Global Oligofructose Market Size, Share, And Business Benefits By Source (Organic, Inorganic), By Product Type (Powder, Liquid, Crystal, Pill), By Application (Food and Beverages, Infant Formula, Dietary Supplements, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157085

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

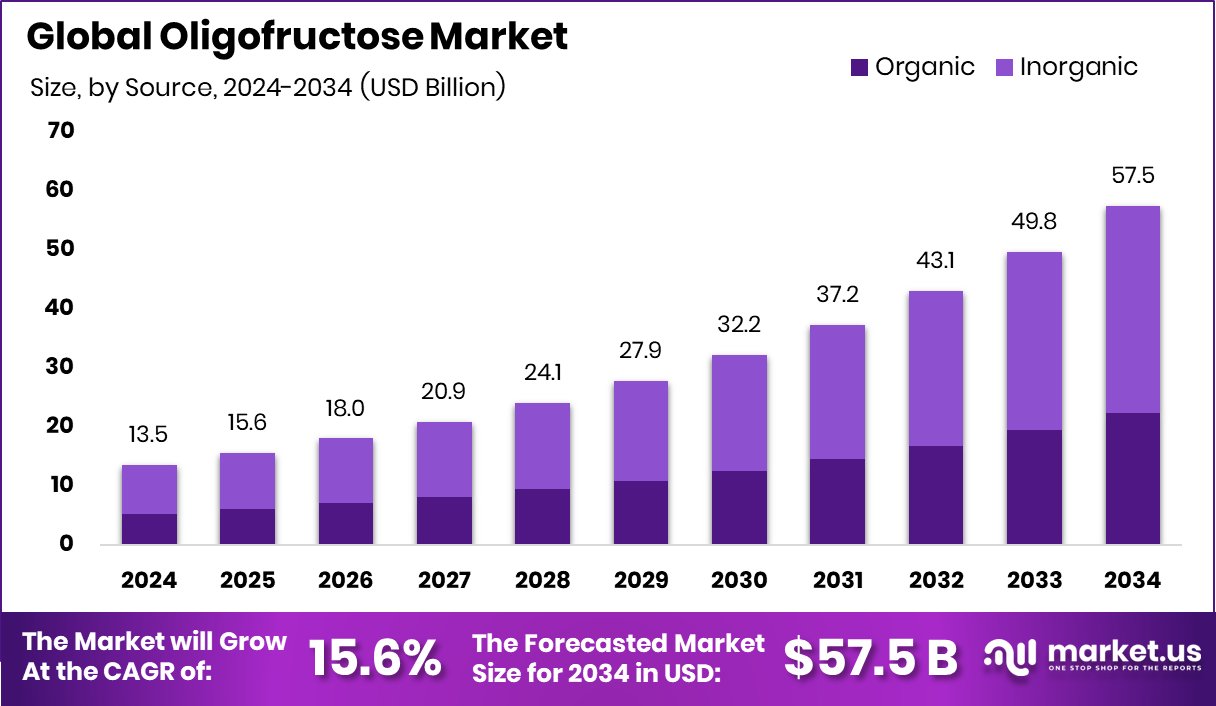

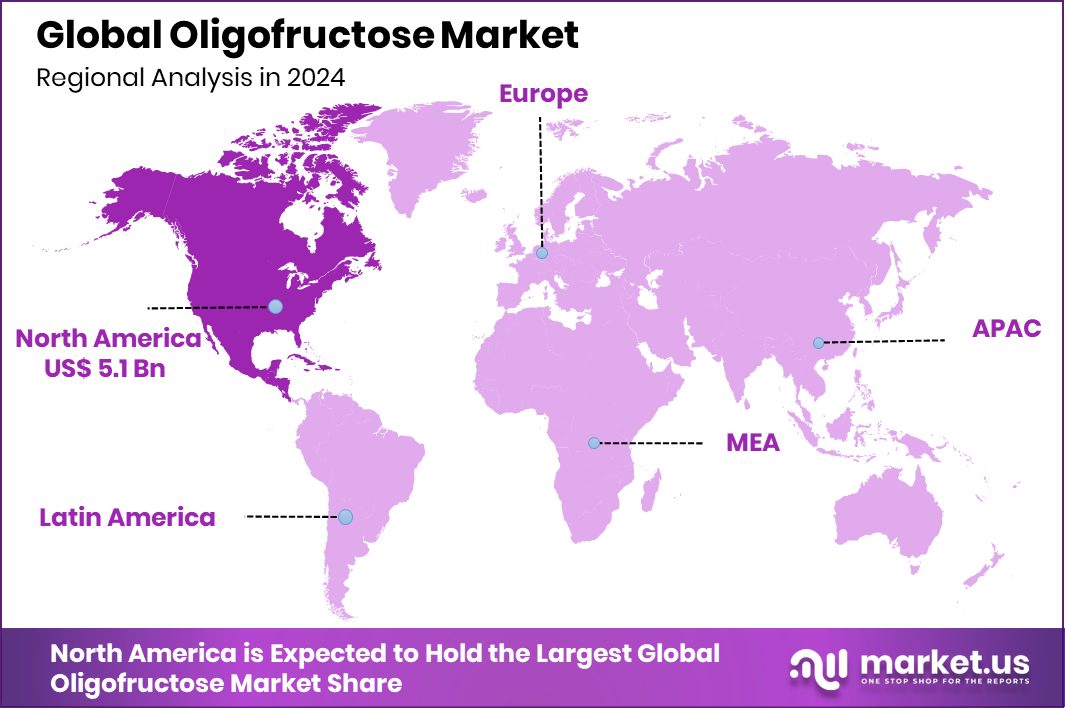

The Global Oligofructose Market is expected to be worth around USD 57.5 billion by 2034, up from USD 13.5 billion in 2024, and is projected to grow at a CAGR of 15.6% from 2025 to 2034. With a 38.4% share, North America’s oligofructose market, USD 5.1 Bn, shows strong regional growth.

Oligofructose is a type of prebiotic fiber derived mainly from chicory root, wheat, or other natural sources. It consists of short chains of fructose molecules and is known for its ability to support gut health by stimulating the growth of beneficial bacteria such as bifidobacteria. It is slightly sweet, low in calories, and often used in food and beverage products as a sugar substitute and fiber enhancer. According to an industry report, ARTAH Nutrition secures £2.85m funding to expand its dietary supplement operations.

The oligofructose market refers to the global trade and consumption of this functional ingredient, driven by its wide use in dietary supplements, bakery, dairy, and functional beverages. With rising consumer awareness of digestive health and natural sweeteners, the market is witnessing steady growth. Food manufacturers are also including oligofructose in clean-label and reduced-sugar products, further broadening its applications. According to an industry report, the FDA requests $7.2 billion to boost food safety, nutrition, medical product oversight, and public health.

One key growth factor is the rising focus on digestive wellness and immunity. As consumers increasingly turn toward prebiotics and probiotics, oligofructose is becoming a preferred choice due to its scientifically backed benefits for gut microbiota balance and overall health. According to an industry report, Unilever Ventures invests $6 million in a Series A round for Perelel Health, a vitamin company.

Demand is also shaped by the growing preference for low-calorie and sugar-free foods. With concerns about obesity and diabetes on the rise, manufacturers are replacing artificial sweeteners with healthier natural options, and oligofructose fits this shift perfectly. According to an industry report, Evidose, based in Warsaw, raises €455k to support the validation of dietary supplement effectiveness.

Key Takeaways

- The Global Oligofructose Market is expected to be worth around USD 57.5 billion by 2034, up from USD 13.5 billion in 2024, and is projected to grow at a CAGR of 15.6% from 2025 to 2034.

- In 2024, inorganic oligofructose dominated the market with 61.2%.

- Powder oligofructose led the market with a 56.4% share in 2024.

