Global Oily Skin Control Products Market Size, Share, Growth Analysis By Product (Cleansers, Moisturizers Toners, Masks, Others), By Function (Oil Absorption, Pore Minimization, Matte Finish, Others), By Active Ingredient (Niacinamide, Salicylic Acid, Clay/Minerals, Zinc PCA, Tea Tree Oil), By Claim (Oil-Free, Non-Comedogenic, Dermatologist-Tested, Fragrance-Free, Others), By End User (Teenagers/Young Adults, Adults, Men), By Distribution Channel (E-Commerce, Pharmacies/Drugstores, Mass Retail, Specialty Beauty Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159512

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Function Analysis

- Active Ingredient Analysis

- Claim Analysis

- End User Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Oily Skin Control Products Company Insights

- Recent Developments

- Report Scope

Report Overview

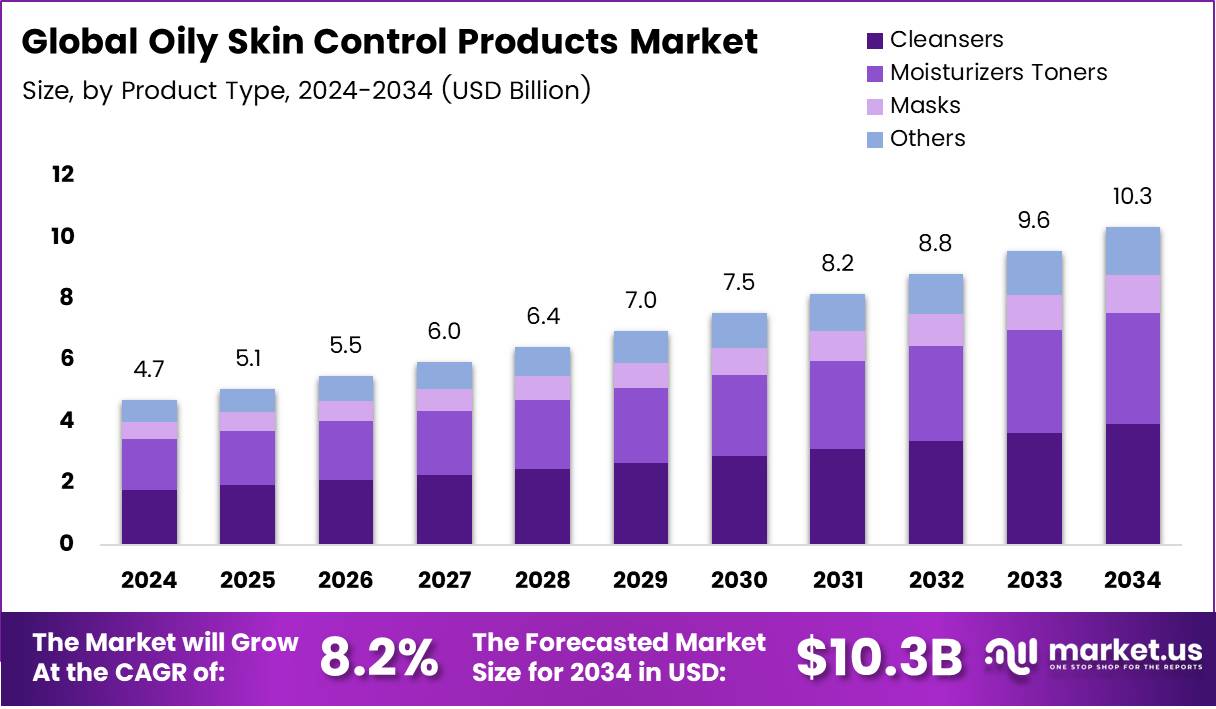

The Global Oily Skin Control Products Market size is expected to be worth around USD 10.3 Billion by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

The Oily Skin Control Products Market has seen consistent growth in recent years due to an increasing awareness of skincare and a growing demand for effective solutions. This market includes a range of products, such as cleansers, moisturizers, and exfoliators, designed specifically for individuals with oily skin. The rise in skin concerns, particularly acne and excess oil production, has driven the popularity of these products.

