Global Online Food Delivery Market By Product Type (Grocery Delivery, and Meal Delivery), By Type (Platform To Consumer Delivery, Restaurant To Consumer Delivery), By Platform Type (Mobile Applications, Websites), By Business Model (Logistics-focused Food Delivery System, Order-focused Food Delivery System, Restaurant-specific Food Delivery System), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 100603

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

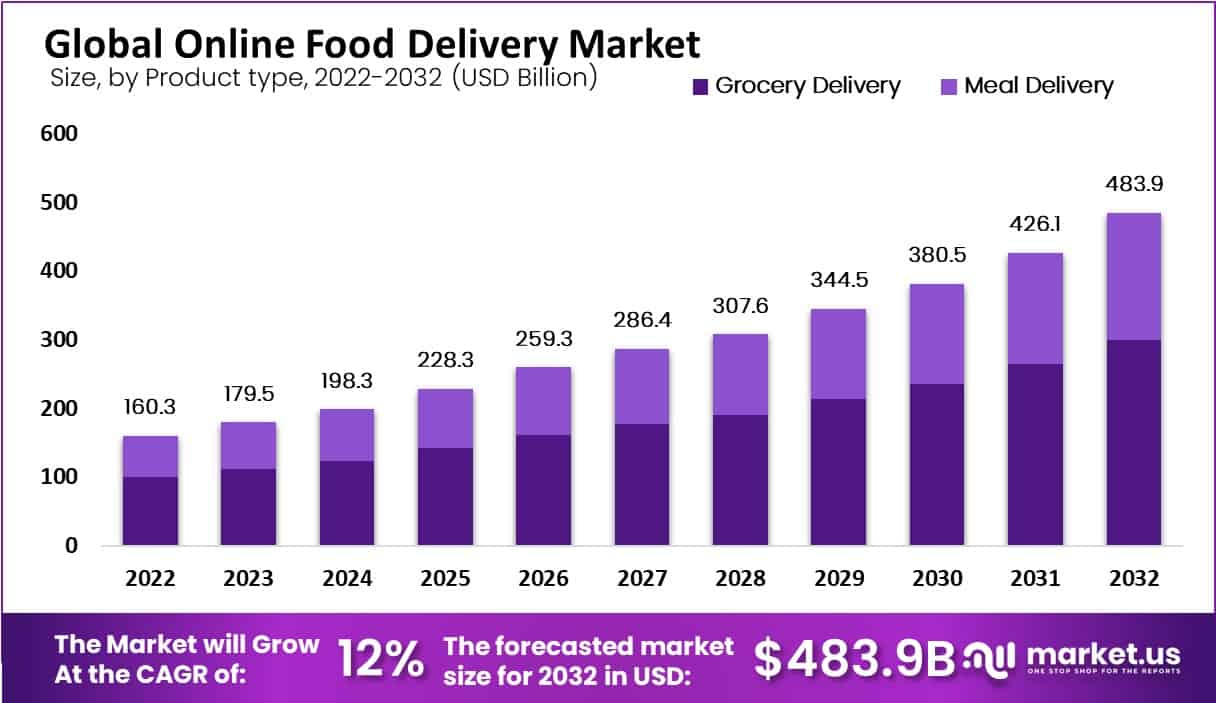

The Global Online Food Delivery Market size is expected to be worth around USD 483.9 Billion by 2033, from USD 179.5 Billion in 2023, growing at a CAGR of 12% during the forecast period from 2024 to 2033.

Online food delivery has transformed the way people order and enjoy food. With just a few taps on a smartphone or clicks on a computer, customers can conveniently browse menus, select their favorite dishes, and have them delivered right to their doorstep. This modern approach to food delivery has gained immense popularity due to its convenience, time-saving benefits, and wide variety of culinary options available.

The Online Food Delivery Market is experiencing rapid expansion, fueled by the increasing convenience it offers and the widespread availability of internet access. As lifestyles become busier and more people seek efficient ways to manage their time, the demand for food delivery services continues to soar. This growth is also propelled by technological advancements, which improve the ordering and delivery processes, making them faster and more user-friendly.

One of the growth factors driving the online food delivery market is the increasing demand for convenience. People today lead busy lives and often find it difficult to cook or dine out regularly. Online food delivery offers a convenient solution by allowing customers to order food from their favorite restaurants and have it delivered right to their doorstep. This convenience factor has been a major driver of the market’s growth.

