Global Open Banking Market Size, Share and Growth Analysis Report By Services (Banking & Capital Markets, Payments, Digital Currencies, Value Added Services), Distribution Channel (Bank Channels, App Markets, Distributors, Aggregators), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 110461

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

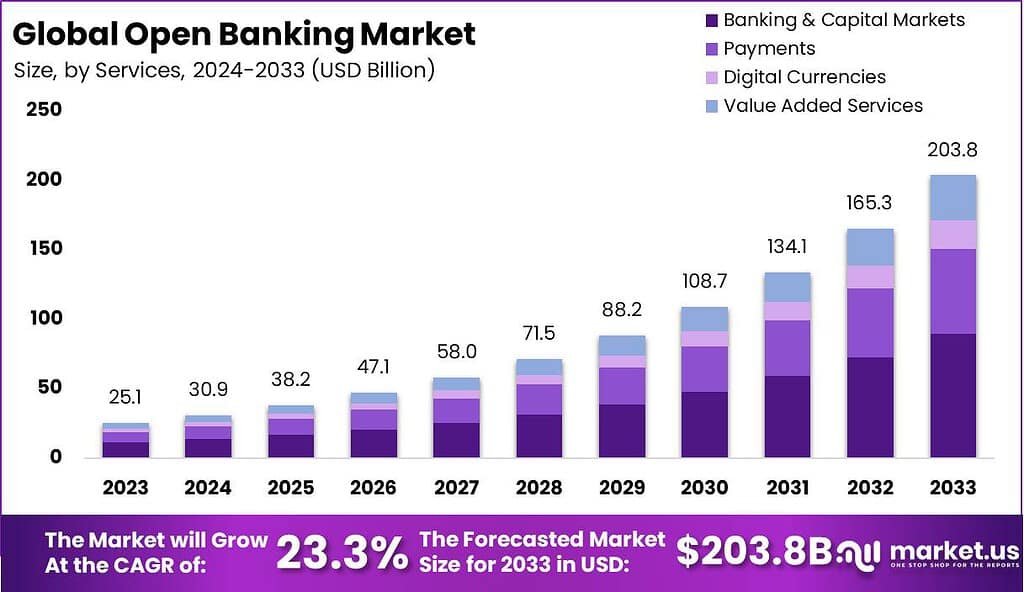

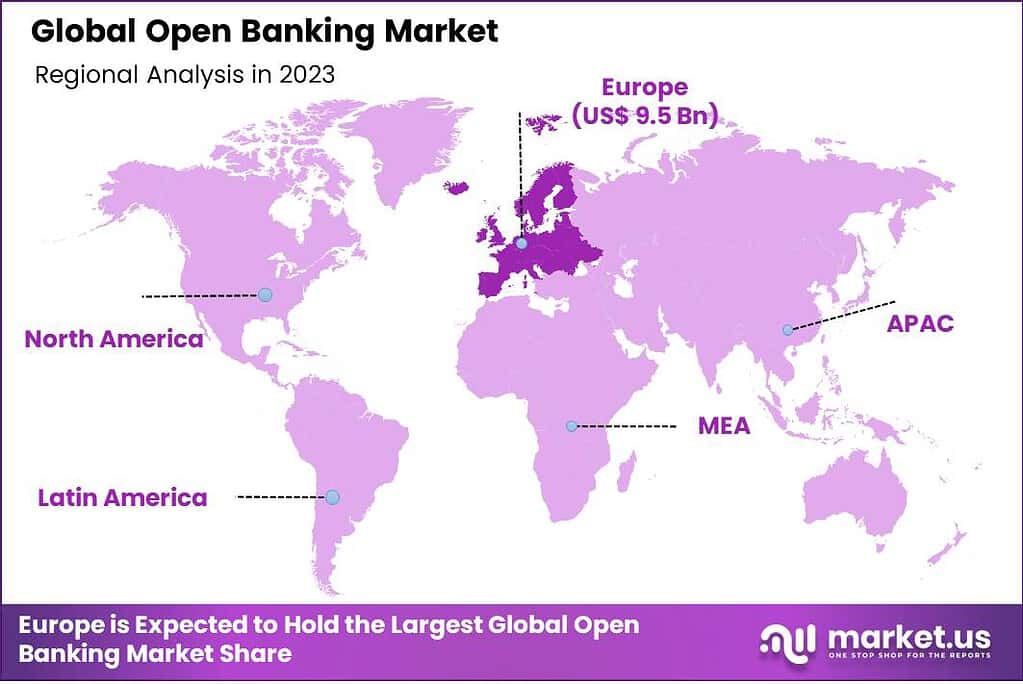

The Global Open Banking Market size is expected to be worth around USD 204 Billion By 2033, from USD 25 Billion in 2023, growing at a CAGR of 23.3% during the forecast period from 2024 to 2033. In 2023, Europe held a dominant market position, capturing more than a 38% share, holding USD 9.5 Billion revenue

Open Banking refers to the practice where banks and other financial institutions open up their data for third-party developers to access via APIs (Application Programming Interfaces). This system allows the creation of new financial services and applications, enhancing the customer experience by providing more transparency and greater control over their financial data. Open Banking aims to increase competition and innovation in the financial sector, offering consumers more tailored and efficient services.

The Open Banking market is rapidly expanding as financial institutions worldwide adopt digital transformation strategies. This market includes services that help secure data sharing between banks and third-party providers, making financial transactions and information management more accessible and customizable. Driven by technological advancements and changing consumer expectations, the Open Banking market is set to revolutionize how financial data is used and shared in the banking industry.

Several factors are driving the growth and expansion of the Open Banking market. Regulatory mandates in various countries require banks to open their data to third parties, aiming to foster competition and innovation. Technological advancements, such as enhanced security measures and improved data analytics, are also pivotal, enabling safer and more efficient data handling. As banks increasingly embrace digital solutions to meet customer needs, the demand for Open Banking services continues to rise, paving the way for a broader market expansion.