The market is expected to continue its expansion as consumers become more conscious of skincare routines. With increasing access to dermatological advice and information, there is an emphasis on products that offer tailored solutions for oily skin. Consumers are moving toward targeted skincare products designed for specific concerns like acne, enlarged pores, and oily texture.

Government investments and regulations also play a crucial role in shaping this market. In many regions, regulatory bodies ensure that skincare products meet specific safety and efficacy standards. This enhances consumer confidence and encourages the use of specialized skincare products, such as those for oily skin. Furthermore, governments are increasingly focusing on educating consumers about the benefits of proper skincare, which indirectly fuels the demand for oily skin control products.

Looking at consumer behavior, it is clear that a significant portion of people purchase skincare products to improve their appearance. According to industry reports, 56% of consumers buy skincare products for appearance enhancement, while 55.6% do so to feel better about themselves. In addition, 41.55% of consumers rely on dermatologists for trusted skincare advice, indicating the importance of professional recommendations in product choice.

The usage of skincare products has also risen, with 40% of facial skincare users reporting increased usage. This surge in product usage aligns with a growing trend of regular skincare routines, which include cleansers, exfoliators, and moisturizers. This indicates strong potential for sustained growth in the Oily Skin Control Products Market. As more consumers seek solutions to manage excess oil, this segment is positioned for continued expansion in the coming years.

Key Takeaways

- The Global Oily Skin Control Products Market is projected to reach USD 10.3 Billion by 2034, growing at a CAGR of 8.2% from 2025 to 2034.

- Cleansers dominate the market with a 38.1% share, crucial for removing excess oil and impurities.

- Oil Absorption functions lead with a 36.6% share, offering effective solutions for persistent oily skin concerns.

- Niacinamide captures 31.8% of the market due to its ability to regulate oil production and provide skin benefits.

- Oil-Free formulations hold a 33.4% market share, offering hydration without adding excess oil to the skin.

