Global Nutricosmetic Ingredients Market Size, Share Analysis Report By Type (Carotenoids, Vitamins, Collagen, Antioxidants, Polyphenolics, Lycopenes, Beta Carotene, Flavones, Plant Based Caeramides, Polypodium Leucomotes), By Product (Dietary Supplements, Function Food And Beverage), By Application (Skin Health, Hair Health, Nail Health, Weight Management), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172453

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

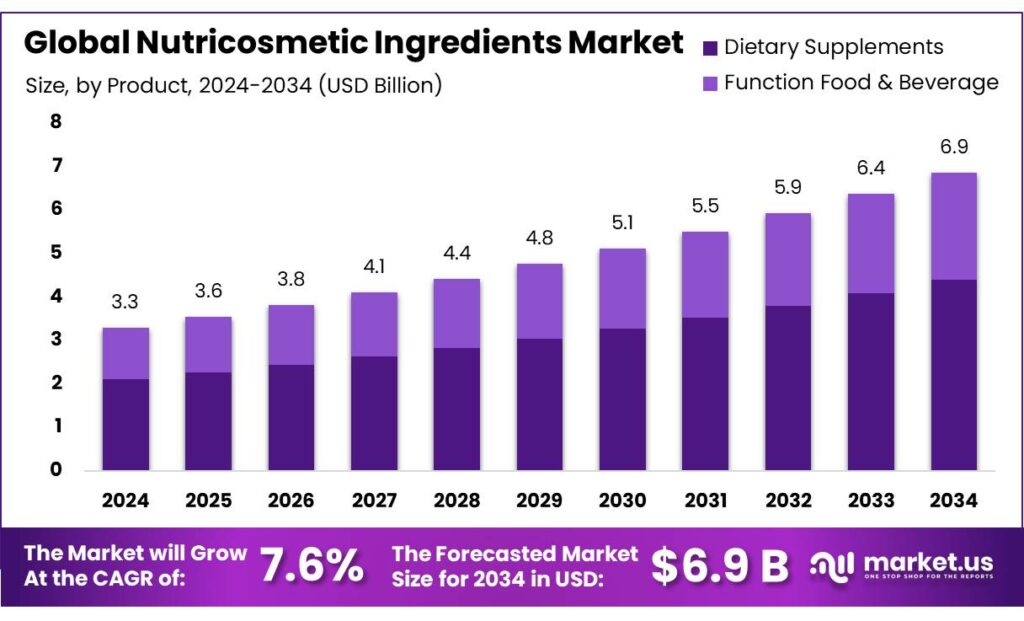

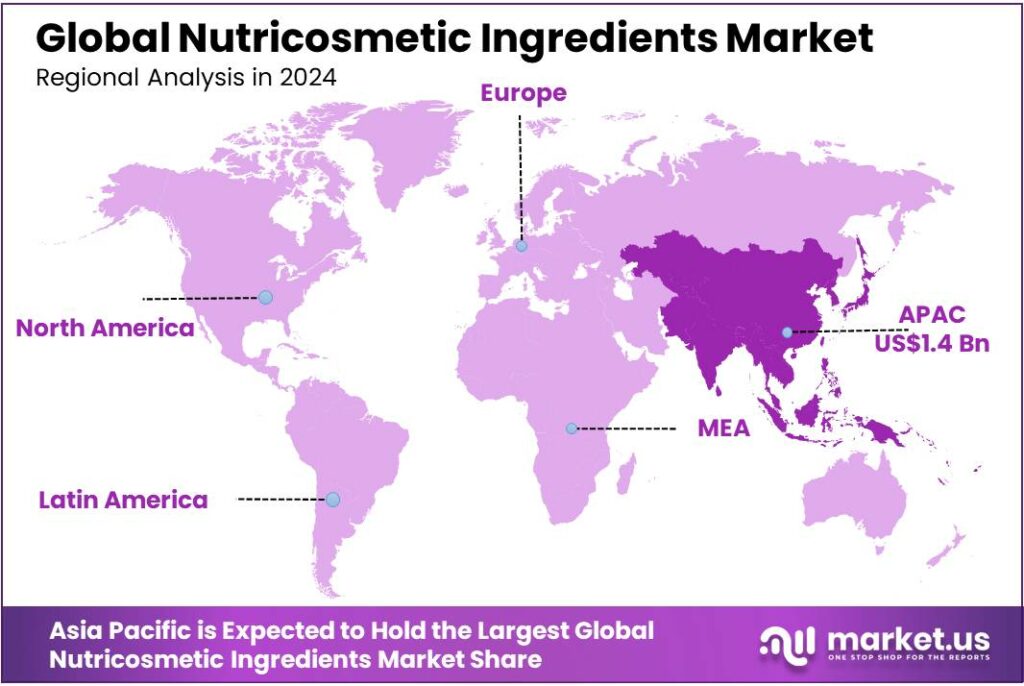

The Global Nutricosmetic Ingredients Market size is expected to be worth around USD 6.9 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific (APAC) held a dominant market position, capturing more than a 44.8% share, holding USD 1.4 Billion in revenue.