Another factor contributing to the growth of online food delivery is the widespread use of smartphones and the internet. With the rise of mobile applications and easy access to the internet, ordering food online has become incredibly accessible. Customers can simply browse through menus, place orders, and make payments with just a few taps on their smartphones. This ease of use has made online food delivery a preferred choice for many consumers

Moreover, the COVID-19 pandemic has further accelerated the growth of the online food delivery market. Lockdowns and social distancing measures forced many restaurants to close their dine-in services, leading to a surge in demand for food delivery. Online platforms quickly adapted to this demand, providing safe and contactless delivery options. This situation has significantly boosted the market’s growth and established online food delivery as an essential service.

Despite the growth opportunities, the online food delivery market also faces challenges. One of the key challenges is maintaining profitability. The competition among various delivery platforms and the need to offer attractive discounts and promotions can put pressure on profit margins. Additionally, ensuring timely and efficient delivery can be a logistical challenge, especially during peak hours or in congested urban areas.

However, amidst these challenges, there are ample opportunities in the online food delivery market. Expanding into new markets, partnering with popular restaurants, and diversifying service offerings are some of the opportunities for growth. Furthermore, the adoption of technology, such as artificial intelligence and data analytics, can help optimize operations, improve customer experience, and drive innovation in the industry.

Key Takeaways

- The online food delivery market is expected to reach USD 483.9 billion by 2032, with a projected CAGR of 12%, driven by technological advancements and changing consumer preferences.

- The average revenue per user (ARPU) in the grocery delivery market is projected to be ~USD 505.11 in 2024.

- China is expected to generate the highest revenue in the online food delivery market, amounting to ~USD 448 billion in 2024.

- The research study predicts delivery revenue growth of 22.2% worldwide, with a notable increase of 29% in the United States.

- In the United States, the ARPU for online grocery deliveries is forecast to reach ~$1,360 in 2023, significantly higher than in China (~$487), Europe (~$448), and the global average (~$449).

- By 2027, approximately 2.5 billion people globally are expected to have meals delivered, with ~1.6 billion of these consumers located in Asia.

- In 2023, the number of online food delivery users worldwide surpassed 1.6 billion, marking a 12% increase from the previous year.

- The adoption of online food delivery services in rural areas saw a 25% increase in 2023, as major industry players expanded their services to previously underserved markets.

- The use of artificial intelligence and machine learning in online food delivery platforms increased by 22% in 2023, enhancing capabilities in personalization, demand forecasting, and route optimization.

- The online food delivery industry’s adoption of sustainable packaging and eco-friendly delivery options is expected to rise by 30% by the end of 2024.

- 68% of customers in the U.S. expressed a preference for ordering from local or independent restaurants through online delivery platforms in 2023.

- Drone deliveries are projected to exceed one million in 2024, although most delivery drones have a carrying capacity between 5 and 25 pounds, potentially limiting larger food orders.

Product Type Analysis

In 2022, the Grocery Delivery segment held a dominant market position within the Online Food Delivery Market, capturing more than a 62% share. This substantial market share can be attributed to several key factors that resonate with consumer preferences and lifestyle trends.

Primarily, the convenience of having groceries delivered directly to one’s door appeals to a wide demographic, including busy professionals, elderly individuals who may have mobility issues, and families that prefer shopping from home. Additionally, the rise of health-conscious consumers who seek fresh, high-quality ingredients for home-cooked meals has significantly fueled the growth of this segment.

The leadership of the Grocery Delivery segment is further reinforced by the strategic partnerships between grocery delivery services and major supermarkets and local food producers. These collaborations have enabled a wider range of products, including organic and specialty items, to be readily available, which caters to the diverse dietary preferences and needs of consumers.

Moreover, advancements in logistics and technology have streamlined the ordering and delivery process, enhancing the overall customer experience by ensuring reliability and speed in deliveries. These factors collectively contribute to why the Grocery Delivery segment is leading the Online Food Delivery Market.

The ongoing enhancements in service quality, coupled with the broadening of product offerings, suggest that this segment will continue to thrive. As consumers increasingly value convenience and quality, grocery delivery services are poised to expand their market presence further, tapping into new regions and demographics.

