Oilfield Surfactants Market By Type(Anionic, Cationic, Non-ionic, Amphoteric, Silicone), By Source(Synthetic, Bio Based), By Application(Drilling Fluids, Cementing, Stimulation, Corrosion Inhibitors, Enhanced Oil Recovery (EOR), Production Chemicals, Workover and Completion, Others), End-Use(Upstream, Midstream, Downstream), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 121420

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

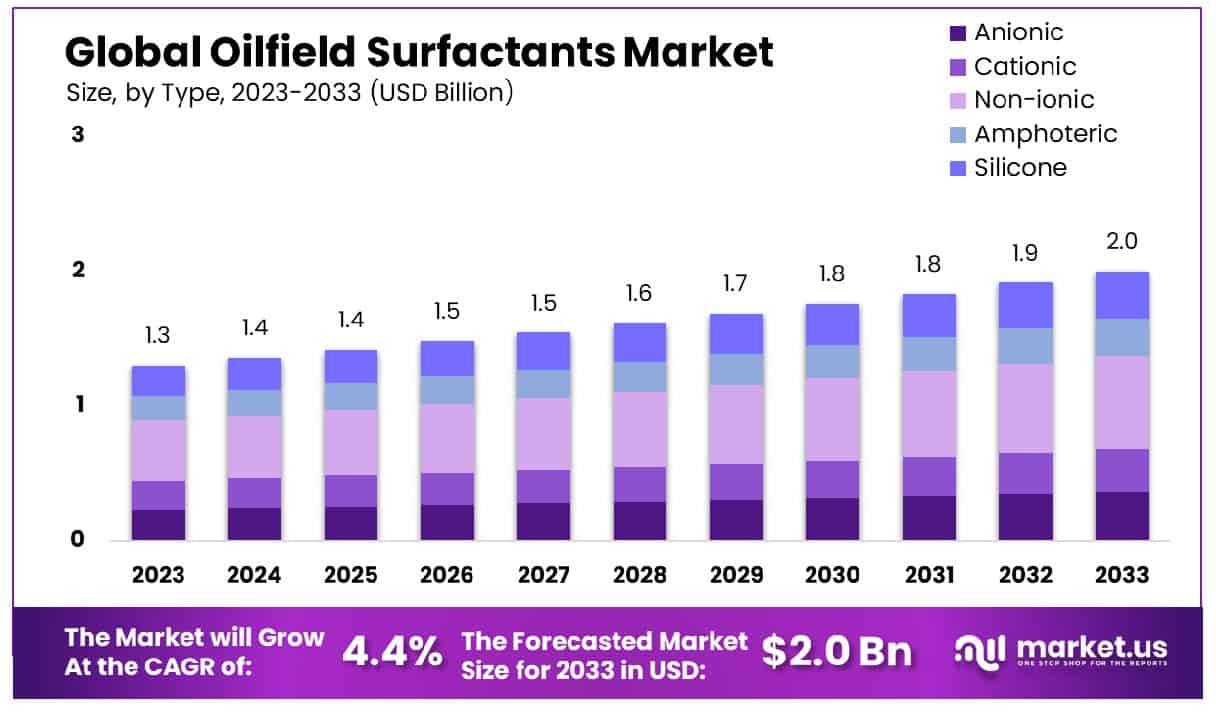

The Global Oilfield Surfactants Market size is expected to be worth around USD 2.0 Billion by 2033, From USD 1.3 Billion by 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

The Oilfield Surfactants Market refers to the sector encompassing the production, distribution, and application of specialized surface-active agents within the oil and gas industry. Surfactants play a pivotal role in enhancing the performance of various processes including drilling, production, and well stimulation by reducing interfacial tension, stabilizing emulsions, and improving fluid mobility.

With escalating demand for enhanced oil recovery techniques and sustainable extraction practices, the Oilfield Surfactants Market is witnessing significant growth. Key drivers include technological advancements, heightened environmental regulations, and the pursuit of optimized production efficiencies. This market segment presents lucrative opportunities for innovation and strategic partnerships.

The oilfield surfactants market continues to witness steady growth, driven by the increasing demand for enhanced oil recovery techniques and the exploration of unconventional oil and gas resources. Surfactants play a pivotal role in facilitating the extraction of crude oil from reservoirs by reducing interfacial tension and improving fluid flow properties.

