Global Ops Shrink Label Market Market Size, Share, Growth Analysis By Product Type (Sleeve Labels, Wrap Labels, Roll-Fed Labels), By Material (PVC, PETG, OPS, PLA, Others), By Classification (Coloring, Transparent), By Application (Food and Beverage, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167439

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

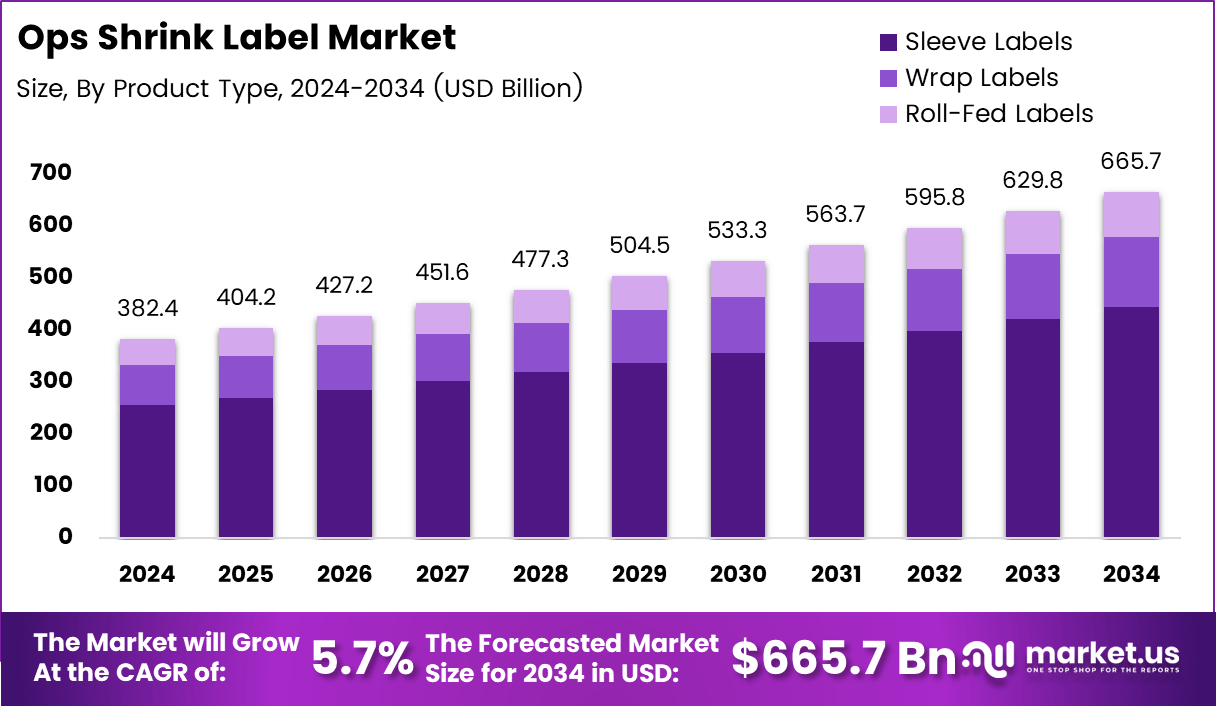

The Global Ops Shrink Label Market size is expected to be worth around USD 665.7 Billion by 2034, from USD 382.4 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The OPS Shrink Label Market demonstrates steady expansion as brands prioritize high-clarity packaging that enhances shelf appeal. Growing FMCG packaging output, rising premiumization, and increased flexibility in decoration formats continue to strengthen demand. Additionally, shifting consumer preferences toward visually rich labels encourages converters to upgrade material structures and adopt more advanced OPS formulations for better print performance.

Moreover, rising automation across labeling lines accelerates the adoption of shrink-sleeve formats due to their stability and adaptability. Manufacturers increasingly explore OPS material because it delivers balanced shrink performance without compromising dimensional stability. As sustainability expectations intensify, companies also transition toward downgauged OPS solutions to reduce material use while maintaining product durability.

Governments further support growth by tightening regulations on pack hygiene, tamper-evident seals, and product-authentication measures. These policies indirectly push brands toward shrink-sleeve formats, which offer stronger security and 360-degree branding. Investments in recycling systems across North America, Europe, and East Asia also encourage the use of shrink films compatible with existing waste-processing streams.