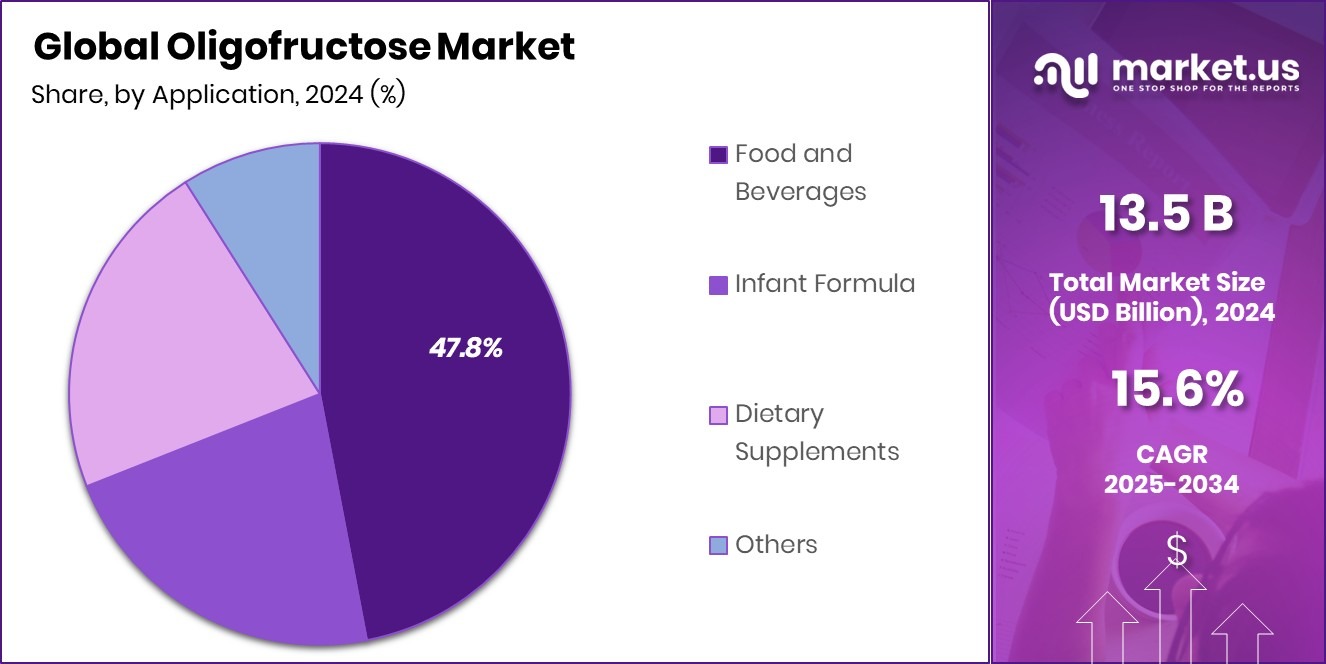

- Food and beverages captured a 47.8% share of the oligofructose market.

- Rising health awareness in North America, valued at USD 5.1 Bn, supports oligofructose market expansion.

By Source Analysis

In 2024, inorganic sources dominated the Oligofructose market, capturing more than 61.2% share.

In 2024, Inorganic held a dominant market position in the By Source segment of the Oligofructose Market, with a 61.2% share. This leadership reflects the strong reliance on large-scale industrial production methods that enable consistent supply, cost-effectiveness, and quality uniformity.

Inorganic sources are widely adopted as they support high-volume manufacturing and meet the rising demand from the food and beverage sector. Their ability to provide stable formulations makes them a preferred choice for processed foods, functional beverages, and nutraceutical applications, where reliability and scalability are critical.

The dominance of inorganic sources is also tied to their established use in the production of prebiotics and dietary fibers. These sources are seen as more economical compared to organic alternatives, making them attractive for manufacturers who seek efficiency while catering to growing consumer demand for gut health and reduced-sugar products. In addition, inorganic sourcing ensures supply chain stability, reducing dependency on agricultural yields that may fluctuate due to climatic conditions.

Looking forward, the share of inorganic sources is expected to remain significant as companies continue to invest in expanding production capacity. With consumer demand for low-calorie and functional foods on the rise, inorganic sourcing provides a practical pathway to meet market needs consistently.

By Product Type Analysis

Powder form led the Oligofructose market in 2024, holding a strong 56.4% market share.

In 2024, Powder held a dominant market position in By Product Type segment of the Oligofructose Market, with a 56.4% share. The powder form of oligofructose has gained preference due to its versatility, ease of handling, and wide range of applications across the food, beverage, and nutraceutical industries. Its stable nature and longer shelf life make it suitable for large-scale production and distribution, while its ability to blend seamlessly with other ingredients supports its integration in functional foods and dietary supplements.

The popularity of powdered oligofructose is also linked to its convenience in formulation. It offers manufacturers flexibility in producing bakery items, dairy products, and powdered health mixes where texture, taste, and uniformity are important. Additionally, the powdered form is easier to transport and store compared to liquid alternatives, lowering overall supply chain costs and ensuring consistent quality for end-use industries.