The demand for Open Banking is primarily fueled by the desire for more personalized banking services and a more comprehensive view of financial options. Consumers benefit from applications that can provide real-time financial advice, budgeting help, and tailored product recommendations. For businesses, the opportunities lie in developing new financial products that integrate seamlessly with banks’ existing systems, providing enhanced services such as faster payments, improved loan processing, and better risk management.

The Open Banking market presents significant opportunities for growth, particularly in developing regions where digital banking adoption is increasing. As more regions enact supportive regulations and as technological infrastructure improves, new markets for Open Banking services are expected to emerge. Furthermore, the ongoing shift towards mobile banking and the integration of AI and machine learning in financial services are opening new avenues for development within this sector.

According to Chris Skinner’s blog, the open banking user base in Europe is experiencing a rapid expansion. From 2020, when there were just 12.2 million users, projections show an impressive average annual growth rate of 50%. By 2024, this number is expected to skyrocket to around 64 million. In the UK, as of early 2024, approximately 11% of consumers and 17% of small businesses have embraced open banking services, highlighting a growing acceptance among both individual customers and the business sector.

As reported by open banking, By January 2024, open banking usage among digitally active consumers had increased to 13%, roughly 1 in 7, a noticeable rise from 1 in 9 just six months earlier. This growth isn’t limited to consumers alone; small business usage also saw a rise, reaching 18%. This uptrend reflects a robust and continued growth in open banking penetration as more users recognize its benefits.

The dynamism of open banking is also evident in transaction volumes. January 2024 marked a milestone with open banking payments hitting a record 14.5 million transactions, a 69% year-on-year growth. Of these, 8% were variable recurring payments, while the majority, 92%, were single immediate payments. This record-setting performance underscores the increasing reliance on open banking for diverse payment needs and the confidence users place in its security and efficiency

Key Takeaways

- The Global Open Banking Market is on a trajectory to grow significantly, projected to expand from USD 25 Billion in 2023 to an impressive USD 204 Billion by 2033. This growth represents a robust compound annual growth rate (CAGR) of 23.3% during the forecast period from 2024 to 2033.