Businesses find new opportunities in beverages, home-care, and nutraceuticals, where shape-complex packaging is expanding rapidly. OPS shrink labels allow brand owners to differentiate through intricate contours without sacrificing speed on high-volume filling lines. As e-commerce grows, demand for durable labels that resist scuffing and temperature fluctuations strengthens the attractiveness of OPS solutions.

According to packaging material insights from industry technical sheets, PETG delivers the highest shrink capability of 78–80%, enabling highly complex bottle profiles. These properties allow converters to experiment with premium shapes across food, beverage, and cosmetics categories. At the same time, strong clarity and mechanical strength support downgauging initiatives that reduce plastic usage and improve cost efficiency.

Furthermore, according to sustainability statements from leading resin suppliers, many OPS shrink materials now achieve more than 60% maximum shrinkage while containing 30% PCR. These specifications help brands comply with recycled-content mandates and extended producer-responsibility policies introduced in the US, EU, and parts of Asia. This regulatory alignment reinforces OPS shrink labels as an adaptable, high-performance choice for modern packaging ecosystems.

Key Takeaways

- The Global OPS Shrink Label Market is projected to reach USD 665.7 Billion by 2034 from USD 382.4 Billion in 2024, growing at a 5.7% CAGR.

- Sleeve Labels lead the product type segment with a dominant share of 66.9%.

- OPS material dominates the material segment with a market share of 48.4%.

- Coloring labels hold the largest classification share at 73.8%.

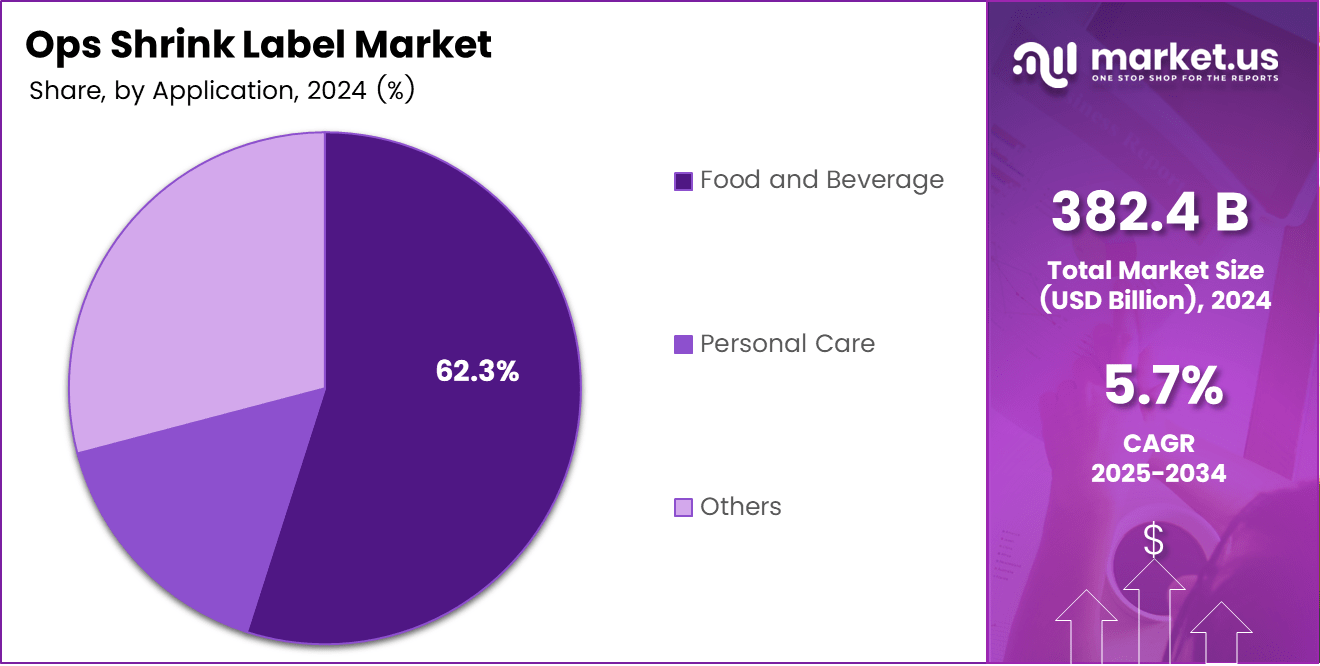

- Food and Beverage represents the top application segment with a 62.3% share.