Nutricosmetic ingredients are the “beauty-from-within” inputs used to formulate ingestible products that support skin, hair, and nail appearance—most commonly collagen peptides, hyaluronic acid, ceramides, carotenoids, biotin and antioxidant vitamins, omega-3s, and probiotics. The category sits at the intersection of functional foods, dietary supplements, and cosmetic science, so it is shaped both by nutrition evidence standards and by beauty-industry brand building. Demand is reinforced by the size and marketing power of the wider beauty ecosystem—for example, Europe alone reported cosmetics and personal care retail sales of €104 billion in 2024.

Industrially, the sector is supported by large-scale ingredient processing and by contract manufacturing capacity that can deliver gummies, capsules, sachets, and ready-to-mix powders at consistent quality. Commercial success often depends on making ingredients “clinically legible” and “sensory friendly”. In the United States, the broader beauty and personal care industry’s economic base remains sizable, with $210.6 billion in total sales in 2022, helping explain why many beauty groups treat ingestibles as a portfolio extension rather than a standalone niche.

- In the U.S., the dietary supplement industry’s broader “engine” effect is visible in economic-impact metrics: $159 billion (2023) overall economic impact, employing >615,000 Americans and generating $6.76 billion in state/local taxes plus $10.7 billion in federal taxes.

Government rules and trusted scientific gatekeepers also shape what can be said on pack, which in turn affects innovation and investment. In the EU, nutrition and health claims operate under Regulation (EC) No 1924/2006, applied from 1 July 2007, which creates a formal pathway for marketing-benefit statements. EFSA’s Article 13.1 consolidation illustrates the scale of scrutiny: 4,637 “main” health-claim entries were submitted for evaluation, clustered from about 10,500 similar claim relationships—an environment that favors brands investing in substantiation and compliant wording.

Key Takeaways

- Nutricosmetic Ingredients Market size is expected to be worth around USD 6.9 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 7.6%.

- Carotenoids held a dominant market position, capturing more than a 23.6% share.

- Mannan-oligosaccharides (MOS) held a dominant market position, capturing more than a 64.8% share.

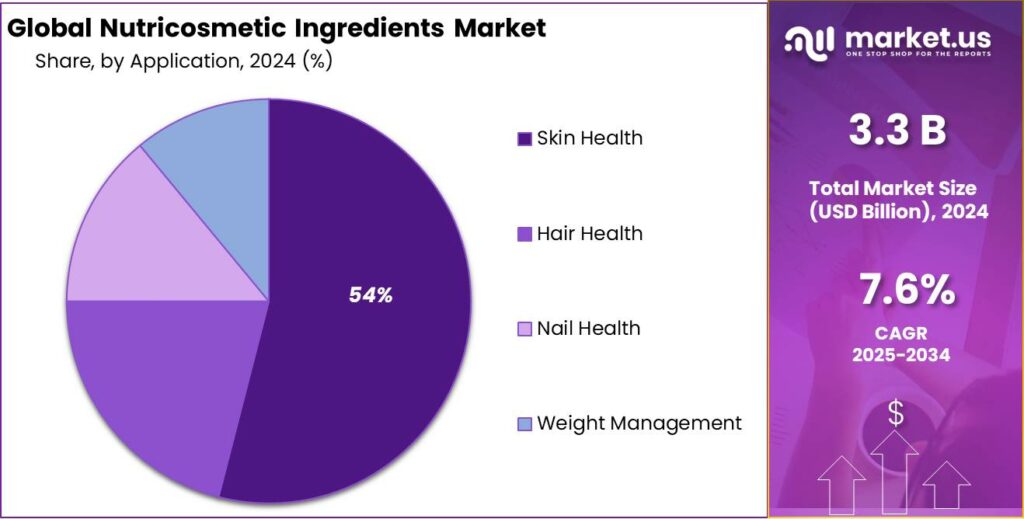

- Skin Health held a dominant market position, capturing more than a 54.5% share.

