Onychomycosis Treatment Market By Treatment Type (Medication-Based Treatments and Device-Based Treatments), By Pathogen Type (Dermatophytes, Non-Dermatophyte Molds & Yeasts), By Disease Type (Distal Subungual Onychomycosis (DSO), Proximal Subungual Onychomycosis, White Superficial Onychomycosis & Candidal Onychomycosis), By Distribution Channels (Retail Pharmacies, Online Pharmacies, and Hospitals and Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154899

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Treatment Type Analysis

- Pathogen Type Analysis

- Disease Type Analysis

- Distribution Channels Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

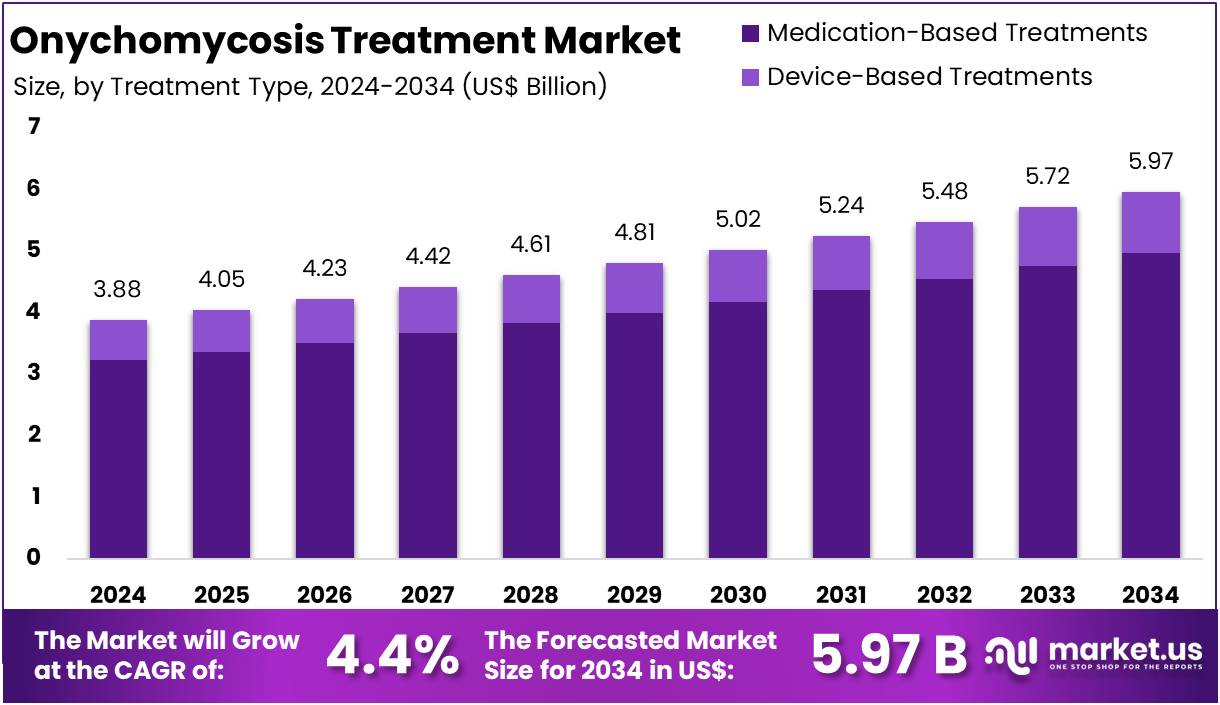

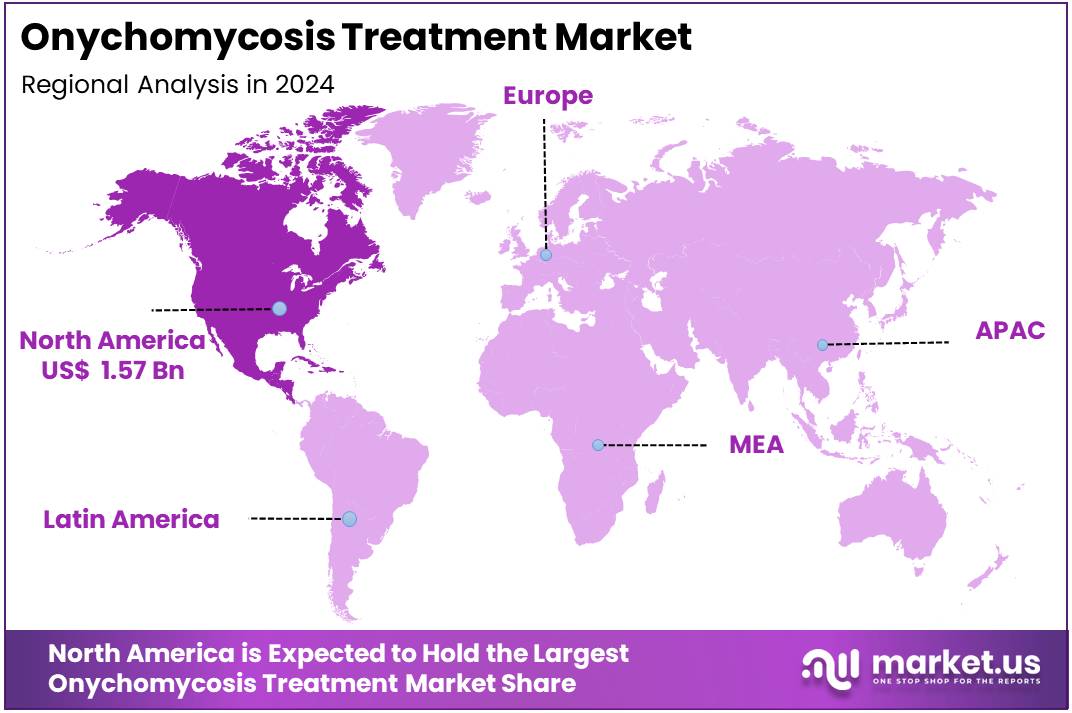

The Onychomycosis Treatment Market Size is expected to be worth around US$ 5.97 billion by 2034 from US$ 3.88 billion in 2024, growing at a CAGR of 4.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.4% share and holds US$ 1.57 Billion market value for the year.

Onychomycosis refers to a fungal infection affecting the nail unit, commonly caused by dermatophytes, in which case it is specifically termed tinea unguium. The broader term onychomycosis includes infections caused by dermatophytes, yeasts, and saprophytic molds. A dystrophic nail, in contrast, is a nail with abnormalities not related to a fungal infection. While onychomycosis can affect both fingernails and toenails, it is notably more common in toenails. The following sections delve into various aspects of this condition, including its disease burden, clinical types, staging, diagnosis, and management, with a focus on toenail onychomycosis.

Approximately 50% of abnormal toenails are affected by fungal infections. The prevalence of onychomycosis is estimated to range from 1% to 8%, with the incidence on the rise. Genetic susceptibility to dermatophyte infections follows an autosomal dominant inheritance pattern. Key risk factors include aging, diabetes, tinea pedis, psoriasis, immunodeficiency, and living in households with individuals affected by onychomycosis. The global onychomycosis treatment market—which comprises therapies for fungal nail infections—is experiencing steady growth due to the increasing prevalence of nail fungal infections, particularly among geriatric and diabetic populations.

Drug therapies is the major treatment option, accounting for more than 80% of revenue, driven by the efficacy and ease of access to oral and topical antifungals such as terbinafine and ciclopirox. In addition to pharmaceutical treatments, the market is seeing rising interest in non-invasive modalities, such as photodynamic therapy and laser treatments, which are particularly attractive for patients intolerant to systemic drugs.