- In 2023, Europe emerged as a powerhouse in the Open Banking landscape, commanding a 38% market share with revenues reaching USD 9.5 Billion. This dominance is attributed to the progressive regulatory frameworks and strong adoption of digital banking solutions across the region, fostering a favorable environment for Open Banking practices.

- Focusing on specific segments within the Open Banking Market, the Banking and Capital Markets segment was particularly prominent in 2023, seizing more than a 44% share. This segment benefits from the deep integration of open APIs that allow third-party developers to build applications and services around the financial institution, enhancing customer experience and offering tailored financial solutions.

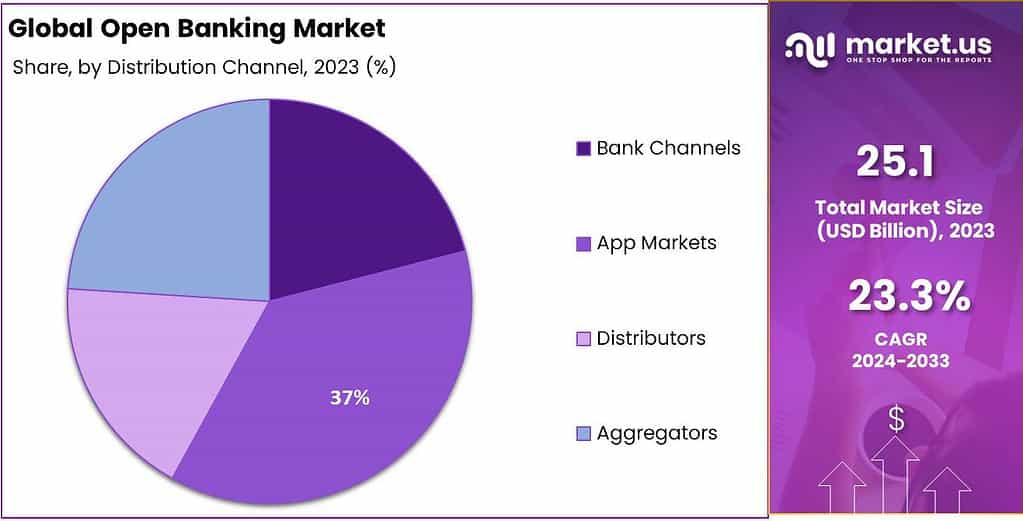

- Moreover, the App Markets segment also demonstrated a significant hold on the market with over a 37% share in 2023. This segment thrives as financial institutions and fintech companies increasingly rely on applications to offer enhanced accessibility and personalized services to users, thereby driving the adoption of open banking platforms.

Open Banking Statistics

- Based on the research findings of wiseabout.money, In January 2023, 7 million UK users were engaged with open banking, showing a significant rise from 2 million in September 2020. Among these, 6.25 million were individual consumers, while 750,000 were businesses.

- Notably, 1.2 million of these users were exploring open banking services for the first time. Currently, 11% of UK consumers are utilizing open banking. The adoption is slightly higher among small and medium enterprises (SMEs), with 16% of them using open banking solutions

- $57 billion was the global value of open banking transactions in 2023, with predictions pointing to even more dramatic growth in the near future.

- In the UK, open banking payments surged to a record 14.5 million transactions in January 2024, marking a significant increase from earlier figures.

- There were around 102 billion open banking API calls made worldwide in 2023, demonstrating a strong and active engagement with open banking platforms.

- API calls in the UK escalated to more than 1 billion per month, highlighting the increasing dependence on this technology for managing financial transactions.

- According to a report from worldmetrics, 47% of banks have embraced Open Banking initiatives. It’s projected that Open Banking could save consumers $18 billion in financial services fees by 2024.

- An encouraging 64% of consumers are open to sharing personal data with banks if it means they receive personalized benefits.

- Open Banking is anticipated to boost retail bank revenues by 10-20%.