- Asia Pacific (APAC) region emerged as the dominating market for nutricosmetic ingredients, capturing a substantial 44.8% share of total market value, equivalent to approximately USD 1.4 billion.

By Type Analysis

Carotenoids lead the nutricosmetic ingredients space with a 23.6% share, supported by strong skin health benefits and wide consumer trust.

In 2024, Carotenoids held a dominant market position, capturing more than a 23.6% share, as their role in supporting skin brightness, anti-aging, and protection against oxidative stress was widely recognized across nutricosmetic formulations. Demand was largely driven by ingredients such as beta-carotene, lutein, lycopene, and astaxanthin, which are commonly used in beauty-from-within products targeting skin glow, UV protection, and overall complexion improvement.

Moving into 2025, stable growth was supported by increasing awareness of preventive skincare, rising intake of antioxidant-rich supplements, and continued innovation in bioavailability-enhanced carotenoid formulations. The segment’s leadership position was further reinforced by its long safety history, clear functional benefits, and acceptance among both younger consumers focused on appearance and aging populations seeking skin protection and wellness support.

By Product Analysis

Dietary supplements dominate with a 64.8% share, driven by daily usage habits and strong consumer trust.

In 2024, Mannan-oligosaccharides (MOS) held a dominant market position, capturing more than a 64.8% share within the nutricosmetic ingredients market under the dietary supplements product segment. This strong position was mainly supported by the wide use of MOS in oral beauty supplements focused on gut health, skin clarity, and immune balance, which are increasingly linked to outward appearance. Dietary supplements remained the preferred product format in 2024 due to their ease of consumption, clear dosage structure, and strong acceptance among consumers seeking long-term beauty-from-within solutions.

MOS-based supplements were commonly positioned as supportive ingredients that improve nutrient absorption and digestive balance, indirectly enhancing skin and hair health outcomes. Entering 2025, demand continued to remain stable as consumers increasingly followed preventive wellness routines and incorporated beauty supplements into everyday nutrition plans. The segment’s dominance was further reinforced by growing awareness of the gut–skin connection, rising repeat purchases, and the perception of dietary supplements as a reliable and consistent delivery format for nutricosmetic ingredients.

By Application Analysis

Skin health leads nutricosmetic demand with a 54.5% share, supported by strong focus on daily skincare nutrition.

In 2024, Skin Health held a dominant market position, capturing more than a 54.5% share, as consumers increasingly linked inner nutrition with visible skin appearance and long-term skin protection. Nutricosmetic ingredients used for skin health were widely adopted in supplements targeting hydration, elasticity, brightness, and protection from environmental stress. Throughout 2024, demand remained high for formulations positioned around anti-aging support and preventive skincare, especially among urban consumers following regular wellness routines.

Moving into 2025, growth momentum was maintained as awareness of nutrition-led skincare continued to rise, supported by higher intake of daily beauty supplements and functional nutrition products. The strong position of skin health applications was further reinforced by consistent consumer trust, visible results over regular usage, and the perception of nutricosmetics as a long-term investment in skin quality rather than a short-term cosmetic fix.

Key Market Segments

By Type

- Carotenoids

- Vitamins

- Collagen

- Antioxidants

- Polyphenolics

- Lycopenes

- Beta Carotene

- Flavones

- Plant Based Caeramides

- Polypodium Leucomotes

By Product

- Dietary Supplements

- Function Food And Beverage

By Application

- Skin Health

- Hair Health

- Nail Health

- Weight Management

Emerging Trends

Rise of Personalized Beauty-From-Within Regimens

One of the latest and most meaningful trends in nutricosmetic ingredients is the shift toward personalization—products designed not just for “general skin health” but for the unique needs of individuals based on age, lifestyle, genetics, and biology. Today’s consumer doesn’t want a one-size-fits-all capsule; they want a daily routine that feels like it was made for them. This trend reflects a deeper change in how people think about beauty and health, shifting from generic promises to tailored support that fits their everyday lives.

Personalization has grown because people increasingly see beauty as connected to total wellness. Rather than buying something because an influencer said it’s good, many now want proof that the ingredient benefits their body. For example, the Council for Responsible Nutrition (CRN) reported that 75% of Americans take dietary supplements—meaning a strong baseline comfort with ingesting nutrients already exists. What’s new is that people now expect these supplements to work with their specific skin or hair priorities, not just general health.