Current Treatment Options (Dug Therapies) for Onychomycosis Treatment

Treatments Mechanism Efficacy Griseofulvin Inhibits fungal mitosis by disrupting microtubule function. Limited efficacy; mycological cure rates approx. 29% for toenails, 80% for fingernails; clinical cure rates lower (3% toenails, 40% fingernails). Long treatment courses (6–18 months) required, resulting in low compliance. Effective mainly against dermatophytes, not for non-dermatophyte or mixed infections. Rarely used now in adults because of inferior cure rates, longer duration, and recurrence. Itraconazole Inhibits ergosterol synthesis (azole class) Effectiveness: Mycological cure rates for toenails up to ~74%, fingernails higher; clinical cure rates around 47–52%. Used in pulse or continuous regimens; effective against dermatophytes and some non-dermatophytes. Terbinafine Blocks squalene epoxidase, disrupting ergosterol synthesis (allylamine). Mycological cure rates 70–78%; clinical cure around 38–52%. Oral terbinafine is considered first-line for dermatophyte onychomycosis due to high efficacy and tolerable side effect profile. Fluconazole Azole antifungal, impairs ergosterol synthesis. Mycological cure rates for toenails up to 79–88%, clinical cure ~64–96% dependent on dosing and duration. Used off-label as oral weekly/biweekly regimens for several months. Voriconazole Triazole class, inhibits fungal ergosterol synthesis. Not routinely indicated for onychomycosis; reserved for resistant or severe/refractory infections due to potential side effects. Posaconazole Extended-spectrum triazole. Also not standard for onychomycosis, but may be considered in resistant/refractory or non-dermatophyte cases. Fosravuconazole L‐lysine ethanolate Prodrug of ravuconazole (triazole), inhibits ergosterol synthesis. Recently approved in some regions (not widely available). Reported high efficacy in clinical trials, including for difficult-to-treat non-dermatophyte infections. Ciclopirox Inhibits fungal cell membrane transport and enzyme activity. Lower cure rates compared to systemics; mostly for mild/moderate cases or in patients ineligible for oral agents. Efinaconazole Topical triazole 10% solution applied daily for 48 weeks. Cure rates higher than ciclopirox but lower than oral agents. Good for mild/moderate distal onychomycosis. Tavaborole Oxaborole antifungal; inhibits leucyl-tRNA synthetase Similar to efinaconazole. Modest cure rates, suitable for mild cases. Amorolfine Inhibits ergosterol synthesis; available as topical lacquer (not universally approved). Comparable to ciclopirox for mild/moderate onychomycosis. Luliconazole Topical imidazole; disrupts fungal cell membrane. Has demonstrated promising results, particularly for interdigital tinea but also investigated in onychomycosis (limited by availability and approvals). As awareness about nail health continues to grow, the demand for non-surgical treatment methods is increasing steadily. This has led to a rise in sales of related treatment products. Public health initiatives such as the CDC’s annual Fungal Disease Awareness Week (FDAW), held from September 18 to 22, 2023, aim to educate people about fungal infections, including onychomycosis. These campaigns have played a key role in raising awareness of the risks linked to fungal diseases, creating a favorable environment for market expansion through improved education and early diagnosis.

These ongoing efforts have highlighted the need for better diagnostic tools and more effective treatment options. This, in turn, is driving growth in the global onychomycosis market. Advances in treatment technologies-such as laser therapy and photodynamic therapy—are offering alternatives to traditional methods. Patients now have options beyond conventional oral and topical antifungal agents. These innovations are gaining traction, especially among patients seeking safer and faster outcomes. The growing adoption of modern therapies reflects a shift in treatment preferences and contributes to the overall market growth.

Key Takeaways

- In 2024, the market for Onychomycosis Treatment generated a revenue of US$ 3.88 billion, with a CAGR of 4.4%, and is expected to reach US$ 5.97 billion by the year 2034.

- The Treatment Type segment is divided into Medication-Based Treatments, and Device-Based Treatments with Medication-Based Treatments the lead in 2024 with a market share of 83.2%.