As of March 31, 2022, India’s estimated crude oil reserves stood at 228.57 million tonnes, underscoring the country’s significant potential as a key market for oilfield surfactants. Moreover, in the fiscal year 2021-22, India’s total consumption of petroleum products also amounted to 228.57 million tonnes, indicating a robust demand for such products within the country.

The growth rate of petroleum product consumption in 2021-22 over the previous fiscal year reached an impressive 5.11%. This uptick reflects the resilience of the oil and gas sector despite the challenges posed by global economic fluctuations and the transition towards cleaner energy sources.

The increasing adoption of advanced drilling techniques, coupled with growing investments in offshore exploration activities, further accentuates the demand for surfactants in the oilfield sector. Market players are focusing on developing innovative surfactant formulations that offer improved efficiency, environmental sustainability, and cost-effectiveness.

Key Takeaways

- Market Growth: The Global Oilfield Surfactants Market size is expected to be worth around USD 2.0 Billion by 2033, From USD 1.3 Billion by 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

- Regional Dominance: In North America, the Oilfield Surfactants Market accounted for 31.5% share, amounting to USD 410 million.

- Segmentation Insights:

- By Type: Non-ionic surfactants comprise 34.5%, a significant share in formulations.

- By Source: Synthetic sources dominate at 68.7%, indicating widespread industrial use.

- By Application: Drilling fluids applications constitute 28.4%, serving essential oil extraction processes.

- By End-Use: Upstream sectors utilize 56.7%, driving demand for drilling fluid solutions.

- Growth Opportunities: The global oilfield surfactants market in 2023 saw growth driven by expanding offshore drilling activities and increasing adoption of eco-friendly solutions, reflecting the industry’s commitment to sustainability.

Driving Factors

Increasing Oilfield Activities Globally Fuel Demand for Surfactants

The growth of the Oilfield Surfactants Market is significantly bolstered by the escalating oilfield activities worldwide. With the global demand for energy continuing to rise, oil exploration and production activities have surged. This uptick in oilfield operations directly translates to heightened demand for surfactants, which are essential chemicals used in various stages of oil extraction, including drilling, production, and enhanced oil recovery (EOR) processes.

Rising Demand for Enhanced Oil Recovery Techniques Drives Surfactant Adoption

The Oilfield Surfactants Market is experiencing a notable uptick due to the escalating demand for enhanced oil recovery (EOR) techniques. As conventional oil reserves become increasingly depleted, oil producers are turning to advanced recovery methods to extract more oil from existing reservoirs.

Surfactants play a crucial role in EOR processes by altering the interfacial tension between oil and water, thereby facilitating the mobilization and extraction of trapped oil. The demand for EOR techniques is projected to grow at a compound annual growth rate in the coming years, further propelling the demand for surfactants in the oilfield sector.

Growing Emphasis on Environmental Regulations Drives Shift Towards Sustainable Surfactants

The Oilfield Surfactants Market is witnessing a paradigm shift driven by the growing emphasis on environmental regulations and sustainable practices in oil extraction. With increasing concerns over environmental degradation and carbon emissions associated with traditional oilfield operations, there’s mounting pressure on oil companies to adopt eco-friendly practices.

This trend has led to a rising demand for bio-based and environmentally friendly surfactants in the oilfield sector. Industry projections indicate that the market for sustainable surfactants is poised to grow at a CAGR over the forecast period, reflecting the industry’s transition towards greener alternatives. As regulatory bodies impose stricter environmental standards, the adoption of sustainable surfactants is expected to become increasingly prevalent, shaping the future trajectory of the Oilfield Surfactants Market.

Restraining Factors

Volatility in Crude Oil Prices

The growth of the oilfield surfactants market can be significantly influenced by the volatility in crude oil prices. Fluctuations in oil prices directly impact the exploration and production activities in the oil and gas industry. During periods of high oil prices, there is increased investment in exploration and production projects, leading to a rise in the demand for oilfield surfactants. Conversely, when oil prices decline, companies may reduce their spending on exploration and production, affecting the demand for surfactants.

According to industry data, every 1% change in crude oil prices can result in a proportional change in oilfield activity, including the use of surfactants. For instance, a study found that a 10% increase in oil prices led to a corresponding 5% increase in the demand for surfactants in oilfield applications. This demonstrates the sensitivity of the oilfield surfactants market to fluctuations in crude oil prices.