The strong uptake of powder reflects consumer demand for products that support digestive health and reduced sugar intake. Powdered oligofructose is frequently used as a low-calorie sweetener and prebiotic fiber, fitting well into the growing trend of health-oriented foods. This steady demand ensures the powdered segment maintains its leadership in the oligofructose market going forward.

By Application Analysis

Food and beverages application drove the Oligofructose market in 2024, accounting for 47.8% share.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Oligofructose Market, with a 47.8% share. This leadership highlights the growing integration of oligofructose into everyday consumables, as manufacturers respond to rising consumer interest in healthier and functional food options.

Within this segment, oligofructose is widely used in bakery, dairy, confectionery, and beverages due to its dual role as a natural sweetener and prebiotic fiber. Its ability to enhance taste while reducing sugar content makes it highly valuable in formulating low-calorie and sugar-free products.

The dominance of food and beverages is also driven by the global shift toward digestive health and wellness. Consumers are increasingly seeking products that offer added nutritional benefits, and oligofructose meets this demand by promoting gut health and improving satiety. Its versatility allows manufacturers to incorporate it into a variety of items, ranging from yogurts and smoothies to energy bars and fortified drinks.

The segment’s leadership further reflects the broad commercial acceptance of oligofructose in clean-label and functional formulations. With food and beverage companies innovating rapidly to meet consumer expectations, this application area is set to sustain strong momentum, ensuring oligofructose remains a key ingredient in the sector’s growth.

Key Market Segments

By Source

- Organic

- Inorganic

By Product Type

- Powder

- Liquid

- Crystal

- Pill

By Application

- Food and Beverages

- Infant Formula

- Dietary Supplements

- Others

Driving Factors

Rising Demand for Prebiotic and Digestive Health Products

One of the strongest driving factors for the oligofructose market is the rising global demand for prebiotic and digestive health products. Consumers today are more aware of the importance of gut health, which is directly linked to overall wellness and immunity.

Oligofructose, being a natural prebiotic fiber, supports the growth of beneficial gut bacteria, making it a preferred ingredient in functional foods and supplements. The trend toward clean-label and natural products has further strengthened its demand in bakery, dairy, and beverages.

With lifestyle-related issues such as obesity and digestive problems increasing, people are actively seeking foods that deliver both taste and health benefits. This steady consumer shift is fueling the strong growth of oligofructose in global markets.

Restraining Factors

High Production Costs Limit Wider Market Expansion

A major restraining factor for the oligofructose market is the high production cost associated with its extraction and processing. Oligofructose is mainly derived from sources like chicory root, and the manufacturing process involves specialized technology and equipment to maintain purity and quality.

These factors raise the overall cost, making the end product more expensive compared to other fibers or sweeteners. For many manufacturers in developing regions, this creates barriers to adoption since cost-sensitive markets may prefer cheaper alternatives.

Additionally, fluctuating raw material availability can further add to price instability. While demand for digestive health solutions is strong, high costs remain a hurdle that slows down mass penetration and limits its accessibility to wider consumer groups.

Growth Opportunity

Expanding Use in Functional and Plant-Based Foods

A key growth opportunity for the oligofructose market lies in its expanding use within functional and plant-based food categories. As consumers shift toward healthier diets, there is a strong demand for products that offer both nutritional benefits and clean-label appeal.

Oligofructose, with its natural prebiotic properties and low-calorie sweetness, fits perfectly into this trend. It can be easily incorporated into plant-based dairy alternatives, protein bars, energy drinks, and fortified snacks, making it attractive for brands innovating in health-focused product lines.

Moreover, the rising popularity of vegan and vegetarian diets opens doors for oligofructose to act as both a functional ingredient and a sugar replacer. This broadening application base presents significant long-term growth opportunities for the market.

Latest Trends

Growing Popularity of Clean-Label Prebiotic Ingredients

One of the latest trends in the oligofructose market is the growing popularity of clean-label prebiotic ingredients. Consumers are becoming more cautious about what goes into their food and prefer products with simple, natural, and recognizable ingredients.

Oligofructose fits this demand well since it is derived from natural sources and provides both sweetness and digestive health benefits without artificial additives. Food and beverage companies are increasingly reformulating their products to highlight oligofructose on labels, positioning it as a functional fiber that supports gut health.