- A notable 78% of executives are convinced that Open Banking will revolutionize financial services within the next 5 years.

- However, 56% of consumers express concerns about the security of their data under Open Banking systems.

- Open Banking provides access to over 3000 financial products and services through APIs.

- 55% of banks view Open Banking as a significant opportunity to enhance customer experience

Services Insights

In 2023, the Banking and Capital Markets segment held a dominant market position within the Open Banking Market, capturing more than a 44% share. This leadership is largely due to the extensive integration of open banking platforms that facilitate real-time data sharing and improved customer service in traditional banks and financial institutions.

The growth in this segment reflects an increased adoption by banks seeking to enhance their strategic offerings and compliance with regulatory standards that encourage financial transparency and data sharing. The dominance of the Banking and Capital Markets segment can also be attributed to the rising demand for innovative financial services solutions that offer enhanced customer experience and better risk management.

Open banking allows banks to provide more personalized banking advice and tailored financial products, which resonates well with the modern customer’s expectations. Additionally, the ability to access a comprehensive view of a customer’s financial data across institutions has paved the way for more competitive and finely tuned financial services.

Another critical factor in the success of this segment is the strategic partnerships between banks and fintech companies. These collaborations leverage technology-driven insights to create advanced financial products and services, driving further adoption of open banking. The ecosystem created by open banking facilitates a network where information flows securely and efficiently, empowering banking and capital market players to innovate and maintain competitive edges.

Thus, the Banking and Capital Markets segment’s leadership in the Open Banking Market is supported by the strategic advantages it offers to traditional financial institutions. As these institutions continue to evolve with digital transformations, this segment is likely to maintain or even expand its market share by continuing to meet the sophisticated financial needs of global customers.

Distribution Channel Analysis

In 2023, the App Markets segment held a dominant market position within the Open Banking Market, capturing more than a 37% share. This significant market share can be largely attributed to the increasing consumer preference for mobile-based financial services, which offer convenience and real-time access to financial data. The proliferation of smartphones and the growing comfort with mobile banking apps have propelled this segment to the forefront of the open banking evolution.

The leadership of the App Markets segment is further reinforced by the surge in fintech innovations that cater to a mobile-first audience. Developers are increasingly focusing on creating applications that integrate seamlessly with open banking APIs, enabling users to manage their finances, make payments, and access financial services all from their mobile devices. This ease of access and the personalized experience provided by these apps appeal to a tech-savvy generation, boosting their popularity and adoption.

Moreover, app markets benefit from a regulatory environment that favors open banking frameworks, encouraging the development of apps that can securely utilize banking data to offer enhanced services. This regulatory support has fostered a trusting environment where consumers are more willing to use third-party apps to access their financial information, leading to further growth in this segment.

Consequently, the App Markets segment’s dominant position in the Open Banking Market is supported by the integration of technology in daily financial activities and the push towards a more connected financial ecosystem. As technology continues to evolve and consumer behaviors shift towards more integrated financial solutions, this segment is expected to maintain its lead by continuously innovating and improving the user experience.

Key Market Segments

Services

- Banking & Capital Markets

- Payments

- Digital Currencies

- Value Added Services

Distribution Channel

- Bank Channels

- App Markets

- Distributors

- Aggregators

Driver

Integration of AI and Big Data Analytics

The Open Banking Market is significantly driven by the integration of Artificial Intelligence (AI) and big data analytics. AI enhances the capabilities of open banking by offering personalized financial services and improving fraud detection measures.

Big data analytics allows banks and third-party providers (TPPs) to analyze extensive customer data, leading to better customer insights and service offerings. This technological convergence empowers financial institutions to offer more efficient and tailored financial services, thus attracting more customers to adopt open banking solutions.

Restraint

Data Security Concerns

One major restraint in the Open Banking Market is the heightened risk of data breaches and cyberattacks due to the increased sharing of sensitive financial information through APIs. The complexities involved in managing consumer consent and ensuring compliance with privacy regulations also pose significant challenges. These security concerns can deter consumers from adopting open banking services, as they might be wary of third-party providers mishandling their financial information.