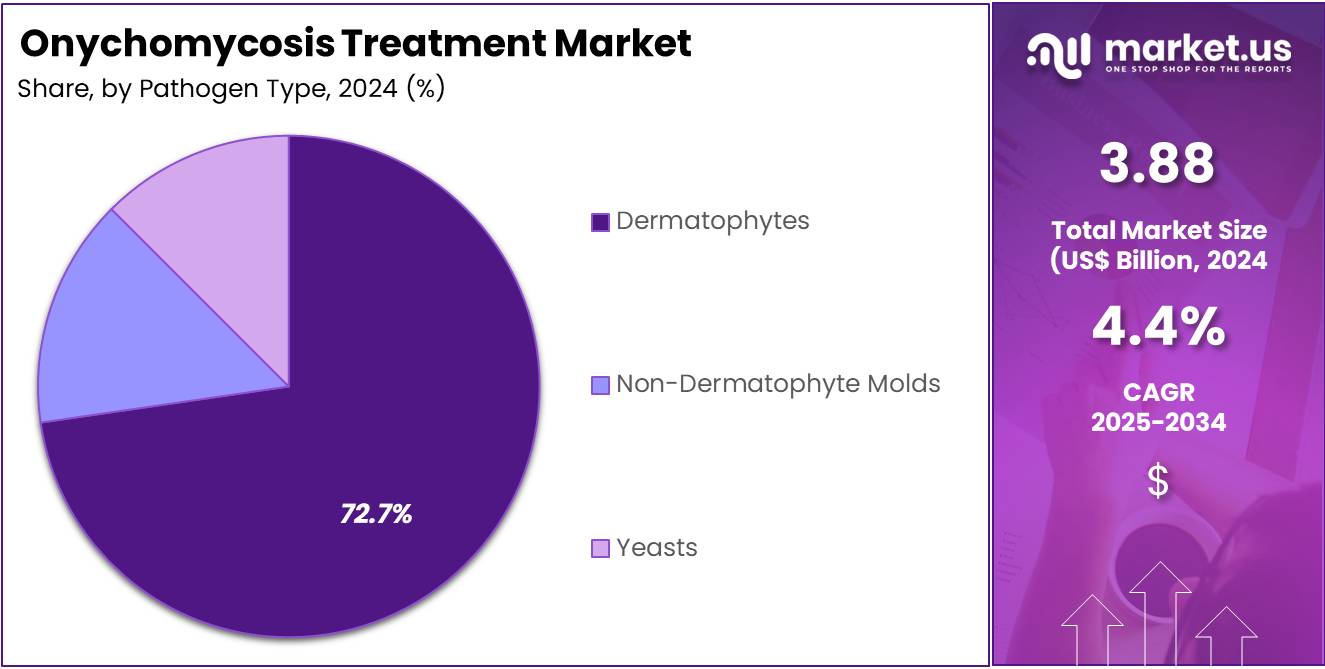

- By Pathogen Type, the market is bifurcated into Dermatophytes, Non-Dermatophyte Molds, and Yeasts, with Dermatophytes is the dominating the market with 72.7% of market share in 2024.

- By Disease Type, the market is classified into Distal Subungual Onychomycosis (DSO), Proximal Subungual Onychomycosis, White Superficial Onychomycosis, and Candidal Onychomycosis, with Distal Subungual Onychomycosis (DSO) accounting for the dominant position in the market in 2024 with 44.8% market share.

- Considering the Distribution Channels segment, the market is bifurcated into Retail Pharmacies, Online Pharmacies, and Hospitals and Clinics, with Retail Pharmacies taking the lead in 2024 with 48.7% market share.

- North America led the market by securing a market share of 40.4% in 2024.

Treatment Type Analysis

Considering the treatment type segment, medication based treatments held the dominanat position in the market accounting for the largest market share of 83.2%. Oral antifungals and topical antifungals are the most popular types of medications used for the treatment. Oral medications are preferred for moderate to severe infections due to their systemic effect, while topical treatments are commonly used for mild cases. The high adoption of these treatments is driven by their effectiveness, availability, and established clinical usage. Also, oral antifungals are preferred for patients with extensive fungal infections, contributing to the growth of the medication-based treatment segment in the market.