This clean-label movement is not just a passing preference but a long-term trend, and it is pushing manufacturers to innovate while using oligofructose as a trusted, consumer-friendly ingredient.

Regional Analysis

In 2024, North America dominated the Oligofructose Market with a 38.4% share, worth USD 5.1 Bn.

The Oligofructose Market shows varied growth across global regions, with North America emerging as the leading market. In 2024, North America held a dominant position, accounting for 38.4% of the market and reaching a value of USD 5.1 Bn.

This leadership is driven by strong consumer awareness of digestive health, rising demand for functional foods, and the increasing shift toward natural and low-calorie ingredients. The region’s advanced food and beverage industry provides a favorable environment for the incorporation of oligofructose into dairy, bakery, and nutraceutical products.

Furthermore, the growing trend of clean-label and prebiotic-rich foods has strengthened its adoption among health-conscious consumers. Europe follows closely, supported by its established functional food sector and regulatory support for prebiotics. Asia Pacific is experiencing rapid momentum due to urbanization and dietary changes, while Latin America and the Middle East & Africa show steady but smaller growth patterns.

Overall, while all regions are contributing to the global market’s expansion, North America clearly dominates as the most influential player, reflecting both consumer demand and industry innovation in oligofructose applications. This regional strength positions North America as the benchmark for growth and innovation in the global oligofructose landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Baolingbao Biology Co. Ltd. continues to strengthen its presence in the oligofructose market with a strong focus on ingredient innovation and large-scale production capacity. The company has positioned itself as a key supplier in Asia and beyond, leveraging its expertise in functional sweeteners and dietary fibers. Its ability to provide consistent quality and competitive pricing makes it a vital player in meeting the rising global demand for prebiotic ingredients.

Beneo GmbH, a well-established name in functional ingredients, plays a central role in the market with its emphasis on health-driven solutions. The company has built its reputation around chicory root–based fibers, with oligofructose being one of its signature offerings. In 2024, Beneo’s strategy is centered on supporting digestive wellness, weight management, and blood sugar control, aligning closely with consumer health trends. Its strong R&D investments and collaborations with food and beverage manufacturers further reinforce its market leadership.

BRENNTAG SE, as a leading distributor of specialty chemicals and ingredients, contributes significantly to the oligofructose market by bridging the gap between manufacturers and end-use industries. In 2024, the company’s strength lies in its extensive global distribution network and technical expertise, enabling efficient supply to diverse sectors, including food, beverage, and nutrition. By offering tailored solutions and technical support, BRENNTAG adds value beyond distribution, ensuring oligofructose reaches a wide range of applications.

Top Key Players in the Market

- Baolingbao Biology Co. Ltd.

- Beneo GmbH

- BRENNTAG SE

- Cargill Inc.

- COSUCRA

- DSM-Firmenich AG

- Galam

- Ingredion Inc.

- Shandong Bailong Chuangyuan Bio-tech Co. Ltd.

Recent Developments

- In June 2025, DSM‑Firmenich broke ground on a new high-tech plant in Parma, Italy. This facility, expected to be completed by Q1 2027, will expand production of dry functional blends, including flavors and possibly fiber-infused products for food applications.

- In May 2025, Beneo entered a global strategic partnership with WACKER to launch the human milk oligosaccharide (HMO) 2’-Fucosyllactose (2’-FL). This move expands Beneo’s portfolio beyond chicory‑derived prebiotics into advanced infant nutrition. WACKER handles production through precision fermentation in Europe, and Beneo manages global commercialization.

Report Scope

Report Features Description Market Value (2024) USD 13.5 Billion Forecast Revenue (2034) USD 57.5 Billion CAGR (2025-2034) 15.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Inorganic), By Product Type (Powder, Liquid, Crystal, Pill), By Application (Food and Beverages, Infant Formula, Dietary Supplements, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Baolingbao Biology Co. Ltd., Beneo GmbH, BRENNTAG SE, Cargill Inc., COSUCRA, DSM-Firmenich AG, Galam, Ingredion Inc., Shandong Bailong Chuangyuan Bio-tech Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Baolingbao Biology Co. Ltd.

- Beneo GmbH

- BRENNTAG SE

- Cargill Inc.

- COSUCRA

- DSM-Firmenich AG

- Galam

- Ingredion Inc.

- Shandong Bailong Chuangyuan Bio-tech Co. Ltd.