Type Analysis

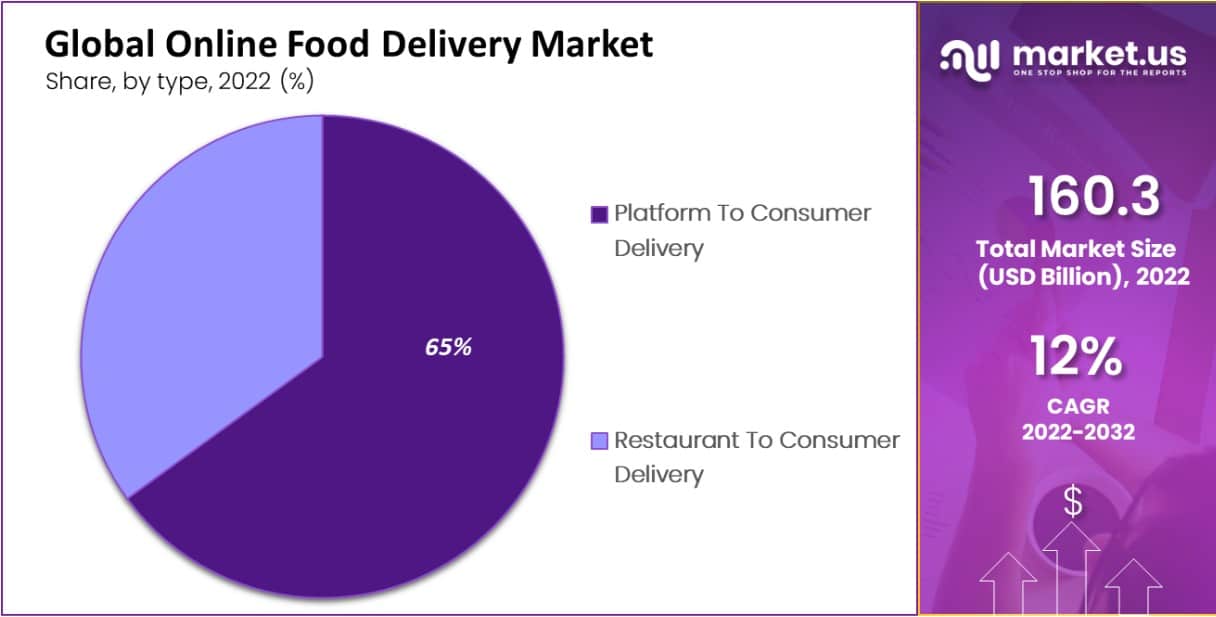

In 2022, the Platform to Consumer Delivery segment held a dominant market position within the Online Food Delivery Market, capturing more than a 65% share. This leadership is primarily driven by the seamless integration of technology in the delivery process, which significantly enhances user convenience.

Platforms that connect consumers directly with a wide range of restaurants offer the flexibility to choose from a variety of cuisines and menu items, all from a single application. This convenience, combined with the ability to easily compare prices, read reviews, and track orders in real-time, has made platform-to-consumer services especially popular among tech-savvy consumers.

Additionally, the success of the Platform to Consumer Delivery segment is bolstered by aggressive marketing campaigns and promotions that attract a substantial customer base. Many platforms utilize advanced data analytics to personalize marketing efforts, offering targeted promotions and discounts that encourage repeat business. The strategic use of technology not only improves customer engagement but also enhances operational efficiencies, enabling faster and more reliable delivery services.

The robust growth of this segment can also be linked to the increasing number of partnerships between delivery platforms and high-traffic restaurants, further expanding the choices available to consumers. These collaborations often result in exclusive deals, which are highly attractive to customers looking for convenience and value.

As digital platforms continue to evolve and refine their service offerings, the Platform to Consumer Delivery segment is expected to maintain its leading position by adapting to changing consumer preferences and technological advancements.

Platform Type Analysis

In 2022, the Mobile Applications segment held a dominant market position in the Online Food Delivery Market, capturing more than a 73% share. This impressive dominance is largely due to the pervasive use of smartphones and the increasing consumer preference for on-the-go access to services.

Mobile applications offer unparalleled convenience, allowing users to order food with just a few taps from anywhere at any time. This ease of use aligns perfectly with the fast-paced lifestyles of modern consumers who value quick and efficient solutions to their daily needs. Furthermore, mobile apps enhance the user experience through features like saved preferences, order tracking, and customized recommendations based on previous orders.

