inc.

- Lifeline Scientific

- Waters Medical Systems LLC

- Carnamedica S.P.

- Other key players

Recent Developments

- In January 2024: XVIVO Perfusion Lund AB was merged into its parent company, XVIVO Perfusion AB. This consolidation streamlined operations across different organ preservation modalities, as reported in the company’s 2023 Report on Operations.

- In January 2024: A Class II device recall was initiated for Custodiol® HTK Solution, an organ preservation solution licensed and distributed in the U.S. by Essential Pharmaceuticals. The FDA listed the recall as event Z-3300-2024, with initiation on January 9, 2024, and posting on September 26, 2024.

- In August 2023: The U.S. FDA granted 510(k) clearance for the BAROguard™ donor lung preservation system. This clearance enabled automated and active control of pressure and temperature during organ transport.

- In August 2023: Bridge to Life completed the divestiture of specific assets to TransMedics. The divested portfolio included EVOSS™ heart & lung and LifeCradle® heart perfusion technologies. The move was aimed at refocusing resources within Bridge to Life’s organ preservation business.

Report Scope

Report Features Description Market Value (2024) US$ 183.5 Million Forecast Revenue (2034) US$ 364.4 Million CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Preservation Technique (Static Cold Storage (SCS), Hypothermic Machine Perfusion (HMP), Normothermic Machine Perfusion (NMP)), By Organ Type (Kidney, Liver, Heart, Lung, Pancreas, Others), By Preservation Solution (University of Wisconsin (UW) Solution, Custodiol HTK, Perfadex, Others), By End-User (Organ Transplant Centers, Hospitals, Specialty Clinics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape XVIVO Perfusion AB, TransMedics Inc., Paragonix Technologies Inc., OrganOx Limited, Bridge to Life Ltd., Dr. Franz Köhler Chemie GmbH, Essential Pharmaceuticals LLC, Organ Recovery Systems, BioLife Solutions Inc., Lifeline Scientific, Waters Medical Systems LLC, Carnamedica S.P., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- XVIVO Perfusion AB

- TransMedics Inc.

- Paragonix Technologies Inc.

- OrganOx Limited

- Bridge to Life Ltd.

- Dr. Franz Köhler Chemie GmbH

- Essential Pharmaceuticals LLC

- Organ Recovery Systems

- BioLife Solutions Inc.

- Lifeline Scientific

- Waters Medical Systems LLC

- Carnamedica S.P.

- Other key players