This trend is visible in how brands are talking about nutricosmetics today. Instead of saying “good for skin,” labels and marketing focus on specific outcomes—like “supports elasticity for mature skin” or “helps with dryness linked to stress.” That consumer language aligns with how regulated function claims are evolving in some regions. In Japan, for instance, the Foods with Function Claims system lets companies submit evidence and then legally communicate a specific function on the package, which has encouraged clearer messaging tied to individual benefits.

The personalization trend also sits on demographic shifts. The World Health Organization notes that by 2030, 1 in 6 people worldwide will be aged 60+, as the number of older adults rises from 1.0 billion in 2020 to 1.4 billion by 2030. Older adults have very different skin and hair concerns from younger consumers, and they are more willing to invest in solutions that speak directly to their condition—for example, age-related loss of skin firmness or thinning hair. This demographic force pushes brands to go beyond generic claims to address specific life-stage needs.

Drivers

Ageing Consumers Want Beauty Benefits They Can Eat

A major driver for nutricosmetic ingredients is the fast-growing older consumer base that wants simple, daily routines for skin firmness, hydration, and hair quality. The World Health Organization notes that by 2030, 1 in 6 people globally will be aged 60+. In the same period, the population aged 60+ is expected to rise from 1.0 billion (2020) to 1.4 billion (2030), and then reach 2.1 billion (2050). These numbers matter for industry because ageing concerns are not occasional—they are continuous.

Another reason the ageing driver is so powerful is that it sits on top of an already strong supplement habit. In the United States, the Council for Responsible Nutrition (CRN) reported that 75% of Americans take dietary supplements (CRN 2024 Consumer Survey, conducted by Ipsos). When three out of four adults already buy supplements, nutricosmetic launches do not need to “create” a new behavior.

The broader beauty economy provides extra pull and makes ingestibles feel mainstream rather than niche. Cosmetics Europe reports European cosmetics and personal care retail sales valued at €104 billion in 2024. That scale matters because large beauty ecosystems normalize beauty spending and help brands educate shoppers through influencers, dermatology storytelling, and premium packaging cues—tools that translate well to ingestibles.

Finally, regulation and government-backed frameworks shape the “trust layer,” which is essential for older consumers. In Europe, rules on nutrition and health claims set expectations for how benefits are communicated, pushing companies to be careful with wording and evidence. The European Commission’s nutrition and health claims framework is a central reference point for what can be said about food-related benefits, encouraging compliant, substantiated messaging.

Restraints

Strict Claims Rules Limit What Brands Can Promise

In the European Union, health-claim communication is shaped by Regulation (EC) No 1924/2006, which has applied since 1 July 2007. This framework matters for nutricosmetics because many ingestible beauty products sit in the “food supplement” space, where claims must be tightly controlled. When a brand cannot clearly say what a collagen, ceramide, or antioxidant blend will do for skin appearance, marketing becomes indirect—focused on “supports normal function” rather than visible results.

The burden becomes clearer when looking at how many claims regulators have had to screen. EFSA explains that the “final list” of Article 13.1 function claims included 4,637 consolidated claims, created after examining over 44,000 claims supplied by EU Member States. In other words, the system is designed to filter heavily. For ingredient suppliers and brand owners, that translates into time, cost, and uncertainty: clinical trials must be well-designed, endpoints must be relevant, and the wording still needs to fit within permitted boundaries.

In the United States, the restraint shows up differently but still affects speed to market. FDA explains that when dietary supplements use certain “structure/function” claims, the firm must notify FDA within 30 days after first marketing the product with the claim. This does not automatically block products, but it pushes companies to build a compliance process, keep documentation tight, and avoid claims that imply disease treatment.

Government-led food safety frameworks also shape how widely nutricosmetics can scale across countries. In India, FSSAI issued directions and orders around nutraceutical regulation and ingredient permissions in 2022, clarifying what is allowed under the “Nutra” category and reinforcing that these products are not meant to “treat or cure” disease.

Opportunity

Clinically Backed Function Claims Unlock Mainstream Growth

A major growth opportunity for nutricosmetic ingredients is to scale products through credible, regulated function-claim pathways—especially in markets where consumers want clear “what it does” messaging and governments have created a structured route for that communication. When brands can lawfully explain a beauty-related function, shoppers understand the value faster, and retailers are more willing to give shelf space. This is why ingredients that come with human study evidence—such as collagen peptides, ceramides, carotenoids, hyaluronic-acid building blocks, and targeted probiotics—are positioned to win the next wave of growth.