These functionalities not only simplify the ordering process but also make it more engaging and personalized, significantly boosting customer satisfaction and loyalty. The integration of various payment options within these apps, from credit cards to mobile wallets, further adds to their convenience, broadening their appeal across different user demographics.

The leadership of the Mobile Applications segment is also supported by continuous technological advancements that improve app functionalities and user interfaces. Developers constantly update mobile apps to ensure they are more intuitive, secure, and feature-rich, which attracts new users while retaining existing ones. As mobile connectivity and smartphone penetration continue to increase globally, the Mobile Applications segment is expected to maintain its leading position by continuously adapting to consumer preferences and technological trends.

Business Model Analysis

In 2022, the Order-focused Food Delivery System segment held a dominant market position within the Online Food Delivery Market. This model, which acts as a mediator between customers and various restaurants, capitalizes on the breadth of its culinary offerings, allowing consumers to explore and order from a diverse array of eateries via a single platform.

This convenience is a critical factor driving its popularity, as it provides users with the flexibility to choose meals that cater to a wide range of tastes and dietary preferences all in one place. The success of the Order-focused Food Delivery System is also supported by its ability to simplify the ordering process. These platforms handle the customer interface, providing a seamless ordering experience that includes easy-to-navigate menus, customer reviews, and comparison options.

Enhanced by robust backend support, they manage the complexities of order tracking and customer service, ensuring that the consumer experience is smooth and hassle-free. This focus on customer satisfaction helps in retaining a loyal customer base and attracts new users who seek convenience and variety.

Moreover, the leading position of this segment is reinforced by strategic partnerships with a multitude of restaurants, which not only expands the variety of food options available but also includes exclusive deals and discounts that are attractive to users. As these platforms continue to evolve, incorporating advanced technologies like AI to predict ordering patterns and offer personalized recommendations, their market share is expected to grow. This continual innovation and adaptation to consumer needs are why the Order-focused Food Delivery System remains a leading segment in the market.

Key Market Segments

Based on Product Type

- Grocery Delivery

- Meal Delivery

Based on Type

- Platform To Consumer Delivery

- Restaurant To Consumer Delivery

Based on the Platform Type

- Mobile Applications

- Websites

Based on the Business Model

- Logistics-focused Food Delivery System

- Order-focused Food Delivery System

- Restaurant-specific Food Delivery System

Driver

Convenience and Technological Integration

The primary driver of the Online Food Delivery Market is the convenience offered by these services, coupled with extensive technological integration. Consumers appreciate the ease of ordering food with just a few clicks, which is particularly appealing given the hectic and busy lifestyles many lead today. Moreover, the market has been propelled by the integration of advanced technologies like AI and machine learning, which enhance user experience through personalized recommendations and more efficient service delivery mechanisms.

Restraint

Desire for Fine Dining Experiences

A significant restraint in the Online Food Delivery Market is the consumer’s desire for fine dining experiences that online delivery simply cannot replicate. Many customers still prefer the ambiance, customer service, and quality assurance that come with dining out. This preference challenges the online food delivery sector, as it must constantly innovate to enhance meal quality and variety to mimic the dine-in experience closely.

Opportunity

Expansion into Health and Wellness Foods

There is a substantial opportunity for growth in the health and wellness sector within the Online Food Delivery Market. As health-consciousness rises, more consumers are looking for convenient access to nutritious and well-prepared meals. Online food delivery platforms can capitalize on this trend by partnering with restaurants that offer healthy food options or even specializing in the delivery of health-focused meals and organic products.

Challenge

Managing Large Delivery Volumes

One of the main challenges faced by the Online Food Delivery Market is managing the surge in delivery volumes, especially as the market grows. High order volumes can lead to logistical complications, slower delivery times, and potential errors in order fulfillment. This issue is particularly pressing during peak hours or in densely populated urban areas where the demand for quick and efficient service is highest. Addressing these operational challenges is crucial for maintaining customer satisfaction and service reliability.

Growth Factors

- Increasing Internet Penetration and Smartphone Usage: The rise in internet connectivity and the widespread adoption of smartphones have significantly facilitated the expansion of online food delivery services, allowing users easy access to various culinary options through apps and websites.

- Changing Consumer Lifestyles: Busy lifestyles and increasing disposable incomes have shifted consumer preferences towards convenience, making online food delivery a preferred option for many, especially among the urban population.