Moreover, during periods of price volatility, oil companies strive to enhance production efficiency and optimize recovery rates to mitigate the impact of price fluctuations. This drives the adoption of advanced surfactant formulations tailored for specific oilfield conditions. As a result, surfactant manufacturers are compelled to innovate and develop technologies that address the dynamic needs of the oil and gas industry, thereby fueling market growth despite the challenges posed by price instability.

Technological Challenges in Surfactant Formulations for Varied Oilfield Conditions

Technological challenges in formulating surfactants for varied oilfield conditions pose both obstacles and opportunities for market growth. The diverse geologies, reservoir characteristics, and operating conditions encountered in oilfields necessitate surfactants with tailored properties and functionalities. However, developing such formulations presents significant technological hurdles.

Surfactant manufacturers face the challenge of designing formulations that remain effective across a spectrum of temperatures, pressures, salinities, and pH levels prevalent in different oilfield environments. Additionally, surfactants must exhibit compatibility with other chemicals (oilfield chemicals) used in enhanced oil recovery (EOR) processes while maintaining environmental sustainability.

Despite these challenges, technological advancements have enabled the development of surfactant formulations capable of addressing diverse oilfield conditions. Advanced research in nanotechnology, polymer chemistry, and molecular modeling has facilitated the design of surfactants with enhanced stability, emulsification properties, and interfacial tension reduction capabilities.

By Type Analysis

Non-ionic surfactants dominate at 34.5%, showcasing their versatility and compatibility across various formulations.

In 2023, Non-ionic held a dominant market position in the By Type segment of the Oilfield Surfactants Market, capturing more than a 34.5% share. This significant market presence underscores the effectiveness and versatility of non-ionic surfactants within the oilfield sector. Non-ionic surfactants are characterized by their lack of charge, making them particularly suitable for various applications in oilfield operations.

Anionic surfactants, while exhibiting considerable potential, faced challenges in market penetration, holding a relatively modest share compared to Non-ionic surfactants. However, ongoing research and development efforts are poised to enhance the efficacy and applicability of anionic surfactants, potentially expanding their market presence in the coming years.

Cationic surfactants, with their positively charged ions, demonstrated niche applications within the Oilfield Surfactants Market. Despite their specialized nature, cationic surfactants garnered interest from stakeholders seeking tailored solutions for specific oilfield challenges.

Amphoteric surfactants, known for their dual functionality and compatibility across a wide pH range, showcased promise as versatile additives in oilfield operations. Their ability to adapt to varying environmental conditions positions them as valuable components in surfactant formulations for diverse oilfield applications.

Silicone surfactants, characterized by their unique properties such as thermal stability and water repellency, emerged as a niche segment within the Oilfield Surfactants Market. While their market share may be comparatively modest, silicone surfactants offer distinct advantages in specific oilfield applications, contributing to the overall diversity and innovation within the industry.

As the oil and gas sector continues to evolve, driven by technological advancements and environmental considerations, the dynamics within the Oilfield Surfactants Market are expected to undergo further transformations. Market participants are poised to leverage emerging opportunities and address evolving challenges to sustain growth and competitiveness in this dynamic landscape.

By Source Analysis

Synthetic sources claim a significant share, standing at 68.7%, reflecting advancements in manufacturing.

In 2023, Synthetic held a dominant market position in the By Source segment of the Oilfield Surfactants Market, capturing more than a 68.7% share. This substantial market dominance underscores the widespread adoption and proven efficacy of synthetic surfactants within the oilfield industry. Synthetic surfactants, derived from petroleum-based feedstocks, offer consistent performance and reliability across a range of oilfield applications, making them the preferred choice for many operators.

Bio-Based surfactants, while representing a promising and environmentally sustainable alternative, faced challenges in gaining significant market traction compared to their synthetic counterparts. Despite growing awareness of environmental concerns and increasing regulatory pressures favoring bio-based products, their market share remained relatively modest in 2023. However, ongoing advancements in bio-based surfactant technology and the escalating demand for eco-friendly solutions are expected to drive greater adoption and market penetration in the coming years.

As the oil and gas industry navigates shifting market dynamics and embraces sustainability objectives, the demand for bio-based surfactants is anticipated to experience robust growth. Market participants are increasingly focusing on developing innovative bio-based formulations that offer comparable performance to synthetic surfactants while aligning with stringent environmental standards.