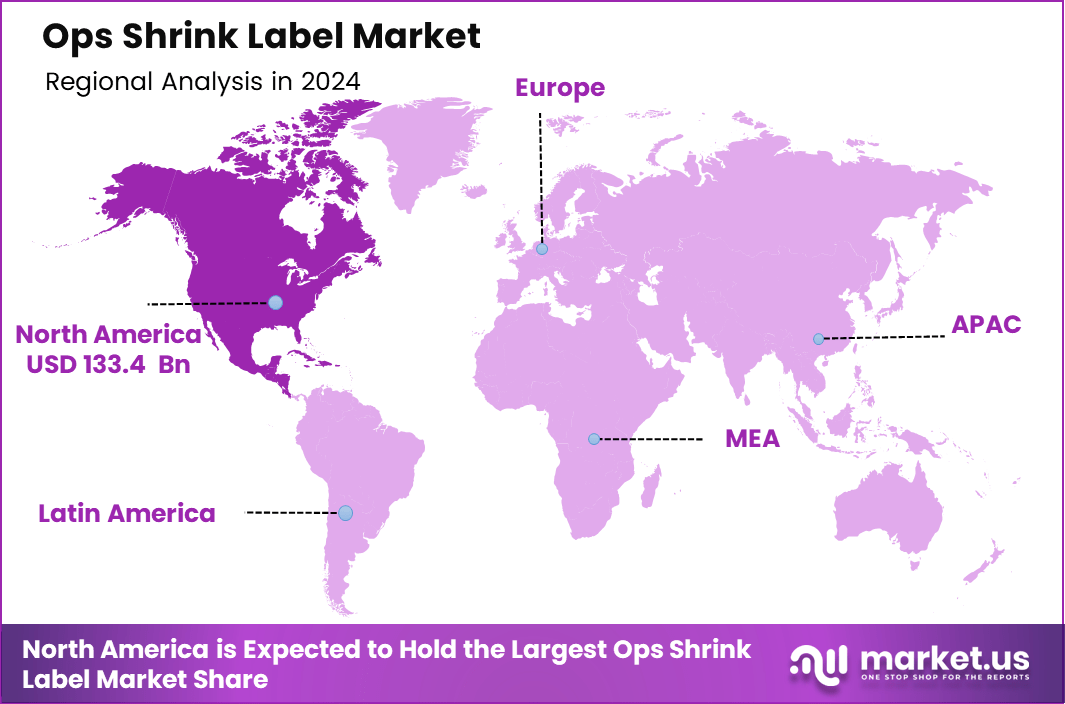

- North America is the leading regional market with a 34.9% share, valued at USD 133.4 billion.

By Product Type Analysis

Sleeve Labels dominate with 66.9% due to their strong print quality and full-body coverage.

In 2024, Sleeve Labels held a dominant market position in the By Product Type Analysis segment of the Ops Shrink Label Market, with a 66.9% share. Sleeve formats enhance shelf visibility, support higher shrink ratios, and adapt to complex container shapes, driving broad adoption across FMCG applications.

Wrap Labels maintained steady acceptance as brands explored cost-efficient decoration options. These labels supported moderate shrink performance, enabling affordable branding transitions. Their simplified application process helped converters meet mid-volume production needs while still offering competitive visual appeal for standard packaging formats in beverages and household goods.

Roll-fed labels advanced gradually as manufacturers optimized operational efficiency. Their compatibility with high-speed lines encouraged adoption in large-scale bottling operations. Although they provide limited shrink capability compared to sleeve formats, they remained relevant for mass-market SKUs seeking balanced cost and branding flexibility.

By Material Analysis

OPS dominates with 48.4% driven by its balanced shrink performance and dimensional stability.

In 2024, OPS held a dominant market position in the By Material Analysis segment of the Ops Shrink Label Market, with a 48.4% share. OPS material accelerated uptake as brands preferred consistent shrink behavior, print clarity, and improved scuff resistance suitable for premium packaging requirements.