Moreover, side effects associated with these drugs are considerably less, still it is a hindering factor in the market. For example, in a clinical trial involving 602 patients treated with fluconazole for systemic fungal infections, including those who were immunocompromised or on multiple concomitant medications, side effects occurring in more than 1% of patients included nausea (3.7%), headache (1.9%), skin rash (1.8%), vomiting (1.7%), abdominal pain (1.7%), and diarrhea (1.5%). In a separate trial, 16 onychomycosis patients were treated with 100mg of fluconazole for six months, and one patient withdrew due to palpitations.

Pathogen Type Analysis

Dermatophytes dominated the Onychomycosis Treatment Market which accounted for over 72.7% market share, responsible for the majority of infections, especially caused by Trichophyton rubrum. Dermatophyte fungi are highly prevalent and are the most common cause of onychomycosis, making up nearly 70% of all cases.

As per a study published in the NCBI Journal in December 2023 highlighted data from a 2004 study conducted in collaboration with the American Academy of Dermatology, which reported a prevalence of 29.4 million cases of superficial fungal infections (SFIs). Between 1995 and 2004, there were approximately 51 million patient visits for these infections. Additionally, between 2005 and 2014, dermatophyte infections accounted for 4,981,444 outpatient visits in the United States, as reported by the Centers for Disease Control and Prevention (CDC). The direct medical cost associated with these infections was approximately USD 845 million in 2019.

The high prevalence of dermatophytes in onychomycosis drives the demand for targeted antifungal treatments, both oral and topical. The established clinical understanding of dermatophytes, along with the availability of effective treatments, further supports the dominance of this pathogen type. As a result, dermatophytes continue to be the leading contributor to the market’s growth in onychomycosis treatment.

Disease Type Analysis

Distal Subungual Onychomycosis (DSO) dominated the Onychomycosis Treatment Market accounting for 44.8% market share as the most common form of the disease. DSO accounts for over 40% of onychomycosis cases and is typically characterized by the infection starting at the tip of the nail, causing discoloration and thickening.

Distal subungual onychomycosis (DSO), the most common type of fungal nail infection, has a prevalence of roughly 2.6% to 2.8% in the general Spanish population according to ScienceDirect.com. More broadly, onychomycosis, which includes DSO, has prevalence rates ranging from 3% to 5% in most studies, but some reports suggest up to 26% in the general population.

The high prevalence of DSO leads to greater demand for antifungal treatments, both oral and topical. This form of onychomycosis is often linked with dermatophyte infections, particularly Trichophyton rubrum, further driving the adoption of effective treatment options. Due to its widespread occurrence and the need for timely management, DSO remains the leading contributor in the market.

Distribution Channels Analysis

Retail Pharmacies dominated the Onychomycosis Treatment Market, accounting for the largest share of sales with 48.7%. This is primarily due to their widespread availability and easy access for consumers. Many patients prefer purchasing over-the-counter (OTC) treatments for onychomycosis, such as topical antifungals, directly from retail pharmacies. The convenience of walking into a local pharmacy and receiving treatment without the need for a prescription has made this distribution channel highly popular.

In September 2024, F2G Ltd, a clinical-stage biopharmaceutical company, announced a US$100 million financing round to support its pipeline of treatments for rare and life-threatening fungal infections. This funding round is led by AMR Action Fund, with co-lead support from ICG. Existing investors—including Novo Holdings, Advent Life Sciences, Sofinnova Partners, Forbion, and others—have also participated actively. The strong investor backing highlights continued confidence in F2G’s novel antifungal research, addressing urgent unmet medical needs in infectious disease management.

Retail pharmacies continue to dominate the distribution channel for onychomycosis treatment, driven by their widespread accessibility. They offer a broad range of therapies suitable for mild to moderate infections, including over-the-counter and prescription-based options. Consumers prefer retail pharmacies due to their convenience, affordability, and familiarity with the service model. This makes them a preferred point of purchase for antifungal therapies. As awareness of fungal nail infections rises, retail pharmacy sales are expected to increase further, strengthening their market position across both urban and semi-urban regions.