Opportunity

Regulatory Support and Innovation

The regulatory environment plays a crucial role in shaping the opportunities within the Open Banking Market. Regulations like the EU’s PSD2 mandate banks to share data securely with authorized TPPs, which fosters innovation and competition in the financial services sector.

This regulatory support encourages the development of new financial tools and services, thus expanding the market potential for open banking by facilitating safer and more innovative financial service offerings.

Challenge

Balancing Innovation with Compliance

A significant challenge in the Open Banking Market is balancing innovation with regulatory compliance. As financial institutions and TPPs innovate to create new services, they must also ensure that these services comply with stringent data protection laws and regulations. This dual requirement can limit the speed at which new offerings are developed and may increase the costs for compliance, thus affecting the overall market growth.

Growth Factors

The growth of the Open Banking Market is propelled by several key factors. A significant driver is the advancing integration of technology such as artificial intelligence and machine learning, which enhances the efficiency and personalization of financial services.

The proliferation of digital banking platforms that facilitate seamless and secure financial transactions is also contributing to the market’s expansion. Regulatory initiatives across various regions are encouraging the adoption of open banking standards, further boosting market growth by creating a more competitive and innovative banking environment.

Emerging Trends

One of the most notable trends in the Open Banking sector is the increasing use of APIs that enable third-party developers to build innovative financial services and products. This trend is underpinned by the growing consumer demand for personalized and on-demand financial services, which open banking platforms are well-positioned to deliver.

Another emerging trend is the strategic collaborations between traditional banks and fintech firms, aiming to enhance service delivery and customer satisfaction. The push towards digital transformation and enhanced data security measures continues to shape the evolving landscape of open banking.

Business Benefits

Open Banking offers substantial business benefits, which include the ability to foster innovation through easier access to banking data and infrastructures via APIs. This access facilitates the development of new financial products and services tailored to specific consumer needs, thus potentially increasing customer loyalty and revenue streams.

Additionally, open banking enables financial institutions to achieve better compliance with regulatory requirements through transparent data sharing practices. It also promotes more strategic partnerships and collaborations, which can lead to enhanced market reach and improved operational efficiencies. Overall, open banking presents opportunities for banks to differentiate themselves in a competitive market by leveraging data to better understand and serve their customers

Regional Analysis

In 2023, Europe held a dominant market position in the Open Banking Market, capturing more than a 38% share with a revenue of USD 9.5 billion. This leadership is attributed to the robust regulatory frameworks such as the Second Payment Services Directive (PSD2) which mandates banks to open access to their data and banking infrastructure through APIs to third-party providers with customer consent. Such regulations not only enhance transparency but also foster competition and innovation within the financial sector.

Europe’s market dominance is further bolstered by a high degree of digital literacy among consumers and the widespread adoption of digital banking solutions across the region. The region’s financial institutions are increasingly collaborating with fintech firms to leverage open banking platforms that offer enhanced customer experiences and more personalized financial services. These partnerships are key in driving the adoption of open banking services, making Europe a leading hub for financial technology innovations.

Moreover, the active participation of numerous startups and established banks in the open banking ecosystem contributes to the region’s leading position. For instance, as of 2021, the European Banking Authority reported nearly 2500 third-party providers registered under PSD2, reflecting the vibrant activity and commitment to leveraging open banking to deliver innovative financial services. This robust infrastructure and supportive regulatory environment not only propel Europe’s market share but also position it as a global leader in driving forward the advancements in open banking.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Open Banking market features a dynamic range of participants from established financial institutions to innovative fintech startups. These key players are actively shaping the market through strategic acquisitions, launching new products, and forming partnerships.

Tink, a leader in the Open Banking market, has significantly expanded its influence through strategic acquisitions. One notable acquisition is its purchase of Instantor, which enhanced Tink’s credit decisioning capabilities with advanced analytics. Tink frequently launches innovative products that empower banks, fintechs, and startups to develop customized financial services.