PVC remained present in legacy applications due to its proven adaptability, though sustainability concerns continued shifting preference toward alternative materials. Its strong shrink force and print compatibility supported use in cost-sensitive segments where recyclability constraints were less demanding.

PETG gained traction as converters sought environmentally aligned solutions. Its high shrink capacity and durability supported tight contour applications. PETG’s compatibility with recycling streams in select regions strengthened its placement in beverage, personal care, and specialty packaging categories.

PLA expanded steadily as brands adopted bio-based materials. Its compostable profile appealed to sustainability-led portfolios, especially in small-batch premium goods. PLA remained limited by processing requirements, but interest grew where circular packaging strategies were prioritized.

Others accounted for niche uses across hybrid material blends. These options supported specific technical needs such as heat resistance or enhanced stiffness. Although smaller in scale, they played an important role in specialized shrink label innovations.

By Classification Analysis

Coloring dominates with 73.8% due to stronger brand visibility and decorative impact.

In 2024, Coloring labels held a dominant market position in the By Classification Analysis segment of the Ops Shrink Label Market, with a 73.8% share. Brands continued investing in high-impact visuals, leveraging full-color designs to improve on-shelf differentiation and support premium positioning across product categories.

Transparent labels advanced due to rising interest in clean-label aesthetics. Their ability to create a no-label appearance helped brands showcase product purity. This segment benefited from expanding use in beverages, cosmetics, and health-focused packaged goods, prioritizing a minimalist visual approach.

By Application Analysis

Food and Beverage dominate with 62.3% supported by higher SKU volumes and branding requirements.

In 2024, Food and Beverage held a dominant market position in the By Application Analysis segment of the Ops Shrink Label Market, with a 62.3% share. Strong FMCG turnover, expanding SKU assortments, and increased demand for 360-degree branding supported accelerated adoption across bottles, cans, and multipacks.

Personal Care sustained consistent use of shrink labels due to growing emphasis on premium packaging aesthetics. The segment adopted OPS and PETG materials for smooth contouring, supporting visually appealing designs for lotions, shampoos, and cosmetic bottles. The shift toward sustainability further encouraged innovation in decorative formats.

Key Market Segments

By Product Type

- Sleeve Labels

- Wrap Labels

- Roll-Fed Labels

By Material

- PVC

- PETG

- OPS

- PLA

- Others

By Classification

- Coloring

- Transparent

By Application

- Food and Beverage

- Personal Care

- Others

Drivers

Rising Demand for Lightweight Packaging Across FMCG and Beverage Sectors Drives Market Growth

The OPS shrink label market is advancing as FMCG and beverage brands increasingly shift toward lightweight packaging to cut material usage and improve logistics efficiency. OPS labels support this transition because they offer good shrink performance while keeping overall packaging weight lower than many alternatives. This helps companies reduce transportation costs and improve sustainability metrics, making OPS labels a preferred choice in high-volume product categories.

The market also benefits from the growing preference for high-clarity labels that improve shelf appeal. OPS films provide excellent transparency, allowing brands to showcase product colors and premium packaging designs more effectively. This level of clarity supports customer engagement, especially in beverages, nutraceuticals, and personal care products, where visual appeal plays a crucial role in purchasing decisions.

At the same time, the expansion of automated shrink-label applicators across manufacturing lines continues to boost OPS label usage. Modern high-speed applicators improve production efficiency and enable companies to handle large label volumes without increasing operational complexity. As automation becomes more widely adopted, OPS shrink labels gain stronger market relevance due to their consistent shrink behavior and reliable machinability.

Restraints

Limited Heat-Resistance Performance Restricts Market Growth

The OPS shrink label market faces challenges due to limited heat-resistance properties, which restrict their suitability for high-temperature filling or pasteurization processes. This limitation makes OPS labels less competitive in categories such as hot-fill beverages and certain household chemicals, where PETG or PVC alternatives may perform better. As more brands expand into heat-intensive production methods, this constraint slows OPS adoption.