Key Market Segments

By Treatment Type

- Medication-Based Treatments

- Device-Based Treatments

By Pathogen Type

- Dermatophytes

- Non-Dermatophyte Molds

- Yeasts

By Disease Type

- Distal Subungual Onychomycosis (DSO)

- Proximal Subungual Onychomycosis

- White Superficial Onychomycosis

- Candidal Onychomycosis

By Distribution Channels

- Retail Pharmacies

- Online Pharmacies

- Hospitals and Clinics

Drivers

Rising Incidence of Onychomycosis

The growing prevalence of onychomycosis is one of the key drivers in the market. Factors such as aging populations, increased diabetes prevalence, and compromised immune systems contribute significantly to the rising number of people affected by this fungal nail infection. For example, according to an observational and descriptive study of the epidemiology of and therapeutic approach to onychomycosis in dermatology offices in Brazil. A total of 7,852 patients participated in the study, with onychomycosis observed in 2,221 (28.3%) of them. The relationship between prevalence and other variables is detailed below.

Prevalence of Onychomycosis by Gender

Gender data was correctly filled out in the questionnaires for 7,849 patients. Among these, 2,219 were diagnosed with onychomycosis. Of the 5,369 women, 1,562 (29.1%) had onychomycosis, while among the 2,480 male patients, 657 (26.5%) were diagnosed with the condition (Graph 1). Of the patients diagnosed with onychomycosis, 1,562 (70.4%) were women. The condition is more common in older adults, particularly those with poor circulation, diabetes, or other health conditions that weaken immunity. From the same source, it was observed that the age group most affected was that of patients aged 60 years, followed by the range between 46 and 59 years.

Additionally, the rise in lifestyle-related issues, such as improper footwear and increased exposure to damp environments, has escalated the frequency of onychomycosis. These factors have led to a higher demand for effective treatment options, and the market is expected to witness further growth in the coming years.

Restraints

Side Effects associated with Current Treatments

While there are numerous treatment options available for onychomycosis, a significant restraint is the potential side effects associated with many of these treatments. Oral antifungal medications, for example, can cause gastrointestinal issues, liver toxicity, and other systemic side effects. This limits their use, particularly among patients with pre-existing health conditions, like liver disease or cardiovascular issues.

Treatment Side Effects Topical: Ciclopirox 8% Side Effects are Minimal. Transient erythema, redness, and burning Topical: Efinaconazole 10% Topical: Tavaborole 5% Topical: Luciconazole Topical: TDT 067 Oral : Terbinafine Drug-drug interactions, hepatotoxicity, and congestive heart failure. Oral: Terbinafine Oral: Itraconazole Oral: Fluconazole Oral: Fosravuconazole Oral: VT-1161 Laser: 1064 nm Nd:YAG lasers Generally mild and self-limited, mostly consisting of transient erythema, edema, mild pain, burning sensation, dry skin, and blisters. Laser: Both short-pulsed and Q-switched lasers Laser: Carbon dioxide lasers Laser: Diode 870, 930 Opportunities

Advancements in Laser Therapy

Non-invasive treatments, especially laser therapy, are rapidly gaining ground in the field of onychomycosis care. Laser treatments-like those utilizing Nd:YAG lasers—offer a modern alternative for patients with toenail fungal infections, particularly those who cannot or do not wish to use oral antifungal medications. One key advantage is that laser therapy avoids systemic side effects, making it a compelling option for those with contraindications to drug therapy. Additionally, patients often require fewer sessions compared to more traditional treatment approaches, adding a layer of convenience and time savings.

Recent studies and systematic reviews highlight that laser therapy can achieve moderate to high mycological cure rates, sometimes nearing 63–70% depending on the laser type and patient selection. While oral medications like terbinafine and itraconazole are still considered more effective for complete cure, lasers provide a safer profile with significantly fewer side effects, mostly limited to mild, temporary discomfort during treatment.

Looking at future market trends, the growing popularity and evolving clinical data around laser therapy are likely to accelerate market expansion for onychomycosis treatments. As both patient and practitioner demand for non-pharmacological, efficient solutions increases, laser technologies are poised to become a significant growth driver in this space.