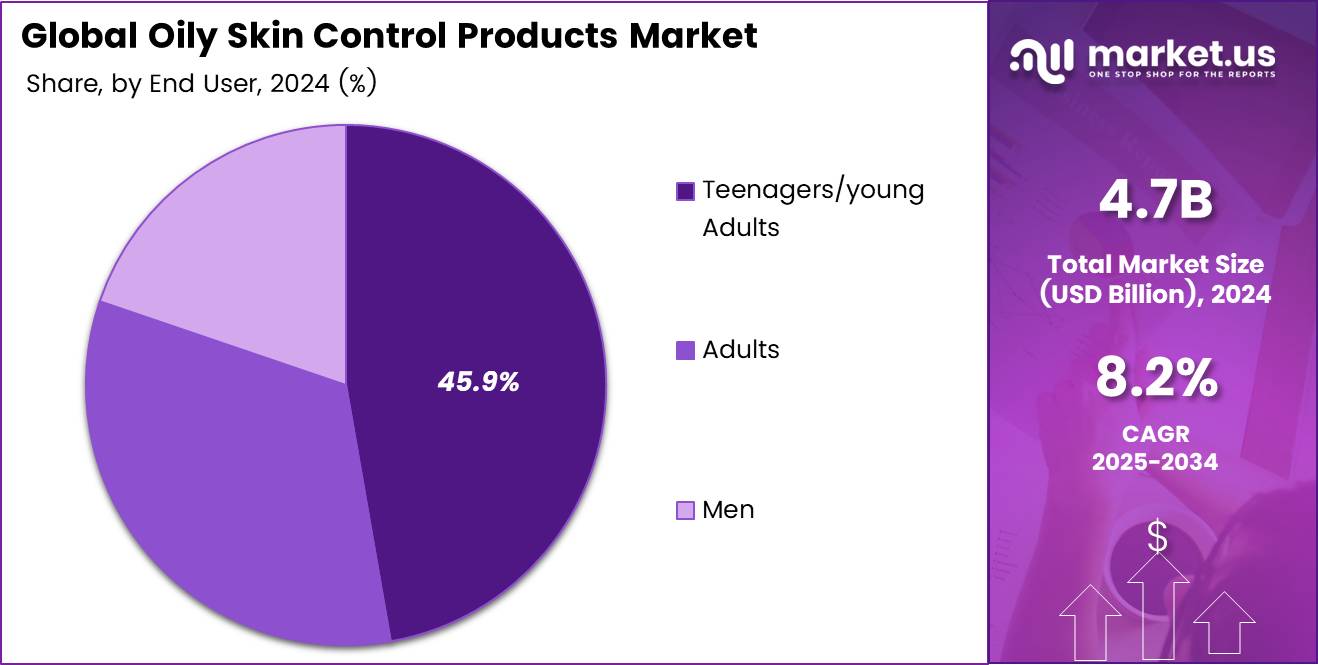

- Teenagers and Young Adults represent 45.9% of the market, driven by hormonal fluctuations causing increased oil production.

- E-Commerce channels lead with a 32.7% share, providing consumers with convenience and detailed product information.

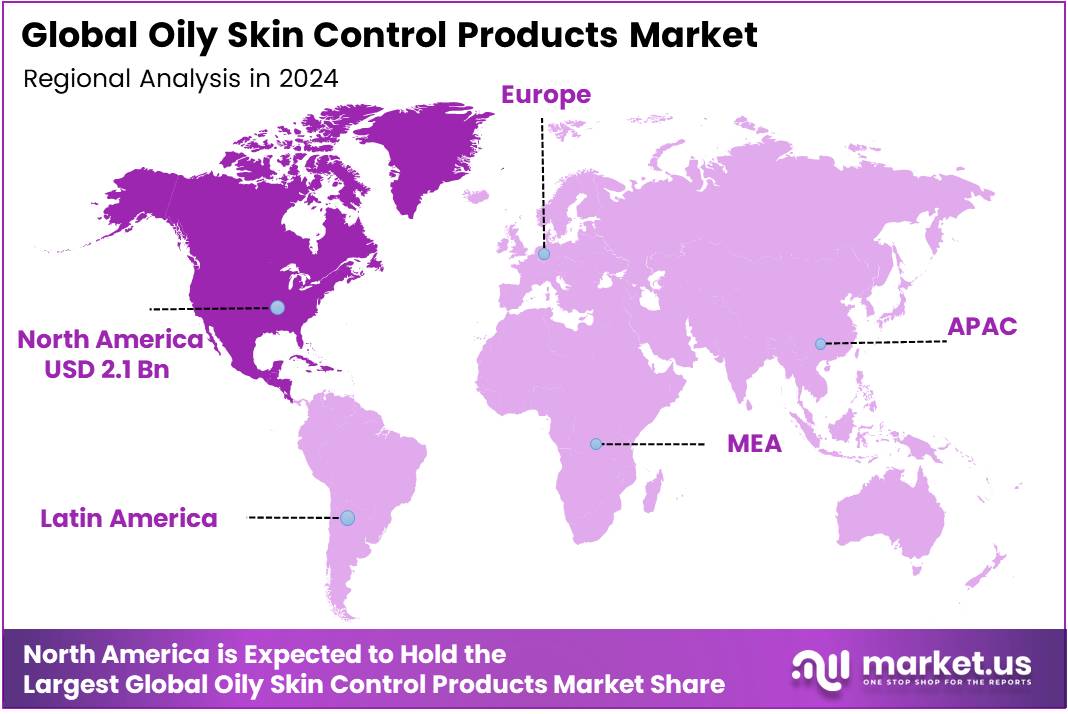

- North America dominates the market with a 45.2% share, valued at USD 2.1 Billion, driven by high demand and strong retail/e-commerce channels.