Another restraint comes from the fluctuations in styrene-based raw material prices, which significantly influence OPS production costs. Variability in global styrene supply, petrochemical market volatility, and regional price shifts increases cost instability for manufacturers. These variations make pricing less predictable for end users, affecting long-term procurement planning and potentially encouraging brands to explore alternate shrink-label materials with more stable cost structures.

Growth Factors

Adoption of Downgauged Formats Creates Strong Market Opportunities

The OPS shrink label market offers multiple growth opportunities as companies adopt eco-optimized and downgauged packaging formats. Reduced-thickness OPS labels help brands achieve material savings without compromising print quality or shrink performance. This shift aligns with global sustainability goals, making downgauged OPS formats increasingly attractive for major FMCG and beverage companies.

Promotional multipacks also unlock new opportunities, as retailers use shrink labels to group products during seasonal campaigns or discount bundles. OPS labels provide strong conformability and good printability, making them suitable for attractive multipack promotions that boost shelf visibility and retail sell-through.

In personal care categories, OPS shrink labels are gaining traction in travel-size and mini-pack formats where lightweight films and premium artwork are essential. OPS transparency and shrink consistency support high-quality branding even on small containers.

Additionally, manufacturers are developing improved OPS material blends that enhance shrink performance and durability. These upgraded formulations expand label design possibilities, reduce distortion, and improve compatibility with different container shapes, opening the door to wider market adoption.

Emerging Trends

Growing Use of 360-Degree Artwork Shapes Market Trends

The OPS shrink label market is seeing strong momentum from the rising use of 360-degree artwork that allows full-body branding. Brands are using OPS labels to deliver immersive visual storytelling, improving product differentiation on crowded retail shelves. This trend is especially prominent in beverages, cosmetics, and specialty foods, where packaging plays a key role in consumer engagement.

Premium aesthetics are also influencing market direction as companies increasingly adopt matte-finish OPS shrink labels. The matte effect offers a modern, high-value look that enhances brand perception and supports premium pricing strategies. This trend is being used widely in craft beverages, skincare products, and designer household items.

Digital printing continues to emerge as a major trend for short-run customization in OPS shrink labels. With shorter product cycles and rising demand for limited-edition packaging, digital printing packaging allows fast turnaround times and cost-effective small-batch production. This flexibility benefits promotional campaigns, regional packaging variants, and seasonal launches, reinforcing OPS labels as a competitive choice in evolving packaging strategies.

Regional Analysis

North America Dominates the OPS Shrink Label Market with a Market Share of 34.9%, Valued at USD 133.4 Billion

North America leads the OPS Shrink Label Market with a dominant share of 34.9%, accounting for a valuation of USD 133.4 billion. The region benefits from strong adoption across beverage, FMCG, and personal care packaging, driven by high demand for premium-label visibility. Advanced automation across labeling lines and the rapid shift toward lightweight packaging formats continue to reinforce regional growth, making North America a key revenue-generating market.

Europe OPS Shrink Label Market Trends

Europe shows steady growth supported by its well-established packaging sector and strong regulatory push toward recyclable and low-impact materials. The increasing preference for high-clarity shrink labels, especially in food, cosmetics, and wellness categories, is boosting OPS label adoption. Sustainability-focused initiatives and the rapid expansion of private-label goods continue to support consistent market penetration across major EU countries.

Asia Pacific OPS Shrink Label Market Trends

Asia Pacific remains one of the fastest-growing regions due to rising consumption of packaged beverages, household items, and personal care products. Expanding manufacturing capabilities and cost-efficient production ecosystems are accelerating OPS label usage among local and global brands. Increasing urbanization and growth in modern retail formats also contribute to higher demand for visually impactful, full-body shrink labels.

Middle East and Africa OPS Shrink Label Market Trends

The Middle East and Africa region is witnessing the gradual adoption of OPS shrink labels, supported by rising beverage production and expanding retail modernization. Growing interest in premium packaging formats, especially within the Gulf countries, is enhancing demand for high-clarity labeling materials. Increasing investments in food and non-alcoholic beverage processing industries further support the region’s emerging market growth.

Latin America OPS Shrink Label Market Trends

Latin America experiences increasing uptake of OPS shrink labels driven by growing FMCG consumption and expanding regional bottling operations. The market benefits from the strong presence of local beverage brands and the rising popularity of promotional multipacks. Economic recovery in key countries and strengthening retail distribution networks continue to create favorable conditions for OPS shrink label adoption.