Impact of Macroeconomic / Geopolitical Factors

Economic factors such as inflation, recession, and shifts in healthcare budgets directly affect both consumer and institutional behavior. During periods of economic uncertainty or recession, many patients may delay seeking treatment for nail disorders or gravitate toward more affordable over-the-counter (OTC) remedies rather than prescription medicines, which can be costly.

Similarly, health insurers and public health systems may tighten reimbursement policies or prioritise funding for more urgent health concerns, which can curb demand for newer, premium technologies like laser therapy. On the other hand, during times of economic strength, higher disposable income and consumer confidence can result in increased uptake of advanced therapies, as patients are more willing and able to invest in convenience and efficacy.

Geopolitically, international trade agreements, import/export restrictions, and sanctions can influence drug pricing, raw material access, and supply chain stability. For instance, global disruptions or trade tensions may lead to drug shortages or price volatility, impacting both manufacturers and patients. Stringent regulatory requirements—such as those imposed by the FDA, EMA, or local authorities—can either accelerate or delay new drug launches and the adoption of emerging therapies, depending on country-specific approval processes and healthcare infrastructure.

Latest Trends

Rising Demand for Over-the-Counter Treatments

A growing trend in the onychomycosis treatment market is the rising demand for over-the-counter (OTC) treatments. OTC antifungal medications, including topical creams, sprays, and nail lacquers, have become a go-to solution for individuals seeking convenience and cost-effective alternatives to prescription treatments.

This shift towards OTC options is driven by increased consumer awareness, accessibility, and the desire for easy-to-use treatments that can be applied at home. Many patients prefer OTC products for mild cases of onychomycosis as they can be purchased without a prescription, allowing for more immediate treatment. The increase in online sales channels has also contributed to this trend, making these products more readily available to a broader demographic. As a result, the demand for OTC onychomycosis treatments is expected to continue growing, driving further innovation and competition in the market.

For instance, in August 2023, Moberg Pharma AB announced that MOB-015 has received national approval in Sweden for the treatment of mild to moderate fungal nail infections in adults. This marks the second country to grant approval for MOB-015, following Ireland’s approval on July 31st. Additionally, Sweden is the first country to approve MOB-015 for over-the-counter (OTC) use.

Regional Analysis

North America is leading the Onychomycosis Treatment Market

North America leads the Onychomycosis Treatment Market accounting for over 40.4% market share due to factors such as advanced healthcare infrastructure, high awareness levels, and a significant patient base. The United States, in particular, accounts for a large share of the market, driven by the prevalence of onychomycosis, especially in older populations and those with underlying conditions like diabetes.

The presence of key players, such as Bausch Health and Novartis, offering widely used treatments like oral antifungals and topical solutions, further bolsters market growth. Additionally, North America benefits from widespread access to dermatologists, enabling early diagnosis and treatment. The region also sees high demand for advanced therapies like laser treatments, adding to its dominant market position.

In December 2021, Bausch Health Companies Inc. and its dermatology division, Ortho Dermatologics, made a key announcement. Their product, JUBLIA (efinaconazole) Topical Solution, 10%, received the APMA Seal of Approval. JUBLIA is used to treat onychomycosis, a fungal infection of the toenails. The product is part of Ortho Dermatologics, one of the largest prescription dermatology businesses in the U.S. The American Podiatric Medical Association (APMA) Seal highlights its clinical effectiveness and safety. This recognition may boost healthcare provider confidence and support increased product adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Onychomycosis Treatment market includes Bausch Health Companies Inc., Galderma S.A., Novartis AG, Pfizer Inc., Moberg Pharma AB, Cipla Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc (GSK), Kaken Pharmaceutical Co., Ltd., Merz Pharma, Bayer AG, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Lumenis Ltd., Medimetriks Pharmaceuticals Inc., TheOTCLab B.V., Xian Janssen Pharmaceutical Ltd., and Others.