Product Type Analysis

Cleansers dominate with 38.1% due to their essential role in daily oily skin care routines and widespread consumer preference.

Cleansers represent the cornerstone of oily skin management, capturing 38.1% market share through their fundamental importance in removing excess sebum and impurities. Their daily-use nature and proven effectiveness in controlling oil production make them indispensable for consumers seeking comprehensive skincare solutions.

Moisturizers have gained significant traction as consumers increasingly recognize that proper hydration prevents overcompensation of oil production. These lightweight, non-greasy formulations specifically designed for oily skin help maintain optimal moisture balance while controlling shine throughout the day.

Toners serve as crucial intermediary products that remove residual impurities while preparing skin for subsequent treatments. Their astringent properties and pore-tightening benefits make them particularly appealing to consumers seeking multi-step skincare routines for enhanced oil control effectiveness.

Masks provide intensive treatment options for weekly deep-cleansing routines. Clay-based and purifying masks offer concentrated oil absorption and pore refinement, appealing to consumers seeking spa-like experiences at home for enhanced skincare results.

Function Analysis

Oil Absorption dominates with 36.6% due to its direct addressing of primary consumer concern regarding excess sebum production.

Oil Absorption functions lead the market with 36.6% share by directly targeting the core issue of oily skin. Products featuring advanced oil-absorbing technologies and ingredients provide immediate visible results, making them highly sought-after solutions for consumers experiencing persistent shine and greasiness concerns.

Pore Minimization represents a growing segment as consumers increasingly understand the connection between enlarged pores and oily skin. These products utilize specialized ingredients that temporarily tighten pores while providing long-term benefits through consistent usage and advanced formulation technologies.

Matte Finish functions cater to consumers seeking immediate aesthetic improvements. These products create smooth, shine-free surfaces that enhance makeup application and longevity, particularly appealing to working professionals and individuals requiring all-day oil control performance.

Other functions encompass specialized benefits like anti-bacterial properties, exfoliation, and brightening effects. These multi-functional products appeal to consumers seeking comprehensive skincare solutions that address oily skin while providing additional beauty and wellness benefits.

Active Ingredient Analysis

Niacinamide dominates with 31.8% due to its proven efficacy in regulating sebum production and improving skin texture.

Niacinamide commands 31.8% market share through its scientifically-proven ability to regulate oil production while providing additional skin benefits. This vitamin B3 derivative offers gentle yet effective results, making it suitable for sensitive oily skin types seeking long-term improvement without irritation.

Salicylic Acid remains a cornerstone ingredient for oily skin management through its beta-hydroxy acid properties. Its ability to penetrate pores and dissolve oil buildup makes it particularly effective for preventing breakouts while maintaining smooth skin texture and appearance.

Clay and Minerals provide natural oil absorption and purification benefits that appeal to consumers seeking organic and sustainable skincare solutions. These ingredients offer immediate oil control while delivering essential minerals that support overall skin health and balance.

Zinc PCA offers antimicrobial properties while regulating sebum production, making it ideal for consumers dealing with both oily skin and occasional breakouts. Tea Tree Oil provides natural antiseptic benefits with oil control properties, appealing to consumers preferring botanical ingredients.

Claim Analysis

Oil-Free claims dominate with 33.4% due to consumer preference for formulations that won’t exacerbate existing oily skin conditions.

Oil-Free formulations capture 33.4% market share by directly addressing consumer concerns about adding oils to already oily skin. These products utilize water-based or gel formulations that provide hydration and treatment benefits without contributing to excess sebum production or clogged pores.

Non-Comedogenic claims provide essential assurance to consumers prone to breakouts. These formulations undergo specific testing to ensure they won’t block pores, making them particularly appealing to individuals with acne-prone oily skin seeking reliable product performance.