- Technological Advancements: Continuous improvements in technology enhance the customer experience by simplifying the ordering process and integrating features like order tracking, personalized recommendations, and more efficient delivery systems.

- Growth of Cloud Kitchens: The model of cloud kitchens has gained popularity as it reduces the overhead for new and existing restaurateurs, aligning well with the surge in online food orders and expanding the variety of offerings available through online delivery platforms.

- Proliferation of Online Payment Options: The integration of various secure and convenient online payment methods has supported the growth of online food delivery services, catering to a tech-savvy consumer base that prefers cashless transactions.

Emerging Trends

- Customization and Personalization: There is an increasing focus on personalized customer experiences, where AI and data analytics are used to tailor menus and make recommendations based on past consumer behavior.

- Expansion into Health and Wellness: As health consciousness rises among consumers, there’s a noticeable trend in online food delivery services offering more healthy, organic, and specialty diet options.

- Use of Eco-friendly Packaging: With growing environmental concerns, more online food delivery companies are adopting sustainable practices, including the use of reusable or biodegradable packaging to appeal to eco-conscious consumers.

- Diversification of Services: Many online food delivery platforms are expanding their services beyond just food delivery to include grocery delivery, meal-kit services, and more, broadening their market reach and customer base.

- Integration of Advanced Technologies: The implementation of robotics and drones for food delivery is on the rise, aiming to reduce delivery times and costs while increasing efficiency and customer satisfaction.

Regional Analysis

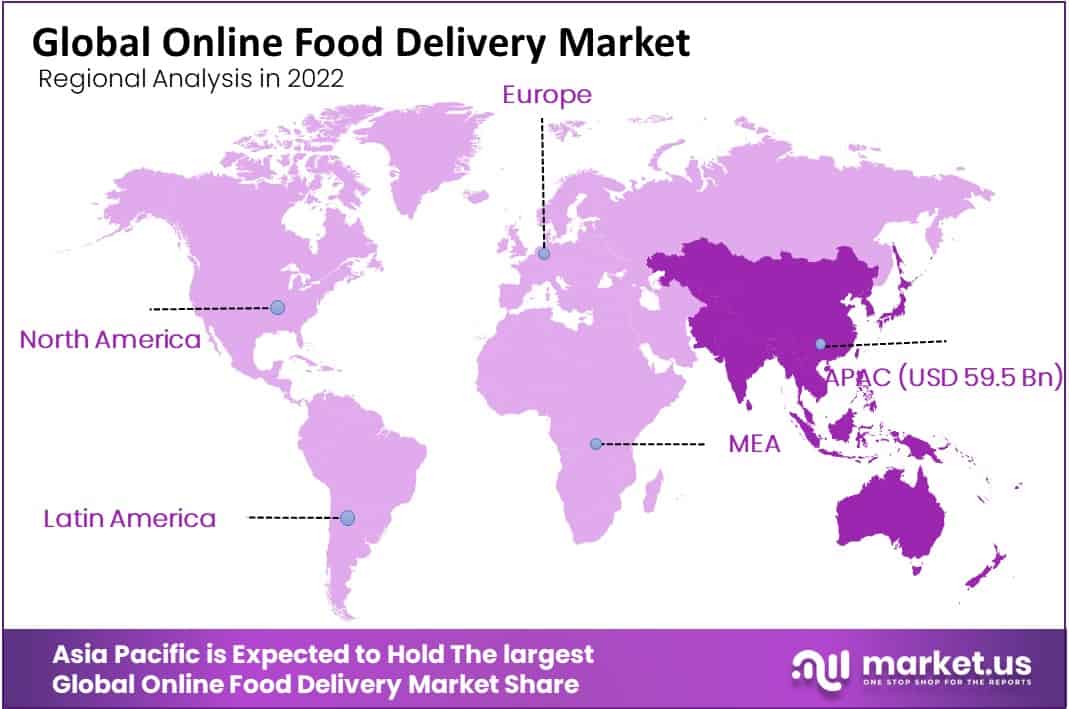

In 2022, Asia Pacific held a dominant market position in the Online Food Delivery Market, capturing more than a 37% share with revenue reaching USD 59.5 billion. This substantial market share is primarily driven by the high population density of the region and the rapid urbanization in countries like China, India, and Japan.