Key Opinion Leaders

Leader Name Opinion Dr. Emily Patterson, MD, FAAD, Bausch Health Companies Inc. “Jublia (efinaconazole) has shown tremendous promise in my clinical practice for treating onychomycosis, especially in patients with mild-to-moderate infections. Topical treatments, like Jublia, allow patients to treat their condition without the systemic side effects often associated with oral antifungals. In my experience, early intervention with topical therapies can significantly reduce the progression of the disease and enhance patient compliance, which is crucial in managing onychomycosis effectively.” Dr. Liam Griffin, PhD, DSc, Galderma S.A. “I believe that oral antifungals have often been over-prescribed for onychomycosis, especially when effective topical treatments are available. Galderma’s new innovations in topical antifungal formulations offer a less invasive alternative for patients. By focusing on topical treatments, we can minimize the risk of side effects while ensuring that the infection is treated at the source. It’s important that clinicians adopt personalized treatment plans that are tailored to the severity of the infection and the patient’s individual needs.” Dr. Olivia Martinez, MD, PhD, Novartis AG “Tavaborole (Kerydin) has been a game-changer in the treatment of onychomycosis, especially for patients who have localized infections or who cannot tolerate oral antifungals due to underlying health conditions. The targeted action of Tavaborole allows for effective treatment with minimal systemic absorption, which is a significant advantage. I always emphasize the importance of combining topical therapies with early diagnosis. Educating patients on the chronic nature of the disease and the importance of adherence is key to achieving long-term success in managing onychomycosis.” Top Key Players in the Onychomycosis Treatment Market

- Bausch Health Companies Inc.

- Galderma S.A.

- Novartis AG

- Pfizer Inc.

- Moberg Pharma AB

- Cipla Limited

- Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc (GSK)

- Kaken Pharmaceutical Co., Ltd.

- Merz Pharma

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lumenis Ltd.

- Medimetriks Pharmaceuticals Inc.

- TheOTCLab B.V.

- Xian Janssen Pharmaceutical Ltd.

- Other key players

Recent Developments

- In September 2024, Moberg Pharma AB announced that it has received information regarding clinical cure outcomes in a subset of patients in its ongoing North American Phase 3 study for MOB-015, a treatment for nail fungus. The number of patients who have achieved clinical cure in this blinded subset is lower than the company’s expectations, prompting Moberg Pharma to inform the market about this development.

- In January 2024, Vanda Pharmaceuticals Inc. announced that the U.S. Food and Drug Administration (FDA) has approved the Investigational New Drug (IND) application to evaluate VTR-297 for the treatment of onychomycosis.

- In April 2020, the U.S. Food and Drug Administration (FDA) approved a supplemental New Drug Application for efinaconazole (JUBLIA) topical solution, 10%, to treat onychomycosis. This approval extends the use of efinaconazole to treat fungal infections of the toenails in patients aged 6 years and older.

Report Scope

Report Features Description Market Value (2024) US$ 3.88 billion Forecast Revenue (2034) US$ 5.97 billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Medication-Based Treatments and Device-Based Treatments), By Pathogen Type (Dermatophytes, Non-Dermatophyte Molds & Yeasts), By Disease Type (Distal Subungual Onychomycosis (DSO), Proximal Subungual Onychomycosis, White Superficial Onychomycosis & Candidal Onychomycosis), By Distribution Channels (Retail Pharmacies, Online Pharmacies, and Hospitals and Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bausch Health Companies Inc., Galderma S.A., Novartis AG, Pfizer Inc., Moberg Pharma AB, Cipla Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc (GSK), Kaken Pharmaceutical Co., Ltd., Merz Pharma, Bayer AG, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Lumenis Ltd., Medimetriks Pharmaceuticals Inc., TheOTCLab B.V., Xian Janssen Pharmaceutical Ltd., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Onychomycosis Treatment MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Onychomycosis Treatment MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bausch Health Companies Inc.

- Galderma S.A.

- Novartis AG

- Pfizer Inc.

- Moberg Pharma AB

- Cipla Limited

- Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc (GSK)

- Kaken Pharmaceutical Co., Ltd.

- Merz Pharma

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lumenis Ltd.

- Medimetriks Pharmaceuticals Inc.

- TheOTCLab B.V.

- Xian Janssen Pharmaceutical Ltd.

- Other key players