Dermatologist-Tested claims offer professional validation and credibility that influences purchase decisions. These products provide consumer confidence through medical professional endorsement, particularly important for individuals with sensitive oily skin requiring gentle yet effective solutions.

Fragrance-Free formulations cater to consumers with sensitive skin or fragrance sensitivities. Other claims encompass various certifications and benefits like hypoallergenic properties, cruelty-free status, and sustainable packaging that appeal to environmentally conscious consumers seeking ethical beauty choices.

End User Analysis

Teenagers/Young Adults dominate with 45.9% due to hormonal changes during puberty causing increased sebum production and oily skin concerns.

Teenagers and Young Adults represent 45.9% of the market due to hormonal fluctuations during adolescence and early adulthood that trigger increased oil production. This demographic actively seeks effective solutions for managing shine, preventing breakouts, and maintaining clear skin during crucial social development periods.

Adults constitute a significant market segment as oily skin concerns often persist beyond adolescence. Environmental factors, stress, and lifestyle changes contribute to continued sebum production, creating demand for sophisticated formulations that address mature skin needs while controlling oil effectively.

Men represent a rapidly growing segment as male grooming awareness increases. Men’s oily skin products feature targeted marketing and formulations addressing specific male skin characteristics, including thicker skin texture and different hormonal influences on sebum production patterns.

This demographic expansion reflects changing attitudes toward male skincare and increasing recognition that oily skin management benefits from gender-specific approaches and product formulations designed for masculine preferences and lifestyle requirements.

Distribution Channel Analysis

E-Commerce dominates with 32.7% due to convenience, extensive product selection, and detailed customer reviews enabling informed purchasing decisions.

E-Commerce channels lead with 32.7% market share through unparalleled convenience and comprehensive product information access. Online platforms provide detailed ingredient lists, customer reviews, and comparison tools that help consumers make informed decisions about oily skin care products suited to their specific needs.

Pharmacies and Drugstores maintain strong presence through professional consultation and immediate product availability. These channels offer trusted environment where consumers can seek advice from pharmacists while accessing established brands with proven track records in oily skin management.

Mass Retail channels provide widespread accessibility and competitive pricing that appeals to budget-conscious consumers. These locations offer convenience shopping experiences where oily skin products are easily accessible alongside other daily necessities and personal care items.

Specialty Beauty Retail channels cater to consumers seeking premium formulations and personalized service. Other channels include direct-to-consumer sales, subscription services, and professional beauty supply stores that serve niche market segments with specialized requirements and preferences.

Key Market Segments

By Product

- Cleansers

- Moisturizers Toners

- Masks

- Others

By Function

- Oil Absorption

- Pore Minimization

- Matte Finish

- Others

By Active Ingredient

- Niacinamide

- Salicylic Acid

- Clay/Minerals

- Zinc PCA

- Tea Tree Oil

By Claim

- Oil-Free

- Non-Comedogenic

- Dermatologist-Tested

- Fragrance-Free

- Others

By End User

- Teenagers/Young Adults

- Adults

- Men

By Distribution Channel

- E-Commerce

- Pharmacies/Drugstores

- Mass Retail

- Specialty Beauty Retail

- Others

Drivers

Growing Prevalence of Oily Skin Issues Drives Market Growth

The oily skin control products market is experiencing significant growth due to several key factors. The increasing number of people suffering from oily skin problems has created a strong demand for effective solutions. This rise in oily skin issues is mainly caused by lifestyle changes, pollution, and dietary habits that affect skin health.

Consumer preferences are shifting toward skincare products that contain natural ingredients. People are becoming more conscious about what they put on their skin and prefer products with botanical extracts and organic components. This trend is pushing manufacturers to develop cleaner formulations.

There is growing awareness about the importance of skincare and personal grooming routines. Social media and beauty influencers have educated consumers about proper skincare practices. This has led to more people investing in quality oily skin control products as part of their daily routines.