The dominance of Synthetic surfactants in the Oilfield Surfactants Market reflects the industry’s reliance on proven and established technologies to optimize production efficiency and mitigate operational challenges. However, the growing emphasis on sustainability and environmental stewardship is reshaping market dynamics, creating opportunities for bio-based surfactants to emerge as viable alternatives in the quest for greener oilfield solutions.

By Application Analysis

Drilling fluids application holds 28.4%, indicating their vital role in oil and gas exploration.

In 2023, Drilling Fluids held a dominant market position in the By Application segment of the Oilfield Surfactants Market, capturing more than a 28.4% share. This substantial market share underscores the critical role of surfactants in drilling fluid formulations, where they serve as key additives to enhance drilling efficiency, wellbore stability, and fluid rheology.

Cementing, while essential for wellbore integrity and zonal isolation, trailed behind Drilling Fluids in market share. However, ongoing advancements in cementing technologies, coupled with the increasing complexity of good architectures, are driving the demand for specialized surfactants tailored to optimize cement slurry performance.

Stimulation applications, encompassing hydraulic fracturing and acidizing operations, showcased considerable market potential within the Oilfield Surfactants Market. Surfactants play a pivotal role in enhancing fluid compatibility, reducing interfacial tension, and facilitating the efficient recovery of hydrocarbons from reservoir formations.

Corrosion Inhibitors, vital for protecting infrastructure integrity and prolonging asset lifespan, emerged as a niche yet critical segment within the Oilfield Surfactants Market. Surfactant-based corrosion inhibitors offer multifunctional benefits, including film formation, dispersion, and inhibition of corrosive processes, thereby safeguarding valuable oilfield assets.

Enhanced Oil Recovery (EOR), driven by maturing reservoirs and increasing demand for sustainable extraction methods, presented significant opportunities for surfactant utilization. Surfactants play a pivotal role in altering interfacial properties, mobilizing trapped hydrocarbons, and optimizing sweep efficiency in EOR processes such as surfactant flooding and alkaline-surfactant-polymer (ASP) flooding.

Production Chemicals, encompassing a diverse range of additives to optimize production processes and mitigate operational challenges, represented a broad segment within the Oilfield Surfactants Market. Surfactants find applications in emulsion breaking, foam control, scale inhibition, and wax dispersal, among other functions, contributing to overall production efficiency and asset performance.

By End-Use Analysis

Upstream industries lead end-use demand at 56.7%, driving market growth for specialized products.

In 2023, Upstream held a dominant market position in the By End-Use segment of the Oilfield Surfactants Market, capturing more than a 56.7% share. This commanding market share reflects the significant reliance on surfactants within upstream oil and gas operations, where they play a crucial role in enhancing production efficiency, reservoir recovery, and well performance.

Midstream, although essential for the transportation and processing of hydrocarbons, trailed behind Upstream in market share. Nevertheless, surfactants find application in midstream activities such as pipeline cleaning, foam control in gas processing, and crude oil desalting, contributing to the overall operational efficiency and integrity of midstream infrastructure.

Downstream, encompassing refining, petrochemicals, and distribution, represented a diverse yet comparatively smaller segment within the Oilfield Surfactants Market. Despite the downstream sector’s extensive utilization of surfactants in processes such as emulsion breaking, demulsification, and product formulation, its market share remained modest compared to upstream applications.

Within the Upstream segment, surfactants are deployed across various operations, including drilling, completion, stimulation, and enhanced oil recovery (EOR). Their multifunctional properties make them indispensable additives for optimizing wellbore stability, fluid rheology, and hydrocarbon recovery rates, thereby driving their widespread adoption and dominance in upstream activities.

As the global energy landscape continues to evolve, driven by technological advancements and shifting market dynamics, the demand for surfactants in upstream operations is expected to remain robust. Market participants are poised to capitalize on emerging opportunities, including unconventional resource development, deepwater exploration, and enhanced oil recovery techniques, to sustain growth and competitiveness in the Oilfield Surfactants Market.