Societe Generale has been an active participant in the Open Banking scene, primarily through its collaborations and partnerships. The bank has merged its traditional banking expertise with modern fintech innovation by partnering with fintech companies to broaden its service offerings. These strategic moves not only enhance Societe Generale’s product portfolio but also strengthen its market position by leveraging new technologies to improve customer service and expand digital banking solutions.

Nordigen stands out in the Open Banking market by focusing on launching cutting-edge products that provide financial insights and enhance transparency. They have carved a niche by specializing in free banking data analytics, appealing to developers and financial service providers. Nordigen’s approach to Open Banking is centered around empowering users with tools that facilitate better financial decisions, setting them apart as innovators in a competitive field.

Top 10 Biggest Key Players

- Tink

- Societe Generale

- Nordigen Solutions

- Deposit Solutions

- Yapily Ltd.

- Jack Henry & Associates Inc.

- Credit Agricole

- Finestra

- BBVA SA

- Revolut Ltd.

- Other Key Players

Recent Developments

- In September 2023, BNY Mellon made a significant move in the financial sector by unveiling Bankify, their new open banking payments solution. Designed with organizations in mind, Bankify facilitates the receipt of payments directly from consumer bank accounts. What sets it apart is its promise of guaranteed funds for business receivables, aiming to streamline the financial operations of companies significantly.

- Earlier in March 2023, Payer Financial Services AB, known for its innovative solutions in B2B payments, launched its open banking payments system across Sweden. This system leverages open banking APIs to allow businesses to process payments efficiently, ensuring complete reconciliation and settlement. Merchants benefit from real-time visibility into the payment status, enhancing transparency and trust in financial transactions.

Report Scope

Report Features Description Market Value (2023) USD 25.1 Bn Forecast Revenue (2033) USD 203.8 Bn CAGR (2024-2033) 23.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered by Services (Banking & Capital Markets, Payments, Digital Currencies, Value Added Services), Distribution Channel (Bank Channels, App Markets, Distributors, Aggregators) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Tink, Societe Generale, Nordigen Solutions, Deposit Solutions, Yapily Ltd., Jack Henry & Associates Inc., Credit Agricole, Finestra, BBVA SA, Revolut Ltd., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Open Banking?Open Banking refers to a system where banks and financial institutions open up access to their data and services to third-party developers and businesses through APIs (Application Programming Interfaces).

What is the open banking market?The open banking market refers to the ecosystem and industry surrounding the practice of open banking. Open banking involves financial institutions opening up access to their data, services, and infrastructure to third-party developers and other financial service providers through standardized Application Programming Interfaces (APIs). This approach fosters innovation, competition, and collaboration within the financial sector.

How big is Open Banking Market?The projected value of the global Open Banking Market is anticipated to be USD 30.9 billion by 2024 and is expected to witness substantial growth, reaching USD 203.8 billion by 2033. The market is poised for a remarkable surge, with a projected compound annual growth rate (CAGR) of 23.3% during the forecast period from 2024 to 2033.

Which banks use open banking?Many banks around the world have embraced open banking to varying extents. Examples of banks that have implemented open banking initiatives include BBVA, Barclays, and HSBC. The extent and nature of open banking practices may differ between institutions and regions.

Is Open Banking safe?Security is a top priority in Open Banking, and strict regulations and standards are in place to ensure the protection of consumers' financial data. Banks and third-party providers must comply with security measures to participate in Open Banking.

Who are the top key players in Open Banking Market?Some of key players include Tink, Societe Generale, Nordigen Solutions, Deposit Solutions, Yapily Ltd., Jack Henry & Associates Inc., Credit Agricole, Finestra, BBVA SA, Revolut Ltd., Other Key Players

-

-

- Tink

- Societe Generale

- Nordigen Solutions

- Deposit Solutions

- Yapily Ltd.

- Jack Henry & Associates Inc.

- Credit Agricole

- Finestra

- BBVA SA

- Revolut Ltd.

- Other Key Players