U.S. OPS Shrink Label Market Trends

The U.S. remains a major contributor to the global OPS shrink label demand due to strong packaging innovation, high product diversity, and rapid technology adoption across labeling systems. The country’s beverage, health, and premium personal care brands increasingly prefer OPS labels for their clarity and lightweight structure. Ongoing investments in automated packaging lines further strengthen the U.S. market outlook.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ops Shrink Label Market Company Insights

In 2024, the OPS Shrink Label Market reflects a balanced mix of established global converters and specialized regional manufacturers, each shaping the industry through innovation, material efficiency, and packaging versatility. All4Labels continues to strengthen its position by expanding sustainable shrink label formats and improving lightweight film applications. Its focus on premium print technologies and flexible converting capabilities enables strong engagement with FMCG and beverage brands seeking high-clarity label solutions. BENISON & CO., LTD. plays a crucial role across Asian markets by offering cost-effective OPS shrink materials with consistent shrink performance. Its growing machinery integration and turnkey packaging systems support higher adoption rates among regional bottlers and consumer-goods producers.

HUBEI HYF PACKAGING is advancing the OPS landscape through improved film extrusion technologies and enhanced transparency standards. Its strong production capacity and emphasis on material purity position it well in markets that prioritize clarity and sustainability. TPL Transparent Paper remains influential in supplying specialty shrink label substrates tailored to converters seeking differentiated visual effects. Its customizable OPS materials help brands achieve unique packaging aesthetics without compromising shrink quality.

Across the broader competitive landscape, companies such as Fuji Seal International, CCL Industries, Amcor plc, Huhtamaki, Klockner Pentaplast, and Cenveo continue to reinforce industry standards through global supply networks and advancements in full-body shrink decoration. Their expertise in high-volume label production, digital print integration, and downgauged OPS structures contributes significantly to market evolution. In summary, competition in 2024 is shaped by innovation in lightweight films, sustainability-oriented materials, and enhanced printing capabilities, allowing the OPS shrink label market to progress toward higher performance and visual differentiation across product categories.

Top Key Players in the Market

- All4Labels

- BENISON & CO., LTD.

- HUBEI HYF PACKAGING

- TPL Transparent Paper

- Fuji Seal International, Inc.

- CCL Industries Inc.

- Amcor plc

- Huhtamaki Oyj

- Klöckner Pentaplast Group

- Cenveo Corporation

Recent Developments

- In Dec 2024, MCC acquired Mexican shrink sleeve label manufacturer Eximpro, expanding its footprint in the Latin American labeling market. This acquisition enhances MCC’s shrink sleeve capabilities and supports closer customer proximity across food, beverage, and consumer packaging segments.

- In Oct 2025, Sleever® strengthened its international growth strategy through the acquisition of Karlville Development SAS France’s business, enhancing its advanced labeling and machinery portfolio. The deal expands Sleever®’s machine range and reinforces its position in high performance sleeve and decoration technologies.

- In Mar 2025, Crestview acquired Smyth Companies, a leading provider of labels and custom packaging solutions serving diverse consumer end markets. This acquisition supports Crestview’s investment strategy by scaling Smyth Companies’ operational capabilities and accelerating growth in value added packaging services.

Report Scope

Report Features Description Market Value (2024) USD 382.4 Billion Forecast Revenue (2034) USD 665.7 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sleeve Labels, Wrap Labels, Roll-Fed Labels), By Material (PVC, PETG, OPS, PLA, Others), By Classification (Coloring, Transparent), By Application (Food and Beverage, Personal Care, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape All4Labels, BENISON & CO., LTD., HUBEI HYF PACKAGING, TPL Transparent Paper, Fuji Seal International, Inc., CCL Industries Inc., Amcor plc, Huhtamaki Oyj, Klöckner Pentaplast Group, Cenveo Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- All4Labels

- BENISON & CO., LTD.

- HUBEI HYF PACKAGING

- TPL Transparent Paper

- Fuji Seal International, Inc.

- CCL Industries Inc.

- Amcor plc

- Huhtamaki Oyj

- Klöckner Pentaplast Group

- Cenveo Corporation