The expansion of e-commerce platforms has made skincare products more accessible to consumers worldwide. Online shopping provides convenience and allows customers to compare products easily. Digital platforms also enable brands to reach customers in remote areas where physical stores may not be available.

Restraints

High Cost of Premium Products Creates Market Restraints

Despite the market’s growth potential, several factors are limiting its expansion. The high cost of premium oily skin control products makes them unaffordable for many consumers. Advanced formulations and high-quality ingredients drive up production costs, which are passed on to customers.

Limited availability in emerging markets restricts market growth in developing regions. Many international brands have not yet established strong distribution networks in these areas. Local consumers often have limited access to specialized oily skin products, creating an unmet demand.

Some oily skin products can cause negative side effects such as irritation, dryness, or allergic reactions. These adverse effects make consumers hesitant to try new products. Concerns about product safety and skin compatibility affect purchasing decisions.

The market faces intense competition from alternative skincare solutions. Home remedies, DIY treatments, and multi-purpose products offer cheaper alternatives to specialized oily skin control products. This competition pressures brands to differentiate their offerings and justify premium pricing.

Growth Factors

Demand for Gender-Specific Products Creates Growth Opportunities

The oily skin control products market presents several promising growth opportunities. There is increasing demand for gender-specific skincare products, particularly for men’s grooming. Male consumers are becoming more interested in skincare routines, creating a new market segment for brands to explore.

Environmental consciousness is driving interest in eco-friendly and sustainable skincare options. Consumers are seeking products with recyclable packaging and environmentally responsible manufacturing processes. Brands that adopt sustainable practices can capture this growing market segment.

Technological advancements in skincare formulations are opening new possibilities. Innovations like nanotechnology, microencapsulation, and targeted delivery systems are improving product effectiveness. These developments allow brands to create more sophisticated solutions for oily skin problems.

Companies are expanding their product lines to target specific age groups. Teen-focused products address hormonal skin changes, while anti-aging lines cater to mature consumers with oily skin. This age-specific targeting helps brands capture different consumer segments and increase market share.

Emerging Trends

Shift Toward Multi-Functional Products Shapes Market Trends

Current market trends are reshaping the oily skin control products landscape. There is a clear shift toward multi-functional skincare products that address multiple concerns simultaneously. Consumers prefer products that can cleanse, moisturize, and control oil in one application, saving time and money.

Social media and influencer marketing are significantly impacting consumer behavior. Beauty influencers and skincare experts share product reviews and recommendations that influence purchasing decisions. Brands are investing heavily in social media marketing to reach target audiences effectively.

The demand for cruelty-free and vegan skincare products is rising rapidly. Ethical consumers are choosing brands that do not test on animals and use plant-based ingredients. Companies are reformulating their products to meet these ethical standards and appeal to conscious consumers.

Customization and personalization are becoming important factors in skincare offerings. Brands are developing tools and services that help consumers choose products based on their specific skin type and concerns. Personalized skincare routines are gaining popularity among consumers who want tailored solutions for their oily skin problems.

Regional Analysis

North America Dominates the Oily Skin Control Products Market with a Market Share of 45.2%, Valued at USD 2.1 Billion

In 2024, North America held the dominant position in the Oily Skin Control Products Market with a market share of 45.2%, valued at USD 2.1 Billion. This dominance is driven by a high demand for skincare products, with consumers in the U.S. and Canada increasingly focusing on maintaining clear and healthy skin. Moreover, the region’s well-established retail and e-commerce channels contribute significantly to market growth.

Europe Oily Skin Control Products Market Trends

Europe holds a significant share in the Oily Skin Control Products Market, with strong growth in countries like the UK, France, and Germany. The demand for these products is fueled by growing consumer awareness of skincare and increasing reliance on dermatologist-recommended products. This region’s market is also influenced by the rising popularity of sustainable and cruelty-free skincare options.