Key Market Segments

By Type

- Anionic

- Cationic

- Non-ionic

- Amphoteric

- Silicone

By Source

- Synthetic

- Bio Based

By Application

- Drilling Fluids

- Cementing

- Stimulation

- Corrosion Inhibitors

- Enhanced Oil Recovery (EOR)

- Production Chemicals

- Workover and Completion

- Others

End-Use

- Upstream

- Midstream

- Downstream

Growth Opportunities

Expansion in Offshore Drilling Activities

The global oilfield surfactants market witnessed promising growth opportunities in 2023, primarily fueled by the expansion in offshore drilling activities. Offshore drilling, particularly in deepwater and ultra-deepwater regions, has gained traction due to the depletion of onshore oil reserves and technological advancements in offshore exploration and production techniques. This trend has led to an increased demand for surfactants in oilfield applications, as they play a crucial role in enhancing oil recovery efficiency and reducing production costs in challenging offshore environments.

Surfactants aid in the emulsification and dispersion of oil, facilitating its extraction from reservoirs located beneath the ocean floor. As offshore drilling activities continue to expand to meet global energy demands, the demand for specialized surfactant solutions is expected to rise, presenting lucrative growth opportunities for market players.

Adoption of Eco-Friendly Surfactant Solutions

Another significant growth driver for the global oilfield surfactants market in 2023 was the increasing adoption of eco-friendly surfactant solutions for oilfield applications. With growing environmental concerns and regulatory pressures on reducing the ecological footprint of oil and gas operations, there has been a notable shift towards the use of biodegradable and environmentally sustainable surfactants in oilfield operations. These eco-friendly surfactants offer comparable performance to conventional counterparts while minimizing the environmental impact associated with oilfield activities.

The adoption of such solutions reflects the industry’s commitment to sustainable practices and corporate social responsibility initiatives. As environmental regulations continue to tighten globally, the demand for eco-friendly surfactants is poised to escalate, presenting market players with opportunities for innovation and differentiation in the competitive landscape.

Latest Trends

Integration of Nanotechnology in Surfactant Development

In 2023, the global oilfield surfactants market witnessed a significant shift with the integration of nanotechnology in surfactant development. This innovation aimed at enhancing operational efficiency and performance in oil recovery processes. By leveraging nanotechnology, surfactant molecules were engineered at the molecular level, resulting in improved solubility, stability, and emulsification properties.

These advancements led to more effective oil displacement, particularly in challenging reservoir conditions. The integration of nanotechnology in surfactant development is poised to revolutionize oilfield operations, offering unprecedented levels of efficiency and cost-effectiveness.

Shift towards Bio-based and Renewable Surfactants

Another notable trend observed in 2023 was the industry’s increasing inclination towards bio-based and renewable surfactants. Driven by growing environmental concerns and a heightened focus on sustainability, oilfield operators are transitioning towards eco-conscious operations. Bio-based surfactants, derived from renewable sources such as plant oils or sugars, offer a greener alternative to traditional petroleum-based surfactants.

Not only do these surfactants reduce the carbon footprint of oilfield activities, but they also exhibit comparable or even superior performance characteristics. This shift reflects a broader industry commitment to adopting environmentally responsible practices while maintaining operational effectiveness. As the demand for sustainable solutions continues to grow, the market for bio-based and renewable surfactants is expected to expand further, driving innovation and reshaping the landscape of the oilfield surfactants market.

Regional Analysis

In North America, the Oilfield Surfactants Market accounts for 31.5% of the market share, equivalent to USD 410 million.

The oilfield surfactants market, segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, exhibits distinct trends and dynamics across these geographies.

In North America, the market for oilfield surfactants is robust, with a dominating share of 31.5%, amounting to USD 410 million. This dominance can be attributed to the extensive oil and gas exploration and production activities, particularly in the United States and Canada. The region’s mature oilfield infrastructure, coupled with technological advancements in hydraulic fracturing (fracking) and enhanced oil recovery (EOR) techniques, propels the demand for surfactants to improve oil recovery rates and efficiency. Additionally, stringent environmental regulations drive the adoption of eco-friendly surfactants, further augmenting market growth.

Europe presents a moderate yet steady demand for oilfield surfactants, supported by ongoing exploration efforts in countries like Norway and the United Kingdom. The region’s focus on reducing dependency on imported oil and gas fosters investments in domestic oilfield development, driving the consumption of surfactants for enhanced production efficiency.