The increasing penetration of internet and smartphone usage in these areas has significantly facilitated the growth of online food delivery services. Moreover, the vibrant food culture and the willingness of consumers to experiment with diverse cuisines have also contributed to the robust growth of this market in the Asia Pacific region.

Meanwhile, North America is also a significant player in the Online Food Delivery Market. This region benefits from a well-established technological infrastructure, which supports sophisticated online ordering systems and efficient delivery logistics. North America’s market is characterized by high consumer spending capability and a substantial demand for convenience, factors that are crucial for the growth of online food delivery services.

The region’s diverse dietary preferences and the presence of various dietary trends, such as veganism and organic food consumption, provide ample opportunities for service providers to diversify their offerings and cater to niche markets. In addition, North America’s food delivery market is bolstered by strategic advancements in service tactics, including the integration of AI and machine learning for improved customer interaction and service personalization.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The food delivery market is highly competitive, with the highest number of players operating in different regions of the world. Uber Eats is one of the biggest players in the food delivery industry, with a global market share of around 30%. The company operates in over 6,000 cities worldwide and partners with over 500,000 restaurants.

Top Key Players in the Market

- Doordash Inc.

- Roofoods Limited (Deliveroo)

- Grubhub Inc.

- Delivery Hero SE

- Uber Technologies Inc.

- Zomato Limited

- Domino’s Pizza Inc.

- Papa John’s International Inc.

- me (Ali baba)

- Pizza Hut

- McDonald’s Corp.

- Other Key Players

Recent Developments

- In April 2023, DoorDash acquired Bbot, a digital ordering and payment solution, enhancing its services for hospitality venues.

- In May 2023, Takeaway.com expanded its grocery delivery services in several European markets, aiming to compete with rapid delivery startups.

- In December 2023, Delivery Hero acquired a majority stake in Glovo, a Spanish on-demand delivery company, to strengthen its presence in Southern Europe.

Report Scope

Report Features Description Market Value (2023) USD 179.5 Bn Forecast Revenue (2032) USD 483.9 Bn CAGR (2023-2032) 12% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type-Grocery Delivery, and Meal Delivery; By Type-Platform to Consumer Delivery, and Restaurant to Consumer Delivery; By Platform-Mobile Applications, and Websites); By Business Model- logistics-Focused food delivery system, Order-focused food delivery system, Restaurant-specific food delivery system; Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Doordash Inc., Takeaway.com Group B.V., Roofoods Limited (Deliveroo), Grubhub Inc., Delivery Hero SE, Uber Technologies Inc., Waiter.com Inc., Zomato Limited, Domino’s Pizza Inc., Papa John’s International Inc., Ele.me (Ali baba), Pizza Hut, McDonald’s Corp., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is online food delivery?Online food delivery is a service that allows customers to order food from restaurants and have it delivered to their doorstep through a digital platform, typically a website or a mobile app.

How does online food delivery work?Customers browse through menus and select dishes from various restaurants using a food delivery app or website. Once the order is placed and payment is made online, the restaurant prepares the food, and a delivery partner picks it up and delivers it to the customer's specified location.

What are the benefits of online food delivery?- Convenience: Customers can order food from a wide range of restaurants without leaving their homes.

- Variety: Access to diverse cuisines and restaurants.

- Time-saving: Avoids the need to cook or travel to a restaurant.

- Tracking: Real-time order tracking to know the status of the delivery.

- Contactless: Especially valuable during times of health concerns (e.g., pandemics).

How do online food delivery platforms make money?Online food delivery platforms typically generate revenue through a combination of commission fees charged to restaurants for using their platform, delivery fees charged to customers, and sometimes additional fees for premium services like faster delivery.

How has COVID-19 impacted the online food delivery market?The COVID-19 pandemic significantly increased the demand for online food delivery due to lockdowns, social distancing, and restaurant closures. Many businesses shifted their focus to delivery and takeout to survive.

Online Food Delivery MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Online Food Delivery MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Doordash Inc.

- com Group B.V.

- Roofoods Limited (Deliveroo)

- Grubhub Inc.

- Delivery Hero SE

- Uber Technologies Inc.

- com Inc.

- Zomato Limited

- Domino’s Pizza Inc.

- Papa John's International Inc.

- me (Ali baba)

- Pizza Hut

- McDonald's Corp.

- Other Key Players