Asia Pacific Oily Skin Control Products Market Trends

Asia Pacific is witnessing robust growth in the Oily Skin Control Products Market. With increasing urbanization, skincare concerns have become more prominent in countries like China, Japan, and India. The growing middle-class population and rising disposable income are contributing to an increased demand for premium skincare products that help manage oily skin.

Middle East and Africa Oily Skin Control Products Market Trends

The Middle East and Africa are experiencing steady growth in the Oily Skin Control Products Market, especially in regions with a high concentration of young consumers. Changing lifestyles and the growing awareness of personal care are expected to drive demand in countries such as the UAE, Saudi Arabia, and South Africa. The market is also impacted by the increasing penetration of international skincare brands in the region.

Latin America Oily Skin Control Products Market Trends

In Latin America, the Oily Skin Control Products Market is showing positive growth, particularly in Brazil and Mexico. This market is driven by the increasing interest in skincare routines and a growing demand for affordable yet effective products to control oil and maintain clear skin. The expansion of local and international brands in the region is expected to further boost market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Oily Skin Control Products Company Insights

In 2024, La Roche-Posay continues to lead the oily skin control products market with its dermatologist-recommended formulations. The brand’s focus on sensitive skin solutions, coupled with its use of soothing thermal water, has made it a top choice among consumers seeking oil control and hydration.

Neutrogena holds a significant position, driven by its extensive range of oil-control products. The brand’s oil-free cleansers and moisturizers are particularly popular for their effectiveness in balancing skin’s oil production while preventing breakouts, positioning it as a market leader in the segment.

Cetaphil appeals to a broad consumer base with its gentle yet effective solutions for oily skin. The brand is known for its non-irritating formulas that provide deep hydration without clogging pores, making it a trusted choice for those with oily or combination skin.

Clinique remains a prominent player by offering specialized skincare solutions for oily skin types. Its 3-step skincare routine, which includes an oil-control cleanser, toner, and moisturizer, continues to be highly recommended for oily skin control. Clinique’s commitment to allergy-tested, fragrance-free products has strengthened its reputation in the market.

These brands are expected to maintain their strong positions in the market due to their ability to deliver effective, dermatologist-approved products tailored to the needs of consumers with oily skin.

Top Key Players in the Market

- La Roche-Posay

- Neutrogena

- Cetaphil

- Clinique

- The Ordinary

- Paula’s Choice

- Kiehl’s

- Murad

- Bioderma

- Olay

Recent Developments

- In June 2025, L’Oréal acquired a majority stake in the UK-based skincare brand Medik8, valued at approximately €1 billion, signaling a significant move in strengthening its dermatology portfolio and expanding its presence in the global skincare market.

- In August 2024, L’Oréal purchased a 10% stake in dermatology firm Galderma from a consortium led by EQT, enhancing its strategic position in the dermatology sector and diversifying its skincare offerings.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 10.3 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cleansers, Moisturizers Toners, Masks, Others), By Function (Oil Absorption, Pore Minimization, Matte Finish, Others), By Active Ingredient (Niacinamide, Salicylic Acid, Clay/Minerals, Zinc PCA, Tea Tree Oil), By Claim (Oil-Free, Non-Comedogenic, Dermatologist-Tested, Fragrance-Free, Others), By End User (Teenagers/Young Adults, Adults, Men), By Distribution Channel (E-Commerce, Pharmacies/Drugstores, Mass Retail, Specialty Beauty Retail, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape La Roche-Posay, Neutrogena, Cetaphil, Clinique, The Ordinary, Paula’s Choice, Kiehl’s, Murad, Bioderma, Olay Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oily Skin Control Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Oily Skin Control Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- La Roche-Posay

- Neutrogena

- Cetaphil

- Clinique

- The Ordinary

- Paula's Choice

- Kiehl's

- Murad

- Bioderma

- Olay