Japan is one of the clearest examples of this opportunity. The Consumer Affairs Agency (CAA) explains that a new category called Foods with Function Claims was introduced in April 2015 to make more products available with labels showing specific nutritional or health functions, under the business operator’s responsibility after submitting supporting information to the CAA. For nutricosmetics, this approach is commercially powerful because it encourages companies to build dossiers and then communicate a function in a controlled, understandable way. In simple terms, Japan rewards brands that do the homework—giving them a clearer story at the point of sale.

Government-led claim frameworks in Europe also shape the opportunity, even if the system is strict. The European Commission notes that EU rules on nutrition and health claims are established by Regulation (EC) No 1924/2006, and that the regulation started to apply on 1 July 2007. For nutricosmetics, this creates an incentive to invest in higher-quality substantiation and compliant messaging. Brands that learn to “translate” science into legally acceptable claims can build stronger long-term trust than competitors relying on vague marketing.

Regional Insights

APAC leads with 44.8% share and USD 1.4 billion, driven by rising beauty-from-within demand and expanding health awareness.

In 2024, the Asia Pacific (APAC) region emerged as the dominating market for nutricosmetic ingredients, capturing a substantial 44.8% share of total market value, equivalent to approximately USD 1.4 billion. The region’s leadership position was supported by strong consumer demand for beauty and wellness products that integrate nutritional benefits with aesthetic outcomes. Rapid urbanization, expanding middle-class populations, and increasing disposable incomes in key markets such as China, India, Japan, and South Korea contributed to heightened consumption of dietary supplements and functional nutrition products aimed at skin health, anti-aging, and overall beauty enhancement.

Consumer preferences in APAC increasingly shifted toward natural and plant-based ingredients, driving formulation trends that emphasize clean labels and scientifically supported benefits. The growing influence of social media, alongside higher investments in digital marketing by leading brands, further amplified regional uptake of nutricosmetic products. In contrast, North America and Europe maintained steady growth with strong interest in preventive skincare and personalized nutrition solutions, but their combined shares trailed APAC’s dominant position.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amway is a global direct-selling giant with an extensive nutricosmetic portfolio under its Nutrilite brand, present in more than 100 countries. Its nutrition and beauty supplement lines are backed by integrated supply chains and e-commerce reach, generating over USD 8.5 billion in related sales through digital and retail channels. Amway’s long history and diversified products strengthen its competitive positioning worldwide.

Skinade is an England-based beauty drink brand that combines collagen, vitamins, and antioxidants to support skin health from within. Available in over 20 international markets, Skinade has delivered millions of servings since launch and maintains a strong niche in liquid nutricosmetic formats, appealing to consumers seeking convenient daily beauty-boosting beverages.

Top Key Players Outlook

- Laboratoire Dermatologique ACM

- Amway

- Vitabiotics Ltd.

- Forza Industries Ltd.

- Skinade

- D-LAB Nutricosmetics

- Pfizer Inc.

- Natrol LLC

Recent Industry Developments

December 31, 2024, Amway reported total global sales of USD 7.4 billion, with the nutrition category—comprising vitamins, minerals and nutricosmetic-oriented supplements—accounting for 64 % of overall revenue, reflecting sustained consumer demand for health-linked beauty products.

In 2024, Vitabiotics Ltd. continued to be a leading UK-based player in the nutricosmetic and dietary supplements sector, with its consumer health market valued at approximately USD 1,815.1 million, reflecting its broad reach and strong brand portfolio that includes daily beauty and wellbeing supplements such as Perfectil for skin, hair, and nails.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Bn Forecast Revenue (2034) USD 6.9 Bn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carotenoids, Vitamins, Collagen, Antioxidants, Polyphenolics, Lycopenes, Beta Carotene, Flavones, Plant Based Caeramides, Polypodium Leucomotes), By Product (Dietary Supplements, Function Food And Beverage), By Application (Skin Health, Hair Health, Nail Health, Weight Management) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Laboratoire Dermatologique ACM, Amway, Vitabiotics Ltd., Forza Industries Ltd., Skinade, D-LAB Nutricosmetics, Pfizer Inc., Natrol LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nutricosmetic Ingredients MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Nutricosmetic Ingredients MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Laboratoire Dermatologique ACM

- Amway

- Vitabiotics Ltd.

- Forza Industries Ltd.

- Skinade

- D-LAB Nutricosmetics

- Pfizer Inc.

- Natrol LLC