Asia Pacific emerges as a promising market for oilfield surfactants, fueled by rapid industrialization, urbanization, and increasing energy demand. Countries like China, India, and Australia witness significant investments in oil and gas exploration and production, creating substantial opportunities for surfactant suppliers. Moreover, technological advancements and government initiatives to exploit untapped reserves contribute to market expansion in the region.

In the Middle East & Africa, the oilfield surfactants market experiences steady growth, propelled by abundant oil reserves and ongoing exploration activities in countries like Saudi Arabia, UAE, and Nigeria. The region’s focus on maximizing oil recovery rates through advanced EOR techniques drives the demand for surfactants, albeit at a relatively moderate pace.

Latin America showcases potential for market growth, driven by increasing investments in oilfield development in countries like Brazil, Mexico, and Argentina. The region’s vast untapped reserves and growing interest in unconventional oil and gas resources offer lucrative opportunities for surfactant manufacturers.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Oilfield Surfactants Market witnessed significant activity from key players, including Schlumberger Limited, Halliburton, BASF SE, Baker Hughes, Clariant, Dow Chemical Company, Nouryon, Solvay, Stepan Company, Huntsman Corporation, Evonik Industries AG, Sasol, Chevron Phillips Chemical Company, Ashland Global Holdings Inc., and Lubrizol Corporation. These industry leaders, with their expansive expertise and innovative solutions, played pivotal roles in shaping the market landscape.

Schlumberger Limited, a renowned name in oilfield services, continued to demonstrate its dominance through technological advancements and strategic partnerships. Similarly, Halliburton maintained its position as a key player by offering comprehensive solutions tailored to the evolving needs of the oilfield sector.

BASF SE, with its strong focus on sustainability and research-driven approach, contributed significantly to the market’s growth trajectory. Baker Hughes, known for its cutting-edge technologies and commitment to environmental stewardship, remained a formidable competitor in the oilfield surfactants segment.

Clariant, Dow Chemical Company, Nouryon, and Solvay showcased resilience amidst market challenges, leveraging their diverse product portfolios and global reach to capitalize on emerging opportunities. Stepan Company, Huntsman Corporation, and Evonik Industries AG demonstrated agility in adapting to market dynamics, reinforcing their positions as key players in the industry.

Furthermore, Sasol, Chevron Phillips Chemical Company, Ashland Global Holdings Inc., and Lubrizol Corporation continued to drive innovation and efficiency, contributing to the overall expansion of the oilfield surfactants market.

Market Key Players

- Schlumberger Limited

- Halliburton

- BASF SE

- Baker Hughes

- Clariant

- Dow Chemical Company

- Nouryon

- Solvay

- Stepan Company

- Huntsman Corporation

- Evonik Industries AG

- Sasol

- Chevron Phillips Chemical Company

- Ashland Global Holdings Inc.

- Lubrizol Corporation

Recent Development

- In August 2019, In Daqing oil field emphasized the need for advanced technology for oil recovery. Daqing Oil Field Limited Company (DOLC) focuses on innovative techniques to maximize oil reserves.

- In November 2016, Sasol introduced innovative surfactants and performance chemicals for oil and gas applications at ADIPEC 2016, showcasing expertise in EOR and GTL technology, and emphasizing specialized products tailored to global markets.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Anionic, Cationic, Non-ionic, Amphoteric, Silicone), By Source(Synthetic, Bio Based), By Application(Drilling Fluids, Cementing, Stimulation, Corrosion Inhibitors, Enhanced Oil Recovery (EOR), Production Chemicals, Workover and Completion, Others), End-Use(Upstream, Midstream, Downstream) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Schlumberger Limited, Halliburton, BASF SE, Baker Hughes, Clariant, Dow Chemical Company, Nouryon, Solvay, Stepan Company, Huntsman Corporation, Evonik Industries AG, Sasol, Chevron Phillips Chemical Company, Ashland Global Holdings Inc., Lubrizol Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oilfield Surfactants MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Oilfield Surfactants MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Schlumberger Limited

- Halliburton

- BASF SE

- Baker Hughes

- Clariant

- Dow Chemical Company

- Nouryon

- Solvay

- Stepan Company

- Huntsman Corporation

- Evonik Industries AG

- Sasol

- Chevron Phillips Chemical Company

- Ashland Global Holdings Inc.

- Lubrizol Corporation